“When you arise in the morning, give thanks for the food and for the joy of living. If you see no reason for giving thanks, the fault lies only in yourself.”

–Tecumseh

Jobs Update

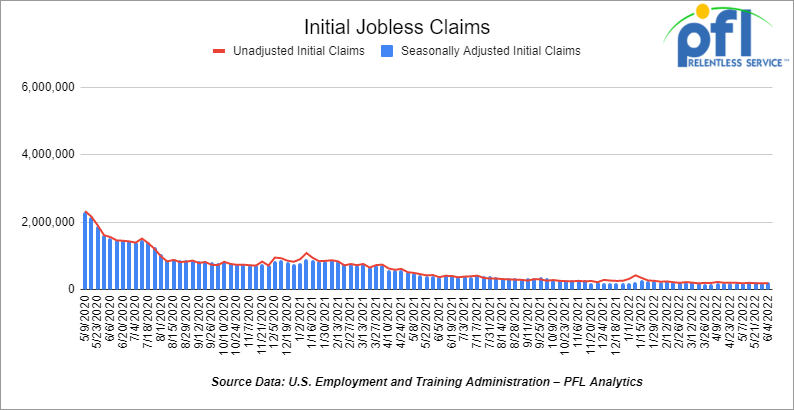

- Initial jobless claims for the week ending June 4th, 2022 came in at 229,000, down 27,000 people week-over-week.

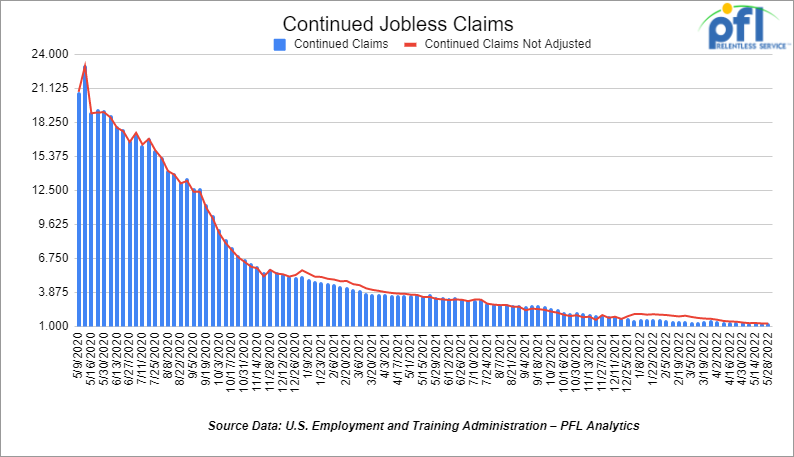

- Continuing claims came in at 1.306 million people, versus the adjusted number of 1.306 million people from the week prior, flat week-over-week.

Stock market down day over day and week over week

The stock market closed the week on a sour note after U.S. inflation accelerated to a fresh 40-year high and consumer sentiment plunged to a record low. Friday’s selloff was broad, with all 30 Dow stocks closing lower and decliners outnumbering advancers on the New York Stock Exchange by 8 to 1. The hot inflation numbers, which showed inflation soaring to 8.6% on an annualized rate, sparked heightened concerns about a recession and more aggressive interest rate policy from the Federal Reserve starting at this week’s meeting. The 2-year Treasury yield, considered highly sensitive to Fed rate hikes, spiked 22 basis points to 3.04%, its highest level since 2008. For the week, it was the worst showing for stocks since January, with the Dow diving 4.6%, the S&P 500 shedding 5%, and the Nasdaq Composite 5.6%.

In overnight trading, DOW futures traded lower and are expected to open at 30,823 this morning down -565 points.

Oil falls as U.S. inflation data surges, China imposes new lockdowns

It was a little bit of a blood bath on Friday of last week, folks. For the day, oil prices sank along with stocks after news that U.S. consumer prices accelerated in May more than expected. Gasoline prices have hit a record high ($5.00 per gallon- a price never seen before) and the cost of food has soared, leading to the largest annual increase in 40 years.

Oil prices fell on Friday of last week after U.S. consumer prices rose and China imposed new COVID-19 lockdown measures – when are they going to learn that lockdowns really don’t work all that well and are ineffective over the long term.

