“It’s not what happens to you, but how you react to it that matters.”

– Epictetus

Jobs Update

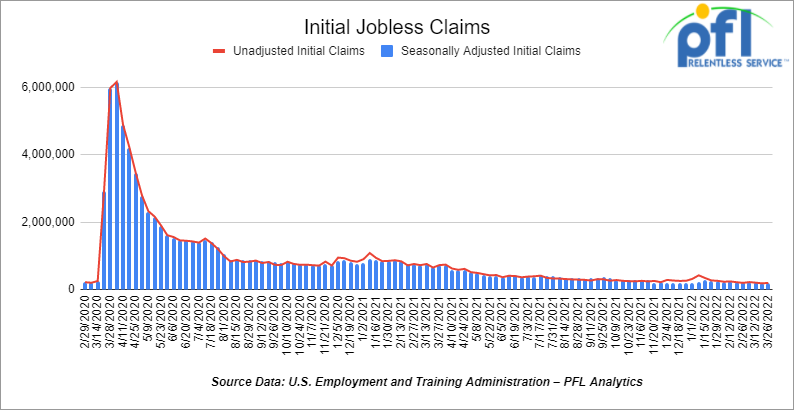

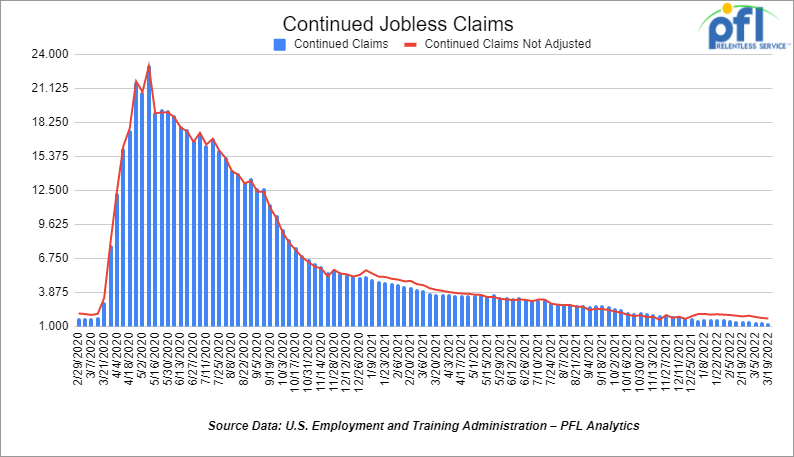

- Initial jobless claims for the week ending March 26, 2022 came in at 202,000, up 14,000 people week-over-week.

- Continuing claims came in at 1.307 million people versus the adjusted number of 1.342 million people from the week prior, down -35,000 people week-over-week.

Stocks were higher on Friday of last week and were mostly higher week-over-week

The DOW closed higher on Friday of last week, up 139.92 points (0.40%), closing out the week at 34,818.27 points, down -42.97 points week over week. The S&P 500 closed higher on Friday of last week, up 15.45 points, and closed out the week at 4,545.86, up 2.8 points week over week. The Nasdaq closed higher on Friday of last week, up 40.98 points (0.29%), and closed out the week at 14,261.5, up 92.2 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,726 this morning up 8 points (+0.02%).

Oil closed lower on Friday of last week and lower week over week

Oil prices traded down on Friday of last week as U.S. allies and members of the International Energy Agency agreed to participate in releasing oil reserves. This is the biggest drop week over week for WTI and Brent in two years. “The looming flood of U.S. barrels does not change the fact that the market will struggle to find enough supply in the coming months,” PVM analyst Stephen Brennock said. “The U.S. release pales in comparison to expectations that 3 million bpd of Russian oil will be shut in as sanctions bite and buyers spurn purchases.” OPEC+ on Thursday of last week stuck with its plans to only add 423K/bpd of output, though member countries are already struggling to meet their quotas. WTI traded down $1.01 or -1.01% to close at $99.27. Brent traded down $.03 or -03% to close at $104.68.

