“From a small seed a mighty trunk may grow.” – Aeschylus

Jobs Update

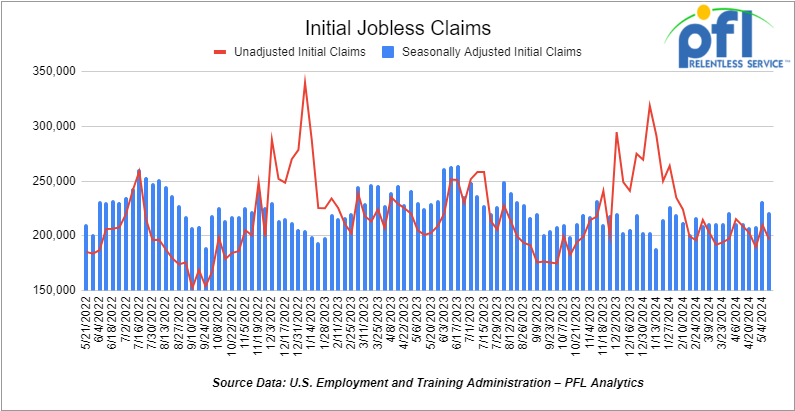

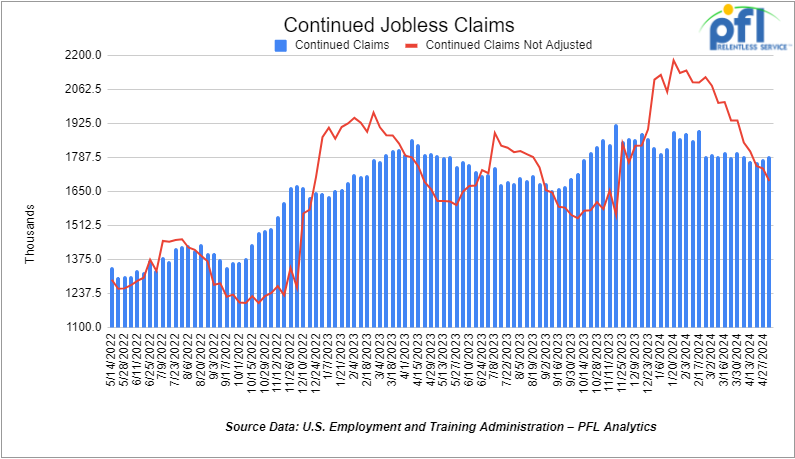

- Initial jobless claims seasonally adjusted for the week ending May 11th, 2024 came in at 222,000, down -10,000 people week-over-week.

- Continuing jobless claims came in at 1.794 million people, versus the adjusted number of 1.781 million people from the week prior, up 13,000 people week-over-week.

Stocks closed mixed on Friday of last week, but higher week over week

The DOW closed higher on Friday of last week, up 134.21 points (0.34%), closing out the week at 40,003.59, up 490.75 points week-over-week. The S&P 500 closed higher on Friday of last week, up 6.17 points (0.12%), and closed out the week at 5,303.27, up 80.59 points week-over-week. The NASDAQ closed lower on Friday of last week, down -12.35 points (-0.08%), and closed out the week at 16,685.97, up 345.1 points week-over-week.

In overnight trading, DOW futures traded higher and are expected to open at 40,144 this morning up 7 points.

Crude oil closed higher on Friday of last week – higher week over week.

WTI traded up US$0.71 per barrel (0.9%) on Friday of last week, to close at $80.06 per barrel, up$1.80 per barrel week-over-week. Brent traded up US$0.70 per barrel (1.1%) to close at US$83.98 per barrel on Friday of last week, up US$1.19 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for July delivery settled Friday at US$11.20 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$66.99 per barrel.

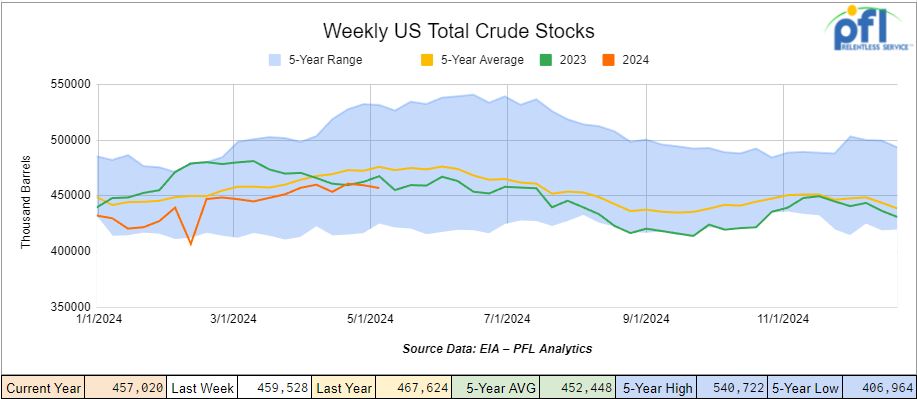

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels week-over-week. At 457.0 million barrels, U.S. crude oil inventories are 4% below the five-year average for this time of year.

