“There is nothing either good or bad, but thinking makes it so.”

― William Shakespeare

Jobs Update

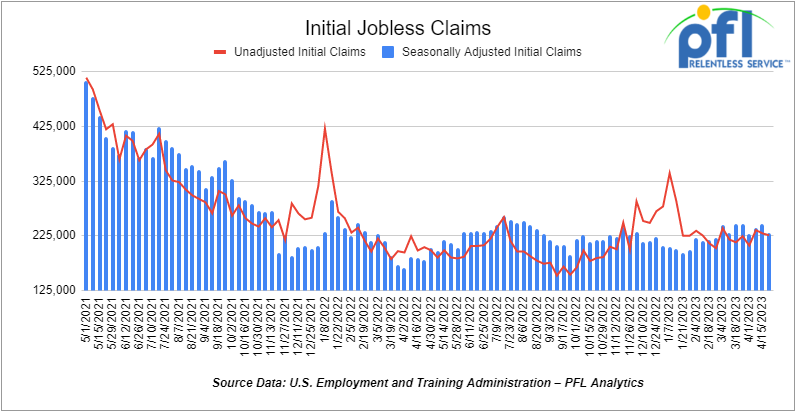

- Initial jobless claims for the week ending April 22nd, 2023 came in at 230,000, down -16,000 people week-over-week.

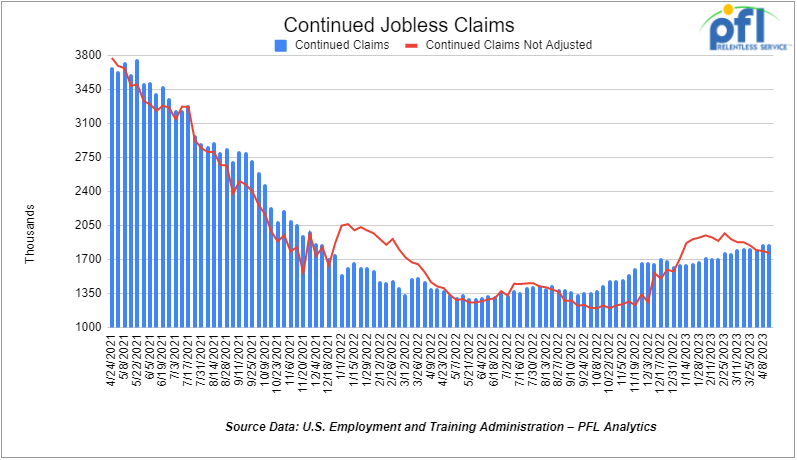

- Continuing jobless claims came in at 1.858 million people, versus the adjusted number of 1.861 million people from the week prior, down -3,000 people week over week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 272 points (+0.8%), closing out the week at 34,098.16, up 289.2 points week over week. The S&P 500 closed higher on Friday of last week, up 34.13 points (+0.83%) and closed out the week at 4,169.48, up 32.44 points week over week. The NASDAQ closed higher on Friday of last week, up +84.35 points (+0.7%), and closed the week at 12,226.58,up 189.38 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,218 this morning up 18 points.

WTI closed higher on Friday of last week, but down week over week

WTI traded up $2.02 per barrel (2.7%) to close at $76.78 per barrel on Friday of last week, but down -$1.09 per barrel week over week. Brent traded up $1.17 per barrel (1.5%) on Friday of last week, to close at US$79.54 per barrel, down -US$2.12 per barrel week over week.

