“Beware of false knowledge; it is more dangerous than ignorance.” George Bernard Shaw

Jobs Update

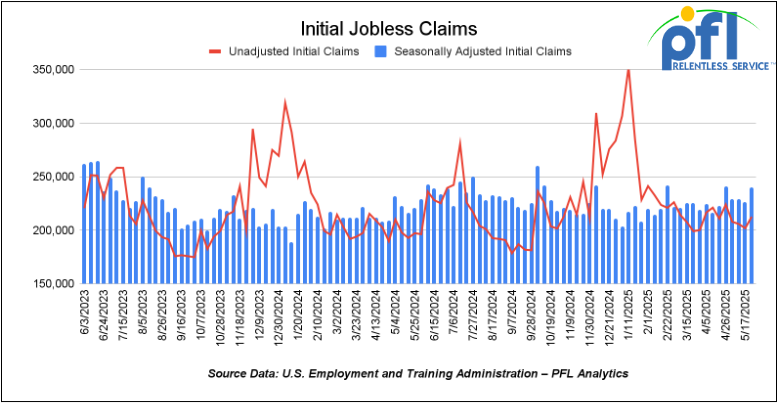

- Initial jobless claims seasonally adjusted for the week ending May 24 came in at 240,000, up 14,000 people week-over-week.

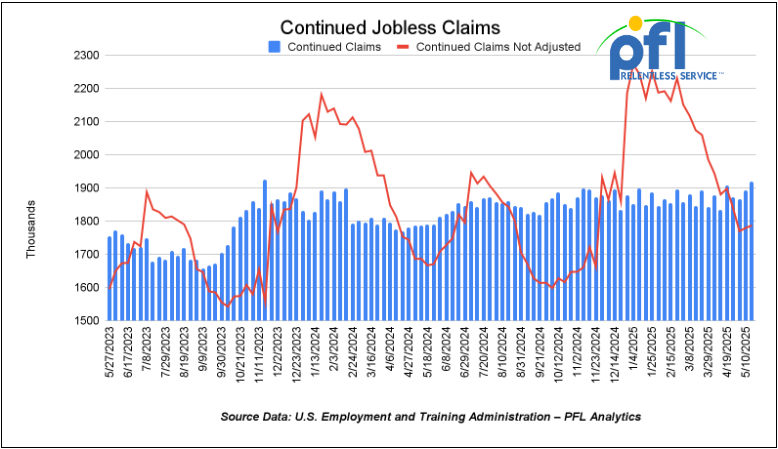

- Continuing jobless claims came in at 1.919 million people, versus the adjusted number of 1.893 million people from the week prior, up 26,000 people week-over-week.

Stocks closed lower on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 54.34 points (+0.13%) , closing out the week at 42,270.07, up 667 points week-over-week. The S&P 500 closed lower on Friday of last week, down -0.48 points, and closed out the week at 5,911.69 up 108.87 points week-over-week. The NASDAQ closed lower on Friday of last week, down -62.11 points, and closed out the week at 19,113.77, up 376.57 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 42,055 this morning down 239 points from Friday’s close.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -15 cents per barrel (-0.25%), to close at $60.79 per barrel on Friday of last week and down -74 cents per barrel week over week. Brent crude closed down –25 cents USD per barrel (-0.39%) on Friday of last week, to close at $63.90 per barrel down -68 cents per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled on Friday of last week at US$9.35 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$50.64 per barrel.