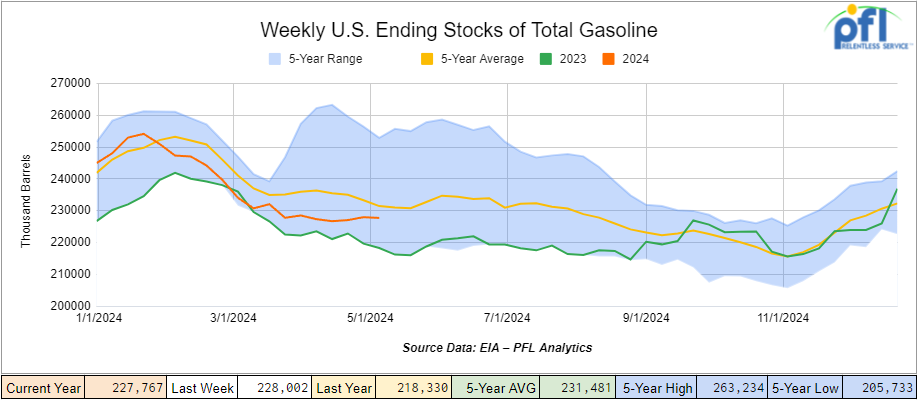

Total motor gasoline inventories decreased by 200,000 barrels week-over-week and are 1% below the five-year average for this time of year.

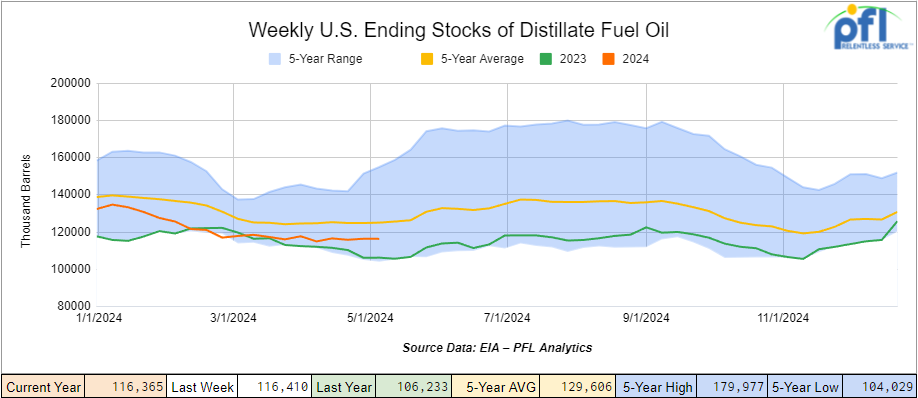

Distillate fuel inventories slightly decreased week-over-week and are about 7% below the five-year average for this time of year.

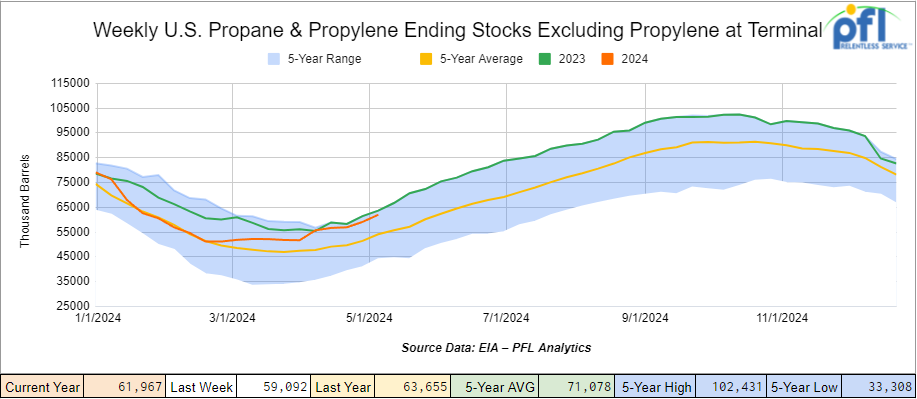

Propane/propylene inventories increased by 2.9 million barrels week-over-week and are 14% above the five-year average for this time of year.

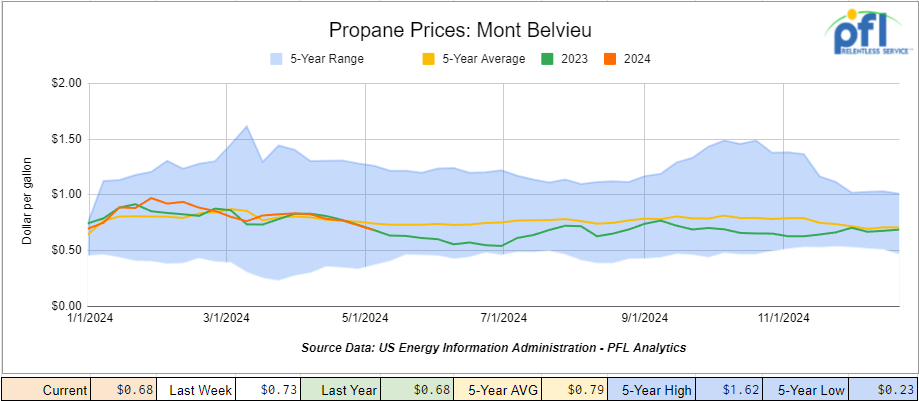

Propane prices closed at 68 cents per gallon, down 5 cents per gallon week-over-week and flat year-over-year.