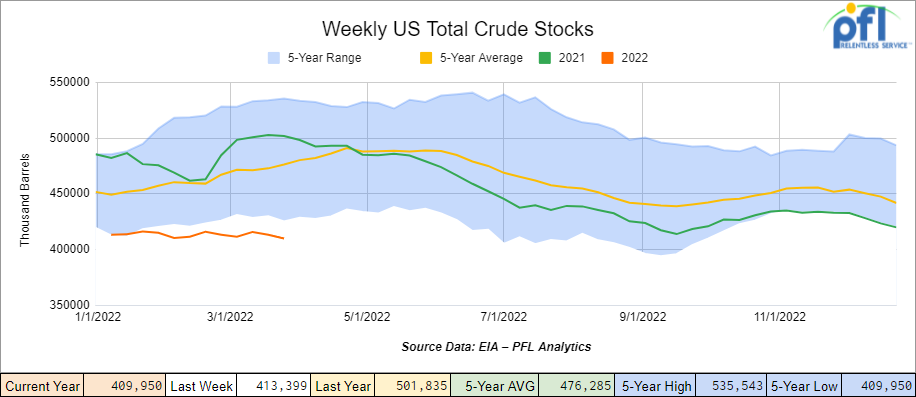

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels week over week. At 413.4 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

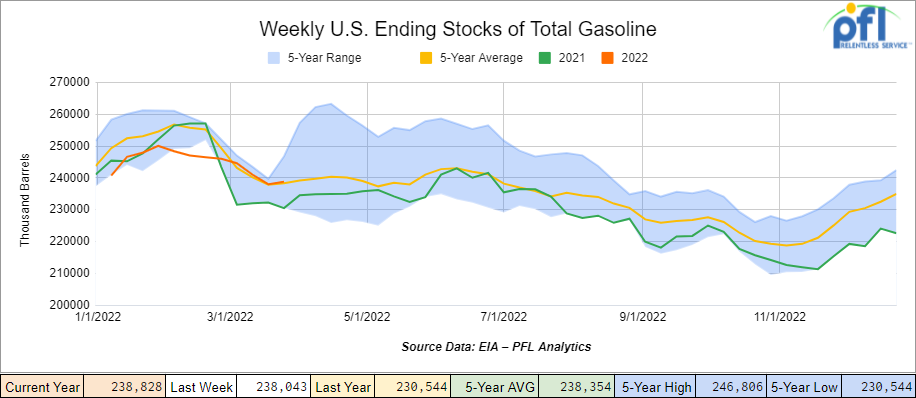

Total motor gasoline inventories increased by 800,000 barrels week-over-week and at the five-year average is nearly flat for this time of year.

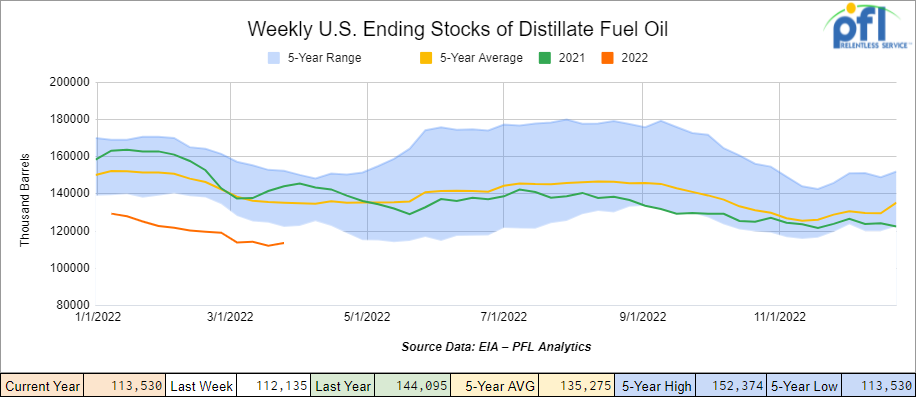

Distillate fuel inventories increased by 1.4 million barrels week over week and are 16% below the five-year average for this time of year.

