“You must take action now that will move you towards your goals. Develop a sense of urgency in your life.”

H. Jackson Brown, Jr.

Jobs Update

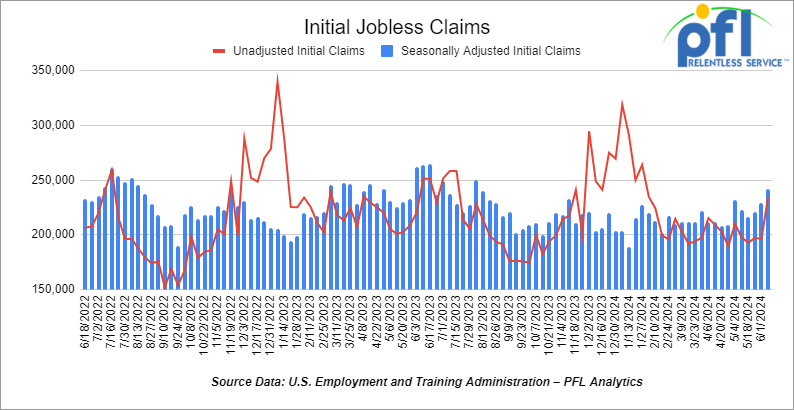

- Initial jobless claims seasonally adjusted for the week ending June 8th, 2024 came in at 242,000, up 13,000 people week-over-week.

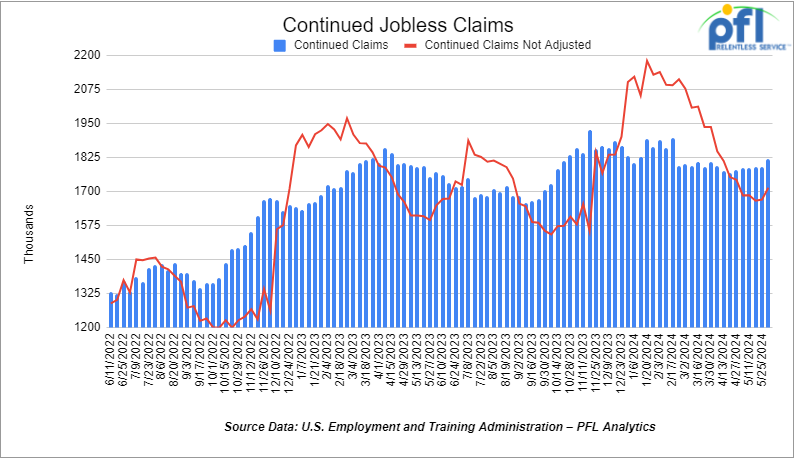

- Continuing jobless claims came in at 1.82 million people, versus the adjusted number of 1.79 million people from the week prior, up 30,000 people week-over-week.

Stocks closed mixed on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -57.94 points (-0.15%), closing out the week at 38,589.16, down -209.83 points week-over-week. The S&P 500 closed lower on Friday of last week, down -2.14 points (-0.04%), and closed out the week at 5,431.6, up 84.69 points week-over-week. The NASDAQ closed higher on Friday of last week, up 21.32 points (0.12%), and closed out the week at 17,688.88 up 555.75 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,514 this morning down 91 points.

Crude oil closed lower on Friday of last week and higher week over week.

WTI traded lower -$0.17 per barrel (-0.22%) on Friday of last week, to close at $78.45 per barrel, up $2.92 per barrel week-over-week. Brent traded down -US$0.13 per barrel (-0.16%) to close at US$82.62 per barrel on Friday of last week, up US$3 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled Friday at US$14.75 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$63.70 per barrel.

