Whenever you find yourself on the side of the majority, it is time to pause and reflect.

Mark Twain

Jobs Update

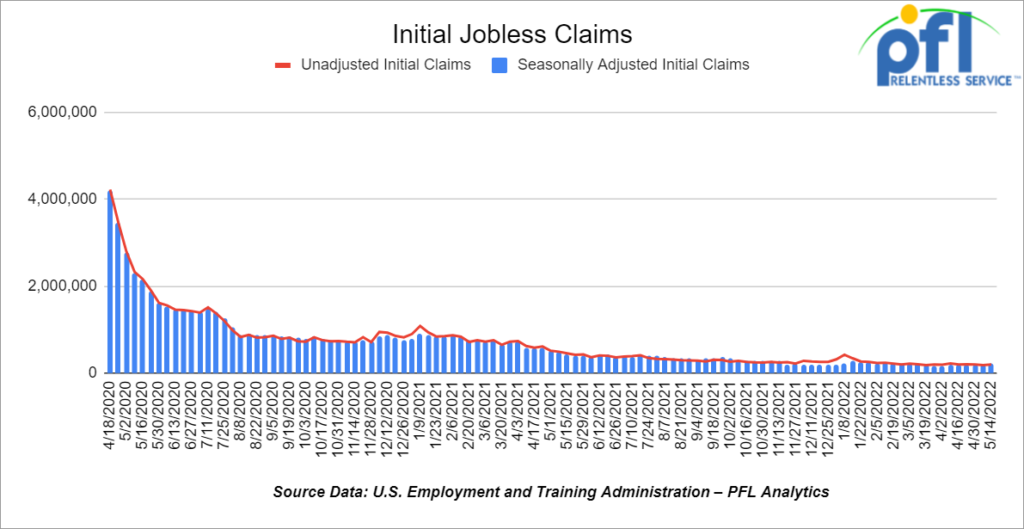

- Initial jobless claims for the week ending May 14th, 2022 came in at 218,000, up 21,000 people week-over-week.

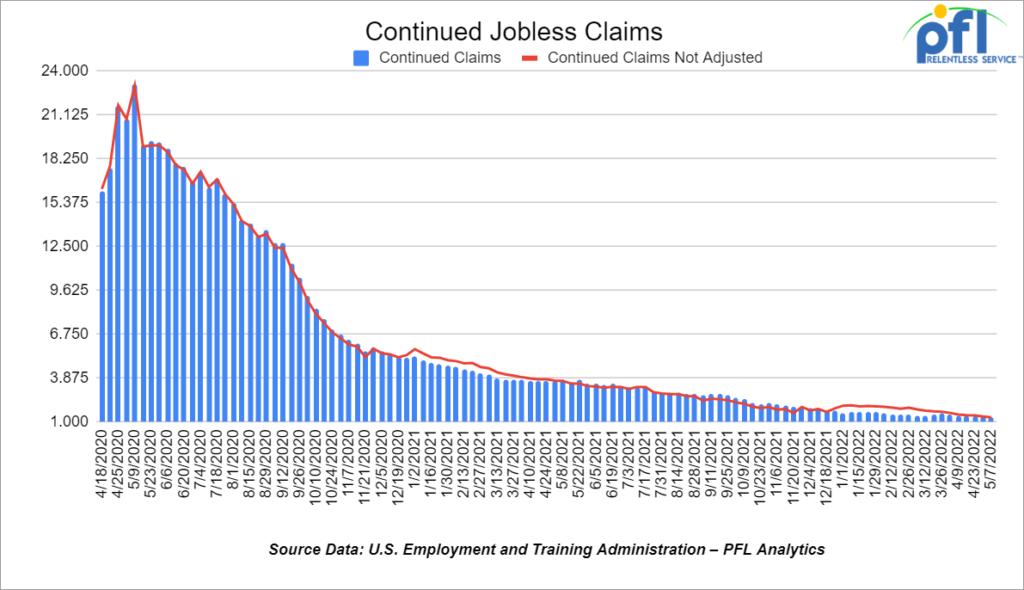

- Continuing claims came in at 1.317 million people, versus the adjusted number of 1.342 million people from the week prior, down -25,000 people week-over-week.

