“Even if you are on the right track, you’ll get run over if you just sit there.” Will Rodgers

COVID 19 and Markets Update

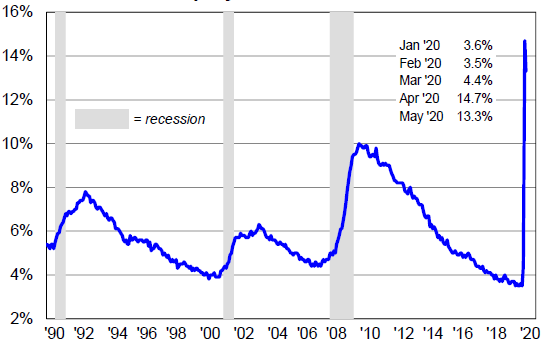

In the United States, we currently have 1,977,899 confirmed COVID 19 cases and 112,054 confirmed deathsOn Thursday of last week, according to the Labor Department, U.S. workers filed an additional 2.1 million jobless claims, bringing the total losses since the coronavirus pandemic to over 41 million.

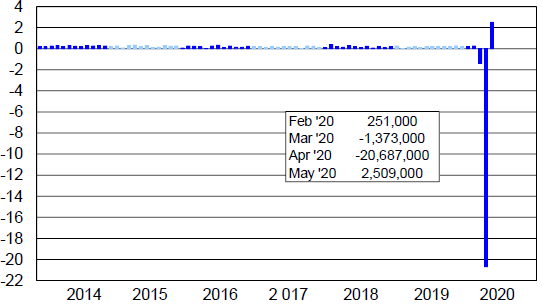

New US Jobs Created

U.S. Unemployment Rate

On the back of Mays’s employment report the DOW surged on Friday closing up 829.16 points (or 3.15%) to close out the week at 27,110.98. In overnight trading, DOW futures traded higher and as of the writing of this report are expected to open up 248 points.

Key Economic Indicators

- The Bureau of Economic Analysis announced on May 28 that U.S. GDP in the first quarter of 2020 fell an annualized 5.0% from Q4 2019.

- The Institute for Supply Management’s Purchasing Managers Index (PMI) improved to 43.1 in May from 41.5 in April. A reading under 50 indicates manufacturing is contracting. May’s reading means manufacturing was in slightly better shape in May than in April.

- Total U.S. manufacturing output fell 13.7% in April 2020 from March 2020, its biggest month over month decline in records going back to 1919.

- The Conference Board’s index of consumer confidence was 86.6 in May, up from 85.7 in April, thanks mainly to a slight increase in the short-term outlook. It’s all relative, but getting better the index was 132.6 in February 2020, so May still represents a 35% decline.

- Total U.S. consumer spending, which accounts for nearly 70% of GDP, fell 13.6% in April 2020 from March 2020. The decline from March to February was 6.9%.

- New light vehicle sales were an annualized and seasonally adjusted 12.2 million in May, up from just 8.7 million in April. The rebound is attributed mainly to sharply higher light truck sales, which accounted for a record 77.2% of total vehicles sales in May.

- According to the Census Bureau, total U.S. housing starts were an annualized and preliminary 891,000 in April 2020 — down 30.2% from March 2020, up 29.7% from April 2019.

Demonstrations over the weekend seemed to be more peaceful in nature – let’s hope the worst is behind us and we can move forward as a nation in a constructive manner.

West Texas Intermediate (WTI) crude for July delivery closed up $2.14 per barrel, or 5.7%, to settle at $39.55 a barrel on the New York Mercantile Exchange on Friday of last week. This represents a 10.7% percent gain week over week.Brent crude futures settled up $2.31, or 5.8 per cent, at US$42.30 per barrel, surging 19.2% per cent week over week.

Both crude benchmarks have had gains over the past six weeks, lifted by the output cuts and signs of improving fuel demand as countries ease lockdowns imposed to fight the Chinese coronavirus outbreak.

Oil is lower in overnight trading and as of the writing of this report, WTI is poised to open at $39.32 down 27cts per barrel from Friday’s close. Some interesting items happening with pipelines here in the U.S. that could affect crude by rail in the US include the following:

- Trump in an executive order Thursday night, instructed his administration to identify pipelines and other projects where environmental permitting could be waved or accelerated . The order envisions giving emergency treatment to shovel ready jobs. This new push by the President could finally get Keystone’s 830,000 barrel a day pipeline built. This would be a negative for crude by rail but a positive for crude producers. Trump cited the 40 million jobs that have been lost as a reason for fast tracking shovel ready projects.

