“Chains of habit are too light to be felt until they are too heavy to be broken.”

Warren Buffett

Jobs Update

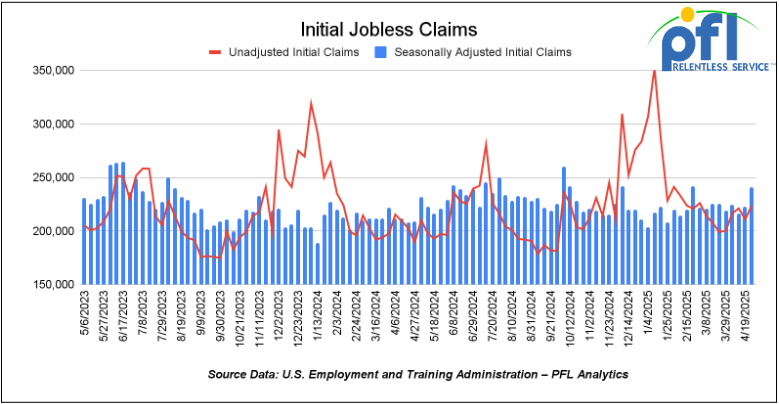

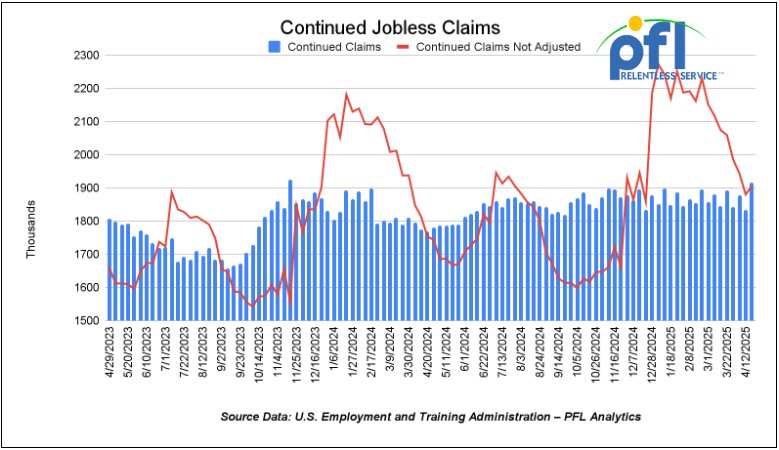

- Initial jobless claims seasonally adjusted for the week ending April 26th came in at 241,000, up 18,000 people week-over-week.

- Continuing jobless claims came in at 1.916 million people, versus the adjusted number of 1.833 million people from the week prior, up 83,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 564.47 points (1.39%) and closing out the week at 41,317.43, up 1,203.93 points week-over-week. The S&P 500 closed higher on Friday of last week, up 82.53 points, and closed out the week at 5,686.67 and up 161.46 points week-over-week. The NASDAQ closed higher on Friday of last week, up 266.99 points (1.54%), and closed out the week at 17,977.73, up 594.8 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 41,169 this morning down 258 points from Friday’s close.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$0.95 per barrel (-1.6%), to close at $58.29 per barrel on Friday of last week and down -$4.73 per barrel week over week. Brent crude closed down -$0.84 USD per barrel (-1.4%) on Friday of last week, to close at $61.29 per barrel, but down -$5.58 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled on Friday of last week at US$9.60 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$52.35 per barrel.

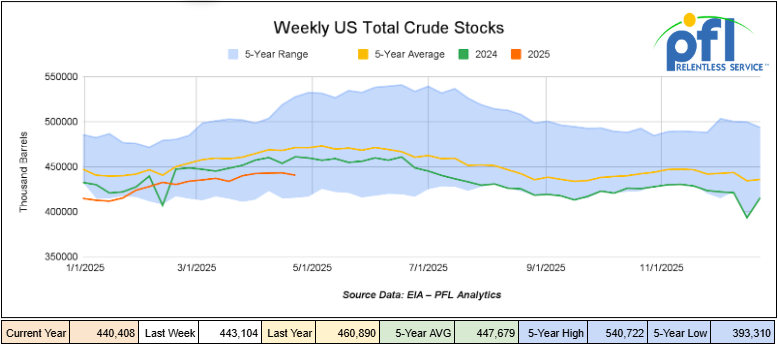

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.7 million barrels week-over-week. At 440.4 million barrels, U.S. crude oil inventories are about 6% below the five-year average for this time of year.

