“ I have always believed, and I still believe, that whatever good or bad fortune may come our way we can always give it meaning and transform it into something of value. “

-Hermann Hesse

Jobs Update

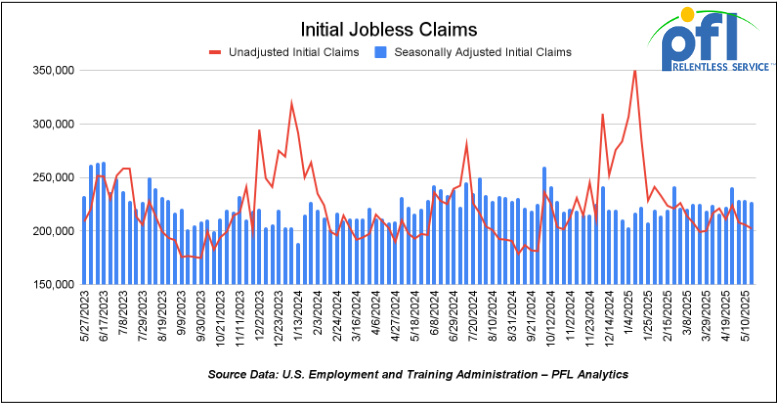

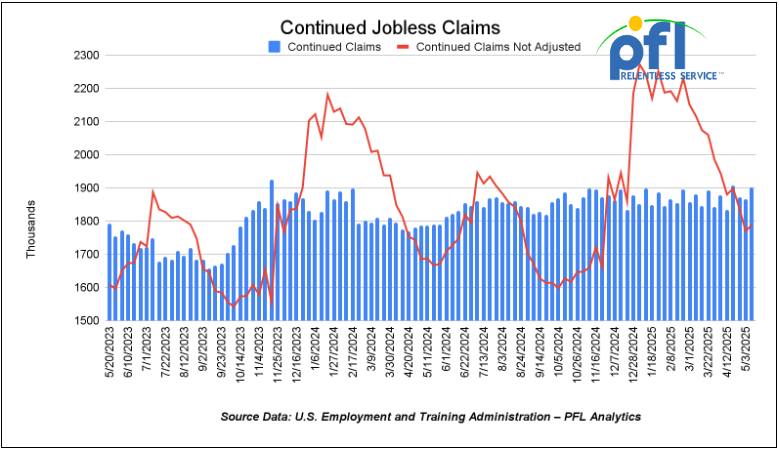

- Initial jobless claims seasonally adjusted for the week ending May 17 came in at 227,000, down -2,000 people week-over-week.

- Continuing jobless claims came in at 1.903 million people, versus the adjusted number of 1.867 million people from the week prior, up 36,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -258.02 points (-0.61%) and closing out the week at 41,603.07, down -1,051.67 points week-over-week. The S&P 500 closed lower on Friday of last week, down -39.19 points, and closed out the week at 5,802.82 down -155.56 points week-over-week. The NASDAQ closed lower on Friday of last week, down -188.53 points, and closed out the week at 18,737.21, down -473.89 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 42,229 this morning up 555 points from Friday’s close.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up +33 cents per barrel (+0.54%), to close at $61.53 per barrel on Friday of last week, but down -96 cents per barrel week over week. Brent crude closed up +34 cents USD per barrel (+0.54%) on Friday of last week, to close at $64.78 per barrel, but down -63 cents per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled on Friday of last week at US$9.75 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$50.72 per barrel.

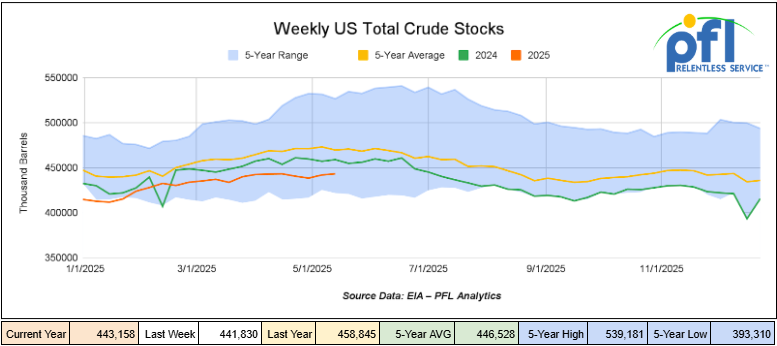

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.3 million barrels week-over-week. At 443.2 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

