“Everyone talks about age, but it’s not about age. It’s about work ethic. Winning never gets old.”

– Lisa Leslie

Jobs Update

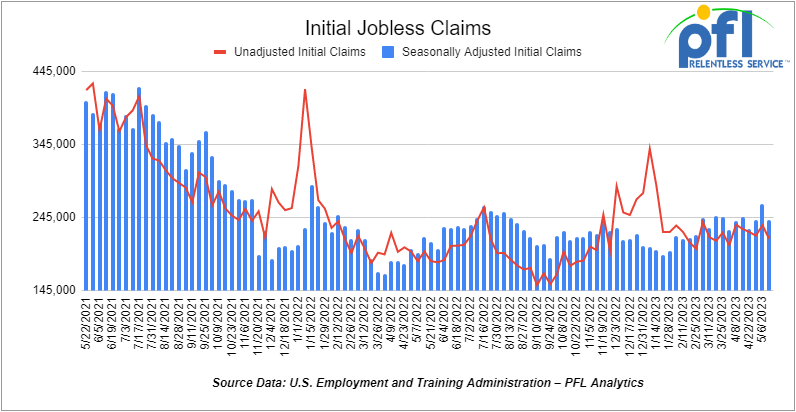

- Initial jobless claims for the week ending May 13th, 2023 came in at 242,000, down -22,000 people week-over-week.

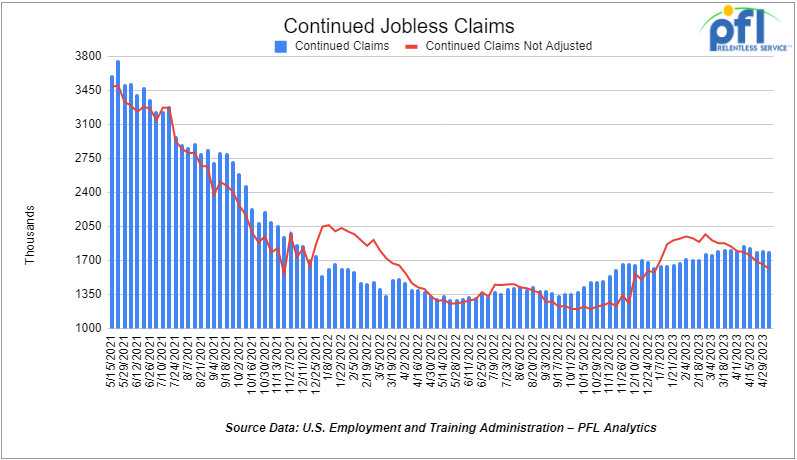

- Continuing jobless claims came in at 1.799 million people, versus the adjusted number of 1.807 million people from the week prior, down -8,000 people week over week.

Stocks closed lower on Friday of last week, but higher week over week

The DOW closed lower on Friday of last week, down -109.28 points (-0.33%), closing out the week at 33,426.63, up +117.12 points week over week. The S&P 500 closed lower on Friday of last week, down -6.07 points (-0.14%), and closed out the week at 4,191.98, up 67.9 points week over week. The NASDAQ closed lower on Friday of last week, down -30.94 points (-0.25%), and closed the week at 12,675.9, up +373.16 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 33,492 this morning down -4 points.

WTI closed lower on Friday of last week, but higher week over week

WTI traded down -$0.25 per barrel (-0.3%) to close at $71.36 per barrel on Friday of last week, up $1.32 per barrel week over week. Brent traded down -US$0.28 per barrel (-0.8%) on Friday of last week, to close at US$75.58 per barrel, up US$1.41 per barrel week over week.

