“The man who will use his skill and constructive imagination to see how much he can give for a dollar, instead of how little he can give for a dollar, is bound to succeed.” – Henry Ford

COVID 19 and Markets Update

In the United States, we currently have 2,593,169 confirmed COVID 19 cases and 127,693 confirmed deaths

On Thursday of last week, according to the Labor Department, U.S. workers filed an additional 1.5 million jobless claims, bringing the total losses since the coronavirus pandemic to 47 million.

The DOW closed lower on Friday closing down 730.05 points (or 2.84%) to close out the week at 25,015.55. The S&P 500 traded 2.42% lower, or down 74.71 points, at 3,009.0.5, on demand destruction fears and the increase of COVID-19 cases across the United States. The Nasdaq finished the session lower as well losing 259.78 points closing out the week at 9,757.22. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open up 100 points.

Natural gas prices fell to 25-year low last week. Natural gas prices fell below $1.50 per MMBtu last week, the lowest level since the early 1990’s as demand for US LNG has collapsed Amid the Chinese COVID-19 virus. U.S. LNG exports fell from 9.8 Bcf/d in March to just 4 Bcf/d by June backing up supplies here in the U.S. for the domestic market to absorb.

West Texas Intermediate (WTI) traded down $.23 (or -.59%) to close at $38.49 on Friday of last week on the New York Mercantile Exchange. Oil prices dipped slightly for the day on Friday posting a negative week for 2 out of the last 3. As virus cases appear to be on the rise in states like Florida, California, and Texas, the market is worried about the negative effects on fuel demand as these are some of the U.S. most populous states.

Brent traded down $.03 or -.073% to close at $41.02on Friday of last week.

Oil is higher in overnight trading and as of the writing of this report and WTI is poised to open at 38.65 up 16 cents per barrel from Friday’s close.

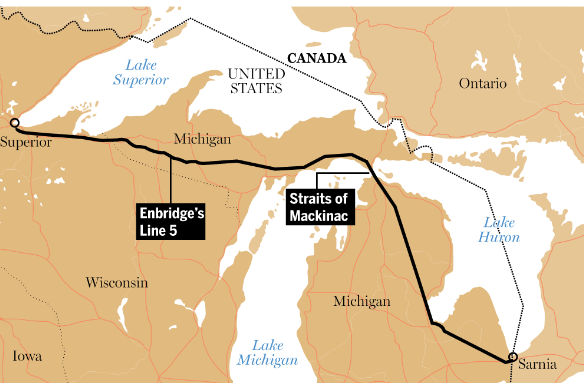

Petroleum car loads declined week over week. The four-week moving average of petroleum carloads declined from 20,061 to 19,677 week over week. CP volumes fell by 12.6% and CN’s volumes fell by 4.4%. Unfavorable basis differentials continue to exist against WTI for the Canadian producer. WSC versus WTI closed at -$9.75 per barrel on Friday. However, Light crude in Edmonton traded sharply lower on Friday of last week losing roughly $2.50 per barrel after a Michigan court ordered Enbridge’s line 5 shut that transports 540,000 barrels per day of crude and natural gas liquids pending a June 30th hearing.

Canadian Energy Market Gets another Blow as Michigan Orders Pipeline Shut DOWN

Enbridge Inc., North America’s largest pipeline company, says Michigan State’s request for a restraining order and injunction against a pipeline connecting Alberta oil to Midwest refineries is “legally unsupportable” and “unnecessary.” But they did it anyways!

Enbridge shut down the twin pipelines through a narrow waterway (the Straits of Mackinac) on the Great Lakes two weeks ago when one of the anchor supports at the bottom of the lake shifted. After inspecting the lines, Enbridge re-opened the west-bound pipe, which was not damaged, but requires an engineering report and work with the U.S. Pipeline and Hazardous Materials Safety Administration on the east-bound pipe.

