“The single biggest problem in communication is the illusion that it has taken place”

– George Bernard Shaw

Weekly Jobless Claims Down Week Over Week a New Pandemic Low

- Initial claims for jobless benefits totaled 444,000 last week, better than the 452,000 estimate.

- The total represented a decline from the previous week’s 478,000 and was the lowest since March 14, 2020.

- Continuing claims rose by 111,000 to 3.75 million, though that number runs a week behind.

- The strong pace of Covid-19 vaccines, or one might say the opening of blue states, has spurred the economic rebound. The U.S. is administering 1.8 million shots a day.

- The total of those receiving benefits tumbled by nearly 900,000 to just shy of 16 million, according to data through May 1.

Stocks mixed on Friday down week over week

The Dow closed higher on Friday of last week, up +123.69 (+0.36%) points closing out the week at 34,207.54, down -174.59 points week over week. The S&P 500 closed lower on Friday of last week, down -3.26 points (+0.08%) and closing out the week at 4,155.86, down -17.99 points week over week. The Nasdaq closed lower on Friday of last week, down -64.75 points (-.48%) and closing out the week at 13,470.99, up +41.01 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 125 points.

Oil jumped on Friday of last week on the back of Gulf Coast Weather Concerns

Oil prices jumped on Friday of last week after three days of losses, driven higher as a storm formed in the Gulf of Mexico, but were on track for a weekly fall as investors braced for the return of Iranian crude supplies after officials said Iran and world powers made progress a on nuclear deal.

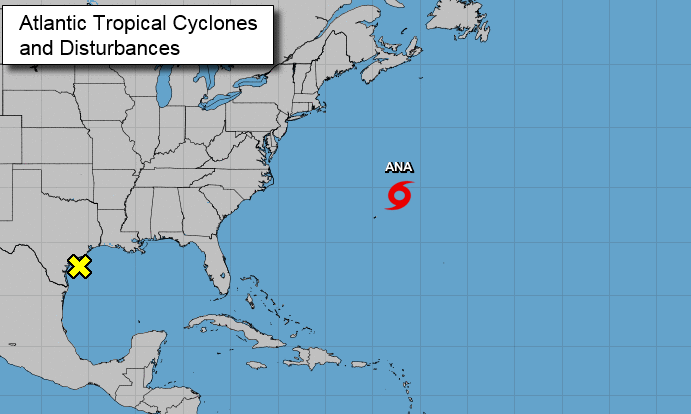

Here we go again, it is almost hurricane season! We’re likely going to see an above-average hurricane season in the Atlantic this year, according to the latest forecast from the National Oceanic and Atmospheric Administration (NOAA). The agency predicts 13 to 20 named storms in the 2021 season in the Atlantic. Of those, NOAA is forecasting between 6-10 to become hurricanes, with top winds of at least 74 mph. While 3-5 of those storms are predicted to become major hurricanes ranked as Category 3, 4, or 5, with top winds of at least 111 miles per hour. We already had one named storm and some activity in the gulf:

Atlantic Tropical Cyclones and Disturbances

WTI crude oil rose +$1.64 a barrel (+2.6%) to settle at $63.58 a barrel on Friday of last week, down -$1.69 a barrel week over week. Brent crude oil also closed higher on Friday gaining +$1.33 a barrel (+2.04%), closing at $66.44 a barrel -$2.27 a barrel week over week. In Canada Can Oils CCI for July delivery settled Friday at US$14.05 below the WTI-CMA. The implied value was $49.18. On Thursday it settled at US$14.50 below the WTI-CMA for July delivery. The implied value was US$47.18/bbl. Crude by rail out of Canada could make sense by Q4 as supply is increasing and basis is widening. Stay tuned.

U.S. commercial crude oil inventories increased by 1.3 million barrels week over week. At 486.0 million barrels, U.S. crude oil inventories are 1% below the five year average for this time of year.

Total motor gasoline inventories decreased by 2.0 million barrels week over week and are 2% below the five year average for this time of year. Finished gasoline and blending components inventories both decreased last week.