Overall, total commercial petroleum inventories increased by 3.5 million barrels during the week ending May 11th, 2024.

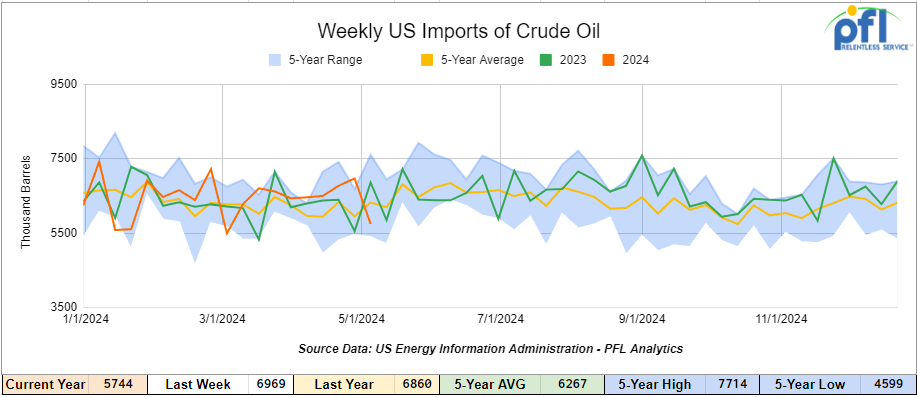

U.S. crude oil imports averaged 6.7 million barrels per day during the week ending May 11th, 2024, a decrease of 226,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 7.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 726,000 barrels per day, and distillate fuel imports averaged 89,000 barrels per day during the week ending May 11th, 2024.

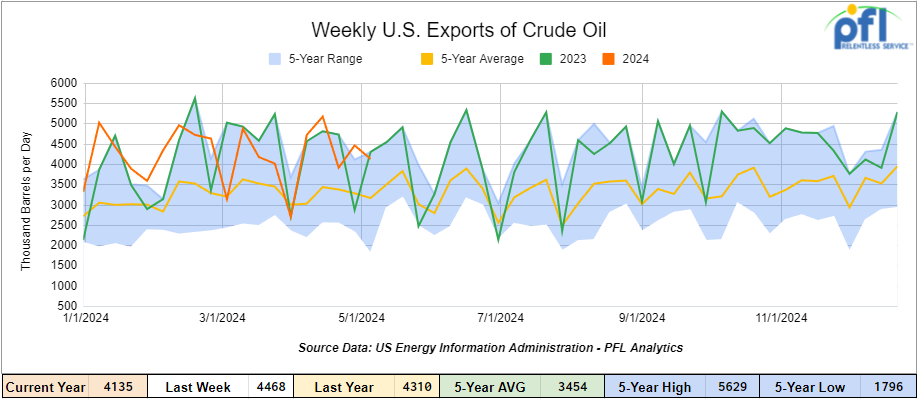

U.S. crude oil exports averaged 4,135 million barrels per day for the week ending May 11th, 2024, a decrease of 333,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.425 million barrels per day.

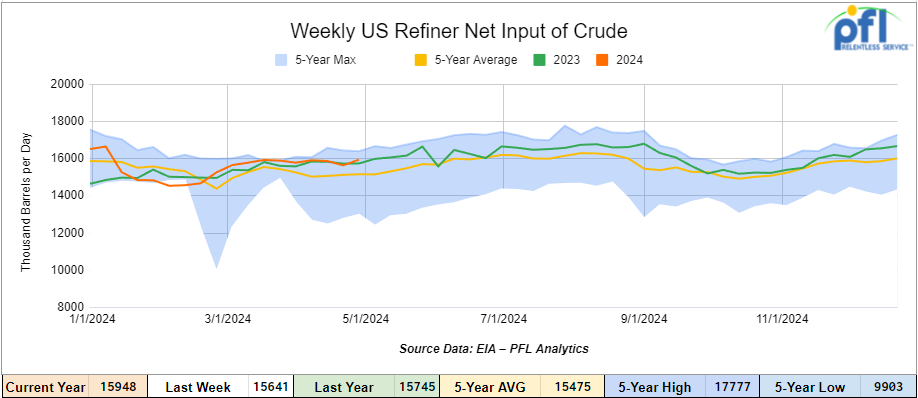

U.S. crude oil refinery inputs averaged 16.3 million barrels per day during the week ending May 10, 2024, which was 307,000 barrels per day more week-over-week.

WTI is poised to open at 79.73, down 33 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 15th, 2024.

Total North American weekly rail volumes were up (0.83%) in week 20, compared with the same week last year. Total carloads for the week ending on May 15th were 331,769, down (-5.28%) compared with the same week in 2023, while weekly intermodal volume was 326,583, up (+7.89%) compared to the same week in 2023. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The most significant decrease came from Coal, which was down (-23.38%). The most significant increase came from Petroleum and Petroleum Products which was up (+13.38%).

In the East, CSX’s total volumes were down (-0.08%), with the largest decrease coming from Grain (-21.14%) while the largest increase came from Petroleum and Petroleum Products (27.05%). NS’s volumes were up (4.21%), with the largest increase coming from Motor Vehicles and Parts (+12.87%) while the largest decrease came from Grain (-17.02%).