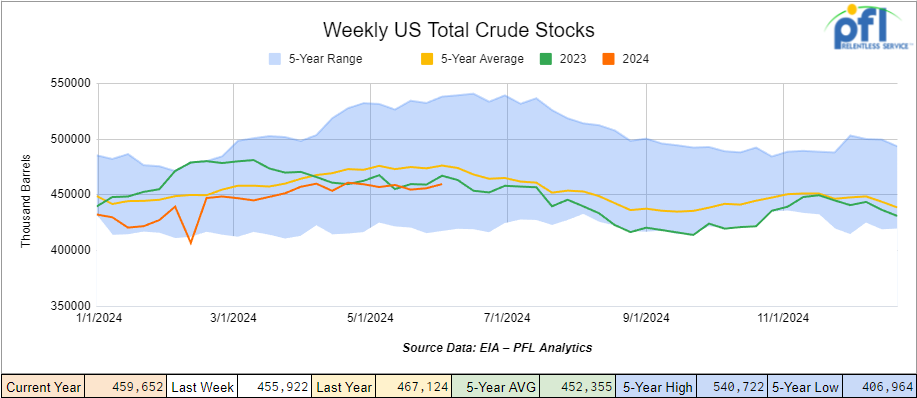

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.7 million barrels week over week. At 459.7 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

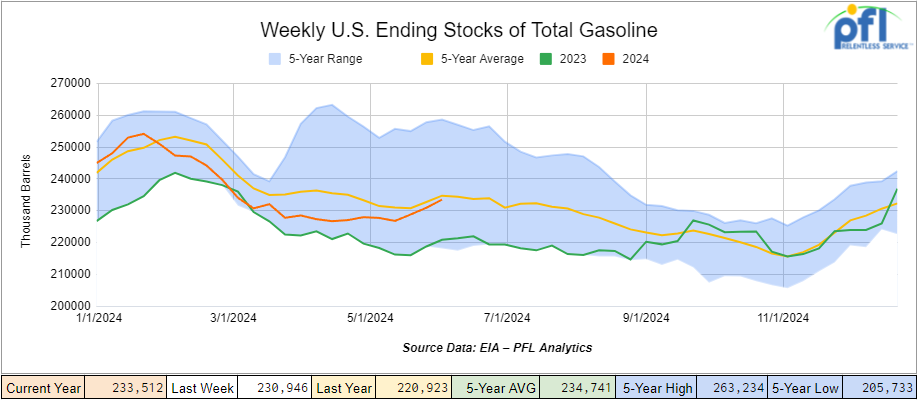

Total motor gasoline inventories increased by 2.6 million barrels week-over-week and are slightly below the five-year average for this time of year.

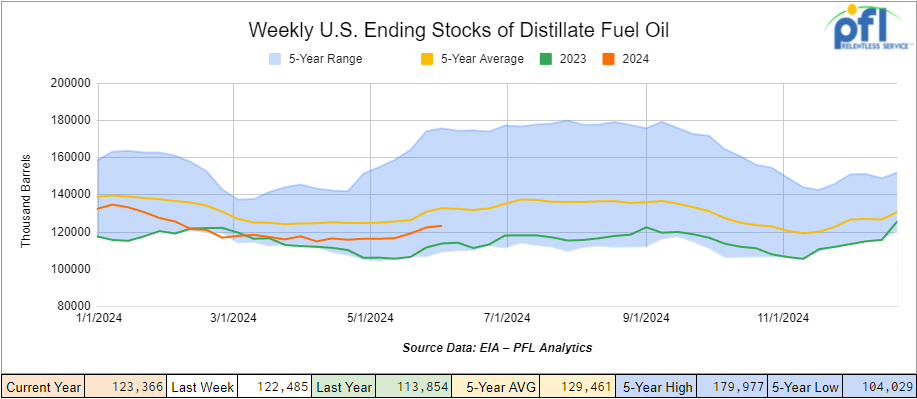

Distillate fuel inventories increased by 900,000 barrels week-over-week and are 7% below the five-year average for this time of year.

