“A life spent making mistakes is not only more honorable but more useful than a life spent doing nothing.”

— George Bernhard Shaw

Jobs Update

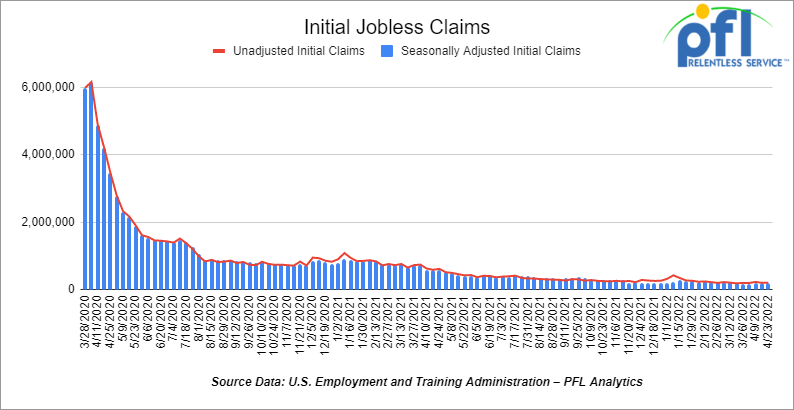

- Initial jobless claims for the week ending April 23rd, 2022 came in at 180,000, down -5,000 people week-over-week.

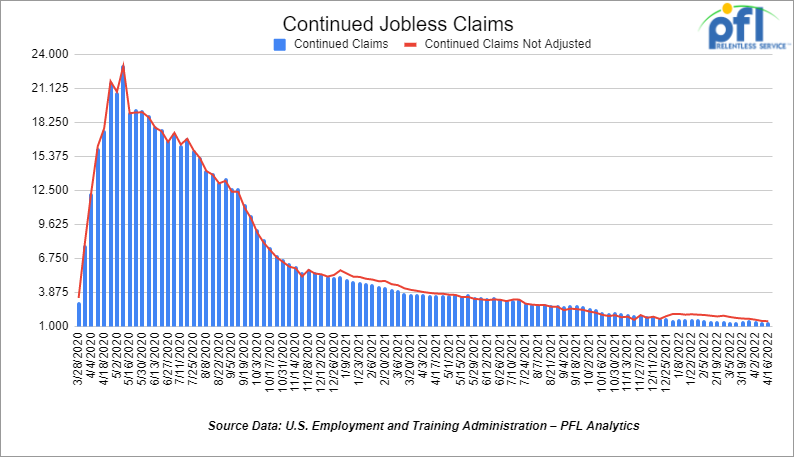

- Continuing claims came in at 1.408 million people versus the adjusted number of 1.409 million people from the week prior, down -1,000 people week-over-week.

Stocks were lower on Friday of last week and down week-over-week

The DOW closed lower on Friday of last week, down -981.18 points (-2.77%), closing out the week at 32,977.21 points, down -834.19 points week-over-week. The S&P 500 closed lower on Friday of last week, down -155.57 points, and closed out the week at 4,131.93, down -139.85 points week-over-week. The Nasdaq closed lower on Friday of last week, down -536.89 points (-4.17%), and closed out the week at 12,334.64, down -504.65 points week-over-week.

Oil closed lower on Friday of last week and higher week over week

Oil prices traded down on Friday of last week, after initially trading higher earlier in the session on a volatile day. Heating oil prices plummeted on Friday of last week into the expiration of the front-month contract, dropping as much as 20% at one point. The heating oil contract expired on Friday, along with the global Brent benchmark and U.S. gasoline futures. Volumes in all three front-month contracts were low, creating outsized volatility in the market and leading to late-day sell-offs, analysts said. “The fireworks were all in the expiring diesel contract,” said Andrew Lipow of Lipow Oil Associates in Houston. “Friday’s expiry was especially volatile and may not be reflective of actual tightness.” Prices closed out the week up slightly, mostly on prospects of a Russian oil embargo by the EU and the result that could have on Russian production.

WTI traded down -$0.67 or -0.64% to close at $104.69, up $2.94 per barrel week over week. Brent traded down -$0.96 or -0.90% to close at $106.30 up $4.23 per barrel week over week.

