“A man has to learn that he cannot command things, but that he can command himself; that he cannot coerce the wills of others, but that he can mold and master his own will: and things serve him who serves Truth; people seek guidance of him who is master of himself.” – James Allen

Jobs Update

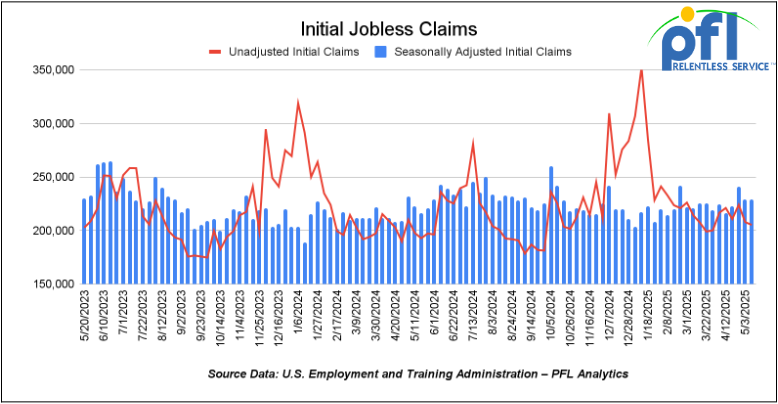

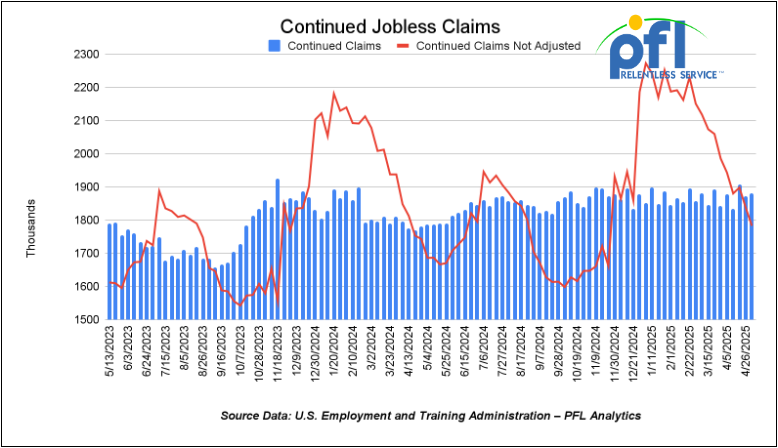

- Initial jobless claims seasonally adjusted for the week ending May 10 came in at 229,000, flat week-over-week.

- Continuing jobless claims came in at 1.881 million people, versus the adjusted number of 1.872 million people from the week prior, up 9,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 331.99 points (+0.78%) and closing out the week at 42,654.74, up 1,405.36 points week-over-week. The S&P 500 closed higher on Friday of last week, up 41.45 points, and closed out the week at 5,958.38 up 298.47 points week-over-week. The NASDAQ closed higher on Friday of last week, up +98.78 points, and closed out the week at 19,211.1, up 1,282.18 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 42,386 this morning down 350 points from Friday’s close.

Crude oil closed higher on Friday of last week and higher week over week.

West Texas Intermediate (WTI) crude closed up $0.87 per barrel (+1.4%), to close at $62.49 per barrel on Friday of last week and up $1.48 per barrel week over week. Brent crude closed up $0.88 USD per barrel (+1.4%) on Friday of last week, to close at $65.41 per barrel and up $1.50 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled on Friday of last week at US$9.15 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$51.84 per barrel.

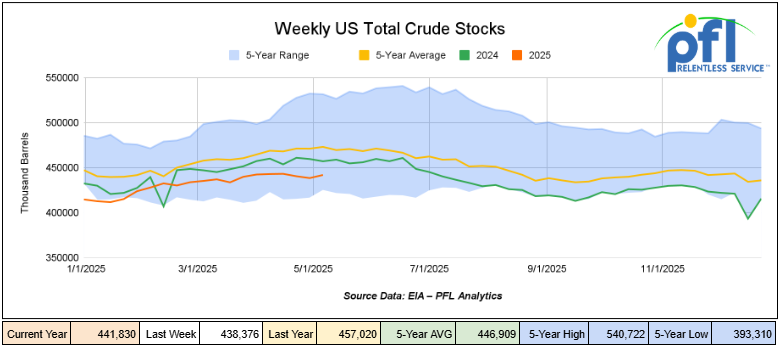

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.5 million barrels week-over-week. At 441.8 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

