“Though nobody can go back and make a new beginning… Anyone can start over and make a new ending.”

– Chico Xavier

Jobs Update

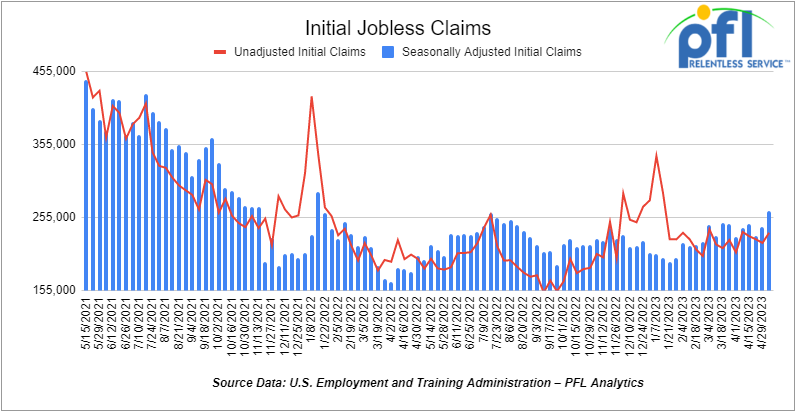

- Initial jobless claims for the week ending May 6th, 2023 came in at 264,000, up +22,000 people week-over-week.

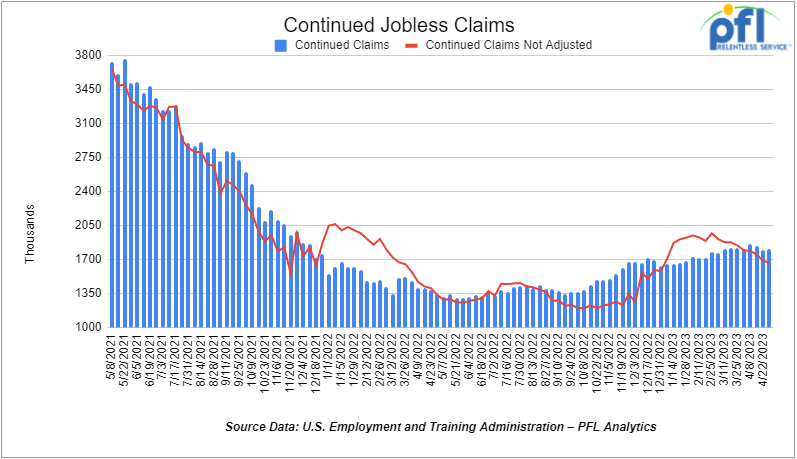

- Continuing jobless claims came in at 1.813 million people, versus the adjusted number of 1.801 million people from the week prior, up 12,000 people week over week.

Stocks closed lower on Friday of last week, and mostly higher week over week

The DOW closed lower on Friday of last week, down -8.89 points (-0.03%), closing out the week at 33,300.62, up +172.88 points week over week. The S&P 500 closed lower on Friday of last week, down -6.54 points (-0.16%), and closed out the week at 4,124.08, down -12.17 points week over week. The NASDAQ closed lower on Friday of last week, down -43.76 points (-0.36%), and closed the week at 12,284.74, up +49.33 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 33,463 this morning up 108 points.

WTI closed lower on Friday of last week and lower week over week

WTI traded down -$0.83 per barrel (-1.2%) to close at $70.04 per barrel on Friday of last week, down -$1.30 per barrel week over week. Brent traded down -US$0.71 per barrel (-1.10%) on Friday of last week, to close at US$74.17 per barrel, down -US$1.13 per barrel week over week.

