“You don’t have to see the whole staircase, just take the first step.”

-Martin Luther King, Jr

Jobs Update

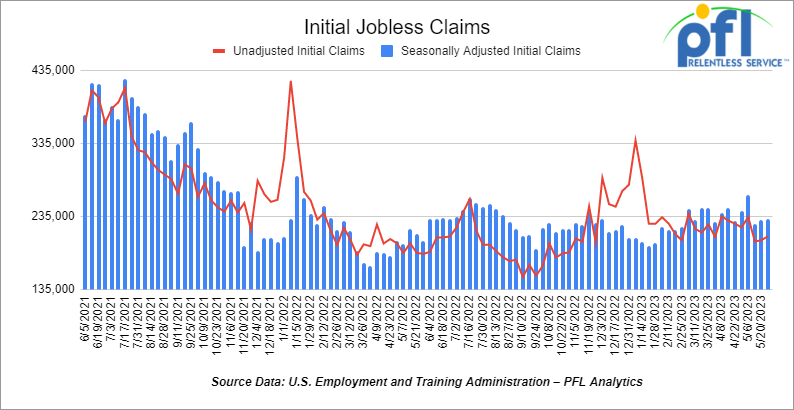

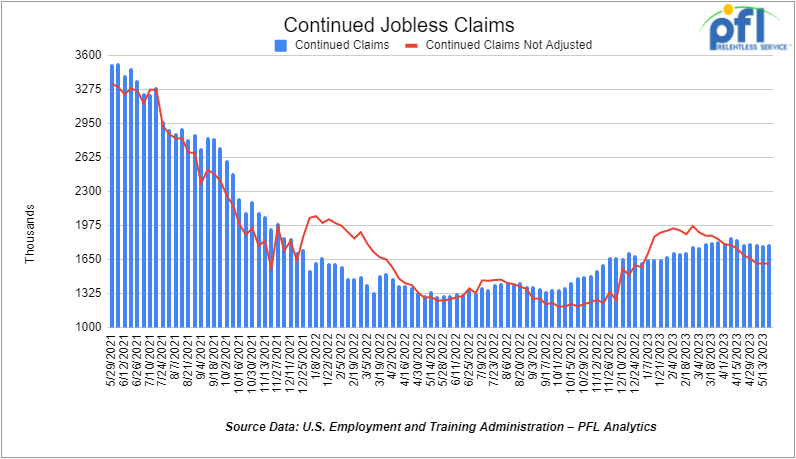

- Initial jobless claims for the week ending May 27th, 2023 came in at 232,000, up +2,000 people week-over-week.

- Continuing jobless claims came in at 1.795 million people, versus the adjusted number of 1.789 million people from the week prior, up +6,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 701.19 points (2.12%), closing out the week at 33,762.76, up 998.11 points week over week. The S&P 500 closed higher on Friday of last week, up 61.35 points (+1.45%) and closed out the week at 4,282.37, up 76.92 points week over week. The NASDAQ closed higher on Friday of last week, up 139.78 points (+1.08%), and closed the week at 13,240.77, up +265.08 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,857 this morning up 40 points.

Crude oil closed higher on Friday of last week, but lower week over week

WTI traded up $1.64 per barrel (+2.3%) to close at $71.74 per barrel on Friday of last week, down -$0.93 per barrel week over week. Brent traded up +US$1.85 per barrel (+2.3%) on Friday of last week, to close at US$76.13 per barrel, down -US$0.82 per barrel week over week.

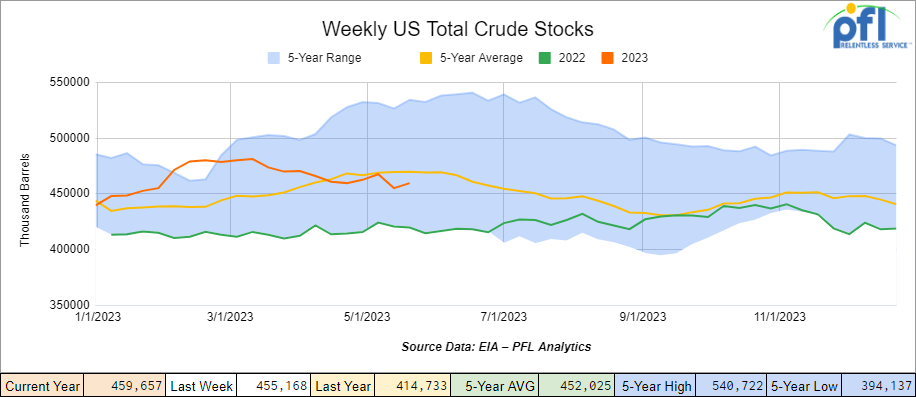

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.5 million barrels week over week. At 459.7 million barrels, U.S. crude oil inventories are 2% below the five/year average for this time of year.