Distillate fuel inventories decreased by 2.3 million barrels week over week and are 5% below the five-year average for this time of year.

Propane/propylene inventories increased by 400,000 barrels week over week and are 18% below the five-year average for this time of year. Total commercial petroleum inventories decreased by 0.2 million barrels last week.

U.S. crude oil imports averaged 6.4 million barrels per day last week, an increase of 900,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged about 6.0 million barrels per day, a 10.9% increase for the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.1 million barrels per day, and distillate fuel imports averaged 267,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.1 million barrels per day during the week ending May 14, 2021 which was 96,000 barrels per day more week over. Refineries operated at 86.3% of their operable capacity last week. Gasoline production increased last week, averaging 9.8 million barrels per day. Distillate fuel production decreased last week, averaging 4.6 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $64.65, up $1.07 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 25.9% year over year in week 19 (U.S. +28.3%, Canada +18.7%, Mexico +18.5%) resulting in quarter to date volumes that are up 25.1% year over year and year to date volumes that are up 10.9% year over year (U.S. +12.1%, Canada +8.0%, Mexico +5.8%). All 11 of the AAR’s major traffic categories posted year over year increases with the largest increases coming from intermodal (+22.9%), motor vehicles & parts (+465.9%) and coal (+47.5%).

In the East, CSX’s total volumes were up 33.6%, with the largest increases coming from intermodal (+31.3%), motor vehicles & parts (+648.1%) and coal (+54.5%). NS’s total volumes were up 32.3%, with the largest increases coming from intermodal (+25.0%), coal (+81.0%), motor vehicles & parts (+704.3%) and metals & products (+100.8%).

In the West, BN’s total volumes were up 29.2%, with the largest increases coming from intermodal (+25.9%), coal (+61.6%) and motor vehicles & parts (+284.2%). UP’s total volumes were up 28.8%, with the largest increases coming from intermodal (+31.7%), motor vehicles & parts (+695.3%) and chemicals (+24.5%).

In Canada, CN’s total volumes were up 20.8%, with the largest increases coming from intermodal (+17.9%), motor vehicles & parts (+825.5%), coal (+67.7%) and metallic ores (+25.7%). RTMs were up 15.5%. CP’s total volumes were up 20.7%, with the largest increases coming from intermodal (+16.7%), coal (+36.3%) and motor vehicles & parts (+934.1%). RTMs were up 16.1%.

KCS’s total volumes were up 38.3%, with the largest increases coming from intermodal (+38.6%), petroleum (+97.8%), motor vehicles & parts (+1,433.1%) and grain (+43.9%).

Source: Stephens

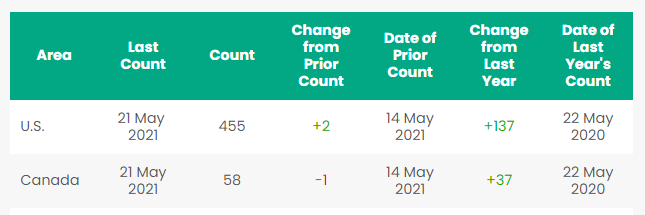

Rig Count

North America rig count is up by 1 rig week over week. The U.S. was up 2 rigs week over week and up by 137 rigs year over year. The U.S. currently has 455 active rigs. (oil rigs up four to 356, gas rigs down one to 99, and miscellaneous rigs down one to zero,) Canada’s rig count was down by 1 rig week over week, and up by 37 rigs year over year and Canada’s overall rig count is 58 active rigs. Year over year we are up 174 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- CP Rail sticks with bid for K.C. Southern: Canadian Pacific Railway Limited declined to boost its $25 billion bid for Kansas City Southern and urged the U.S. carrier to reject Canadian National Railway Company’s higher offer anyway, saying it poses a greater risk of getting blocked by regulators.

- Dakota Access Pipeline – Well folks, the battle to shut DAPL down is over for now – U.S. District Court Judge James Boasberg said DAPL can continue to operate during the Army Corps of Engineers environmental review which is expected to be completed in March 2022. He added that the Standing Rock Sioux tribe who really wanted the pipeline shut down “have offered no grounds for concluding that vacating the easement last year would put them in a different place where they are now”. This is a victory for the oil industry, but a loss for any crude by rail aspirations out of the Bakken.

