“I’ve missed more than 9000 shots in my career. I’ve lost almost 300 games. 26 times, I’ve been trusted to take the game-winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Michael Jordan

Jobs Update

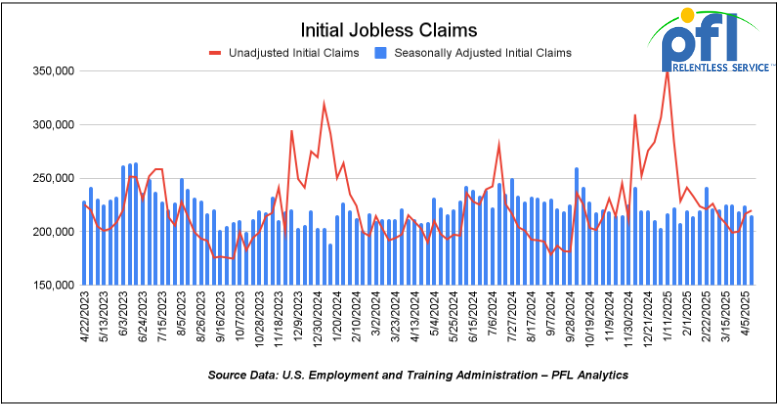

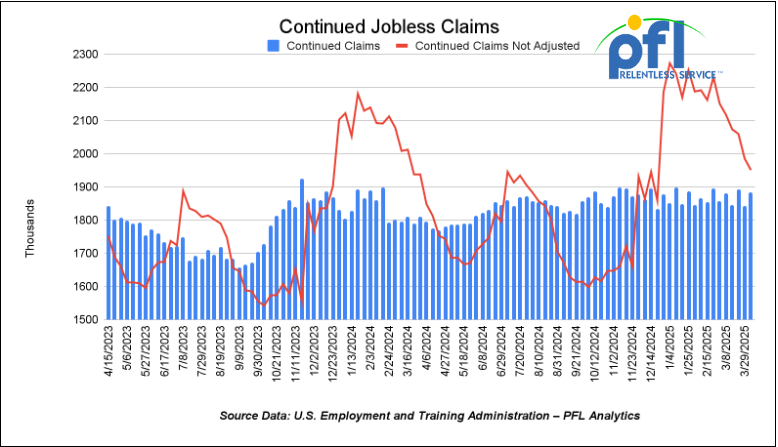

- Initial jobless claims seasonally adjusted for the week ending April 12th came in at 215,000, down 9,000 people week-over-week.

- Continuing jobless claims came in at 1.885 million people, versus the adjusted number of 1.844 million people from the week prior, up 41,000 people week-over-week.

Stocks closed mixed on Thursday of last week, but lower week over week

The DOW closed lower on Thursday of last week, down -486.41 points (-1.23%) and closing out the week at 39182.98, down -1029.73 points week-over-week. The S&P 500 closed higher on Thursday of last week, up 10.99 points, and closed out the week at 5,286.69, but lower -76.67 points week-over-week. The NASDAQ closed lower on Thursday of last week, down 33.36 points (-0.2%), and closed out the week at 16,273.8, down -450.66 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,955 this morning, down 374 points from Friday’s close.

Crude oil closed higher on Thursday of last week and higher week over week.

West Texas Intermediate (WTI) crude closed up $2.16 per barrel (3.5%), to close at $64.68 per barrel on Thursday of last week, up $3.18 per barrel week over week. Brent traded up $2.11 USD per barrel (3.2%) on Thursday of last week, to close at $67.96 per barrel, up $3.20 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for June delivery settled on Thursday of last week at US$9.60 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$51.46 per barrel.