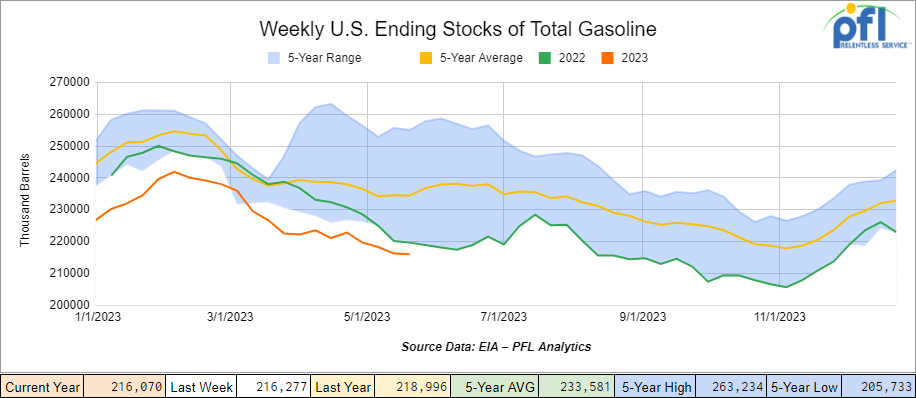

Total motor gasoline inventories decreased by 200,000 barrels week over week and are 8% below the five-year average for this time of year.

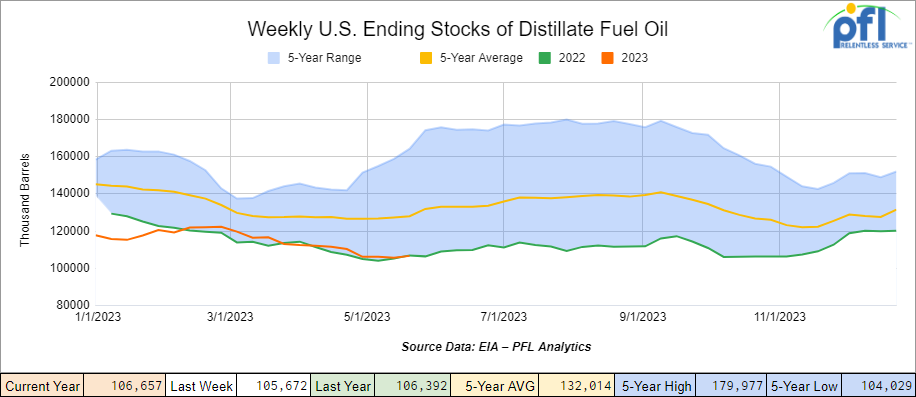

Distillate fuel inventories increased by 1 million barrels week over week and are 18% below the five-year average for this time of year.

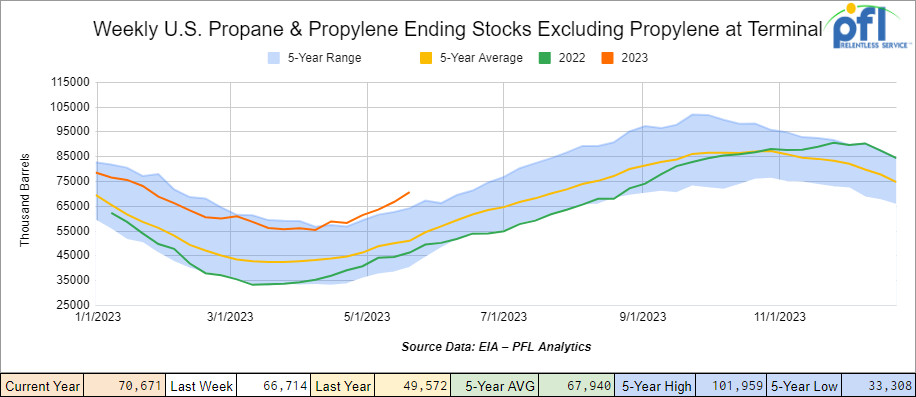

Propane/propylene inventories increased by 4 million barrels week over week and are 33% above the five-year average for this time of year.