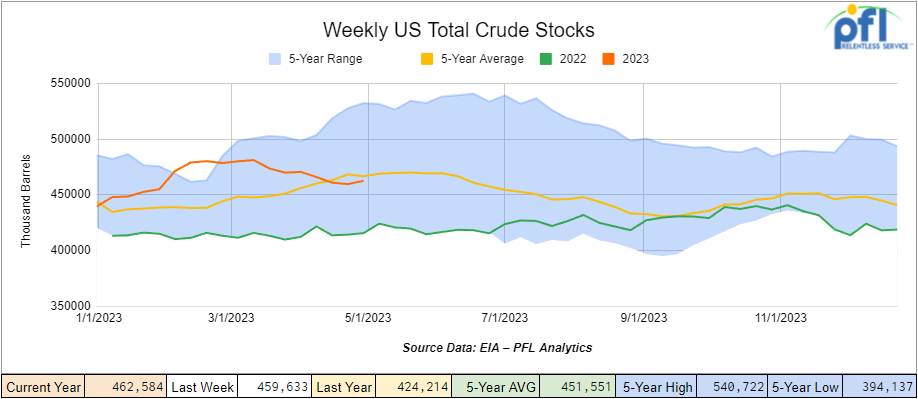

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.0 million barrels week over week. At 462.6 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

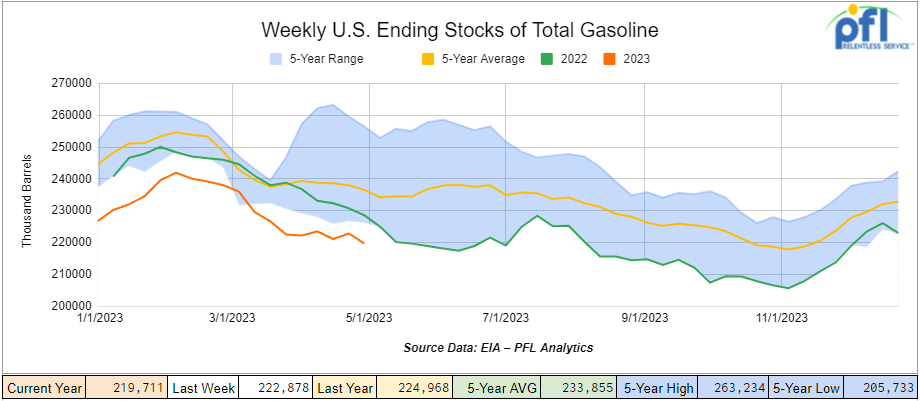

Total motor gasoline inventories decreased by 3.2 million barrels week over week and are 7% below the five-year average for this time of year.

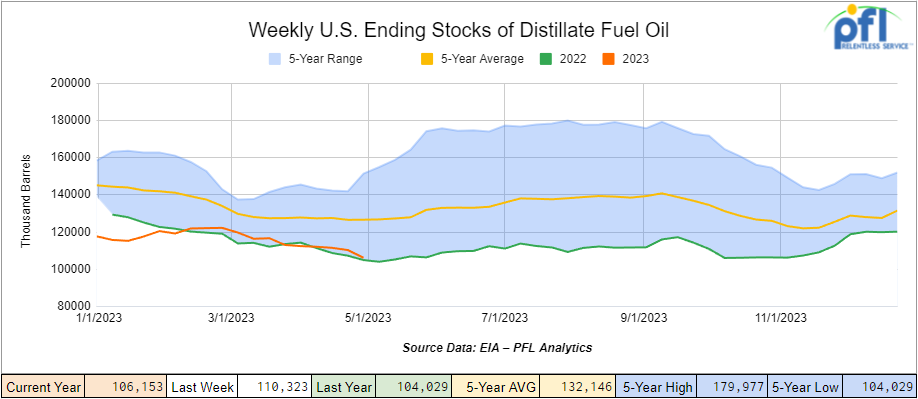

Distillate fuel inventories decreased by 4.2 million barrels week over week and are 16% below the five -ear average for this time of year.