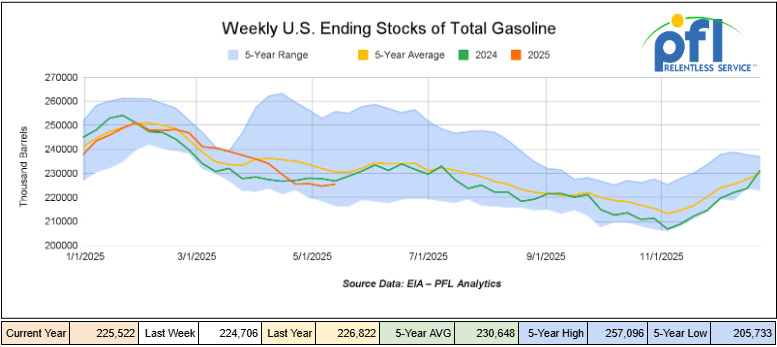

Total motor gasoline inventories increased by 800,000 barrels from last week and are 2% below the five-year average for this time of year.

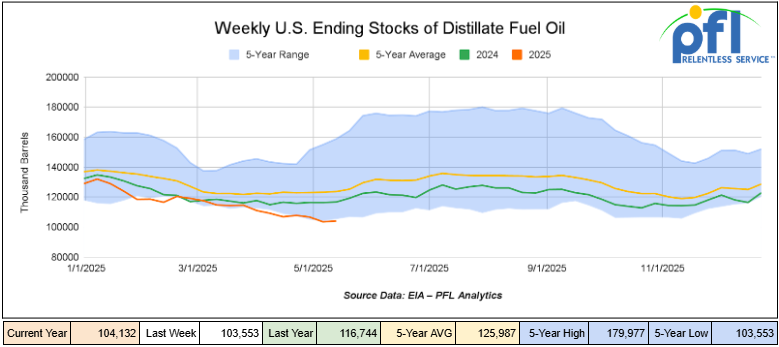

Distillate fuel inventories increased by 600,000 barrels week-over-week and are 16% below the five-year average for this time of year.

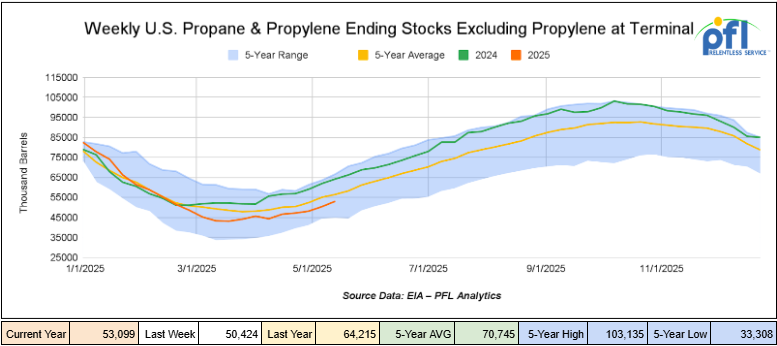

Propane/propylene inventories increased by 2.7 million barrels week-over-week and are 7% below the five-year average for this time of year.

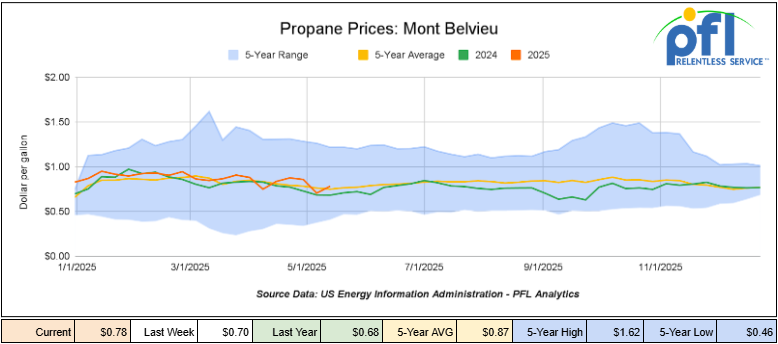

Propane prices closed at 78 cents per gallon on Friday of last week, up 8 cents per gallon week-over-week, and up 10 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 4.9 million barrels last week during the week ending May 16, 2025.