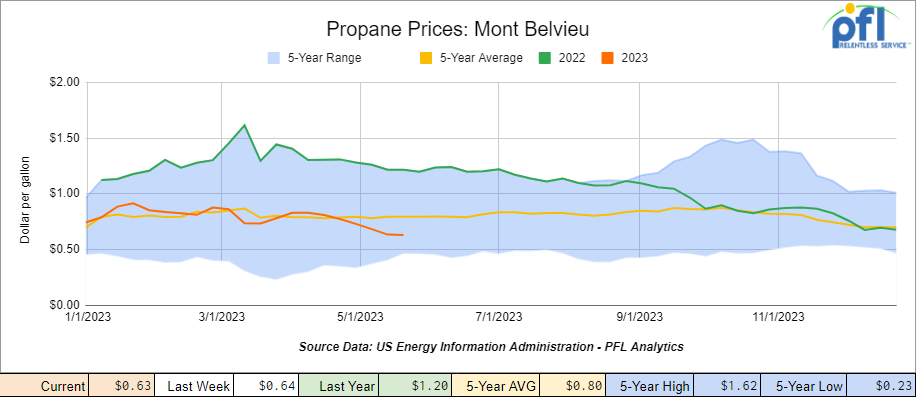

Propane prices closed at 63 cents per gallon, down 1 cent per gallon week over week and down 57 cents per gallon year over year, as inventories increase

Overall, total commercial petroleum inventories increased by 11.3 million barrels week over week.

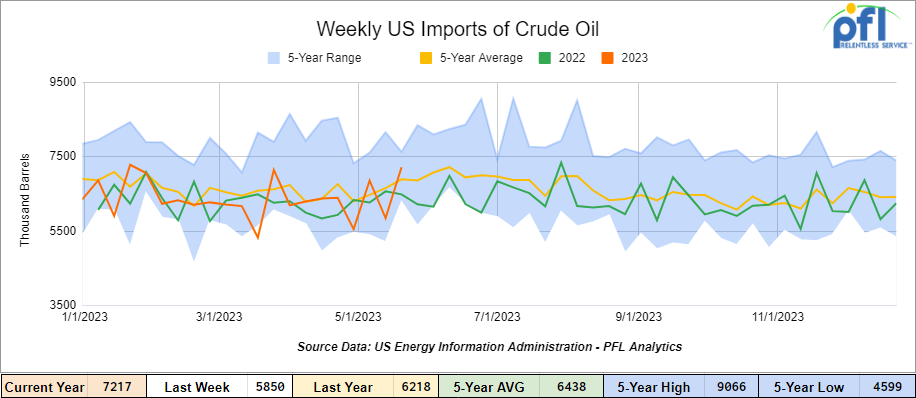

U.S. crude oil imports averaged 7.2 million barrels per day during the week ending May 26th, 2023, an increase of 1,367 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 0.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 833,000 barrels per day, and distillate fuel imports averaged 199,000 barrels per day during the week ending May 26th, 2023.

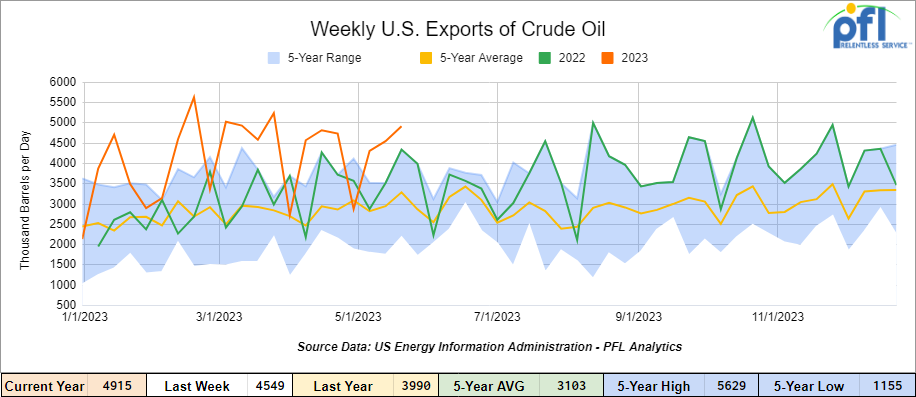

U.S. crude oil exports averaged 4.915 million barrels per day for the week ending May 26th, 2023, an increase of 366,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.162 million barrels per day.

