“Believe you can and you’re halfway there” – Theodore Roosevelt

Jobs Update

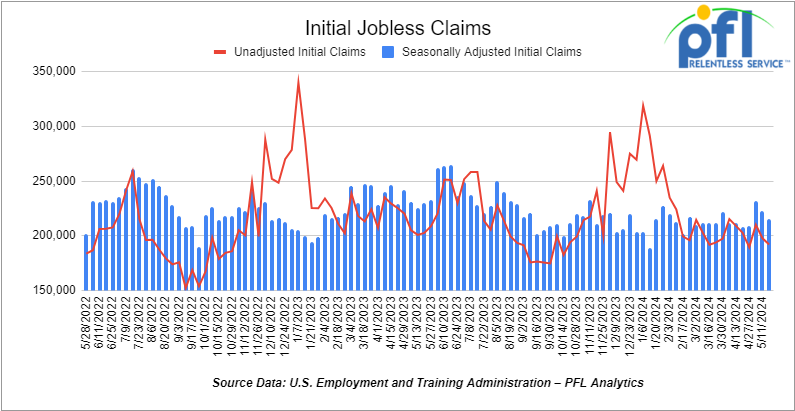

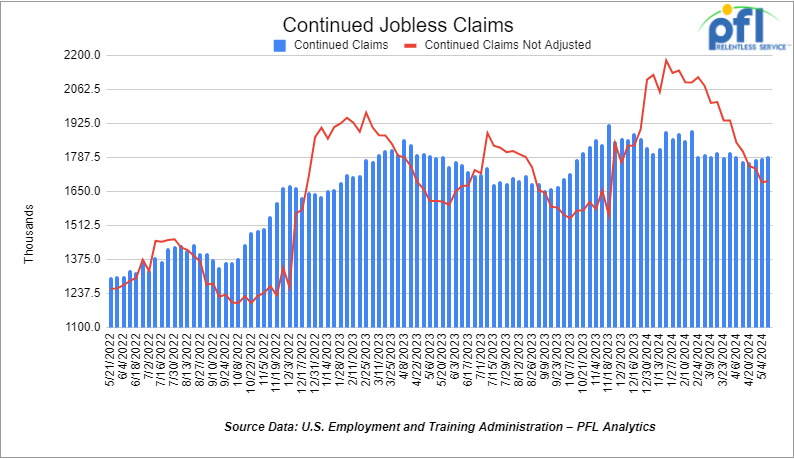

- Initial jobless claims seasonally adjusted for the week ending May 18th, 2024 came in at 215,000, down -8,000 people week-over-week.

- Continuing jobless claims came in at 1.794 million people, versus the adjusted number of 1.786 million people from the week prior, up 8,000 people week-over-week.

Stocks closed higher on Friday of last week, but mixed week over week

The DOW closed higher on Friday of last week, up 4.33 points (0.01%), closing out the week at 39,069.59, down -934 points week-over-week. The S&P 500 closed higher on Friday of last week, up 36.88 points (0.7%), and closed out the week at 5,304.72, up 1.45 points week-over-week. The NASDAQ closed higher on Friday of last week, up 184.76 points (1.11%), and closed out the week at 16,920.79, up 264.82 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,179 this morning up 22 points.

Crude oil closed higher on Friday of last week – lower week over week.

WTI traded up US$0.85 per barrel (1.1%) on Friday of last week, to close at $77.72 per barrel, down -$2.34 per barrel week-over-week. Brent traded up US$0.76 per barrel (0.93%) to close at US$82.12 per barrel on Friday of last week, down -US$1.86 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled Friday at US$11.00 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$65.31 per barrel.

