“Tough times don’t last. Tough people do.”

Robert H. Schuller

COVID 19 and Markets Update

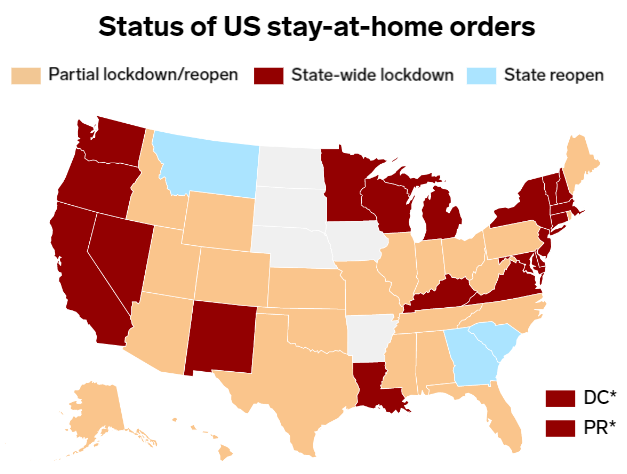

In the United States, we currently have 1,360,000 confirmed COVID 19 cases and 80,574 confirmed deaths. Restrictions have eased in 40 states. We will see how it goes folks we need to get back to work – be safe!

Railcar Volumes

Well its official, the worst jobs report since the Great Depression was issued on Friday showing that 14.7% of Americans are officially unemployed as of April 30th. On Thursday of last week, according to the Labor Department, U.S. workers filed an additional 3.2 million jobless claims, bringing the total losses since the coronavirus pandemic to 33.5 million. Experts say the unemployment rate could peek at 20% or higher.Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $24.02 down .72 cents per barrel from Friday’s close. North American oil companies have shut production faster than analysts expected and are on track to withdraw about 1.7 million barrels per day of output by the end of June. The production cuts have caused an increasing number of cars being sent to storage (see PFL storage report issued moments ago if you didn’t get it – May 11, 2020 report is already posted click here to view

Key economic indicators recently released are as follows:

- The Bureau of Economic Analysis (BEA) announced April 29 that Q1 2020 U.S. GDP fell an annualized 4.8% from Q1 2019.

- The Purchasing Managers Index from the Institute for Supply Management fell from 49.1 in March 2020 to 41.5 in April 2020. A PMI below 50 is thought to indicate that manufacturing is contracting.

- Total industrial output fell 5.4% in March 2020 from the prior month as the pandemic led many factories to suspend operations late in the month. Manufacturing output fell 6.2%.

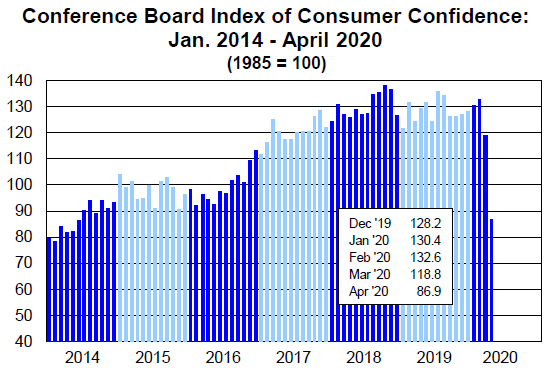

- The Conference Board’s consumer confidence index followed a sharp decline in March with an even steeper decline in April down to 86.9 from 118.8 in March its lowest levels since 2014 – see chart:

- U.S. consumer spending fell 7.5% in March from February, while retail sales fell 8.7%. April’s figures are expected to be much worse. Consumer spending is the U.S. economy’s key driver, accounting for around 70% of GDP.

- New light vehicle sales were an annualized and seasonally adjusted 8.6 million in April 2020, down 24.5% from March’s 11.4 million and down 47.9% year-over-year. This is the lowest monthly sales figure in 50 years.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

North American Rig Count

Total North American rail volumes were down 21.1% year over year in week 18 (U.S. -22.1%, Canada -15.8%, Mexico -29.4%), resulting in quarter to date volumes that are down 19.5% and year to date volumes that are down 9.9% (U.S. -11.4%, Canada -5.8%, Mexico -5.0%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-13.4%), coal (-43.3%) and motor vehicles & parts (-90.1%).In the East, CSX’s total volumes were down 22.9%, with the largest decreases coming from motor vehicles & parts (-95.3%), coal (-42.2%) and intermodal (-12.7%). NS’s total volumes were down 29.5%, with the largest decreases coming from intermodal (-19.2%), coal (-52.7%) and motor vehicles & parts (-93.3%).