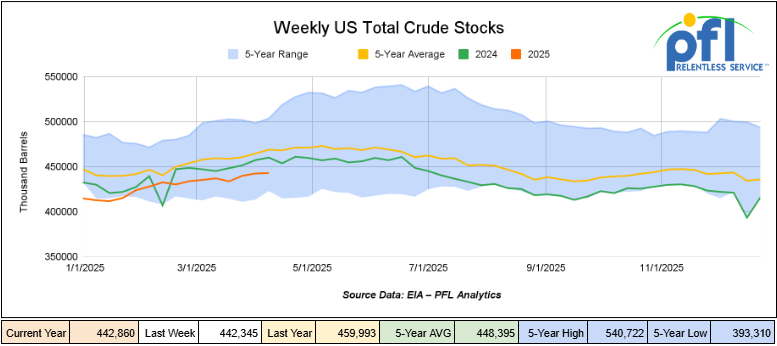

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 500,000 barrels week-over-week. At 442.9 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

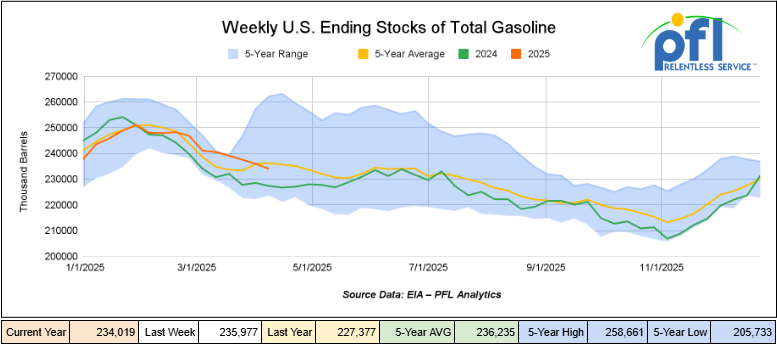

Total motor gasoline inventories decreased by 2 million barrels week-over-week and are 1% below the five-year average for this time of year.

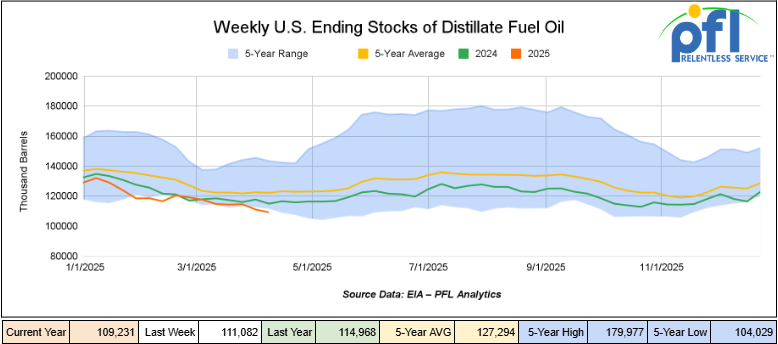

Distillate fuel inventories decreased by 1.9 million barrels week-over-week and are 11% below the five-year average for this time of year.

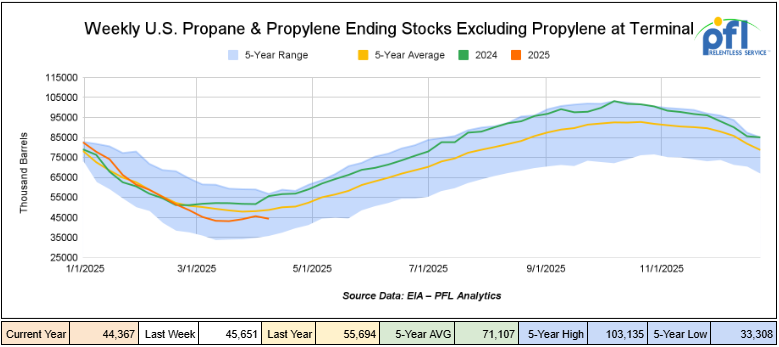

Propane/propylene inventories decreased by 1.3 million barrels week-over-week and are 9% below the five-year average for this time of year.

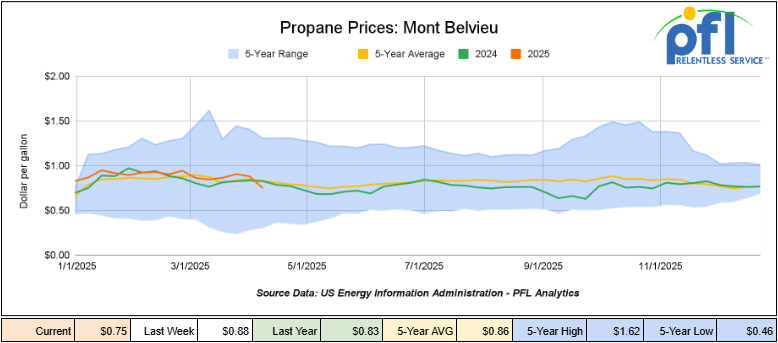

Propane prices closed at 75 cents per gallon on Friday of last week, down 13 cents per gallon week-over-week, and down 8 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 2.1 million barrels during the week ending April 11, 2025.

