“Do not wait to strike till the iron is hot; but make it hot by striking.”

– William Butler Yeats

Jobs Update

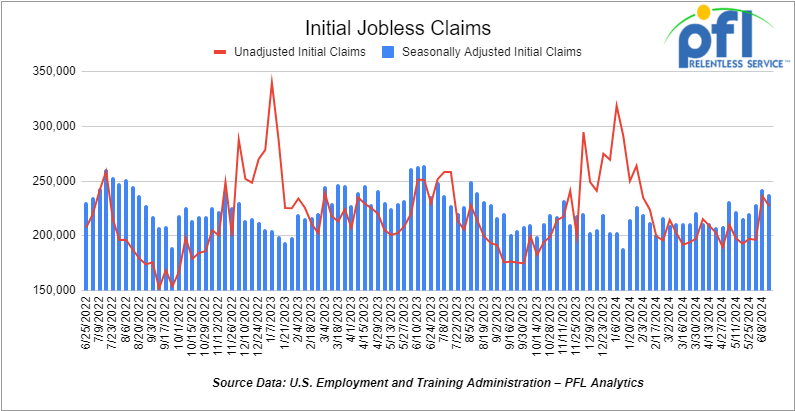

- Initial jobless claims seasonally adjusted for the week ending June 15th, 2024 came in at 238,000, down -5,000 people week-over-week.

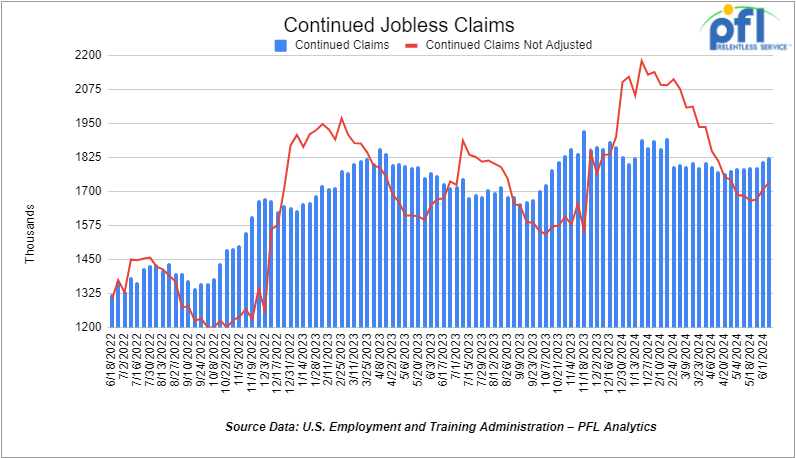

- Continuing jobless claims came in at 1.828 million people, versus the adjusted number of 1.813 million people from the week prior, up 15,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 15.57 points (0.04%), closing out the week at 39,150.33, up 561.17 points week-over-week. The S&P 500 closed lower on Friday of last week, down -8.55 points (-0.16%), and closed out the week at 5,464.62, up 33.02 points week-over-week. The NASDAQ closed lower on Friday of last week, down -32.23 points (-0.18%), and closed out the week at 17,689.36 up 0.48 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 39,668 this morning up 85 points.

Crude oil closed lower on Friday of last week but higher week over week.

WTI traded lower -$0.56 per barrel (-0.07%) on Friday of last week, to close at $80.73 per barrel, up $2.28 per barrel week-over-week. Brent traded down -US$0.47 per barrel (-0.6%) to close at US$85.242 per barrel on Friday of last week, up US$2.62 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for August delivery settled Friday at US$13.10 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$ 67.12 per barrel.