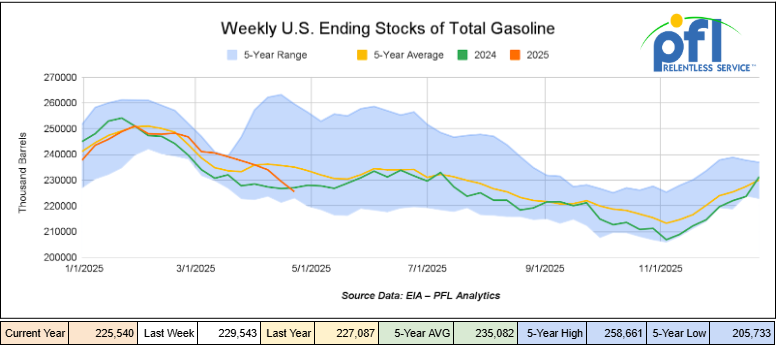

Total motor gasoline inventories decreased by 4 million barrels week-over-week and are 4% below the five-year average for this time of year.

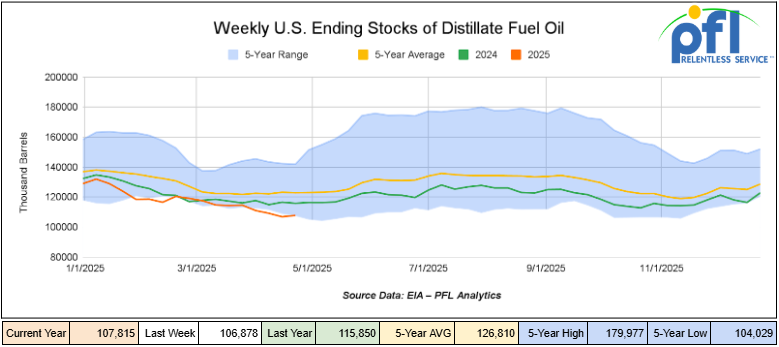

Distillate fuel inventories increased by 900,000 barrels week-over-week and are about 13% below the five-year average for this time of year

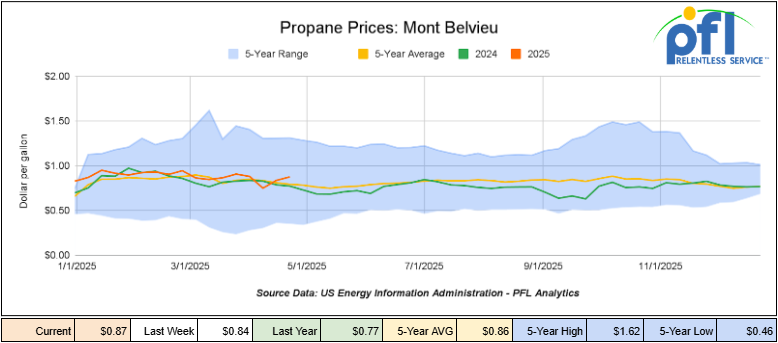

Propane/propylene inventories increased by 600,000 barrels week-over-week and are 8% below the five-year average for this time of year.

Propane prices closed at 87 cents per gallon on Friday of last week, up 3 cents per gallon week-over-week, and down 10 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 4.2 million barrels during the week ending April 25, 2025.

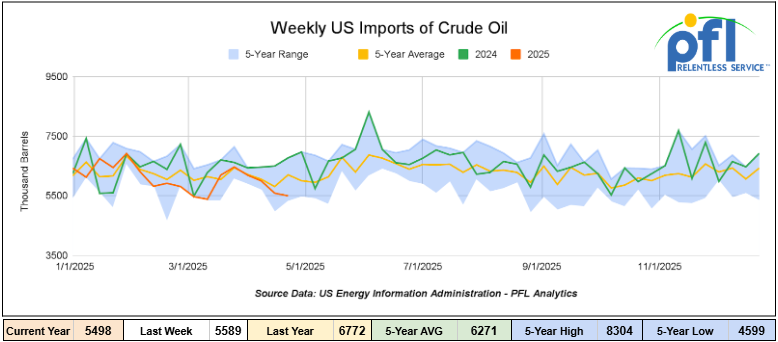

U.S. crude oil imports averaged 5.5 million barrels per day during the week ending April 25, 2025, a decrease of 90,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 5.8 million barrels per day, 11% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 581,000 barrels per day, and distillate fuel imports averaged 99,000 barrels per day during the week ending April 25, 2025.