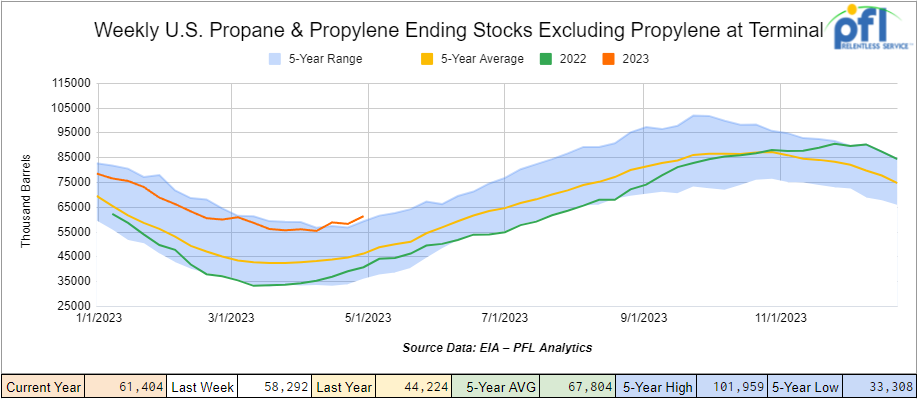

Propane/propylene inventories increased by 3.1 million barrels week over week and are 29% above the five-year average for this time of year.

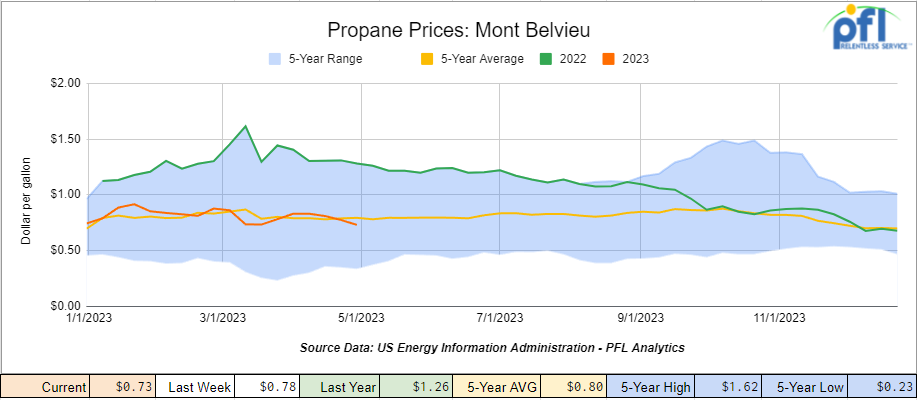

Propane prices closed at 73 cents per gallon, down 5 cents per gallon week over week and down 53 cents per gallon year over year, as inventories increase.

Overall, total commercial petroleum inventories increased by 500,000 barrels during the week ending May 5th, 2023.

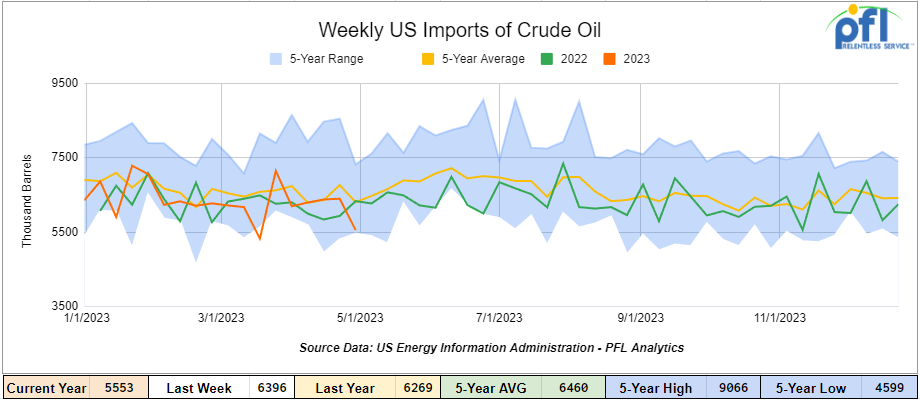

U.S. crude oil imports averaged 5.6 million barrels per day during the week ending May 5th, 2023, a decrease of -843,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 1.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 853,000 barrels per day, and distillate fuel imports averaged 111,000 barrels per day during the week ending May 5th, 2023.