In the West, BN’s total volumes were up (1.63%), with the largest increase coming from Petroleum and Petroleum Products (21.49%) while the largest decrease came from Coal, down (-36.17%). UP’s total rail volumes were down (-1.27%) with the largest decrease coming from Coal, down (-25.97%) while the largest increase came from Chemicals which was up (+11.3%).

In Canada, CN’s total rail volumes were up (3.51%) with the largest decrease coming from Grain, down (-58.03%) while the largest increase came from Nonmetallic Minerals, up (+32.04%). CP’s total rail volumes were up (3.3%) with the largest increase coming from Other (+67.14%) while the largest decrease came from Nonmetallic Minerals, down (-38.29%).

KCS’s total rail volumes were down (-12.58%) with the largest decrease coming from Grain (-29.83%) and the largest increase coming from Chemicals (+6.4%).

Source Data: AAR – PFL Analytics

Rig Count

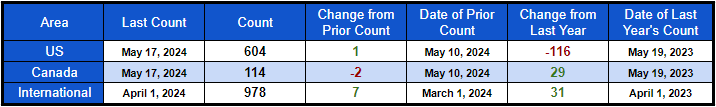

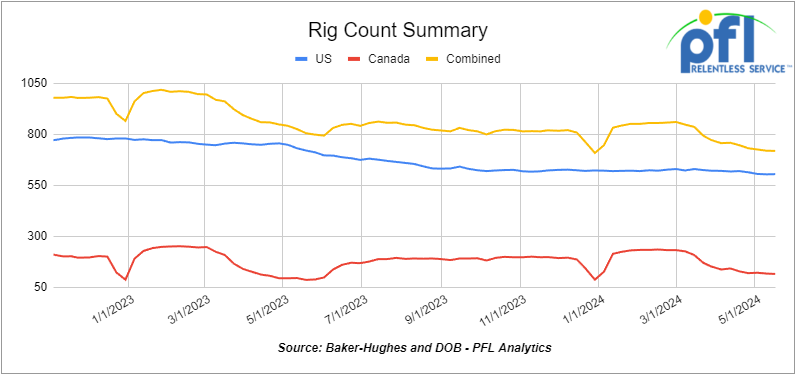

North American rig count was down by -1 rigs week-over-week. U.S. rig count was up by 1 rigs week-over-week, and down by -116 rigs year-over-year. The U.S. currently has 604 active rigs. Canada’s rig count was down by 2 rigs week-over-week, and up by 29 rigs year-over-year. Canada’s overall rig count is 114 active rigs. Overall, year-over-year, we are down -87 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28.167 from 27,944 which was an increase of 223 rail cars week-over-week Canadian volumes were lower. CPKC’s shipments were lower by -1.8% week over week. CN’s volumes were lower by -0.2% week-over-week. U.S. shipments were up across the board. The NS had the largest percentage increase and was up by +17.3%.