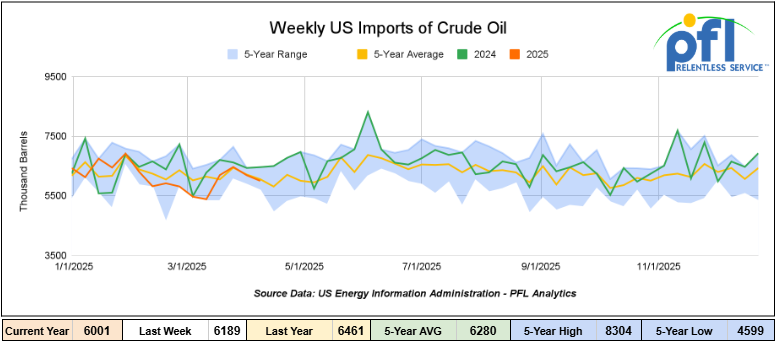

U.S. crude oil imports averaged 6 barrels per day last week, decreased by 189,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 6.2 million barrels per day, 5.2% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 531,000 barrels per day, and distillate fuel imports averaged 102,000 barrels per day during the week ending April 11, 2025.

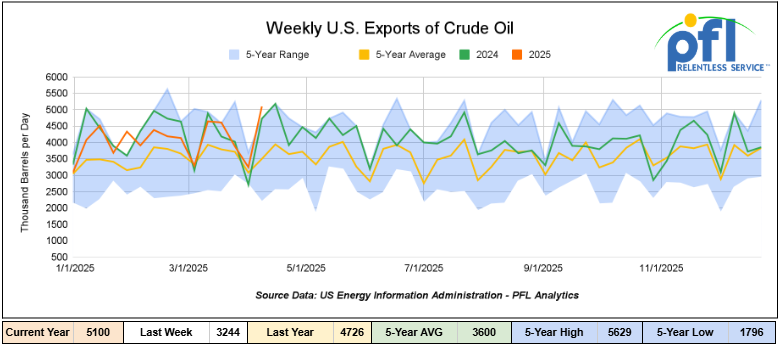

U.S. crude oil exports averaged 5.1 million barrels per day during the week ending April 11, 2025, an increase of 1.856 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.209 million barrels per day.

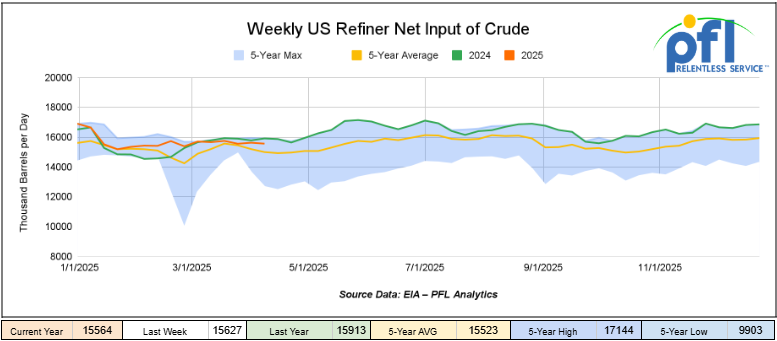

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending April 11, 2025, which was 64 thousand barrels per day less week-over-week.

WTI is poised to open at $62.77, down -1.91 per barrel from Thursday’s close.

North American Rail Traffic

Week Ending April 16, 2025.

Total North American weekly rail volumes were up (2.94%) in week 16, compared with the same week last year. Total carloads for the week ending on April 16 were 336,789, up (1.52%) compared with the same week in 2024, while weekly intermodal volume was 336,101, up (4.41%) compared to the same week in 2024.