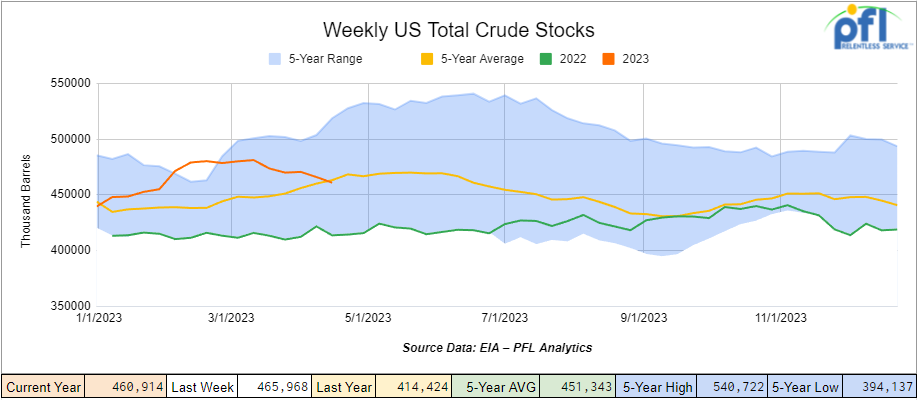

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 5.1 million barrels week over week. At 460.9 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

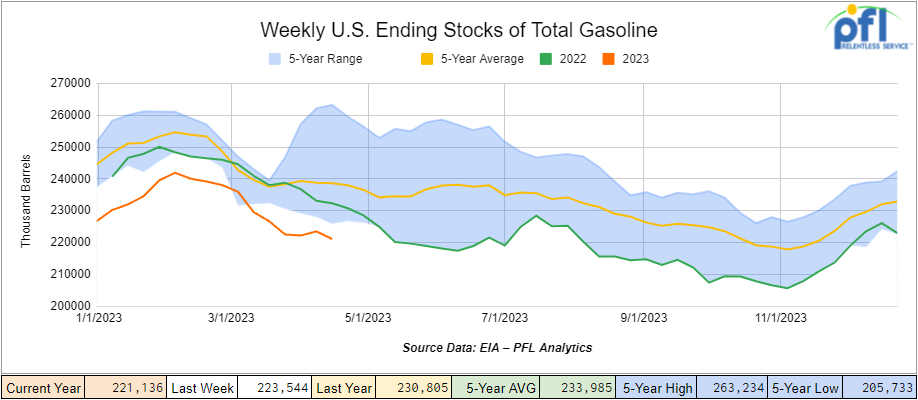

Total motor gasoline inventories decreased by 2.4 million barrels week over week and are 7% below the five-year average for this time of year.

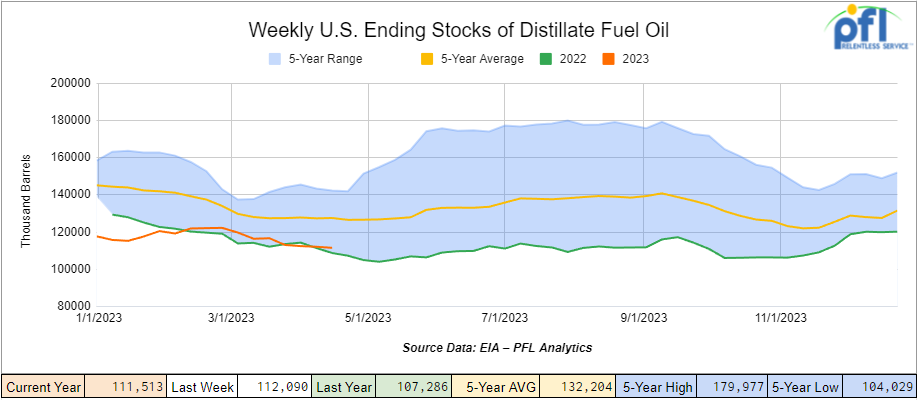

Distillate fuel inventories decreased by 600,000 thousand barrels week over week and are 12% below the five-year average for this time of year.

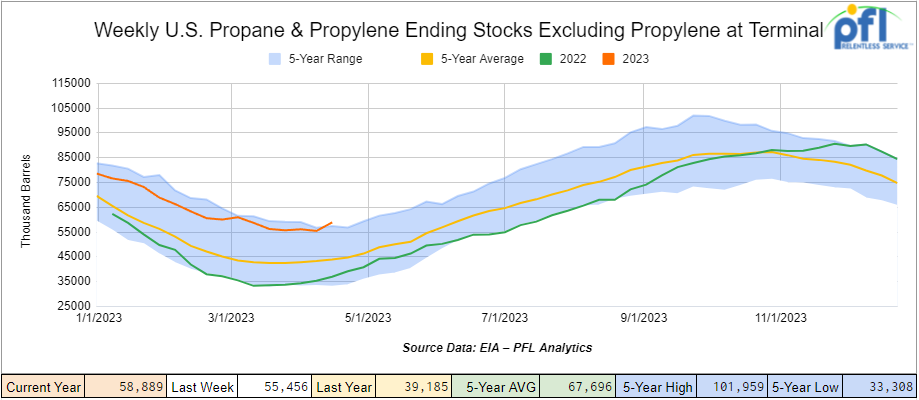

Propane/propylene inventories increased by 3.4 million barrels week over week and are 32% above the five-year average for this time of year.