- Folks, even when a pipeline is built and operating it is not safe from environmental scrutiny. Energy Transfer’s Dakota access pipeline that has been operating since 2017 is facing a new set of environmental challenges. The pipeline that is 570,000 barrels per day is in front of a US district court in Washington DC where a judge will decide whether to shut the line while a new environmental review is pending. It seems crazy, but the judge is actually considering it. A decision to shut in the pipeline would have ravaging effects on farmers as well as many other industries within the region. This could lead to more production shut ins, or a displacement of grain shipments by higher priced crude by rail.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

North American Rig Count

Total North American rail volumes were down 16.5% year over year in week 22 (U.S. -17.3%, Canada -12.2%, Mexico -23.0%), resulting in quarter to date volumes that are down 19.4% and year to date volumes that are down 11.6% (U.S. -13.0%, Canada -7.3%, Mexico -9.3%). Ten of the AAR’s Eleven major traffic categories posted year over year declines with the largest decreases coming from intermodal (-9.9%), coal (-32.9%), motor vehicles & parts (-61.6%) and metallic ores & metals (-28.0%).In the East, CSX’s total volumes were down 21.5%, with the largest decreases coming from coal (-48.7%), motor vehicles & parts (-69.0%) and intermodal (-10.8%). NS’s total volumes were down 23.8%, with the largest decreases coming from coal (-61.0%), intermodal (-10.2%), motor vehicles & parts (-58.2%) and metals & products (-44.8%).

In the West, BN’s total volumes were down 17.1%, with the largest decreases coming from coal (-31.0%), intermodal (-9.9%) and petroleum (-46.2%). UP’s total volumes were down 16.6%, with the largest decreases coming from intermodal (-16.1%), motor vehicles & parts (-79.9%), chemicals (-15.4%), stone sand & gravel (-28.6%) and petroleum (-36.6%). The largest increase came from grain (+29.7%).

In Canada, CN’s total volumes were down 13.8% with the largest decreases coming from motor vehicles & parts (-68.5%), intermodal (-5.1%), petroleum (-32.1%) and stone sand & gravel (-64.1%). RTMs were down 14.9%. CP’s total volumes were down 14.6%, with the largest decreases coming from coal (-29.2%), motor vehicles & parts (-59.9%), petroleum (-41.1%), intermodal (-7.2%) and stone sand & gravel (-72.8%). RTMs were down 9.1%.

KCS’s total volumes were down 22.7%, with the largest decreases coming from intermodal (-25.2%) and motor vehicles & parts (-85.1%).

Looking back on May

Total U.S. carloads fell 27.7% in May 2020 from May 2019, the biggest year-over-year decline for any month on record. Intermodal traffic was down 13.0% in May, better than the 17.2% decline in April. May was the worst month for U.S. coal carloads in history, breaking the record set in April. Excluding coal, carloads fell 21.9%. Big declines were in motor vehicles and parts, petroleum products, crushed stone, sand, and gravel, chemicals; and steel-related categories. Good news is carloads at the end of May were generally better than they were at the beginning of May.

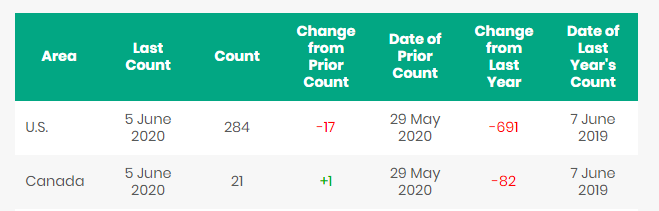

North America rig count continues to deteriorate and is down 16 rigs week over week with the U.S. losing 17 rigs again this week and Canada gaining 1 rig week over week. Year over year we are down 773 rigs collectively. Canada now has 21 rigs nationwide operating and the U.S. has 284.

North American Rig Count Summary

Railcar Markets

PFL is offering: : Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. Much wanted pre pandemic C02 cars are now available for lease get them while you can. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: Older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. Being used for water service. 15-20 5200 Cuft hoppers for grain service, Plate C boxcars for purchase, lined cars suitable for propylene glycol service. Looking further out 29.5 CPC 1232 veggie oil cars are wanted for non-food grade service 20 cars 3-5 year term.

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|