“The entrepreneur always searches for change, responds to it, and exploits it as an opportunity.”

– Peter Drucker

Jobs Update

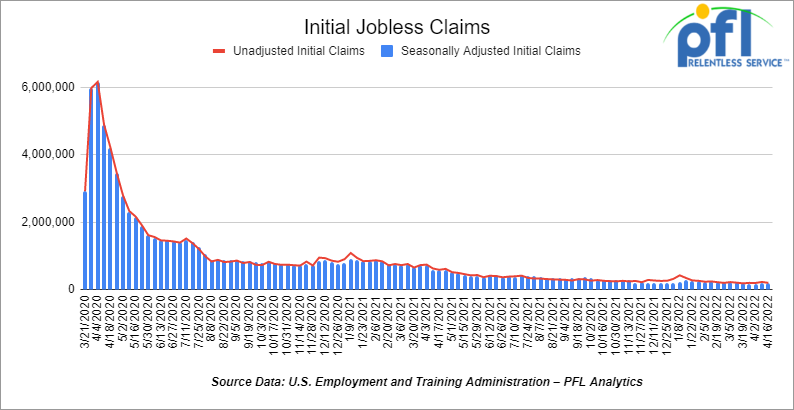

- Initial jobless claims for the week ending April 16th, 2022 came in at 184,000, down -2,000 people week-over-week.

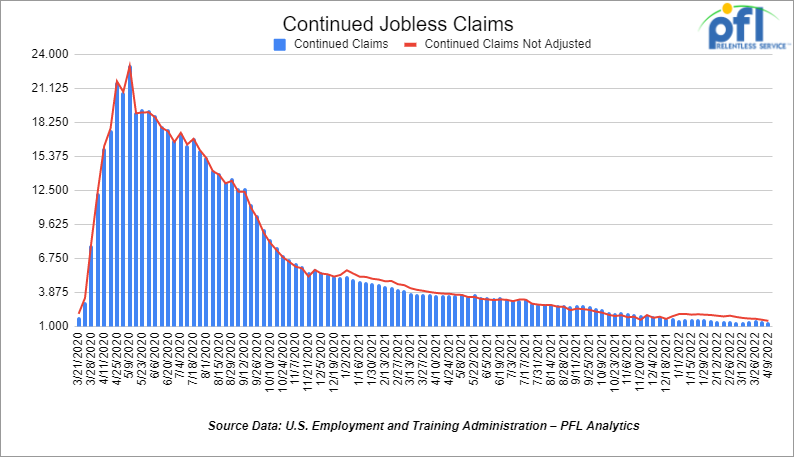

- Continuing claims came in at 1.417 million people versus the adjusted number of 1.523 million people from the week prior, down -48,000 people week-over-week.

Stocks were lower on Friday of last week and down week-over-week

The DOW closed lower on Friday of last week, down -981.36 points (-2.82%), closing out the week at 33,811.4 points, down -639.83 points week-over-week. The S&P 500 closed lower on Friday of last week, down -121.88 points, and closed out the week at 4,271.78, down -120.81 points week-over-week. The Nasdaq closed lower on Friday of last week, down -335.36 points (-2.55%), and closed out the week at 12,839.29, down -511.79 points week-over-week.

InIn overnight trading, DOW futures traded lower and are expected to open at -248 this morning up 33,480 points.

Oil closed lower on Friday of last week and lower week over week

Oil prices fell on Friday of last week, posting a weekly loss of almost 5% as financial markets were down across the board. Fed Chair Jerome Powell said that a 50 bps rate hike is on the table for the next Fed meeting in May which pushed the dollar to two-year highs. “At this stage, fears over China’s growth and over-tightening by the Fed, capping U.S. growth, seem to be balancing out concerns that Europe will soon widen sanctions on Russian energy imports,” said Jeffrey Halley, an analyst at brokerage OANDA. Morgan Stanley raised its 3q Brent forecast up by $10 per barrel to $130, citing a “greater deficit” this year than previously expected. WTI traded down $1.72 or -1.66% to close at $102.07. Brent traded down $2.13 or -1.97% to close at $106.20. “At this stage, fears over China’s growth and over-tightening by the Fed, capping U.S. growth, seem to be balancing out concerns that Europe will soon widen sanctions on Russian energy imports,” said Jeffrey Halley, an analyst at brokerage OANDA. Morgan Stanley raised its 3q Brent forecast up by $10 per barrel to $130, citing a “greater deficit” this year than previously expected. WTI traded down $1.72 or -1.66% to close at $102.07. Brent traded down $2.13 or -1.97% to close at $106.20.

