“If knowledge can create problems, it is not through ignorance that we can solve them.”

– Isaac Asimov

Jobs Update

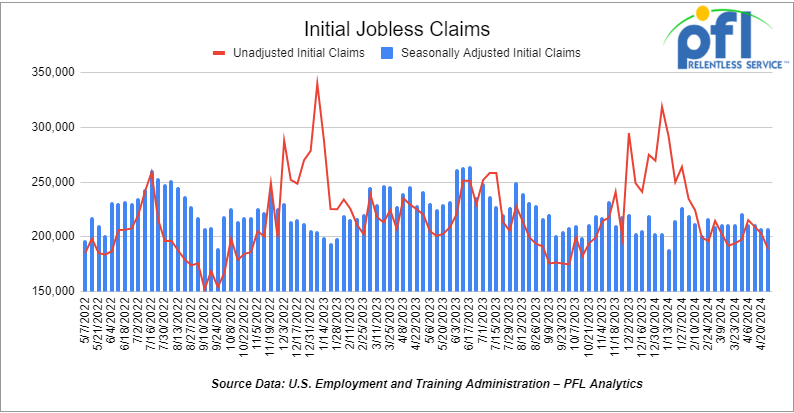

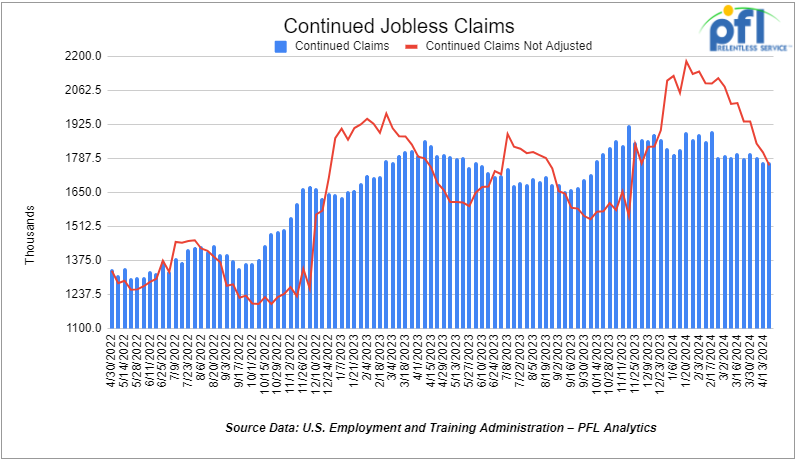

- Initial jobless claims seasonally adjusted for the week ending April 27th, 2023 came in at 208,000, flat week-over-week.

- Continuing jobless claims came in at 1.774 million people, versus the adjusted number of 1.774 million people from the week prior, flat week-over-week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 450.02 points (1.18%), closing out the week at 38,675.68, up 436.02 points week-over-week. The S&P 500 closed higher on Friday of last week, up 63.59 points (1.26%), and closed out the week at 5,127.79, up 27.83 points week-over-week. The NASDAQ closed higher last week, up 215.37 points (1.98%), and closed out the week at 16,156.33, up 228.43 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 38,916 this morning up 84 points..

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded down -$0.84 per barrel (-1.06%) to close at $78.11 per barrel on Friday of last week, down -$5.74 per barrel week-over-week. Brent traded down -US$0.71 per barrel (-0.85%) on Friday of last week, to close at US$82.93 per barrel, down -US$6.57 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled Friday at US$11.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$66.40 per barrel.