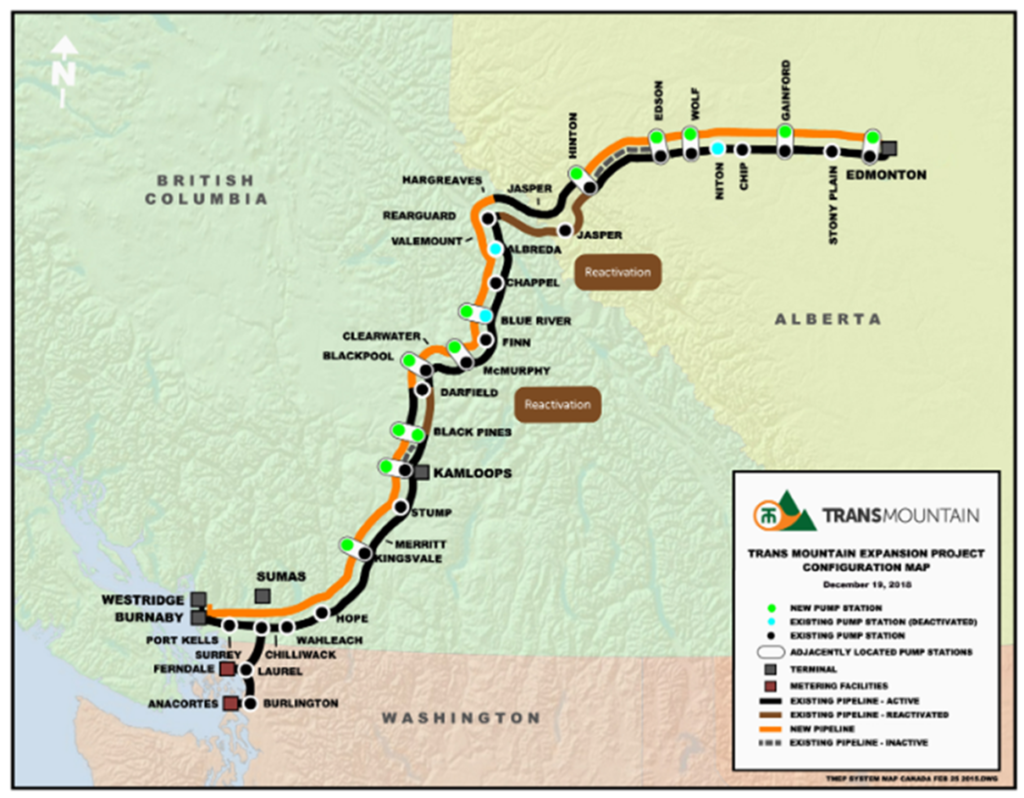

We Continue to Watch Trans Mountain Pipeline Expansion

The 598,000 barrel-per-day expansion is now fully operational, the total capacity of the new pipeline system is 890,000 barrels per day. Construction delays from environmental and indigenous groups raised havoc on the project. Suncor started loading the first heavy crude from the TMX over the weekend to a Chinese refiner named Sinochem. The Cargo is set to be delivered to China sometime in June. PetroChina, Shell, and P66 are lined up to take at least two tankers each. The Shell and P66 loads are expected to hit the U.S. west coast.

Trans Mountain Pipeline system Map

Source: Trans Mountain – PFL Analytics

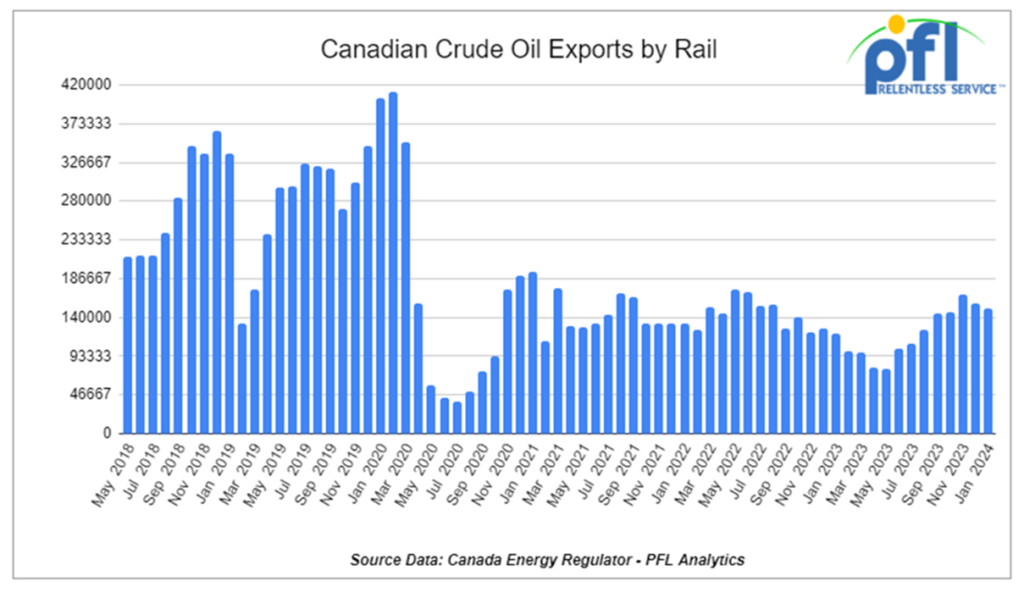

We are watching Crude by Rail out of Canada.

At least we are trying, folks. The last time the Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers was on March 20, 2024. For January 2024, Canada exported 150,292 barrels per day by rail (down by -6,850 barrels per day month over month). This was the second consecutive month-over-month decline after the seventh consecutive month-over-month increase but still the third-highest reading since June of 2022. The CER is two months behind in reporting crude by rail numbers – we don’t know why this is and e-mails and phone calls made by PFL staff have gone unanswered. Hopefully, they will catch up soon and continue to report timely data.

We are expecting to see volumes shipped by rail to increase despite Trans Mountain pipeline expansion completion. As we see it now, Cenovus and Strathcona will play a big part in this growth. Both companies, amongst other things, are focused on producing undiluted bitumen which is shipped via rail as a non-haz product in unit car trains. This method of transport is competitive with pipelines.

On an earnings call on Wednesday of last week, Strathcona Resources Ltd. continues to build output as assets gained in the company’s fourth quarter 2023 acquisition of Pipestone Energy Corp. continue to perform well. First quarter production volumes increased by 40,962 boe/d to an average of 185,122 boe/d compared to 144,160 boe/d for the same quarter of 2023. “Of note, over the previous two quarters sales volumes of certain of Strathcona’s Lloydminster heavy oil assets were in aggregate 4,400 barrels per day less than production as heavy oil volumes from Strathcona’s-owned rail terminal were held in inventory for the expansion of a unit train unloading facility in the U.S. Gulf Coast,” said Rob Morgan,

“This purpose-built facility is now fully operational, and its current inventory will be sold at a premium to WCS at Houston pricing over the subsequent two quarters.”

Connor Waterous, senior vice president and chief financial officer, said the company’s increased crude-by-rail capacity to the Gulf Coast will help grow cash flows.

“We’ve built about 4,400 barrels per day of heavy crude inventory over the last couple of quarters and we’re confident that we should be able to draw down most of it if not all of that over the course of Q2 and into the start of Q3,” he said.

