“To be successful, you have to have your heart in your business, and your business in your heart.”

– Thomas Watson

Jobs Update

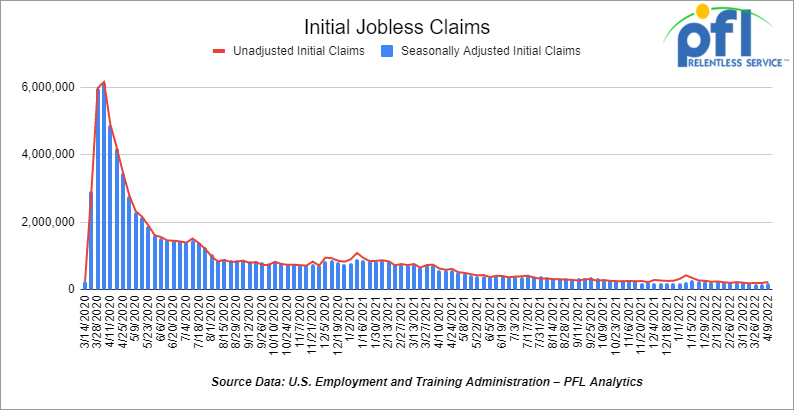

- Initial jobless claims for the week ending April 9th, 2022 came in at 185,000, up 18,000 people week-over-week.

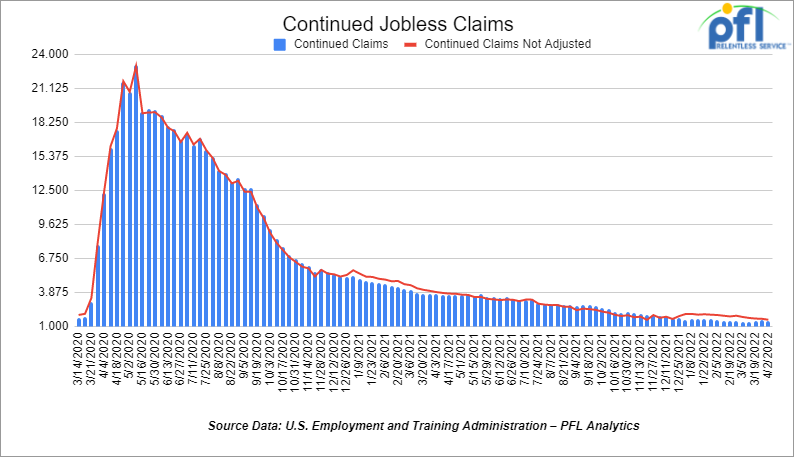

- Continuing claims came in at 1.475 million people versus the adjusted number of 1.523 million people from the week prior, down -48,000 people week-over-week.

Stocks were lower on Thursday of last week and down week-over-week

The DOW closed lower on Thursday of last week, down -133.36 points (-0.33%), closing out the week at 34,451.23 points, down -269.89 points week-over-week. The S&P 500 closed lower on Thursday of last week, down 54 points, and closed out the week at 4,392.59, down -95.69 points week-over-week. The Nasdaq closed lower on Thursday of last week, down -292.51 points (-2.14%), and closed out the week at 13,351.08, down -359.92 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 34,252 this morning down -106 points.

Oil closed higher on Thursday of last week and higher week over week

Oil prices settled higher on Thursday of last week after an early decline as investors covered short positions ahead of the long weekend and on news that the European Union might phase in a ban on Russian oil imports. U.S. West Texas Intermediate futures (WTI) closed up $2.70 per barrel or 2.59% at $106.95 per barrel. Brent futures settled up $2.92, or 2.68% at US$111.70 per barrel. Both contracts recorded their first weekly gain in April.

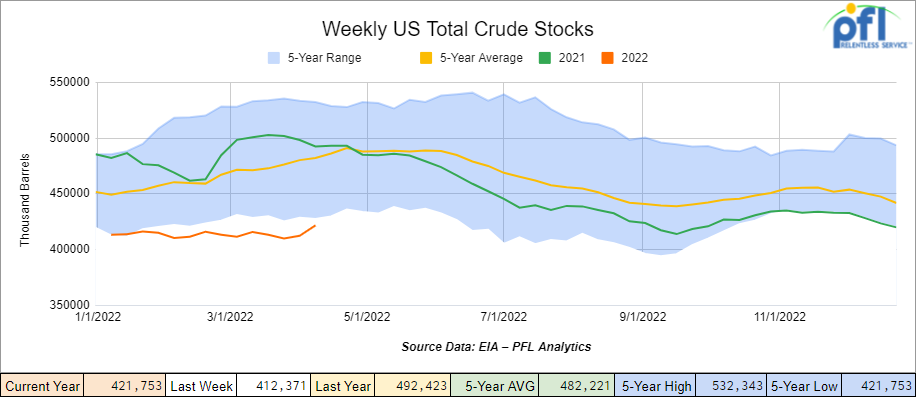

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 9.4 million barrels week over week. At 421.8 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