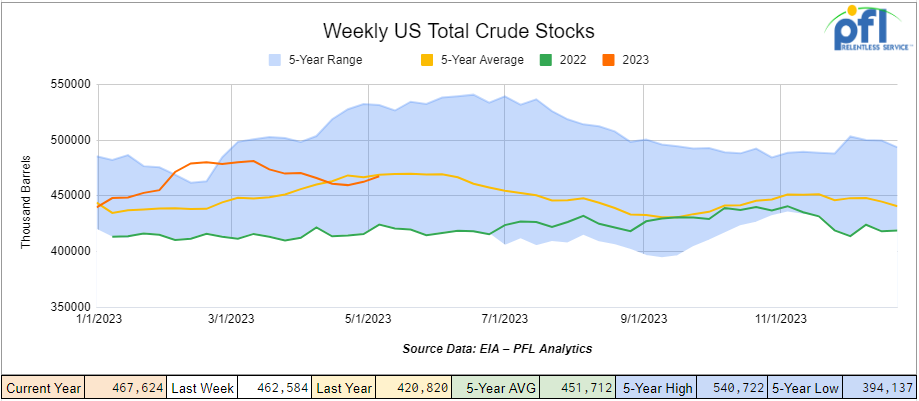

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 5 million barrels week over week. At 467.6 million barrels, U.S. crude oil inventories are slightly below the five-year average for this time of year.

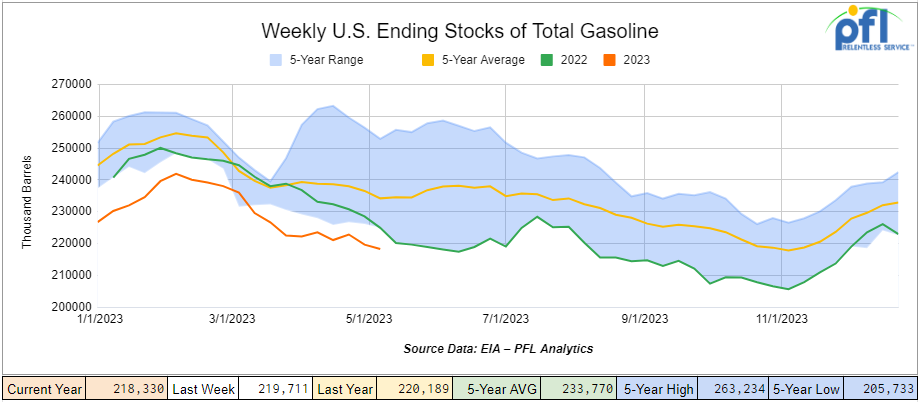

Total motor gasoline inventories decreased by 1.4 million barrels week over week and are 6% below the five-year average for this time of year.

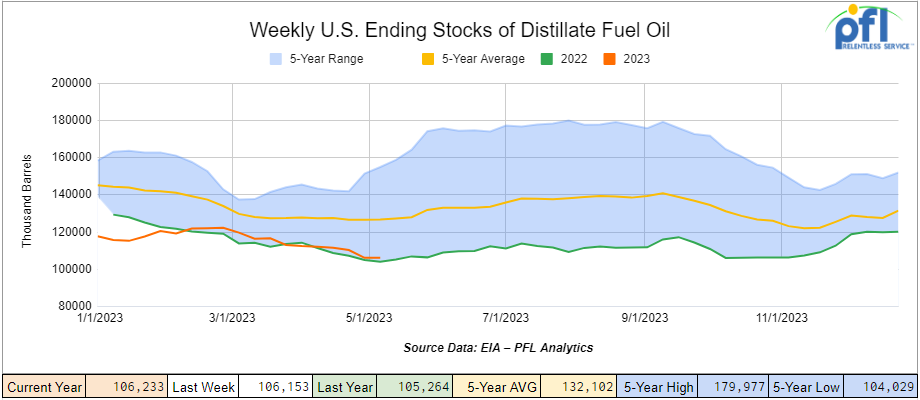

Distillate fuel inventories increased by 100,000 barrels week over week and are 16% below the five-year average for this time of year.