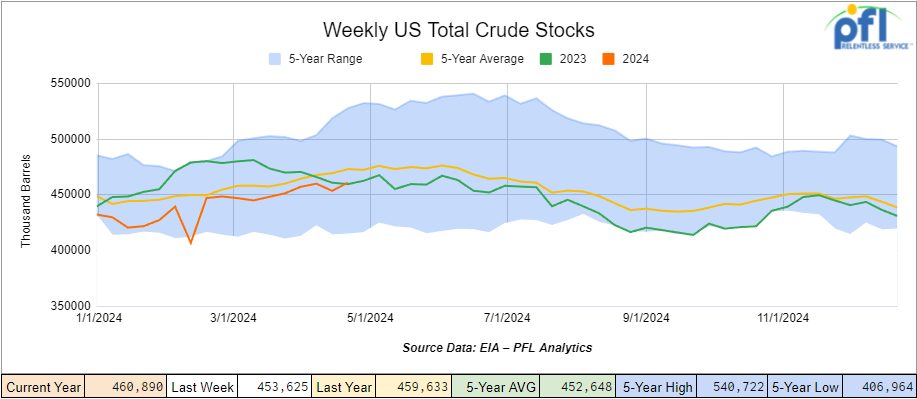

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 7.3 million barrels week-over-week. At 460.9 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

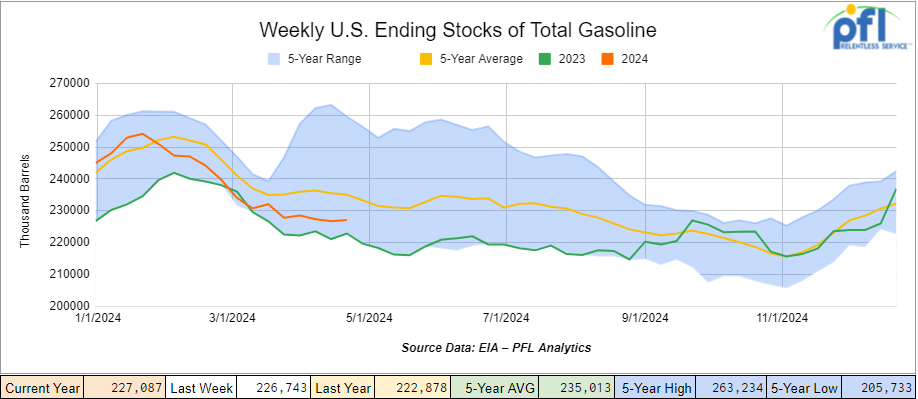

Total motor gasoline inventories increased by 300,000 barrels week-over-week and are about 3% below the five-year average for this time of year.

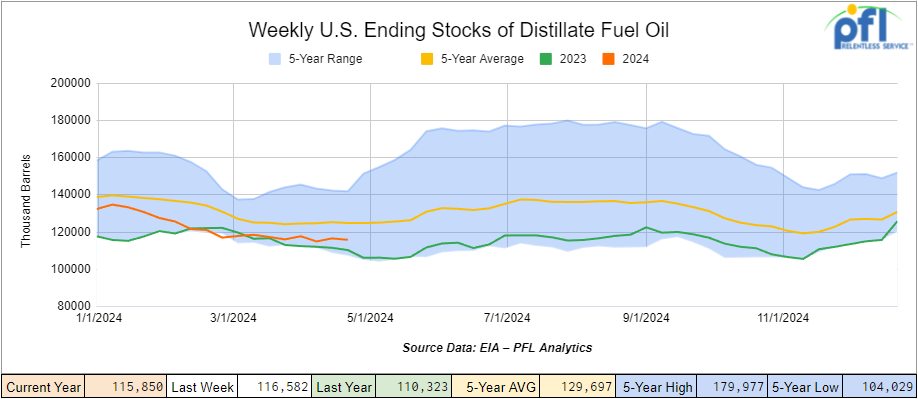

Distillate fuel inventories decreased by 700,000 barrels week-over-week and are 7% below the five-year average for this time of year.