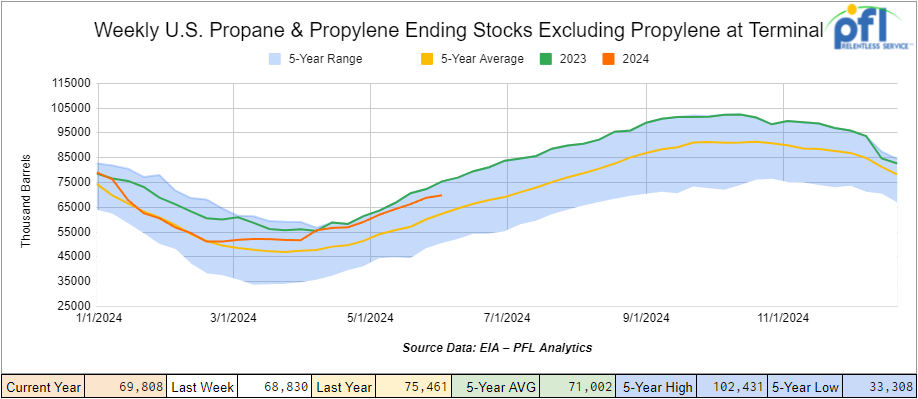

Propane/propylene inventories increased by 1 million barrels week-over-week and are 11% above the five-year average for this time of year.

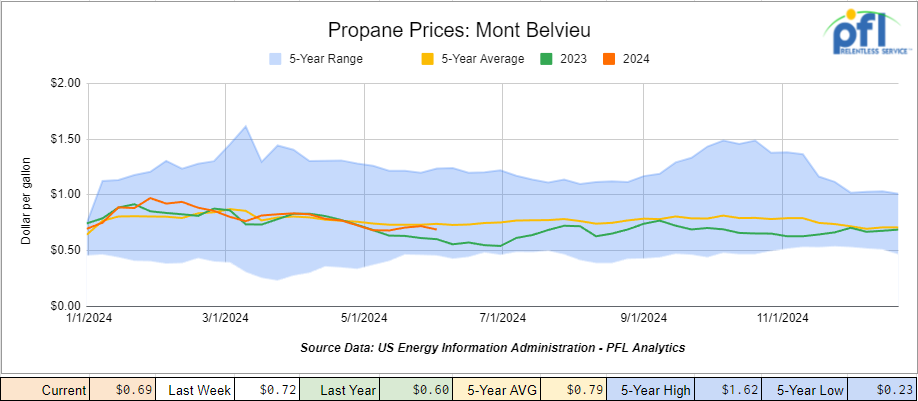

Propane prices closed at 69 cents per gallon, down 2 cents week-over-week, and up 9 cents year-over-year

Overall, total commercial petroleum inventories increased by 11.5 million barrels, during the week ending June 7th, 2024.

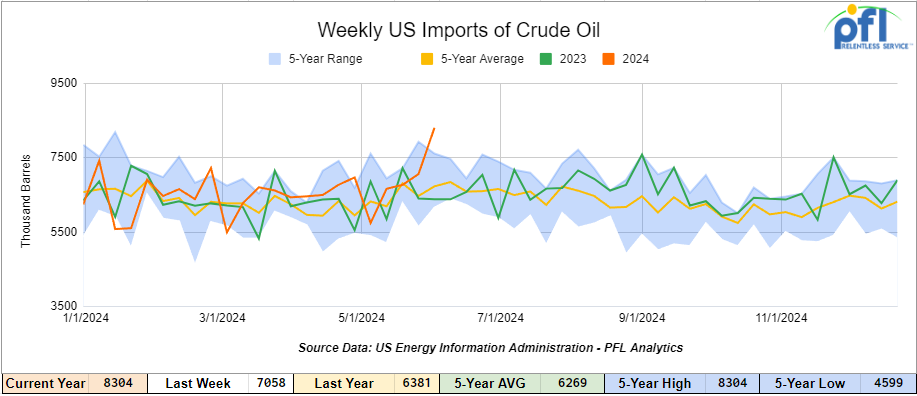

U.S. crude oil imports averaged 8.3 million barrels per day during the week ending June 7th, 2024, an increase of 1.2 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 7.2 million barrels per day, 11.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 912,000 barrels per day, and distillate fuel imports averaged 91,000 barrels per day, during the week ending June 7th, 2024.