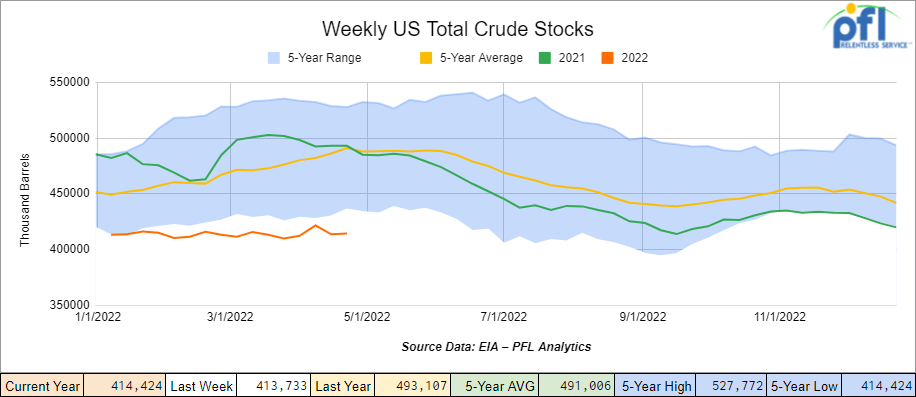

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 700,000 barrels week over week. At 414.4 million barrels, U.S. crude oil inventories are 16% below the five-year average for this time of year.

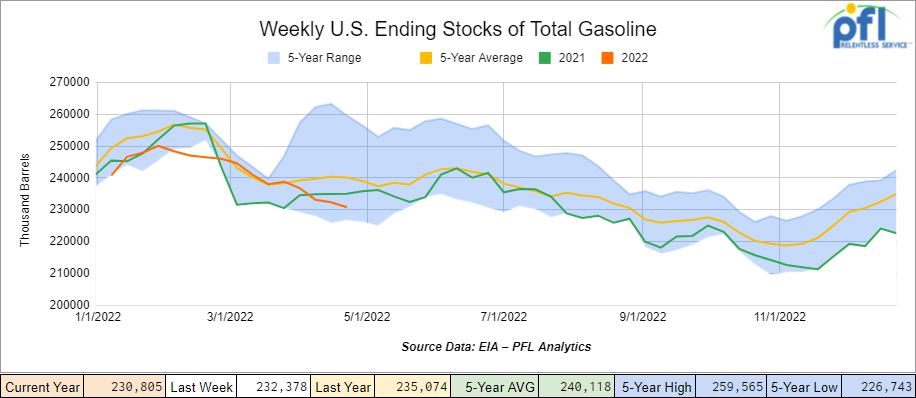

Total motor gasoline inventories decreased by 1.6 million barrels week over week and are 4% below the five-year average for this time of year.

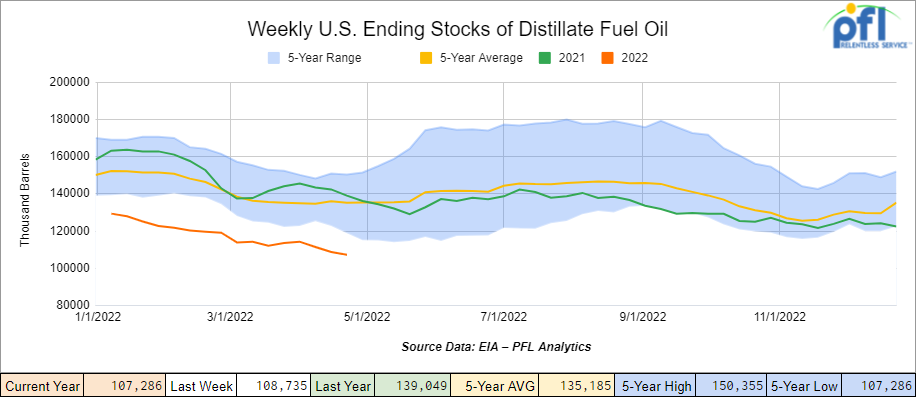

Distillate fuel inventories decreased by 1.4 million barrels week over week and are 21% below the five-year average for this time of year.

