“Identify your problems, but give your power and energy to solutions.”

– Tony Robbin

Jobs Update

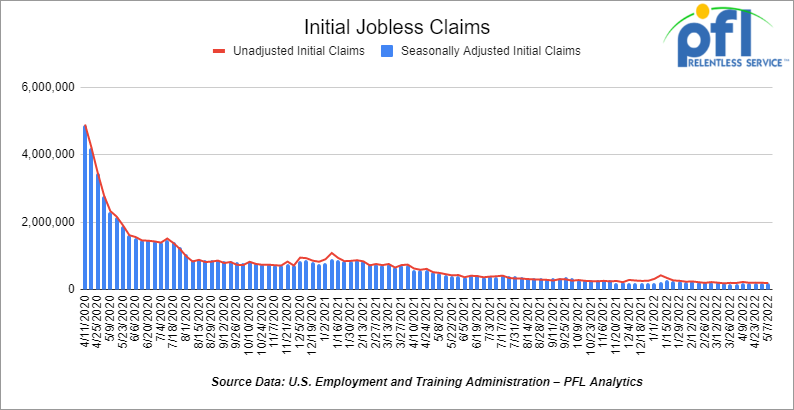

- Initial jobless claims for the week ending May 7th, 2022 came in at 203,000, up 1,000 people week-over-week.

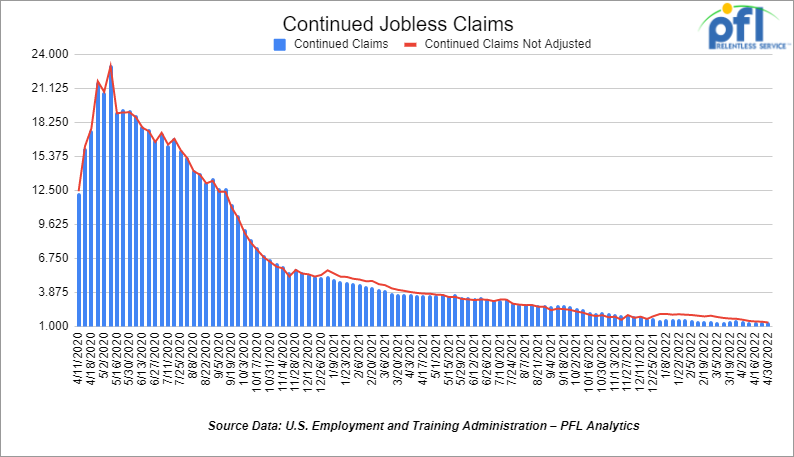

- Continuing claims came in at 1.343 million people, versus the adjusted number of 1.387 million people from the week prior, down 44,000 people week-over-week.

Stocks closed higher on Friday of last week, but down hard week-over-week

Stocks bounced higher on Friday to close a chaotic week in the financial markets, helped in the end by Federal Reserve Chairman Jerome Powell’s reassurance that rate hikes on the order of 75 basis points were off the table for now. Volatility on Friday was added by Elon Musk’s announcement that his planned acquisition of Twitter was “temporarily on hold” because of concerns about fake accounts, which initially sent the stock reeling down 9.7%. Maybe Musk wants to buy cheaper in the wake of the markets selling off – time will tell. Friday’s gains were not enough to erase sharp losses for the full week, as investors worried about the Fed’s ability to turn back raging inflation without knocking the U.S. economy into a recession – we may be in one already, folks.

The DOW closed higher on Friday of last week, up +466.36 points (+1.47%), closing out the week at 32,196.66 points, down -702.71 points week-over-week. The S&P 500 closed higher on Friday of last week, up 93.81 points, (+2.39%) and closed out the week at 4,023.89 down -99.45 points week-over-week. The Nasdaq closed higher on Friday of last week, up +434.04 points (+3.82%), and closed out the week at 11,805, down -339.66 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 32,090 this morning down -30 points.