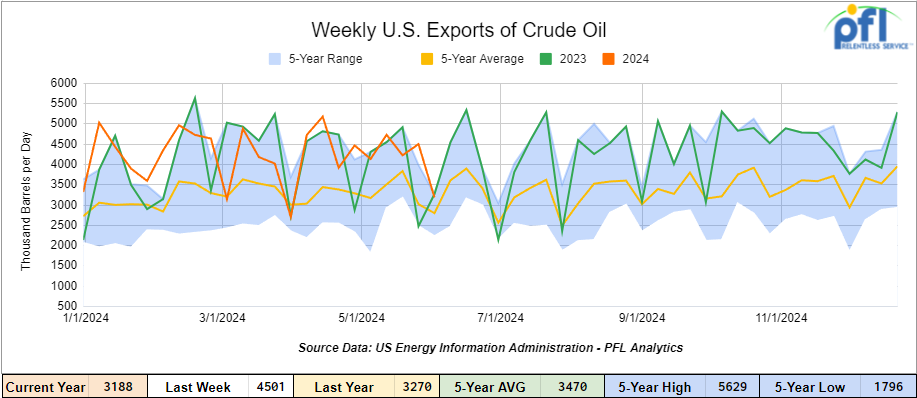

U.S. crude oil exports averaged 3.188 million barrels per day for the week ending June 7th, 2024, a decrease of 1.313 million per day week-over-week. Over the past four weeks, crude oil exports averaged 4.161 million barrels per day.

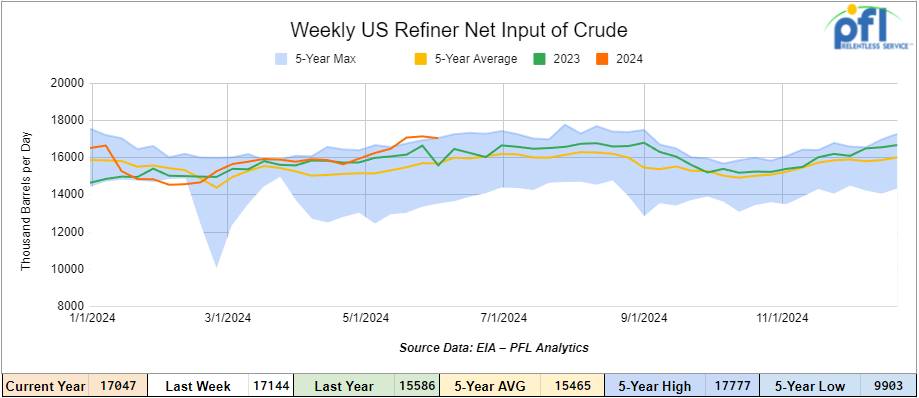

U.S. crude oil refinery inputs averaged 17 million barrels per day during the week ending June 7, 2024, which was 98,000 barrels per day less week-over-week.

WTI is poised to open at $78.36, down 9 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending June 12th, 2024.

Total North American weekly rail volumes were up (3.72%) in week 24, compared with the same week last year. Total carloads for the week ending on June 12th were 338,635, down (-2.02%) compared with the same week in 2023, while weekly intermodal volume was 337,779, up (+10.2%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-13.53%). The most significant increase came from Intermodal which was up (+10.2%).

In the East, CSX’s total volumes were up (2.84%), with the largest decrease coming from Other (-8.9%) while the largest increase came from Petroleum and Petroleum Products (17.44%). NS’s volumes were up (5.61%), with the largest increase coming from Chemical (+10.99%) while the largest decrease came from Grain (-28.58%).

In the West, BN’s total volumes were up (9.02%), with the largest increase coming from Grain (47.57%) while the largest decrease came from Coal, down (-26.47%). UP’s total rail volumes were up (2.66%) with the largest decrease coming from Nonmetallic Minerals, down (-23.3%) while the largest increase came from Petroleum and Petroleum Products which was up (+26.56%).

In Canada, CN’s total rail volumes were down (3.87%) with the largest decrease coming from Grain, down (-24.45%) while the largest increase came from Nonmetallic Minerals, up (+51.45%). CP’s total rail volumes were down (-9.96%) with the largest increase coming from Other (+15.38%) while the largest decrease came from Forest Products, down (-32.43%).KCS’s total rail volumes were down (-9.41%) with the largest decrease coming from Intermodal (-26.35%) and the largest increase coming from Motor Vehicles and Parts (+32.39%).