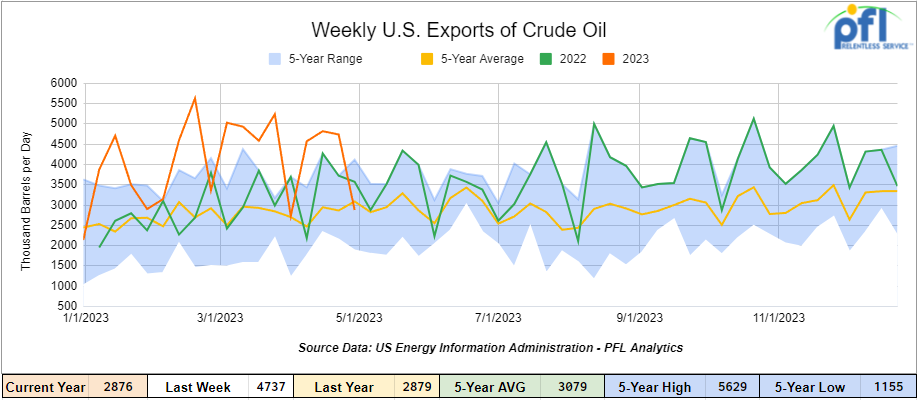

U.S. crude oil exports averaged 2.876 million barrels per day for the week ending May 5th, 2023, a decrease of -1.861 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.251 million barrels per day.

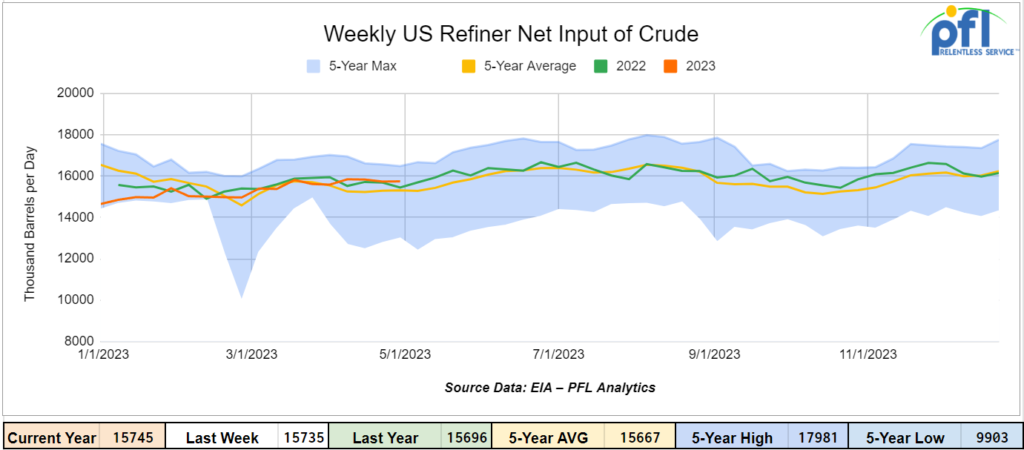

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending May 5, 2023, which was up 10,000 barrels per day week over week.

As of the writing of this report, WTI is poised to open at $70.29 up $0.22 per barrel from Monday’s close.

North American Rail Traffic

Week Ending May 10th, 2023.

Total North American weekly rail volumes were down (-6.55%) in week 18 compared with the same week last year. Total carloads for the week ending on May 10th were 347,868, down (-0.56%) compared with the same week in 2022, while weekly intermodal volume was 303,261, down (-12.58%) compared to the same week in 2022. 8 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Intermodal (-12.58%). The largest increase came from Motor Vehicles and Parts (+9.03%).

In the east, CSX’s total volumes were up (+0.17%), with the largest decrease coming from Intermodal (-7.09%) and the largest increase from Motor Vehicles and Parts (+22.31%). NS’s volumes were down (-6.98%), with the largest decrease coming from Petroleum and Petroleum Products (-19.58%) and the largest increase from Metallic Ores and Minerals (+8.72%).