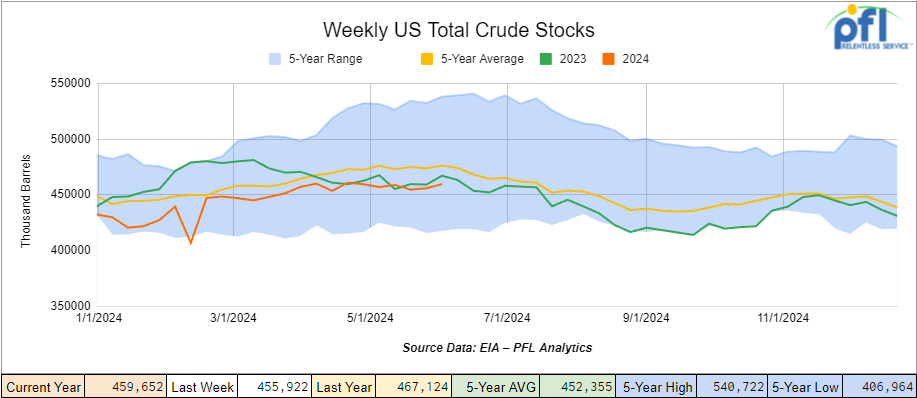

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels week-over-week. At 457.1 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

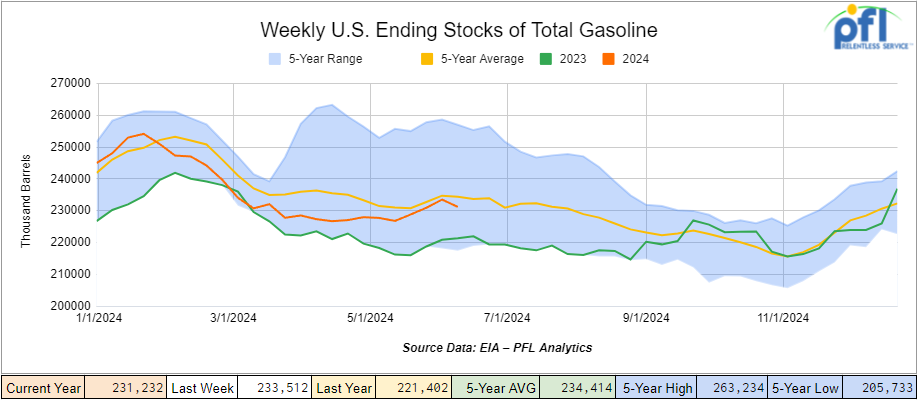

Total motor gasoline inventories decreased by 2.3 million barrels week-over-week and are 1% below the five-year average for this time of year.

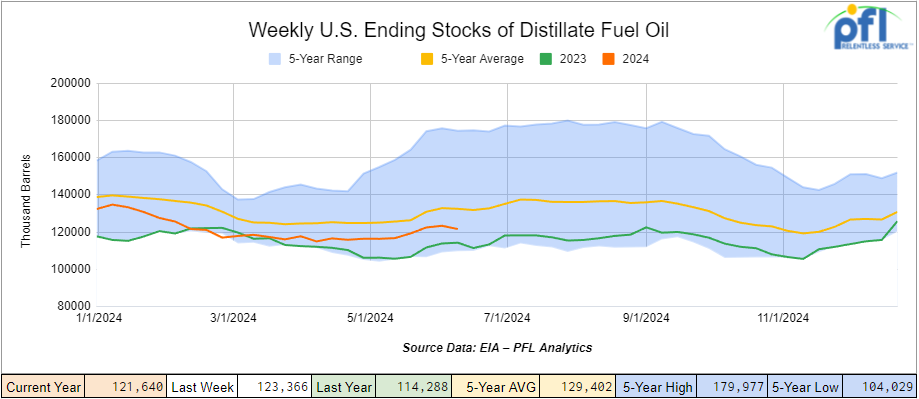

Distillate fuel inventories decreased by 1.7 million barrels week-over-week and are 8% below the five-year average for this time of year.

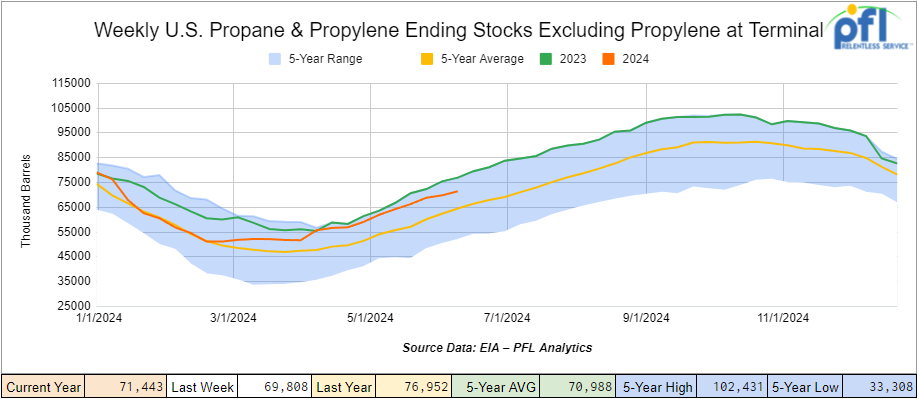

Propane/propylene inventories increased by 1.6 million barrels week-over-week and are 10% above the five-year average for this time of year.