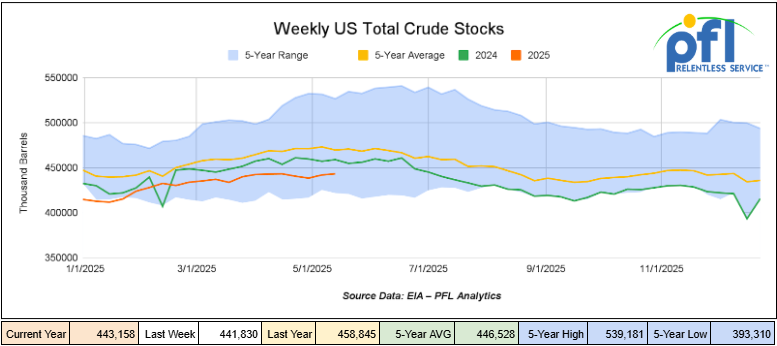

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.8 million barrels week-over-week. At 440.4 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

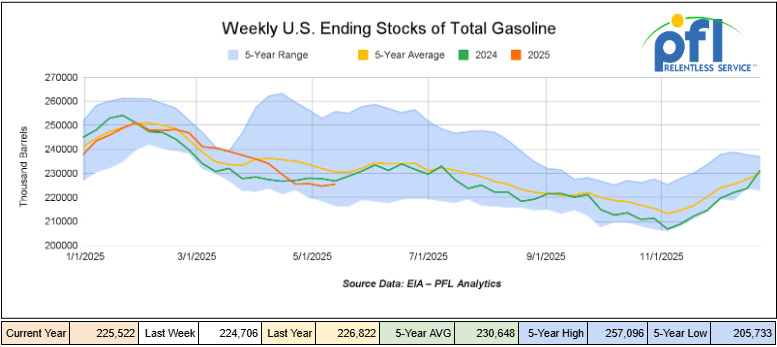

Total motor gasoline inventories decreased by 2.4 million barrels week-over-week and are 3% below the five-year average for this time of year.

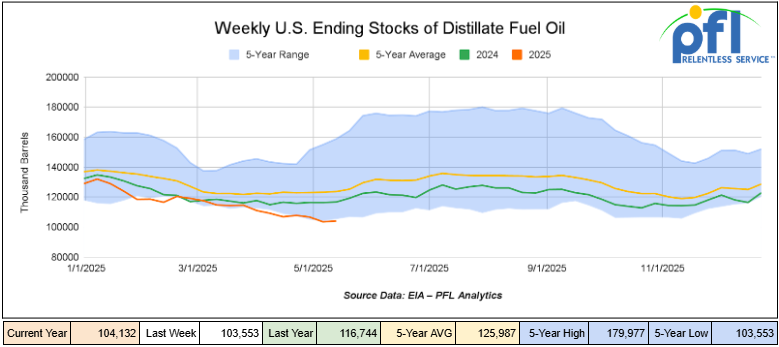

Distillate fuel inventories decreased by 700,000 barrels week-over-week and are 17% below the five-year average for this time of year.

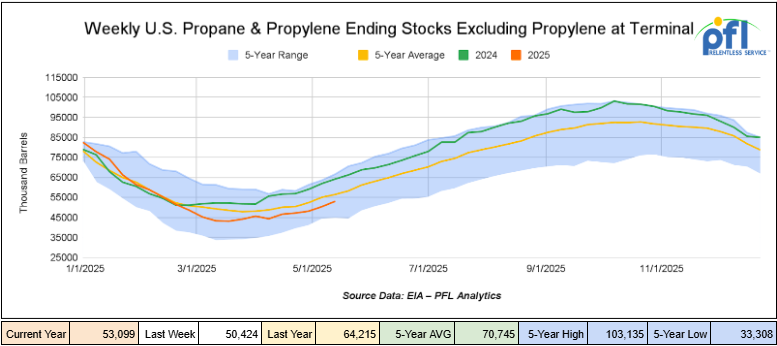

Propane/propylene inventories increased by 2 million barrels week-over-week and are 4% below the five-year average for this time of year.

