“Success is not final, failure is not fatal: it is the courage to continue that counts.”

Winston Churchill

COVID 19 and Markets Update

It seems like GroundHog Day at this point folks but, the battle continues with COVID -19 as cases continue to rise over the weekend in the U.S. and deaths from the Chinese Virus inflicted on the United States and the rest of the world continue. In the United States, we currently have 759,786 confirmed cases and 40,683 confirmed deaths. Restrictions are easing in certain states for now and the path forward is now being left up to the individual governors and each individual State to get back to work. Here in Florida, we are now allowed to go to the beach once again!The United States and Canada have agreed to keep their shared border closed for non-essential travel for another 30 days to prevent the spread of the coronavirus. The restrictions on the world’s longest border crossing took effect on March 21, while allowing trade and other travel deemed essential to continue. “This is an important decision and one that will keep people on both sides of the border safe,” Trudeau said in a news conference on Saturday. Canada, with a population of 38 million people (roughly 10% of the U.S. population), has more than 32,000 cases of infection and 1,340 deaths from COVID-19, as of Saturday. Several of America’s hardest-hit areas including New York State share a border with Canadian provinces. Both countries have testing shortages.

It was not a good jobs report on Thursday of last week, as approximately 5 million jobs were lost, bringing the total losses since the outbreak to over 22 million.

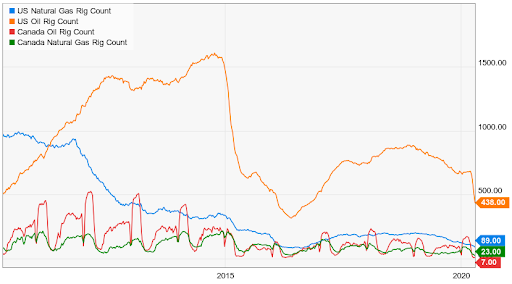

In last week’s rail report, we wrote about the historic deal that OPEC announced and our conclusion was “that it really didn’t matter.” Unfortunately, it looks like we were right. While the production cut is effective in May, the Saudis have been slamming the U.S. with cheap oil. Saudi oil shipments to the U.S. have nearly quadrupled since February to a whopping 1.46 million barrels per day in the first two weeks of April. To further exacerbate a bad situation, there are 20 Saudi tankers headed to the gulf carrying 40 million barrels of crude oil for an expected arrival in late May. Talk about kicking a guy when he is down! Crude by rail is all but dead in the short term as producers across North America decide to shut in production due to economic conditions making it difficult to secure barrels for future delivery and loadings, particularly in the Bakken. Despite all the negative news with energy and crude, energy stocks have rallied over the last couple of sessions as the market anticipates this being the bottom and a sharp rebound is likely at some point. We would agree with this forecast. Oil is getting pretty close to free, particularly in Canada, where it costs more to have a pint of beer than to buy a barrel of crude!

Oil is lower in overnight trading and WTI is poised to open lower and as of the writing of this report (8:15 EST) WTI is printing $11.23 down 38.5% per barrel from Friday’s close

Equities traded up on Friday, with the DOW closing up 704.81 points or 3.0% on the day. This gain was propelled by Gilead Sciences Inc (GILD) experimental drug “Remdesivir” seemingly having a dramatic effect on 125 patients suffering from COVID-19 in Chicago. Overnight trading futures traded lower and we are expected to open down 512 or 2.12% (8:15am EST) points on the DOW.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

Total North American rail volumes were down 20.1% year over year in week 15 (U.S. -21.9%, Canada -12.2%, Mexico -28.5%), resulting in QTD volumes that are down 18.1% and year to date volumes that are down 7.7% (U.S. -9.1%, Canada -4.3%, Mexico -1.7%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-18.6%), coal (-34.3%) and motor vehicles & parts (-87.8%).In the East, CSX’s total volumes were down 23.2%, with the largest decreases coming from intermodal (-18.7%), motor vehicles & parts (-90.5%) and coal (-36.2%). NS’s total volumes were down 32.8%, with the largest decreases coming from intermodal (-26.4%), coal (-56.2%) and motor vehicles & parts (-92.5%).

In the West, BN’s total volumes were down 17.4%, with the largest decreases coming from intermodal (-15.3%), coal (-30.7%), motor vehicles & parts (-75.9%), petroleum (-21.6%) and stone sand & gravel (-32.3%). The largest increase came from grain (+16.6%). UP’s total volumes were down 22.0%, with the largest decreases coming from intermodal (-22.9%), motor vehicles & parts (-86.8%) and coal (-27.7%).

In Canada, CN’s total volumes were down 15.4% with the largest decreases coming from intermodal (-14.4%), motor vehicles & parts (-90.1%), petroleum (-27.8%) and lumber & wood (-28.8%). The largest increase came from metallic ores (+10.4%). RTMs were down 12.8%. CP’s total volumes were down 8.5%, with the largest decreases coming from motor vehicles & parts (-76.3%) and coal (-31.7%). The largest increase came from chemicals (+17.1%). RTMs were down 7.2%.

KCS’s total volumes were down 22.9%, with the largest decreases coming from intermodal (-35.6%) and motor vehicles & parts (-92.5%).

The Surface Transportation Board released March’s headcount data for the U.S. rails. For the industry as a whole, March headcount was down 11.8% year over year versus February’s headcount that was down 12.5% year over year. We are not surprised to see additional reductions given the current economic environment. We expect headcount reductions to continue as the impact from COVID-19 materializes more meaningfully in the days to come.

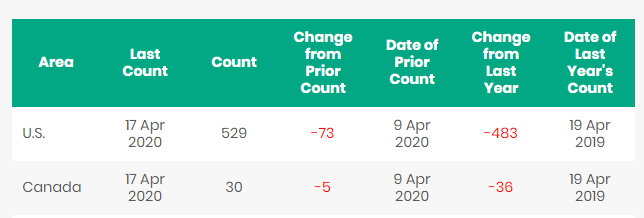

North American rig count is down 78 rigs week over week with the U.S. losing 73 rigs and Canada losing 5 rigs week over week. Year over year we are down 519 rigs collectively. Cuts in drilling continue as demand for oil continues to decline and storage continues to fill. Canada now only has 30 rigs nationwide operating and the U.S. has 529.

North American Rig Count Summary

Another blow to the rail car industry is Greenbrier Companies in the U.S. decision to suspend the production of new railcars in the Greenbrier Gunderson manufacturing facility in Portland, Oregon. The move was taken due to the economic impact of Covid-19 according to Greenbrier’s press release. The changes in production and staff are based on the projected freight railcar demand in the future and the previously announced measures of cost-cutting and strengthening of the balance sheet. Greenbrier laid off 200 production workers and office staff, some of whom will receive severance packages.

Railcar Markets

PFL is offering: 25.5s for any service. 117Rs last used in diesel for dirty to dirty lease. CPC1232 non coil non insulated last used in gasoline service. Call PFL for details today as the markets as changing daily!

PFL is seeking: seeking: 50-100 340Ws for winter service in the Conway area, Plate C boxcars and 20 CO2 Cars.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|