Stocks closed mixed on Friday of last week and down week-over-week

The DOW closed higher on Friday of last week, up +8.77 points (+0.03%), closing out the week at 31,261.9 points, down -934.76 points week-over-week. The S&P 500 closed higher on Friday of last week, up 0.57 points, and closed out the week at 3,901.36 down -122.53 points week-over-week. The Nasdaq closed lower on Friday of last week, down -33.88 points -0.30%), and closed out the week at 11,354.62, down -450.38 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open this morning at 31,510, up 297 points.

Oil closed higher on Friday of last week and higher week over week

Oil prices settled slightly higher on Friday as a planned European Union ban on Russian oil and easing of COVID-19 lockdowns in China countered concerns that slowing economic growth will hurt demand.

WTI gained week over week for its fourth straight which was last not seen since February of this year. Brent gained one percent week over week last week after falling one percent the prior week.

U.S. West Texas Intermediate (WTI) crude for June delivery rose $1.02 per barrel or (0.9%), to settle at $113.23 per barrel on its day as the front-month on Friday of last week. The more actively-traded WTI contract for July was up 0.4% settling at $110.28 per barrel. Brent futures for July delivery rose 51 cents, or 0.5%, to US$112.55 per barrel.

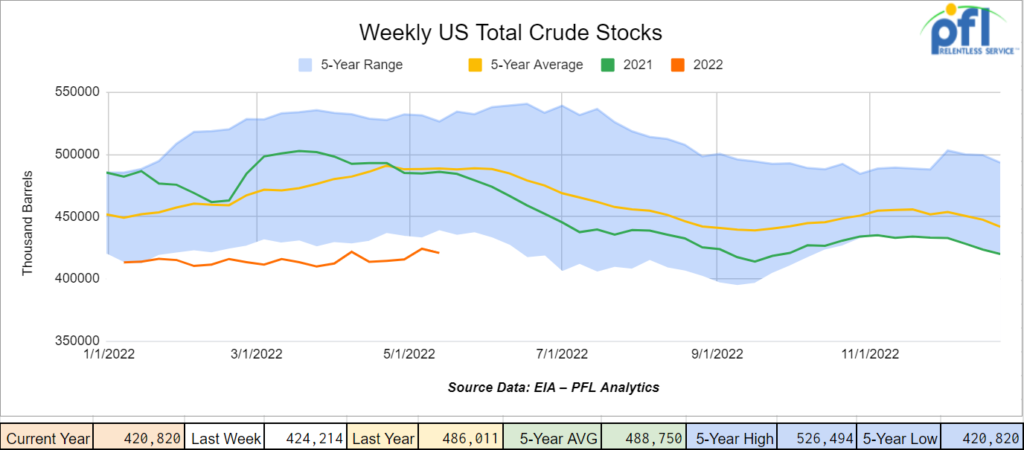

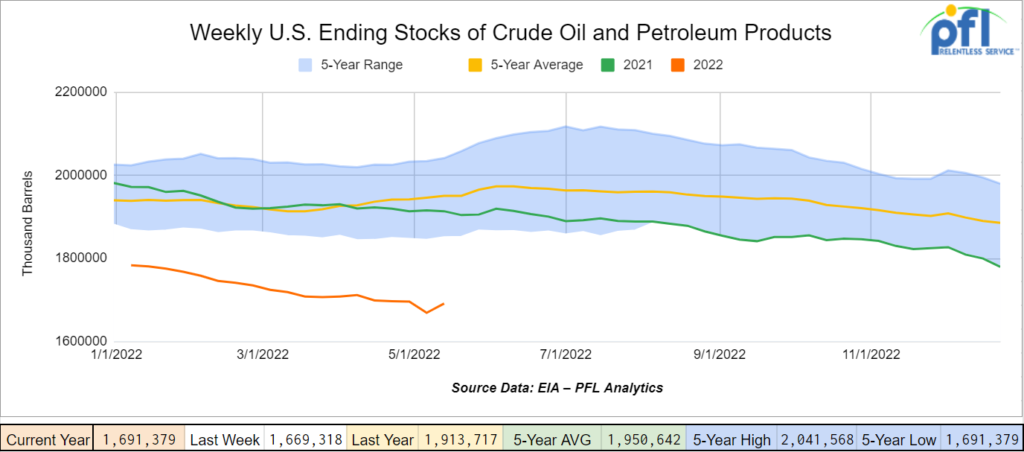

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.4 million barrels week over week. At 420.8 million barrels, U.S. crude oil inventories are 14% below the five-year average for this time of year.

