“Set your goals high, and don’t stop till you get there.” – Bo Jackson

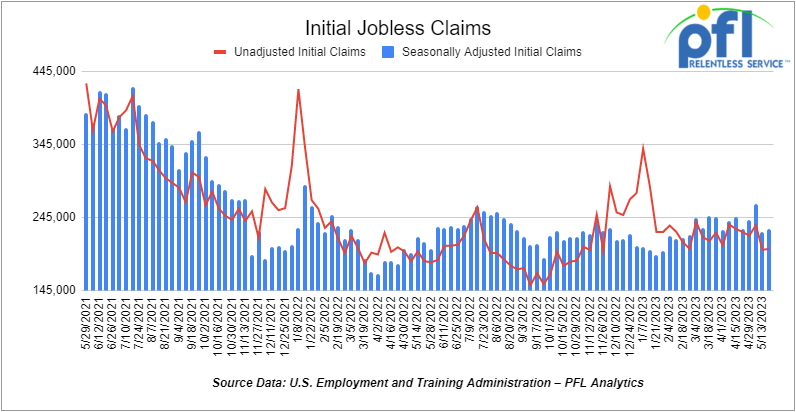

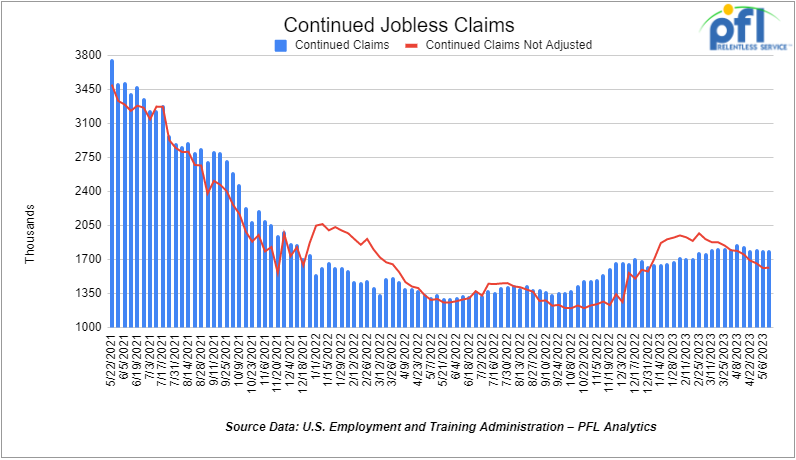

Jobs Update

- Initial jobless claims for the week ending May 20th, 2023 came in at 229,000, up 4,000 people week-over-week.

- Continuing jobless claims came in at 1.794 million people, versus the adjusted number of 1.799 million people from the week prior, down -5,000 people week over week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 328.69 points (1%), closing out the week at 33,093.34, down -442.57 points week over week. The S&P 500 closed higher on Friday of last week, up 54.17 points (+1.3%) and closed out the week at 4,205.45, up 13.47 points week over week. The NASDAQ closed higher on Friday of last week, up 277.59 points (+2.19%), and closed the week at 12,975.69, up +317.79 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 32,218 this morning up 93 points.