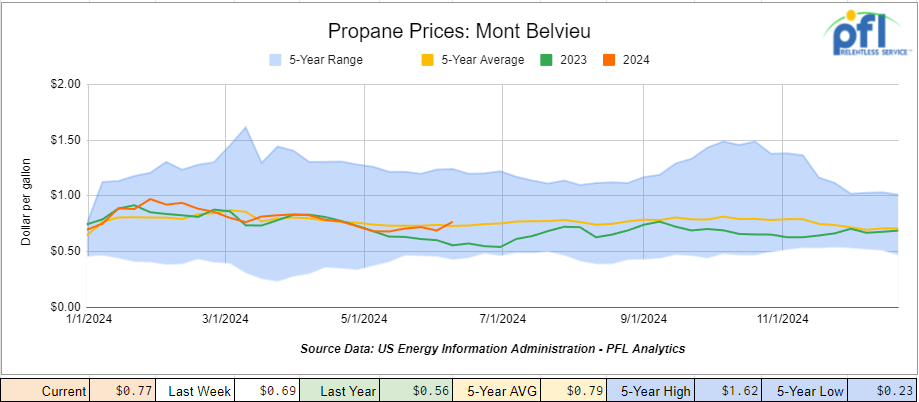

Propane prices closed at 77 cents per gallon, up 8 cents week-over-week and up 21 cents year-over-year.

Overall, total commercial petroleum inventories decreased by 200,000 barrels during the week ending June 14th, 2024.

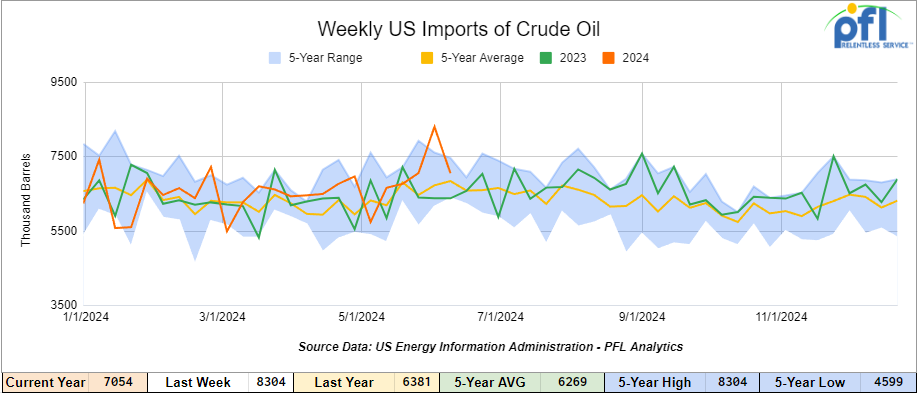

U.S. crude oil imports averaged 7.1 million barrels per day during the week ending June 14th, 2024, a decrease of 1.3 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 7.3 million barrels per day, 11.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1 million barrels per day, and distillate fuel imports averaged 150,000 barrels per day during the week ending June 14th, 2024.

