“Hope is important because it can make the present moment less difficult to bear. If we believe that tomorrow will be better, we can bear a hardship today.”

– Thich Nhat Hanh

US Jobless Claims

The number of people seeking unemployment benefits rose higher than expected last week to 719,000 from 684,000, a week prior. The four-week rolling average, however, fell to its lowest level since March 2020.

Job creation soared to a seven-month high of 916,000 in March as easing business restrictions and broadening vaccination availability alleviated barriers to travel, dining and shopping. Hiring last month was led by the leisure and hospitality sector with 280,000 personnel, followed by a combined 190,000 roles in public and private education, fields heavily impaired by forced closures. The unemployment rate now stands at 6.0%.

Markets were up Week over Week-Tech Rally Led by Microsoft

The Dow closed higher on Thursday of last week, up +171.66 (+0.52%) closing out the week at 33,153.21 points, up +80.33 points week over week. The S&P 500 closed higher on Thursday of last week, up +46.98 points (+1.18%) and closing out the week at 4,019.87, up +45.33 points week over week. The Nasdaq closed higher on Thursday of last week, up +233.23 points (+1.76%) closing out the week at 13,480.11 points, up +341.39 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 228 points.

Crude up slightly week over week in what was a volatile short week

WTI crude oil for May delivery rose +$2.29 to settle at $61.45 a barrel Thursday of last week, up $0.48 a barrel week over week. Brent crude oil for May delivery also rose higher gaining $2.12 a barrel on Thursday of last week closing at $64.86 a barrel, up $0.29 per barrel week over week. Oil rose week over week despite news that OPEC+ reached an agreement to gradually ease production cuts for May. However, oil has been pretty much flat at the end of each trading week for the past three weeks with extreme volatility in between.

U.S. commercial crude oil inventories decreased by 0.9 million barrels week over week. At 501.8 million barrels, U.S. crude oil inventories are 6% above the five-year average for this time of year. Total motor gasoline inventories decreased by 1.7 million barrels week over week and are 4% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories increased by 2.5 million barrels week over week and are 4% above the five year average for this time of year.

Propane/propylene inventories decreased by 2.0 million barrels last week and are 18% below the five year average for this time of year. The amount of propane in storage is worrisome. Strong Asia demand has kept the front month higher and propane is in backwardation giving little or no incentive to store for the upcoming winter months.

Total commercial petroleum inventories decreased by 1.3 million barrels week over week.

U.S. crude oil imports averaged 6.1 million barrels per day last week, up by 0.5 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 5.7 million barrels per day, 9.4% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 619,000 barrels per day, and distillate fuel imports averaged 441,000 barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $61.40, down -$1.05 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 14.1% year over year in week 12 (U.S. +16.1%, Canada +12.4%, Mexico -3.6%) resulting in year to date volumes that are up 4.3% year over year (U.S. +4.5%, Canada +6.2%, Mexico -5.5%). 6 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+23.8%), motor vehicles & parts (+134.0%) and grain (+15.7%). The largest decrease came from metallic ores & metals (-5.0%).

In the East, CSX’s total volumes were up 11.6%, with the largest increase coming from intermodal (+22.7%) and motor vehicles & parts (+68.3%). NS’s total volumes were up 12.2%, with the largest increases coming from intermodal (+14.4%) and motor vehicles & parts (+131.9%).

In the West, BN’s total volumes were up 19.7%, with the largest increases coming from intermodal (+35.5%), coal (+10.7%) and motor vehicles & parts (+74.5%). The largest decrease came from petroleum (-21.5%). UP’s total volumes were up 10.4%, with the largest increases coming from intermodal (+27.1%) and grain (+27.0%). The largest decreases came from chemicals (-11.0%) and coal (-13.8%).

In Canada, CN’s total volumes were up 12.6%, with the largest increases coming from intermodal (+31.4%) and motor vehicles & parts (+97.0%). The largest decrease came from metallic ores (-24.0%). RTMs were up 10.0%. CP’s total volumes were up 11.2%, with the largest increases coming from grain (+58.7%), motor vehicles & parts (+157.7%) and intermodal (+6.2%). RTMs were up 9.9%.

KCS’s total volumes were up 14.9%, with the largest increases coming from intermodal (+21.4%), coal (+119.6%) and petroleum (+47.8%).

Source: Stephens

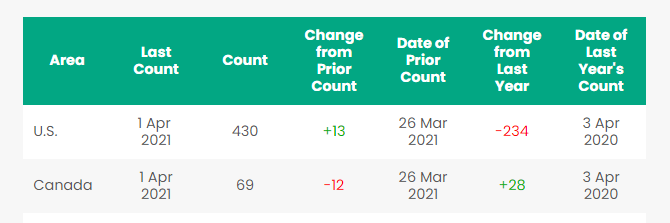

Rig Count

North America rig count is up by 1 rig week over week. The U.S. was up by 13 rigs week over week The U.S. currently has 430 active rigs. Canada’s rig count was down by 12 rigs week over week and Canada’s overall rig count is 69 active rigs. Even though Canada’s Rig count is down week over week due to spring breakup (some wells can only be drilled on when the land is frozen). Canada’s rig count is up 28 rigs year over year. Year over year we are down 206 rigs collectively.