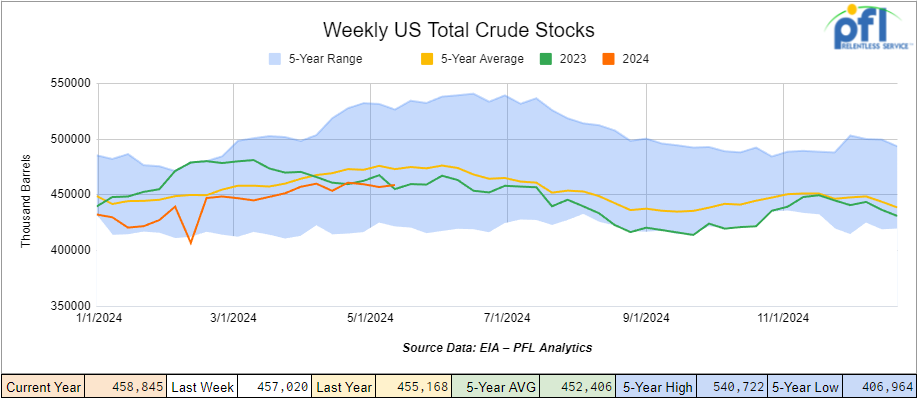

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.8 million barrels week-over-week. At 458.8 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

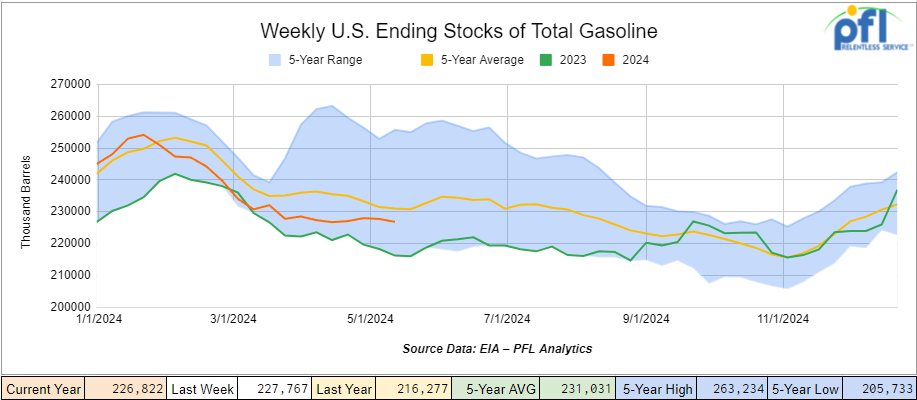

Total motor gasoline inventories decreased by 900,000 barrels week-over-week and are 2% below the five-year average for this time of year.

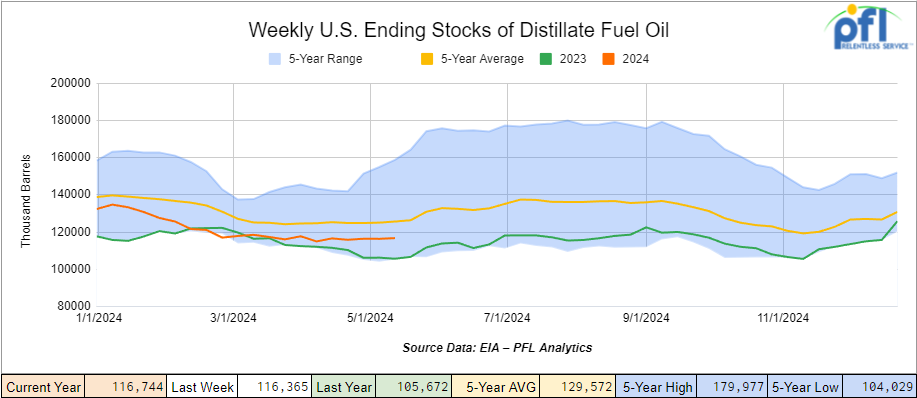

Distillate fuel inventories increased by 400,000 barrels week-over-week and are 7% below the five-year average for this time of year.

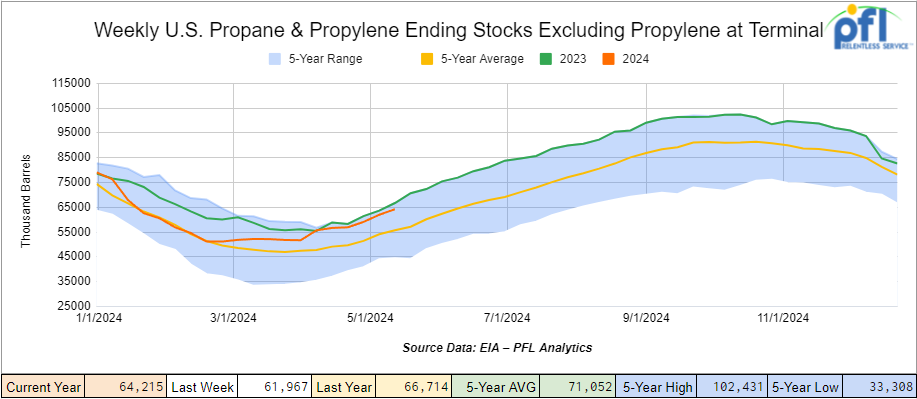

Propane/propylene inventories increased by 2.2 million barrels week-over-week and are 14% above the five-year average for this time of year.