West Texas Intermediate (WTI) crude fell 84 cents to settle at US$120.67 per barrel. Brent crude fell $1.06 to settle at US$122.01 per barrel

Both WTI and Brent still posted weekly gains, 1.9 percent for Brent and 1.5 percent for WTI.

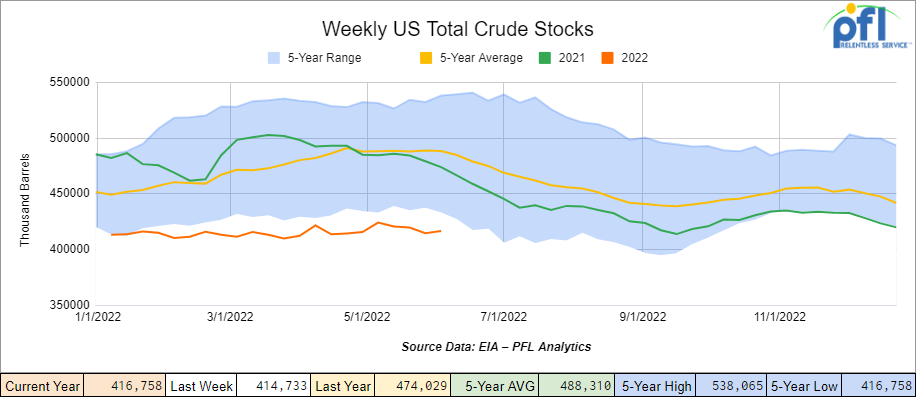

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by +2.0 million barrels week over week. At 416.8 million barrels, U.S. crude oil inventories are 15% below the five-year average for this time of year.

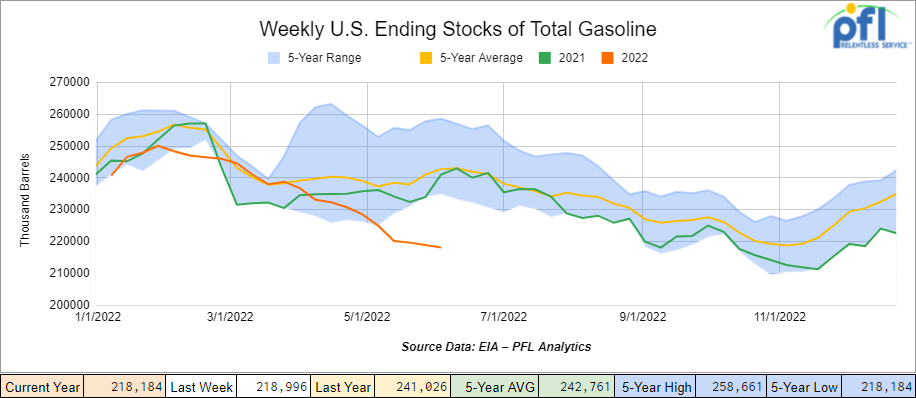

Total motor gasoline inventories decreased by -800,000 barrels week over week and are 10% below the five-year average for this time of year.

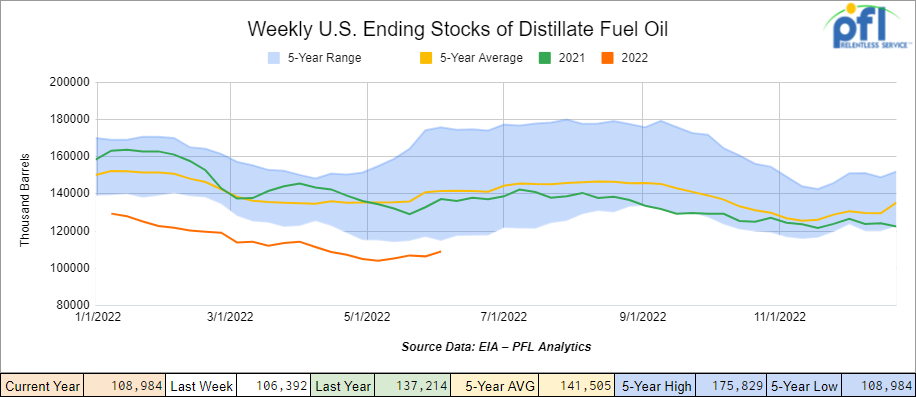

Distillate fuel inventories increased by +2.6 million barrels week over week and are 23% below the five-year average for this time of year.