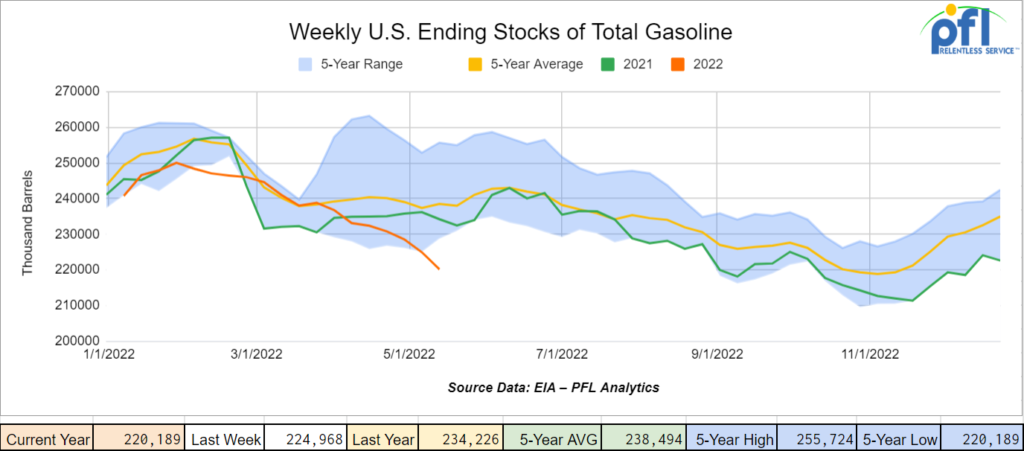

Total motor gasoline inventories decreased by 4.8 million barrels week over week and are 8% below the five-year average for this time of year.

Distillate fuel inventories increased by 1.2 million barrels week over week and are 22% below the five-year average for this time of year.

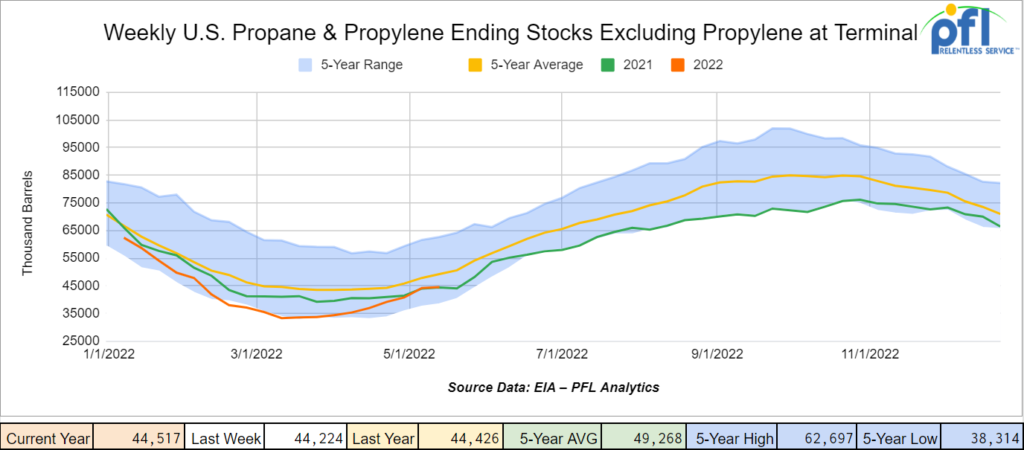

Propane/propylene inventories increased by 300,000 barrels week over week and are 10% below the five-year average for this time of year.