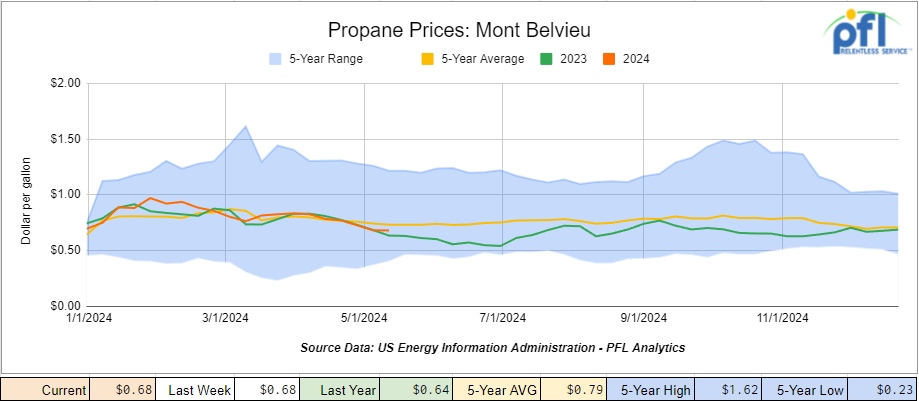

Propane prices closed at 68 cents per gallon, flat week-over-week, but down 4 cents year-over-year.

Overall, total commercial petroleum inventories increased by 7.5 million barrels. during the week ending May 17th, 2024.

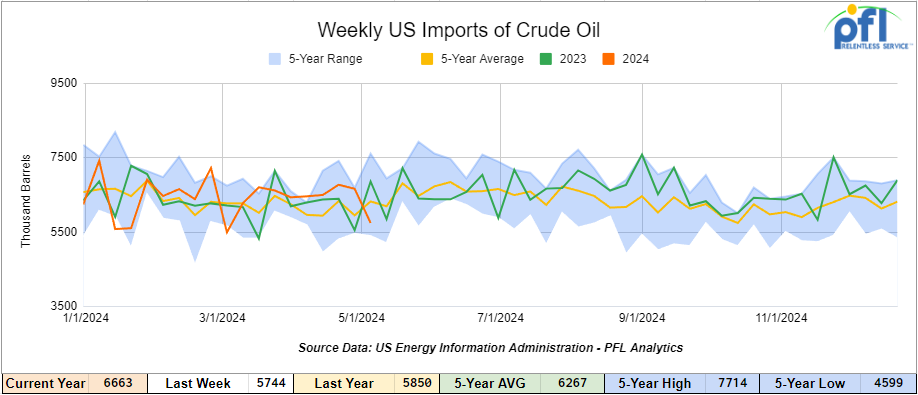

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending May 17th, 2024, a decreased of 81,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.8 million barrels per day, 10.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 773,000 barrels per day, and distillate fuel imports averaged 98,000 barrels per day. during the week ending May 17th, 2024.