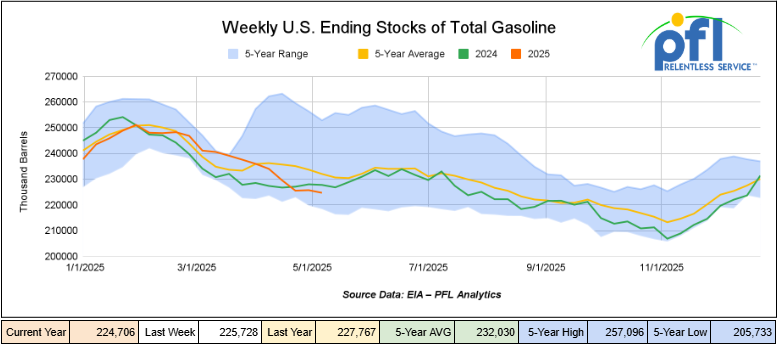

Total motor gasoline inventories increased by 200,000 barrels week-over-week and are 3% below the five-year average for this time of year.

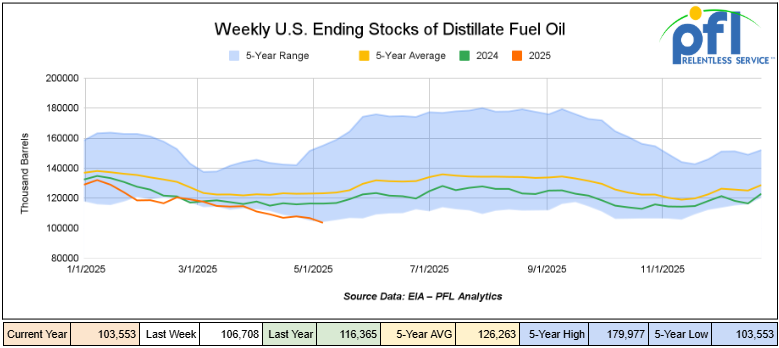

Distillate fuel inventories decreased by 3.2 million barrels week-over-week and are 16% below the five-year average for this time of year.

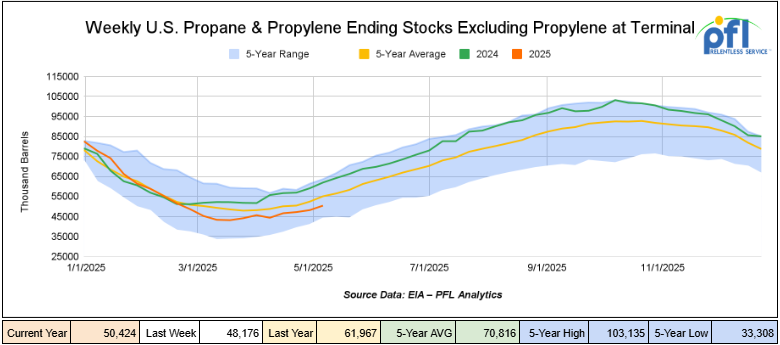

Propane/propylene inventories increased by 2.2 million barrels week-over-week and are 9% below the five-year average for this time of year.

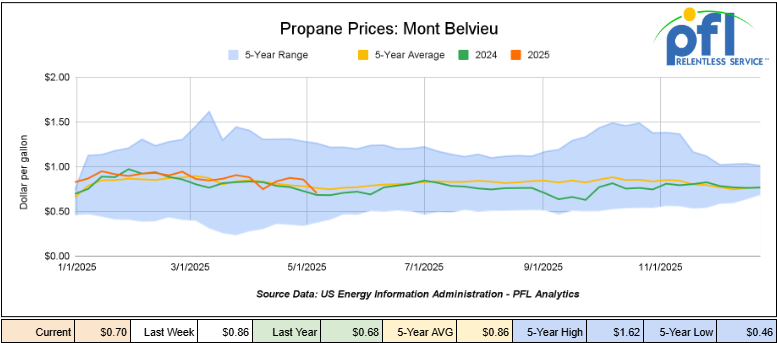

Propane prices closed at 70 cents per gallon on Friday of last week, down 16 cents per gallon week-over-week, but up 2 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 4.9 million barrels during the week ending May 9, 2025.