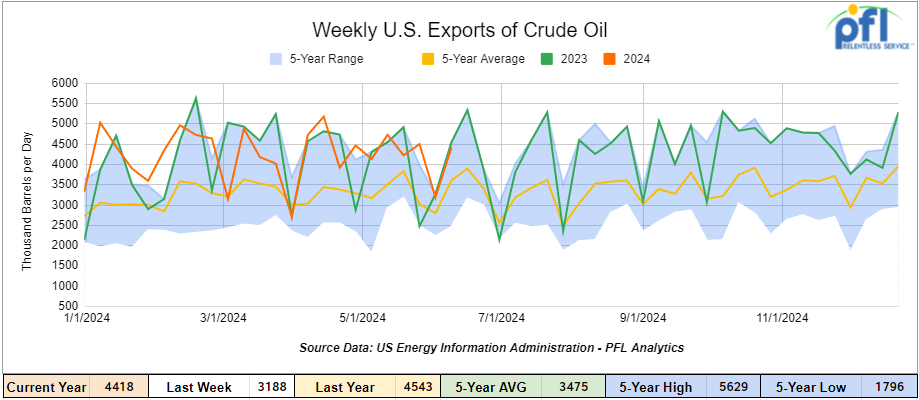

U.S. crude oil exports averaged 4.418 million barrels per day for the week ending June 14th, 2024, an increase of 1.23 million per day week-over-week. Over the past four weeks, crude oil exports averaged 4.083 million barrels per day.

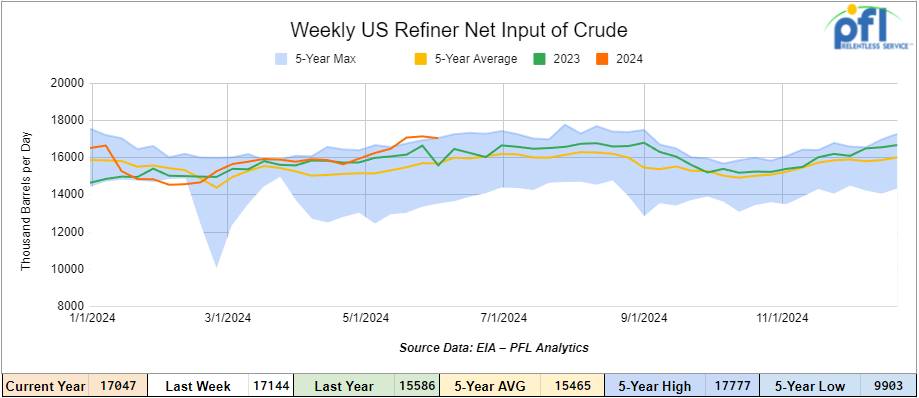

U.S. crude oil refinery inputs averaged 16.8 million barrels per day during the week ending June 14, 2024, which was 281,000 barrels per day less week-over-week.

WTI is poised to open at $81.09, up 36 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 19th, 2024.

Total North American weekly rail volumes were up (4.35%) in week 25, compared with the same week last year. Total carloads for the week ending on June 19th were 344,275, down (-0.08%) compared with the same week in 2023, while weekly intermodal volume was 339,127, up (+9.26%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-12.29%). The most significant increase came from Grain which was up (+18.7%).

In the East, CSX’s total volumes were up (2.9%), with the largest decrease coming from Grain (-9.27%) while the largest increase came from Petroleum and Petroleum Products (21.25%). NS’s volumes were up (7.64%), with the largest increase coming from Intermodal (+12.11%) while the largest decrease came from Metallic Ores and Metals (-6.81%).

In the West, BN’s total volumes were up (6.89%), with the largest increase coming from Chemicals (32.86%) while the largest decrease came from Coal, down (-24.92%). UP’s total rail volumes were up (3.05%) with the largest decrease coming from Nonmetallic Minerals, down (-19.22%) while the largest increase came from Grain which was up (+30.48%).

In Canada, CN’s total rail volumes were down (0.8%) with the largest decrease coming from Grain, down (-24.45%) while the largest increase came from Coal, up (+39.31%). CP’s total rail volumes were down (-0.44%) with the largest increase coming from Grain (+122.08%) while the largest decrease came from Farm Products, down (-40.47%).

KCS’s total rail volumes were down (-6.26%) with the largest decrease coming from Coal (-24.33%) and the largest increase coming from Motor Vehicles and Parts (+67.14%).