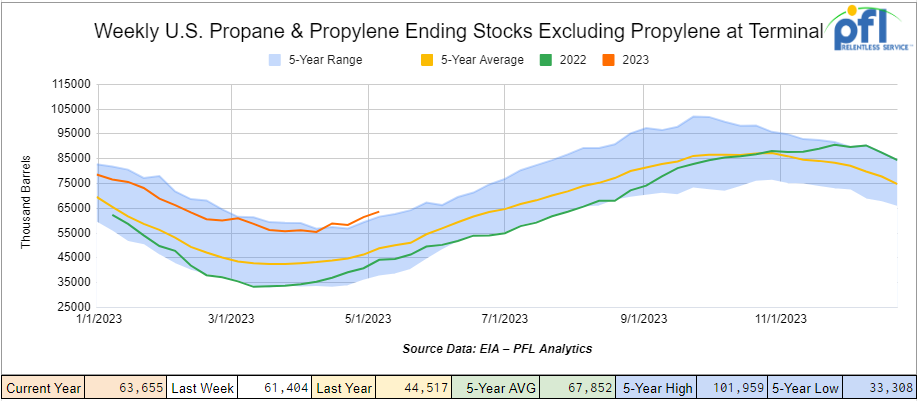

Propane/propylene inventories increased by 2.3 million barrels week over week and are 30% above the five-year average for this time of year. Why are propane inventories so high? Increased production is a factor, but it is mostly weather. The EIA estimates that U.S. propane consumption averaged 0.986 million barrels per day (b/d) during the 2022–2023 winter heating season (October through March), the least for a winter heating season on record, starting in 2010. Reduced average winter U.S. propane consumption was influenced by less consumption during the coldest winter months of December, January, and February.

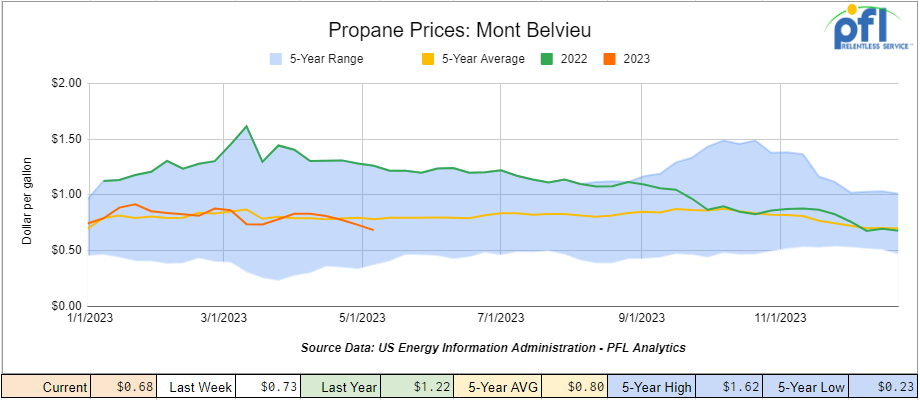

Propane prices closed at 68 cents per gallon, down 5 cents per gallon week over week and down 54 cents per gallon year over year, as inventories increase.

Overall, total commercial petroleum inventories increased by 7.6 million barrels during the week ending May 12th, 2023.

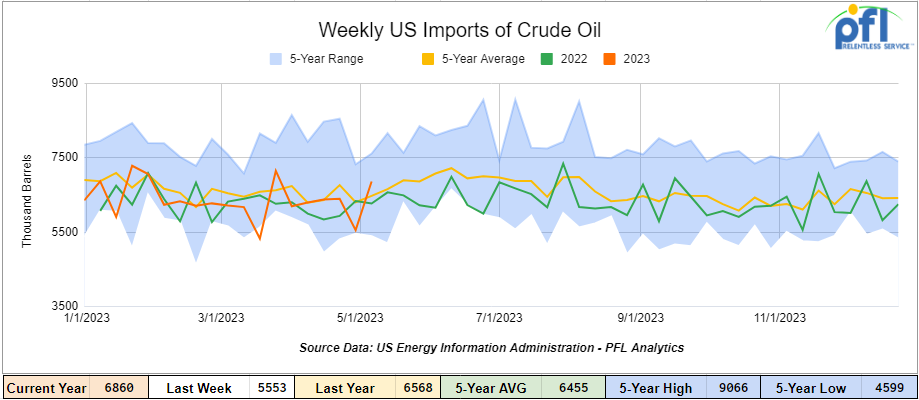

U.S. crude oil imports averaged 6.9 million barrels per day during the week ending May 12th, 2023, an increase of 1,306,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 0.3% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 844,000 barrels per day, and distillate fuel imports averaged 128,000 barrels per day during the week ending May 12th, 2023.