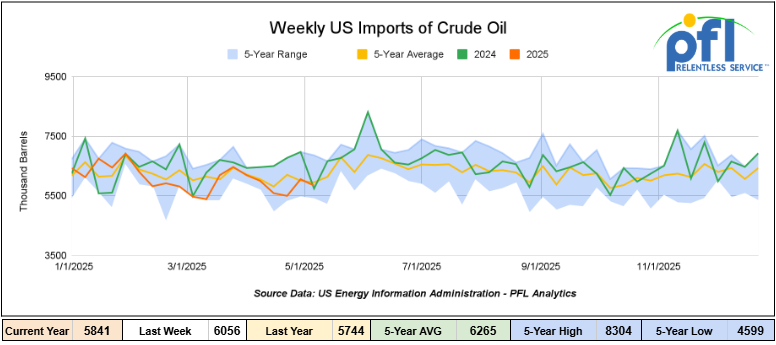

U.S. crude oil imports averaged 5.8 million barrels per day during the week ending May 9, 2025, a decrease of 214,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 14.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 822,000 barrels per day, and distillate fuel imports averaged 179,000 barrels per day during the week ending May 9, 2025.

U.S. crude oil exports averaged 3.369 million barrels per day during the week ending May 9, 2025, a decrease of 637,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3.761 million barrels per day.

U.S. crude oil refinery inputs averaged 16.4 million barrels per day during the week ending May 9, 2025, which was 330,000 barrels per day more week-over-week.

WTI is poised to open at 61.99, down 50 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending May 15, 2025.

Total North American weekly rail volumes were down (-2.04%) in week 20, compared with the same week last year. Total carloads for the week ending on May 15 were 321,803, down (3%) compared with the same week in 2024, while weekly intermodal volume was 323,140, down (-1.05%) compared to the same week in 2024.

9 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest decrease came from Petroleum and Petroleum Products, which was down (-18.36%), while the largest increase was from Coal, which was up (14.69%).

In the East, CSX’s total volumes were up (+2.17%), with the largest decrease coming from Petroleum and Petroleum Products (-18.40%), while the largest increase came from Coal (+31.89%). NS’s volumes were up (5.34%), with the largest increase coming from Coal (+22.85%), while the largest decrease came from Farm Products (-7.31%).

In the West, BN’s total volumes were up (+5.91%), with the largest increase coming from Coal (26.45%), while the largest decrease came from Metallic Ores and Metals (-19.73%). UP’s total rail volumes were up (+2.48%), with the largest increase coming from Coal (+32.16%), while the largest decrease came from Motor Vehicles and Parts (-8.87%).

In Canada, CN’s total rail volumes were down (-10.37%) with the largest increase coming from Grain, up (+98.55%), while the largest decrease came from Intermodal Units (-24.43%).

Notice Regarding CP and KCS Rail Traffic Data

Please note that CP (Canadian Pacific) and KCS (Kansas City Southern) rail traffic data will not be published this week. Moving forward, data from both entities will be consolidated and reported under the unified CPKC (Canadian Pacific Kansas City) banner. This change reflects the completion of the merger between CP and KCS and ensures alignment with the integrated operations of the combined company.

We appreciate your understanding and will provide the updated CPKC data in subsequent reports.