Oil closed higher on Friday of last week and higher week over week

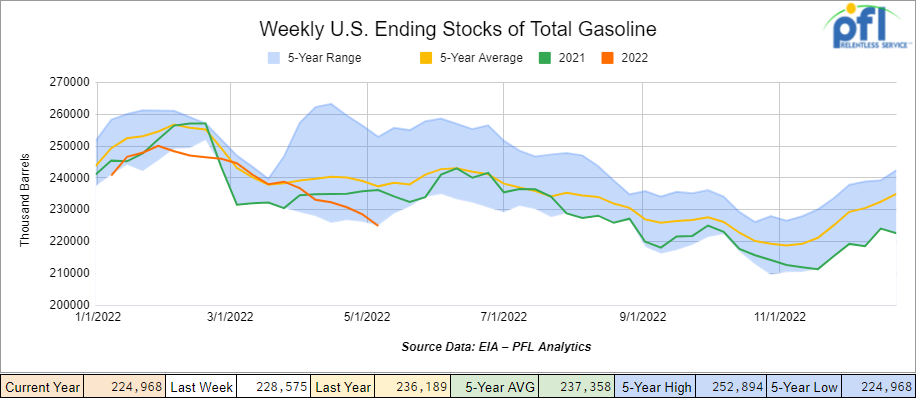

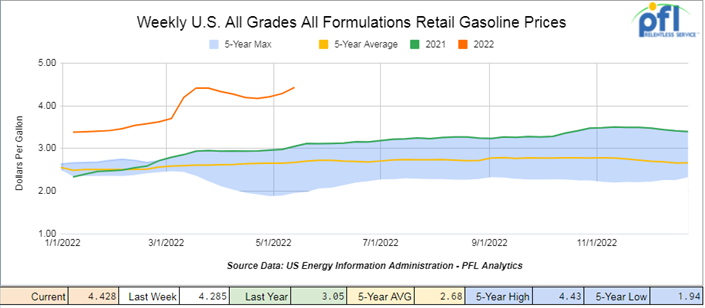

Oil prices rose on Friday of last week as gasoline prices jumped to yet another record high and China seemed ready to ease some pandemic restrictions. Gasoline inventories fell for their sixth straight week and futures shot up to all-time highs, boosting the crack spread for refiners. There has not been an increase in U.S. gasoline storage since March and driving season is just around the corner.

Friday’s close was the highest for WTI in six weeks and is the third price rise week over week. On the demand side, China is pledging to help support its economy, open up shops and ease travel restrictions in Shanghai this month. However the USD still remains near 20 year highs and will put pressure on oil prices going forward. WTI traded up $4.36 or 4.11% to close at $110.49. Brent traded up $3.76 or 3.5% to close at $111.21.

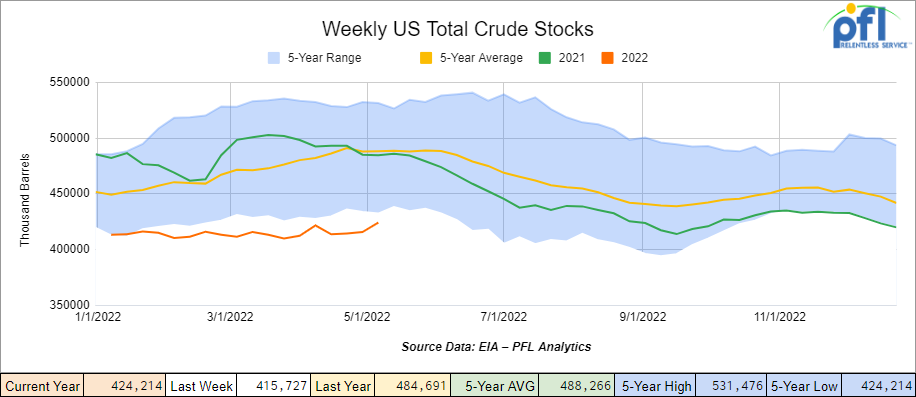

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 8.5 million barrels week over week. At 424.2 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

Total motor gasoline inventories decreased by 3.6 million barrels week over week and are 5% below the five-year average for this time of year.

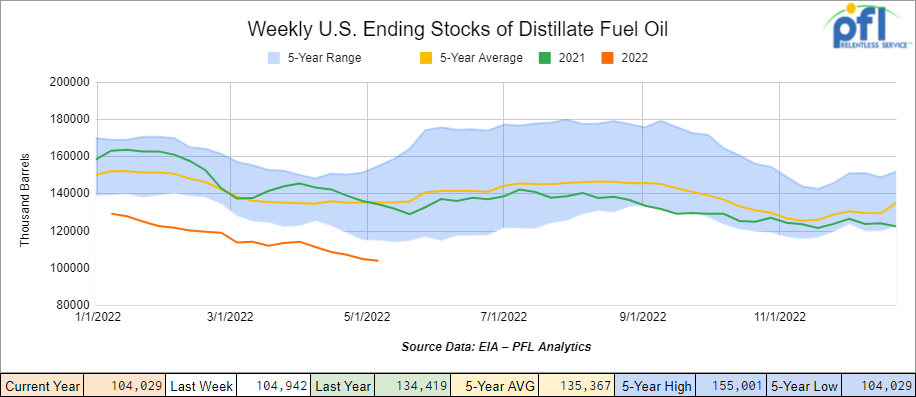

Distillate fuel inventories decreased by 900,000 barrels week over week and are 23% below the five-year average for this time of year.