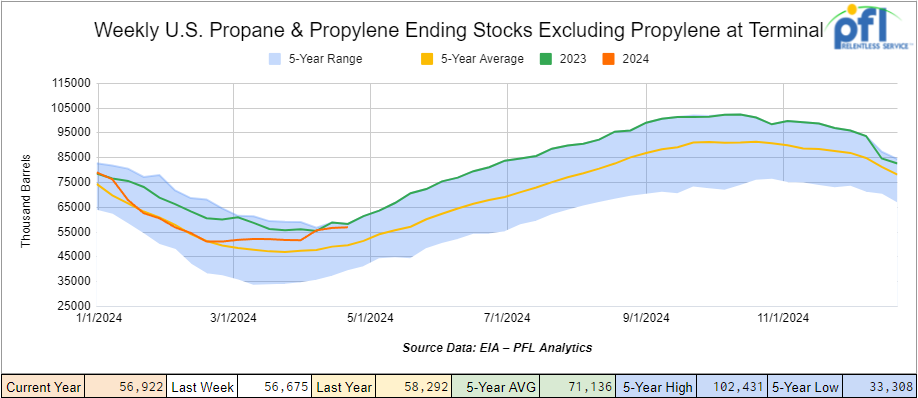

Propane/propylene inventories increased by 200,000 barrels week-over-week and are 14% above the five-year average for this time of year.

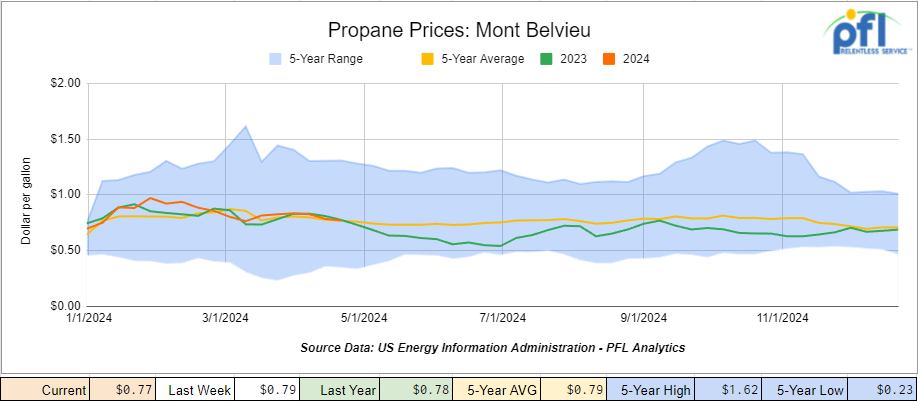

Propane prices closed at 77 cents per gallon, down 2 cents week-over-week and down 1 cents year-over-year.

Overall, total commercial petroleum inventories increased by 7.9 million barrels during the week ending April 26th, 2024.

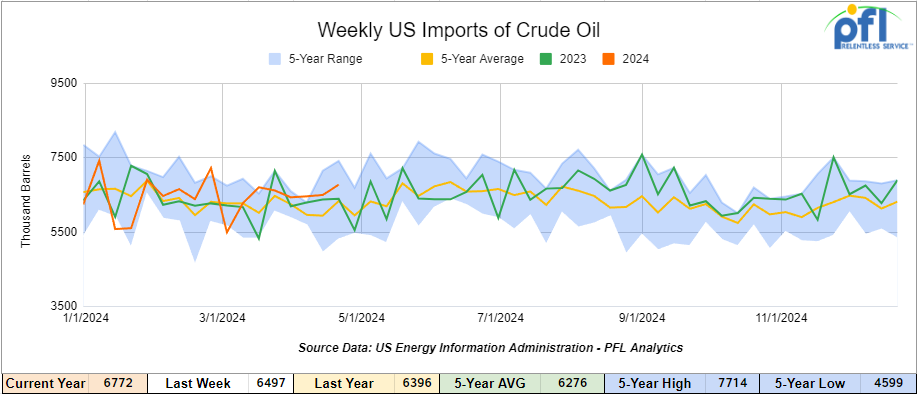

U.S. crude oil imports averaged 6.8 million barrels per day during the week ending April 26th, 2024, an increase of 274,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.5 million barrels per day, 3.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 977,000 barrels per day, and distillate fuel imports averaged 103,000 barrels per day during the week ending April 26th, 2024.