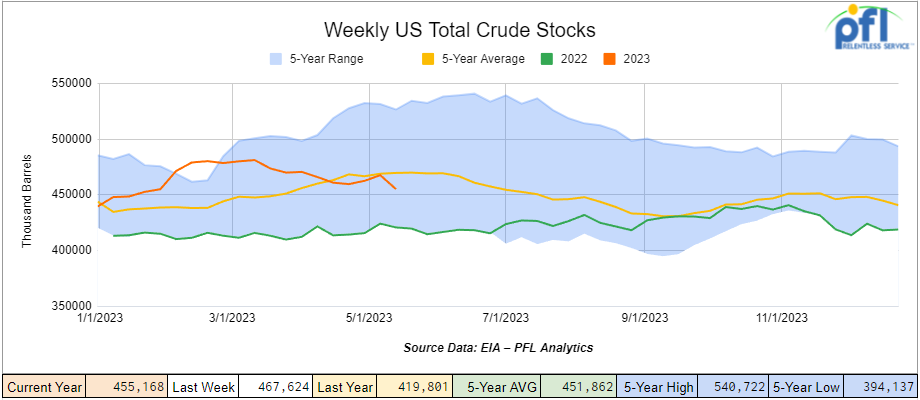

Crude oil closed higher on Friday of last week and higher week over week

WTI traded up $0.84 per barrel (+1.2%) to close at $72.67 per barrel on Friday of last week, up $1.31 per barrel week over week. Brent traded up US$0.36 per barrel (0.9%) on Friday of last week, to close at US$76.95 per barrel, up US$1.37 per barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by -12.5 million barrels week over week. At 455.2 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

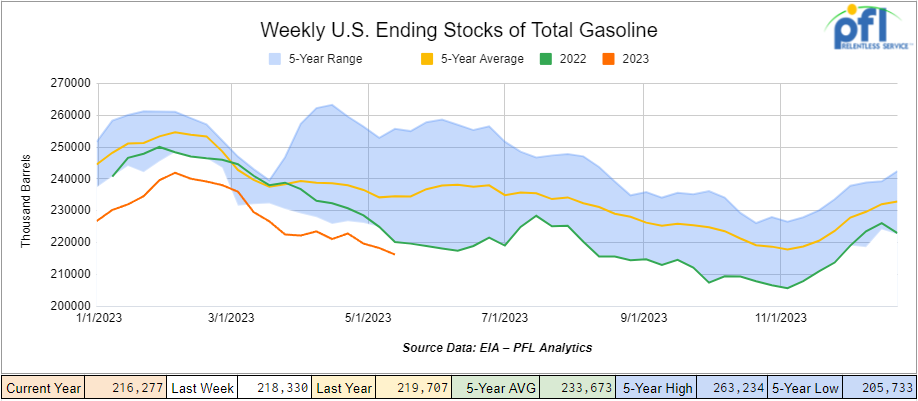

Total motor gasoline inventories decreased by -2.1 million barrels week over week and are 8% below the five-year average for this time of year.

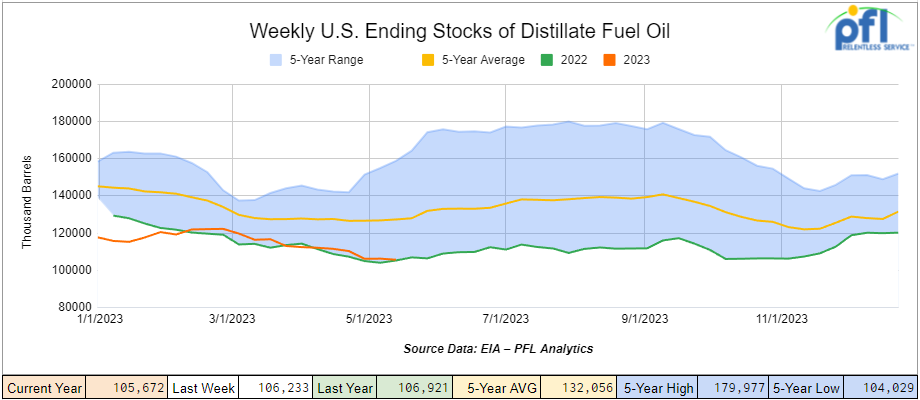

Distillate fuel inventories decreased by -600,000 barrels week over week and are 18% below the five-year average for this time of year.

