“Leadership is not about a title or a designation. It’s about impact, influence and inspiration. Impact involves getting results, influence is about spreading the passion you have for your work, and you have to inspire team-mates and customers.”

– Robin S. Sharma

Jobs Update

Weekly Jobless Claims down week over week

Fewer Americans filed new claims for unemployment benefits last week, as companies held on to their workers amid the growing labor shortage that helped to curb job growth in April.

Initial claims for state unemployment benefits totaled a seasonally adjusted 473,000 for the week ended May 8, compared to 507,000 in the prior week, the Labor Department said on Thursday of last week. Economists polled had forecast 490,000 applications for the latest week.

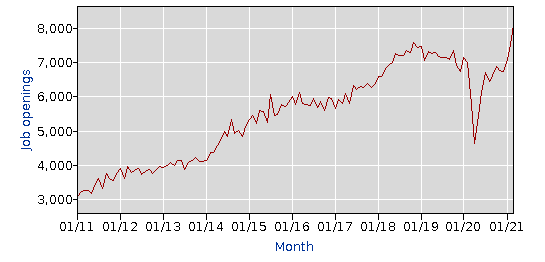

Well folks, job openings are at a record 8.1 million and nearly 10 million people are officially unemployed, companies are scrambling for labor. Layoffs are at all-time lows. (See below)

Job Openings and Labor Turnover Survey (in Millions)

We think it is about time the umbilical cord is cut and people start to get back to work and there should be no need to pay people to stay at home anymore – let’s quit spending, start working to our fullest extent and let’s roll America.

Stocks closed strong on Friday, but down week over week

The Dow closed higher on Friday of last week, up +360.68 (+1.06%) points closing out the week at 34,382.13 down -395.63 points week over week. The S&P 500 closed higher on Friday of last week, up +61.35 points (+1.49%) and closing out the week at 4,173.85, down -58.75 points week over week. The Nasdaq closed higher on Friday of last week, up +304.99 points (+2.32%) closing out the week at 13,429.98 down -322.26 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 126 points.

Oil Prices Closed Strong on Friday demand in India still a concern

Oil prices rose on Friday of last week, reversing some of the last Thursday’s sharp losses as the stock market strengthened and the U.S. dollar got weaker against a basket of currencies. Gains were capped by the coronavirus situation in major oil consumer India. WTI crude oil rose +$1.55 a barrel (+2.43%) to settle at $65.27 a barrel on Friday of last week, up +$1.69 a barrel week over week. Brent crude oil also closed higher on Friday gaining +$1.66 a barrel (+2.28%), closing at $68.71 a barrel up +$1.95 a barrel week over week.

U.S. commercial crude oil inventories decreased by 400,000 barrels week over week. At 484.7 million barrels, U.S. crude oil inventories are 2% below the five year average for this time of year.

Total motor gasoline inventories increased by 400,000 barrels week over week and are 1% below the five-year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 1.7 million barrels week over week and are 3% below the five-year average for this time of year.

Propane/propylene inventories increased by 2.5 million barrels week over week and are 17% below the five-year average for this time of year.

Total commercial petroleum inventories increased by 3.9 million barrels last week.

U.S. crude oil imports averaged 5.5 million barrels per day last week, up 37,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 5.7 million barrels per day, up 7.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 936,000 barrels per day, and distillate fuel imports averaged 208,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending May 7, 2021 down 223,000 barrels week over week. Refineries operated at 86.1% of their operable capacity last week. Gasoline production averaged 9.6 million barrels per day. Distillate averaged 4.7 million barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $65.38, up 1 cent per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 23.2% year over year in week 18 (U.S. +26.9%, Canada +12.0%, Mexico +23.8%) resulting in quarter to date volumes that are up 24.9% year over year and year to date volumes that are up 10.1% year over year (U.S. +11.3%, Canada +7.5%, Mexico +5.2%). 10 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+22.6%), motor vehicles & parts (+576.4%), coal (+29.8%) and metallic ores & metals (+45.1%).

In the East, CSX’s total volumes were up 33.6%, with the largest increases coming from intermodal (+34.4%), motor vehicles & parts (+1,676.8%) and coal (+42.4%). NS’s total volumes were up 32.3%, with the largest increases coming from intermodal (+26.1%), coal (+61.7%), motor vehicles & parts (+832.8%) and metals & products (+82.9%).