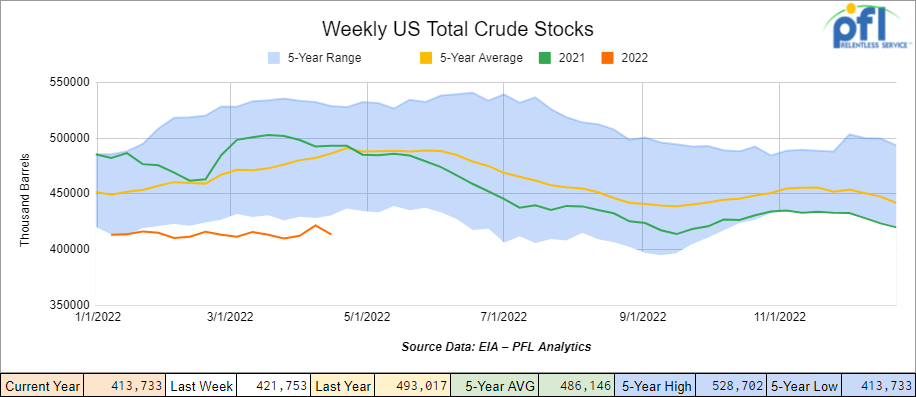

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 8.0 million barrels week over week. At 413.7 million barrels, U.S. crude oil inventories are 15% below the five-year average for this time of year.

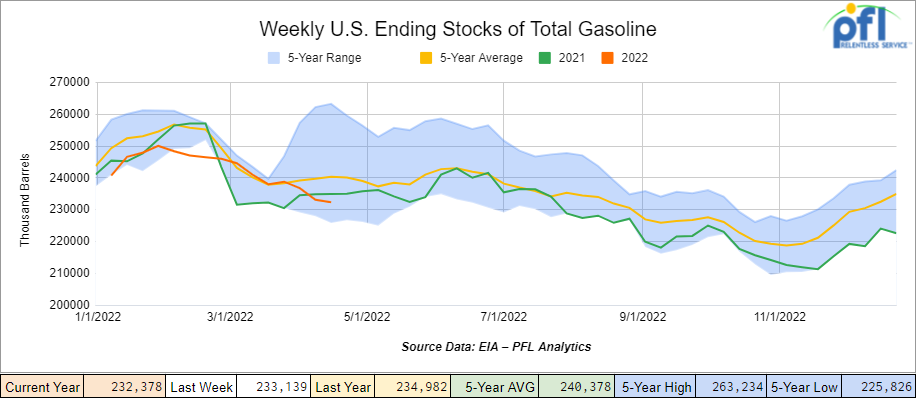

Total motor gasoline inventories decreased by 800,000 barrels week over week and are 3% below the five-year average for this time of year.

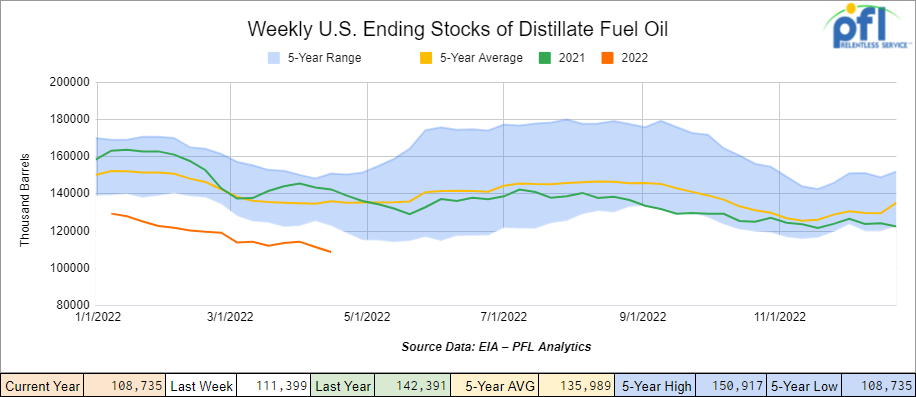

Distillate fuel inventories decreased by 2.7 million barrels week over week and are 20% below the five year average for this time of year.