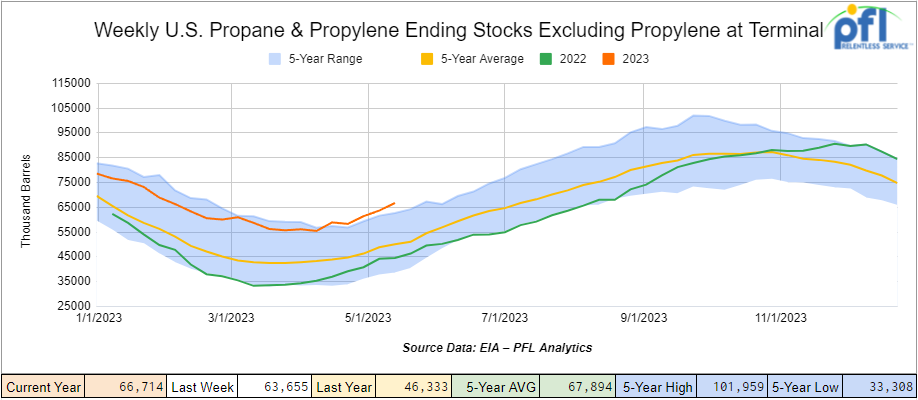

Propane/propylene inventories increased 3.1 million barrels week over week and are 32% above the five-year average for this time of year.

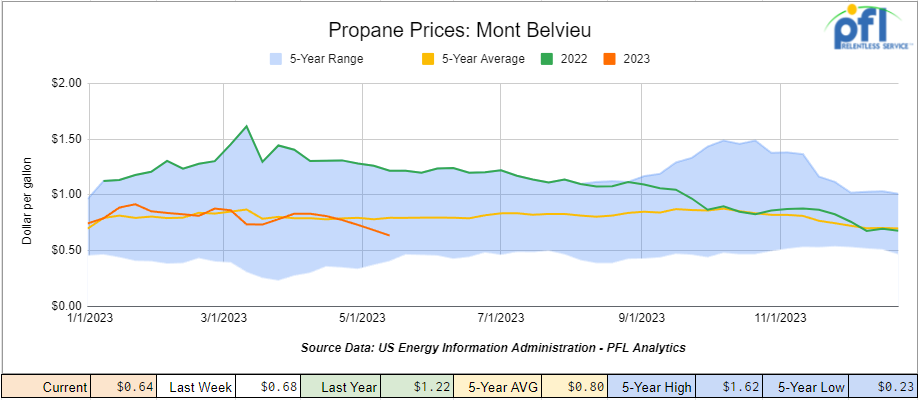

Propane prices closed at 64 cents per gallon, down 4 cents per gallon week over week and down 58 cents per gallon year over year, as inventories increase.

Overall, total commercial petroleum inventories decreased by -10.8 million barrels during the week ending May 19th, 2023.

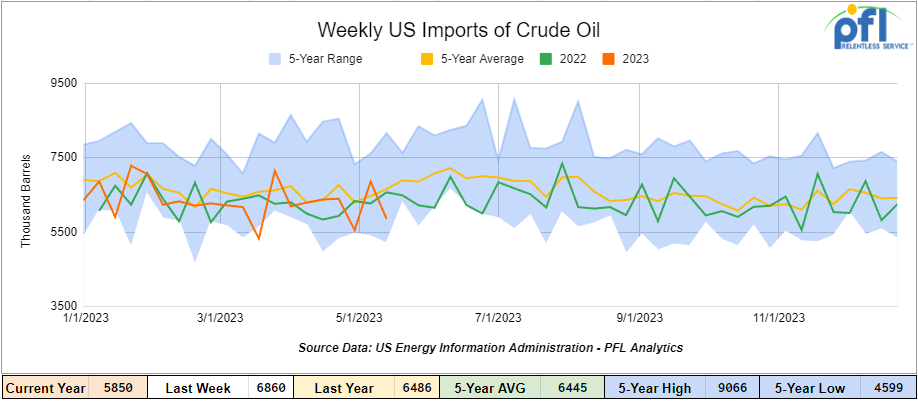

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending May 19th, 2023, a decrease of 1.01 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 3.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 763,000 barrels per day, and distillate fuel imports averaged 156,000 barrels per day during the week ending May 19th, 2023.