“When you think about the size of the crude-by-rail opportunity for us, we’re making about 30,000 barrels per day of thermal volumes at our Lloydminster business all of which are currently sent down to the Gulf Coast via rail,” he said.

“In terms of the capacity of the crude-by-rail that we have up in Saskatchewan, our thinking is we can probably push about 50,000 barrels per day of crude.

“And when we think about the downstream capacity of the terminals in the Gulf Coast and the appetite of the buyers on the Gulf Coast for our crude, our thinking is that it is also north of, call it, 50,000 barrels per day.”

In Cold Lake, Strathcona spun a new pad of eight-well pairs at Tucker and began tie-in of seven infills and five well pairs at Lindbergh. Production at Cold Lake remains strong, with the first quarter of 2024 marking the fifth consecutive quarterly increase in production, driven by ongoing optimization of legacy well production at Lindbergh and Tucker.

Production for the Lloydminster heavy oil segment decreased to 52,092 boe per day from 57,641 boe/d in the same period of 2023. This decrease is primarily due to lower production volumes from Saskatchewan thermal properties. Stay tuned we may see some shifting of the C/I car back up to Canada for undiluted bitumen.

We Continue to watch Renewables.

We had a rather lengthy segment on renewables last week including RINS, LCFS Credits, Oregon’s Clean Fuels Program (CFP) Credit, renewable diesel, ethanol, and biodiesel. The amount of renewables blended into other carbon-based fuels that generate RINS came out last week. The process of turning feedstock such as tallow and other animal fats or oils in renewable diesel also generates RINS and in some cases, LCFS credits or Oregon’s Clean Fuels Program (CFP) Credits. Not surprisingly, RIN generation ramped up in April amid surging Renewable Diesel Production. Renewable Identification Number (“RIN”) credit generation in April ramped up more than 7% from March EPA data showed on Thursday of last week.

The agency said 2.06 billion credits were generated last month across all RIN categories, up 7.1% month over month and 11.9% year over year. April’s monthly total marked the highest RIN generation level for that month in the history of the Renewable Fuel Standard program.

Ethanol-related D6 RIN generation reached 1.195 billion credits in April, up 0.6% from March and 3.4% above the same month of 2023. D6 renewable fuel RINs are generated primarily by blending corn-based ethanol in the U.S. gasoline supply.

EPA said 780.12 million biomass-based diesel D4 RIN credits were generated last month, up 19.5% from March and 29.26% above the same month of 2023.

Within the April D4 total, 492.7 million RINs were generated from renewable diesel — up 24% from March, while 273.9 million RINs came from biodiesel, up from 243.8 million RINs in March. There were also 1.34 million renewable jet fuel RINs reported generated, up from 1.25 million in March.

Advanced biofuel D5 RIN generation in April fell to 16.1 million RINs, down 0.5% from March and down 10.5% from a year prior.

Cellulosic biofuel D3 RIN creation totaled 68.85 million RINs, up 3.8% month over month and up 7.5% year over year. There were 47,750 cellulosic diesel D7 RINs reported generated, up from 60,193 in March.

Total D6 RIN generation through April was up 1.6% year-to-date at 4.8 billion RINs, D4 RIN generation was up 26.1% at 2.852 billion, D3 RIN generation was up 15.9% at 211.93 million, and D5 RIN generation was down 13% at 68.8 million.

Total RIN generation of 7.93 billion RINs through April of this year, up 9.5% year over year.

Although RINS were higher week over week LCFS credits took another bath. D4 RINS closed out the day, and the week, at 49 and ½ of a cent per RIN, up 1 and ½ cents per RIN from Thursday’s close, and up 3 and ½ cents per RIN week over week. Meanwhile, D6 RINS also closed at 49 and ½ of a cent per RIN, also up 1 and ½ cents per RIN from Thursday’s close, and up 3 and ½ cents per RIN week over week. LCFS credits in California on a very slow day on Friday of last week closed at $41 per MT, flat from Thursday’s close, but down $7 per MT week over week.

Renewables as part of the supply chain are a huge component of railcar demand. Corn, soybeans, waste oils, and animal fats are a massive component not to mention the finished goods such as ethanol, biodiesel, and renewable diesel. Once we hit blending walls, those values for the credits deteriorate and are a bit of what we are seeing now. We are keeping a close eye on this one. Stay tuned to PFL for the latest and greatest.

We Continue to the Potential Rail Strikes in Canada

As it relates to CN in an effort to avoid a work stoppage, CN tabled a new offer to the Teamsters Canada Rail Conference (TCRC), the Class I announced Thursday of last week.

The new offer remains compliant with the federal government’s duty and rest period rules (DRPR) which define the requirements related to the hours of work and rest periods for employees who are in positions designated critical to safe railway operations, CN officials said in a press release.

Bargaining began in 2023 for new agreements that would cover train and engine employees and rail traffic controllers. Since then, CN’s proposals have focused on modernizing the collective agreement to enhance employee safety, introducing predictable scheduling with planned consecutive days off, better work-life balance, and increased financial compensation, company leaders said.

As the TCRC would not negotiate those “enhancements for a more modern agreement,” CN has made the revised offer within the existing parameters of the current collective agreement, CN officials said in a press release. The revised offer eliminates the hourly rate and scheduling proposal and continues to comply with the DRPR, they added.