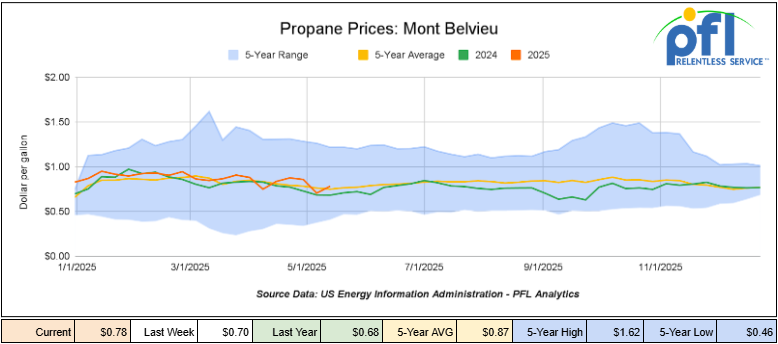

Propane prices closed at 77 cents per gallon on Friday of last week, down 1 cent per gallon week-over-week, but up 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 700,000 barrels during the week ending May 23, 2025.

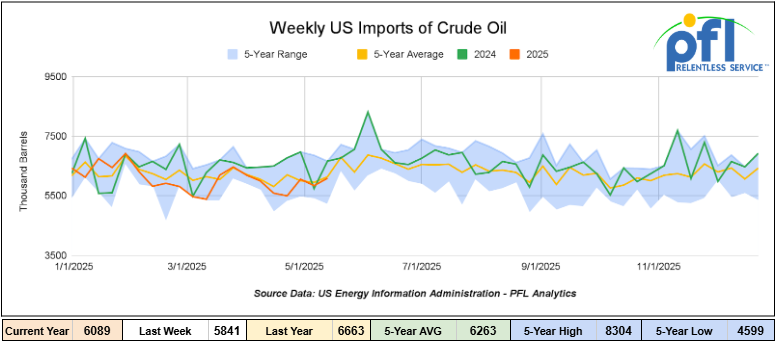

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending May 23, 2025, an increase of 262,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6 million barrels per day, 10.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 755,000 barrels per day, and distillate fuel imports averaged 114,000 barrels per day during the week ending May 23, 2025.

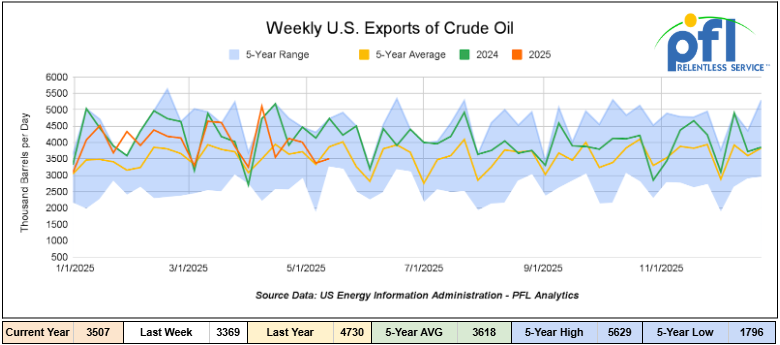

U.S. crude oil exports averaged 4.301 million barrels per day during the week ending May 23, 2025, an increase of 794,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.796 million barrels per day.

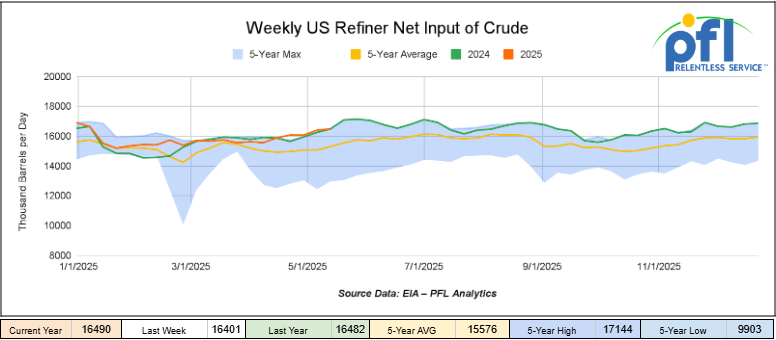

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending May 23, 2025, which was 162,000 barrels per day less week-over-week.

