“Example is not the main thing in influencing others, it is the only thing.”

– Albert Schweitzer

Weekly Jobless Claims Down Week Over Week a New Pandemic Low

- Initial claims for jobless benefits totaled 406,000 last week, better than the 425,000 estimate.

- The total represented a decline from the previous week’s 444,000 and was the lowest since March 14, 2020.

- Continuing claims fell sharply, declining by 96,000 to 3.64 million, bringing the four-week moving average down to 3.68 million. That number runs a week behind the headline claims total.

- In a separate report, the Commerce Department left its initial estimate on first-quarter gross domestic product unchanged at 6.4%. Also, orders for long-lasting goods unexpectedly declined by 1.3% in April, against the forecast for a 0.9% gain. However, excluding transportation, orders rose 1%.

Stocks up Friday of last week and up week over week

The Dow closed higher on Friday of last week, up +64.81 (+0.19%) points closing out the week at 34,529.45, up +321.91 points week over week. The S&P 500 closed higher on Friday of last week, up +3.23 points (+0.08%) and closing out the week at 4,204.11, up +48.25 points week over week. The Nasdaq closed higher on Friday of last week, up +12.46 points (+0.09%) and closing out the week at 13,748.74, up +277.75 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 238 points.

Oil had best week since April – 37 Million Americans were projected to hit the Roads this past weekend.

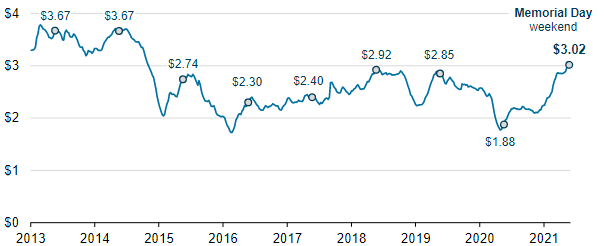

West Texas Intermediate rose 4.3 per cent last week. A bunch of positive U.S. economic data last week continued to highlight the recovery taking shape in the world’s largest oil-consuming country. Americans are expected to unleash demand that was built up during the pandemic from beginning this past weekend and into the days to come as driving season is in full swing. With more drivers taking to the road and with some of the lowest gasoline stockpiles in almost 30 years, some see the U.S. facing a supply squeeze on par with those seen when a hurricane knocks out oil refineries in Texas and Louisiana. U.S. average gasoline prices pre Memorial Day weekend are the highest they have been since 2014 (see chart)

U.S. Average Retail Price ($/gal)

WTI crude declined Friday of last week -$0.53 a barrel for July delivery to settle at $66.32 a barrel, up +$2.74 a barrel week over week. Brent crude oil for July settlement which expired on Friday of last week closed higher gaining +$0.17 a barrel, closing at $69.63 up +$3.19 a barrel week over week.

U.S. commercial crude oil inventories decreased by 1.7 million barrels week over week. At 484.3 million barrels, U.S. crude oil inventories are 2% below the five year average for this time of year.

Total motor gasoline inventories decreased by 1.7 million barrels week over week and are 3% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories decreased by 3.0 million barrels week over week and are 8% below the five year average for this time of year.

Propane/propylene inventories decreased by 400,000 barrels week over week and are 21% below the five year average for this time of year.

Total commercial petroleum inventories decreased by 7.7 million barrels last week.

U.S. crude oil imports averaged 6.3 million barrels per day last week, down by 138,000 thousand barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.9 million barrels per day, 0.5% more than the same four-week period last year.

Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.0 million barrels per day, and distillate fuel imports averaged 273,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending May 21, 2021 which was 123,000 barrels per day more than the previous week’s average. Refineries operated at 87.0% of their operable capacity last week. Gasoline production decreased last week, averaging 9.7 million barrels per day. Distillate fuel production increased last week, averaging 4.7 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $68.15, up $1.83 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 22.4% year over year in week 20 (U.S. +23.4%, Canada +19.1%, Mexico +21.6%) resulting in quarter to date volumes that are up 24.6% year over year and year to date volumes that are up 11.4% year over year (U.S. +12.7%, Canada +8.5%, Mexico +6.6%). All 11 of the AAR’s major traffic categories posted year over year increases with the largest increases coming from intermodal (+20.4%), coal (+37.2%) and motor vehicles & parts (+256.9%).

In the East, CSX’s total volumes were up 26.7%, with the largest increases coming from intermodal (+26.3%), motor vehicles & parts (+195.0%), coal (+52.1%) and chemicals (+23.0%). NS’s total volumes were up 31.9%, with the largest increases coming from intermodal (+17.9%), coal (+123.2%), motor vehicles & parts (+397.6%) and metals & products (+91.1%).

In the West, BN’s total volumes were up 24.1%, with the largest increases coming from intermodal (+20.4%), coal (+35.5%) and motor vehicles & parts (+186.5%). UP’s total volumes were up 24.4%, with the largest increases coming from intermodal (+27.5%), motor vehicles & parts (+535.2%) and chemicals (+17.9%).

In Canada, CN’s total volumes were up 24.2%, with the largest increases coming from intermodal (+31.8%), coal (+72.3%), motor vehicles & parts (+279.5%), stone sand & gravel (+109.4%) and chemicals (+13.9%). RTMs were up 23.7%. CP’s total volumes were up 20.4%, with the largest increases coming from motor vehicles & parts (+622.4%), coal (+44.1%), chemicals (+27.1%) and intermodal (+7.2%). RTMs were up 21.5%.