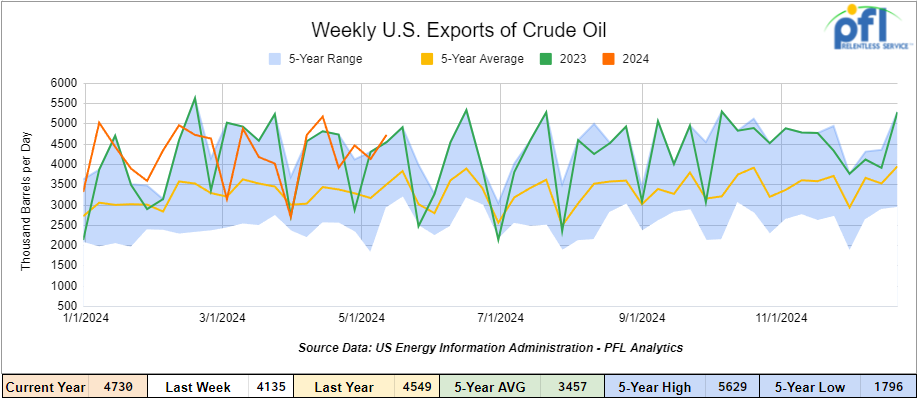

U.S. crude oil exports averaged 4,73 million barrels per day for the week ending May 17th, 2024, an increase of 595,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.313 million barrels per day.

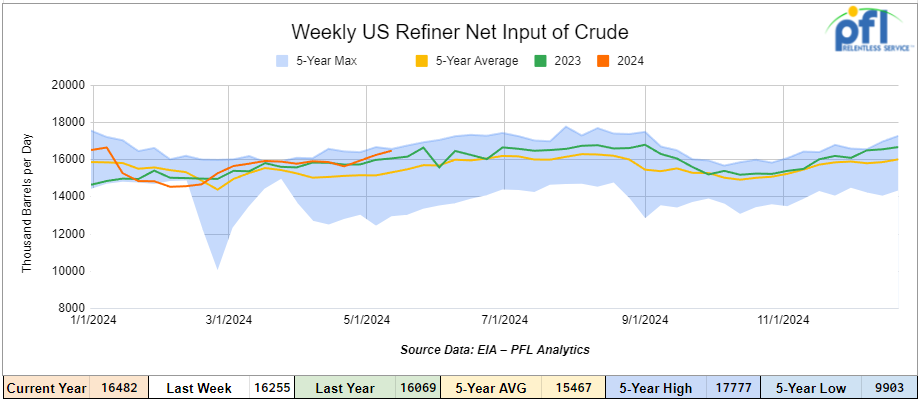

U.S. crude oil refinery inputs averaged 16.5 million barrels per day during the week ending May 17, 2024, which was 227,000 barrels per day more week-over-week.

WTI is poised to open at $78.85, up $1.13 per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 22nd, 2024.

Total North American weekly rail volumes were up (0.83%) in week 21, compared with the same week last year. Total carloads for the week ending on May 22nd were 336,724, down (-1.9%) compared with the same week in 2023, while weekly intermodal volume was 329,075, up (+6.66%) compared to the same week in 2023. 9 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-18%). The most significant increase came from Petroleum and Petroleum Products which was up (+6.94%).

In the East, CSX’s total volumes were up (5.39%), with the largest decrease coming from Grain (-4.74%) while the largest increase came from Petroleum and Petroleum Products (22.38%). NS’s volumes were up (3.44%), with the largest increase coming from Metallic Ores and Metals (+11.95%) while the largest decrease came from Coal (-3.41%).

In the West, BN’s total volumes were up (3.03%), with the largest increase coming from Grain (20.09%) while the largest decrease came from Coal, down (-27.87%). UP’s total rail volumes were down (-1.55%) with the largest decrease coming from Coal, down (-28.46%) while the largest increase came from Chemicals which was up (+8.78%).

In Canada, CN’s total rail volumes were up (1.25%) with the largest decrease coming from Grain, down (-45.67%) while the largest increase came from Nonmetallic Minerals, up (+89.53%). CP’s total rail volumes were up (4.86%) with the largest increase coming from Intermodal (+48%) while the largest decrease came from Coal, down (-51.27%).

KCS’s total rail volumes were down (-15.68%) with the largest decrease coming from Coal (-15.68%) and the largest increase coming from Motor Vehicles and Parts (+48.42%).