Source Data: AAR – PFL Analytics

Rig Count

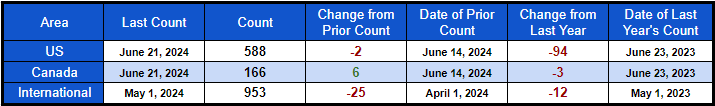

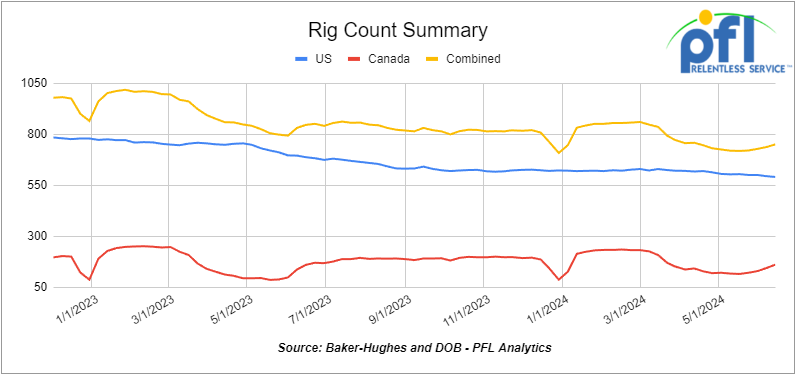

North American rig count was up by 4 rigs week-over-week. U.S. rig count was down by 2 rigs week-over-week, and down by -94 rigs year-over-year. The U.S. currently has 588 active rigs. Canada’s rig count was up by 6 rigs week-over-week, and down by -3 rigs year-over-year. Canada’s overall rig count is 166 active rigs. Overall, year-over-year, we are down -97 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,890 from 27,749, which was a gain of +141 raicars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by +7.6% week over week, CN’s volumes were higher by +6.9% week-over-week. U.S. shipments were mostly lower. The CSX had the largest percentage decrease and was down by -8.2% week over week. The BN was the sole gainer and was up by +9.9%.

Canadian Greenwashing Bill (C-59) officially passed and puts a strangle on Energy Companies in Canada – Suncor Speaks out – Alberta Fighting Back

Pathway Alliance a group of six Canadian oil sand producers removed a bunch of material last week from it’s website in response to the official passing of Bill C-59 by Canada’s Federal Government after it passed its third and final reading in Canada’s Senate on Wednesday of last week. Pathways is a proponent of a Carbon capture project for Alberta’s oil sands region. In a nutshell, Oil companies in Canada are not allowed to talk about what they are doing to help out the environment, unless the claim is based on adequate and proper substantiation in accordance with internationally recognized methodology. What does this mean? Well, no one really knows, but there is certainly going to be a bunch of law suits against Canadian oil companies and the far left are loving it. Suncor spoke out in a press release on Thursday of last week.

Calgary, Alberta – Suncor Energy (TSX: SU) (NYSE: SU), one of the largest oil sands companies in Canada, and a member of the Pathways Alliance, is steadfast in our commitment to environmental performance and operational emissions reduction. To support our commitment, we have strived to be transparent about our actions and plans, which we believe is critical to building trust and driving improvement.

However, our ability to remain transparent has been significantly compromised as a result of Bill C-59, which was recently passed and includes amendments to the Competition Act related to environmental and climate disclosure. With these changes, it is possible that certain public representations by a business about the benefits of the work it is doing to protect or restore the environment or address climate change will violate the Competition Act and subject it to significant financial penalties unless the business can adequately and properly substantiate their claims according to “internationally recognized methodology,” which may or may not exist.

Creating a public disclosure standard that is so vague as to lack meaning and that relies on undefined “internationally recognized methodology” opens the door for frivolous litigation, particularly by private entities who will now be empowered to directly enforce this new provision of the Competition Act. This represents a serious threat to freedom of communication.

These amendments create significant uncertainty and risk for all Canadian companies regardless of sector, that communicate publicly about environmental performance, including actions to address climate change. As a result, we have been forced to remove information on environmental and climate performance, progress, and plans from our website, social media platforms and other communications channels at this time. These actions are a direct consequence of this legislation and are not related to our commitments or belief in the accuracy of our environmental communications.

The result of this legislation, which has been quickly put in place with little or no consultation, is to silence Canadian businesses taking climate action. We will continue to impress on the federal government the need for clarity regarding these new amendments so that we and all other industries can share the important work we are doing to preserve and restore the environment and address climate change.