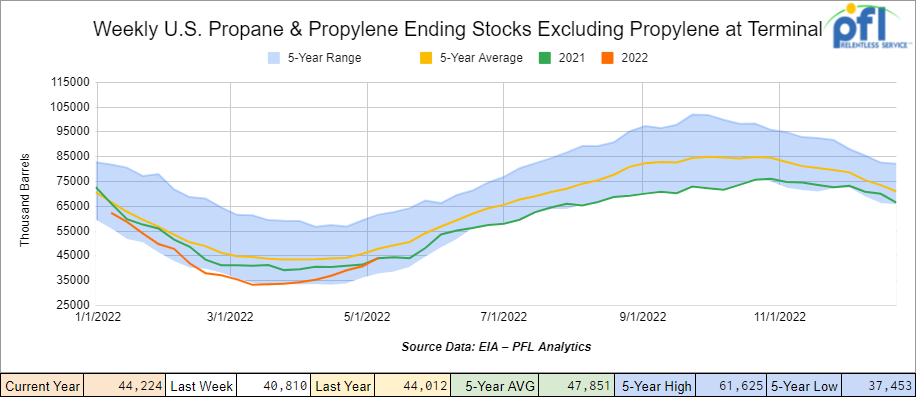

Propane/propylene inventories increased by 3.4 million barrels week over week and are 8% below the five-year average for this time of year.

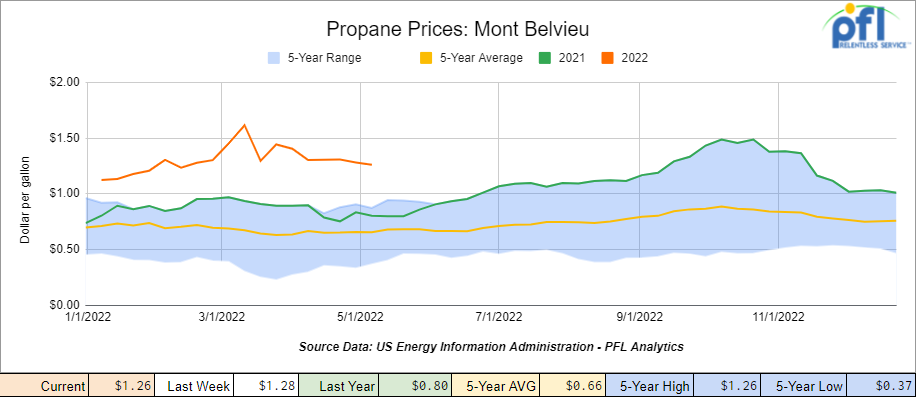

Propane prices were down three cents week over week closing out the week at $1.28 per gallon but were up 45 cents year over year. The five-year average for propane prices is 66 cents per gallon.

Overall, total commercial petroleum inventories increased by 9.9 million barrels for the week ending May 6th, 2022.