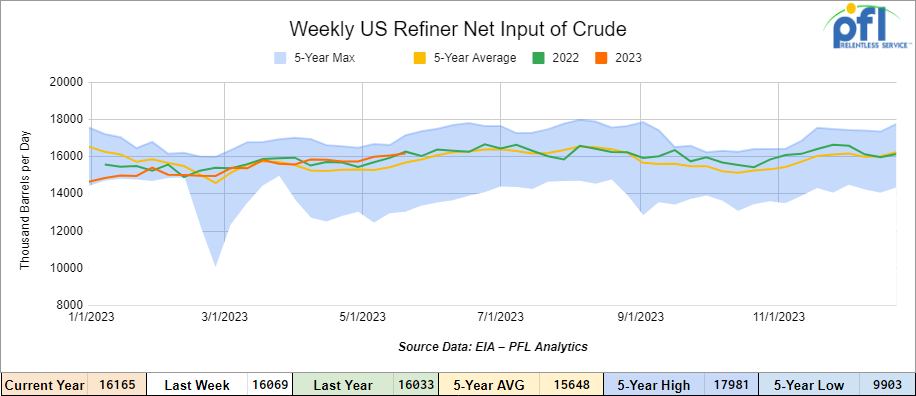

U.S. crude oil refinery inputs averaged 16.2 million barrels per day during the week ending May 26, 2023, which was 96,000 barrels per day more week over week.

As of the writing of this report, WTI is poised to open at $73.07, up $1.33 from Monday’s close.

North American Rail Traffic

Week Ending May 31st, 2023.

Total North American weekly rail volumes were down (-5.82%) in week 21 compared with the same week last year. Total carloads for the week ending on May 31st were 355,060, up (+0.94%) compared with the same week in 2022, while weekly intermodal volume was 310,495, down (-12.51%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Intermodal (-12.51%). The largest increase came from Motor Vehicles and Parts (+16.51%).

In the east, CSX’s total volumes were down (-4.91%), with the largest decrease coming from Coal (-12.76%) and the largest increase from Motor Vehicles and Parts (+20.35%). NS’s volumes were down (4.24%), with the largest decrease coming from Petroleum and Petroleum Products (-21.64%) and the largest increase from Chemicals (+16.85%).

In the West, BN’s total volumes were down (-9.98%), with the largest decrease coming from Intermodal (-17.96%), and the largest increase coming from Nonmetallic Minerals (+29.55%). UP’s total rail volumes were down (-1.64%) with the largest decrease coming from Other (-9.93%) and the largest increase coming from Motor Vehicles and Parts (+25.79%).

In Canada, CN’s total rail volumes were down (-8.82%) with the largest increase coming from Coal (+27.52%) and the largest decreases coming from Grain (-27.52%). CP’s total rail volumes were down (-1.55%) with the largest decrease coming from Grain (-32.80%) and the largest increase coming from Coal (+43.74%).

KCS’s total rail volumes were down (-8.91%) with the largest decrease coming from Intermodal (-22.57%) and the largest increase coming from Farm Products (+30.86%).

Source Data: AAR – PFL Analytics

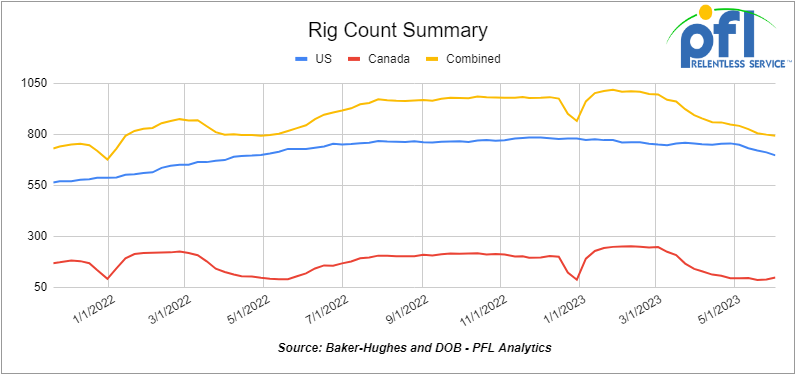

Rig Count

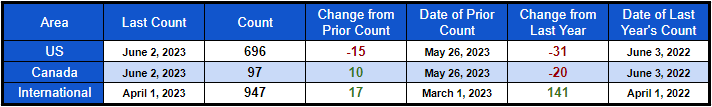

North American rig count was down by -5 rigs week over week. U.S. rig count was down by -15 rigs week over week and down by -31 rigs year-over-year. The U.S. currently has 696 active rigs. Canada’s rig count up by +10 rigs week-over-week and down by -20 rigs year over year. Canada’s overall rig count is 97 active rigs. Overall, year-over-year, we are down -51 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,458 from 25,431, which was a gain of +27 rail cars week-over-week. Canadian volumes rose week over week; CPKC’s shipments increased by 11.6% week over week, and CN’s volumes were higher by +4.7% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +9.6% week-over-week. The BN was the sole decliner and was down by -11.8%

We are watching Canadian Politics

Alberta had a closely watched election on Monday of last week in Canada’s Oil patch. In what should have not been a close election, it was as the left-wing New Democrat Party (NDP) gained some seats, but did not take over the conservative pro-energy United Conservative Party (UCP). The UCP formed a majority government getting 52.59% of the popular vote and 49 of the 87 seats available. The capital of Alberta is Edmonton and the NDP got all 20 seats available in that city. Calgary, which normally leans to the right, was a battleground where the NDP gained three seats from the last election and now holds 14 of the 26 seats available as that city’s demographics change.