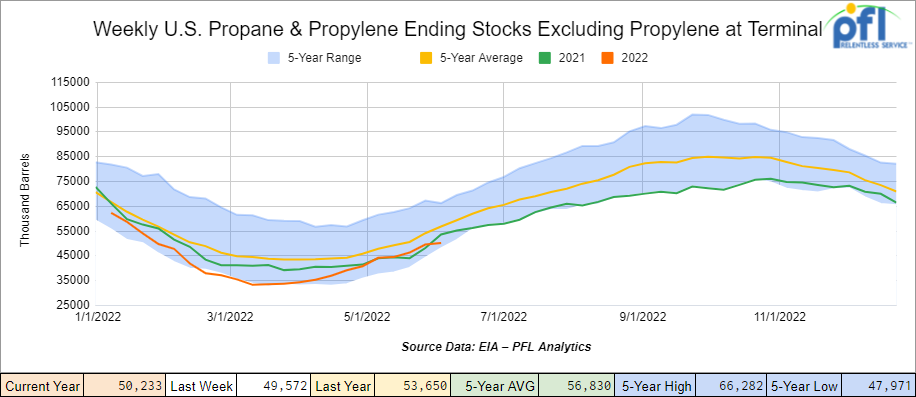

Propane/propylene inventories increased by +700,000 barrels week over week and are 12% below the five-year average for this time of year.

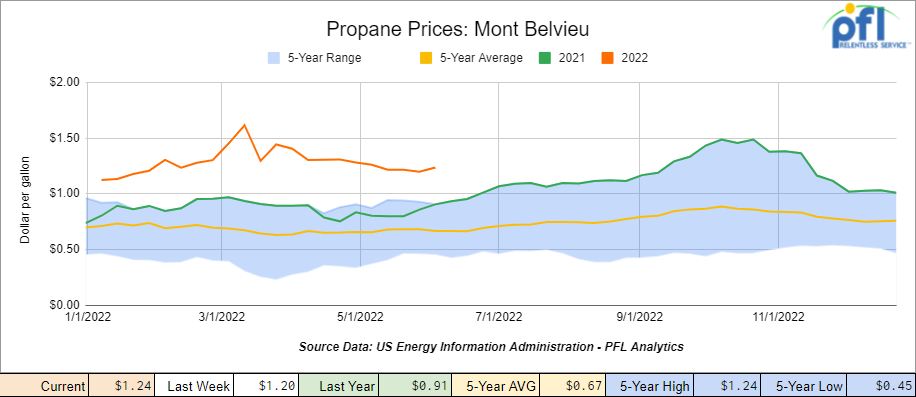

Propane prices were up 4 cents per gallon week over week closing at $1.24 per gallon and up 33 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 11.0 million barrels week over week

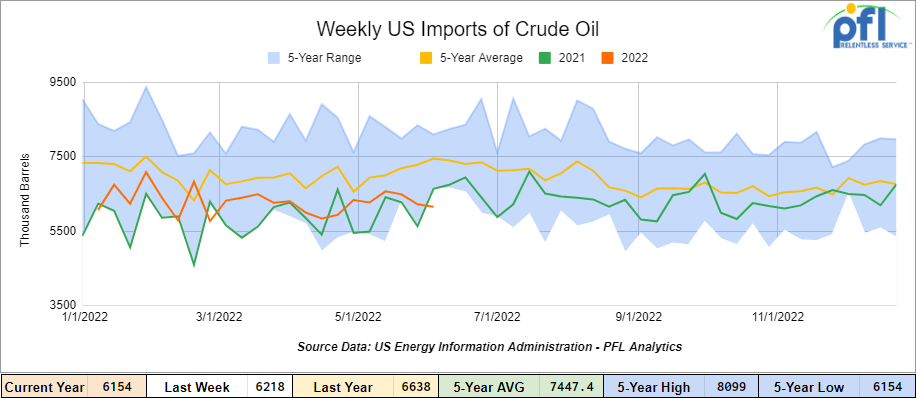

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending June 3rd, 2022, down by 64,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 1.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 1.2 million barrels per day, and distillate fuel imports averaged 220,000 barrels per day during the week ending June 3rd, 2022.