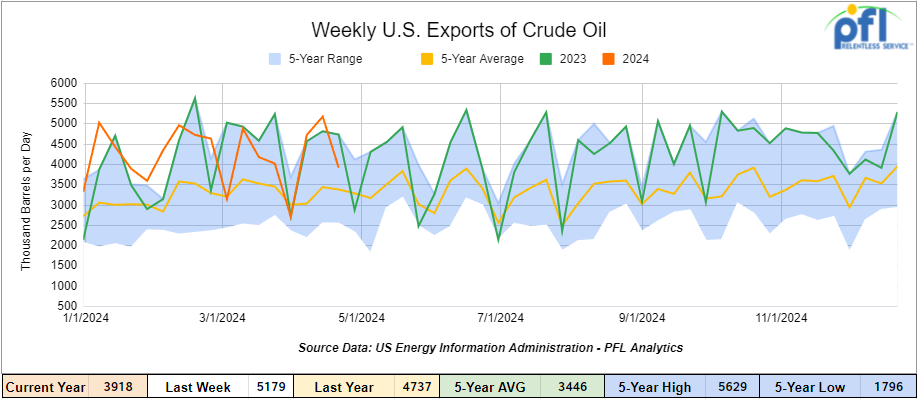

U.S. crude oil exports averaged 4,179 million barrels per day for the week ending April 19th, 2024, an increase of 453,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4,159 million barrels per day.

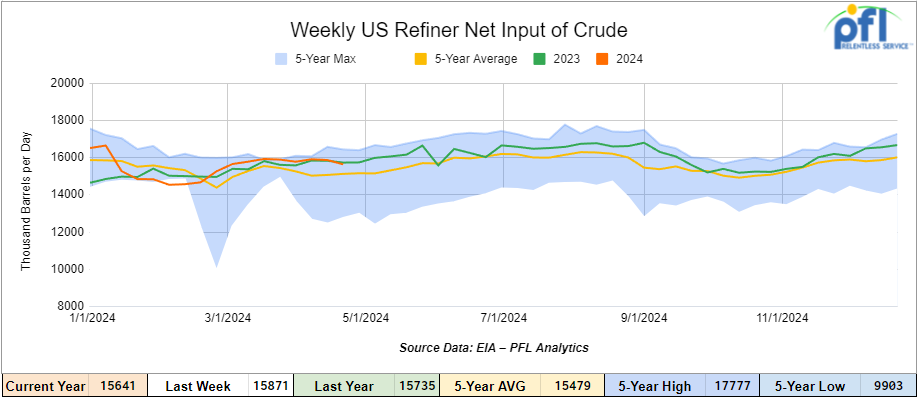

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending April 26, 2024, which was 230,000 barrels per day less week-over-week.

WTI is poised to open at $78.80, up 69 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 1st, 2024.

Total North American weekly rail volumes were up (0.88%) in week 18, compared with the same week last year. Total carloads for the week ending on May 1st were 335,121, down (-6.35%) compared with the same week in 2023, while weekly intermodal volume was 327,183, up (+6.53%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-25.98%). The most significant increase came from Other which was up (+7.62%).

In the East, CSX’s total volumes were up (0.32%), with the largest decrease coming from Coal, down (-10.67%) while the largest increase came from Petroleum and Petroleum Products (20.28%). NS’s volumes were up (3.66%), with the largest increase coming from Nonmetallic Minerals (+17.33%) while the largest decrease came from Grains (-16.49%).

In the West, BN’s total volumes were up (+84%), with the largest increase coming from Grain (+14.09%) while the largest decrease came from Coal, down (-35.37%). UP’s total rail volumes were down (-1.27%) with the largest decrease coming from Coal, down (-31.6%) while the largest increase came from Other which was up (+26.63%).

