“The only person who never makes a mistake is the person who never does anything.”

-Theodore Roosevelt.

Weekly Jobless Up Week over Week Unexpectedly

- Initial jobless claims unexpectedly rose last week despite an ongoing recovery in the U.S. employment market, the Labor Department reported Thursday of last Week.

- First-time filings for unemployment insurance for the week ended June 12 totaled 412,000, compared with the previous week’s 375,000. That was the highest number since May 15.

- Economists were expecting 360,000 new claims for last week.

- Continuing claims, were little changed at 3.52 million.

- All of the increase essentially came from two states – Pennsylvania saw a gain of 21,590, while California rose 15,712, according to data released.

Stocks down Friday of last week and down week over week

U.S. stocks finished out another volatile week lower, with the Dow and S&P 500 posting sharp weekly losses and the Nasdaq erasing its advance for the week on Friday of last week. The prospect of higher interest rates, run away inflation, a rising U.S. dollar, and a potential shift by the Fed weighed heavily on the market’s value stocks. The Dow closed lower on Friday of last week, down -533.37 (-1.58%) points closing out the week at 33,290.08, down -1,189.52 points week over week. The S&P 500 closed lower on Friday of last week, down -55.41 points (-1.31%) and closing out the week at 4,166.45, down -80.99 points week over week. The Nasdaq closed lower on Friday of last week, down -130.97 points (-0.92%) and closing out the week at 14,030.38, down -39.04 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 196 points.

Oil Rises Fourth Week in a row on the back of Demand Optimism

According to Goldman Sachs, strong U.S. demand growth is being passed on to Europe and emerging markets, where India is showing improvements. Global oil demand has hit 97 million barrels per oil per day recently, up from 95 million barrels per day from just a few weeks ago. Consumption before the pandemic stood at 100 million barrels per day, so we are almost there folks!

WTI crude oil rose on Friday of last week +$0.60 a barrel to settle at $71.64 a barrel, up +73 cents a barrel week over week. Brent crude oil for August delivery closed higher on Friday of last week gaining +$0.43 a barrel, and closing at $73.51, up $0.82 a barrel week over week.

U.S. commercial crude oil inventories decreased by 7.4 million barrels week over week. At 466.7 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

Total motor gasoline inventories increased by 2.0 million barrels week over week and are at par with the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased.

Distillate fuel inventories decreased by 1.0 million barrels week over week and are 6% below the five-year average for this time of year.

Propane/propylene inventories increased by 1.5 million barrels last week and are 13% below the five-year average for this time of year.

Total U.S. commercial petroleum inventories decreased by 4.6 million barrels last week.

U.S. crude oil imports averaged 6.7 million barrels per day last week, up by 108,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged about 6.3 million barrels per day, 5.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.1 million barrels per day, and distillate fuel imports averaged 371,000 barrels per day

U.S. crude oil refinery input averaged 16.3 million barrels per day during the week ending June 11, 2021, which was 412,000 barrels per day more than the previous week’s average. Refineries operated at 92.6% of their operable capacity last week. Gasoline production increased last week, averaging 9.9 million barrels per day. Distillate fuel production increased last week, averaging 5.1 million barrels per day

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $71.82, up 18 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 15.3% year over year in week 23 (U.S. +17.9%, Canada +9.3%, Mexico +5.4%) resulting in quarter to date volumes that are up 22.6% year over year and year to date volumes that are up 12.2% year over year (U.S. +13.7%, Canada +9.0%, Mexico +4.7%). 10 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+14.5%), coal (+35.5%), metallic ores & metals (+28.4%) and chemicals (+17.3%).

In the East, CSX’s total volumes were up 22.4%, with the largest increases coming from intermodal (+23.3%), coal (+63.4%) and chemicals (+17.0%). NS’s total volumes were up 17.6%, with the largest increases coming from intermodal (+11.4%), coal (+74.3%), metals & products (+67.5%) and chemicals (+21.7%).

In the West, BN’s total volumes were up 20.8%, with the largest increases coming from intermodal (+20.7%), coal (+24.7%), grain (+17.9%) and metallic ores (+320.2%). UP’s total volumes were up 14.0%, with the largest increases coming from intermodal (+13.5%), chemicals (+27.9%), coal (+19.2%) and motor vehicles & parts (+19.9%).