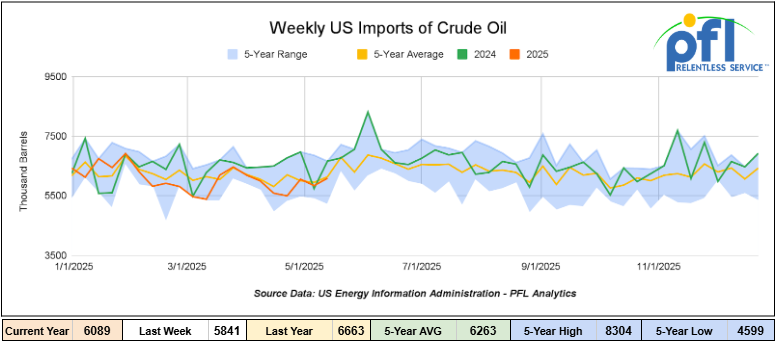

U.S. crude oil imports averaged 6.1 million barrels per day last week during the week ending May 16, 2025, an increase of 247,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 5.9 million barrels per day, 13.5% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 747,000 barrels per day, and distillate fuel imports averaged 141,000 barrels per day during the week ending May 16, 2025.

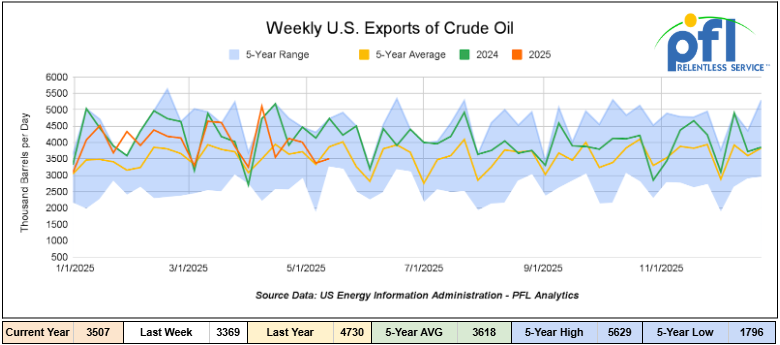

U.S. crude oil exports averaged 3.507 million barrels per day during the week ending May 16, 2025, an increase of 138,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.751 million barrels per day.

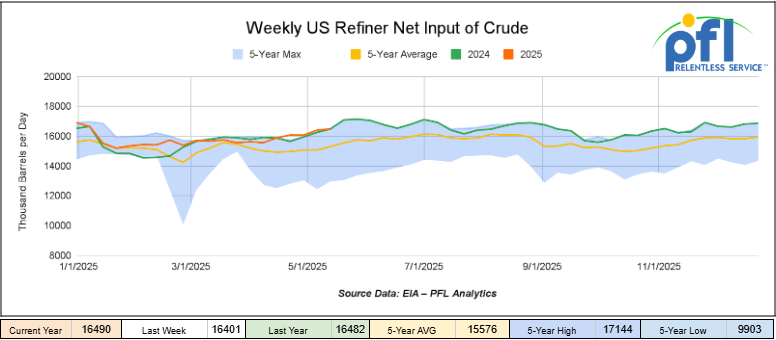

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending May 9, 2025, which was 330,000 barrels per day more week-over-week.

WTI is poised to open at $61.79, up 29 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 21, 2025.

Total North American weekly rail volumes were down (-2.91%) in week 21, compared with the same week last year. Total carloads for the week ending on May 21 were 355,803, down (-0.7%) compared with the same week in 2024, while weekly intermodal volume was 322,472, down (-5.24%) compared to the same week in 2024.

8 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Forest Products, which was down (-14.76%), while the largest increase was from Coal, which was up (+14.96%).

In the East, CSX’s total volumes were down (-2.45%), with the largest decrease coming from Metallic ores and Metals (-14.98%), while the largest increase came from Grain (+33.46%). NS’s volumes were up (+2.04%), with the largest increase coming from Motor Vehicles and Parts(+7.94%), while the largest decrease came from Forest Products (-7.54%).