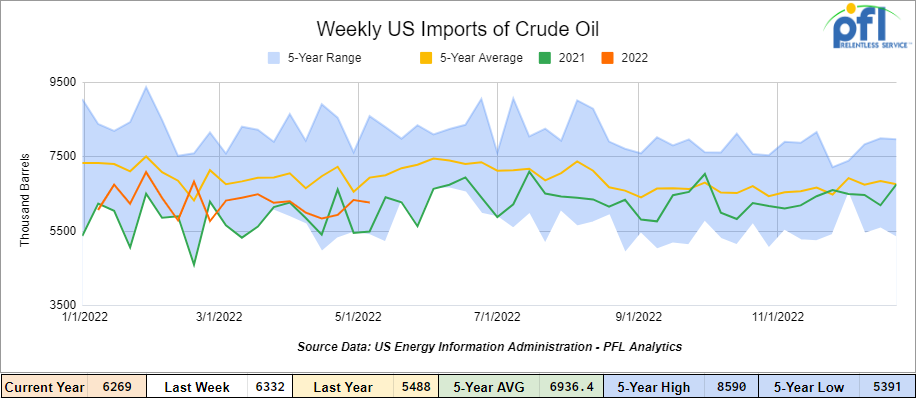

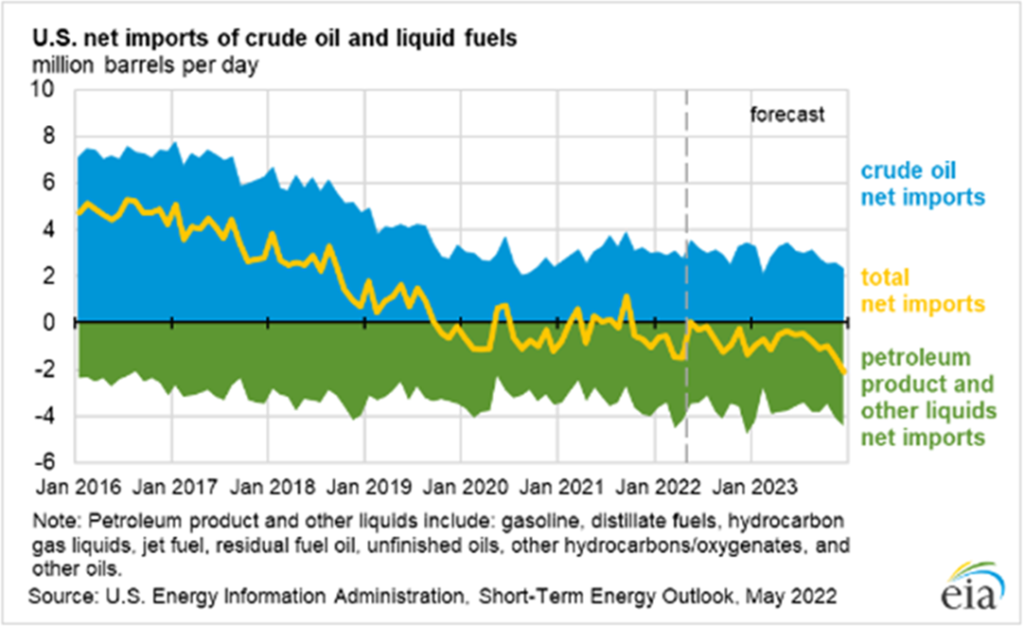

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending May 6, 2022, down by 62,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.1 million barrels per day, 6.2% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 695,000 barrels per day, and distillate fuel imports averaged 122,000 barrels per day for the week ending May 6, 2022.

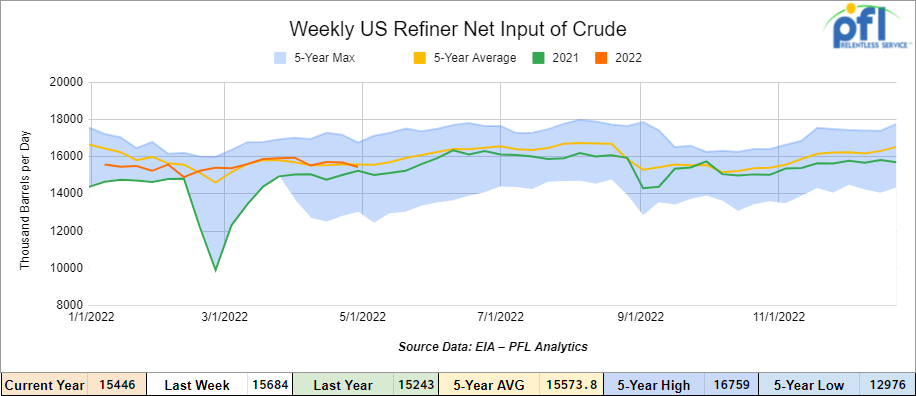

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending May 6, 2022 which was 230,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $109.40, down -$1.09 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 1.9% year over year in week 18 (U.S. -3.5%, Canada +0.6%, Mexico +12.6%) resulting in quarter to date volumes that are down 4.0% year over year and year to date volumes that are down 3.9% year over year (U.S. -3.4%, Canada -6.9%, Mexico +2.7%). 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-3.1%) and grain (-18.7%). The largest increase came from motor vehicles and parts (+27.4%).