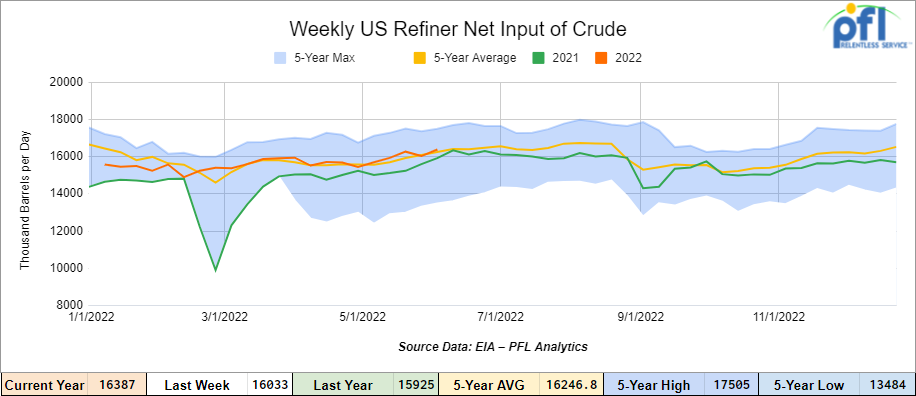

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending June 3, 2022, which was 355,000 barrels per day more week over week.

As of the writing of this report, WTI is poised to open at 118.92, down -$1.75 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.4% year over year in week 22 (U.S. -2.8%, Canada -6.3%, Mexico +2.1%) resulting in quarter-to-date volumes that are down 3.7% year over year and year to date volumes that are also down 3.7% year over year (U.S. -3.5%, Canada -6.1%, Mexico +3.0%). 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-5.2%) and farm products & food (-10.2%). The largest increase came from motor vehicles & parts (+10.3%).

In the East, CSX’s total volumes were down 0.9%, with the largest decrease coming from coal (-8.1%). The largest increase came from motor vehicles & parts (+12.1%). NS’s total volumes were down 3.2%, with the largest decrease coming from intermodal (-6.6%) The largest increase came from coal (+16.6%).

In the West, BN’s total volumes were down 2.8%, with the largest decrease coming from intermodal (-6.7%). The largest increase came from grain (+37.6%). UP’s total volumes were down 2.0%, with the largest decreases coming from intermodal (-2.1%) and grain (-17.5%). The largest increases came from stone, sand & gravel (+17.2%).

In Canada, CN’s total volumes were down 7.7%, with the largest decrease coming from intermodal (-15.9%). The largest increase came from petroleum (+24.6%). Revenue per ton-miles was down 6.1%. CP’s total volumes were down 1.6%, with the largest decrease coming from grain (-48.4%). The largest increases came from intermodal (+10.6%) and chemicals (+13.1%). Revenue per ton-miles was down 5.3%.

KCS’s total volumes were up 4.1%, with the largest increases coming from intermodal (+6.4%) and grain (+36.0%). The largest decrease came from petroleum (-32.2%).