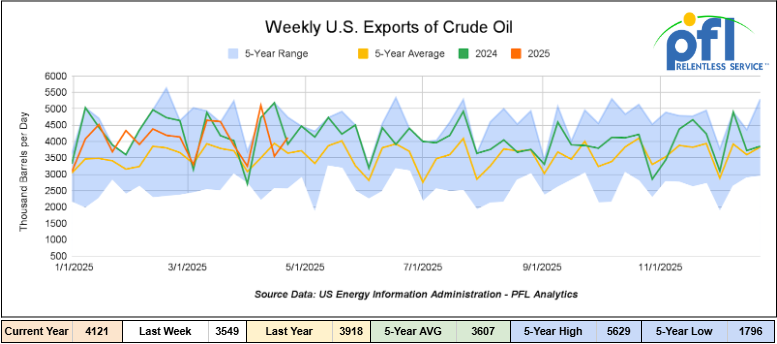

U.S. crude oil exports averaged 4.121 million barrels per day during the week ending April 25, 2025, an increase of 572,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.004 million barrels per day.

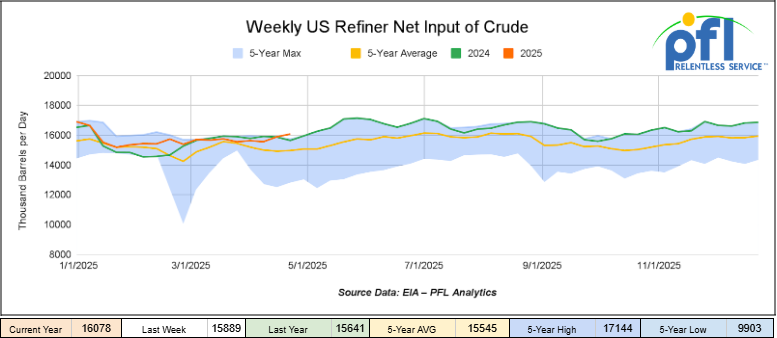

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending April 25, 2025, which was 189,000 barrels per day more than week-over-week.

WTI is poised to open at 57.47, down -82 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 30, 2025.

Total North American weekly rail volumes were up (+6.3%) in week 18, compared with the same week last year. Total carloads for the week ending on April 30 were 356,244, up (+6.3%) compared with the same week in 2024, while weekly intermodal volume was 330,278, up (+0.95%) compared to the same week in 2024.

8 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest increase came from Coal, which was up (+29.41%), while the largest decrease was from Motor Vehicles and Parts, which was down (-10.02%).

In the East, CSX’s total volumes were down (0.32%), with the largest decrease coming from Motor Vehicles and Parts (-10.11%) while the largest increase came from Metallic Ores and Metals (+9.22%). NS’s volumes were up (2.45%), with the largest increase coming from Coal (+34.31%) while the largest decrease came from Other (-14.94%).

In the West, BN’s total volumes were up (6.70%), with the largest increase coming from Coal (28.93%) while the largest decrease came from Nonmetallic Minerals (-6.67%). UP’s total rail volumes were up (+5.55%), with the largest increase coming from Grain (+59.02%), while the largest decrease came from Motor Vehicles and Parts (-21.31%).

In Canada, CN’s total rail volumes were down (-7.49%) with the largest increase coming from Grain, up (+95.11%), while the largest decrease came from Intermodal Units (-29.74%). CP’s total rail volumes were up (15.59%) with the largest increase coming from Coal (+153.65%), while the largest decrease came from Chemicals (-21.01%).

KCS’s total rail volumes were up (+17.1%) with the largest increase coming from Farm Products (+67.38%), while the largest decrease came from Other (-34.65%).