WTI is poised to open at $63.02, up $2.23 per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 28, 2025.

Total North American weekly rail volumes were down (-2.05%) in week 22, compared with the same week last year. Total carloads for the week ending on May 28 were 324,222, up (0.31%) compared with the same week in 2024, while weekly intermodal volume was 318,851, down (-4.33%) compared to the same week in 2024.

6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Forest Products, which was down (-16.95%), while the largest increase was from Coal, which was up (+12.07%).

In the East, CSX’s total volumes were down (-1.68%), with the largest decrease coming from Petroleum and Petroleum Products (-12.91%), while the largest increase came from Grain (+7.87%). NS’s volumes were up (+4.34%), with the largest increase coming from Coal (+24.83%), while the largest decrease came from Chemicals (-8.02%).

In the West, BN’s total volumes were down (-6.46%), with the largest increase coming from Motor Vehicles and Parts (+18.43%), while the largest decrease came from Coal (-19.65%). UP’s total rail volumes were up (+0.75%), with the largest increase coming from Coal (+24.47%), while the largest decrease came from Farm Products (-7.98%).

In Canada, CN’s total rail volumes were down (-4.42%) with the largest increase coming from Grain, up (+52.94%), while the largest decrease came from Intermodal Units (-30.88%). CPKCS’s rail volumes were down 16.75%, with the largest increase coming from Coal (+21.05%), while the largest decrease came from Forest Products (-66.58%)

Source Data: AAR – PFL Analytics

Rig Count

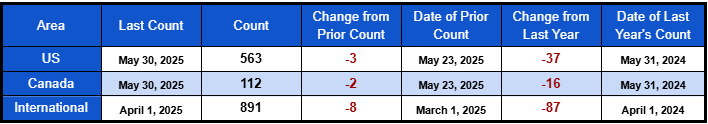

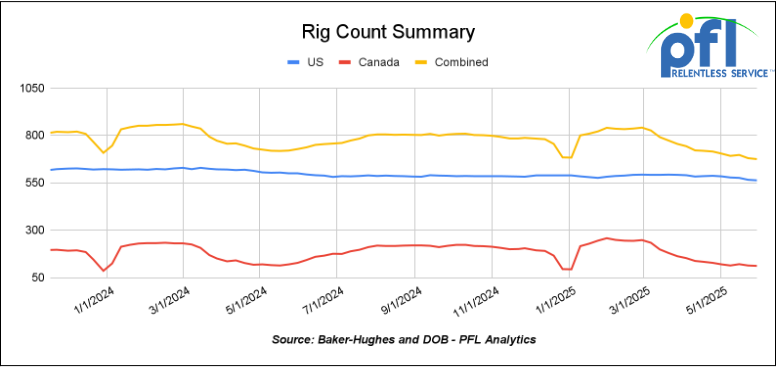

North American rig count was down by -5 rigs week-over-week. U.S. rig count was down -3 rigs week over week and down by -37 rigs year-over-year. The U.S. currently has 563 active rigs. Canada’s rig count down -2 rigs week-over-week and down by -16 rigs year-over-year. Canada currently has 112 active rigs. Overall, year-over-year, we are down by -53 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,395 from 27,255 which was an increase of +140 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were lower by -11.0% week over week, CN’s volumes were higher by +3.0% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +15.0%. The CSX was the sole decliner and was down by -6.0%

We Watching are New York and Natural Gas – is the tide turning?

Is New York considering expanding much needed pipeline infrastructure?

Two long-stalled natural gas pipeline projects in New York may soon be back on the table. Pipeline developer Williams Companies is preparing to resubmit permit applications to federal regulators for the Constitution and Northeast Supply Enhancement (NESE) pipelines, according to sources familiar with the situation.

This move aligns with President Trump’s broader push to bolster fossil fuel infrastructure and roll back initiatives focused on renewable energy that were championed by the previous administration.