Alberta is fighting back – The Alberta government is actively exploring the use of every legal option on the federal Bill C-59, including a constitutional challenge or the use of the Alberta Sovereignty within a United Canada Act “to protect the free speech rights of all Alberta workers, leaders and companies in our world-class energy sector.”

The omnibus bill contains a truth-in-advertising amendment that would require corporations to provide evidence to support their environmental claims.

“The federal Liberal and NDP coalition has passed draconian legislation that will irreparably harm Canadians’ ability to hear the truth about the energy industry and Alberta’s successes in reducing global emissions,” the province stated.

We are watching More Funding for Climate Change Initiatives

Folks, we don’t know where all the money is coming from, but it seems to us it is almost daily that we hear another funding initiative to clean up the environment with the printing of more money. On Friday of last week, the U.S. Department of Energy (“DOE”) and the Environmental Protection Agency (“EPA”) announced $850 million to reduce methane pollution from the oil and gas sector.

According to the DOE and the EPA funding from President Biden’s Investing in America Agenda Builds on Nearly 100 Cross-Government Actions that are Sharply Reducing Methane Pollution in Support of Clean Air, Good Jobs, and Climate Action.

The federal funding will go towards projects that will help monitor, measure, quantify, and reduce methane emissions from the oil and gas sectors as part of President Biden’s Investing in America agenda. According to the government agencies, the Oil and natural gas facilities are the nation’s largest industrial source of methane, a climate “super pollutant” that they claim is many times more potent than carbon dioxide and is responsible they say for approximately one third of the warming from greenhouse gases occurring today. According to the DOE and EPA Thursday of last week’s announcement builds on unprecedented action across the Biden Administration to dramatically cut methane pollution, with agencies taking nearly 100 actions in 2023 alone, including the finalization of an EPA rule that will yield an 80% reduction in methane emissions from covered oil and gas facilities they claim.

This funding from the Inflation Reduction Act—the largest climate investment (if you can call it an investment) in history – and the agencies claim will help mitigate legacy air pollution, create good jobs in the energy sector and disadvantaged communities, reduce waste and inefficiencies in U.S. oil and gas operations, and realize near-term emissions reductions, helping the United States reach Biden’s climate and clean air goals. We report you decide.

Sick about hearing about Electric Cars Problems? So Are We!

With an estimated 3 million electric cars cruising on American roads, an urgent warning on Friday of last week was made following multiple reports of drivers getting stuck inside the vehicles or locked out of them if an onboard battery dies. Becky Lebow says she and her daughter were driving a rented Tesla when a 12-volt battery powering the car’s electronics died, locking them inside. Unsure how to get out, they called a tow truck driver who didn’t know either. He had said he had never experienced that and he wasn’t sure how he was going to get us out. Alice Moran says it happened to her too on a 97-degree day in Palm Springs. If we had been on our way to Vegas, for example, that is a long, desolate stretch.

And even if you call 911, we might have been dead by the time they got there. The National Highway Traffic Safety Administration is now urging the owners of electric vehicles to familiarize themselves with the vehicle’s features. including the manual door release location, and immediately replace their 12-volt battery if they receive a low battery warning. Most electric vehicles have a main battery that powers the car and a smaller battery for onboard electronics, including the door release and windows. If that 12-volt battery dies, experts say neither will work. So if the power goes out while you’re inside, how do you get out? Well, in a Tesla, Model 3, look to the armrest to find the unmarked latch, push up, and you’re out. But, if you’re trying to get inside, that’s a different issue.

We now know that batteries for EV’s don’t work so well in the cold, but what about hot weather? A recent study from Recurrent found electric cars can lose up to 30% of total range in extremely hot weather.

Sal Mendoza-Santos is a parts and production manager at Speed Street Collison Center, an auto body shop in Lowell, North Carolina.

Mendoza-Santos said depending on geographic location and climate, extreme weather like heat can impact EVs.

He said there are things drivers can do to mitigate any possible issues during the hotter weather conditions.

“With summer and heat coming, you don’t want to start charging your vehicle in extreme high heat, “Mendoza-Santos said. “It will put wear and tear on your main battery. If you’ve got to charge it, do it at a place with shade, or if you can wait and do it at the end of the day at night to charge at home.”

Lease Bids

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 200, 30K Any Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 15, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website