In Canada, CN’s total rail volumes were down (-4.8%) with the largest decrease coming from Grain, down (-31.24%) while the largest increase came from Nonmetallic Minerals, up (+20.97%). CP’s total rail volumes were down (-15.23%) with the largest increase coming from Intermodal (+40.79%) while the largest decrease came from Coal, down (-65.31%).

KCS’s total rail volumes were down (-12.35%) with the largest decrease coming from Nonmetallic Minerals (-34.56%) and the largest increase coming from Motor Vehicles and Parts (+21.53%).

Source Data: AAR – PFL Analytics

Rig Count

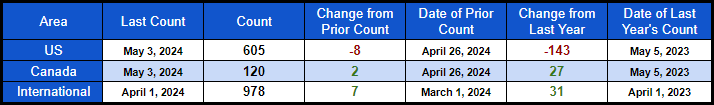

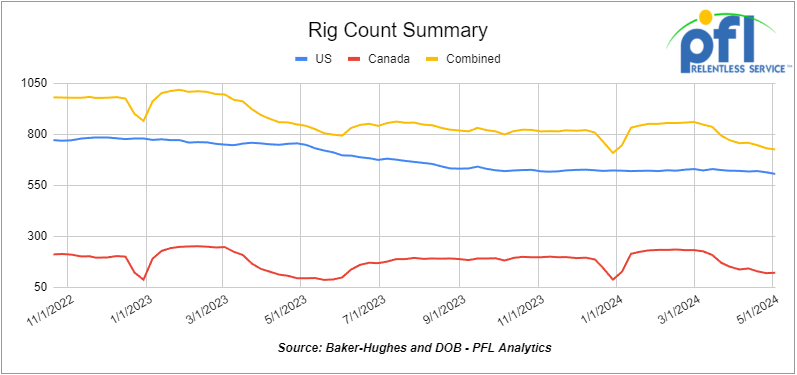

North American rig count was down by -6 rigs week-over-week. U.S. rig count was down by -8 rigs week-over-week, and down by -143 rigs year-over-year. The U.S. currently has 605 active rigs. Canada’s rig count was up by 2 rigs week-over-week, and up by 27 rigs year-over-year. Canada’s overall rig count is 120 active rigs. Overall, year-over-year, we are down -116 rigs collectively.

International rig count was up by 7 rigs month over month and up by 31 rigs year over year. Internationally there are 978 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,878 from 28,056 which was a decline of 178 rail cars week-over-week Canadian volumes were mixed. CPKC’s shipments were lower by -.08% week over week. CN’s volumes were higher by +.04% week-over-week. U.S. shipments were mostly lower. The NS had the largest percentage increase and was up by +8.0% and was the sole gainer. The BN had the largest percentage decrease and was down by 11.9%

We are Watching Trans Mountain Pipeline – It’s here to stay, folks

Trans Mountain Pipeline Route

With the arrival of May 1st, Trans Mountain Corporation’s C$34-billion, much-delayed pipeline expansion enters its most important stage yet.

Prior to the Canada Energy Regulator (CER) granting the final permits on April 30, Chief Financial and Strategy Officer Mark Maki, and Senior Director of Business Development Jason Balasch, talked to the DOB about ramping up pipeline operations, the impact on the company and the Canadian oil industry, the higher tolling rates, and encouraging WTI (West Texas Intermediate) / WCS (Western Canadian Select) price differential shifts.

Maki said in the run-up to the official launch, they’d been following a screen that showed growing amounts of oil moving in the pipeline throughout April, and “making good progress.”

“In terms of the company, the gang here is extraordinarily excited about having the chance to be a part of the next big pipeline expansion in Western Canada…. You’ll see an improvement in pricing for the producing community here in Western Canada which is fantastic news,” Maki said.