In the West, BN’s total volumes were up 28.9%, with the largest increases coming from intermodal (+26.4%), coal (+40.3%), motor vehicles & parts (+333.2%), metallic ores (1,637.1%), grain (+23.0%) and stone sand & gravel (+67.6%). UP’s total volumes were up 27.5%, with the largest increases coming from intermodal (+32.9%), motor vehicles & parts (+690.5%) and chemicals (+25.0%).

In Canada, CN’s total volumes were up 17.7%, with the largest increases coming from intermodal (+16.5%), motor vehicles & parts (+657.0%), coal (+57.2%) and metallic ores (+20.9%). RTMs were up 15.3%. CP’s total volumes were up 8.9%, with the largest increases coming from intermodal (+5.2%) and motor vehicles & parts (+371.5%). RTMs were up 4.9%.

KCS’s total volumes were up 42.2%, with the largest increases coming from intermodal (+46.4%), petroleum (+99.5%), motor vehicles & parts (+2,489.0%) and coal (+76.6%).

Source: Stephens

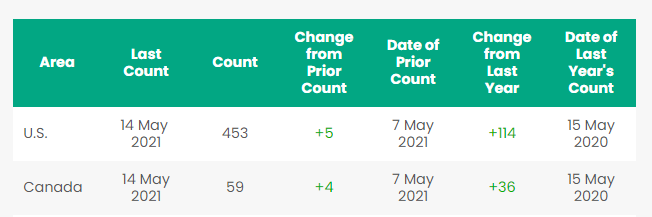

Rig Count

North America rig count is up by 9 rig’s week over week. The U.S. was up 5 rigs week over week and up by 114 rigs year over year. The U.S. currently has 453 active rigs (oil rigs 352, gas rigs 100 and miscellaneous rigs at 1). Canada’s rig count was up by 4 rigs week over week, and up by 36 rigs year over year and Canada’s overall rig count is 59 active rigs. Year over year we are up 150 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

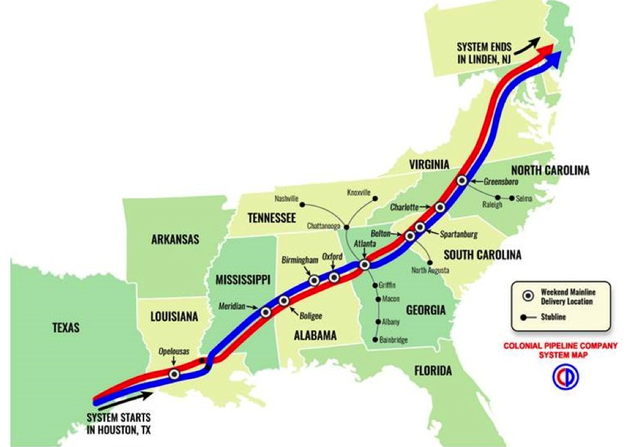

Colonial Pipeline

After paying $5Mil in ransom (which is needless to say worrisome) get ready for more attacks to our infrastructure. Colonial Pipeline said on Saturday that all of its systems are back to operating normally, including the pipeline it shut down a week ago amid a ransomware attack. The pipeline is now servicing all its markets the company tweeted. Colonial carries 45 percent of the fuel supplies for the eastern United States.

Enbridge Line 5

Enbridge Line 5 – May 12 came and went – that was the day the Governor of Michigan had said that Enbridge must shut down its pipeline. Well, Enbridge continued to ignore the Governor! Michigan’s Governor Gretchen Whitmer told Enbridge that ignoring the shutdown order constitutes trespassing and unjust enrichment. Last Tuesday the Government of Canada intervened on behalf of Enbridge – Canada filed an amicus curiae brief in the U.S. District Court for the Western District of Michigan,” said Natural Resources Minister Seamus O’Regan. “This brief supports the continued mediation between Enbridge Inc. and the State of Michigan, underlines that Line 5 is a critical energy and economic link between Canada and the United States, and conveys Canada’s belief that the U.S. federal court is the proper jurisdiction to hear the case between Michigan and Enbridge.” Line 5 is a vital piece of infrastructure for Canada and the United States and has safely operated at the Straits of Mackinac for 68 years, he added. “It remains the safest, most efficient way to transport fuel to refineries and markets and is a reliable source of energy for Michigan, Ohio, Pennsylvania, Ontario and Quebec,” the minister noted. “This pipeline is as important to Canada as it is to the U.S. It heats both Canadian and American homes. It supports both Canadian and American jobs.” He added: “Under the federal court’s order, Enbridge and Michigan have entered into a mediation process and are meeting regularly. We remain confident this will lead to a solution. In filing this amicus brief, we worked with the governments of Alberta, Saskatchewan, Ontario and Quebec. We are continuing to work together to defend Line 5, leaving no stone unturned in defending Canada’s energy security and the workers who built this country.”