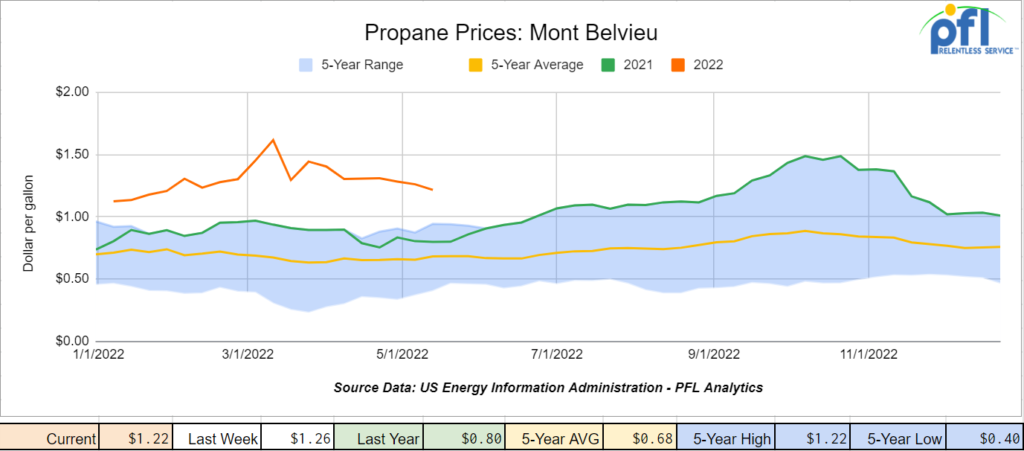

Propane prices continued to decline week over week albeit slowly losing 4 cents per gallon to settle at $1.22 per gallon. Propane prices are up 42 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 2.9 million barrels week over week.

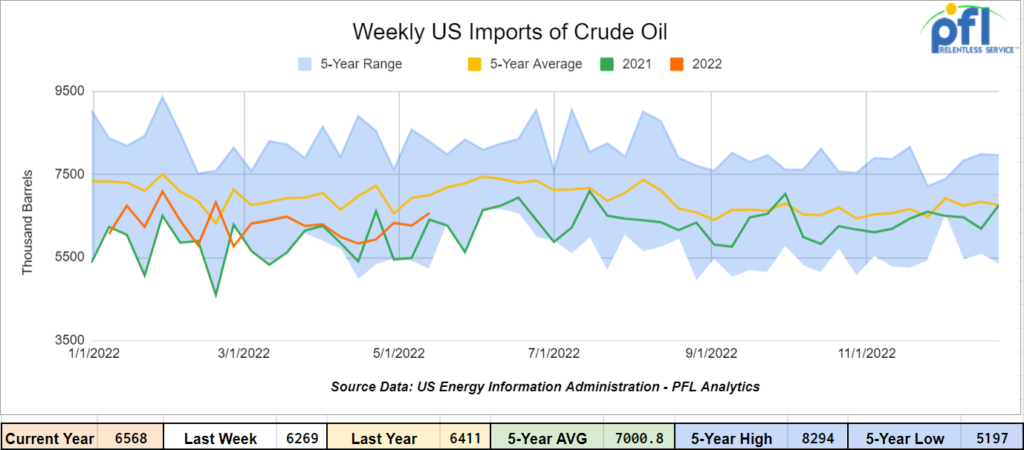

U.S. crude oil imports averaged 6.6 million barrels per day during the week ending May 13th 2022, up by 299,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.3 million barrels per day, 4.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 876,000 barrels per day, and distillate fuel imports averaged 114,000 barrels per day for the week ending May 13, 2022.