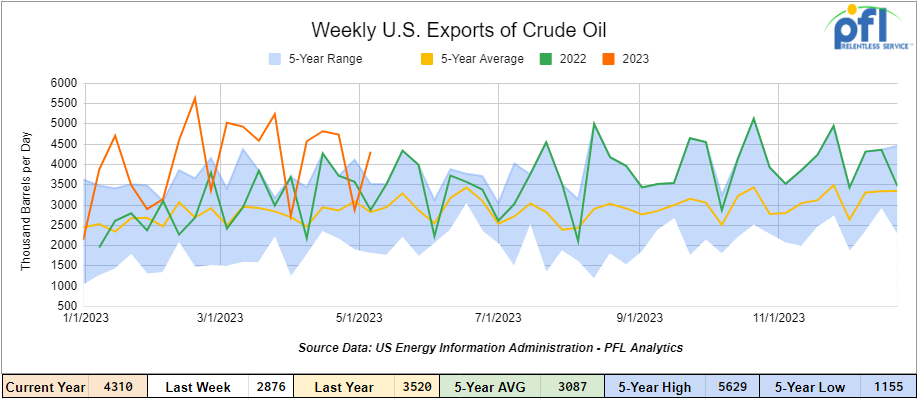

U.S. crude oil exports averaged 4.310 million barrels per day for the week ending May 12th, 2023, an increase of 1.434 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.186 million barrels per day.

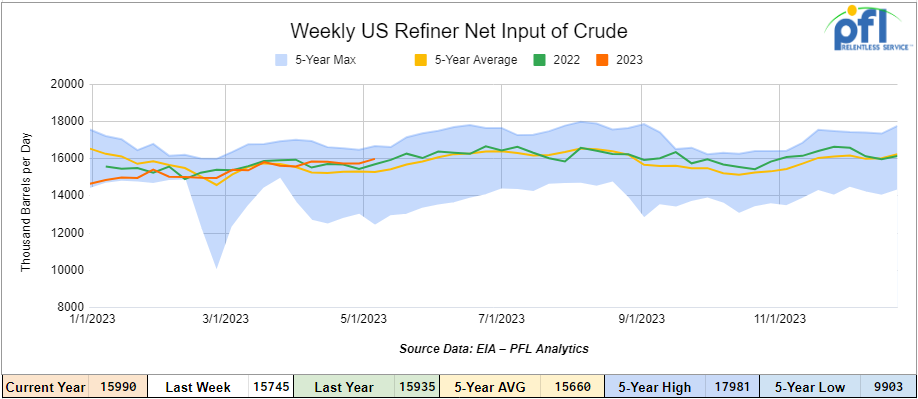

U.S. crude oil refinery inputs averaged 16 million barrels per day during the week ending May 12, 2023, which was 245,000 thousand barrels per day more week over week.

As of the writing of this report, WTI is poised to open at $71.55, flat from Monday’s close.

North American Rail Traffic

Week Ending May 17th, 2023.

Total North American weekly rail volumes were down (-6.5%) in week 19 compared with the same week last year. Total carloads for the week ending on May 17th were 250,429, up (+0.14%) compared with the same week in 2022, while weekly intermodal volume was 302,705, down (-13.16%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Intermodal (-13.16%). The largest increase came from Motor Vehicles and Parts (+17.1%).

In the east, CSX’s total volumes were down (-4.37%), with the largest decrease coming from Petroleum and Petroleum Products (-19.97%) and the largest increase from Coal (+15.53%). NS’s volumes were down (-4.84%), with the largest decrease coming from Petroleum and Petroleum Products (-19.97%) and the largest increase from Metallic Ores and Minerals (+15.53%).