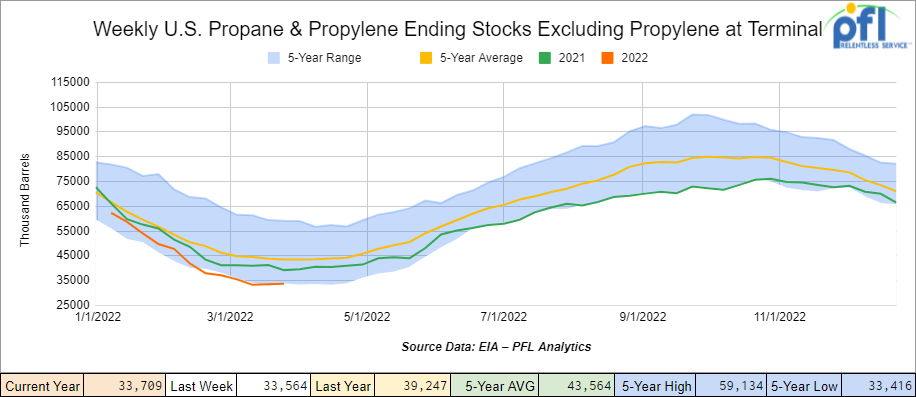

Propane/propylene inventories increased by 100,000 barrels week over week and are 23% below the five-year average for this time of year.

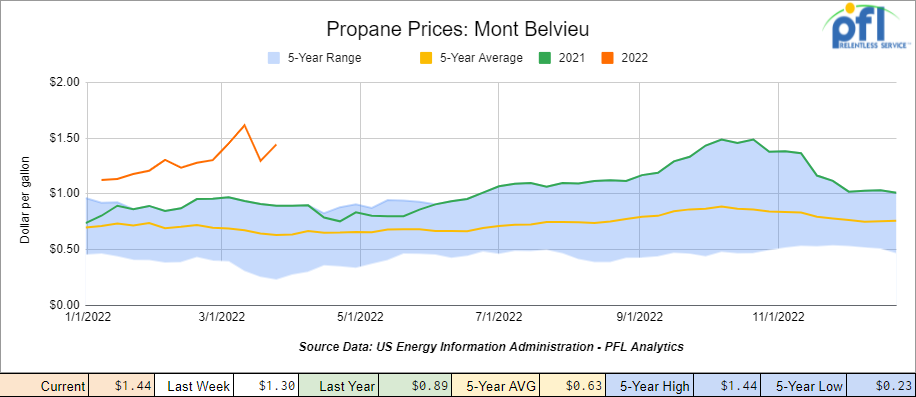

Propane prices traded higher week over week and are up 14 cents per gallon and up 55 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 1.8 million barrels last week.

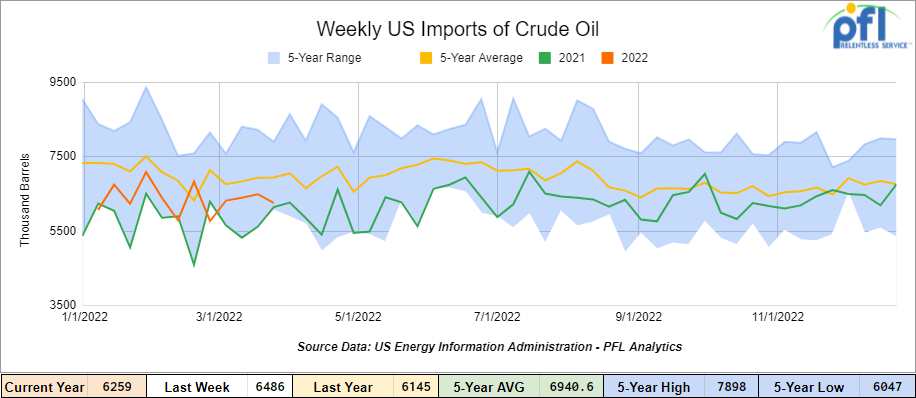

U.S. crude oil imports averaged 6.3 million barrels per day for the week ending March 25th, down by 227,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 11.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 656,000 barrels per day and distillate fuel imports averaged 155,000 barrels per day for the week ending March 25th.

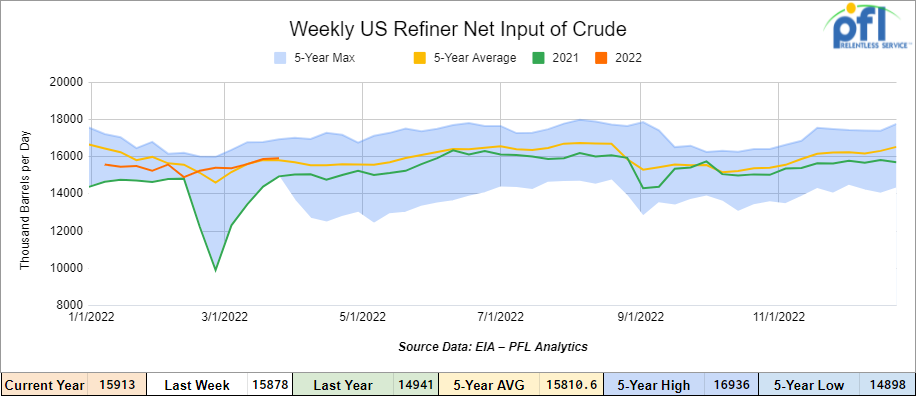

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending March 25, 2022, which was 35,000 barrels per day more than the previous week’s average