In the West, BN’s total volumes were up (+2.02%), with the largest increase coming from Motor Vehicles and Parts (+25.66%), while the largest decrease came from Forest Products (-14.71%). UP’s total rail volumes were up (+4..81%), with the largest increase coming from Coal (+43.89%), while the largest decrease came from Motor Vehicles and Parts (-3.78%).

In Canada, CN’s total rail volumes were down (-11.25%) with the largest increase coming from Grain, up (+37.98%), while the largest decrease came from Intermodal Units (-33.23%). CPKCS’s rail volumes were up 23.69%, with the largest increase coming from Other (388.44%), while the largest decrease came from Farm Products (-4.78%)

Source Data: AAR – PFL Analytics

Rig Count

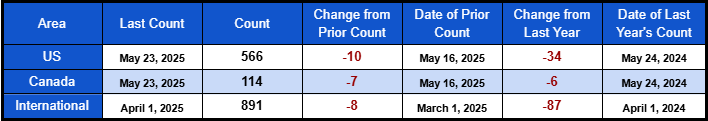

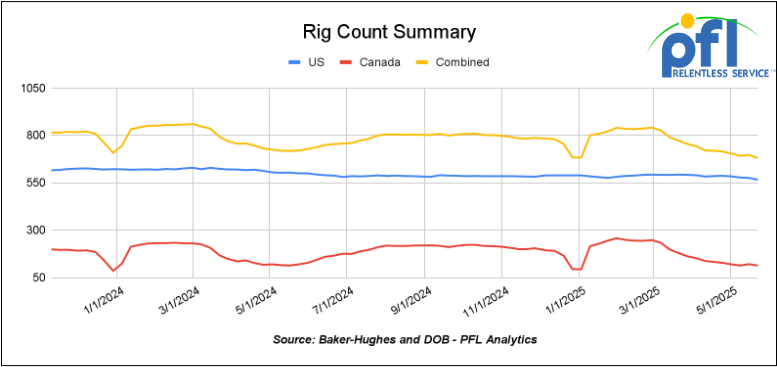

North American rig count was down by -17 rigs week-over-week. U.S. rig count was down -10 rigs week over week and down by -34 rigs year-over-year. The U.S. currently has 566 active rigs. Canada’s rig count down -7 rigs week-over-week and down by -6 rigs year-over-year. Canada currently has 114 active rigs. Overall, year-over-year, we are down by -40 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,255 from 27,074 which was an increase of +181 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -0.60% week over week, CN’s volumes were lower by -7.50% week-over-week. U.S. shipments were mixed. The CSX had the largest percentage increase and was up by +11.8%. The UP had the largest percentage decrease and was down by -2.4%

We are watching Canadian Crude by Rail

Crude by rail out of Canada increased month over month. The Canadian Energy regulator reported on Friday of last week, that 77,520 barrels were exported per day during the month of March 2025, up from 65,399 barrels in February of 2025, an increase of 12,121 barrels per day, month over month.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines and raw bitumen shipped as a non-haz product, which is not able to flow in pipelines and is competitive with pipeline tolls. This is a growing market to keep an eye on despite the downturn we are now seeing. Other factors would be existing long-term contractual commitments and basis -we really need to see basis the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense for diluted bitumen (condensate added). We don’t anticipate seeing that anytime soon – a bunch of turnarounds about to happen in Canada limiting crude available to be shipped. As reported in last week’s report, Strathcona recently purchased the Hardisty Rail Terminal. Current capacity of that terminal is 250,000 barrels per day and is only running at 50,000 barrels per day, so lots of room to grow and move raw bitumen out of Alberta to U.S. refineries.

We Are Watching Solar

A razor-thin vote in the U.S. House on Thursday last week sent shockwaves through clean energy markets but did not surprise us as Trump did promise to get rid of as much as he could regarding what he call’s the “Green Fake Deal”.

Lawmakers passed a budget bill on Thursday that slashes key clean energy tax credits, putting Solar’s rapid growth — and its freight momentum — on the chopping block. The measure cuts back the 48E Investment Tax Credit and 45Y Production Tax Credit, giving developers just 60 days post-enactment to qualify. It also kills the 25D Residential Credit after 2025 and blocks third-party-owned systems — a blow to the dominant rooftop model.