Source Data: AAR – PFL Analytics

Rig Count

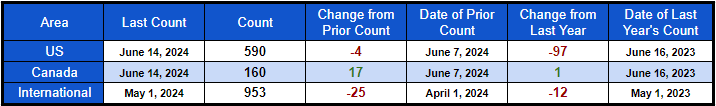

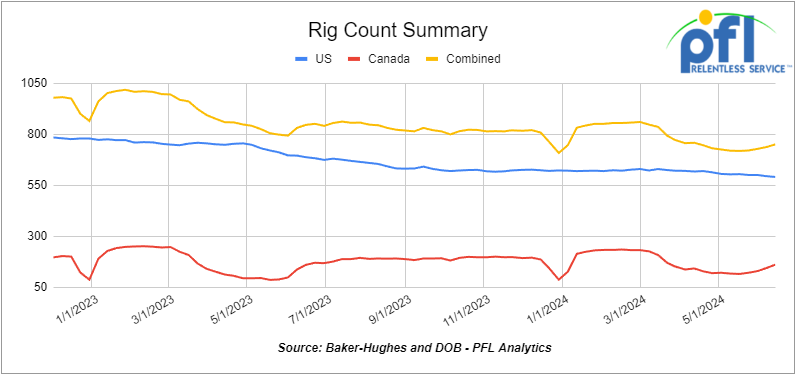

North American rig count was up by 13 rigs week-over-week. U.S. rig count was down by 4 rigs week-over-week, and down by -97 rigs year-over-year. The U.S. currently has 590 active rigs. Canada’s rig count was up by 17 rigs week-over-week, and up by 17 rigs year-over-year. Canada’s overall rig count is 160 active rigs. Overall, year-over-year, we are down -96 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We Continue to Watch Potential Rail Strikes in Canada

Members of a Canadian rail workers union will vote again on whether to authorize a strike at the CN and CPKC that could disrupt commodity deliveries across North America. The Teamsters Rail Conference (TCRC) has been meeting with the two railroads to replace 3 contracts that expired at the end of last year.

After voting for a strike, the Canadian Industrial Relations Board (CIRB) intervened to determine if rail deliveries of critical commodities such as propane need to continue if a strike were to occur. The board is not expected to release a decision until June 15th. In the meantime, TCRC members will vote again between June 14th to June 29th whether or not to strike. The start date for a possible strike is unclear. Stay tuned to PFL we are watching this one closely.

We are Watching Baltimore – Open for Business

The main ship channel to the Port of Baltimore has been fully cleared of debris and was reopened on Monday of last week, 11 weeks after a cargo ship lost power and struck the Francis Scott Key Bridge.

“We’ve cleared the Fort McHenry Federal Channel for safe transit,” Col. Estee Pinchasin, Baltimore District commander for the U.S. Army Corps of Engineers, said in a news release.

The ship channel was restored to its original operational dimensions of 700 feet wide and 50 feet deep for cargo ships through the port.

In May, federal investigators released a report that said the ship went through multiple power failures before colliding with the bridge. Great for rail – rail activity is back to normal.

We are Watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,749 from 27,866, which was a loss of -117 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments rose by +11.4% week over week, CN’s volumes were higher by +1.3% week-over-week. U.S. shipments were mostly higher. The UP had the largest percentage increase and was up by 29.2%. The BN was the sole decliner and was down by -3.8%

We Continue to Watch Trans Mountain Pipeline

Twenty-two oil tankers are scheduled to load this month in Vancouver with crude from the expanded Trans Mountain pipeline, which is running 80% full with a “little bit” of spot capacity also being used, a Trans Mountain executive said on Wednesday of last week. Six weeks after the project started commercial operations, Trans Mountain Corporation’s chief financial and strategy officer Mark Maki said so far the system is operating as expected and final costs for the expansion are not expected to rise significantly.

Trans Mountain expansion, which tripled pipeline capacity from Alberta to Canada’s Pacific Coast to 890,000 barrels, started commercial operations on May 1 and traders are closely watching flows to gauge demand. Eighty per cent, or 707,000 barrels per day, of the pipeline’s capacity is reserved for long-term contracted shippers, while the remaining 20 per cent is available for spot barrels. Canadian Producers are coming to the table and expected to see production increases by 275,000 barrels a day in 2024.