As of the writing of this report, WTI is poised to open at $98.93, down $0.34 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 4.5% year-over-year in week 12 (U.S. -3.2%, Canada -11.3%, Mexico +7.2%) resulting in quarter-to-date volumes that are down 4.0% year-over-year (U.S. -2.7%, Canada -10.3%, Mexico +3.7%). 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-6.9%) and grain (-18.7%). The largest increases came from coal (+6.9%) and chemicals (+2.3%).

In the East, CSX’s total volumes were down 1.7%, with the largest decrease coming from coal (-10.6%). The largest increase came from motor vehicles & parts (+15.6%). NS’s total volumes were flat year-over-year, with the largest decrease coming from motor vehicles & parts (-10.5%) and the largest increase coming from intermodal (+1.0%).

In the West, BNSF’s total volumes were down 4.4%, with the largest decreases coming from intermodal (-9.8%), stone sand & gravel (-23.3%), and petroleum (-16.8%). The largest increase came from coal (+9.6%). UP’s total volumes were up 1.0%, with the largest increases coming from coal (+31.0%) and chemicals (+13.7%). The largest decreases came from intermodal (-4.4%) and grain (-24.8%).

In Canada, CN’s total volumes were up 2.2%, with the largest increases coming from coal (+89.3%), metallic ores (+20.4%), and petroleum (+38.9%). The largest decreases came from intermodal (-4.6%), grain (-27.1%) and farm products (-64.0%). RTMs were up 1.6%. CP’s total volumes were down 30.9% (which includes the impact from a ~2.5-day strike), with the largest decreases coming from intermodal (-29.6%), grain (-46.3%), and coal (-37.6%). Revenue per ton-miles was down 40.2%.

KCS’s total volumes were down 1.2%, with the largest decrease coming from petroleum (-42.4%). The largest increase came from motor vehicles and parts (+43.7%).

Source: Stephens

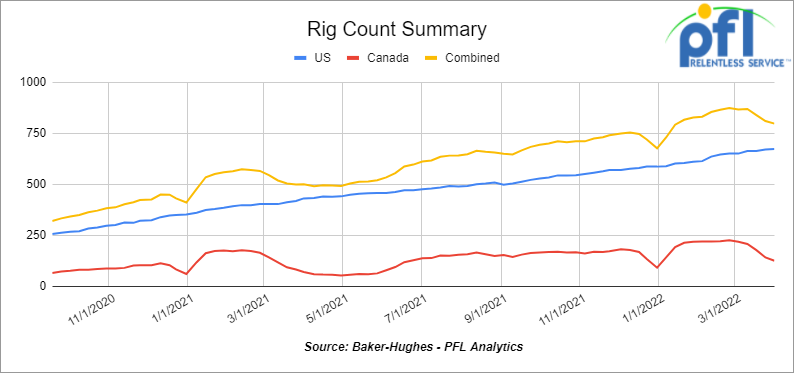

Rig Count

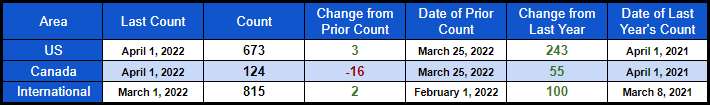

North American rig count is down by -13 rigs week over week. U.S. rig count was up by 3 rigs week over week and up by 243 rigs year over year. The U.S. currently has 673 active rigs. Canada’s rig count was down by -16 rigs week over week and up by 55 rigs year over year and Canada’s overall rig count is 124 active rigs. Overall, year over year, we are up 298 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