In the East, CSX’s total volumes were up 0.2%, with the largest increase coming from motor vehicles & parts (+12.7%). NS’s total volumes were down 3.5%, with the largest decreases coming from intermodal (-4.2%) and coal (-12.5%). The largest increase came from motor vehicles & parts (+29.2%).

In the West, BN’s total volumes were down 2.2%, with the largest decreases coming from intermodal (-3.7%) and chemicals (-10.8%). The largest increase came from motor vehicles & parts (+33.3%). UP’s total volumes were down 4.2%, with the largest decreases coming from intermodal (-10.7%) and grain (-18.5%). The largest increases came from stone, sand & gravel (+20.0%), and coal (+8.5%).

In Canada, CN’s total volumes were up 1.9%, with the largest increases coming from coal (+51.5%) and motor vehicles & parts (+41.7%). The largest decreases came from metallic ores (-10.8%) and grain (-22.2%). RTMs were up 2.9%. CP’s total volumes were up 0.6%, with the largest increases coming from intermodal (+7.2%) and motor vehicles & parts (+73.0%). The largest decreases came from grain (-33.6%) and farm products (-59.7%). Revenue per ton-miles was down 2.4%.

KCS’s total volumes were up 0.1%, with the largest increase coming from intermodal (+8.1%). The largest decrease came from petroleum (-39.4%) and coal (-34.4%).

Source: Stephens

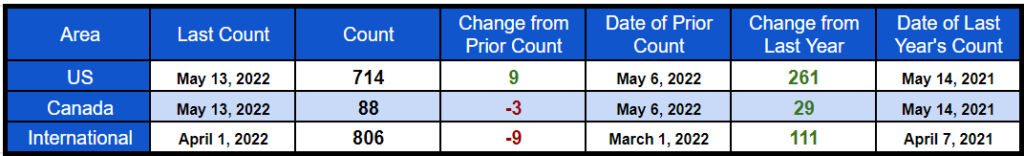

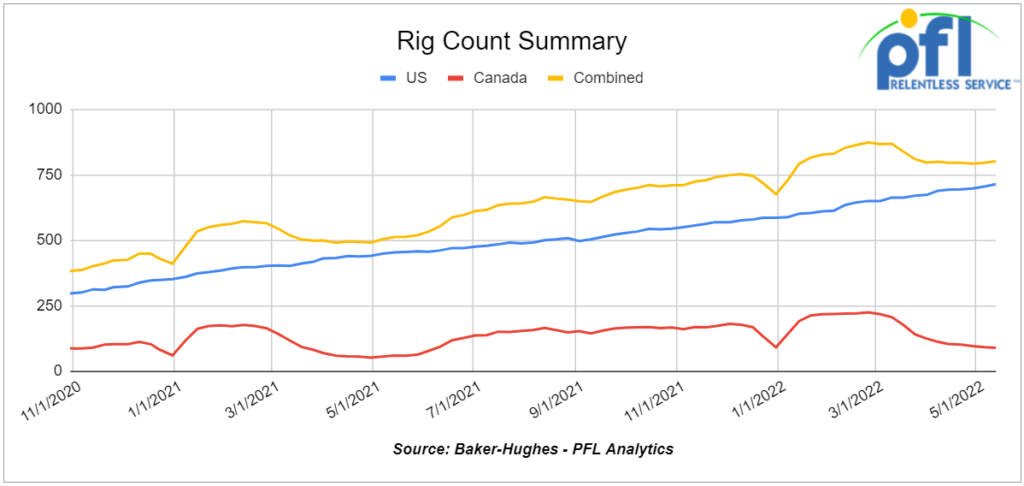

Rig Count

North American rig count was up 6 rigs week over week. U.S. rig count was up by 9 rigs week-over-week and up by 261 rigs year over year. The U.S. currently has 714 active rigs. Canada’s rig count was down by -3 rigs week-over-week and up by 29 rigs year-over-year. Canada’s overall rig count is 88 active rigs. Overall, year over year, we are up 290 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,244 from 23,468, which is a loss of -224 rail cars week-over-week. Canadian volumes were mixed: CN’s shipments were up by 2.2%, while CP volumes were down by 9.9%. U.S. volumes were also mixed with the CSX having the largest percentage increase (up by 5.6%). While the NS has the largest percentage decrease (down by 7.4%).

