“So live as if you were living already for the second time and as if you had acted the first time as wrongly as you are about to act now!”

― Viktor E. Frankl

Jobs Update

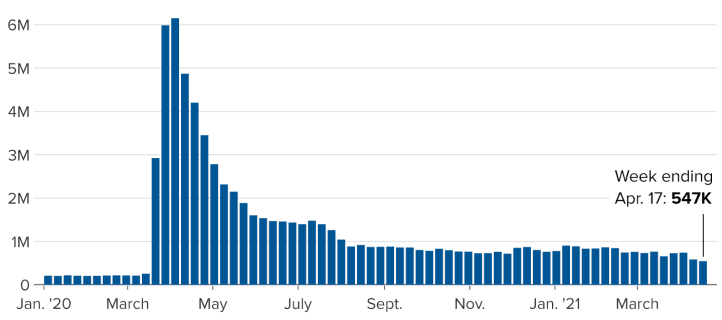

The U.S. jobs market recovery accelerated its pace last week as fewer Americans headed to the unemployment line, the Labor Department reported Thursday of last week.

First-time claims for unemployment insurance totaled 547,000, well below the Dow Jones estimate for 603,000 and a new low for the Covid-19 pandemic era. (See chart)

Initial Claims for Unemployment Insurance

Continuing claims also fell to 3.67 million, dropping by 34,000, also a new low and another indication that conditions are improving. Nevertheless, about 8 million fewer Americans are at work than before COVID and blue state shutdowns are still a significant problem for the U.S. economy. Approximately 17.4 million Americans are still receiving benefits under various programs.

Markets Were Slightly Down Week Over Week- as Biden Touts Massive Increase in Capital Gain Tax

The DOW sold off of on Thursday of last week on a report that the Biden administration will propose higher capital gains on wealthy Americans. Biden’s plan is a capital gains tax to as high as 43.4% for very wealthy Americans and would hike the capital gains rate to 39.6% for those earning $1 million or more, up from 20% currently. The Dow did manage to close higher on Friday of last week, up +227.59 (+0.67%) closing out the week at 34,043.49 points, down -157.18 points week over week. The S&P 500 closed higher on Friday of last week, up +45.19 points (+1.09%) and closing out the week at 4,180.17, down -5.3 points week over week. The Nasdaq closed higher on Friday of last week, up +198.39 points (+1.44%) closing out the week at 14,016.81 points, -35.53 points week over week. The week will be an extremely busy week in the markets with a third of the S&P 500 reporting earnings, a Federal Reserve meeting, and new spending and tax proposals from the White House. Big Tech is a highlight of the earnings calendar, with Apple, Microsoft, Amazon, Facebook and Alphabet all releasing results. The Fed is not expected to take any action, but economists expect it to defend its policy to let inflation run hot.

In overnight trading, DOW futures are flat and expected to open up this morning a mere 3 points.

Crude weaker week over week as demand concerns in India raises concerns for traders

According to Bloomberg, India has been setting record numbers of daily coronavirus cases, threatening demand in the world’s third-largest oil importer. The country’s diesel and gasoline consumption could fall by a fifth this month, and traders said the nation’s largest refiner had refrained from buying West African oil last week. WTI crude oil for June delivery did rise +$0.71 to settle at $62.14 a barrel on Friday of last week, down $-1.09 a barrel week over week. Brent crude oil also closed higher also gaining +$0.71 a barrel on Friday of last week, closing at $66.11 a barrel down -$0.66 a barrel week over week.

U.S. commercial crude oil inventories increased by 600,000 barrels week over week. At 493.0 million barrels, U.S. crude oil inventories are 1% above the five year average for this time of year.

Total motor gasoline inventories increased by 100,000 barrels week over week and are 3% below the five year average for this time of year. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 1.1 million barrels week over week and are 2% above the five year average for this time of year.

Propane/propylene inventories decreased by 100,000 barrels week over week and are 18% below the five year average for this time of year. Total commercial petroleum inventories increased by 3.6 million barrels last week.

U.S. crude oil imports averaged 5.4 million barrels per day week over week down by 448,000 thousand barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 5.9 million barrels per day, 5.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 1.1 million barrels per day, and distillate fuel imports averaged 162,000 barrels per day.

U.S. crude oil refinery inputs averaged 14.8 million barrels per day during the week ending April 16, 2021 which was 286,000 barrels per day less than the previous week’s average. Refineries operated at 85.0% of their operable capacity last week. Gasoline production decreased last week, averaging 9.4 million barrels per day. Distillate fuel production decreased last week, averaging 4.6 million barrels per day.