Source Data: AAR – PFL Analytics

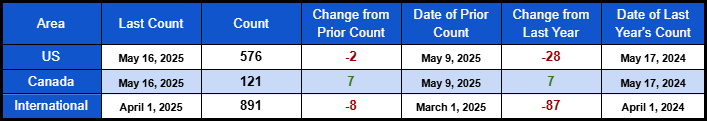

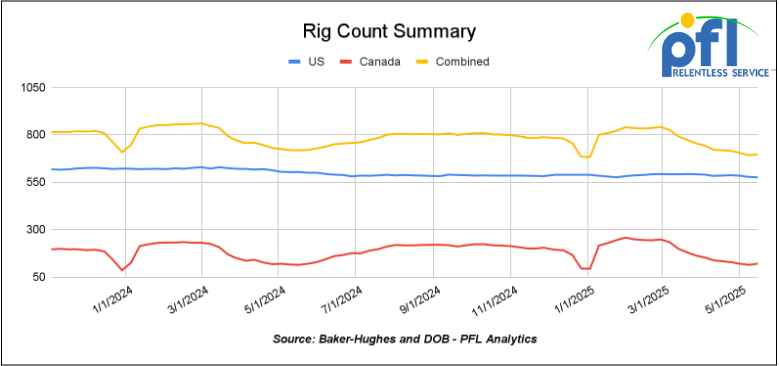

Rig Count

North American rig count was up by +5 rigs week-over-week. U.S. rig count was down -2 rigs week over week and down by -28 rigs year-over-year. The U.S. currently has 576 active rigs. Canada’s rig count was up +7 rigs week-over-week and up by +7 rigs year-over-year. Canada currently has 121 active rigs. Overall, year over year we are down by -21 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,074 from 26,949 which was an increase of +125 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments were higher by +15.0% week over week, CN’s volumes were higher by +8.0% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +6.0%. The CSX had the largest percentage decrease and was down by -6.0%

We are watching Strathcona they are busy up in Canada

During the first quarter of 2025, Strathcona signed a definitive agreement to acquire the Hardisty Rail Terminal (HRT) for cash consideration of approximately C$45 million and closed on the acquisition early in the second quarter.

The HRT is located in Hardisty, Alberta, and is the largest crude-by-rail terminal in Western Canada with capacity of 262,000 barrels per day – year-to-date throughput is only 50,000 barrels per day, so lots of room to grow.

Originally built and operated by USD Partners, HRT is directly connected to the Hardisty Diluent Recovery Unit, an innovative facility which separates diluent from raw bitumen prior to rail transportation, that can be a competitive netback for upstream producers versus pipeline alternatives. The raw bitumen is shipped as a non-haz product.

Hardisty Energy Terminal

Source Data: US Development Group – PFL Analytics

HRT has an estimated replacement cost of approximately C$200 million and free cash flow over the past 12 months of approximately C$12 million, 80% of which is underpinned by long-term take-or-pay contracts with an investment-grade counterparty.

Together with Strathcona’s Hamlin Terminal, Strathcona now owns and operates rail terminals servicing approximately 80% of the total current crude-by-rail volumes in Western Canada.

In another transaction(s) Strathcona has entered into definitive agreements to sell substantially all of its Montney assets for approximately C$2.84 billion.

Montney

Source Data: Strathcona – PFL Analytics

There are three separate transactions that include:

- The sale of its Kakwa asset to ARC Resources Ltd. for approximately C$1.695 billion in total value (C$1.650 billion in cash and approximately C$45 million in assumed lease obligations);

- The sale of its Grande Prairie asset for approximately C$850 million in total value (C$750 million in cash and approximately C$100 million in assumed lease obligations);

- The sale of its Groundbirch asset to Tourmaline Oil Corp. for C$291.5 million in common shares of Tourmaline.

The Kakwa sale is expected to occur early in the third quarter of 2025, subject to receipt of regulatory approvals and the satisfaction of other customary closing conditions.

The Grande Prairie sale is expected to occur early in the third quarter of 2025, subject to receipt of regulatory approvals and the satisfaction of other customary closing conditions.

The Groundbirch sale is expected to occur in the second quarter of 2025, subject to receipt of regulatory approvals and the satisfaction of other customary closing conditions. The share consideration is not subject to any lock-up periods beyond a four-month statutory hold period.

Strathcona has C$5.5 billion of tax pools at March 31, 2025 and does not expect any cash taxes to result from the Montney dispositions.

Upon completion of the Montney dispositions, Strathcona will be a pure-play heavy oil company producing approximately 120,000 barrels per day (100 per cent oil, 95,000 barrels per day thermal, 25,000 barrels per day conventional) with a 50-year 2P reserve life index and positive net cash (including marketable securities).

In other Strathcona news, Strathcona will offer to acquire all the issued and outstanding common shares of MEG Energy, not already owned by Strathcona or its affiliates, for 0.62 of a common share of Strathcona and $4.10 in cash per MEG share.

Based on the closing share price of the Strathcona shares on the Toronto Stock Exchange on May 15, 2025, the offer represents total consideration of $23.27 per MEG share (82.4% Strathcona shares and 17.6% cash), reflecting a 9.3% cent premium based on the closing price of the MEG shares on the TSX on May 15, 2025.