Source Data: AAR – PFL Analytics

Rig Count

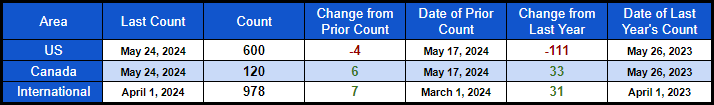

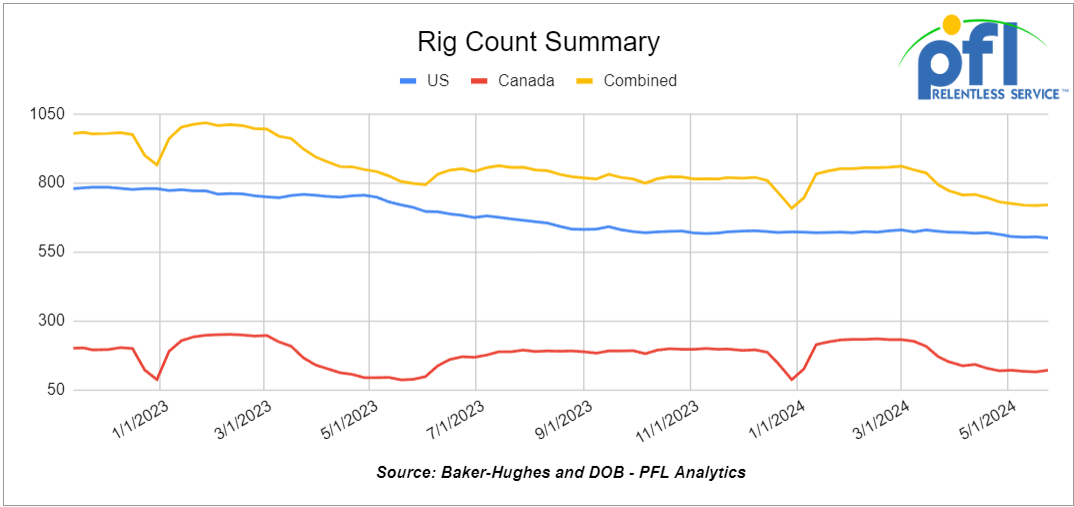

North American rig count was up by 2 rigs week-over-week. U.S. rig count was down by -4 rig week-over-week, but down by -111 rigs year-over-year. The U.S. currently has 603 active rigs. Canada’s rig count was up by 6 rigs week-over-week, and up by 33 rigs year-over-year. Canada’s overall rig count is 120 active rigs. Overall, year-over-year, we are down -78 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 28,053 from 28,167, which was a decrease of 114 rail cars week-over-week Canadian volumes were higher. CPKC’s shipments were higher by +9.5% week over week. CN’s volumes were higher by +1.6% week-over-week. U.S. shipments were down across the board. The BN had the largest percentage decrease and was down by -8.5%.

We are watching the Biden Administration and Energy

In another White House energy development, President Joe Biden’s administration will sell nearly 1 million barrels of gasoline in the U.S. – managed stockpile in northeastern states as required by law, the Department of Energy said on Tuesday of last week, effectively closing the near decade-old reserve.

The department created the Northeast Gasoline Supply Reserve in 2014 after Superstorm Sandy left motorists scrambling for fuel. Storing refined fuel is costlier than storing crude oil, so closing the reserve was included in U.S funding legislation signed in March by Biden. Bids are due today and the Treasury Department’s general funds get proceeds from the sale, the department said.

The volumes will be allocated in quantities of 100,000 barrels with each barrel containing 42 gallons, the department said. The gasoline should flow into local retailers ahead of the Fourth of July holiday, it said. Energy Secretary Jennifer Granholm said the Department of Energy had timed the sale to coincide with the run-up to peak summer driving demand.

“By strategically releasing this reserve in between Memorial Day and July 4th, we are ensuring sufficient supply flows to the … northeast at a time hardworking Americans need it the most,” Granholm said in a release. But, only representing several hours of U.S. consumption the sale will have 0 impact!