However, the Michigan Attorney General Dana Nessel filed an injunction last Monday asking a county judge in the state to suspend operation of Line 5, which carries 540,000 barrels of oil per day, until an investigation is conducted. (See Enbridge line 5)

Enbridge Line 5 Pipeline System

The state of Michigan claims that Enbridge provided no explanation of what caused this damage and a woefully insufficient explanation of the current condition and safety of the pipeline as a result of this damage,” Nessel said in a release last Monday. “We cannot rely on Enbridge to act in the best interests of the people of this state so I am compelled to ask the court to order them to do so.”

Michigan Governor Gretchen Whitmer (who campaigned to shut the pipeline down permanently) also sharply criticized the company in a release last weekend.

“Given the gravity of this matter, I was taken aback to learn the company has unilaterally resumed operation of the west leg without even opportunity for discussion,” Whitmer said, adding the company’s “disregard for the safety and well-being of our Great Lakes” was unacceptable.

Enbridge denied these allegations but never the less was ordered shut down on Thursday of last week after it was restarted pending a June 30th hearing. The pipeline supplies 55% of heating supplies needed across the state. It’s closure will interrupt several U.S. and Canadian refineries. Line 5 feeds refineries in Toledo (PBF), Detroit (Marathon), Sarnia (Imperial Oil) Montreal (Suncor). The Governor of Michigan praised the court’s decision last week. The stakes have never been higher for Enbridge as it continues to battle the state. We will see what tomorrow brings. It is our guess that the pipeline will be able to resume operations and this is yet another temporary setback of many for Enbridge. If the pipeline were to remain shut, it would seem on the surface to be a positive for crude by rail stay tuned to PFL for the latest and greatest.

In a never ending battle in other targeted lawsuits against the oil patch, last week the District of Columbia and Minnesota filed lawsuits against Exxon, American Petroleum Institute and Koch. The DC attorney general sued ExxonMobil , BP, Royal Dutch Shell and Chevron over its decades-long campaign of climate disinformation. A day earlier, Minnesota’s attorney general filed a similar lawsuit against Exxon, Koch Industries and the American Petroleum Institute. Unlike past cases, which sought damages for the company’s role in fueling climate change, these cases hinge on consumer protection violations.

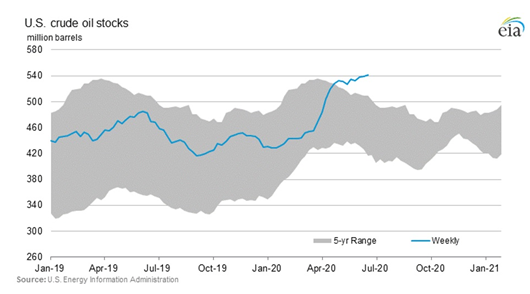

US Crude and Gasoline Inventories

U.S. crude inventories rose by 1.44 million barrels last week. U.S. inventories now stand at 540.74 million barrels a new fresh record:

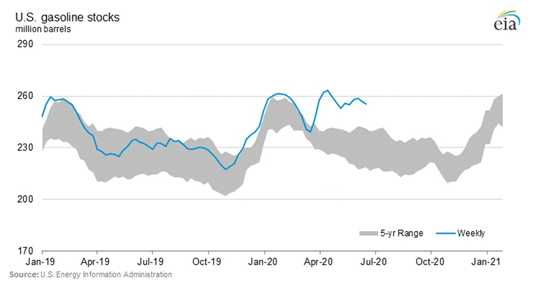

Gasoline inventories were down 1.673 MM/bbls (vs a forecasted draw of -1.61MM/bbls) while demand for gasoline was up 740K/bpd. The gasoline number would seem to suggest that we’re definitely seeing an improvement in demand,”

We have been extremely busy at PFL with return on lease programs and railcar storage. Please call PFL now at 239-390-2885 if you are looking for rail car storage or have storage availability.