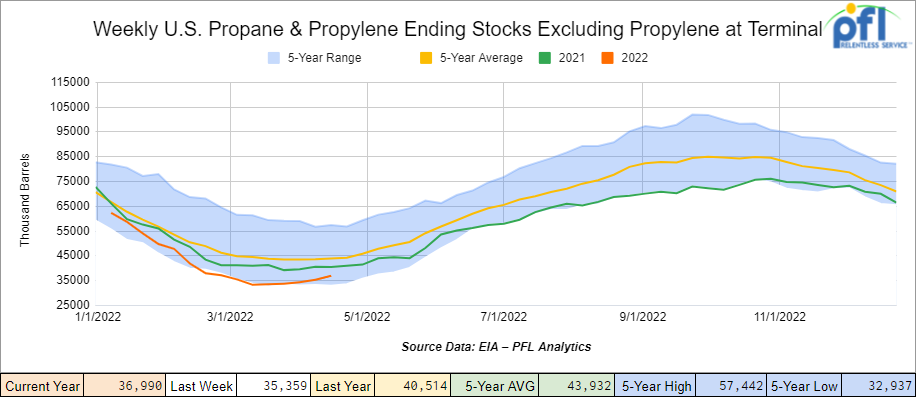

Propane/propylene inventories increased by 1.6 million barrels week over week and are 16% below the five-year average for this time of year.

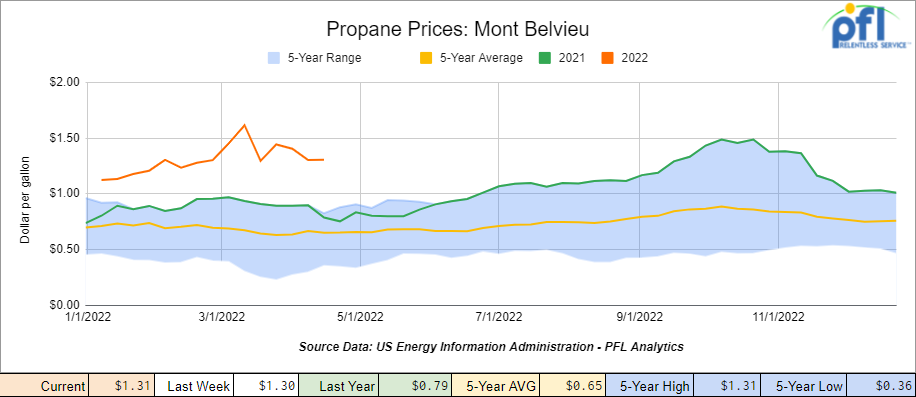

Propane prices closed slightly higher week over week gaining 1 cent per gallon but up 52 cents a gallon year over year.

Overall, total commercial petroleum inventories decreased by 8.1 million barrels week-over-week.

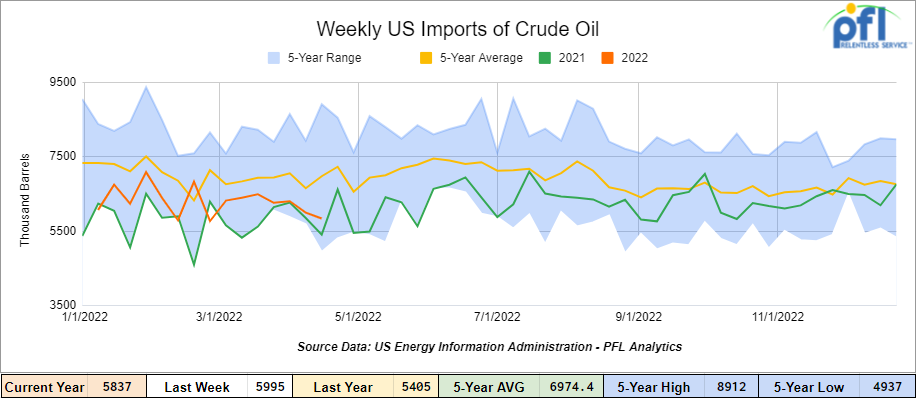

U.S. crude oil imports averaged 5.8 million barrels per day for the week ending April 15th, down by 159,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 3.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 597,000 barrels per day, and distillate fuel imports averaged 104,000 barrels per day for the week ending April 15, 2022.