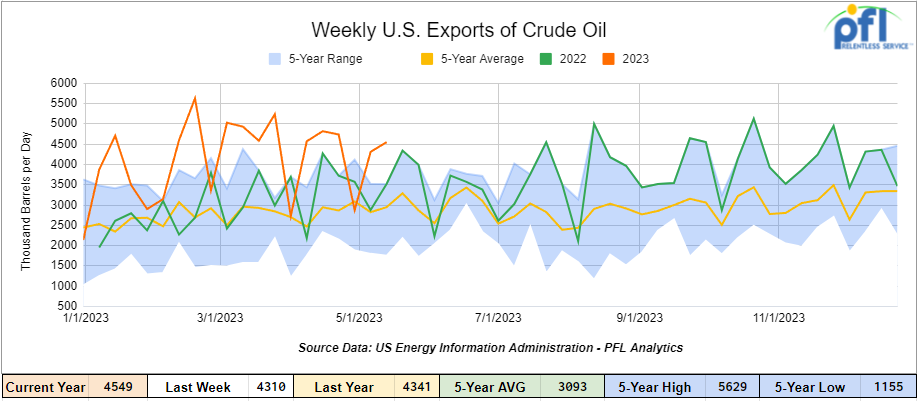

U.S. crude oil exports averaged 4.549 million barrels per day for the week ending May 19th, 2023, an increase of 239,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.118 million barrels per day.

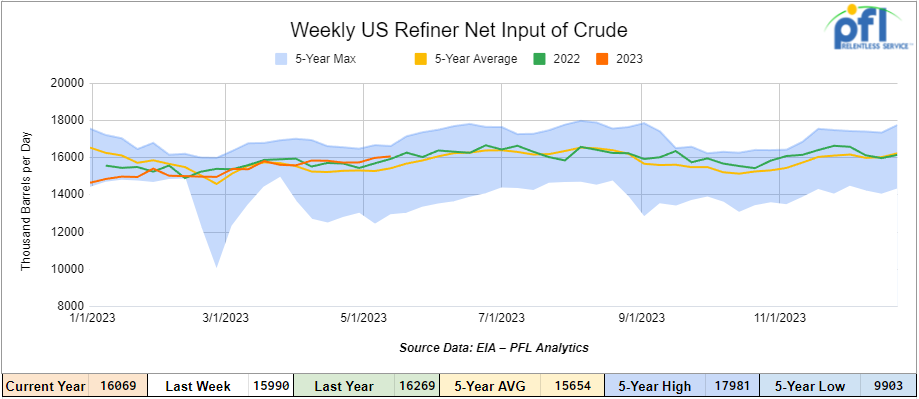

U.S. crude oil refinery inputs averaged 16.1 million barrels per day during the week ending May 19, 2023, which was 79,000 barrels per day more week over week.

As of the writing of this report, WTI is poised to open at $71.21, down -$1.46 from Monday’s close.

North American Rail Traffic

Week Ending May 24th, 2023.

Total North American weekly rail volumes were down (-7.08%) in week 20 compared with the same week last year. Total carloads for the week ending on May 24th were 343,237, down (-2.85%) compared with the same week in 2022, while weekly intermodal volume was 308,533, down (-11.37%) compared to the same week in 2022. 9 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-12.54%). The largest increase came from Motor Vehicles and Parts (+14.37%).

In the east, CSX’s total volumes were down (-2.77%), with the largest decrease coming from Intermodal (-9.22%) and the largest increase from Motor Vehicles and Parts (+27.89%). NS’s volumes were down (-4.39%), with the largest decrease coming from Petroleum and Petroleum Products (-20.84%) and the largest increase from Grain (+15.81%).

In the West, BN’s total volumes were down (-13.59%), with the largest decrease coming from Grain (-22.66%), and the largest increase coming from Motor Vehicles and Parts (+10.14%). UP’s total rail volumes were down (-2.84%) with the largest decrease coming from Other (-18.10%) and the largest increase coming from Motor Vehicles and Parts (+21.92%).

In Canada, CN’s total rail volumes were down (-6.36%) with the largest increase coming from Farm Products (+6.26%) and the largest decreases coming from Nonmetallic Minerals (-35.94%). CP’s total rail volumes were down (-10.12%) with the largest decrease coming from Grain (-42.45%) and the largest increase coming from Other (+79.37%).

KCS’s total rail volumes were down (-18.26%) with the largest decrease coming from Intermodal (-32.22%) and the largest increase coming from Motor Vehicles and Parts (+35.09%).