Upon completion of the offer, Strathcona expects to have approximately 379 million Strathcona shares outstanding and approximately $1.5 billion in net debt. Strathcona expects to file the formal offer to purchase and takeover bid circular for the offer in the next two weeks. For more information as it relates to Strathcona bid for MEG please click here

We are Watching Ethanol and CCS Legislation in Iowa

Last week, Iowa’s Senate approved House File 639, a bill that significantly restricts carbon capture and sequestration (CCS) projects. The legislation imposes a 25-year limit on pipeline permits, blocks renewals, and adds strict permitting and insurance requirements—effectively halting CCS efforts in the state.

Why it matters: Ethanol producers rely on CCS to reduce carbon intensity scores and qualify for premium low-carbon fuel markets in California and Canada. Without CCS, future production growth may be at risk or at least ethanol producers will not get the price premium they were hoping to get – reduced rail traffic could also result.

Monte Shaw, Executive Director of the Iowa Renewable Fuels Association, stated:

“This bill doesn’t just hurt ethanol. It cuts off future demand for Iowa corn and rail freight alike.”

Rail Impact: Ethanol is a core rail commodity. U.S. ethanol carloads averaged 24,000 per month in Q1 2025, with Iowa accounting for close to 30% of national output. Any slowdown in Iowa’s ethanol industry would hit volumes for Class I and short-line railroads alike.

CCS projects would also generate incremental rail demand—construction materials, CO₂ equipment, and captured CO₂ itself. That opportunity is now uncertain if HF 639 becomes law.

HF 639 is now on Governor Reynolds’ desk. Industry groups are pushing for a veto. Stay tuned to PFL we are watching this one closely.

We Are Watching the U.S.–China Freight Surge – It’s Time to Move!

Folks, there is a little whiplash going on out there as far as trade and freight goes. On May 12, the U.S. and China agreed to a 90-day break in their trade war. Both countries lowered tariffs—U.S. tariffs on Chinese goods dropped from 145% to 30%, and China lowered its tariffs on American produced products.

The impact was immediate: freight demand took off.

Hapag-Lloyd saw bookings jump 50% in just one week. CEO Rolf Habben Jansen said,

“We’ve already seen more volume between China and the U.S. in the last few days—and it’s still climbing.”

In total, container traffic from China to the U.S. surged 277% last week. Retailers are rushing to bring in goods before the back-to-school season and the next tariff deadline in August. Ocean freight rates have already increased 8%, and they’re still rising.

What this means for rail:

- Intermodal volumes are coming. Expect a wave of inbound shipments hitting the West Coast by late June. Railroads, like UP and BNSF, will be moving fast to clear ports—creating opportunity for well cars and supporting boxcar traffic.

- Lease demand could firm. If you have idle equipment near port-adjacent intermodal hubs or inland distribution points, this is the moment to reposition. Short-term lease rates could rise in high-demand corridors.

- Shippers: book early. Capacity will tighten quickly. If you rely on rail from West Coast gateways, now is the time to lock in service.

UP CEO Jim Vena summed it up: “We should come out of this in the next few weeks,” pointing to a rebound in international volume.

This may be a short-term window—tariffs return mid-August if talks stall. But right now, there’s volume to chase! Stay tuned to PFL, we are watching this one closely.

We are Watching Key Economic Indicators

Industrial Output and Capacity Utilization

Manufacturing accounts for approximately 75% of total output. Manufacturing output in April was down -0.01% from March 2024.

Capacity utilization is a measure of how fully firms are using the machinery and equipment. Capacity Utilization was down -0.14% from March in April.

Producer Price Index (PPI) | Consumer Price Index (CPI)

In April 2025, the U.S. Producer Price Index (PPI) declined by 0.5% month over month, marking the sharpest drop since the onset of the pandemic and reversing a flat reading in March. On an annual basis, wholesale inflation continued to ease. Core PPI—which excludes food, energy, and trade services—fell by 0.1%, following a 0.2% increase in March. The decline was broad-based: service prices dropped 0.7%, trade margins fell 1.6%, and transportation and warehousing prices declined by 0.4%. Goods prices were unchanged overall, though food and energy components decreased by 1.0% and 0.4%, respectively.

The Consumer Price Index (CPI) increased by 0.2% month over month in April, following a 0.1% decline in March. Over the past 12 months, the all-items index rose 2.3% before seasonal adjustment, down slightly from 2.4% in March.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, 30K Any Type Tanks needed off of various class 1s in various locations for 1-5 years. Cars are needed for use in Condensate service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website