“We’re excited about what it means for the basin, what it means for access for Canadian barrels to the Pacific markets at a time when the focus is very much on energy and security, and Canada is a wonderful partner for that.

“For Alberta it’s great news, for the people in the producing community we think it’s great news, so we’re very happy for where we’re at.”

The company itself will also be transformed, with the additional 590,000 bbls/d added to its current 300,000 bbls/d, simultaneously more than tripling Trans Mountain’s EBITDA, said Balasch.

“And then from a contractual basis we’re much more of a commercial entity now than in the past,” Balasch added.

After May 1’s kick-off, Maki said the 1,150-kilometre pipeline will fill up in sections, “think of almost like a series of box cars in a train,” reaching capacity by around mid-May as it flows on its way to Burnaby, B.C.’s Westridge Marine Terminal. There, ships sized up to Aframax class will be waiting to load up.

A Tanker at Westridge Marine Terminal

Source: DOB – PFL Analytics

What is next for crude by rail out of Canada and the Coiled and Insulated Car?

The Trans Mountain Pipeline will immediately soak up any excess supply out of Canada and that is why we have seen the WTI/WCS differential tighten so much as of late. Although Canadian Oil sand projection is increasing, it is not enough to immediately fill the pipeline. It is expected that the pipeline will be filled within 2 years. We don’t anticipate a huge resurgence in crude-by-rail activity until we have additional pipeline constraints, however, other crude-by-rail activities are expected to increase despite the excess pipe in the short term. These include:

1) Stranded barrels with no pipeline access.

2) Undiluted bitumen has been popular for crude by rail as it ships as a non-haz product, and is competitive with pipeline tariffs, and cannot be transported in a pipeline due to its consistency (solid) and requires a coiled and insulated car. These volumes are increasing at the same time diluted bitumen gets directed to pipelines.

The coiled and insulated car has been popular with renewable diesel producers for feedstock.

We continue to watch Canada’s Potential Rail Strike

The TCRC electronic strike began April 8th and will wrap up May 1st, Its official Canadian railway workers at CN, CPKC voted to strike, the Union said on Monday of last week. Thousands of railway workers in Canada at Canadian National Railway, and Canadian Pacific Kansas City, have voted overwhelmingly to strike as early as May 22.

PFL has been working with a number of shippers to provide backup railcar storage, particularly for customers heading back to Canada after exporting products into the United States. Please call PFL for further details.

Fundamentally, things are looking good for Natgas LPGs, and Coal, which means more Rail