Source: Stephens

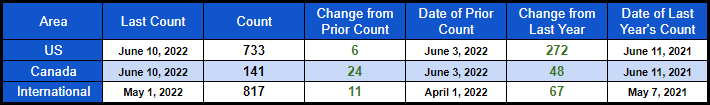

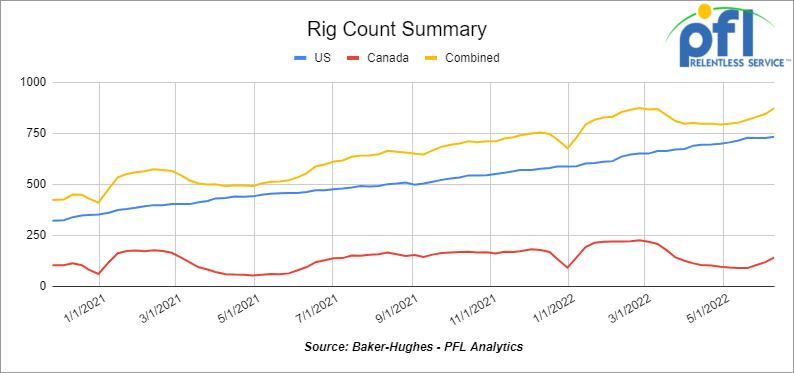

Rig Count

North American rig count was up 30 rigs week over week. U.S. rig count was up 6 rigs week-over-week and up by 272 rigs year over year. The U.S. currently has 733 active rigs. Canada’s rig count was up by 24 rigs week-over-week and up by 48 rigs year-over-year. Canada’s overall rig count is 141 active rigs. Overall, year over year, we are up 320 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,089 from 24,401, which is a loss of 312 rail cars week-over-week. This is a little bit of a setback after three weeks of gains. Canadian volumes were lower as spreads between heavy sour crude in Canada and the U.S. Gulf Coast made long-haul shipments less attractive: CN’s shipments were down by 3.2% and CP volumes were down by 11.2% Although the basis widened in Canada last week closing at -$20.60 (WCS) against WTI that same grade of crude from Canada widened in the Gulf to -$8.25 against WTI per barrel, leaving only $12 and some change to move the product from Alberta to the U.S. Gulf Coast. Supply is starting to recover in Canada and inventories are starting to build again. It will be interesting to see if we hit a pipeline wall anytime soon and see if the basis widens further. Shell’s offshore Urasa platform is putting pressure on Alberta crude in the Gulf, as Urasa was recently put back on line after repairs were completed from last year’s hurricanes, and believe it or not Biden in his wisdom selling sour crude from the SPR has also put pressure on Canadian grades (Biden may have it out for Alberta without even realizing it). There are too many moving pieces to determine when and if CAD crude by rail will make a comeback. It seems to us that the Biden administration should stop the SPR, let the market work and let producers drill and let pipelines get built, and change its anti-energy policy. It seems to us that he does say he is doing this in public appearances but now is blaming oil companies for the run-up in prices but the reality of the administration’s actions speaks for itself. Stay tuned to PFL, your information source for CBR.

U.S. volumes were down across the board with the NS having the largest percentage decrease, down by 18.1%.

June Rail Update

North American rail volumes were down -2.9% year over year in the month of May compared to -4.5% year over year in the prior 4-week period. The volume decline was primarily driven by intermodal (due to network congestion and supply constraints) and grain (due to weak Canadian grain shipments and labor-related inefficiencies). In May, the main area of focus continued to be on weakness in rail service, and the STB issued its response to the service hearing hosted in late April (see decision ID 51225 from 5/6/2022 here . Since that time, the rails have posted their service recovery plans and disclosed additional service data that we will be tracking closely. We expect a very slow in service recovery due to staffing challenges. While we are seeing some improvement on the NS and the CSX the BN seems to be still encountering significant issues. When combining this with more uncertainty around both the freight cycle and the economy, finding a positive catalyst for the rails could be more challenging in the months ahead.