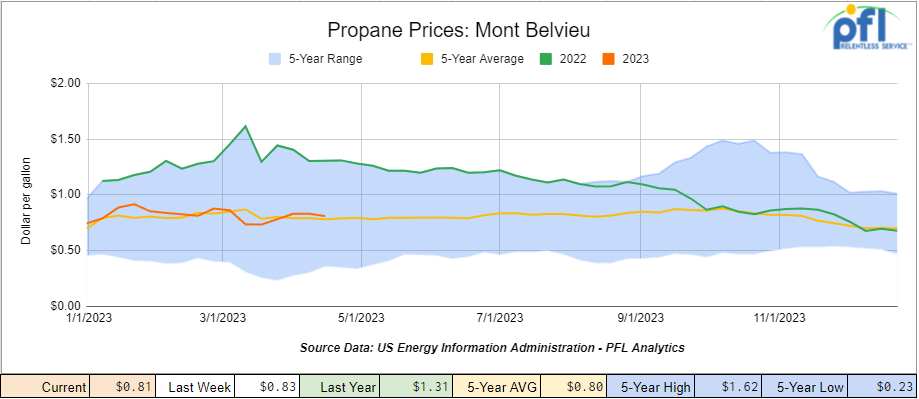

Propane prices closed at 81 cents per gallon, down 2 cents per gallon week over week and down 50 cents per gallon year over year as inventories increase.

Overall, total commercial petroleum inventories decreased by 400,000 barrels last week.

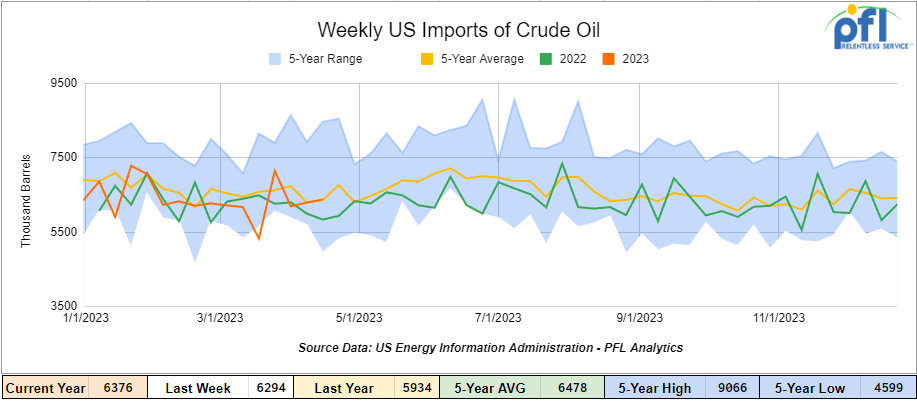

U.S. crude oil imports averaged 6.4 million barrels per day during the week ending April 21st, 2023, an increase of 81,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged about 6.5 million barrels per day, 8.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 1,022,000 barrels per day, and distillate fuel imports averaged 93,000 barrels per day during the week ending April 21st, 2023.