7 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest increase came from Grain, which was up (18.82%) while the largest decrease was from Forest Products, which was down (-6.79%)

In the East, CSX’s total volumes were up (3.58%), with the largest decrease coming from Farm Products (-8.18) while the largest increase came from Grain (38.82%). NS’s volumes were up (6.7%), with the largest increase coming from Petroleum and Petroleum Products (28.21%) while the largest decrease came from Farm Products (-3.63%).

In the West, BN’s total volumes were up (2.8%), with the largest increase coming from Coal (15.85%) while the largest decrease came from Metallic Ores and Metals (-15.27%). UP’s total rail volumes were up (4.23%), with the largest increase coming from Grain (23.88%), while the largest decrease came from Motor Vehicles and Parts (-11.19%).

In Canada, CN’s total rail volumes were down (-12.28%) with the largest increase coming from Grain, up (+49.51%), while the largest decrease came from Intermodal (-29.34%). CP’s total rail volumes were down (-7.54%) with the largest increase coming from Coal (25.77%), while the largest decrease came from Other (-27.42%).

KCS’s total rail volumes were up (10.95%) with the largest increase coming from Coal (+36.09%), while the largest decrease came from Motor Vehicles and Parts (-30.15%).

Source Data: AAR – PFL Analytics

Rig Count

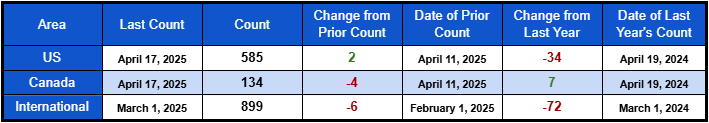

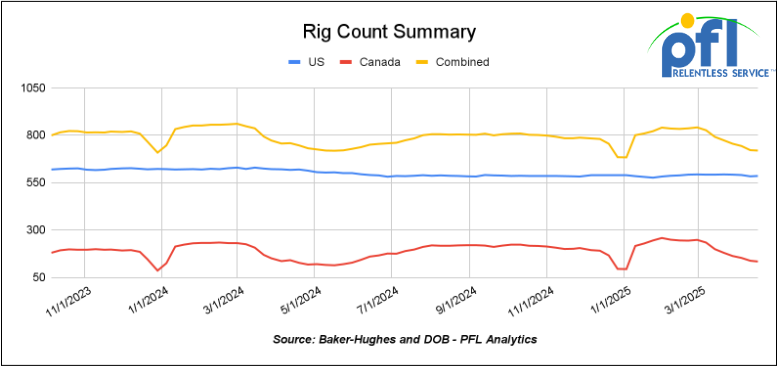

North American rig count was down by -2 rigs week-over-week. U.S. rig count was up 2 rigs week over week and up by 2 rigs year-over-year. The U.S. currently has 585 active rigs. Canada’s rig count was down -4 rigs week-over-week and up by 7 rigs year-over-year. Canada currently has 134 active rigs. Overall, year over year we are down by -27 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We were attending AAR Tank Car Committee Meeting last week

PFL was on the ground in Nashville, TN last week for the AAR Tank Car Committee and Hazmat meetings (April 14–17) as an exhibitor and an attendee. These annual meetings are a key touchpoint between regulators, car owners, and industry partners. The Spring 2025 meeting brought several important regulatory updates and compliance changes that directly affect tank car owners and fleet operators.

Key Updates from the AAR Tank Car Committee Meetings – April 2025

Here’s what you need to know—and what steps you should take now to stay compliant.

1. Phase-Out of Class 111 & CPC-1232 Cars – May 1, 2025, Deadline

One of the most pressing topics was the final phase-out of legacy tank cars used to move Class 3 flammable liquids (like crude and ethanol). Both U.S. and Canadian regulators are aligned on this:

- In Canada: As of May 1, 2025, Class 111 and CPC-1232 tank cars (including jacketed/unjacketed) can no longer be used for flammable liquid service. Importantly, Transport Canada has confirmed no Temporary Certificates (OTMA) will be issued to allow continued use past this date.