Industry reaction was swift. The Solar Energy Industries Association warned the bill threatens 300,000 jobs and could derail over 280 solar and storage manufacturing sites.

Solar has become a freight bright spot for the class 1’s – feeding new intermodal volumes, project cargo, and domestic factory output. A slowdown in installations means a slowdown in shipments.

Rail Snapshot:

Solar-related shipments jumped 16% YOY (year-over-year) in 2024, outpacing the YOY growth of most commodities.

Class I carriers expanded routes and capabilities to support the surge — especially in the Southwest and Midwest.

Solar freight is now a line item in long-term capital plans.

A refined tax environment could send that growth off a cliff – just as railroads ramp up to cash in on more clean energy infrastructure.

The bill now heads to the Senate, where it could face opposition. But, the uncertainty is already reverberating through logistics planning.

“This could upend an economic boom,” said SEIA’s Abigail Ross Hopper. “It’s not just solar jobs. It’s supply chain, grid reliability — the whole thing.”

Stay tuned to PFL – we are watching this one.

We Are Watching Coal in Michigan

In a Rare Display Trump officials order a 1,400 MW Michigan coal power plant must stay open on eve of shutdown.

The Trump administration is intervening to keep one of Michigan’s largest remaining coal-burning power plants on temporary life support, weeks before it is slated to go cold and dark for good.

Energy Secretary Chris Wright invoked authority reserved for wartime or periods of electricity demand-related emergencies to order Consumers Energy’s J.H. Campbell coal plant to “remain available for operation” through the summer months.

Consumers Energy has been gearing up to take it offline as early as June, beginning a process of decommissioning the plant.

The Campbell plant is situated on the shores of Lake Michigan in the middle of Ottawa County.

“Today’s emergency order ensures that Michiganders and the greater Midwest region do not lose critical power generation capability as summer begins and electricity demand regularly reach high levels,” Wright said in a statement.

The order occurred on Friday of last week and will last for 90 days. Environmentalists are angry.

“Consumers Energy plans to comply with the 90-day pause from the Department of Energy. We are reviewing the executive action and the overall impact on our company,” said Consumers spokesperson Katie Carey in a statement.

We Are Watching Hurricane Season

Well folks Hurricane season is right around the corner. NOAA predicts above-normal 2025 Atlantic hurricane season. NOAA’s outlook for the 2025 Atlantic hurricane season, which runs from June 1 to November 30, predicts a 30% chance of a near-normal season, a 60% chance of an above-normal season, and a 10% chance of a below-normal season.

The agency is forecasting a range of 13 to 19 total named storms (winds of 39 mph or higher). Of those, 6-10 are forecast to become hurricanes (winds of 74 mph or higher), including 3-5 major hurricanes (category 3, 4 or 5; with winds of 111 mph or higher). NOAA has a 70% confidence in these ranges.

We Are Watching Class 1 Industry Head Count

Class I railroads employed 119,649 workers in the United States in April 2025, a 0.09% increase from March 2025’s count of 119,543 and a -2.70% year-over-year decrease from April 2024’s total of 122,967, according to Surface Transportation Board data.

Four of the six employment categories posted month-over-month increases between March and April 2025. These were Executives, officials, and staff assistants, up 0.32% to 7,863 workers; Maintenance of Way and Structures, up 1.06% to 28,848 workers; Maintenance of Equipment and Stores, up 0.21% to 17,058 workers; and Transportation (other than train and engine), up 0.30% to 5,025 workers.

The categories that posted month-over-month decreases were Professional and Administrative, down -0.78% to 9,591 workers; and Transportation (train and engine), down -0.38% to 51,264 workers.

Year over year, only one category posted an employment gain: Transportation (other than train and engine), up 1.01%.

Categories that registered year-over-year decreases in April 2025 were Executives, officials, and staff assistants, down -1.68%; Professional and Administrative, down -5.32%; Maintenance of Way and Structures, down -1.13%; Maintenance of Equipment and Stores, down -4.30%; and Transportation (train and engine), down -3.02%.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, 30K Any Type Tanks needed off of various class 1s in various locations for 1-5 years. Cars are needed for use in Condensate service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website