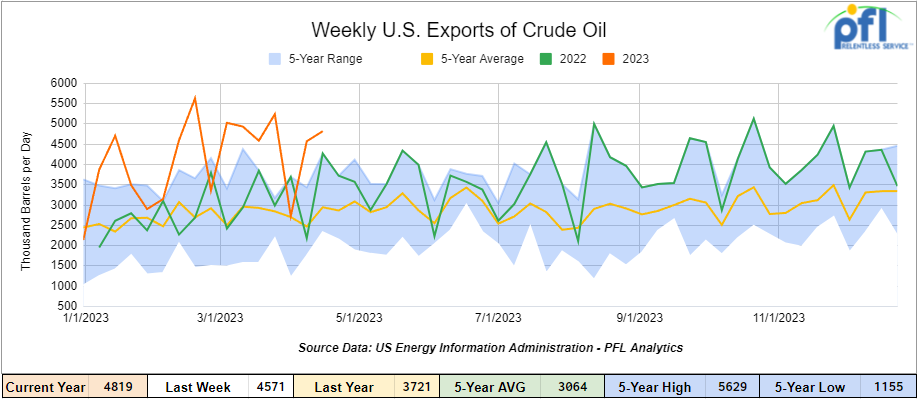

U.S. crude oil exports averaged 4.819 million barrels per day for the week ending April 21st, 2023, an increase of 248,000 barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.339 million barrels per day.

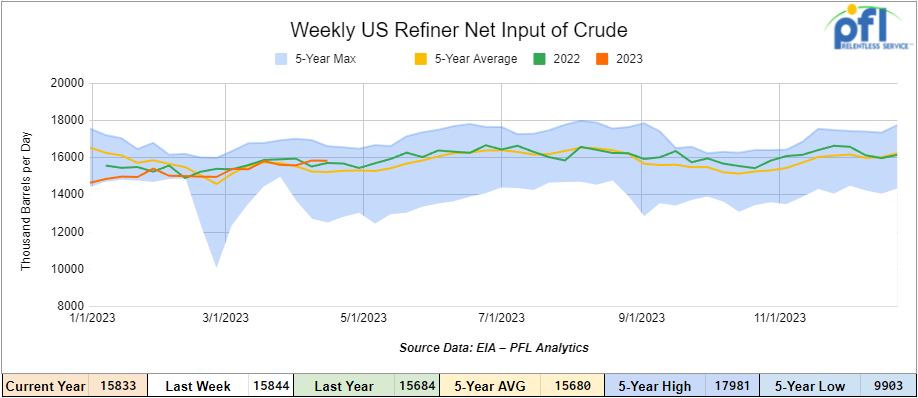

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending April 21, 2023 which was 11 thousand barrels per day lower week over week.

As of the writing of this report, WTI is poised to open at $75.21 down -$1.57 per barrel from Monday’s close.

North American Rail Traffic

Week Ending April 26th, 2023.

Total North American weekly rail volumes were down (-4.82%) in week 16 compared with the same week last year. Total carloads for the week ending on April 26th were 358,983, up (2.62%) compared with the same week in 2022, while weekly intermodal volume was 300,874, down (-12.39%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Intermodal (-12.39%). The largest increase came from Coal (+13.12%).

In the east, CSX’s total volumes were down (-0.27%), with the largest decrease coming from Intermodal (-9.03%) and the largest increase from Motor Vehicles and Parts (+24.45%). NS’s volumes were down (-5.93%), with the largest decrease coming from Petroleum and Petroleum Products (-35.80%) and the largest increase from Grain (+35.36%).

In the West, BN’s total volumes were down (-9.5%), with the largest decrease coming from Intermodal (-20.19%), and the largest increase coming from Motor Vehicles and Parts (+24.09%). UP’s total rail volumes were up (1%) with the largest decrease coming from Other (-21.89%) and the largest increase coming from Motor Vehicles and Parts (+26.91%).

In Canada, CN’s total rail volumes were down (-9.48%) with the largest increase coming from Other (+21.54%) and the largest decreases coming from Intermodal (-22.98%). CP’s total rail volumes were down (-8.36%) with the largest decrease coming from Chemicals (-24.41%) and the largest increase coming from Other (+138.71%).

KCS’s total rail volumes were down (-8.38%) with the largest decrease coming from Farm Products (-20.36%) and the largest increase coming from Petroleum and Petroleum Products (+23.16%).