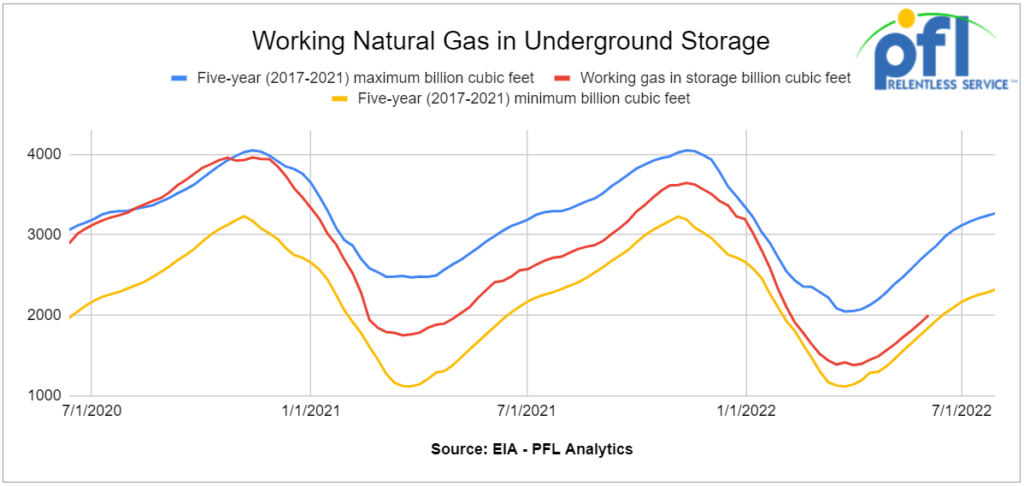

Natural Gas

Freeport LNG plant blast adds to strain on global supplies – Freeport LNG, an operator of one of the largest U.S. export plants producing liquefied natural gas (LNG), shut down on Wednesday of last week and will be down for 3 weeks. The event caused a short-term sell-off of Natgas here in the United States and a spike in European natural gas prices temporarily (prices went up 30% in the UK). Freeport LNG provides 20% of U.S. LNG processing capability (Explosion Caught live see below)

Source: Quintana Beach County Park

The shutdown is positive news for American consumers, who have seen Natgas prices quadruple over the past two years – the same timeline that exports from new plants like Freeport LNG and Corpus Christi LNG began to soar. U.S. LNG plants consume 13% of the total American natural gas supply, 2% from Freeport LNG alone. American Henry Hub natural gas futures shed 6% in trading on Wednesday of last week on news of Freeport LNG’s shutdown. Our guess is Natgas is heading to storage which is not a bad thing for the U.S. as we are roughly 15% below the 5-year average where we should be for this time of year (see chart below). It is our guess the shutdown of Freeport will be a non-event as this volume can be made up to Europe IF the problem is resolved as anticipated as there was some slack in the system (we were not shipping LNG at 100% capacity) – stay tuned to PFL for further updates.

Washington’s Energy Policies

Wish we didn’t have to watch them, but we have no choice, we are living it. Aside from Blaming Exxon (who apparently made more money than God last quarter according to Biden) and other oil companies for the run-up in energy prices here in the United States a few crazy things going on right now:

- Biden invokes Defense Production Act on clean energy technologies – Citing the need to lower energy costs and reduce the nation’s dependence on fossil fuels, President Joe Biden last week invoked the Defense Production Act (DPA) to speed up the production of clean energy technologies. We can’t make this stuff up, folks – it’s for real – you are not living in a fiction novel or having a bad dream – can’t wait to print more money and pay even more for everything! Biden is authorizing the use of DPA in the production of five energy technologies, the White House said in a statement: solar panel parts; building insulation; heat pumps for heating and cooling buildings; power grid infrastructure, such as transformers; and equipment for making electricity-generated fuels including electrolyzers, fuel cells, and platinum group metals.

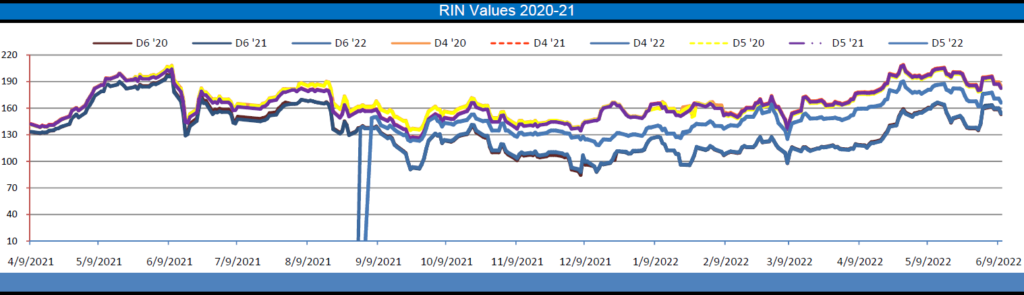

- As refiners here in the U.S. struggle to meet the demands of the U.S. consumers the EPA kicked some of the smaller refiners while they were down by getting rid of the small refiner exemption, retroactively forcing them to buy RINS and driving up RIN prices (see RIN chart below). Don’t get us wrong we love Ethanol and Biodiesel as we of course love rail here at PFL, however, to do this in a retroactive fashion is nothing more than punitive and could cause some refiners to shudder their doors. Guess that is what Washington wants to do – get rid of big oil, make you pay more at the pump and elsewhere so they can have the excuse to roll out the green new deal (which is not green at all!) Have a great week folks and be safe out there.

Source: PFL Analytics

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Need to be lined for calcium chloride.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|