In the West, BN’s total volumes were down (-13.99%), with the largest decrease coming from Intermodal (-21.56%), and the largest increase coming from Other (+13.96%). UP’s total rail volumes were up (+0.47%) with the largest decrease coming from Other (-21.64%) and the largest increase coming from Grain (+18.76%).

In Canada, CN’s total rail volumes were down (-10.99%) with the largest increase coming from Metallic Ores and Minerals (+14.19%) and the largest decreases coming from Grain (-65.64%). CP’s total rail volumes were down (-6.2%) with the largest decrease coming from Farm Products (-21.25%) and the largest increase coming from Other (+110.53%).

KCS’s total rail volumes were down (-12.29%) with the largest decrease coming from Intermodal (-24.61%) and the largest increase coming from Motor Vehicles and Parts (+38.03%).

Source Data: AAR – PFL Analytics

Rig Count

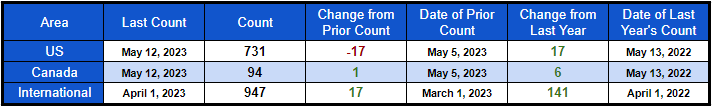

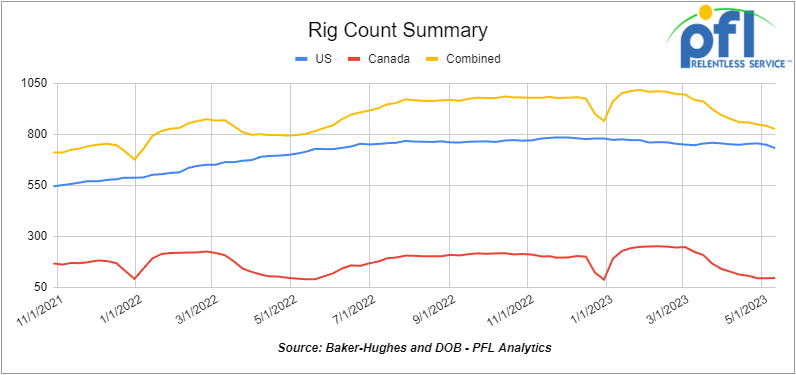

North American rig count was down by -16 rigs week over week. U.S. rig count was down by -17 rigs week over week and up by +17 rigs year-over-year. The U.S. currently has 731 active rigs. Canada’s rig count is up by 1 rig week-over-week and up by 6 rigs year over year. Canada’s overall rig count is 94 active rigs. Overall, year-over-year, we are up +23 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 22,335 from 22,412, which was a loss of -77 rail cars week-over-week. Canadian volumes were lower week over week; CP’s shipments decreased by -13.6% week over week, and CN’s volumes were lower by -0.4% week-over-week. U.S. shipments were mixed. The UP had the largest percentage increase and was up by +13.8% week-over-week. The CSX had the largest percentage decrease and was down by -16.1%.

We are Watching Washington – Rail Safety Bill Passes Senate Committee

The future of a railway safety bill created in response to the Feb. 3 derailment of an NS train in East Palestine, Ohio, is uncertain even though it passed a Senate committee, paving the way for a vote on the Senate floor. The 16-11 vote on Wednesday of last week fell mostly along party lines, with Democrats voting in favor of the bill and most Republicans voting against it. Senate Republicans Eric Schmitt of Missouri and J. D. Vance of Ohio voted in favor of the bill.