In Canada, CN’s total volumes were up 11.4%, with the largest increases coming from intermodal (+13.3%), coal (+73.3%), metallic ores (+13.7%) and chemicals (+17.5%). The largest decrease came from farm products (-70.9%). RTMs were up 11.0%. CP’s total volumes were up 14.8%, with the largest increases coming from intermodal (+18.9%) and coal (+38.3%). The largest decrease came from grain (-21.5%). RTMs were up 10.1%.

KCS’s total volumes were up 21.2%, with the largest increases coming from intermodal (+21.9%) and petroleum (+61.1%).

Source: Stephens

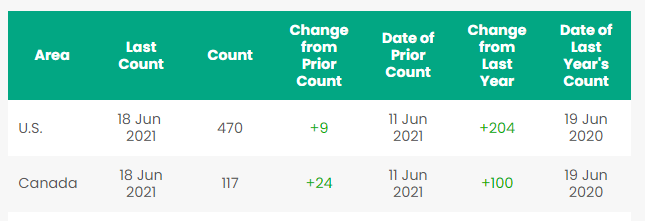

Rig Count

North American rig count is up by 33 rigs week over week. The U.S. was up by 9 rigs week over week and up by 204 rigs year over year. The U.S. currently has 470 active rigs. Canada’s rig count was up by 24 rigs week over week, and up by 100 rigs year over year and Canada’s overall rig count is 117 active rigs. Year over year we are up 304 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,285, from 23,410 a loss of 125 rail cars week over week. Canadian volumes were mixed – CP shipments declined by 7.4% while CN shipments were up by 3%. U.S. volumes were mostly lower. The CSX had the largest percentage increase, up by 8.7% and the BN had the largest percentage decrease down by 5.4%.

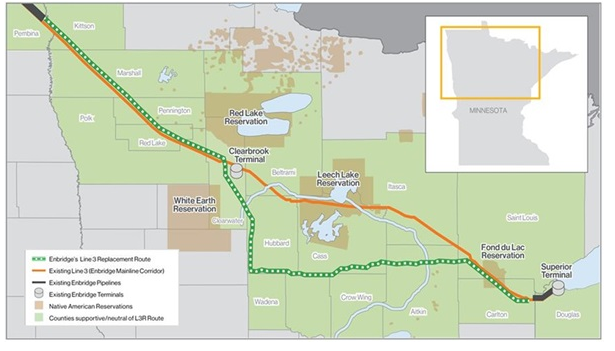

- Enbridge line 3 – Enbridge Inc. is months away from turning on the taps on the first meaningful new pipeline addition out of Canada in six years following a favorable court ruling in Minnesota. In a 2-1 decision on Monday of last week that pipeline opponents have promised to appeal, Minnesota Court of Appeals upheld Calgary-based Enbridge’s permits to build the 670,000-barrels-per-day Line 3 pipeline replacement across the state. The favorable decision means that Enbridge will avoid another delay in completing the project, which is now expected to be in service in the fourth quarter of this year. “These decisions were not made in a vacuum. Rather, they followed vigorous public debate,” Judge Lucinda Jesson wrote in the decision last Monday. Line 3 will result in 400,000 bpd of excess pipeline capacity out of Western Canada (See below disputed piece of pipe)

Final Line 3 Replacement Project route

As highlighted in last week’s rail report, Canadian oil supply is set to climb to a record high in the second half of 2021, The decision by Minnesota is fortuitous for the Canadian producer and the pipeline will be filled immediately upon completion a little bit of a headwind for crude by rail out of Canada for the time being.

Source: Enbridge - CN & KCS Merger update – A major rail union has asked the Surface Transportation Board to reject CN’s request for a voting trust for its merger with Kansas City Southern. Jeremy Ferguson, president of the International Association of Sheet Metal, Air, Rail, and Transportation Workers, Transportation Division, (SMART) said in a filing that the trust would harm employees of both railroads because of the amount of debt CN would take on, along with “the real possibility that the CN transaction would fail the regulatory test in the end.” Calling the merger anti-competitive because of route overlaps — specifically the parallel CN and KCS routes from the Midwest to New Orleans — Ferguson says the union expects “significant job losses on either CN or KCS because ultimately, the transaction would require either a sale or abandonment of duplicative rail lines.”