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,404 from 23,207 a drop of 203 rail cars week over week. Canadian volumes were up week over week. CP shipments rose by 2.4% and CN were up by 4.7%. U.S. rail road operators were mixed, BN had the largest percentage decrease, down by 11.9% and the NS had the largest percentage increase up by 18.1%.

New Railcar Orders

New railcar orders improved to 6,200 units in the first quarter of 2021 (vs. 3,400 in the fourth quarter of 2020) the backlog did increase 1% sequentially to 34,800 units. Overall, orders are improving sequentially but remain well below replacement levels. Additionally, rising commodity prices (particularly steel for rail cars) are driving railcar prices higher and as a result lessees and leasing companies are hesitant to place new orders. Inquiry levels are on the rise for new and existing cars due to rail volume growth, higher railcar utilization rates due to the increasing of scrapping of unwanted cars due to the high scrap values owners are getting. Expect rail car storage levels to continue to decrease and lease rates for existing cars to gradually move higher and at some point production of new cars to accelerate.

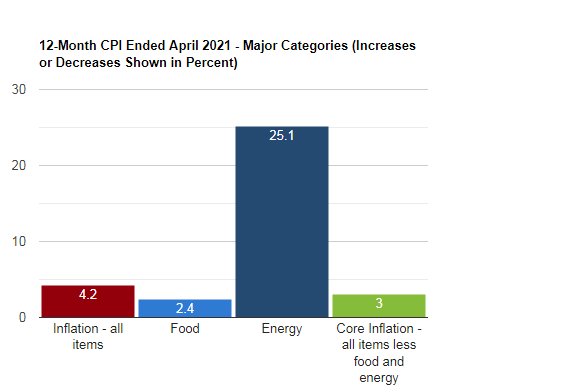

Inflation

Folks, we are watching inflation gone wild and you have not seen anything yet as prices for everything continue to trend higher right before our eyes, lumber is up 250% alone, corn is up as is all grains, gasoline you name it and we have not seen it hit the books yet- look at the last twelve months:

The price of gasoline soared 49.6% in the 12 months ended April compared to the 22.5% increase reported in March, according to the most recent inflation data published May 12, 2021 by the U.S. Labor Department’s Bureau of Labor Statistics (BLS).

Gasoline is an important category reported within the BLS’s monthly report on consumer inflation, the Consumer Price Index (CPI). “Gasoline (all types)” is listed as a subcategory under the overall “Energy” index for commodities. Shipping rates are expected to skyrocket in Q3 and Q4.

Bottom line the government needs to stop stimulus and people need to go out and get the jobs that are out there and forget about raising taxes.

CN & CP Battle

Update on the CN& CP battle for the KCS – Well folks it looks as though CN is winning. The KCS board has found that the CN offer is superior to CP’s and CP has 5 business days from Thursday of last week to make a counteroffer or to convince KCS’s board that CN’s offer is not superior. CP said they will respond in the allotted time but is not going to enter a bidding war. CN is happy and feels their proposal will win as their offer does not require shareholder approval while the CP’s does. CN’s proposal, which KCS must accept by 5 p.m. ET on Friday, May 21, will be subject to approval by KCS shareholders. In addition The Surface Transportation Board (STB) still has to approve the merger.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 90-110 Pressure Cars 340s in Alberta on the CN 2-4 years Butane/Propane

- 10-15 Stainless 23.5 cars coiled and insulated in the East 1-2 years

- 5 Gondolas for Sale for aggregate in Texas any line

- 15-25 3915 CF PD Hoppers in Chicago any class one 3 year lease – negotiable

- 50-100 117Rs 30.3 gallon for refined products UP and BN Texas negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- 200 4300 Hoppers in Canada – Lined and dirty Negotiable

- 80 6350 Grain Hoppers in Nebraska on the BN Clean Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s – negotiable

- 37 BRAND NEW 5161 Sugar Hoppers in Arkansas UP – negotiable

- Several hundred small Hoppers Various Locations and Product – negotiable

- 205 117Js 29K BRAND NEW in Colo and Iowa off the UP, BNSF – price negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 340W Pressure Cars Montana or Kansas LPG last in – negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49 for sale – negotiable

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for sale 3000-5800 CF 263 and 286 multiple locations negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|