The bill is expected to have continued debate in the Senate and the U.S. House of Representatives on the bill’s more contentious items, including regulations that would require at least two people to operate a freight train. The bill, if passed as is, according to Senator Cruz would dramatically increase the costs of energy for consumers and we agree. Turn times that are already problematic would decrease and create havoc on the industry. The bill is 80 pages long and includes increased deployment of wayside defect detectors; expanding the types of chemicals that would trigger specific safety requirements; restricting speeds of trains that are carrying large amounts of flammable liquids and passing through urban areas; notifying states about the types and frequency of trains transporting hazardous materials through the state; prohibiting the railroads from imposing time restrictions on those inspecting trains; and raising fines for violating rail safety regulations from $100,000 to $10 million. It needs 60 votes to get through the Senate.

The Federal Railroad Administration (FRA) and the U.S. Department of Transportation have issued their own safety advisories in response to recent train derailments, and stakeholders are waiting for recommendations from the National Transportation Safety Board after that agency completes its investigation into the NS derailment. Stay tuned to PFL for ongoing details.

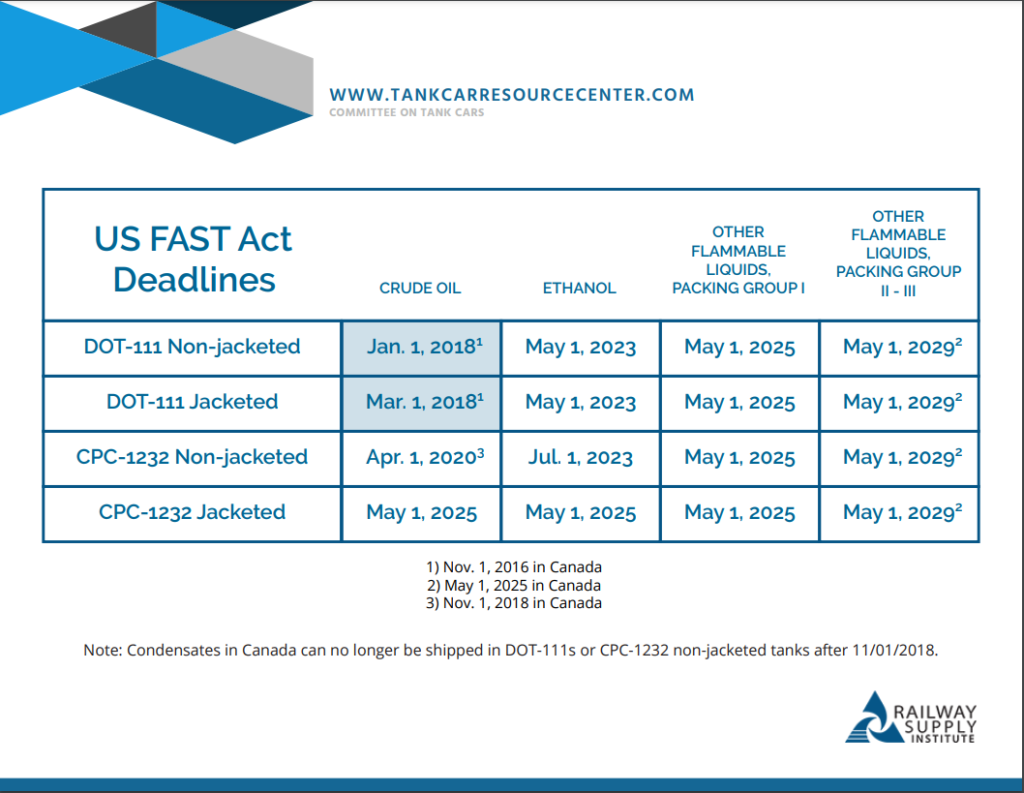

Stranded Cars with Residual Crude and Ethanol CPC 1232’s – DOT 111

Folks, this is becoming a problem for people. If you have cars sitting in storage that cannot be moved to be sold, moved to scrap, or if you are considering a change or service or at least having them ready for a change of service, PFL can help you navigate through this logistical nightmare. If you are a tank car owner and are not ready to make any of these decisions right now, then our advice is to get ready for any one of these scenarios happening because one of them will. Be proactive and not reactive, negotiate with potential buyers/lessees from a position of strength and not from one of weakness. Please take note of the following:

1) If you have a large number of cars in a single location – get the cars cleaned now and at least a basic inspection done on them. PFL Field Services can turn-key this entire process. We are set up to clean at 165 different short lines or facilities. If we are not set up with the facility you are storing your cars on, we will make it happen. It is not going to cost as much as you think. Get those cars ready to be shipped out now. They can’t stay in storage forever.