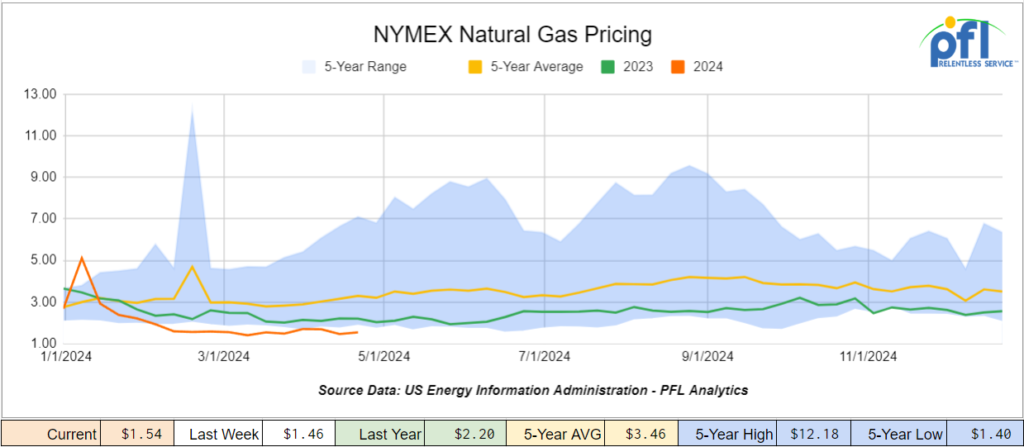

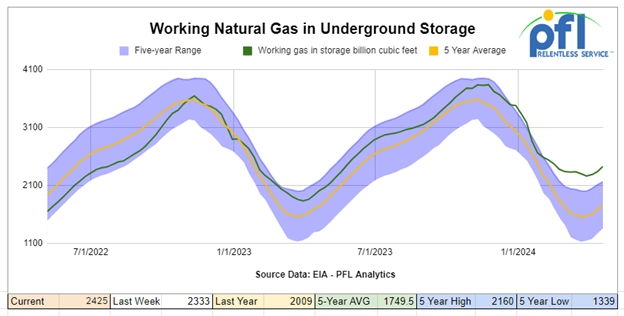

Folks, like it or not America needs more good reliable, affordable clean-burning energy. Batteries, Solar, and wind are not going to make it. We just have to learn from Germany. After hitting a bottom of $1.54 per MMBTU Natgas closed at $2.14 per MMBTU on Friday of last week – we are bullish Natgas and the associated liquid production that comes with it.

Here are a few factors:

- AI Data Centers Slow Shift to Renewables. An explosion of so-called hyperscale data centers in places such as Northern Virginia has upended plans by electric utilities to cut the use of fossil fuels. In some areas, that means burning coal for longer than planned. These giant data centers will provide the computing power needed for artificial intelligence. They are setting off a four-way battle among electric utilities trying to keep the lights on, tech companies that like to tout their climate credentials, consumers angry at rising electricity prices, and regulators overseeing investments in the grid and trying to turn it green. Roughly 70% of global internet traffic passes through the area’s data centers. A spider web of power lines connecting data centers to the grid crisscrosss neighborhoods and parks. More are coming.

Amazon Web Services, Amazon.com’s cloud-computing business, invested $52 billion in Virginia from 2011 to 2021 and plans to invest a further $35 billion by 2040. Loudoun County, Va., has nearly 37 million square feet of data center space, and 42 million square feet more has been proposed.

Many new data centers coming to Northern Virginia are known as hyperscale, or facilities that are far larger than previous generations of data centers. The big ones use as much power as the city of Seattle.

Utilities want more fossil fuels to meet demand. For many utilities, the solution to rising demand is to keep coal-fired power plants burning for longer and add natural gas power plants to balance big expansions of renewables.

Utilities in Georgia and North Carolina are adding fossil-fuel power or considering delaying the shutdown of coal-fired plants to meet the demands of data centers and other industries. Duke Energy told regulators it needs three new gas-fired power plants in the Carolinas. Otherwise, it says it will have to keep coal plants open. - Mexico needs U.S. NatGas. Mexico imports of U.S. natural gas surge as domestic production sputters – spotlight. NGI. North American natural gas futures worked their way higher last week amid tighter U.S. production due to a variety of factors and storage injections slowing. Mexico imports, meanwhile, of U.S. natgas have started to increase.

- U.S. liquefied natural gas (LNG) and liquefied petroleum gas (LPG, mostly propane) exports both hit new all-time record highs for the period of Jan. 1 through April 29 this year. And that’s despite the fact that the Freeport LNG export facility has experienced a major outage since January and was plagued with production problems. Looks as though that is behind us. When running at capacity Freeport can export 2 bcf of liquefied natural gas every day.

- We are feeding Europe a bunch of natural gas and LPGS amid the curtailment of Russian flows. Gazprom last week announced record-breaking losses as it builds a pipeline to China to replace its sales to Europe.

Lease Bids

- 25, 30K 117R Tanks needed off of in for 2-3 Year. Cars are needed for use in Condensate service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term would look at longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 15, 29.2, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 15, 25.5, DOT 111 Tanks located off of UP or BN in Houston. Cars were last used in Sunflower Oil. 1 Year

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year.

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website