New Anti-gouging bill to be proposed by Dems in Congress this Week

Here we go again. Let’s blame the companies and the rest of the world for the high price of gasoline and other products. The more they talk about it, the more they think you believe it. The U.S House of Representatives is going to vote on a price-gouging bill this week that would make it unlawful for “companies to charge unconscionably excessive” prices for gasoline and other refined products during energy emergencies. Democrats say the price bill is needed to protect consumers who have little choice but to pay today’s record-high fuel prices at a time when oil companies are making billions of dollars in quarterly profits. When you read into the proposed bill it resembles something we might see in a Mexican bill and may be the first step in price control which is not helpful to any free market. In our mind, if you want lower prices, cut the red tape in Washington, reinstate Keystone and let the free market work instead of the constant abuse and punishment of those that are trying to help.

Biden cancels massive oil and gas lease sale

The Biden Administration canceled one of the most high-profile oil and gas lease sales pending before the Department of the Interior on Wednesday of last week, as Americans face record-high prices at the pump. The Department of Interior halted the potential to drill for oil in over 1 million acres in Alaska’s Cook Inlet, along with two lease sales in the Gulf of Mexico. The move comes as Biden has taken a few actions to combat high gas prices, despite his administration’s generally hostile approach to the oil industry. “Due to lack of industry interest in leasing in the area, the Department will not move forward with the proposed Cook Inlet OCS oil and gas lease sale,” they said. You can’t make this stuff up. See retail prices below:

Butane Can Lower Gasoline Prices. Leaders from Appalachian natural gas producers told U.S. Sen. Joe Manchin (D-WV) in a letter last week that butane could be an effective means of lowering gasoline prices.

Representatives from Marcellus Shale Coalition in Pennsylvania, Kentucky Gas and Oil Association, and the Gas and Oil Association of West Virginia wrote the Senator to express their view that while President Joe Biden’s administration permitted increased ethanol blends to reduce pump prices, they believe butane blends could also lower gas prices.

“Butane has always been relied upon as a historically cost-effective way to blend gasoline during periods of supply disruptions,” the authors Dave Callahan, Ryan Watts, and Charlie Burd write. “Most recently, the Biden Administration issued a waiver in the spring of 2021 when the Colonial Pipeline was offline, allowing gasoline blenders to utilize butane to increase supply and lower costs for the consumer.”