Source Data: AAR – PFL Analytics

Rig Count

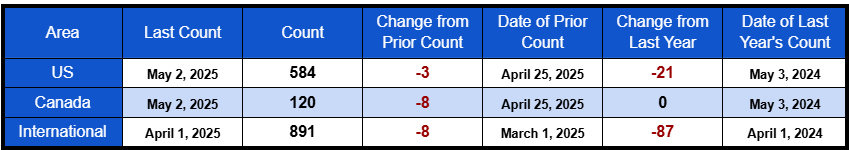

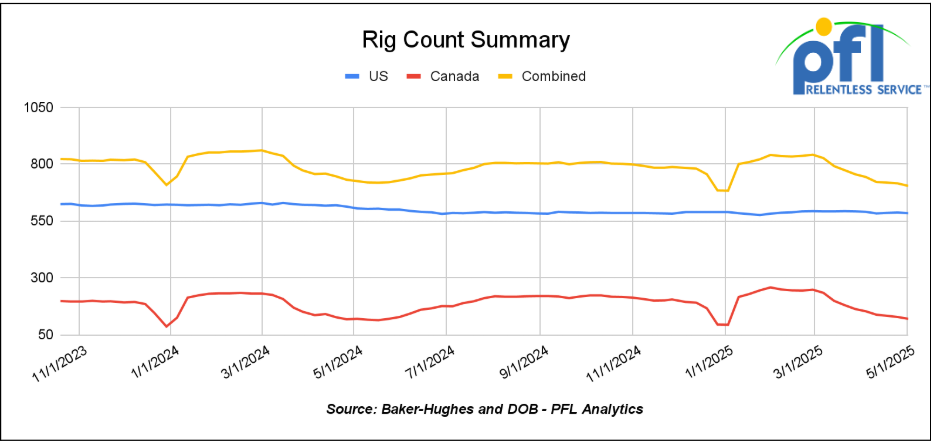

North American rig count was down by -11 rigs week-over-week. U.S. rig count was down -3 rigs week over week, and down by -21 rigs year-over-year. The U.S. currently has 584 active rigs. Canada’s rig count was down -8 rigs week-over-week but flat year-over-year. Canada currently has 120 active rigs. Overall, year over year we are down by -21 rigs collectively.

International rig count which is reported monthly was down by -8 rigs month-over-month and down -87 rigs year-over-year. Internationally there are 891 active rigs.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 26,837 from 26, 951 which was a decrease of -114 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +7.3% week over week, CN’s volumes were lower by -5.8% week-over-week. U.S. shipments were also mixed. The NS had the largest percentage increase and was up by +8.8%. The CSX had the largest percentage decrease and was down by -3.5%

We are Watching Canada

Folks, there was an election held in Canada on Monday of last week and Canada elected Mark Carney’s left leaning Liberal Party Leader to be the country’s Prime Minister who replaced disgraced Trudeau as leader just 8 weeks ago.

Canada’s Balance of Power

Source: Elections Canada – PFL Analytics

Half of the country is not happy about the outcome. Carney’s/Trudeaus old green deal is in full force and if Carney does not back down is going to rip the country apart, and destroy the average Canadian way of life who is already struggling. The Federal Government of Canada is also on a Collision Course with the Provinces of Alberta and Saskatchewan.

The premiers of both provinces outlined expectations of any new government prior to the election.

In a meeting with Prime Minister Mark Carney, Alberta Premier Danielle Smith provided Carney with a list of demands any new government “must address within the first six months of their term to avoid an unprecedented national unity crisis.”

The first potential area of conflict is how the new government deals with the tariff threat from the U.S., said Smith.

“Alberta, as owner of the resource, will not accept an export tax or restriction of Alberta’s oil and gas to the United States, “and our province is no longer agreeable to subsidizing other large provinces who are fully capable of funding themselves.”

Other demands included:

- Guaranteeing Alberta full access to oil and gas corridors to the north, east, and west;

- Repealing Bill C-69, the Impact Assessment Act;

- Lifting the tanker ban off the B.C. coast;

- Eliminating the oil and gas emissions cap;

- Scrapping Clean Electricity Regulations;

- Ending the prohibition on single use plastics;

- Abandoning the net-zero car mandate;

- Returning oversight of the industrial carbon tax to the provinces;

- Halting the federal censorship of energy companies.

“As premier, I invite the prime minister to immediately commence working with our government to reset the relationship between Ottawa and Alberta with meaningful action rather than hollow rhetoric,” Smith said in a statement on Tuesday of last week.