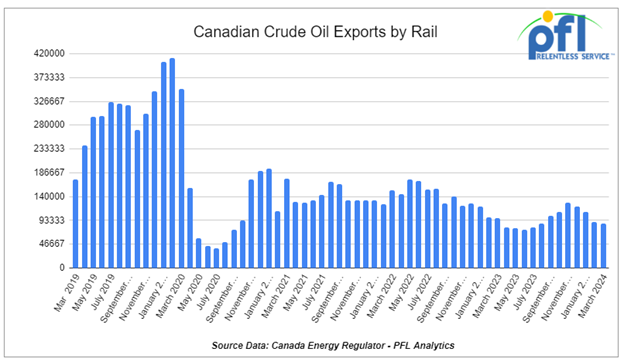

On the back of Trans Mountains operations, crude by rail numbers have been lower after peaking at over 400,000 barrels per day they have dropped substantially to 77,000 barrels per day and expected to hover somewhere near 60,000 – 70,000 barrels per day until capacity gets tight once again which may be sooner than once thought. Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines, raw bitumen shipped as a non-haz product and not able to flow in pipelines and are competitive with pipeline tolls. Other factors that lead to “an always” crude by rail market out of Canada are existing long term contractual commitments and basis. To that end , we really need to see basis the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense for the commercial trader.

Trans Mountain pipeline is owned by the Canadian government, which has been criticized for the cost of the expansion ballooning to nearly five times its 2017 budget estimate. The final cost of the project was CAD$34 billion.

We are watching The Mountain Valley Pipeline

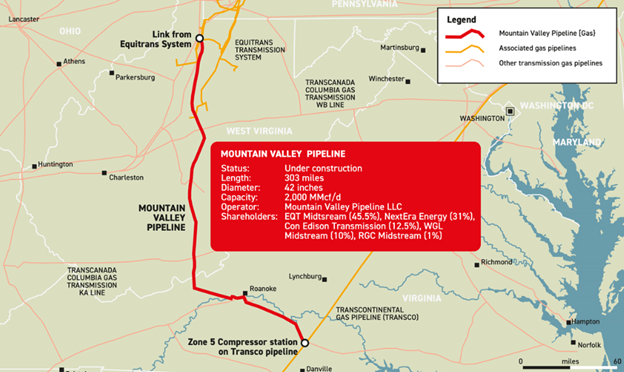

In a good news story for the American people, Equitrans Midstream Corp. has placed into service the 303-mile Mountain Valley natural gas pipeline (MVP) on June 14 after satisfying all applicable legal and regulatory requirements and receiving all remaining approvals from the US Federal Energy Regulatory Commission.

MVP is now available for interruptible or short-term firm transportation service until long-term firm capacity obligations begin on July 1, 2024.

MVP runs from Wetzel County, WV, to an interconnect with Transcontinental Gas Pipeline Co.at the latter’s Compressor Station 165 in Pittsylvania County, Va. The 2-bcfd underground pipeline was originally scheduled to begin operations in 2018, but had been delayed repeatedly by litigation that doubled the project costs to $7.85 billion.

Mountain Valley Pipeline

Source – Global Energy Infrastructure – PFL Analytics

We are Watching Renewables

According to an International Agricultural Trade (“IAT”) report released by the USDA last week, the recent swell of US renewable diesel (“RD”) production has dramatically impacted global feedstock trading.

Based on EIA production data provided for the IAT report, RD production climbed from 1 billion gallons annually in 2021 to roughly 2.5 billion gallons in 2023 and continues to climb as refiners here in the U.S. continue to add capacity aggressively.

The U.S. has expanded imports of animal fats and vegetable oils for use as feedstocks for RD production and to backfill other feedstocks like soybean oil that have been diverted to RD production. The IAT report showed an expectation of RD production growing and altering feedstock markets, with production growth highly contingent upon federal and state policies and feedstock availability.