In the West, BN’s total volumes were down (-13.21%), with the largest decrease coming from Forest Products (-21.5%), and the largest increase coming from Motor Vehicles and Parts (+9.39%). UP’s total rail volumes were up (+1.13%) with the largest decrease coming from Other (-21.08%) and the largest increase coming from Motor Vehicles and Parts (+23.11%).

In Canada, CN’s total rail volumes were down (-9.95%) with the largest increase coming from Motor Vehicles and Parts (+12.14%) and the largest decreases coming from Grain (-34.04%). CP’s total rail volumes were down (-3.21%) with the largest decrease coming from Chemicals (-18.59%) and the largest increase coming from Petroleum and Petroleum Products (+41.46%).

KCS’s total rail volumes were down (-14.75%) with the largest decrease coming from Intermodal (-28.16%) and the largest increase coming from Motor Vehicles and Parts (+13.93%).

Source Data: AAR – PFL Analytics

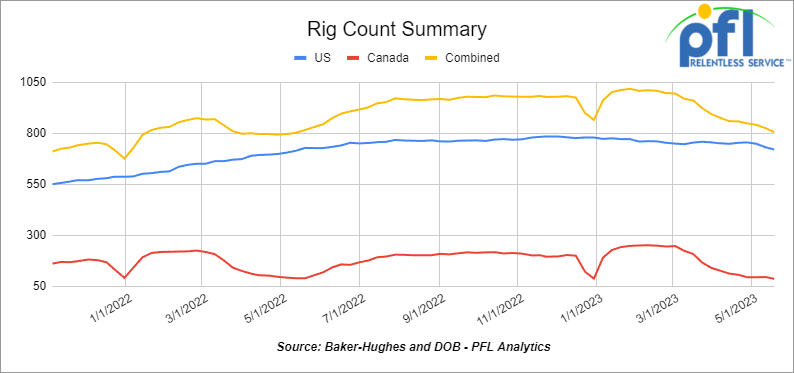

Rig Count

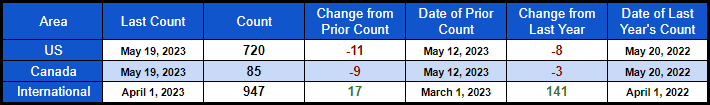

North American rig count was down by -20 rigs week over week. U.S. rig count was down by -10 rigs week over week and up by +11 rigs year-over-year. The U.S. currently has 720 active rigs. Canada’s rig count down by -9 rigs week-over-week and down by -3 rigs year over year. Canada’s overall rig count is 85 active rigs. Overall, year-over-year, we are down -11 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,326 from 25,299, which was a gain of +27 rail cars week-over-week. Canadian volumes were mixed week over week; CPKC’s shipments rose by +9.5% week over week, and CN’s volumes were lower by -3% week-over-week. U.S. shipments were mixed. The BN had the largest percentage increase and was up by +10.2% week-over-week. The CSX had the largest percentage decrease and was down by -7.4%.

We are watching Canada’s Trans Mountain Pipeline

Canada’s 590,000 barrel per day Trans Mountain Expansion (TMX) crude pipeline will need more financing to be completed as construction costs soar, according to a report issued by the Canada Development Investment Corporation (CDEV), which manages corporate interests for the government of Canada. The report was released last week.

Trans Mountain Corporation (TMC) was created by the Canadian government in 2018 to complete the expansion of the existing Trans Mountain Pipeline carrying crude from Edmonton, Alberta, to Burnaby, British Columbia, when Kinder Morgan threatened to cancel the project. The price tag for the expansion project in 2017 was CAD $7.4bn according to Kinder Morgan, but it tripled to C$21.4bn in February 2022, and then grew again to C$30.9bn ($22.3bn) in March of this year.

The expansion is roughly 80pc complete and projected to be in service in early 2024, provided financing constraints are solved in time.