In the West, BN’s total volumes were down 21.5%, with the largest decreases coming from coal (-50.7%), intermodal (-10.2%), motor vehicles & parts (-81.8%) and petroleum (-33.8%). UP’s total volumes were down 23.8%, with the largest decreases coming from intermodal (-21.7%), motor vehicles & parts (-93.4%), coal (-34.2%), chemicals (-14.4%), stone sand & gravel (-21.1%) and petroleum (-40.5%).

In Canada, CN’s total volumes were down 19.2% with the largest decreases coming from motor vehicles & parts (-91.3%), intermodal (-5.7%), petroleum (-37.4%), chemicals (-19.9%), stone sand & gravel (-56.7%) and coal (-31.7%). RTMs were down 22.7%. CP’s total volumes were down 16.4%, with the largest decreases coming from petroleum (-50.8%), intermodal (-10.0%), motor vehicles & parts (-86.0%) and coal (-20.5%). RTMs were down 13.7%.

KCS’s total volumes were down 30.3%, with the largest decreases coming from intermodal (-26.3%), motor vehicles & parts (-96.9%), petroleum (-40.7%) and grain (-43.3%).

On April 30, 2020, the Surface Transportation Board (STB or Board) issued three decisions regarding demurrage. These decisions essentially adopted the October 7, 2019 notice of proposed rulemaking in EP 759 and notice of proposed policy statement in EP 757.

In Demurrage Billing Requirements (EP 759) regarding third-party intermediaries and shippers, the Board issued a final rule that is effective June 20, 2020. This means third-party intermediaries, shippers and railroads will have to comply with the new rule on this date. However, in order to make the rule effective, the third-party intermediary would have to enter into an agreement with a shipper that requires the shipper to pay any demurrage charges at the third-party intermediary’s facility. There is no requirement that the shipper enter into an agreement. If there is an agreement, the railroad must comply with it.

In Demurrage Billing Requirements (EP 759) regarding demurrage invoice information requirements, the Board issued a Supplemental Notice of Proposed Rulemaking (SNPRM) seeking comments on additional information that should be required on demurrage invoices in addition to the information set forth in the Notice of Proposed Rulemaking (NPRM). As a result, none of these requirements are effective at this point including those in the original NPRM. Comments are due on June 5, 2020 and replies are due on July 6, 2020.

In Policy Statement on Demurrage and Accessorial Rules and Charges (EP 757) the Board issued a final Statement of Board Policy that essentially followed the Proposed Policy Statement. The Statement becomes effective May 30, 2020. The Board intended for the Statement to be used by shippers and railroads as useful guidance in evaluating the reasonableness of demurrage charges. The Board did not make these statements into actual rules. However, a shipper or railroad can use these principles in future negotiations or proceedings regarding demurrage charges whether in court, at the Board or in arbitration.

In conclusion, the STB’s three decisions provide shippers with guidance and rules to defend against rail carrier demurrage charges.

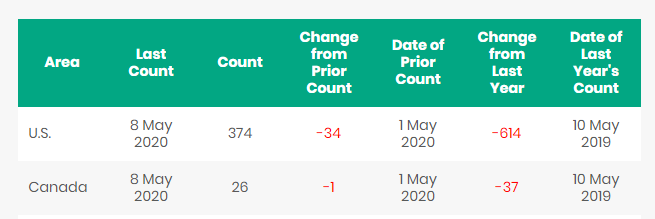

North American rig count continues to deteriorate and is down 35 rigs week over week with the U.S. losing 34 rigs and Canada losing 1 rig week over week. Year over year we are down 651 rigs collectively. Canada now only has 26 rigs nationwide operating and the U.S. has 374.

North American Rig Count Summary

The season officially begins June 1, but some meteorologists who have been tracking ocean and atmospheric dynamics over the past few months say conditions are ripe for storms. Experts are calling for 16 named storms.

Railcar Markets

PFL is offering: Various tank cars for lease with potential dirty to dirty service including gasoline, diesel, crude oil and LPG services – terms negotiable short and long term opportunities available. Sand cars, Box cars, coal cars and hoppers. A number of cars are available for sale.

PFL is seeking: Older DOT 111 cars 25,000 to 26,000 – can be either coiled or non-coiled on a 3-5 year lease – must be clean. 50-100 340Ws for winter service in the Conway area, Plate C boxcars for purchase, CO2 Cars for lease.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|