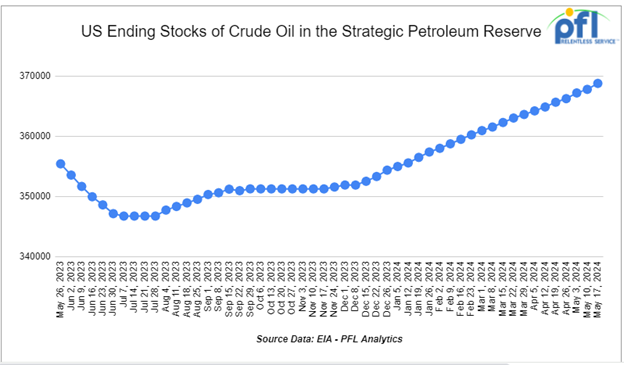

In case you missed it, the Biden Administration is raising the price that the U.S. is willing to pay to refill the Strategic Petroleum Oil Reserves (“SPR”) that the administration drained in front of the midterms in an attempt to lower gas prices at the pump for the benefit they said of the American Consumer. The selling of crude out of the SPR lowered our reserves to the lowest level in 40 years. The Energy Department said in a filing that it will pay as much as $79.99 a barrel. This was the first time the administration had set an explicit price ceiling and is higher than the previous informal cap of $79 per barrel. If you ask us, the White House has to stop playing oil trader!

We are watching Hurricane Season

Folks, here we go again with hurricane season. The official start is Saturday of this week (June 1). U.S. forecasters (NOAA) are expecting a big one. U.S. government forecasters said on Thursday of last week up to seven major hurricanes may form in an “extraordinary” year.

An average hurricane season produces 14 named storms (winds of at least 39 miles per hour or 63 kph), of which seven become hurricanes (winds over 74 mph or 119 kph) and three become “major,” with wind speeds over 111 mph (178 kph).

Warm sea temperatures and falling wind shear conditions at the height of the hurricane season in August and September are expected to contribute to more and stronger storms this year, the forecasters say.

“This forecast has higher ranges than 2005,” said lead forecaster Matthew Rosencrans in a news conference webcast from Washington, D.C. “These are the highest ranges we have ever forecasted.”

In 2023 there were three major hurricanes that formed among seven hurricanes and 20 named storms, the fourth-greatest number of named storms since 1950. The most damaging, Idalia, tore up the west coast of Florida and made landfall as a Category 3 hurricane.

NOAA’s forecast is among several closely monitored by coastal communities and energy companies.

The widely watched Colorado State University forecast issued in April projected five major hurricanes out of 11 total hurricanes that are part of a projection for 23 named tropical storms.

The U.S. Gulf of Mexico accounts for 15% of total U.S. crude oil production, 5% of its dry natural gas output, and nearly 50% of the nation’s oil refining.

NOAA’s forecast is in line with other initial outlooks. Private forecaster AccuWeather has said there is a 10-15% chance of 30 or more named storms in the 2024 hurricane season, which runs until November 30.

We are watching the Trans Mountain Pipeline – the Canadian Government intends to sell the pipeline at the same time, making sure it includes Indigenous Group ownership.

Canada is amending regulations on how it manages the state-owned Trans Mountain oil pipeline in order to facilitate its sale to Indigenous groups, according to an official government notice published on Wednesday of last week.

The long-delayed Trans Mountain expansion project (TMEP)nearly triples shipments of Alberta oil to Canada’s Pacific Coast to 890,000 barrels per day and started commercial operations on May 1, with the first tanker set to load by the end of this month.

The C$34 billion ($24.88 U.S. billion) project, which cost more than four times its original budget, was bought by the Liberal government in 2018 to ensure construction went ahead.

Ottawa plans to sell the pipeline now that it is complete and wants to enable Indigenous communities along the route to buy a stake.

The amendments would allow Canada Development Investment Corporation (CDEV), the crown corporation that owns Trans Mountain, to conduct certain transactions such as incorporating new subsidiaries without needing approval from senior government ministers, according to a notice in the government’s official newspaper, the Canada Gazette.

Those subsidiaries could be used to market spot pipeline capacity, broaden insurance coverage, and incorporate a special-purpose acquisition vehicle that would allow individual Indigenous communities to buy into the pipeline.

“It is essential that CDEV and its TMEP-related subsidiaries be provided the tools to act as quickly as counterparts in the competitive energy sector without needing to seek GIC (Governor in Council) authorization for each individual transaction,” the notice in the Gazette said. It will be interesting to see how this one plays out – we will keep watching this one for you.

Lease Bids

- 20, 4750’s Thru Hatch Hopper Covereeds needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25, 30K 117R Tanks needed off of in for 2-3 Year. Cars are needed for use in Condensate service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term, would look at a longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 25, 33K, 400W Pressure Tanks located off of IHB in Hammond, IN. Cars were last used in propylene. 1-year term.

Sales Offers

- 20, Refer Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website