TMC owed C$16.1bn to the Canadian government at the end of 2022, with C$11.5bn of that related to the construction of the new line. The remaining C$4.6bn is from the government’s 2018 purchase of the existing 300,000 b/d Trans Mountain pipeline and the expansion project.

Soaring construction costs prompted Canada’s finance minister to declare in early 2022 that subsequent cost overruns would have to be financed by other means.

TMC estimates construction efforts will require another C$9.1bn this year. While there is some space on an external loan facility, that too is approaching credit limits.

TMC arranged in April 2022 with the government backing a C$10bn loan facility with a syndicate of third parties. That has since been amended to C$11bn and the maturity date pushed out by two more years to March 2025. A C$1.6bn chunk of the loan was directed to government-related debt while further drawdowns in 2022 left it with a balance of C$7.2bn at year-end.

All told, amounts owed to the government and third parties ended the year at over C$23bn.

Trans Mountain attributed the increased costs to inflation, supply chain challenges, flooding in British Columbia, challenging terrain, and labor shortages, among other reasons.

The Canadian government has maintained that it will not be a long-term owner of the two pipelines and related assets and is looking to sell the assets upon completion of the project.

Trans Mountain Pipeline (TMP)

Source: Trans Mountain Pipeline

We are watching Natural Gas

Folks, the Mountain Valley Pipeline (“MVP”) is happening. The Biden administration granted the permit that MVP was waiting for on Tuesday of last week on the back of pressure from Senator Joe Manchin. The permit, issued by the U.S. Department of Agriculture’s Forest Service, allows the Equitrans Midstream Corp $6.6 billion Mountain Valley pipeline to run through the Jefferson National Forest straddling Virginia and West Virginia. The project would unlock gas supplies from Appalachia, the country’s biggest shale gas basin.

Mountain Valley Pipeline (MVP)

Source: Mountain Valley Pipeline

NatGas Prices are moving higher – we called a bottom when Natgas touched below $2 per MMBTU. Why? Natural gas forward prices have rallied on signs of easing oversupply. There has been a sharp decline in upstream activity foreshadowing a potential curtailment in domestic production, and with summer cooling demand just around the corner, natural gas forwards rallied. Week over week fixed price gains of 20 cents per MMBTU or more were widespread throughout the Lower 48; benchmark Henry Hub closed relatively flat on Friday of last week but higher week over week at $2.58/MMBtu. Last week’s news of a 16-rig decline in natural gas-directed drilling in the latest Baker Hughes Co. data catalyzed a move higher for futures prices, and regional hubs rallied accordingly during the May 11-17th trading period.

There are a number of items at play here on the supply side:

1) Drilling reductions – Producers have already announced a reduction in activity levels in Haynesville and the Northeast, which we have incorporated into our base-case view. However, due to the time lag between spud and completion, the near-term volume reduction from new drill wells will not have a material volumetric impact on summer balances.

2) Deferred completions -The NYMEX forward curve has taken on a wide contango structure, incentivizing more wells to be brought online next winter when prices are significantly higher. Although this strategy would reduce near-term production volumes, an even larger oversupply could occur longer term through the build-up of significant well inventory.

3) Economic wellhead shut-ins – When regional prices fall below operating costs, existing production may become uneconomic. Wells can either be shut in or choked back to cut significant volumes quickly. The wide regional summer basis makes the Northeast especially susceptible and, historically, producers have said they can shut in volumes for extended periods without endangering long-term well production.

Less Natgas production means less liquids and less rail cars needed, however, longer-term we are bullish Natgas and associated liquid production it is the only fuel that makes sense if the Dems keep weaning us off of coal for power generation.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K DOT 111 Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of any class 1 in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of in Canada. Cars were last used in Crude. Dirty to Dirty

- 25, 28.3K, Dot 111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free Move, Dirty to Dirty

Sales Offers

- 100-200, 31.8K, CPC 1232 Tanks located off of BN in Chicago. Dirty/Clean

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Call for information

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|