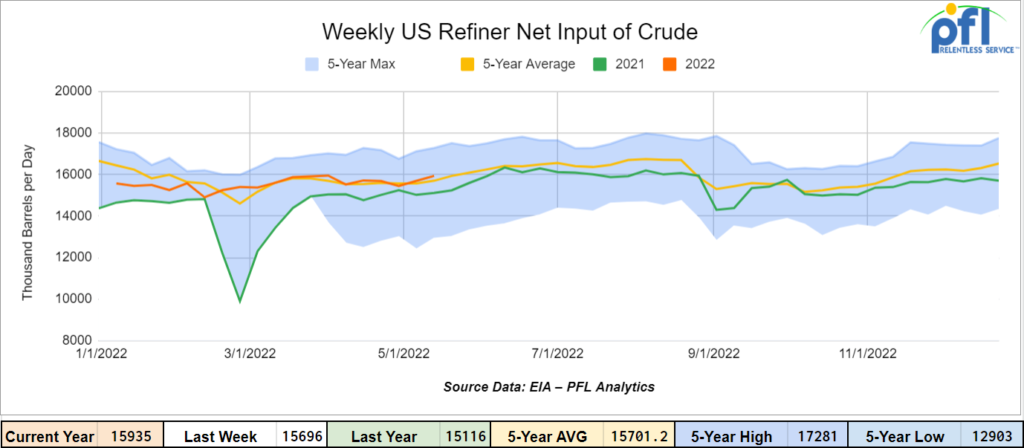

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending May 13, 2022 which was 239,000 barrels per day more than the previous week’s average

As of the writing of this report, WTI is poised to open at $111.28, up $1.00 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 4.2% year over year in week 19 (U.S. -5.4%, Canada -3.5%, Mexico +11.2%) resulting in the quarter to date volumes that are down 4.0% year over year and year to date volumes that are down 3.9% year over year (U.S. -3.5%, Canada -6.7%, Mexico +3.1%). 9 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-4.2%) and grain (-18.2%). The largest increase came from motor vehicles and parts (+11.3%).

In the East, CSX’s total volumes were up 0.6%, with the largest increase coming from intermodal (+2.4%). The largest decrease came from chemicals (-6.2%). NS’s total volumes were down 4.9%, with the largest decreases coming from intermodal (-3.7%) and coal (-20.3%).

In the West, BN’s total volumes were down 5.4%, with the largest decreases coming from intermodal (-8.0%) and coal (-4.4%). The largest increase came from motor vehicles & parts (+19.8%). UP’s total volumes were down 5.1%, with the largest decreases coming from intermodal (-8.8%) and grain (-16.0%). The largest increase came from stone, sand & gravel (+23.9%).

In Canada, CN’s total volumes were up 1.0%, with the largest increases coming from coal (+31.7%) and petroleum (+26.2%). The largest decreases came from intermodal (-2.4%) and chemicals (-8.8%). Revenue per ton-miles was up 2.5%. CP’s total volumes were down 8.0%, with the largest decreases coming from grain (-34.8%) and coal (-25.6%). The largest increase came from stone, sand & gravel (+38.8%). Revenue per ton-miles was down 13.1%.

KCS’s total volumes were up 4.5%, with the largest increase coming from intermodal (+11.1%). The largest decrease came from petroleum (-21.4%).