“A large majority of Albertans are deeply frustrated that the same government that overtly attacked our provincial economy almost unabated for the past 10 years has been returned to government.”

“The status quo can no longer continue”, she added.

“Albertans are proud Canadians that want this nation to be strong, prosperous, and united, but we will no longer tolerate having our industries threatened and our resources landlocked by Ottawa.

“In the weeks and months ahead, Albertans will have an opportunity to discuss our province’s future, assess various options for strengthening and protecting our province against future hostile acts from Ottawa, and to ultimately choose a path forward.”

Saskatchewan Premier Scott Moe laid out a similar agenda, during a recent speech to the Canadian Association of Energy Contractors (CAOEC).

“The next one to four months are going to be very choppy,” Moe said, but he is seeing movement in the right direction both in the U.S. on the trade front and in Ottawa on the regulatory front.

At home, after a decade of stagnation, it appears momentum is building to move necessary export projects forward, he said. The recent cutting of the federal carbon tax to zero is one positive sign, he said. Discussions on building an east-west infrastructure corridor are another boost. But there is much more to do.

“We’re aware of the production cap, which is what it is. And we’re going to have a real conversation about it.”

Provinces are also working to regain regulatory control over resources from the federal government to speed development and remove roadblocks, he said.

Meanwhile. Carney seems to be focused on emissions and climate change.

Carney said, “we are going to aggressively develop projects that are in the national interest in order to protect Canada’s energy security, diversify our trade, and enhance our long-term competitiveness — all while reducing emissions.”

“We will work with the oil and gas sector to reduce their emissions in a cost effective and efficient manner; we cannot lose sight of our obligation to address climate change while ensuring the long-term competitiveness of Canada’s energy sector.” Investment in Canada’s Energy sector is setting itself up to be muted.

There aren’t many signs of optimism emerging from the Canadian oilpatch that a fourth-straight Liberal government in Ottawa will be a boon for energy development in Canada.

Distrust of the Liberals and longstanding frustration over the party’s policies on energy, including the Impact Assessment Act (Bill C-69 or the “no-more-pipelines act”) and the federal emissions cap on oil and gas, appear not to have been alleviated by Mark Carney’s campaign pledge to “build Canada strong” with a renewed focus on the economy.

In an article in Canada’s National Post last week, the oil patch in Canada is unsettled and does not trust Canada’s new leader. “I’m troubled by the fact that most of these things the prior administration put in place, Mark Carney has not committed to altering or changing. In fact, he’s committed to standing behind some of these really damaging bills,” Precision Drilling Corp. chief executive Kevin Neveu said, noting Carney’s addition of a carbon border adjustment mechanism to the existing stack of emissions policies.

“When you continue focusing on these border-based carbon policies and internal carbon policies, you’re putting the climate agenda as a top policy priority, which I think is wrong-minded. Completely wrong-minded.”

A recent survey of energy executives and institutional investors suggests that last Monday’s election outcome doesn’t bode well for oil and gas investment in the months and years ahead.

ATB Capital Markets’ annual spring energy survey of about 60 executives from oil and gas companies and energy service providers, along with 40 institutional investors, said 73 percent of them viewed a Liberal minority government as having a negative impact on their willingness to grow or reinvest in Canadian operations or equities, with 30 percent considering it “significantly negative.”

The survey was conducted last month, but the results were only released Tuesday of last week because ATB’s status as a Crown corporation limits what it can publish during the election period.

National Bank CEO calls for new energy projects, unity, as tariffs put ‘pause’ on the economy.

Executives from Canada’s major pipeline and energy companies said in an open letter last month to federal political leaders that Ottawa’s industrial carbon tax is counterproductive.

Federal energy and environmental policies ranked as the most pressing concern facing the Canadian energy sector for the sixth consecutive survey, ATB said. U.S. tariffs and Canada’s reciprocal tariffs ranked behind access to capital on a list of the sector’s top perceived risks.

“We do need to focus on sort of not doing damage to ourselves in this country,” Tristan Goodman, president of the Explorers and Producers Association of Canada, said. “Federal policies have broadly not been constructive or positive in helping develop natural resources generally, not just in energy, but broadly in mining and other types of projects — they have been absolutely unhelpful and negative for all Canadians.”