Oil is lower in overnight trading and WTI is poised to open at $61.02, $1.12 per barrel or (-1.80%) from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 28.0% year over year in week 15 (U.S. +32.2%, Canada +12.4%, Mexico +45.0%) resulting in quarter to date volumes that are up 25.1% year over year and year to date volumes that are up 7.4% year over year (U.S. +8.2%, Canada +7.2%, Mexico -1.6%). All of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+32.5%), motor vehicles & parts (+713.6%) and coal (+23.7%).

In the East, CSX’s total volumes were up 29.5%, with the largest increases coming from intermodal (+40.4%) and motor vehicles & parts (+792.2%). NS’s total volumes were up 37.1%, with the largest increases coming from intermodal (+38.1%), motor vehicles & parts (+1,936.9%) and coal (+30.0%).

In the West, BN’s total volumes were up 35.4%, with the largest increases coming from intermodal (+40.6%), coal (+51.4%) and motor vehicles & parts (+334.3%). The largest decrease came from petroleum (-23.0%). UP’s total volumes were up 32.3%, with the largest increases coming from intermodal (+44.5%), motor vehicles & parts (+668.8%) and grain (+50.1%).

In Canada, CN’s total volumes were up 11.8%, with the largest increases coming from intermodal (+11.5%), motor vehicles & parts (+629.6%), grain (+38.2%) and stone sand & gravel (+77.1%). RTMs were up 16.5%. CP’s total volumes were up 19.4%, with the largest increases coming from intermodal (+13.7%), coal (+40.8%), motor vehicles & parts (+432.6%) and grain (+19.4%). RTMs were up 8.4%.

KCS’s total volumes were up 49.3%, with the largest increases coming from intermodal (+53.3%), petroleum (+69.5%) and motor vehicles & parts (+1,188.3%).

Source: Stephens

Rig Count

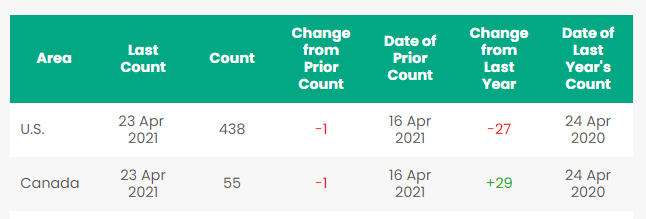

North America rig count is down by 2 rig’s week over week. The U.S. was down by 1 rig week over week. The U.S. currently has 438 active rigs (oil rigs were down one to 343, gas rigs were unchanged at 94 and miscellaneous rigs unchanged at 1 rig) Canada’s rig count was down by 1 rig week over week, but up by 29 Rigs year over year and Canada’s overall rig count is 55 active rigs. Year over year we are up 2 rigs collectively. This is the first time we have received a positive year over year gain in North American rig count in a long time – expect the trend to continue as last year was a blood bath for drillers and producers alike.

North American Rig Count Summary

Things We are Keeping an Eye on

- The White House – The Biden administration is proposing a new capital gains tax that could shake the markets this week if passed. The new rate if passed will be to 39.5% and if you take into account the sir tax it will be 43.5% if you make over $1M a year. The White House also unveiled its international climate finance strategy, which includes pushing lending arms of the government – U.S. International Development Finance Corporation, the Millennium Challenge Corporation and the Export-Import Bank – to virtually eliminate fossil fuel lending, except in extraordinary circumstances.

- The Dakota Access Pipeline (“DAPL”) –DAPL is running out of options. In last week’s rail report we gave the status of the battle that rages on for the shutdown of the operating 570,000 barrel per pipeline that The Standing Rock Sioux Tribe who claims DAPL could threaten its water supply wants the pipeline shut down now. Here is the latest and greatest:

a:) Energy Transfer asked the U.S. Court of Appeals for the District of Columbia to rehear the case. They wanted the court to rehear the case and claimed that the appeals court contradicted previous U.S. court decisions. On Friday of last week, a three judge panel denied DAPL’s request for an appeal.

b:) Energy Transfer was also asked by the court to update the court on potential economic impacts of a shut down. Well, they did last week. DAPL said that the shutdown of the pipeline would cause “immediate economic shock”, cost North Dakota’s oil producers up to $700Mil dollars a month, cause significant rail congestion, and the State of North Dakota could loose $1.1 – $2.5 billion dollars in tax revenue this year alone. The Standing Rock tribe has until April 23 to inform the court if they will respond. The irony in the whole DAPL pipeline shut down controversy is there is another tribe known as MHA Nation that owns a significant amount of oil and gas reserves on their Indian Reservation in the Bakken that stands to lose $160 Million a year if the pipeline is shut, representing 80% of their budget.