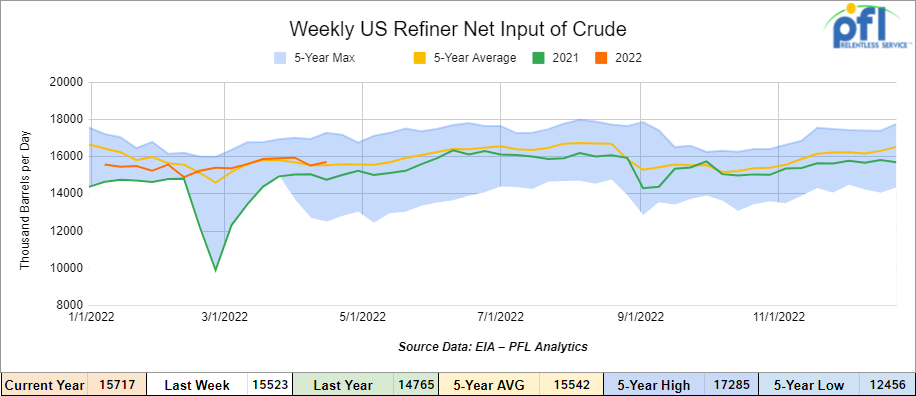

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending April 15, 2022, which was 194,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $97.88, down -$4.19 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 7.5% year-over-year in week 15 (U.S. -8.1%, Canada -5.0%, Mexico -8.8%) resulting in quarter-to-date volumes that are down 4.3% year-over-year and year-to-date volumes that are down 3.9% year-over-year (U.S. -2.9%, Canada -8.5%, Mexico +1.4%). 9 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-8.1%) and grain (-28.4%). The largest increase came from coal (+2.7%).

In the East, CSX’s total volumes were down 0.5%, with the largest decrease coming from intermodal (-3.1%). The largest increase came from motor vehicles & parts (+15.7%). NS’s total volumes were down 5.2% year-over-year, with the largest decrease coming from intermodal (-6.8%).

In the West, BN’s total volumes were down 9.8%, with the largest decreases coming from intermodal (-10.1%), grain (-27.0%), and coal (-4.3%). UP’s total volumes were down 6.2%, with the largest decreases coming from intermodal (-12.5%) and grain (-23.6%). The largest increases came from chemicals (+11.9%) and coal (+9.5%).

In Canada, CN’s total volumes were up 0.1%, with the largest increases coming from coal (+69.3%), motor vehicles & parts (+48.5%) and petroleum (+23.2%). The largest decreases came from farm products (-77.8%), grain (-27.5%) and metallic ores (-10.8%). Revenue per ton-miles was up 0.9%. CP’s total volumes were down 10.2%, with the largest decreases coming from grain (-39.8%) and farm products (-73.0%). Revenue per ton-miles was down 11.9%.

KCS’s total volumes were down 3.6%, with the largest decreases coming from petroleum (-18.4%) and intermodal (-3.8%). The largest increase came from metals & products (+45.5%).

Source: Stephens

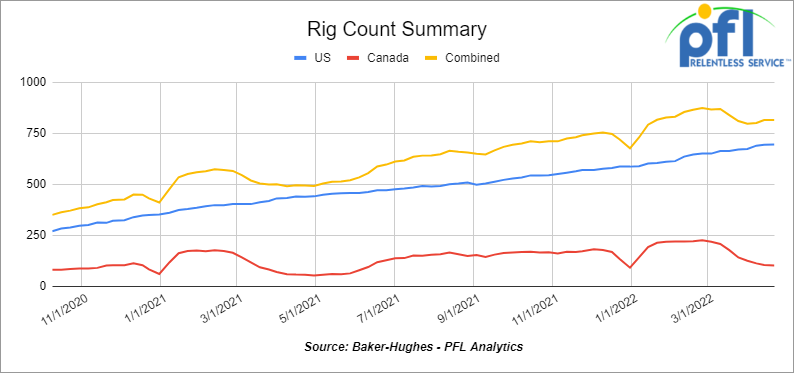

Rig Count

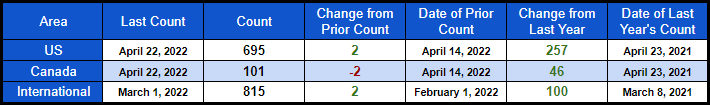

North American rig count is flat week over week. U.S. rig count was up by 2 rigs week-over-week and up by 257 rigs year over year. The U.S. currently has 695 active rigs. Canada’s rig count was down by -2 rigs week-over-week and up by 46 rigs year-over-year and Canada’s overall rig count is 101 active rigs. Overall, year over year, we are up 303 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,061 from 23,339, which is a loss of -278 rail cars week-over-week. Canadian volumes were mixed: CP shipments rose by 8.2% while CN volumes were down by 5.1%. U.S. volumes were down across the board with the BN having the largest percentage decrease (down by 11.3%).