- In the U.S., PHMSA and FRA have also confirmed that May 1, 2025, marks the end for jacketed CPC-1232 cars used in Packing group I flammable service unless upgraded to DOT-117 spec. Packing Group II & III Flammable liquids phase out is still set for May 1st, 2029..

Review your fleet for any non-compliant cars that will either need to be retrofitted to DOT-117 standards or removed from service to avoid operational disruptions.

2. Update Your Contact Information in FindUs.Rail

Railroads are urging car owners to update contact information in FindUs.Rail to ensure quick communication if repairs are needed, avoiding delays from outdated or multiple ownership records.

3. Fiberglass-Only 117R Cars – Special Compliance Requirements

Operators using fiberglass-only 117R cars need to ensure they are:

- Outfitted with a modification marking plate.

- Covered under the appropriate Equivalency Certificate.

- Clearly marked with the SR-number.

This is critical for both compliance and ensuring your cars remain eligible for interchange.

4. 4-Port Pressure Air Test Requirement – Effective July 1, 2025

Starting July 1, 2025, all Single Car Air Brake Tests (SCABT) must use a 4-Port Pressure Air Test, as required by the AAR’s Standard S-4027.

This test uses four pressure sensors to monitor the performance of the brake system during testing, giving a more complete and accurate picture of system integrity. It’s a major step up from traditional testing methods and helps catch issues that could go unnoticed otherwise.

Why it matters:

If your testing doesn’t meet this new standard by the deadline, your cars may be flagged as non-compliant and pulled from service, potentially impacting operations.

What to do now:

- Upgrade testing equipment: Ensure your cars are equipped with AAR-approved 4-port adapters.

- Train staff: Make sure your teams understand the new procedure and are prepared to execute it properly.

- Audit compliance: Confirm that every SCABT conducted on your fleet after July 1 meets the 4-port requirement—older methods will not be accepted.

Fleet owners should check with their contract shops or in-house maintenance teams to verify readiness ahead of the deadline.

5. FRA Audits Emphasize Owner Responsibility

The Federal Railroad Administration (FRA) completed 27 car owner audits so far in 2025, with a strong focus on training and responsibility.

Key message:

Car owners—not shops—are responsible for repairs on cars that fail inspection. Ensure you have the right training programs and oversight in place to maintain compliance.

6. Canadian Regulatory Update

TDG Oversight Shift

As a reminder, April 1, 2025, Transport Canada restructured its TDG program:

- TDG rail inspectors now report to the Rail Safety and Security Directorate (RSS).

- Other TDG tasks, like regulations and risk management, stay under the TDG Program Hub.

Tank Car Standards

TP14877-2018 is still in effect. However, a new standard—CGSB-43.147-2023 (updated Feb 2025)—has been published and is expected to be adopted soon. It’s available on the CGSB site.

Inspection Red Flags

Recent TC inspections flagged issues that could ground cars, including uncalibrated test tools, missing procedures, lack of owner approval, incomplete qualification stencils, and poor loading oversight.

Action Items:

- Keep documentation up to date

- Ensure shops follow approved procedures

- Regularly review inspection and record-keeping processes

Summary of Key Action Items

To avoid service interruptions and compliance violations, here’s what to focus on now:

- Transition or upgrade DOT-111 and CPC-1232 cars used in Canada before the May 1, 2025, deadline.

- Update your FindUs.Rail profile to ensure your cars are traceable and contactable.

- Comply with fiberglass-only 117R marking and certification requirements.

- Prepare for the 4-port pressure test rule which is taking effect July 1, 2025.

- Review your inspection and repair responsibilities—car owners are ultimately accountable.

- Audit your shops and loading facilities to address known issues before inspections.

At PFL, we’re here to help you keep your fleet running smoothly and in full compliance. If you’re unsure of how these updates affect your operations or need help finding compliant equipment, our team is ready to assist. Contact us anytime — we’re here to help!

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 27,297 from 27,268 which was an increase of 29 rail cars week-over-week. Canadian volumes were higher. CPKC’s shipments were higher by +15.4% week over week, CN’s volumes were higher by +11.4% week-over-week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +7.9%. The CSX was the sole decliner and was down by -9.1%

We are watching Pipelines

Keystone

South Bow Corp. has safely restarted the Keystone Pipeline (Keystone) after receiving regulatory approval from the Pipeline and Hazardous Materials Safety Administration (PHMSA), following South Bow’s response to an oil release at Milepost 171 (MP-171) of Keystone on April 8, 2025, near Fort Ransom, North Dakota.