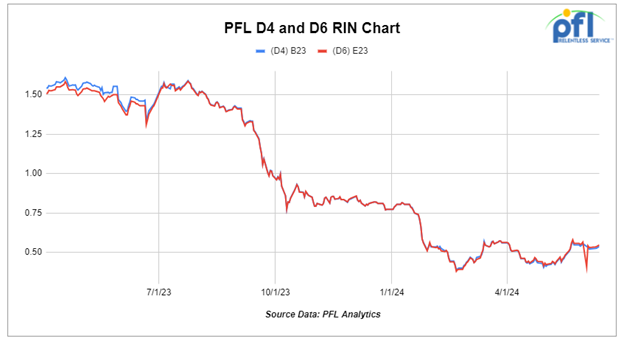

Why so much growth you ask? Well it is all linked to government incentives. Two federal policies incentivize RD and biodiesel production and they are the Blender’s Tax Credit and the Renewable Fuel Standard (D4 RINS are generated by making renewable diesel that can be sold to obligated parties).

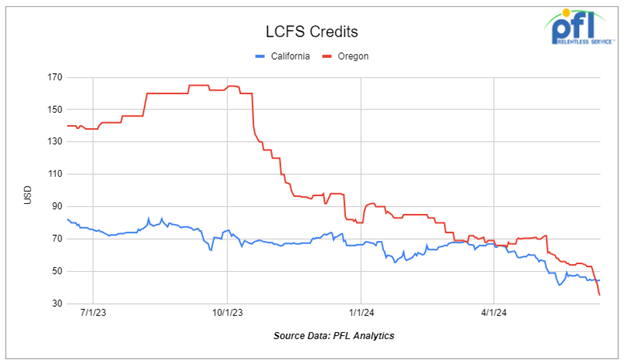

The California Low Carbon Fuel Standard (LCFS credits are generated by making renewable diesel that can be sold to obligated parties) is the driver for RD expansion by creating a financial incentive to direct RD volumes to the state of California. According to the report, California RD consumption doubled between 2020 and 2023, with biomass-based diesel accounting for roughly 60% of the state’s diesel pool compared to the rest of the U.S. hovering in the low single digits.

As the largest-consuming and fastest-growing state, California plays a significant role in the accelerated build of RD capacity and production. Other states have similar incentives, including Oregon. The problem is that the more production that is added, the lower the incentives go and RINS and Credits have been falling hard making the economics of making the fuel less attractive. See charts below:

The increase of U.S. imports of animal fats and vegetable oils is linked to the growth of RD capacity and production, spurred by demand for those feedstocks. In December 2022, EPA announced that canola oil meets the RFS requirements for use as a RD feedstock, resulting in canola oil imports surging to record levels. The U.S. moved from accounting for 50-60% of Canadian canola oil exports to 91% in 2023. Canada announced plans to expand crush capacities in the next several years.

U.S. import values for animal fats and vegetable oils more than doubled from 2020 to 2023, according to the report. Used cooking oil imports from China more than tripled in 2023. The relationship between U.S. imports of animal fats and vegetable oils should develop in lockstep with biomass-based diesel production, with an additional policy boost coming in January 2025 when the federal government transitions from a blender’s credit to a producer’s credit. That will shift the tax credit only to biomass-based diesel produced in the U.S., further driving the demand for imports of fats and oils to U.S. refineries incentivized to produce biofuels domestically.

At the end of the day, RD production will balance out – cost of equipment is expensive, government incentives should continue to fall and demand for imported feed stocks will cause the price of those feed stocks to rise. We will see a sweet spot at some point in what is becoming a competitive landscape. Rail has benefited dramatically from RD production shipping tallow and other oils from the midwest to RD production facilities scattered across the U.S.

Lease Bids

- 20, 4750’s Through Hatch Covered Hoppers needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 200, 30K Any Tanks needed off of UP or BN in Texas for RD. Cars are needed for use in Dirty service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, Covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year+

- 53, 2 containers, Flats Double-stack rail transports located off of KCS in Texas. Cars are clean Lease or sell. (Intermodal Container)

- 15, 33K, 340W Pressure Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 5, 25.5K, DOT 111 Tanks located off of UP in Kansas. Cars were last used in Veg Oils. 2 Year Term

Sales Offers

- 24, 5300CF, Plate C Boxcars located off of NS or CSX in Southeast.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website