STB to Hold Meetings This Week

On Tuesday and Wednesday, the STB will hold hearings to discuss the current state of freight rail service, where 11 panels are scheduled to discuss current issues over the two days. The first two rails to report this week are UP and CSX. Rail service continues to be a significant issue and has impeded growth and has even shut down and slowed down some plants that rely on rail service. At the same time, some have had to put more cars into service as turnaround times have been so bad at the end of the day putting fuel on the fire as the class ones are now wanting cars off their network. It is a problem folks. The rails point to hiring as the source of the problem, we look for more clarity on problems and solutions to improve the network Stay tuned to PFL we will be watching this closely.

Man Dies from Injuries after a Hazardous Materials Incident

One man has unfortunately been pronounced dead after a “hazardous materials incident” left him and another with serious injuries earlier this month at an Eagle Rail Car facility in Indiana.

Washington Indiana Police Detective Barry Hudson was contacted by an Eagle Railcar Services employee saying a man was down on the property. Officials said the call quickly changed to an incident involving two men down on the property.

Life-saving measures were performed on both men by first responders on the scene before they were transferred to a hospital facility in Evansville, Indiana. James Ware, one of the men injured in the incident, passed away on Easter.

The Indiana Occupational Safety and Health Administration says it is conducting a “safety compliance inspection” that could take several months.

Update on DOE selling our emergency Oil Reserves

Well folks it’s the same old same old, let’s sell our emergency reserves instead of motivating production increases and fast-tracking new pipelines and expansions waiting to be built. The DOE issued Contract Awards for 30 Million Barrels of Crude Oil, on Thursday of last week and announced plans for a third emergency sale on what it says is “to address continued market and supply disruptions related to President Putin’s war on Ukraine.”

Combined with already-scheduled releases, these contracts mean that the SPR is now scheduled to deliver 50 million barrels in May and June. The DOE plans to issue a third Notice of Sale on May 24, 2022, for an additional 40 million barrels and for delivery starting in June, and further details will be posted at that time.

The DOE says “These releases come as a part of a comprehensive plan to address Putin’s “Price Hike” at the pump and to establish true energy independence and lower costs for Americans into the future.” Folks, we totally disagree with this statement if we were energy independent like we once were, we would not have a price hike and we could care less what Putin is doing in Ukraine (aside from his humanitarian crimes). It is this administration’s actions of stifling oil and gas companies’ investments and canceling or holding up pipeline expansion whenever and wherever they can.

On April 1, 2022, DOE issued the second Notice of Sale for a price-competitive sale of 30 million barrels of SPR crude oil. A total of 16 companies responded to this notice, submitting 126 bids for evaluation. Contracts were awarded to the following 12 companies:

- Atlantic Trading & Marketing, Inc. (2.1 million barrels)

- Chevron USA (1.025 million barrels)

- Equinor Marketing & Trading (0.7 million barrels)

- ExxonMobil Oil Corporation (3.6 million barrels)

- Glencore Ltd. (2.6 million barrels)

- Marathon Petroleum Supply and Trading LLC (2.375 million barrels)

- Mercuria (0.5 million barrels)

- Motiva Enterprises LLC (4.05 million barrels)

- Phillips 66 Company (2.5 million barrels)

- Shell Trading (US) Company (2.75 million barrels)

- Unipec America, Inc. (0.95 million barrels)

- Valero Marketing and Supply Company (6.85 million barrels)

From this sale, the SPR sold a total of 30 million barrels, and of that amount, 8 million barrels were sold from the SPR’s Bryan Mound site (near Freeport, TX), 9.6 million barrels from the West Hackberry site (near Hackberry, LA), 3.7 million barrels from the Bayou Choctaw site (near Baton Rouge, LA), and 8.7 million barrels from the Big Hill site (near Winnie, TX).

For more information on the administration’s sale of our emergency reserves stay tuned to PFL.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off of the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag gons needed in Texas off of the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off of the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty-to-dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the Midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 268 multiple locations negotiable

- 100 3200 Covered Hoppers for sale price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|