Alberta’s election of the conservative leader, Danielle Smith, puts her on a collision course with Canada’s Liberal Prime Minister Justin Trudeau over climate policies that she claims will undermine the province’s massive fossil fuel industry.

In her victory speech in front of cheering supporters in Canada’s oil capital Calgary, Smith called on Albertans to stand up against policies including the federal government’s proposed oil and gas emissions cap and clean electricity regulations, expected to be unveiled within weeks.

“Hopefully the prime minister and his caucus are watching tonight,” Smith said. “As premier I cannot under any circumstances allow these contemplated federal policies to be inflicted upon Albertans.”

Smith said Trudeau’s Liberal climate policies will destroy tens of thousands of jobs in the oil and gas sector, which contributes more than 20% to Alberta’s annual Gross Domestic Product. The federal government says Canada needs to cut emissions from oil and gas production to stay competitive as the world transitions to net-zero by 2050. Stay tuned to PFL as the battle rolls on in Canada.

We are watching NGL’s

As natural gas production increases here in the U.S., so does NGL production. On the NGL front U.S. midstream companies are actively charting a course to expand their natural gas liquids export capacity.

Dallas-based Energy Transfer aims to enhance its Nederland terminal on the U.S. Gulf Coast by adding 250,000 barrels per day (bpd) of LPG and ethane export capability by mid-2025, a $1.25 billion investment. Energy Transfer has secured long-term contracts for the expansion and is actively negotiating for additional capacity. Meanwhile, they set sail towards enabling ethane exports from the Marcus Hook terminal, bracing it with refrigeration and storage capacity while contemplating further expansions.

Meanwhile, Houston-based Enterprise Products Partners is looking to add 240,000 bpd of ethane exports from Morgan’s Point terminal near Beaumont, Texas. Enterprise is also pushing forward with increasing LPG export capacity by 120,000 bpd at their Houston terminal.

Finally, Targa Resources is looking to expand propane export capacity at Galena Park terminal and exploring additional expansions. Targa is also expanding its NGL fractionation capabilities to meet increasing natural gas production from the Permian basin.

As our readers know, pressure cars have been hard to come by and we don’t see this demand subsiding anytime soon. Stay tuned to PFL . We are watching this one.

We are watching Russia and OPEC

Russia has been a thorn in Saudi Arabia’s side – selling cheap oil and overproducing (the Saudis want the price of oil at $80 per barrel or higher). There was an OPEC+ meeting that took place yesterday and went late into the evening in Vienna. The outcome of that meeting is that Saudi Arabia will make additional voluntary cuts of 1mn barrels per day (“bpd”) to its oil production in an effort to prop up prices.

The kingdom’s energy minister Prince Abdulaziz bin Salman, OPEC’s de facto leader, made the move as part of a deal in which several weaker African members will have quotas reduced from next year. Russia, the world’s second-largest oil exporter, could also have its production targets lowered, though the group said this was subject to review. Meanwhile, the United Arab Eremites will be able to increase its production.

The 1mn bpd cut will initially be for July but could be extended.

The Opec+ group’s collective production targets were adjusted to 40.5mn bpd through 2024, formalizing and extending the voluntary cuts announced in April at the group level.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 25-50, 25.5K 117J, 117R, CPC 1232 Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Asphalt service.

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K 117J Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 10, 30K DOT 111, 117, CPC 1232 Tanks needed off of UP or BN in Beaumont, Houston, Sunray for 6 Months. Cars are needed for use in Diesel service. Dirty to Dirty

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service. Q1

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers are needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 30, 23.5K, DOT111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, DOT111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn syrup. Free Move

- 20, 20k, DOT111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, DOT111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, DOT111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of in Canada. Cars were last used in Crude. Dirty to Dirty

- 25, 28.3K, DOT111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free Move, Dirty to Dirty

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Call for information

- 150, 89’6, Flats located off of CN in Canada.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|