c:) The State of North Dakota is now asking a federal court to allow it to intervene as a defendant in the Energy Transfer case. The state said its interest in the pipeline is not properly represented by the U.S. Army Corps of Engineers as the Corps punted the pipeline back to the Biden administration to make the ruling as to whether or not to shut DAPL down during an environmental review. The state of North Dakota says that it will vigorously intervene so stay tuned to PFL for future developments but it seems to us that it could be an uphill battle. - Keeping an eye on Enbridge Line 5 – We gave our readers an update on that battle last week which of course in another pressing rail event. As our readers and listeners well know full well the Governor of Michigan – Governor Gretchen Whitmer really wants this pipeline shut down. Here is the latest and greatest on that battle:

a:) A victory for Enbridge on Wednesday of last week. The Michigan Public Service Commission (MPSC) determined that its review of the proposed four-mile Line 5 tunnel under the Straits of Mackinac should not include an examination of the entire 641-mile pipeline. The MPSC’s determination on aligns with Administrative Law Judge Dennis Mack’s ruling issued in October, when he wrote “the replacement of the four-mile segment of Line 5 in the Straits is not cause for review of the entire pipeline system.”

b:) On Friday of last week, Enbridge and the state of Michigan met for mediation as ordered by the court. They agreed to meet yet again on April 28th and May 18th. Stay tuned to PFL for future developments we will report them as we see them. - Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 23,819 from 24,330 a drop of 511 rail cars week over week. Canadian volumes were up week over week. CP shipments rose by 3.3% and CN were up by 8.6%. U.S. rail road operators were mostly higher, BN had the largest percentage decrease, down by 13.8% and the NS had the largest percentage increase up by 11.2%. We expect to see crude by rail to pick as we limp along in 2021 as basis continues to widen in Alberta (WTI against WTI closed at $US-$12.55 for June delivery – The implied value was US$48.72 a barrel). We will see Gibson’s and Phillips DRU come on line later this quarter (40,000 barrels per day that will all be railed as a non hazmat product). Also don’t forget that some shippers have sunk transportation costs and pipelines are backed up once again with Enbridge rejecting 53% of its nominations for Canadian Heavy. So throw out the arb theory – crude by rail out of CANADA will continue to grow despite the arb as the underlying physical price of crude increases.

- CP & CN Fight over the KCS – Who is going to win? Maybe no one as law makers warns that CN and CP bids for the KCS should set off alarm bells. The chairman of the U.S. House of Representatives transportation and infrastructure committee said Friday the potential acquisition of the Kansas City Southern freight railroad should set off “alarm bells” about industry consolidation. Representative Peter DeFazio, a Democrat, said the deal could spark a “new wave of railroad mergers that stifle competition and trigger industry-wide consolidation.”

- “Wall Street will make money from railroad consolidation, but the U.S. economy and work force will be worse off for it,” he said. Both Canadian National Railway Co. and Canadian Pacific Railway Ltd. have offered to buy Kansas City Southern. Canadian National said on Thursday it had informed Kansas City’s board about its confidence in winning regulatory approvals for its US$33.7-billion offer for the U.S. railroad. Canadian Pacific told the U.S. Surface Transportation Board the merged railroads “would remain only the fifth largest railroad in the United States – both on a track-mile basis and on an operating revenue basis” and would not be anti-competitive. CN argued that “the fiercest and most aggressive ‘competitor’ to the freight rail industry is the trucking industry, which has a dominant market share for the transportation of most commodities – including intermodal traffic.” The railroads would have limited overlap – just 1 percent of their network – and CN said it would work with customers to ensure they would not be served by just one railroad as a result of a merger. Mr. DeFazio said that there were 33 Class I, or major, railroads in 1980. “Today there are seven, and a merger between KCS and Canadian National or Canadian Pacific would leave only six.” He added that a series of mergers “will likely result in a significant reduction of the railroad work force, a work force that has lost tens of thousands of jobs since 2015, and will negatively impact the rail network’s ability to provide affordable and reliable access for our nation’s shippers.”

- On a sad note -two men died from an explosion in a rail car tanker at a repair facility in central Wyoming, on Wednesday of last week at the Wasatch Railcar Repair facility southeast of Shoshoni, Police Chief Chris Konja said in a statement.

“Two men were unresponsive inside the tanker. Because of noxious gases, a specialized confined quarter’s team from the Casper Fire Department responded,” Konja said. The bodies of the men, ages 18 and 28, were recovered from the tanker. Their names have not been released and the cause of the explosion is being investigated in coordination with the Occupational Safety and Health Administration (OSHA) and the Federal Railroad Association (FRA).

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 110 117 J’s 28.3 for dirty to dirty service in Alberta for crude.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 40-70 5200cf hoppers with food grad lining needed in California for 1 Year with option to renew.

- 95 Double Plug Plate F Box Cars in Washington

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|