“You have power over your mind – not outside events. Realize this, and you will find strength.”

― Marcus Aurelius

Jobs Update

The number of Americans applying for unemployment benefits tumbled last week to 576,000, a post-COVID-19 low and a sign that layoffs are easing as the economy recovers from the pandemic recession. The Labor Department said Thursday that applications plummeted by 193,000 from a revised 769,000 a week earlier. Jobless claims are now down sharply from a peak of 900,000 in early January.

For the week ending March 27th, 16.9 million people were continuing to collect jobless benefits, down from 18.2 million in the previous week.

The drop in claims comes after employers added 916,000 jobs in March, the most since August, in a sign that a sustained recovery is taking hold as vaccinations accelerate, and pandemic business restrictions are lifted in many blue states.

Markets were up Week over Week- Reaching new all-time Highs

The Dow closed higher on Friday of last week, up +164.68 (+0.48%) closing out the week at 34,200.67 points, up +400.07 points week over week. The S&P 500 closed higher on Friday of last week, up +15.05 points (+0.36%) and closing out the week at 4,185.47 4, up +56.67 points week over week. The Nasdaq closed higher on Friday of last week, up +13.58 points (+0.10%) closing out the week at 14,052.34 points, up +152.15 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 76 points.

Crude up week over week as demand bounces – U.S. Dollar weaker

WTI crude oil declined -$0.33 to settle at $63.23 a barrel on Friday of last week, up $3.91 a barrel week over week. Brent crude oil also closed lower losing -$0.17 a barrel on Friday of last week, closing at $66.77 a barrel, up $3.82 per barrel week over week. Although oil prices traded down slightly on Friday they closed up week over week as financial markets hit new records and we had some positive economic data from the US reporting agencies. U.S. retail sales surged in March, up 9.8%, much better than expected. This can be attributed in part to the vaccine rollout, blue states finally opening up and joining the party and stimulus payments, data shows the economy is now rebounding across many sectors. Sophie Griffiths of OANDA said “Better-than-expected stockpile data – both EIA and API – a weaker U.S. dollar and optimism surrounding more energy demand helped oil book its strongest daily gains since late March on Wednesday”. Supply discipline going forward will be key for oil price direction. The USD fell to a four week low on Thursday of last week.

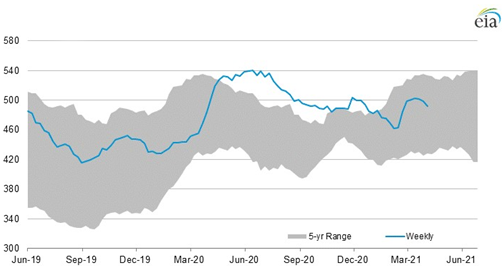

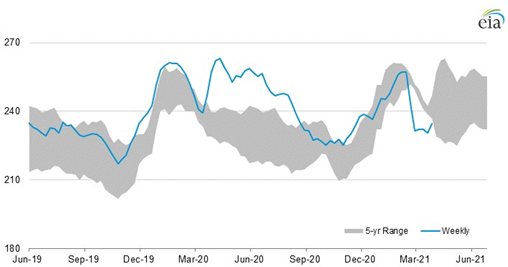

U.S. commercial crude oil inventories decreased by 5.9 million barrels from week over week. At 492.4 million barrels, U.S. crude oil inventories are 1% above the five year average for this time of year. Total motor gasoline inventories increased by 300,000 barrels week over week and are 2% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. (See Charts below for U.S. Crude and Gasoline stock piles)

U.S. Commercial Crude Oil Stocks (million of barrels)

U.S. Commercial Gasoline Stocks (million of barrels)

Distillate fuel inventories decreased by 2.1 million barrels week over week and are 4% above the five year average for this time of year.

Propane/propylene inventories increased by 1.0 million barrels week over week and are 16% below the five year average for this time of year. Total commercial petroleum inventories decreased by 9.1 million barrels last week.

U.S. crude oil imports averaged 5.9 million barrels per day last week, down by 411,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.0 million barrels per day, 0.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 839,000 barrels per day, and distillate fuel imports averaged 261,000 barrels per day.

U.S. crude oil refinery inputs averaged 15.1 million barrels per day during the week ending April 9, 2021 which was 7,000 barrels per day more than the previous week’s average. Refineries operated at 85.0% of their operable capacity last week. Gasoline production increased last week, averaging 9.6 million barrels per day. Distillate fuel production increased last week, averaging 4.6 million barrels per day.

