“Politics is the ability to foretell what is going to happen tomorrow, next week, next month and next year and to have the ability afterwards to explain why it didn’t happen. ”

Winston Churchill

COVID 19 and Markets Update

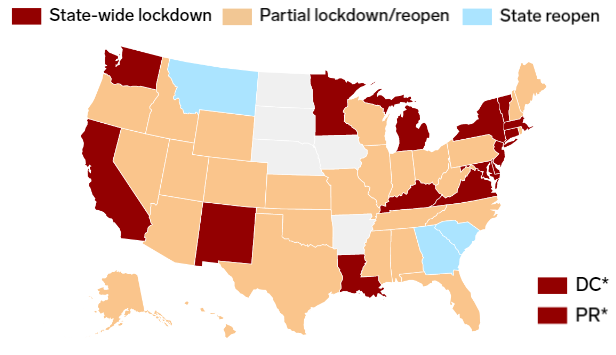

In the United States, we currently have 1.52 million confirmed COVID 19 cases and 89,932 confirmed deaths. Map is looking better for economic growth.Status of US stay-at-home and re-opening orders

Oil climbed to the highest level since mid-March to post its third weekly gain as economies begin to reopen and signs suggest that demand is recovering. WTI for June delivery closed up a $1.87 to settle at $29.43 per barrel in New York on Friday of last week. OPEC is optimistic that the worst of the oil crisis is over and sees signs that the global economy is starting to recover. However, the oil market’s recovery remains fragile. According to Bloomberg, more than 30 tankers laden with crude from Saudi Arabia are set to reach the U.S. this month and the next.

Oil is higher in overnight trading and as of the writing of this report, WTI is poised to open at $32.20 up $2.72 per barrel from Friday’s close.

The DOW traded up on Friday 60.08 points (or .25%) to close out the week at 23,685.42 points down 645.90 points week over week. In overnight trading, DOW futures traded higher and as of the writing of this report is expected to open up at 23,923 up 406 points.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

Total North American rail volumes were down 20.5% year over year in week 19 (U.S. -22.1%, Canada -12.0%, Mexico -33.2%), resulting in quarter to date volumes that are down 19.7% and year to date volumes that are down 10.4% (U.S. -11.9%, Canada -6.2%, Mexico -6.7%). All of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-13.8%), coal (-39.8%), motor vehicles & parts (-90.2%) and metallic ores & metals (-27.6%).In the East, CSX’s total volumes were down 26.2%, with the largest decreases coming from intermodal (-18.1%), motor vehicles & parts (-96.4%) and coal (-43.1%). NS’s total volumes were down 30.9%, with the largest decreases coming from intermodal (-19.7%), coal (-59.9%), motor vehicles & parts (-92.7%), metals & products (-49.7%) and chemicals (-27.0%).

In the West, BN’s total volumes were down 20.9%, with the largest decreases coming from coal (-43.2%), intermodal (-11.1%), motor vehicles & parts (-83.4%) and petroleum (-37.1%). UP’s total volumes were down 24.6%, with the largest decreases coming from intermodal (-24.5%), motor vehicles & parts (-91.0%), coal (-29.8%) and chemicals (-19.5%). The largest increase came from grain (+18.2%).

In Canada, CN’s total volumes were down 16.4% with the largest decreases coming from motor vehicles & parts (-92.6%), petroleum (-38.8%), metallic ores (-22.5%), stone sand & gravel (-65.1%), intermodal (-3.4%) and coal (-27.7%). The largest increase was farm products (+63.6%). RTMs were down 14.9%. CP’s total volumes were down 9.3%, with the largest decreases coming from motor vehicles & parts (-87.7%), petroleum (-46.5%), coal (-27.9%) and stone sand & gravel (-71.8%). RTMs were down 10.1%.

KCS’s total volumes were down 28.7%, with the largest decreases coming from intermodal (-30.9%) and motor vehicles & parts (-97.5%).

During the first quarter of this year, new railcar orders decreased 2,300 units or -27% to 6,200 units from 8,500 during the fourth quarter of 2019. Backlog fell 10% to 46,300. We expect order trends to continue given current headwinds related to weak rail volumes, elevated railcar storage levels, PSR implementation and a distressed energy sector. FTR Intel recently lowered its 2020 delivery forecast to 20.6K units (from 38.2K units) and lowered its 2021 delivery forecast to 22.3K units (from 35.8K units). This forecast now assumes a 64% year-over-year decline in 2020 and an 8% year-over-year increase in 2021.

North American Rig Count

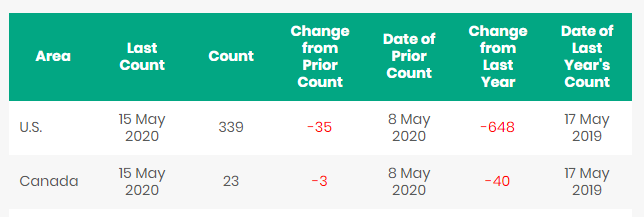

North American rig count continues to deteriorate and is down 38 rigs week over week with the U.S. losing 35 rigs and Canada losing 3 rigs week over week. Year over year we are down 688 rigs collectively. Canada now only has 23 rigs nationwide operating and the U.S. has 339.North American Rig Count Summary

While hedging for oil producers is common practice and has helped them with the recent downturn of oil consumption due to COVID-19 other sectors that use hedging as a tool have taken a blow such as airlines are taking a double whammy as they reel from the huge drop-off in business caused by the coronavirus, some face a second hit from this year’s historic plunge in oil prices.

Some international airlines have hedges locked in for years of fuel costs, a method aimed at smoothing out turbulence in the energy markets and providing guidance on one of the industry’s biggest expenses. Since they are not consuming the fuel they anticipated they are left with a naked long position and their hedge has worked against adding to the further bleeding of cash at least in the short term.

Hurricane season this year came a little early this year with tropical storm Arthur being the first storm of the 2020 hurricane season hovering off the east coast of Florida and heading north. Hurricane season does not officially start until June 1.

Railcar Markets

PFL is offering: Various tank cars for lease with potential dirty to dirty service including gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: Older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. 15-20 5200 Cuft hoppers for grain service, Plate C boxcars for purchase, CO2 Cars for lease.

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|