North American Rig Count Summary

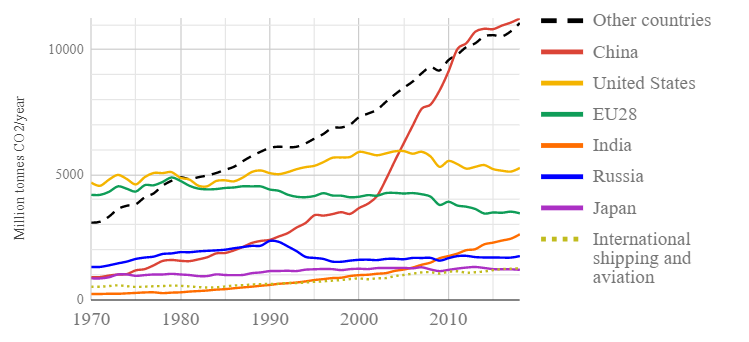

Things We are Keeping an Eye on

New York City loses court battle with major oil companies

Many likely did not even know this, but the City of New York was suing five major oil companies (BP plc, Chevron, Conoco Phillips, Exxon Mobil and Royal Dutch Shell) for damages due to global warming. Well, a federal appeals court on Thursday of last week rejected New York City’s effort to hold the five major oil companies liable to help pay the costs of addressing harm caused by global warming. It rejected the city’s efforts to sue under state nuisance law for damages caused by the companies’ “admittedly legal” production and sale of fossil fuels, and said the city’s federal common law claims were displaced by the federal Clean Air Act. Judge Sullivan said “Global warming presents a uniquely international problem of national concern, it is therefore not well-suited to the application of state law.” Sullivan added that while the Clean Air Act did not address emissions from outside the country, foreign policy concerns and the risk of courts “stepping on the toes of the political branches” barred the city’s lawsuit. Nick Paolucci, a spokesman for the city’s law department, said the city was disappointed it could not hold the oil companies “accountable for the environmental damage they knew their products would cause.” We think we are all doing what we can to be environmentally conscious this is getting a little out of control. Even if the U.S. was to emit zero CO2, China emits double what we do then there is India, Russia – list goes on. To be fair to China on a per capita basis they emit ½ of what the U.S. does. The most recent data that we could find shows that the U.S. is working hard to reduce its CO2 footprint while other developing countries, China and India are increasing. See chart below:

World Fossil Carbon Dioxide Emission 1970-2018

Not that we are trying to point the finger or assess blame in any way, but this is the reality that we have. The simple fact is the world is growing and developing. Growing populations and expanding economies in the developing world will drive energy demand growth. Do car manufactures get sued for making automobiles that consume the products that oil companies produce next? Does the defense department get sued for buying airplanes and tanks that run on fossil fuels? We need to work together for a better solution and suing doesn’t help.

There is a lot of good stuff happening out there to reduce our environmental footprint at all levels and innovation is the key to moving forward. ExxonMobil and Porche are partnering up to test synthetic fuels made from hydrogen and captured CO2. The fuel is expected to reduce greenhouse gas emissions by up to 85% and can be burned in the cars that we drive today. If successful, that is a game changer for the world. Carbon capture can be done in many ways and burning more clean natural gas seems to be the way to go – Waste Management already runs a lot of their fleet on clean burning natural gas and has invested heavily in renewable natural gas at their landfills across the country. On the flip side, think of all the energy that goes into making solar panels and wind turbines. As many know, they don’t last forever and need to be maintained and recycled at their end of life and eventually replaced. Not that we are against solar and wind in any way, but there needs to be a balanced approach. Everyone can agree that we do want cleaner air and water. Let’s work together America! If we work together maybe the world will work with us. Without the rest of the world working with us we are all doomed anyways if you buy into the theory that we only have 7 years and 96 days left until we are past the tipping point of irreversible change

Petroleum by Rail

The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 26,230 from 26,340 week over week. Canadian volumes were mixed week over week on the back of a higher basis differentials in Alberta resulting from decreasing inventories. On the first day of the trading cycle in Alberta on Thursday of last week, WCS closed out the day at -$9.80 against WTI making it impossible for commercial players without sunk costs to transport crude by rail. CP shipments fell by 15.6% and CN volumes were flat. U.S. rail road operators were mixed as well, CSX had the largest percentage increase, up by 10.6% while BN’s shipments were down by 16.4%.

ARS Canada Rolling Stock Co.

ARS Canada Rolling Stock Co. is entering the North American freight railcar market with support from a $3 million CAD repayable contribution from the New Brunswick Provincial government in Canada. All we can say about this is “good luck to them” – it is a tough market out there right now with lots of capacity but as all of us know things can change without notice!

Suez Canal

US ports, shippers face major fallout from Suez Canal chaos – Nearly a third of Asian export boxes shipped to the East Coast transit the Suez Canal. A key risk to ports in the weeks and months ahead is “vessel bunching,” when ships go off schedule and arrive too close together, filling up anchorages. This will occur at box ports in the wake of the Suez crisis as the canal queue unwinds — first at European ports, then at East Coast ports. It looks as though it will be impossible to catch up two weeks of stalled traffic at this point, expect some blank sailings to be announced (canceling of entire sailings). Also one would expect higher freight rates in the days and weeks to come in an already tight market and a disruption in intermodal traffic on the east coast.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

• 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

• 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

• 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

• 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

• 20 Cars (Any Size 28.3K and up) needed for the use in Crude Service. Needed in Kentucky for 1 year

PFL is offering:

• Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

• 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting April 1.

• Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

• 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

• 218 73 ft 286 GRL riser less deck, center part for sale,

• 19 auto-max II automobile carrier racks – tri-49

• 10 food grade stainless steel cars

• 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

• Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

• 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

• 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

• 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|