CN’s announcement follows news that Canada’s labor minister has asked the Canada Industrial Relations Board (CIRB) to review whether a potential work stoppage by TCRC members would cause harm to the safety or health to the public.

At the same time, Canadian Pacific Kansas City and Teamsters Canada Rail Conference leadership resumed meetings on Thursday of last week with the help of federal mediators in an attempt to reach new collective agreements for train and engine employees and rail traffic controllers, the Class I announced on Wednesday of last week.

The announcement followed news that Canada’s labor minister asked the CIRB as in the case with the CN to review whether a potential work stoppage by TCRC members would cause harm to the safety or health of the public. Earlier this month, TCRC members voted to authorize strikes at CPKC and CN as early as May 22.

In an update on negotiations, CPKC officials said the Class I remains committed to negotiating renewed agreements. CPKC officials said:

- The CIRB has requested submissions from CPKC and the TCRC as well as other interested stakeholders by May 21; the parties have until May 31 to file replies;

- CPKC has proposed to the TCRC that both parties agree on the services that should be maintained in the event of a strike or lockout. “We believe this would eliminate the need for the CIRB referral process and bring much-needed clarity regarding the timing of any potential strike or lockout,” CPKC officials said;

- If no maintenance of services agreement is reached, it’s unlikely the parties will be in a position to initiate a legal strike or lockout within the next 60 days;

- CPKC on May 15 voluntarily offered to enter binding arbitration to avoid a work stoppage, but TCRC declined.

The CIRB’s involvement means that work stoppage cannot occur until the board issues a decision as with the case with the CN. So, a strike for the CPKC is also averted for now.