The Constitution Pipeline, originally proposed in 2012, was designed to carry natural gas 124 miles from the Appalachian shale fields into New York and New England. Despite sitting near one of the world’s most productive gas reserves, the Northeast faces some of the country’s highest energy costs due to a lack of pipeline infrastructure. The project was scrapped in 2020 after New York State denied a critical water-quality permit, following years of legal disputes.

Williams plans to revive the Northeast Supply Enhancement (NESE) project, which would expand its existing pipeline system under New York Harbor. The company halted work on NESE in 2023 after nearly a decade of delays.

In a March interview, Williams’ CEO, Alan Armstrong, expressed hesitation about restarting the Constitution project without clear state support. “We’re not going to stick our necks out again unless the path is made crystal clear,” he said.

NY Governor Hochul’s office maintains that no specific deal was made with Trump regarding the pipelines. However, her administration has taken a more flexible stance on natural gas than that of the previous administration. Earlier this year, New York approved an expansion of an existing gas pipeline—a move seen as a softening of the state’s stance on fossil fuel infrastructure.

Governor Hochul’s speaking about a wind project recently, emphasized the need to balance legal compliance with affordability and energy reliability for consumers. While she didn’t mention pipelines, Trump officials and energy executives interpreted her comments as a signal of openness to increasing pipeline capacity. Burgum echoed this sentiment online, praising Hochul’s “willingness to move forward on critical pipeline capacity.”

Increased pipeline capacity in the Northeast will lead to more gas production in the region along with associated LPGs, which would great for rail.

We are watching GATX

Folks, we’re watching another shake-up in the North American rail landscape and it’s a big one.

On May 29, 2025, Wells Fargo signed a deal to offload its $4.4 billion rail equipment leasing portfolio. The buyer? A new joint venture between rail leasing heavyweight GATX Corporation and infrastructure investment giant Brookfield Infrastructure. This is a massive handoff—one that could reshape the leasing market across North America.

The Deal, At a Glance – Here’s what’s moving:

Wells Fargo is exiting the rail game entirely. That means around 105,000 railcars under operating leases and 23,000 railcars and 440 locomotives under finance leases are changing hands.

Brookfield will take over the finance lease portion directly. GATX and Brookfield will split the operating lease assets through a JV—70% Brookfield, 30% GATX to start, with GATX managing all commercial and operational activities. They also have the option to take full ownership down the line.

The deal is expected to close in Q1 2026. Wells Fargo says this is part of a broader strategy to simplify and focus on core services. EVP David Marks said the deal helps the company “focus on products and services that are core to our clients.” In other words: rail leasing no longer makes the cut.

This wasn’t a distressed sale. This was a power handoff, and it sets the stage for growth under new leadership.

What This Means for the Rail World:

For GATX, it’s a natural expansion of their dominant role in the railcar leasing space. With Brookfield’s backing, GATX gains access to new capital and the ability to grow at scale. For Brookfield, it’s another strategic play in hard infrastructure—adding reliable, income-generating assets to their portfolio.

If you’re a shipper with Wells Fargo-leased assets, now’s the time to pay attention. Lease terms, pricing, and asset repositioning strategies could shift under the new ownership.

PFL’s Take:

At PFL, we’re watching this closely. This is a huge shift in leasing capacity—and with it comes opportunity. If you’re considering new lease arrangements, evaluating storage options, or wondering how this change might affect your footprint—we’re here to help.

The Bottom Line:

This May 29th announcement is a strategic retreat by Wells Fargo and a bold forward move by GATX and Brookfield. Big players are consolidating—make sure you’re aligned with a partner who can keep you moving, no matter how the tides shift.