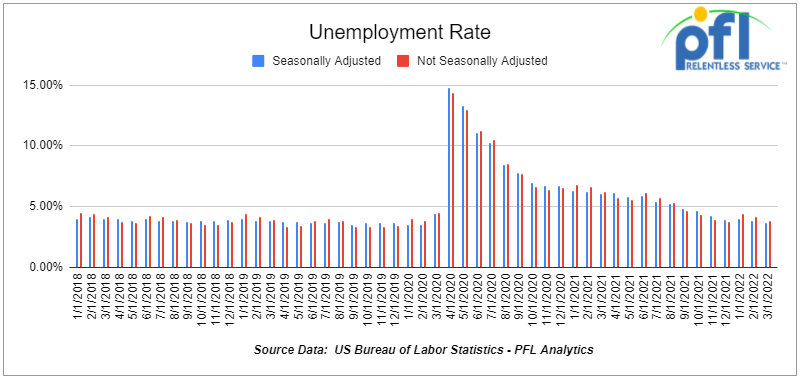

March Unemployment Numbers

U.S. employers added 431,000 jobs in March as tumbling COVID-19 cases offset concerns about soaring inflation and the war in Ukraine. The unemployment rate fell from 3.8% to 3.6%, the Labor Department said Friday of last week. That puts it just above the 50-year low of 3.5% just before the pandemic upended the economy in March 2020. The economy has now added more than 400,000 jobs a month for 11 months, the longest such streak on record.

President Joe Biden touted the drop in unemployment which is down from 6.4% when he entered office – as the “fastest decline in unemployment to start a president’s term ever recorded.”

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,902 from 24,117, which is a loss of 215 rail cars week-over-week. Canadian volumes were flattish – CP shipments were down by 3.7% while CN volumes were up by 1.7%. U.S. volumes were mostly lower with the NS having the largest percentage increase (up by 5.3%) CSX had the largest percentage decrease down by 9.5%.

President Biden and Washington, In their Collective Wisdom, Decides to Control Prices at the Pump Heading into the Midterms.

We thought the Petroleum Reserves were supposed to be used for supply disruptions and not price control – we were wrong. The U.S. Department of Energy’s (DOE) Office of Fossil Energy and Carbon Management (FECM) announced on Friday of last week a Notice of Sale of crude oil from the Strategic Petroleum Reserve (SPR). This Notice of Sale follows President Biden’s announcement on Thursday of last week authorizing the sale of crude oil from the SPR to address the significant market supply disruption caused by Putin’s war on Ukraine and aid in lowering energy costs for American families, the release says.

The SPR will release approximately one million barrels of crude oil per day over the next six months. Crude oil in this emergency sale will enter the market in two releases.

The first 90 million barrels will be released between May and July, through two notices of sale totaling 70 million barrels and 20 million barrels are already scheduled to be released in May 2022. The remaining 90 million barrels will be released between August and October 2022. DOE must receive bids for the first notice of sale no later than 10:00 a.m. Central Time on April 12, 2022, and will award contracts to successful offerors no later than April 21, 2022.