Source: Stephens

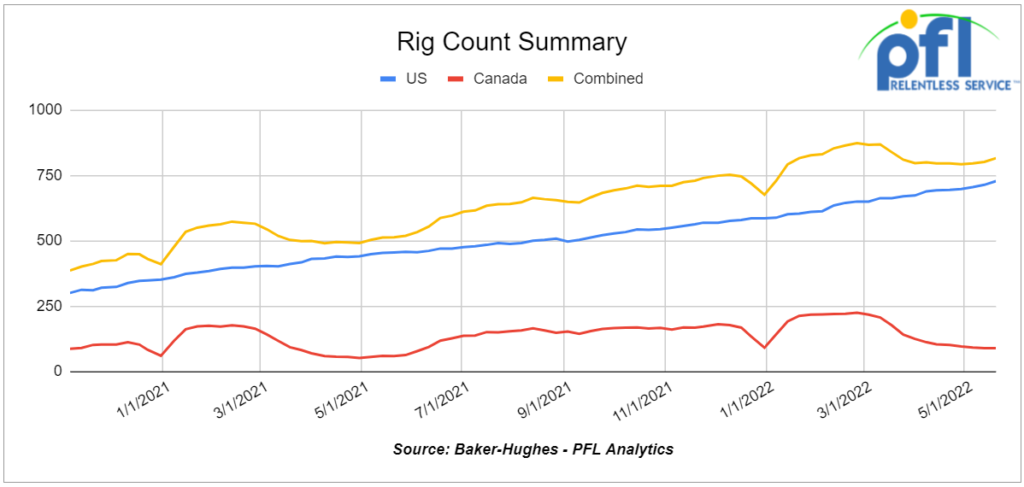

Rig Count

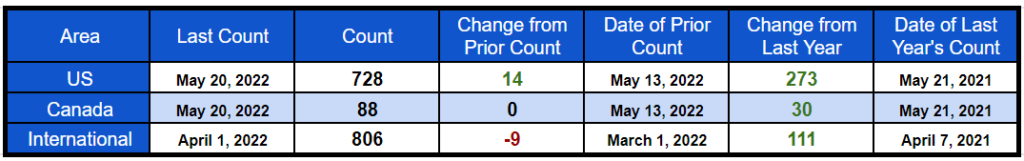

North American rig count was up 14 rigs week over week. U.S. rig count was up by 14 rigs week-over-week and up by 273 rigs year over year. The U.S. currently has 728 active rigs. Canada’s rig count was flat week-over-week and up by 30 rigs year-over-year. Canada’s overall rig count is 88 active rigs. Overall, year over year, we are up 303 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,413 from 23,244, which is a gain of 169 rail cars week-over-week. Canadian volumes were mixed: CN’s shipments were up by 3.8% while CP volumes were down by 2.2% U.S. volumes were also mixed with the BN having the largest percentage increase (up by 8.8%). While the UP had the largest percentage decrease (down by 7.9%).

Crude by Rail Out of Alberta

Still not happening anytime soon. Enbridge has accepted all pipeline nominations for June deliveries on its mainline system and this is the fourth consecutive month that they have done so. Planned maintenance in the oil sands has contributed to this spare capacity and the addition of 370,000 barrels per day has also helped. Inventory levels in Alberta has steadily worked down, falling to 64 million barrels down 17 million barrels since October of last year. WCS basis ended the last trading cycle against WTI right around -$13.50 per barrel still not representing a commercial play,

Rail Head Count Up Slightly

The Surface Transportation Board (STB) released April headcount data for the U.S. rails. For the industry as a whole, April headcount was up 0.3% sequentially versus March headcount that was up 0.7%. On a year-over-year basis, industry headcount decreased 0.5% vs. March headcount that was down 0.4% year over year. All of the rails saw slight growth in headcount for the month with the exception of KCS which was down -0.7%. Increasing headcount has clearly been a focal point for the industry, particularly with the STB regulatory pressures are intensifying. The Class Ones need to significantly improve headcount to support better rail service. Class 1 customers have had to put more cars than needed into service to compensate and some have been told to take cars out of service if you can believe that one. We have quite a few folks that are really worried about their business as they cannot make promised deliveries to customers and are running risks of having to shut in plants due to lack of rail service. Let’s hope for some improvement in the second half of 2022.

New Railcar Orders Robust

New railcar orders remain elevated at 13,000 units in Q122 versus 13,500 in Q421 and backlog increased 7.5% sequentially to 46,200 units. Overall, the demand environment remains strong. Railcar utilization continues to improve sequentially and continues to drive rail lease rates for certain car types higher.

First-quarter deliveries were 8,000 units up 34% year over year, but down 1% quarter over quarter. FTR Intel recently adjusted its 2022 delivery forecast to 41,700 units (from 43,500 units) and its 2023 delivery forecast to 53,000 units (from 56,300 units). This forecast now assumes a 42% year-over-year increase in 2022 and a 27% year-over-year increase in 2023. Railcar orders in the first quarter of 2022 orders were 13,000 units, up 6,800 units year over year.

Congestion in the rail network has driven railcar demand higher.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 10-100 20K lined tanks most anywhere for Urea Ammonium Nitrate 5 year lease negotiable

- Clean 20-25.5 tanks for palm oil CN or BNSF midwest for 2-4 yaars negotiable

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- Hoppers for minerals, soda ash, potash in various locations for up to 5 years

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

- 100 3200 Covered Hoppers for sale price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|