Source Data: AAR – PFL Analytics

Rig Count

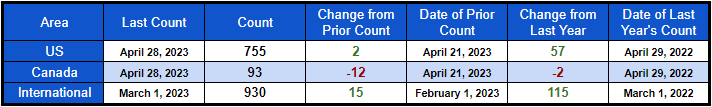

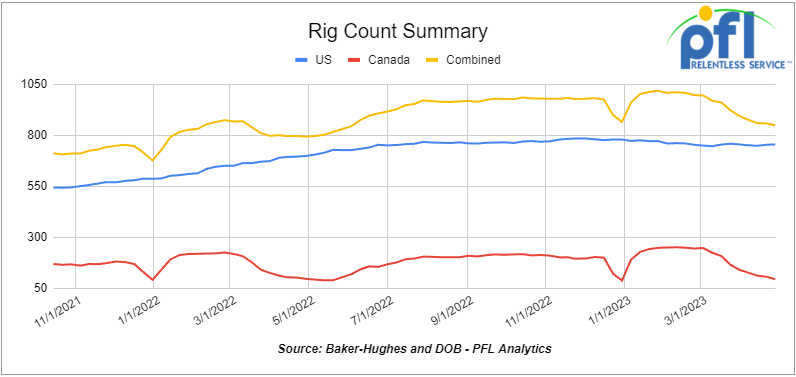

North American rig count was down by -10 rigs week over week. U.S. rig count was up by 2 rigs week over week and up by +57 rigs year over year. The U.S. currently has 755 active rigs. Canada’s rig count was down by -12 rigs week-over-week and down by -2 rigs year over year. This is the first time in a long time that Canada’s overall rig count saw a year over year decline. Canada’s overall rig count is 93 active rigs. Overall, year over year, we are up +55 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 22,729 from 23,460, which was a loss of -731 rail cars week-over-week. Canadian volumes rose week over week; CP’s shipments increased by +1.8% week over week, and CN’s volumes were higher by +6.3% week-over-week. U.S. shipments were down across the board. The NS had the largest percentage decrease and was down by -11.8% week-over-week.

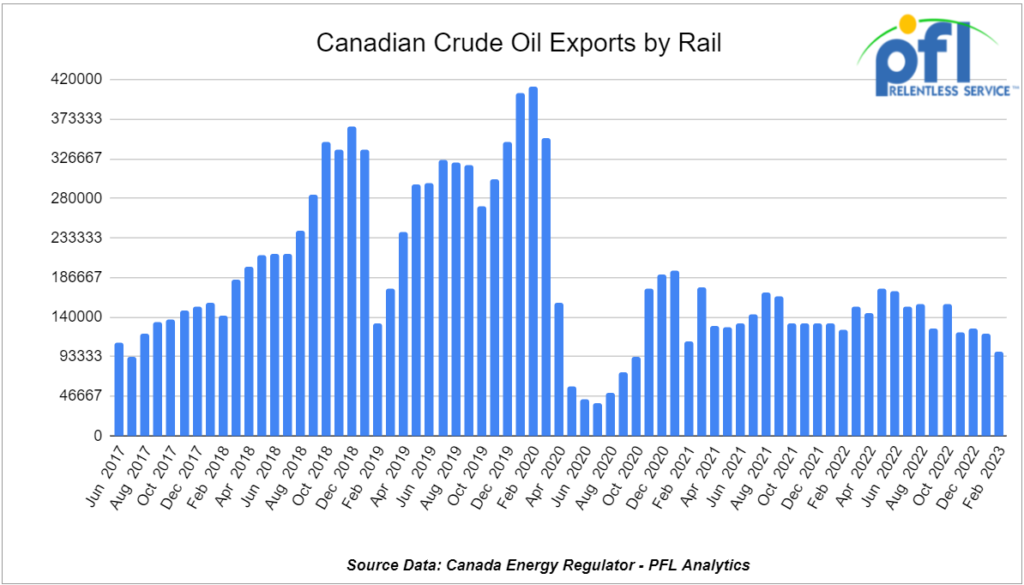

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on April 25, 2023. For February 2023, Canada exported 90,387 barrels per day by rail (down by -20,688 barrels per day month over month); the weakest showing since October of 2020 – a horrible month indeed.

We were expecting to see volumes increase as we head into April as the weather warms and producers begin to build inventory, but that has not been the case.

Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. Gibson currently operates a 50,000-barrel-per-day Diluent Recovery Unit out of Hardisty Alberta and Cenovus is looking to add 200,000 barrels per day of capacity in four clips of 50,000 barrels per day each. This will mean a lot of rail cars are going to be needed, but it is a matter of timing and the market has certainly not been predictable, to say the least with quite a bit of government interference and world geopolitical concerns.

WCS for June delivery settled Friday at US$14.80 below the WTI-CMA. The implied value was US$61.67. On Thursday, it settled at US$14.90 below the WTI-CMA for June delivery. The implied value was US$59.55/bbl.

California approves banning diesel truck sales by 2036

In a not-so-shocking revelation, the California air regulators approved regulations on Friday of last week to ban the sale of traditional combustion trucks that run off diesel by year 2036 in the state. What about all the renewable diesel refineries being built?

The rule must now be approved or denied by President Biden’s U.S. Environmental Protection Agency. California’s vehicle emissions standards are regularly followed by other states – don’t see it happening this go around.

Known as Advanced Clean Fleets, this action puts the Golden State on the path toward fully transitioning medium and heavy-duty trucks there to zero-emissions technology by 2045. Major fleet operators also have the option to begin that process next year.

Big rigs, local delivery, and government fleets must transition by 2035 while garbage trucks and local buses must be zero-emission by 2039 and all other vehicles covered by the rules must be zero-emission by 2042, according to the office of Governor Gavin Newsom. Companies would be required to disclose their use of big rigs by 2024. This adds to California’s Advanced Clean Trucks rule, which was approved by the Biden administration in March. That rule requires manufacturers to accelerate sales of new zero-emissions heavy-duty trucks by 2035.

The California Air Resources Board also OKed a first-in-the-country rule to limit train pollution. That regulation aims to accelerate cleaner locomotive technologies, limit idling and require newly built passenger and freight trains to be zero-emissions by 2030 and 2035, respectively.

“The two regulations work in tandem to drastically cut air pollution – especially in disadvantaged communities – and achieve Governor Newsom’s bold vision for [zero emissions vehicles] in California,” the governor’s office said in a release, noting that vulnerable communities located near trucking corridors and warehouse locations have some of the worst air nationwide.

We are watching Washington & Biden backing MVP Natural Gas Pipeline

Biden is now Backing EQT’s Mountain Valley Pipeline (MVP) enraging the left. Folks, we have never thought there was anything wrong with natural gas. It is clean burning, and we need to burn as much of it as we can to keep our electrical grid healthy as coal plants come offline. The Biden administration is now supporting MVP, an embattled natural gas pipeline project that is 90% complete which is championed by Democratic Sen. Joe Manchin — angering climate advocates and prompting some Capitol Hill Democrats to question the president’s motives. Energy Secretary Jennifer Granholm voiced support in a letter to regulators last week for the $6.6 billion Mountain Valley Pipeline, which would carry gas 303 miles through West Virginia and Virginia to mid-Atlantic and Southeastern markets. It’s not sitting well with progressive lawmakers and environmentalists, who are still burning after the administration approved a massive oil project in Alaska. They call the MVP a climate and health hazard. Stay tuned to PFL – we are watching this one closely.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas for 3 years. Cars are needed for use in Any service.

- 25, 30K 117 Tanks needed off of CN in Canada for 1 year. Cars are needed for use in Refined Products service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Cuastic service.

- 13-15, Any Flat Bottom Gondolas needed off of any class 1 in Texas for 1-3 Years. For lease or purchase

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 10-20, 20K-25K CPC 1232 or 117J Tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

- 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of any class 1 in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

- 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 2-4, 28K DOT 111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Open Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

- 20, 17K DOT 111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Iowa. Cars are needed for use in CO2 & Ethanol service.

- 1-2, Any DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas. Cars are needed for use in Any service. Coiled and Insulated

- 45, 3000 cf PDs Hoppers needed off of any class 1 in Texas. Cars are needed for use in 3 years service. Negotiable

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer / Corn Syurp. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of CN in Canada. Cars were last used in Crude. Free Move, Dirty to Dirty

Sales Offers

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|