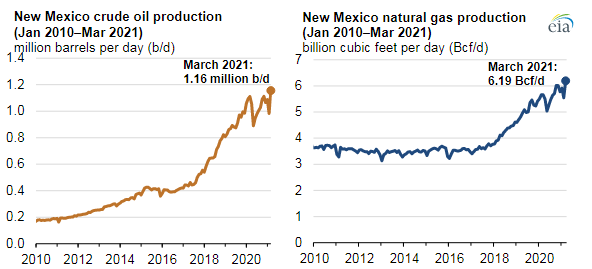

- New Mexico – According to the EIA, New Mexico had record-high production of crude oil and natural gas in March 2021, averaging 1.16 million barrels per day (b/d) of crude oil and 6.19 billion cubic feet per day (Bcf/d) of natural gas. New Mexico has now taken over North Dakota as the countries number 2 producer. We will see how long it lasts. Who would have thought! (See Chart below)

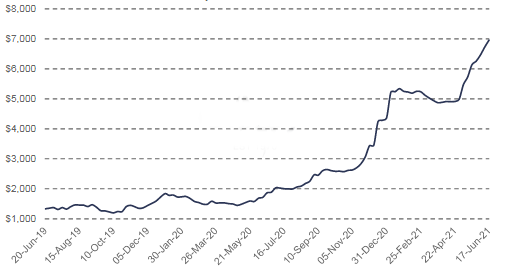

- Shipping costs have gone wild – Transporting a 40-foot steel container of cargo by sea from Shanghai to Rotterdam now costs a record $10,522, a whopping 547% higher than the seasonal average over the last five years, according to Drewy Shipping. Drewy’s index rose by 3.4% on Thursday of last week and costs are expected to accelerate. (See Chart)

World Container Index – Assessed by Drewy $ per 40 ft container

With upwards of 80% of all goods traded are transported by sea, freight-cost surges are threatening to boost the price of everything from toys, furniture, computers, coffee and other commodities. Then there is the cost of rail to get it to a location near you! Folks, we really don’t know how we are going to avoid inflation – maybe consumer spending will have to give, but that in turn will lead to a downturn in in the economy – it is a very complex situation we seem to find ourselves in right now and no one knows the answer – stay tuned to PFL as we will try to keep you as informed as we can.

Source: Drewy - Renewable Identification Numbers (RINS) have plummeted over the last two weeks after making all-time highs as the Biden administration signaled that they may provide relief for the countries refineries. RINS in a very busy session on Friday of last week did, however, close higher on short covering ahead of the weekend. Ethanol RINS (D6 RINS) closed out the day and the week at $1.43 per RIN, up 15 and ½ cents per RIN day over day but down 32 cents per RIN week over week. Biodiesel RINS (D4 RINS) closed out the day and the week at $1.52 per RIN, up 14 cents per RIN day over day, but down 34 cents per RIN week over week.

- Carbon Capture In The Oil Sands – Pembina Pipeline Corp. and TC Energy Corp. have announced a plan to develop a carbon transportation and sequestration system in Alberta last week. The companies say the project will form the backbone of Alberta’s carbon capture utilization and storage industry. It will be capable of transporting more than 20 million tons of carbon dioxide annually and can be expanded. Folks, we have always thought that it is better to capture the carbon instead of getting rid of oil – more to come on this one, but we like it!

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale and lease 3000-5800 CF 263 and 286 multiple locations negotiable

- 45 Boxcars 60ft Plate F’s Located in Tenn CSX – Lease Negotiable

New Mexico Crude Oil and Natural Gas Production

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

• 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

• 95 Double Plug Plate F Box Cars in Washington

• 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

• 8 Hoppers for plastic pellets wanted to purchase

• 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

• 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

• 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

• 10 6,300CF or greater covered hoppers needed in the Midwest.

• 10 PD cars for cement service for purchase.

• 20 17K tank cars for purchase. Must be food grade.

• 100 30k 117J/Rs or Jacketed 1232s needed in Chicago for refined products. For jet fuel looking for dirty to dirty service.

• 50-100 C/I food grade tank cars needed for veg oil in the Midwest for 1 year

• 50 3200-3600CF Open Top Hoppers. Need to Be aluminum body, interior bracing, and rivets. Needed on CP for 3-5 Years.

• 8 Gasoline Cars can be DOT 111s, 117R’s, or 117Js needed in Georgia.

PFL is offering:

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|