2) If you have cars scattered all over the country and need to aggregate them to a central location, we need to be smart about where to put those cars. PFL can certainly help. You can ship the cars under a OTMA-3 to a PFL storage location, potentially to PFL storage in St. Louis where we have access to all class 1’s and PFL will clean and provide a basic inspection.PFL’s customers have had extreme success with this location with the class 1 accessibility and reasonable storage costs. We can even offer scrapping if necessary at competitive prices. With St. Louis, you don’t need to rush into making a decision you may regret later.

For those not familiar with the current regulations see the handy little table below – courtesy of Rail Supply Institute.

For more details, call the desk at 239-390-2885 – we are here to help!

We are Watching the EPA

In another round of Washington wisdom, the EPA announced on Thursday of last week new carbon pollution standards for coal and natural gas-fired power plants that it claims will protect public health, reduce harmful pollutants and deliver up to $85 billion in climate and public health benefits over the next two decades.

“By proposing new standards for fossil fuel-fired power plants, EPA is delivering on its mission to reduce harmful pollution that threatens people’s health and wellbeing,” said EPA Administrator Michael S. Regan. “EPA’s proposal relies on proven, readily available technologies to limit carbon pollution and seizes the momentum already underway in the power sector to move toward a cleaner future. Alongside historic investment taking place across America in clean energy manufacturing and deployment, these proposals will help deliver tremendous benefits to the American people—cutting climate pollution and other harmful pollutants, protecting people’s health, and driving American innovation.”

This is all done in the name of climate change – while Washington is determined to starve the U.S. of affordable energy China is surging ahead with coal, rapidly approving and building new power plants despite its own promises to cut back on carbon as the world apparently plunges ever deeper into a climate crisis. In 2022, 2 coal plants were approved and permitted every week by China and India commissioned 10. Looks as though these countries don’t think we are in a climate crisis.

These new rules will force U.S. coal plants to shut down, forcing renewables as the only alternative (some of which don’t exist in commercial form). Think there is going to be a little pushback here.

On a side note, Texas Natural Gas Prices turned negative last week. For the first time in almost three years, next-day natural gas prices at the Waha hub in Texas settled in negative territory closing at -$0.35 per mmBtu, on the back of robust production of associated gas in the Permian basin as well as mild weather and pipeline maintenance. Why are we not burning more natural gas for electricity generation is the question we should be asking each other. – stay tuned to PFL for further details.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 30-50, 33K 340W Pressure Tanks needed off of any class 1 in any location for 6-12 Months. Cars are needed for use in Propane service.

- 60-150, 30K DOT 111 Tanks needed off of TYR, UP in Corpus Christi, TX for 1 year. Cars are needed for use in Diesel service.

- 100, 30K 117J Tanks needed off of CN in Detroit for 1 Year. Cars are needed for use in Refined Fuel service.

- 15, 28.3K 117J Tanks needed off of any class 1 in any location for 3 year. Cars are needed for use in Glycerin & Palm Oil service.

- up to 50, 31.8K 117J, 117R, CPC 1232 Tanks needed off of any class 1 in Texas or Ohio for 1-3 years. Cars are needed for use in Diesel/Gasoline service.

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Cuastic service.

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of any class 1 in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 3-5 Year. Cars are needed for use in magnesium chloride service. SDS onhand

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations. Cars are needed for use in Any service.

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn syrup. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located in Canada. Cars were last used in Crude. Free Move, Dirty to Dirty

- 25, 28.3K, Dot 111 Tanks located off of UP in Texas. Cars were last used in Biodiesel. Free Move, Dirty to Dirty

Sales Offers

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|