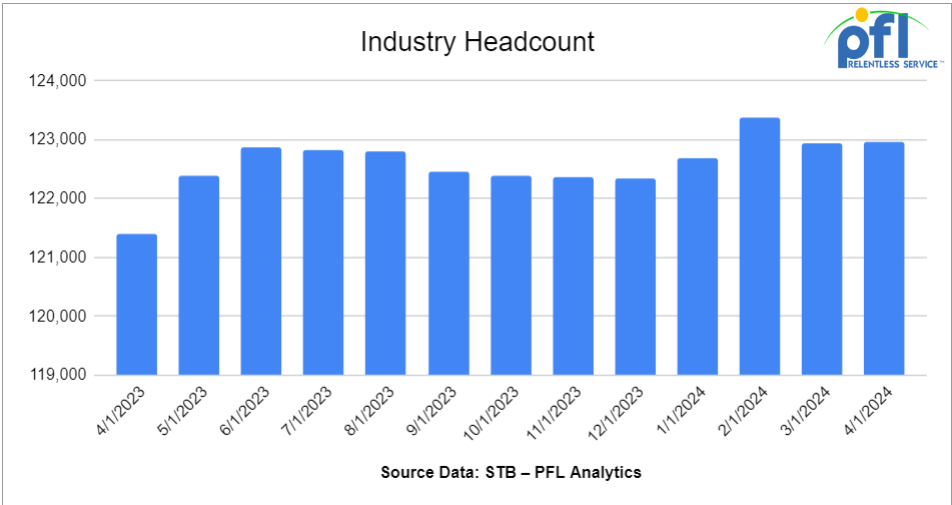

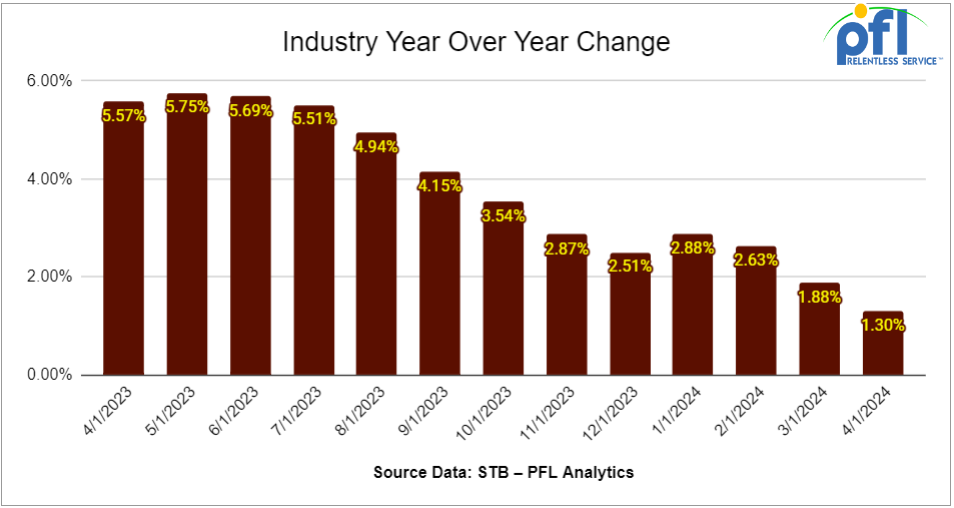

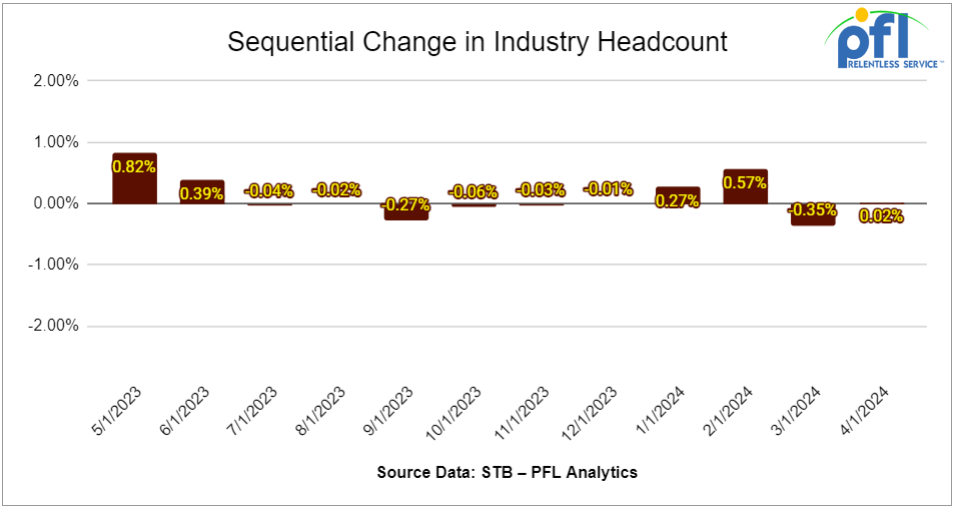

We are watching Class 1 Industry Headcount

Class Is employed 122,941 workers in the United States in March, a 0.35% decrease from February 2024’s count but a 1.88% year-over-year increase, according to Surface Transportation Board data.

Three of the six employment categories posted month over month increased between February and March. They were – maintenance of ways and structures, up 0.4% to 28,891 workers; transportation (other than train and engine), up 0.1% to 4,933; and transportation (train and engine), up 0.08% to 52,910.

Categories that posted month-over-month decreases were professional and administrative, -1.9% to 10,247 employees; maintenance of equipment and stores, -1.88% to 17,889; and executives, officials and staff assistants, -0.74 to 8,071.

Year over year, four categories posted employment gains. They were – transportation (train and engine) at 3.64%; professional and administrative, 1.75%; transportation (other than train and engine), 1.11%; and maintenance of way and structures, 0.96%.

Categories that registered year-over-year decreases in March were executives, officials and staff assistants, -0.93%; and maintenance of equipment and stores, -0.08%.

Lease Bids

- 20, 4750’s Thru Hatch Hopper Covereeds needed off of UP BN in USA West for 3 years. Cars are needed for use in Fertilizer service.

- 25, 30K 117R Tanks needed off of in for 2-3 Year. Cars are needed for use in Condensate service.

- 100, 15.5K DOT 111 Tanks needed off of Any Class 1 in USA for 1-3 Years. Cars are needed for use in Molten Sulfur service.

- 50, 30K 117 Tanks needed off of BNSF or UP in TX for 3-6 Months. Cars are needed for use in Crude service. will look at smaller cars. Prefer short term, would look at a longer term. Domestic use only

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in Ok, TX for 3 Year. Cars are needed for use in Asphalt service.

- 100, 25.5K DOT 111 Tanks needed off of Any Class 1 in Texas for 3 Years +. Cars are needed for use in Asphalt service.

- 30, 29K 117J Tanks needed off of BN or CN in Houston or Edmonton for 1-2 Year. Cars are needed for use in Biodiesel service.

- 200-400, 30K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Gas/Diesel service. 1-2 Year

- 10, 25.5K-28.3K DOT 111 Tanks needed off of UP or BN in Houston for 2 Year. Cars are needed for use in Resin service.

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

- 100, 30K Dot 111, CPC 1232, DOT 117R, DOT 117J Tanks needed off of CP or CN in Edmonton for 1 Year. Cars are needed for use in Diesel service.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tank s needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in aggregate service. Gravity dump

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in Fuels service.

Lease Offers

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease available until Fall.

- 50, ~5400, covered Hoppers located off of NS, IORY in MI. Cars were last used in bean meal. 1 year

- 53, 2 containers, Flats Intermodel Double Stacks located off of KCS in Texas. Cars are clean Lease or sell

- 100, 33K, 340W Pressures located off of CN or CP in Canada. Cars are clean

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 100+, 29K, 117R Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Up to 4 Years

- 100+, 29K, 117J Tanks located off of All Class Ones in St Louis. Cars were last used in Veg Oils. Returned by end of 2026

- 15, 33K, 340W Tanks located off of All Class Ones in North America. Cars were last used in Propane/Butane. Up to 1 year.

- 100, 30K, 117J Tanks located off of UP or BN in Texas. Cars were last used in Ethanol. Up to 1 year. Must go into ethanol service.

- 200, 25.5K, 117J Tanks located off of CPKC in Moving. Cars were last used in Crude. 6-12 Months

- 25, 33K, 400W Pressure Tanks located off of IHB in Hammond, IN. Cars were last used in propylene. 1-year term.

Sales Offers

- 20, Refer Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 19, 4400, Rotary Gondolas located off of UP and BN in California and Wyoming.

- 7, 30K, DOT 111 Tanks located off of UP in TX, CA, NM.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website