We are watching the U.S. Supreme Court

It was a busy and endless news day for positive rail developments on Friday of last week. In other rail news, the U.S. Supreme Court ruled on Friday of last week that federal agencies are not required under the National Environmental Policy Act (NEPA) to evaluate environmental impacts of projects that are outside their direct regulatory purview. The 8–0 decision clears the path for the 88-mile Uinta Basin Railway project in Utah, which will facilitate the transportation of up to 350,000 barrels of crude oil per day from the Uinta Basin to national markets. The Surface Transportation Board (STB) had initially approved the project, but a lower court vacated that decision, arguing that the environmental review failed to account for the broader impacts of increased oil drilling and downstream emissions. The Supreme Court disagreed, finding the STB’s focus on the direct effects of the rail line sufficient under NEPA.

This ruling marks a significant shift in how environmental reviews may be conducted for major infrastructure projects going forward. By narrowing the scope of what agencies must consider under NEPA, the Court’s decision may accelerate fossil fuel and transportation developments by sidestepping analysis of indirect or cumulative environmental effects, such as greenhouse gas emissions or ecological disruptions in neighboring states. Environmental groups and 15 states, including Colorado, opposed the project, citing risks to air quality, water resources, and the Colorado River watershed. Nonetheless, the ruling establishes a precedent that could limit legal challenges to similar projects in the future, reshaping the regulatory landscape for federal infrastructure approvals.

We are watching Canadian National Railway

Canadian National Railway (CN) has announced a substantial investment of C$765 million in 2025 to enhance its rail infrastructure in Quebec and Saskatchewan. In Quebec, CN is allocating C$475 million toward track maintenance and infrastructure upgrades, with a particular focus on improving operational efficiency at the Taschereau rail yard in Dorval. This investment aims to bolster the reliability and capacity of the rail network, facilitating the efficient movement of goods. In Saskatchewan, CN plans to invest C$290 million to support sustainable growth and meet the evolving demands of the freight transportation sector, particularly concerning essential commodities such as grain and fertilizers.

In addition to these infrastructure investments, CN reported positive performance metrics for the week ending May 24, 2025. The company experienced a 0.8% year-over-year increase in carloads and a 3.3% rise in revenue ton-miles (RTMs), indicating a steady growth in freight volume and operational efficiency. These figures reflect CN’s commitment to enhancing its service capabilities and supporting the broader economic landscape through strategic investments and operational improvements.

We are Watching Economic Indicators

Consumer Spending

In April 2025, total consumer spending adjusted for inflation rose by 0.2% over March 2025, a slowdown from the 0.7% gain in March and the 0.4% increase in February. This deceleration reflects growing caution among households amid tariff-related economic uncertainty. According to the U.S. Bureau of Economic Analysis, the increase in current-dollar personal consumption expenditures (PCE) was $47.8 billion, driven by a $55.8 billion rise in services spending, partially offset by an $8.0 billion decline in goods spending.

The personal saving rate climbed to 4.9% in April, up from 3.9% in March, reaching its highest level in a year. This increase suggests that consumers are opting to save more amid economic uncertainties.

Year-over-year, the PCE price index rose by 2.1%, down from 2.3% in March, indicating continued moderation in consumer inflation.

Consumer Confidence

The Conference Board’s Index of Consumer Confidence increased to 98 in May 2025, up from 85.7 in April.

The University of Michigan’s Index of Consumer Sentiment increased to 52.2 in April, up from 50.8 in April.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 30-50, 6000cf Steel Hoppers needed off of CSX or NS in East for 5 Year. Cars are needed for use in petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

- 20, 28.3K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

- 10, 30, 117R Tanks located off of CN in Wisconsin. Cars were last used in Gasoline. Multiyear

- 33, 30, 117R Tanks located off of UP in Gulf. Cars are clean Multiyear

- 50, 30, 117R Tanks located off of UP in Gulf. Cars were last used in Diesel. Multiyear

- 120, 29.8K, 117R/117J Tanks located off of CPKC in MN. Cars were last used in Ethanol.

- 50, 20K, DOT 111 Tanks located off of UP or BN in Wichita Falls, TX. Cars were last used in HCL.

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website