According to the company’s website, South Bow is actively progressing its response and recovery efforts, having repaired and replaced the impacted pipe, and recovered substantially most of the estimated release volume of 3,500 barrels of oil, working now to remediate the impacted soil. South Bow’s primary focus remains the safety of onsite personnel and mitigating risks to the environment and the community surrounding Fort Ransom. South Bow says it will continue working closely with regulators, local officials, landowners, and the community.

On April 11, 2025, PHMSA issued a Corrective Action Order (CAO), requiring South Bow to undertake certain corrective actions in response to the MP-171 incident. As part of the CAO, South Bow developed a restart plan that was subsequently approved by PHMSA, authorizing Keystone’s return to service under certain operating pressure restrictions. South Bow says that they are committed to the safe operation of Keystone and has notified the Canada Energy Regulator that the Company is also implementing certain operating pressure restrictions on the Canadian sections of the pipeline. The pipeline was operating within its design and regulatory approval requirements at the time of the incident.

Keystone Pipeline System

Spanning 4,300 Km the pipeline transports liquids across three Canadian provinces and eight US states

Source: Southbow – PFL Analytics

Enbridge Line 5

Folks, this one has not hit the radar for some time. Enbridge Line 5 is a 645-mile oil pipeline owned by the Canadian multinational corporation Enbridge. Constructed in 1953, the pipeline conveys crude oil from western Canada to eastern Canada via the Great Lakes states. Line 5 is part of the Enbridge Lakehead System and passes under the environmentally sensitive Straits of Mackinac, which connect Lake Michigan to Lake Huron. The 30-inch pipeline carries 540,000 barrels of synthetic crude, natural gas liquids, sweet crude, and light sour crude per day. Line 5 runs between Superior, Wisconsin, and Sarnia, Ontario. The Enbridge terminal at Superior transports western Canadian crude oil from various incoming pipelines (including lines 1–4) to Line 5 and Line 6, which go around the northern and southern shores of Lake Michigan respectively. From Superior, Line 5 travels east to the Upper Peninsula of Michigan, then runs southeast to Rapid River, near Escanaba. Governor Whitmer of Michigan wanted the pipeline shut down really badly and in fact ordered it to be shut down. She sided with native Americans and environmental groups. Enbridge refused to comply with her order and it has been in the courts for some time. Well, it looks as though the Trump administration stopped the nonsense last week.

The U.S. Army Corps of Engineers Detroit District, heeding an emergency order from President Donald Trump to expedite the review process for energy supply projects, will accelerate its permitting process for a proposed tunnel for an oil and gas pipeline under the Straits of Mackinac lake bottom.

Line 5 Tunnel Proposal

We are watching Key Economic Indicators

Industrial Output and Capacity Utilization

Manufacturing accounts for approximately 75% of total output. Manufacturing output in March was down 0.32% from February 2025.

Capacity utilization is a measure of how fully firms are using the machinery and equipment. Capacity Utilization was down 0.45% from February in March.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 5000CF Covered Hoppers needed off of UP or BN in Houston for 6 Month. Cars are needed for use in Fertilizer service. Needed ASAP

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, 30K Any Type Tanks needed off of various class 1s in various locations for 1-5 years. Cars are needed for use in Condensate service.

- 6, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Av Gas service.

- 10, 25.5K-30K 117R or 117J Tanks needed off of UP or BN in Texas for 1 year. Cars are needed for use in Dicyclopentadiene service.

- 70, 30K DOT 117R/ DOT 117J Tanks needed off of UP in Corpus Christi for 5 Year. Cars are needed for use in Gasoline service.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in US and Canada. Cars were last used in Propane. Summer or Longer Lease Available.

- 100, 6250, Covered Hoppers located off of UP in US . Cars were last used in DDG. 1 Year term. Dirty to Dirty. Free move on UP.

- 25-50, 19.6K, DOT 111 Tanks located off of UP in US. Cars were last used in Molases .

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website