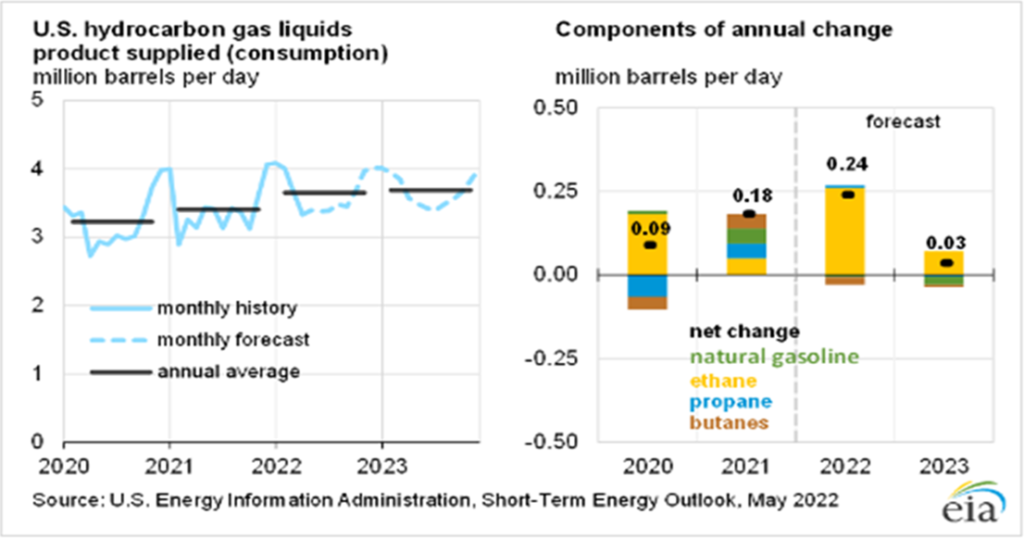

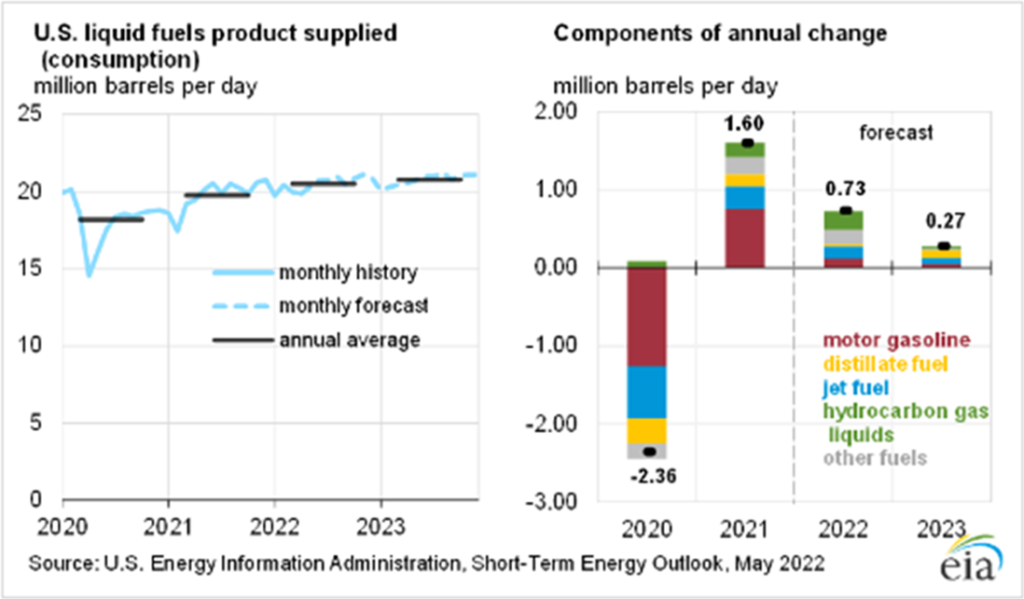

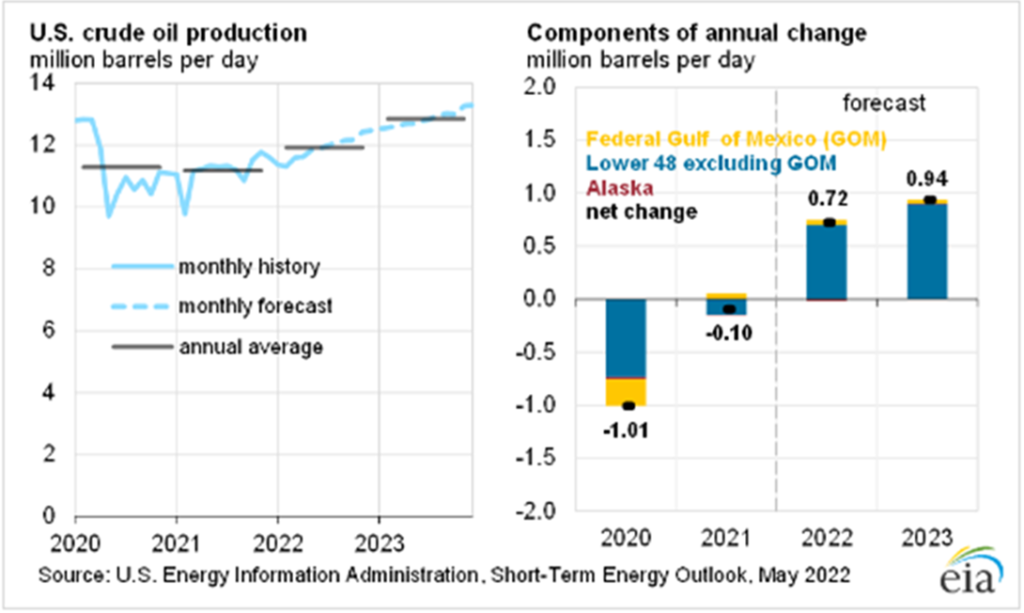

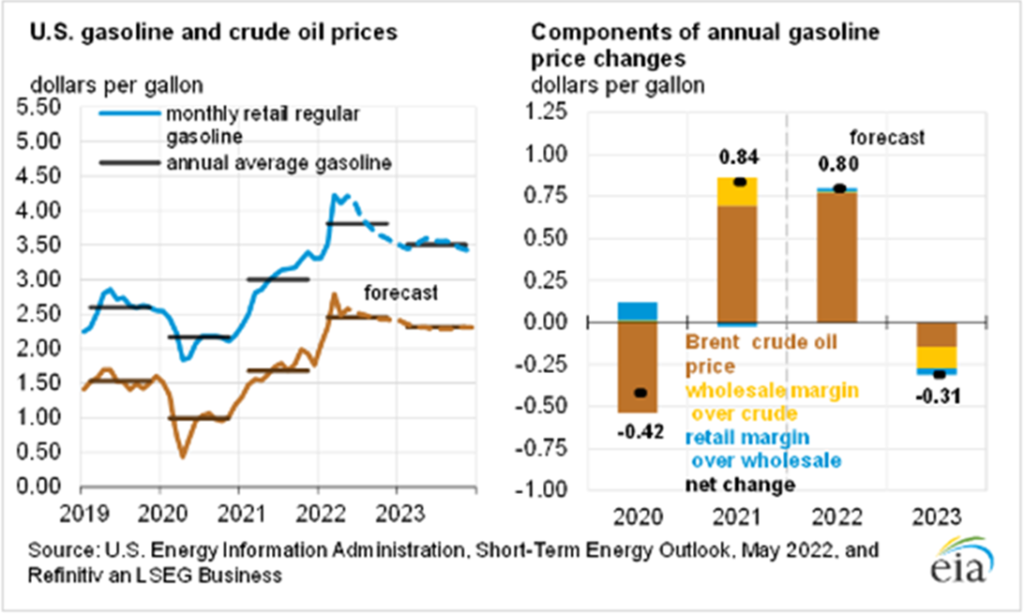

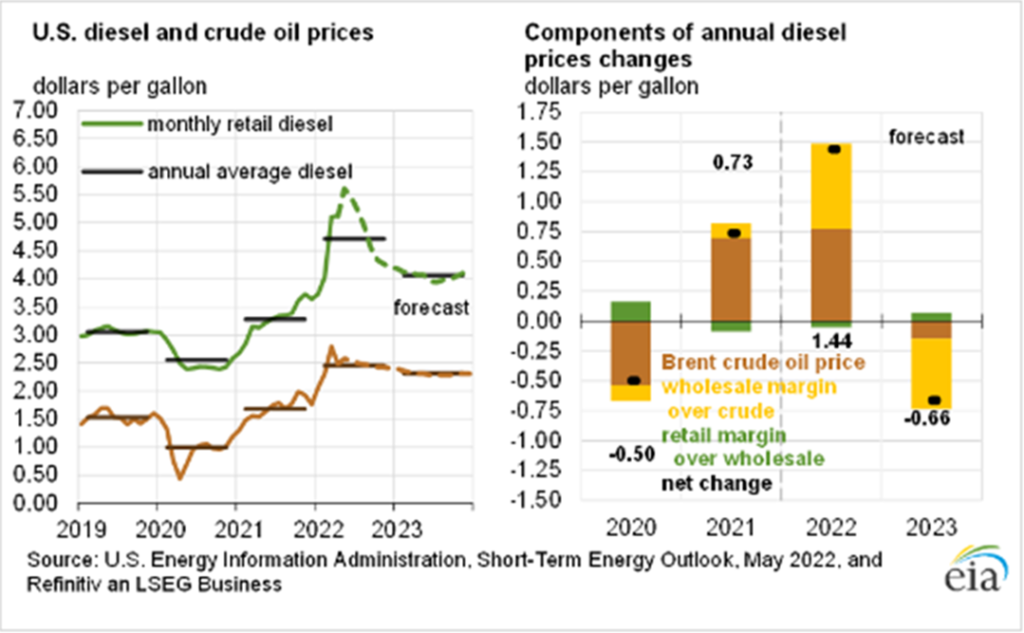

EIA Revises Short Term Energy Outlook

On May 10th, the EIA announced that U.S. crude output will grow slower than expected this year and next year. U.S. crude oil production is forecasted to average 11.9 million barrels per day in 2022, up 700,000 million barrels per day from 2021. The EIA forecasts that production will increase to more than 12.8 million barrels per day in 2023, surpassing the previous annual average record of 12.3 million b/d set in 2019. (See below interesting charts)

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 10-100 20K lined tanks most anywhere for Urea Ammonium Nitrate 5 year lease negotiable

- Clean 20-25.5 tanks for palm oil CN or BNSF midwest for 2-4 yaars negotiable

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- Hoppers for minerals, soda ash, potash in various locations for up to 5 years

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

- 100 3200 Covered Hoppers for sale price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|