Oil is lower in overnight trading and, as of the writing of this report, WTI is poised to open at $62.96, down 17 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 22.2% year over year in week 14 (U.S. +24.5%, Canada +10.8%, Mexico +48.4%) resulting in year to date volumes that are up 6.2% year over year (U.S. +6.8%, Canada +6.9%, Mexico -4.0%). All of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+28.4%), motor vehicles & parts (+468.0%) and coal (+15.0%).

In the East, CSX’s total volumes were up 25.5%, with the largest increases coming from intermodal (+37.3%), motor vehicles & parts (+513.5%), coal (+14.0%) and chemicals (+15.2%). NS’s total volumes were up 29.9%, with the largest increases coming from intermodal (+30.5%), motor vehicles & parts (+896.0%) and coal (+34.7%).

In the West, BN’s total volumes were up 24.2%, with the largest increases coming from intermodal (+32.5%), coal (+25.4%) and motor vehicles & parts (+211.9%). UP’s total volumes were up 21.4%, with the largest increases coming from intermodal (+31.4%), motor vehicles & parts (+389.2%), chemicals (+14.1%) and grain (+27.7%).

In Canada, CN’s total volumes were up 13.8%, with the largest increases coming from intermodal (+20.4%) and motor vehicles & parts (+376.4%). RTMs were up 11.7%. CP’s total volumes were up 10.9%, with the largest increases coming from motor vehicles & parts (+299.7%), coal (+39.3%), intermodal (+5.5%) and grain (+19.1%). RTMs were up 7.6%.

KCS’s total volumes were up 30.8%, with the largest increases coming from intermodal (+52.1%), motor vehicles & parts (+717.7%), petroleum (+56.1%) and coal (+67.1%)

The Surface Transportation Board (STB) recently released March headcount data for the U.S. rails. For the industry as a whole, March headcount was down 10.1% year over year versus February headcount that was down 10.6% year over year. On a sequential basis, industry headcount was up 0.8% versus the 5-year February average of flat sequentially. Every rail saw year over year declines in headcount but each saw sequential increases. Looking ahead, expect the year over year declines in headcount to moderate based on improving volumes.

Source: Stephens

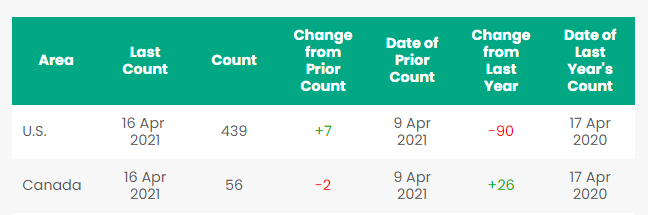

Rig Count

North America rig count is up by 5 rig’s week over week. The U.S. was up by 7 rigs week over week The U.S. currently has 439 active rigs (oil rigs were up seven to 344, gas rigs were up one to 94, and miscellaneous rigs down one rig to one). Canada’s rig count was down by 2 rigs week over week but up by 26 Rigs year over year and Canada’s overall rig count is 56 active rigs. Year over year we are down 64 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

- The Dakota Access Pipeline (“DAPL”) – Is in our mind the most important pressing rail event and we continue to monitor DAPL. As our readers and listeners are aware,The Standing Rock Sioux Tribe who claims DAPL could threaten its water supply really wants the 570,000 barrel per day crude oil pipeline originating from the Bakken shut down and DAPL has been fighting for its life. The Biden administration punted a potential DAPL shutdown to the Judge that ordered the pipeline shut down to begin with – below is a Coles notes update:

a:) Energy Transfer has one week from today the 19th to update the court on potential economic impacts of a shut down.

b:) Energy Transfer last week asked the U.S. Court of Appeals for the District of Columbia to rehear the case. They want the court to rehear the case in which the pipeline was ordered to shut down to begin with. Energy Transfer claims that the appeals court contradicted previous U.S. court decisions.

c:) A decision of a shutdown could be seen in early May or maybe the entire case if Energy Transfer is successful with the District of Columbia will be retried.