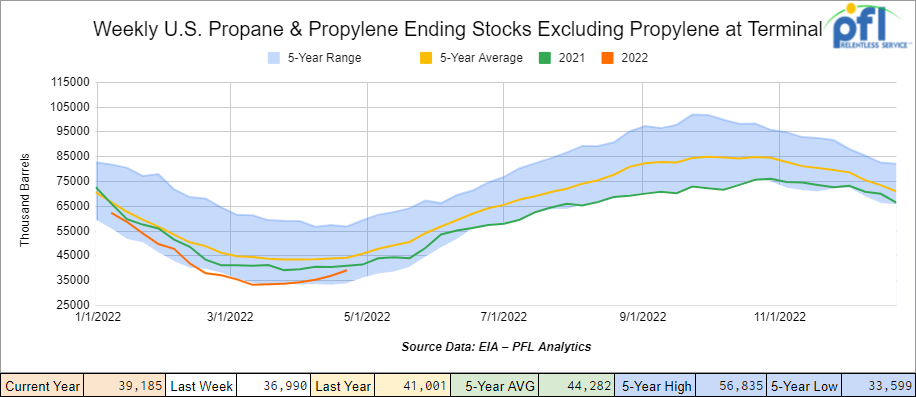

Propane/propylene inventories increased by 2.2 million barrels week over week and are 12% below the five-year average for this time of year.

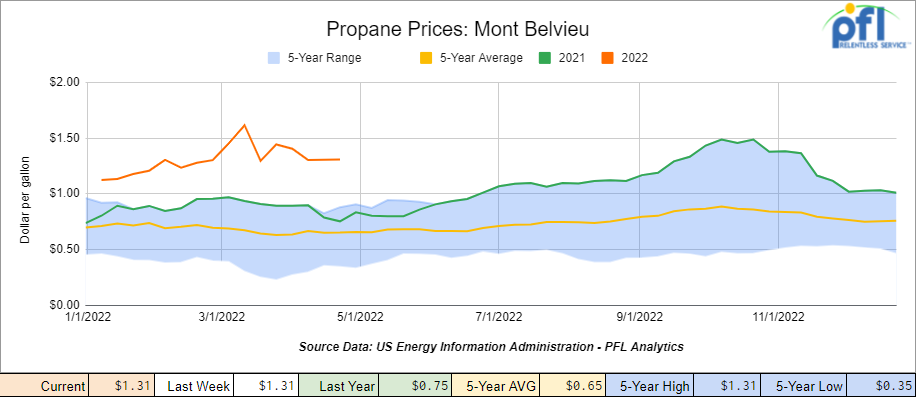

Propane prices were flat at $1.31 per gallon week over week, but up 56 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 700,000 barrels for the week ending April 22, 2022.

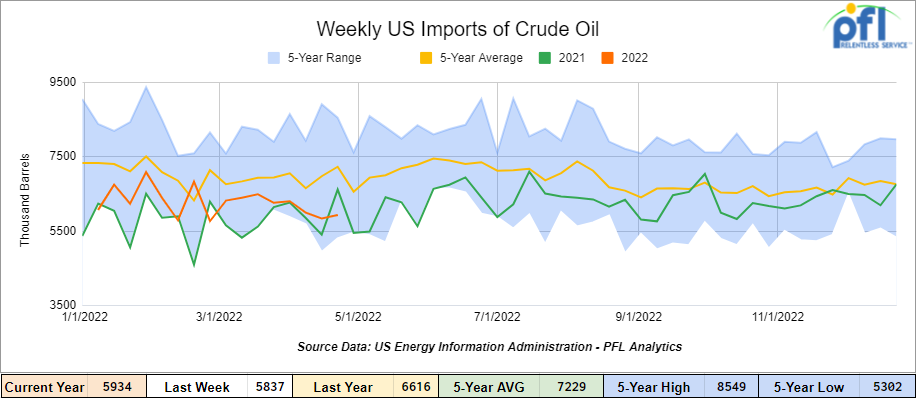

U.S. crude oil imports averaged 5.9 million barrels per day during the week ending April 22nd, 2022, up by 98,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, 0.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 845,000 barrels per day, and distillate fuel imports averaged 125,000 barrels per day for the week ending April 22, 2022.