Source Data: AAR – PFL Analytics

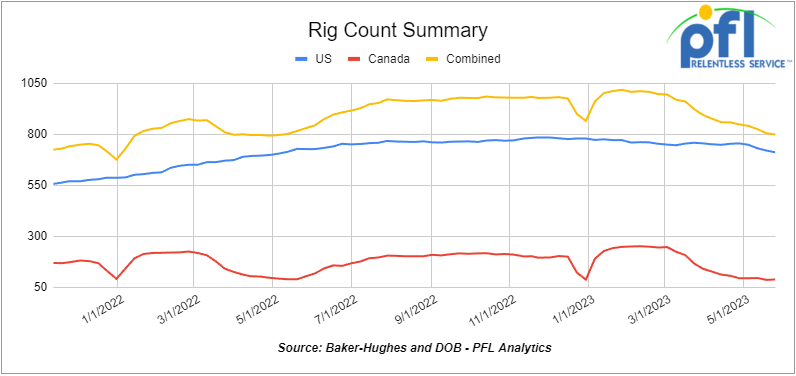

Rig Count

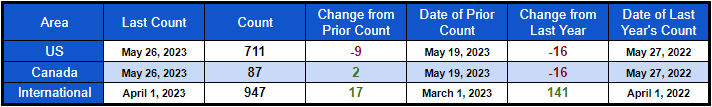

North American rig count was down by -7 rigs week over week. U.S. rig count was down by -9 rigs week over week and down by -16 rigs year-over-year. The U.S. currently has 711 active rigs. Canada’s rig count up by +2 rigs week-over-week and down by -16 rigs year over year. Canada’s overall rig count is 87 active rigs. Overall, year-over-year, we are down -32 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We were at NARS Last Week

Folks, we were present at the North American Rail Shippers Association (“NARS”) annual meeting last week in Chicago. The speakers were great and it was decently attended – all the high level people were there. PFL was a proud exhibitor at the event and was great to see old friends and meet new ones! Marty Oberman from the Surface Transportation Board is all over the class 1’s for not hiring more people and improving service. A lot of rail business, according to Marty, has been lost to truck because of the bad rail service. He had some pretty interesting statistics. NS President Alan Shaw is putting safety as the number 1 priority of that class 1. He hired Atkins Nuclear Secured (ANS), a member of SNC-Lavalin Group, to conduct an independent review of the company’s safety culture. Reporting directly Alan Shaw, ANS will evaluate the railroad’s safety training programs, employee engagement, oversight and monitoring, and communications protocols and practices. “The nuclear industry is the gold standard for industrial safety, and we intend to set the gold standard for the railroad industry,” said Shaw. Other speakers included Katie Farmer and Roger C. Tutterow, PHD who gave an economic update. For Information on NARS and if you have any questions please give us a call on the desk.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,431 from 25,431, which was a gain of +105 rail cars week-over-week. Canadian volumes fell week over week; CPKC’s shipments decreased by -9.1% week over week, and CN’s volumes were lower by -1.5% week-over-week. U.S. shipments were mostly higher. The BN had the largest percentage increase and was up by +2.8% week-over-week. The CSX was the sole decliner and was down by -1.4%