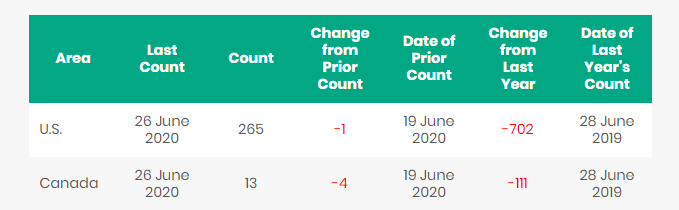

Rig Count

North America rig count continues to move lower and is down 5 rigs week over week with the U.S. losing 1 rig and Canada losing 4 rigs. Year over year we are down 813 rigs collectively. Canada now has 13 rigs nationwide operating and the U.S. has 265 rigs now operating.

North American Rig Count Summary

North American Rail Traffic

For this week 25, total U.S. weekly rail traffic was 457,278 carloads and intermodal units, down 12.9 percent compared with the same week last year.

Total carloads for the week ending June 20 were 201,823 carloads, down 21.8 percent compared with the same week in 2019, while U.S. weekly intermodal volume was 255,455 containers and trailers, down 4.4 percent compared to 2019.

None of the 10 carload commodity groups posted an increase compared with the same week in 2019. Commodity groups that posted decreases compared with the same week in 2019 included coal, down 26,340 carloads, to 52,392; metallic ores and metals, down 8,176 carloads, to 14,459; and nonmetallic minerals, down 6,839 carloads, to 29,478.

For the first 25 weeks of 2020, U.S. railroads reported cumulative volume of 5,306,511 carloads, down 15.7 percent from the same point last year; and 5,933,616 intermodal units, down 10.8 percent from last year. Total combined U.S. traffic for the first 25 weeks of 2020 was 11,240,127 carloads and intermodal units, a decrease of 13.2 percent compared to last year.

North American rail volume for the week ending June 20, 2020, on 12 reporting U.S., Canadian and Mexican railroads totaled 294,794 carloads, down 19.3 percent compared with the same week last year, and 334,884 intermodal units, down 6 percent compared with last year. Total combined weekly rail traffic in North America was 629,678 carloads and intermodal units, down 12.7 percent. North American rail volume for the first 25 weeks of 2020 was 15,545,401 carloads and intermodal units, down 11.9 percent compared with 2019.

Canadian railroads reported 72,171 carloads for the week, down 14.9 percent, and 64,537 intermodal units, down 7.7 percent compared with the same week in 2019. For the first 25 weeks of 2020, Canadian railroads reported cumulative rail traffic volume of 3,465,280 carloads, containers and trailers, down 8 percent.

Mexican railroads reported 20,800 carloads for the week, down 7 percent compared with the same week last year, and 14,892 intermodal units, down 21.5 percent. Cumulative volume on Mexican railroads for the first 25 weeks of 2020 was 839,994 carloads and intermodal containers and trailers, down 10.2 percent from the same point last year.

Railcar Markets

PFL is offering: : Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Clean and new cars are available for longer term leases. C02 cars are now available for lease, so get them while you can. A number of sand cars, box cars, coal cars and hoppers are also available for sale.

PFL is seeking: 100 DOT 117s R’s or J’s for gasoline service – need in Port Arthur for 2 months with a two months option, 2 Covered hoppers to purchase 5500 series for storage at plant site in the Chicago area BN or NS connection, 5-10 syrup cars in the Midwest, 100 steel coal gons for sale, need 10 20K to 23.5 coiled and insolated for one year in ethylene glycol, 10 CPC 1232 or other for Industrial Alcohol use in Indiana off the NS for 6 months lessee would take ethanol cars clean then use for industrial alcohol service and deliver the cars back to you with industrial alcohol heals (cars would be accepted with ethanol heels please call to discuss) 5 CPC 1232 or other for Ethanol use in MN for 6 months.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. We also assist fleets and lessors with leases and sales and offer Total Fleet Evaluation Services.We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS. WE HAVE JUST COMPLETED A JOB IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|