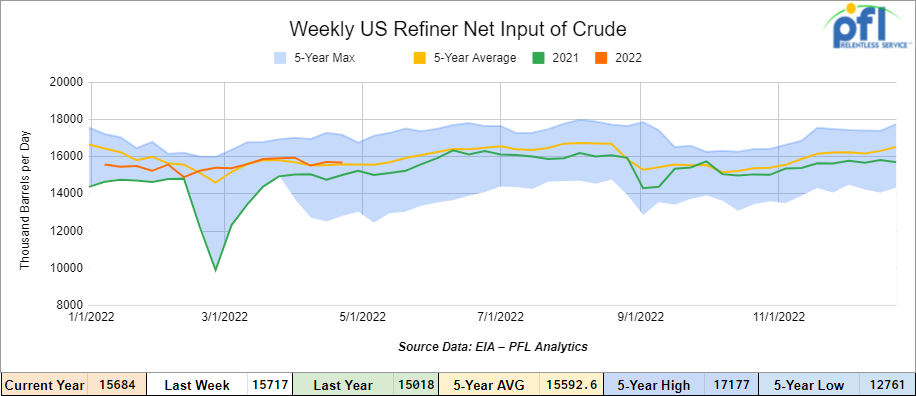

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending April 22, 2022, which was 33,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at $97.88, down -$4.19 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down -5.8% year over year in week 16 (U.S. -7.4%, Canada flat, Mexico -5.0%) resulting in quarter-to-date volumes that are down -4.8% year-over-year and year-to-date volumes that are down -4.0% year-over-year (U.S. -3.2%, Canada -8.0%, Mexico +1.0%). 9 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-7.8%) and grain (-13.3%). The largest increase came from motor vehicles and parts (+17.2%).

In the East, CSX’s total volumes were down -1.9%, with the largest decrease coming from intermodal (-4.3%). The largest increase came from stone, sand & gravel (+25.4%). NS’s total volumes were down -5.4% year-over-year, with the largest decreases coming from intermodal (-5.8%) and coal (-17.0%). The largest increase came from motor vehicles & parts (+15.5%).

In the West, BN’s total volumes were down -7.8%, with the largest decreases coming from intermodal (-9.8%) and coal (-8.1%). UP’s total volumes were down -6.3%, with the largest decreases coming from intermodal (-12.3%) and grain (-19.9%). The largest increase came from stone, sand & gravel (+18.5%).

In Canada, CN’s total volumes were up +3.1%, with the largest increases coming from coal (+57.7%), motor vehicles & parts (+73.5%) and petroleum (+14.2%). The largest decreases came from farm products (-76.1%) and chemicals (-11.3%). Revenue per ton-miles was up 3.3%. CP’s total volumes were down -3.9%, with the largest decreases coming from grain (-30.3%), intermodal (-3.6%), and farm products (-35.4%). Revenue per ton-miles was down 3.2%.

KCS’s total volumes were up +0.1%, with the largest increase coming from grain (+36.5%). The largest decrease came from petroleum (-28.7%).