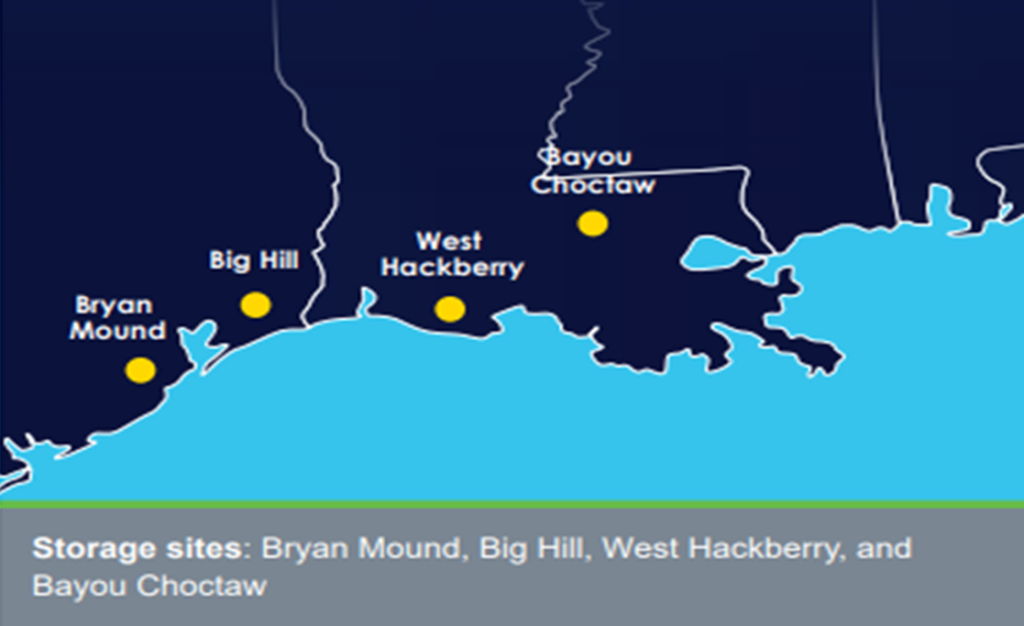

The May through July sales will be conducted with crude oil from the following four SPR sites:

• Up to 20.5 million barrels from Big Hill

• Up to 21.5 million barrels from West Hackberry

• Up to 18 million barrels from Bryan Mound

• Up to 10 million barrels from Bayou Choctaw

Strategic Petroleum Reserves

Source: DOE – PFL Analytics

The SPR is the world’s largest supply of emergency crude oil, and the federally owned oil stocks are stored in underground salt caverns at four storage sites in Texas and Louisiana. The SPR has a long history of protecting the economy and American livelihoods in times of emergency oil shortages, says the DOE.

Ethanol groups are not happy and believe the President completely ignored them as a solution: “Doubling down on petroleum dependence is not an economically or environmentally sustainable solution for lower gas prices and it completely undermines this administration’s ambitious climate objectives,” Geoff Cooper, President and CEO of the Renewable Fuels Association (RFA) said in a statement.

“It is baffling to us that President Biden continues to overlook ethanol, which is the most readily available, lowest-cost, and lowest-carbon option for extending our nation’s fuel supply. Rather than draining our Strategic Petroleum Reserve and scolding U.S. oil producers for failing to increase production, we believe the administration should be empowering farmers and ethanol producers.”

Any company registered in the SPR’s Crude Oil Sales Offer Program is eligible to participate in this and other SPR crude oil sales. Other interested companies may register through the SPR’s website: Crude Oil Sales Offer Program. In our mind, this is not a great idea. It has the potential to balance supply and prices until the Midterm elections, then what? The main problem is policy – let producers drill, stop trying to shut down pipelines and change government policy.

Oil executives to testify before Congress on record-high gas prices

Executives from six of the nation’s largest oil companies have agreed to testify before a key congressional panel next week about the rising cost of gasoline.

U.S. Rep. Diana DeGette (D-CO), who serves as chair of the House Energy and Commerce Oversight and Investigations subcommittee – which oversees the nation’s fossil fuel industry – announced on Tuesday of last week that executives from Chevron, ExxonMobil, BP, Shell, Devon Energy, and Pioneer Natural Resources will all appear before the panel on Wednesday, April 6, to answer lawmakers’ questions about the industry’s role in the skyrocketing cost of gasoline.

“Americans across the country are suffering from the skyrocketing cost of gasoline, while some of the nation’s largest oil companies are reporting record-high profits,” DeGette said. “We will not sit back and allow the fossil fuel industry to take advantage of the American people and gouge them at the pump. We want to know what’s causing these record-high prices and what needs to be done to bring them down immediately.”

Among the executives that have agreed to testify include:

- David Lawler, Chairman and President, BP America, Inc.

- Michael K. Wirth, Chairman and Chief Executive Officer, Chevron Corporation

- Darren W. Woods, President and Chief Executive Officer, ExxonMobil

- Gretchen Watkins, President, Shell USA, Inc.

- Richard E. Muncrief, President and Chief Executive Officer, Devon Energy Corporation

- Scott D. Sheffield, Chief Executive Officer, Pioneer Natural Resources Company

The House Energy and Commerce Oversight and Investigations subcommittee hearing will begin at 10:30 a.m. ET on Wednesday, April 6. It is PFL’s position that current government policies have resulted in higher gas prices. This hearing is just another waste of taxpayer money and another example of an administration that does not take responsibility for anything and runs around the country and the world, finger-pointing trying to deflect their own incompetence.

Source: Gas prices at the Mobile station outside of the Beverly Center in Los Angeles, CA Thursday, March 10, 2022. (Photo by David Crane, Los Angeles Daily News/SCNG)

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Needs to be lined.

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|