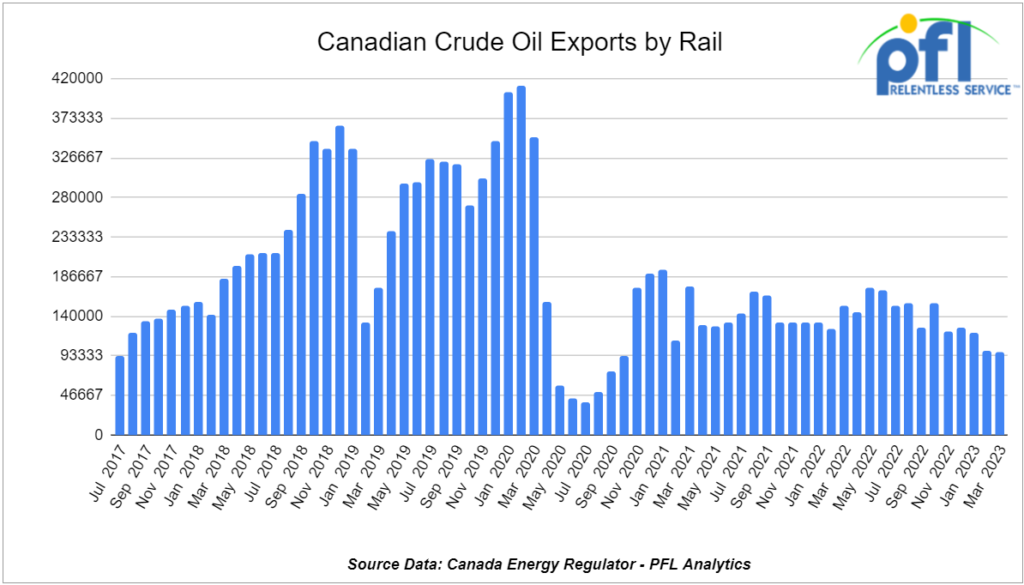

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on May 23, 2023. For March 2023, Canada exported 97,817 barrels per day by rail (down by -1,570 barrels per day month over month); the weakest showing since October of 2020 – another horrible month.

We were expecting to see volumes increase as we head into April as the weather warms and producers begin to build inventory, but that has not been the case.

Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines.

WCS for July delivery settled Friday at US$13.45 below the WTI-CMA. The implied value was US$61.67. On Thursday, it settled at US$13.75 below the WTI-CMA for July delivery. The implied value was US$58.12/bbl.

We are watching – WTI Midland Joining Brent Index

S&P Global Platts has decided to add WTI Midland crude to its dated Brent oil price assessment for June deliveries. This marks the first time a crude from outside the British and Norwegian North Sea region has been included in the basket, which previously consisted of five British and Norwegian crudes.

The inclusion of WTI Midland in the Brent benchmark means that the international index’s pricing will be more influenced by U.S. fundamentals, such as Strategic Petroleum Reserve releases and production levels in the Permian Basin.

The volume of WTI Midland crude being delivered to Europe has been increasing, replacing Russian crude that is restricted due to Western sanctions. This further enhances the significance of WTI Midland in European refineries and, consequently, in the Brent benchmark.

Brent’s value is determined by the cheapest crude in the basket, and if WTI Midland had been part of the Brent benchmark in 2021, it would have set the price about 68% of the time, according to James Gooder, a vice president at Argus.

Christopher Haines, an oil analyst at research consultancy Energy Aspects, suggests that the inclusion of WTI Midland in Brent could potentially lead to increased price volatility in Brent contracts due to significant month-to-month variations in the amount of WTI delivered to Europe.

Overall the importance of WTI Midland in the Brent benchmark is growing along with potential implications for pricing and market dynamics.

The inclusion of WTI in Brent will also affect the arbitrage, which refers to the price differentials of crude oil at different locations that determine the economics of buying and transporting specific crudes. Brent’s wide usage as a pricing benchmark for other grades, such as Dubai, means that the inclusion of WTI will have broader implications on pricing dynamics.

Rebecca Babin from CIBC Private Wealth US expects the WTI/Brent spreads to continue tightening as the inclusion date approaches.

The inclusion of WTI Midland in dated Brent has also led to increased hedging activity as traders are uncertain about how demand and prices will change for both dated Brent and WTI Midland. Contracts for WTI at Houston and Midland on the CME Group exchange have been traded as far ahead as December 2026, and open interest across the Midland and Houston contracts has reached a record level.

Additionally, oil majors have reportedly been buying the spread between WTI and Brent in anticipation of the change to manage any potential risk after the inclusion of Midland in the dated Brent benchmark.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K DOT 111 Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of any class 1 in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of in Canada. Cars were last used in Crude. Dirty to Dirty

- 25, 28.3K, Dot 111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free Move, Dirty to Dirty

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Call for information

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|