d:) If we do see a shutdown, expect a resurgence in crude by rail out of that region. While some crude can be redirected on other pipelines approximately 300,000 barrels per day will need to find a home via rail raising the costs of 117’r and J’s. It is going to be a scramble folks if that happens – keep in touch with PFL for the latest and greatest and get ready to act. - Keeping an eye on Enbridge Line 5 – Another pressing rail event. As our readers and listeners well know the Governor of Michigan – Governor Gretchen Whitmer really wants this pipeline shut down. Coles notes version:

a:) Enbridge Line 5 transports crude and NGLs through Michigan and into Ontario. The pipeline splits into two 20-inch-diameter parallel pipelines (east and west) that travel under the Straits of Mackinac (between Lake Michigan and Lake Huron).

b:) On November 13, 2020 Michigan’s governor filed legal action to force the closure of the pipeline. The government stated that they were revoking an easement granted in 1953 that allowed the company to build Line 5 through the Straits of Mackinac

c:) On January 12, 2021 Enbridge wrote a letter to Governor Whitmer stating that a court order from the Pipeline and Hazardous Materials Safety Administration (under the Department of Transport) would be needed to shut down Line 5. Enbridge disputes that Michigan has the authority to impose a shutdown on a federally approved pipeline and has stated that it will not comply with the order.

d:) The closure of this pipeline could mean lower propane supply in Michigan or need the need for propane to be delivered via rail or truck. Enbridge estimates that the pipeline supplies 65% of propane demand in Michigan’s Upper Peninsula, and 55% of Michigan’s statewide propane needs. A Sarnia fractionator owned by Plains CANADA could be forced to operate at a reduced capacity or shut-down entirely given its reliance on the pipeline and the limitations of rail. Also other refineries on both sides of the border will be drastically affected.

e:) Well, this Friday (April 16th)Enbridge is heading to arbitration as ordered with the State of Michigan, so stay tuned to PFL as we are watching this one closely. With the potential closure of DAPL and line 5 it could be a game changer for rail in 2021. - Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 24,330 from 24,993 a drop of 663 rail cars week over week. Canadian volumes were mixed week over week. CP shipments fell by 7.7% and CN were up by 6.1%. U.S. rail road operators were mostly higher, CSX had the largest percentage decrease, down by 4.7% and the BN was had the largest percentage increase up by 9%.

- Consumer spending and the effects on distribution channels – Retail sales, including food services, as noted increased 9.8% in March month over month according to last Thursday’s Census Bureau data. Furniture and home furnishing sales increased 5.9% from February and 46.8% year-over-year. Building materials and garden supplies (+12.1% and +29.4%, respectively), clothing (+18.3% and +101.1%, respectively), sporting goods (+23.5% and +73.5%, respectively) and non-store sales, or e-commerce, (+6% and +28.7%, respectively) were some of the notable categories.

Trucking volumes consequently have remained at elevated levels as more of the economy comes back online and retailers continue to address diminished inventory levels. Here is the Coles note version on trucking trends:

- Dry-van TL spot rates were relatively unchanged versus 30 days ago, but remain +60% year over year and at decade-highs. Rising fuel prices will also likely add to spot market prices.

- Domestic freight shipments in March were +10% year over year and +6% month over month according to Cass.

- Demand commentary remains positive for 2021 given strong end-market demand and low inventory levels.

- Average truckload rates ex-fuel (weighted average of contract and spot) were 10% higher year over year in March according to Cass Information Systems, and 10% above the multi-year lows during mid-2020.

The high-demand environment is expected to linger as containers continue to flood U.S. ports. The BN has a plan that they put in place to cut intermodal congestion by making operational changes and increasing fees to shippers that don’t move their trains or have their trains moved when promised. Call PFL for more details. We smell inflation folks!

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 30K 117R or J’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.20 Cars (Any Size 28.3K and up) needed for the use in Crude Service. Needed in Kentucky for 1 year

- 80 Pressure cars 340s west or east coast 1-2 years dirty to dirty butane or propane – negotiable

- 200 117Rs in Texas for refined products dirty or clean – price negotiable

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting ASAP.

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-49

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 20-30 29K C/I 117J cars for lease up to 1 year. Dirty in Biodiesel and can be returned dirty.

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken curde and can be returned dirty.

- 100 29K C/I 117J cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 100-200 LPG Tanks dirty to dirty up to 5 years – various locations – negotiable

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 21 111s 29K tanks last in alcohol dirty on the CN in Wisconsin for lease price negotiable

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|