“Expect the best. Prepare for the worst. Capitalize on what comes.”

Zig Ziglar

COVID 19 and Markets Update

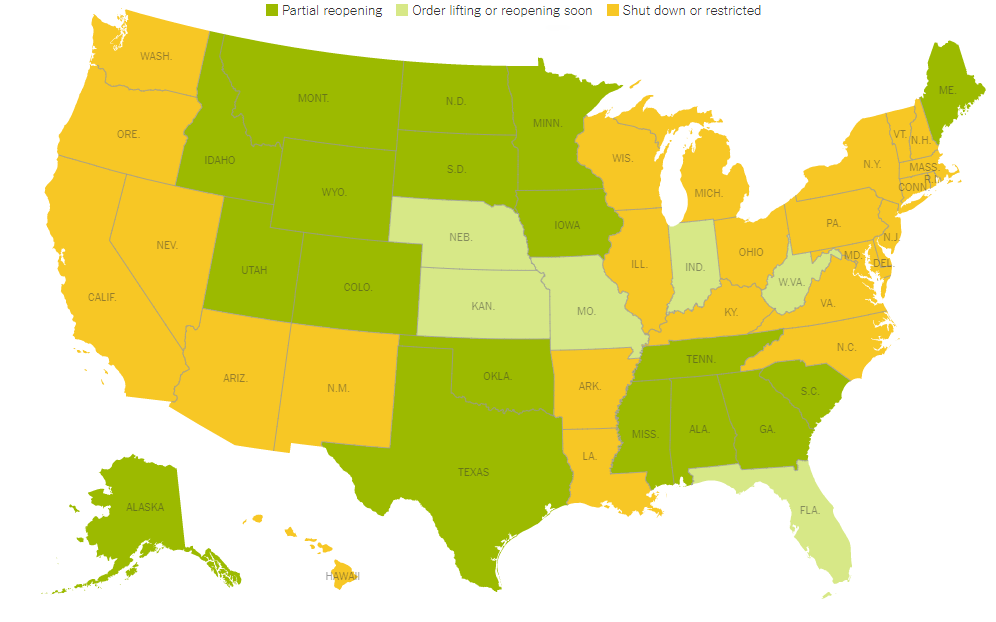

In the United States, we currently have 1,158,341 confirmed cases and 67,686 confirmed deaths. Restrictions have eased in a number of states as some believe the health risks of opening up the economy now outweigh the benefits of remaining shut down.

Five Eyes (FVEY)

There is an intelligence sharing agreement that is not very well known, called Five Eyes (FVEY). It is an agreement between the United States, the United Kingdom, Canada, Australia and New Zealand to share intelligence with one another. The Australian’s leaked a report over the weekend that was prepared for the 5 countries that held China responsible for the spreading of the virus out of Wuhan. China is apparently furious with Australia and promised trade retaliations against Australia. President Trump, on his way to Camp David on Friday, said there is more to come on China. Last night President Trump in a FOX News town hall stated “We are going to have to find out why China did not contain Coronavirus”. Stay tuned and be safe! As a matter of interest here who is talking to whom in the intelligence community involving FVEY:FVEY Agencies Involved in Data Sharing

Oil is lower in overnight trading and WTI is poised to open at $18.79 down 99 cents per barrel from Friday’s close.

Equities traded lower on Friday, with the DOW closing down 622.03 points on the day or 2.55%. In overnight trading, futures traded lower and we are expected to open down roughly 300 points on the DOW. On Thursday of last week, the Labor Department reported roughly 4.0 million people filed for unemployment the previous week, bringing the total number of job losses to more than 30 million in the last six weeks. On Wednesday of last week, GDP data showed that the economy shrank in the first quarter at a rate of 4.8 percent, the biggest contraction since the Great Depression. Consumer spending for March showed its biggest decline on record. At the same time, the stock market closed out April with a bang, with the S&P notching its best monthly gain since 1987. The stock market just had its best month in decades at the same time the labor market had its worst month — possibly ever — amid the backdrop of a rapidly contracting U.S. economy. To us, it does not make sense for equities to continue to move higher in the short term as the underlying fundamentals do not seem supportive. In the longer term, given tensions with China, it seems to us a good portion of the supply chain is going to be brought back to the U.S. or other countries that are friendlier and in line with U.S. interests creating new investment opportunities – it is hard to tell what those investment opportunities are just yet. On a side note, and just in case you didn’t catch it over the weekend, Warren Buffett took a hit in the first quarter of $50B and completely exited from the airlines and is sitting on $137B in cash.

The good news is oil rebounded from its lows last week. WTI traded up $.94 on Friday or 5% to close at $19.78 per barrel.

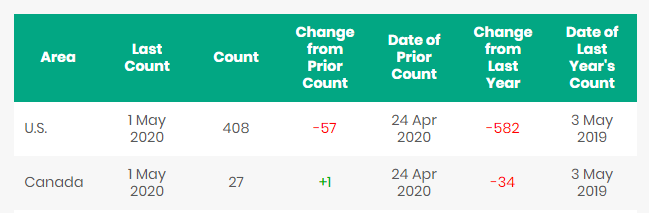

Railcar Volumes

Total North American rail volumes were down 20.2% year over year in week 17 (U.S. -22.4%, Canada -12.0%, Mexico -24.5%), resulting in quarter to date volumes that are down 19.1% and year to date volumes that are down 9.2% (U.S. -10.7%, Canada -5.2%, Mexico -3.6%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-13.9%), coal (-37.5%) and motor vehicles & parts (-89.1%).In the East, CSX’s total volumes were down 24.2%, with the largest decreases coming from motor vehicles & parts (-95.4%), coal (-42.5%) and intermodal (-13.3%). NS’s total volumes were down 30.5%, with the largest decreases coming from intermodal (-21.3%), coal (-59.5%) and motor vehicles & parts (-92.3%).

In the West, BN’s total volumes were down 22.3%, with the largest decreases coming from coal (-39.0%), intermodal (-13.3%), motor vehicles & parts (-80.9%) and petroleum (-33.9%). UP’s total volumes were down 23.3%, with the largest decreases coming from intermodal (-22.8%), motor vehicles & parts (-89.9%), coal (-33.4%), chemicals (-19.1%) and petroleum (-46.8%).

In Canada, CN’s total volumes were down 15.4% with the largest decreases coming from motor vehicles & parts (-92.6%), intermodal (-6.2%) and petroleum (-35.8%). RTMs were down 17.0%. CP’s total volumes were down 8.6%, with the largest decreases coming from motor vehicles & parts (-87.5%), petroleum (-42.5%) and stone sand & gravel (-74.8%). The largest increase came from intermodal (+5.5%). RTMs were down 9.1%.

KCS’s total volumes were down 26.4%, with the largest decreases coming from intermodal (-23.5%), motor vehicles & parts (-96.3%) and petroleum (-30.8%).

An increasing number of cars are being stored. The short term result is fewer cars are online (down -10.2% year over year across Class 1s) is resulting in decreasing dwell times (down -9.6% year over year across Class 1s). KCS’s petroleum/refined products has averaged -10% year over year growth over the past 3 weeks, the first time it has gone negative since mid-2018 when Mexican Energy Reform became increasingly supportive.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

North American Rig Count Summary

Railcar Markets

PFL is offering: Various tank cars with potential dirty to dirty service including gasoline, diesel, crude oil and LPG services – terms negotiable. Sand cars, Box cars, coal cars and hoppers. Call PFL today to discuss your needs and our availability

PFL is seeking: older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. 50-100 340Ws for winter service in the Conway area, Plate C boxcars for purchase, CO2 Cars for lease

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|