KCS’s total volumes were up 47.2%, with the largest increases coming from intermodal (+63.4%), petroleum (+97.6%) and motor vehicles & parts (+1,112.9%)

Source: Stephens

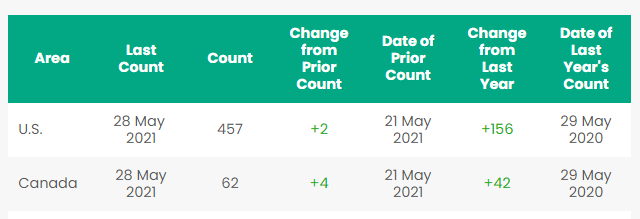

Rig Count

North America rig count is up by 6 rigs week over week. The U.S. was up 2 rigs week over week and up by 156 rigs year over year. The U.S. currently has 457 active rigs. Canada’s rig count was up by 4 rigs week over week, and up by 42 rigs year over year and Canada’s overall rig count is 62 active rigs. Year over year we are up 198 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- With the green new deal seemingly in full force and with a 6 trillion budget unleashed by the White House ahead of the Memorial Day weekend, it seems energy companies are under fire to get things moving ASAP.

a:) A court in the Netherlands ruled on Wednesday of last week that Shell must reduce its emissions. By 2030, Shell must cut its CO2 emissions by 45% compared to 2019 levels, a civil court ruled. The Shell group is responsible for its own CO2 emissions and those of its suppliers, the verdict said. It is the first time a company has been legally obliged to align its policies with the Paris Climate Acord (The legally binding treaty came into force on 4 November 2016. The U.S. withdrew under former President Donald Trump, but has since rejoined under President Joe Biden), said Friends of the Earth (FOE). The FOE are the environmental group who brought the case to court against Shell in 2019, alongside six other bodies and more than 17,000 Dutch citizens. Though the decision only applies in the Netherlands, it could have wider effects elsewhere. Under the terms of the Paris Agreement on climate change nearly 200 nations agreed to keep global temperatures “well below” 2 degrees C above pre-industrial levels. Shell is expected to appeal the decision.

b:) Also on Wednesday of last week, Suncor (one of Canada’s largest integrated oil companies) said it plans on cutting its greenhouse gas emissions by 34% by 2030 as a step toward the Canadian government’s target of national net zero in 2050. By 2025, Suncor expects to become Alberta’s third-largest electricity supplier with alternative power projects. Emissions-cutting plans also include oil sands energy efficiency measures, renewable and biofuel blends, hydrogen production, and carbon capture utilization and storage.

c:) It seems to us traditional renewables – Ethanol and biodiesel are not going to be spared – A U.S. Senate bill that would create a technology-neutral tax credit for energy producers able to achieve net-zero or negative greenhouse-gas (GHG) emissions by 2030 is likely headed to the floor, despite the fact that it failed to win majority support from the Senate Finance Committee at a markup on Wednesday of last week. The Clean Energy America Act, which was introduced by Wyden in April, also would eliminate tax breaks for fossil fuels. The bill was introduced after the Biden administration set a target of cutting U.S. GHG emissions 50% from a 2005 baseline by 2030. Wyden’s carbon-linked credit would replace certain renewable fuel-specific tax breaks, including the $1/gal biomass-based diesel blender’s credit, which is set to expire by the end of 2022. Biofuel industry groups earlier this month, however, expressed concern that first-generation renewable fuels like ethanol and biodiesel could have difficulty reaching the 2030 target unless the federal government revises its carbon intensity (CI) calculations. Bottom line it does not look like that is going to happen, folks.

There are many other companies that have announced carbon changing measures and looks as though things are going to change quicker than anyone had previously thought.

d:) While we are going green China is burning more coal – Chinese coal consumption is poised to hit a record this year, contradicting a view held by many climate change and energy experts that the voracious coal usage in the world’s second-biggest economy had peaked.

A 4% surge in Chinese coal demand, coupled with higher consumption elsewhere in Asia, as well as in the U.S. and Europe, will trigger a large increase in carbon emissions, the International Energy Agency said last week, days before global leaders plan a virtual gathering to discuss the climate change challenge. - Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,091 from 23,044, a gain of 47 rail cars week over week. Again both Canadian and U.S. volumes were mixed – CN shipments rose by 3.2% while CP were down by 4.2%, BN had the largest percentage decrease in the U.S., down by 7.4% and the NS had the largest percentage increase up by 14.8%.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

- 18-25 5,200CF or greater covered hoppers needed in Illinois off the CN or NS.

- 20-25 30K 117Rs for the use in ethanol in the Midwest. Dirty to dirty service/

- 10 6,300CF or greater covered hoppers needed in the Midwest.

- 8 plastic pellet hoppers for purchase.

- 10 PD cars for cement service for purchase.

- 20 17K tank cars for purchase. Must be food grade.

- 40 30k 117Js needed in Chicago for refined products. For jet fuel looking for dirty to dirty service.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 10 Covered Hoppers 6300 CF in Wisconsin CN for 1 year Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- Several hundred small Hoppers Various Locations and Product – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale 3000-5800 CF 263 and 286 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|