Source: Stephens

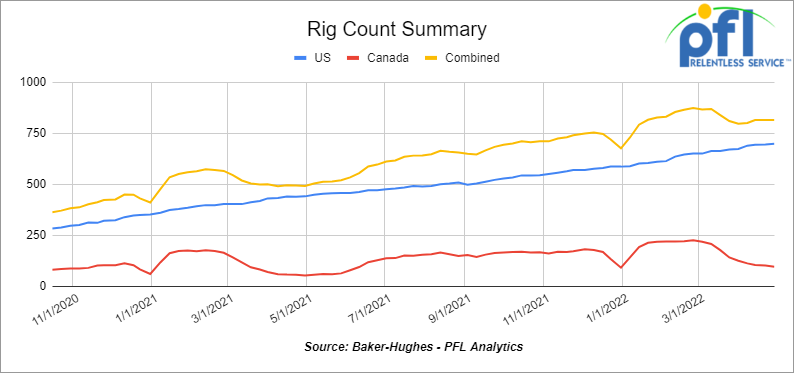

Rig Count

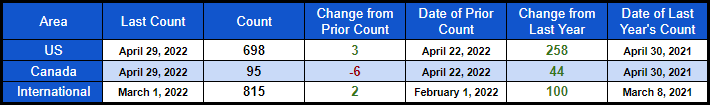

North American rig count flat week over week. U.S. rig count was up by 3 rigs week-over-week and up by 258 rigs year over year. The U.S. currently has 698 active rigs. Canada’s rig count was down by -6 rigs week-over-week and up by 44 rigs year-over-year. Canada’s overall rig count is 95 active rigs. Overall, year over year, we are up 302 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 23,293 from 23,061, which is a gain of +232 rail cars week-over-week. Canadian volumes were lower: CP shipments were flat while CN volumes were down by 7.4%. U.S. volumes were up across the board with the BN having the largest percentage increase (up by 21.7%).

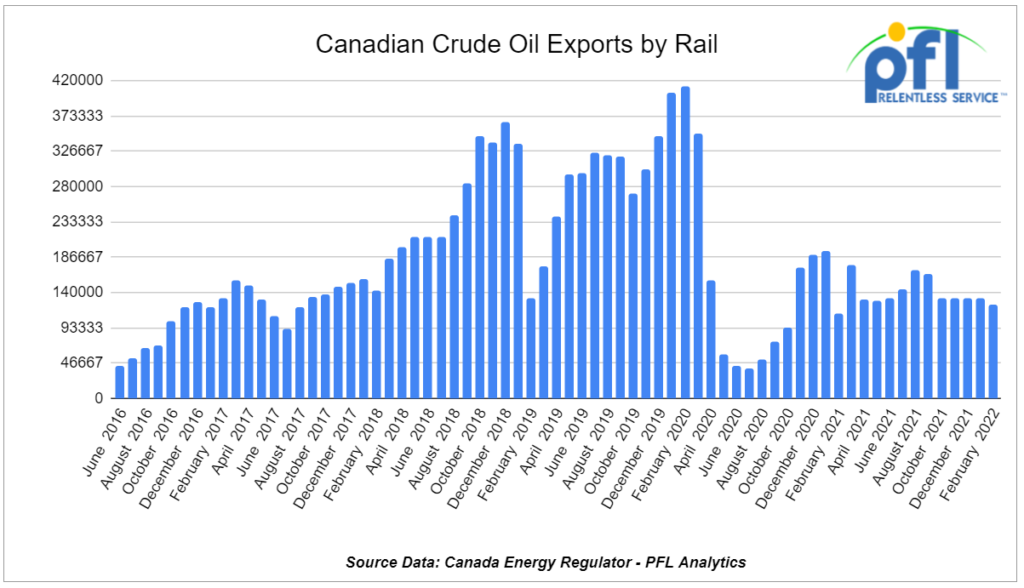

Canadian Crude By Rail

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on Thursday of last week. For February 2022, Canada exported 124,781 barrels per day by rail, down 7,686 barrels per day month over month and a far cry from its peak of 411,991 barrels per day in February 2020 two years ago.

STB Meetings

Well folks, a lot to unpack here. The crux of the meetings has ultimately been Precision Scheduled Railroading. Designed to improve efficiency and reduce costs, PSR is now being blamed for the significant service delays. This along with the shortage of crews or available personnel is causing the largest supply chain issue we have ever seen. Pete Buttigieg opened the meeting, the first time someone in his position has personally come before the STB in twenty years. Major shippers from a wide range of industries appeared at the hearing to bash the railroads, claiming their poor service is not just hurting their industries but the overall economy. The railroads, for their part, unanimously admitted that the current level of service is unacceptable. They took exception to blaming PSR and other cost-cutting measures, and instead blamed the unprecedented nature of the pandemic, which caused major swings in demand, as well as supply chain bottlenecks such as congestion at ports.