- Enbridge Line 5 update – The mediator in the dispute between Enbridge Inc. and the state of Michigan over the Line 5 pipeline says the two sides plan to keep talking. Retired U.S. District Court Judge Gerald Rosen, who was appointed in March to oversee the talks, says the parties discussed a “range of issues” when they met Tuesday of last week. Rosen’s report filed with the Federal Court in Michigan says the talks will continue and both sides anticipate further sessions together. Rosen’s report offers no details as to when the next meeting will take place or how long the talks are likely to continue. It does however suggest that the pipeline, which proponents insist is a vital energy conduit for much of the U.S. Midwest as well as Ontario and Quebec, will remain in operation for the time being. Michigan Gov. Gretchen Whitmer originally wanted the line shut down by May 12 to prevent an ecological disaster in the Straits of Mackinac, where the cross-border pipeline crosses the Great Lakes. The Canadian government joined the legal fray last week and argued a shutdown would deal a “massive and potentially permanent” blow to Canada’s economy and energy security, as well as risk lasting damage to relations with the United States. If allowed to stand, Michigan’s “unilateral action” would foster doubt about any foreign-policy commitments the U.S. might choose to make if any one state can so easily undermine them, the brief said. Sarah Hubbard, a legislative expert in Michigan with lobbying firm Acuitas LLC, told a Wilson Center panel last week that Whitmer (who faces a re-election campaign next year)finds herself trying to satisfy two of the constituencies who got her elected in 2018: organized labor and environmentalists. “That’s where I see it right now –– you’ve got these two major factions that are her supporters really fighting with each other over this,” Hubbard said. “She’s trying to figure out how to thread the needle.” Folks, the battle to shut down line 5 in our mind is all but over, they will throw the governor a bone. The Governor of Michigan is too small to take on her opponents which are a lot of really big companies and a not so small Country – Canada itself. Don’t be surprised to see Keystone resurface as a going concern.

- Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,044 from 23,204,a drop of 160 rail cars week over week. Both Canadian and U.S. volumes were mixed – CP shipments rose by 6.5% while CN were down by 5.3%, BN had the largest percentage increase in the U.S., up by 13.9% and the NS had the largest percentage decrease down by 9.3%.

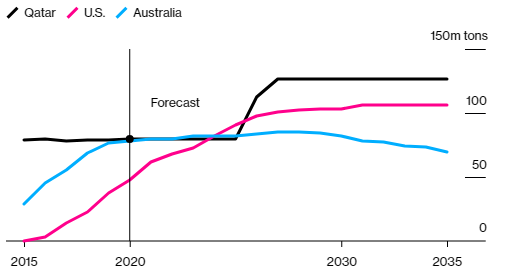

- Qatar’s planning a US $29 billion expansion and does not want the U.S. as the top exporting nation and slashing prices – The world’s top exporter of liquefied natural gas is ramping up production dramatically and undercutting competitors in a bid to squeeze them out the market.

Qatar is dropping prices and pushing ahead with a $29 billion project to boost its exports of the fuel by more than 50%, stymieing the prospects of new plants elsewhere. It’s also established a trading team to compete in the nascent spot market and pushing into Asia more aggressively, according to people familiar with the matter.

TOP LNG Supplies

LNG terminals, where gas is cooled into a liquid for shipping via tanker, take roughly four years to build. Investors in new projects are wary of oversupply in coming years after Qatar Petroleum, the world’s biggest and lowest-cost LNG producer, announced big expansion plans in February.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 8 Hoppers for plastic pellets wanted to purchase

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 10 Covered Hoppers 6300 CF in Wisconsin CN for 1 year Negotiable

- 20 117R 30K plus tanks for ethanol in Wisconsin off the CN Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- Several hundred small Hoppers Various Locations and Product – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale 3000-5800 CF 263 and 286 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|