Elongated timelines for project approvals, which cause significant budget overruns or cancellation of infrastructure projects in their entirety, could continue to drive Canadian midstream companies in particular to focus on the U.S. “at Canada’s expense,” he said.

Investors and companies may also be less likely to take risks or deploy capital under an unstable minority government, analysts said, since such governments rarely last more than two years.

Some have also said they’re concerned about the potential policy uncertainty that could come from the Liberals being forced to seek the support of either the NDP or Bloc Québécois in order to remain in power effectively turning their minority government into a majority giving conservatives no voice at all.

We are Watching LNG in Canada

Some are thinking that in Canada, if you can’t build anymore pipelines, maybe you can rail some LNG? The Summit Lake PG LNG Project is back in the spotlight in Canada last week as the public comment period was extended to May 9, 2025.

Proposed by JX LNG Canada Ltd., the project aims to produce up to 2.7 million tonnes of LNG annually, transporting it by rail to the Port of Prince Rupert for export.

By using existing CN rail infrastructure, JX LNG bypasses the complexities and costs of building new pipelines that are difficult to get approval to build. For Canadian natural gas producers, this concept could offer a faster, more flexible route to Asian markets without the delays tied to pipeline expansions like Coastal GasLink.

While LNG-by-rail is legal, the proposal has raised concerns over safety, as transporting cryogenic gas over long distances is untested at this scale. However, proponents argue that modern tank cars and safety protocols can mitigate risks.

If successful, Summit Lake could:

- Compete with U.S. LNG exports, particularly those from the Gulf Coast.

- Increase demand for LNG railcars and logistics, especially from Canadian National Railway (CN).

- Shift Canadian gas flows, diverting gas that might have gone to U.S. markets through pipelines, to rail exports.

- Set a new regulatory precedent for LNG transport by rail across North America.

Key Dates

- Public comment period: Extended through May 9, 2025

- Construction start: 2026

- Operations begin: 2028

The problem, as we see it, is the cost of each rail car is crazy – making a 117J looks like child’s play. The cost of a new LNG rail tank car, designed for transporting Liquefied Natural Gas, can range from $650,000 to $750,000. These specialized cars, which meet DOT-113C120W standards for cryogenic materials, are designed to safely transport super-cooled liquids like LNG. Insurance for transporting LNG could also be pricey, given the risks involved in doing so. We doubt the return will be there, but stranger things have happened. No LNG has ever been transported by rail in the United States while there was a rule allowing it; the Biden administration suspended it in 2023. PFL is curiously watching this one closely.

We are Watching Renewables

In an announcement last week, the U.S. energy storage industry has committed $100 billion to building and sourcing American-made grid batteries by 2030. The American Clean Power Association underscores a sharp pivot toward domestic manufacturing to meet 100% of U.S. storage demand and reduce dependence on foreign supply chains.

Over 25 battery manufacturing plants are now under construction or expansion across the country, part of a surge expected to create more than 350,000 jobs. The effort supports not only the growth of renewables but also ensures fossil fuel power can stay reliable by storing excess grid energy not consumed during off peek hours when the sun is not shining in essence flatting the grid somewhat for peak use they said.

Still, industry leaders warn the plan hinges on steady tax and trade policies, faster permitting, and ramped-up domestic mining for critical minerals like lithium and cobalt—resources that remain largely imported. More mine jobs would be great if anything.

For freight and industrial sectors, the move promises years of infrastructure activity. From raw material shipments to facility construction, the logistics behind this buildout could be sizable.

We are watching Key Economic Indicators

Consumer Confidence

The Conference Board’s Index of Consumer Confidence decreased to 86 in April 2025, down from 92.9 in March.

The University of Michigan’s Index of Consumer Sentiment fell to 50.8 in April, down from 57.9 in March.

Consumer Spending

In March 2025, total consumer spending adjusted for inflation rose by 1% over February 2025. This follows a gain of 0.6% in February. According to the government, year-over-year inflation-adjusted total spending in March 2025 was up 3.1%. Inflation-adjusted spending on goods increased by 1.2% in March, following a 0.7% rise in February. Inflation-adjusted spending on services rose by 0.9% in March, building on a 0.5% gain in February and marking the thirteenth consecutive month-to-month increase.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, 30K Any Type Tanks needed off of various class 1s in various locations for 1-5 years. Cars are needed for use in Condensate service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website