“In recent weeks the board has received communications from a broad range of stakeholders of serious problems affecting the freight rail network, namely inconsistent and unreliable service which has had serious impacts on rail users, particularly those shipping agriculture and energy products,” Martin Oberman, STB Chairman said. The STB was looking to these meetings to see what they could do, if anything, to alleviate or help the situation. This would include taking emergency authority or passing immediate legislation to help fix certain issues such as shortening trains or incentivizing new engineers to come work for the railroads. We here at PFL have seen the effects of the lengthening transit times as shippers have been adding additional cars to their fleets to offset slower turn times. Unfortunately, this is also adding to the problem as more cars than usual are entering the rotation. Stay tuned to PFL for more updates.

Diesel Crisis

There is a diesel crisis upon us and it is impacting consumers and businesses in a much bigger way than the average gasoline buyer is aware of. As of Friday, the average price nationwide for diesel stands at $5.18/gallon. Why is this significant? Practically everything we buy, brick and mortar or online is delivered by diesel. The railroads, 18-wheelers, and delivery trucks are all powered by diesel. Container ships are powered by a diesel relative, bunker oil.

As diesel rises in price, due in part to the war in the Ukraine and refiner capacity limitations, everything we buy will go up in price, adding to the overall pain of inflation. With Russia cutting off natural gas supplies to Poland and Bulgaria, those countries will have to turn to alternative fuels which could cause diesel to top $6/gallon. “I’ve started to use the term diesel ‘crisis’, Tom Kloza, head of global energy research at OPIS, told CNBC. “It clearly is a crisis that’s happening before our eyes. I wouldn’t rule out line shortages or $6 in places beyond California. Folks, imagine if a diesel shortage creates lines of 18-wheelers trying to fill up? Many of which carry perishable foods and critical medicines?

The Fed’s attempt to tame inflation will be muted if the cost of energy does not abate. The administration has their hands tied due to factors here in the US and well beyond the borders. Stay tuned to PFL for updates on this ongoing crisis.

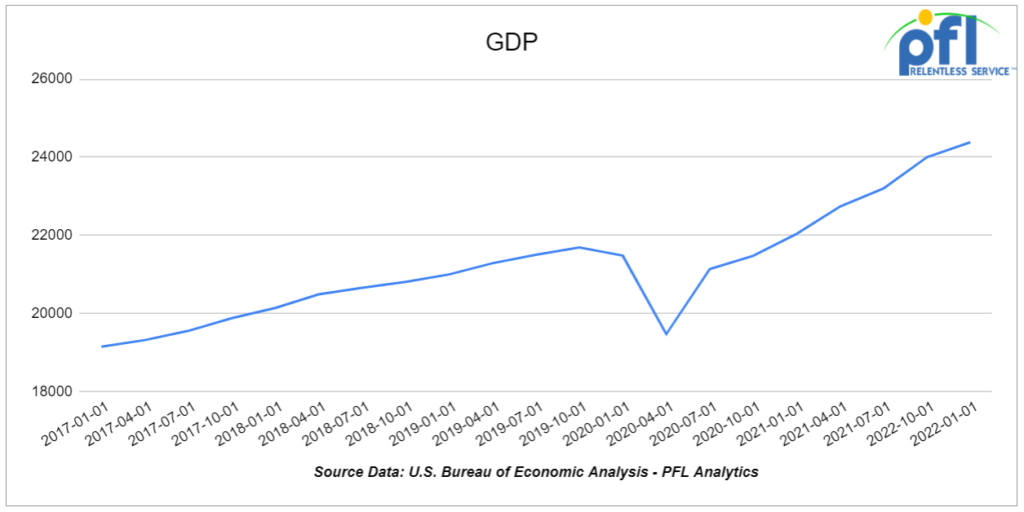

U.S. Economy

The U.S. economy shrank for the first time since 2020. Gross domestic product fell at a 1.4% annualized rate in the first quarter following a 6.9% pace of growth at the end of last year, the Commerce Department’s preliminary estimate showed Thursday of last week.

The contraction they say was due to a jump in imports and a drop in exports, coupled with a slower buildup of businesses’ stockpiles. They also said inflation was transitory – we will have to see how all of this plays out. On a year-over-year basis, the economy grew by 3.6%.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the Midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

- 100 3200 Covered Hoppers for sale price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|