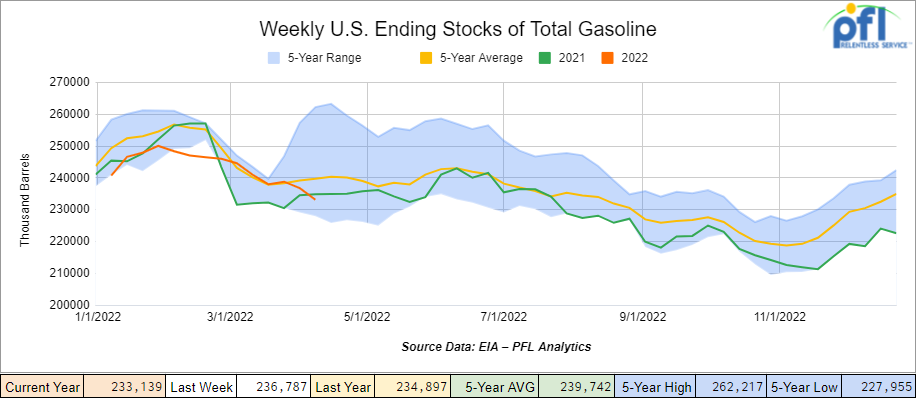

Total motor gasoline inventories decreased by 3.6 million barrels week-over-week and are 3% below the five-year average for this time of year.

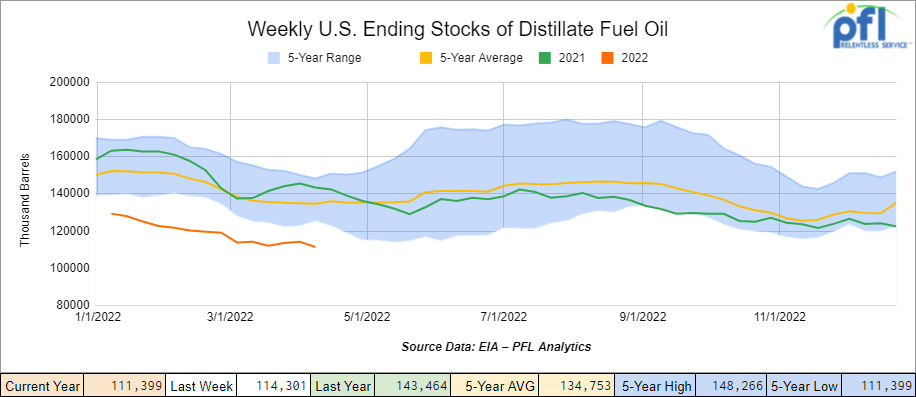

Distillate fuel inventories decreased by 2.9 million barrels week-over-week and are 17% below the five-year average for this time of year.

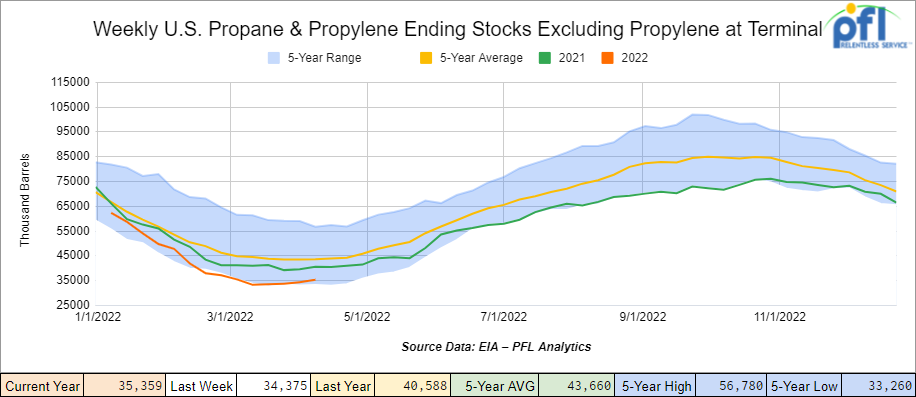

Propane/propylene inventories increased by 1.0 million barrels week-over-week and are 19% below the five-year average for this time of year.

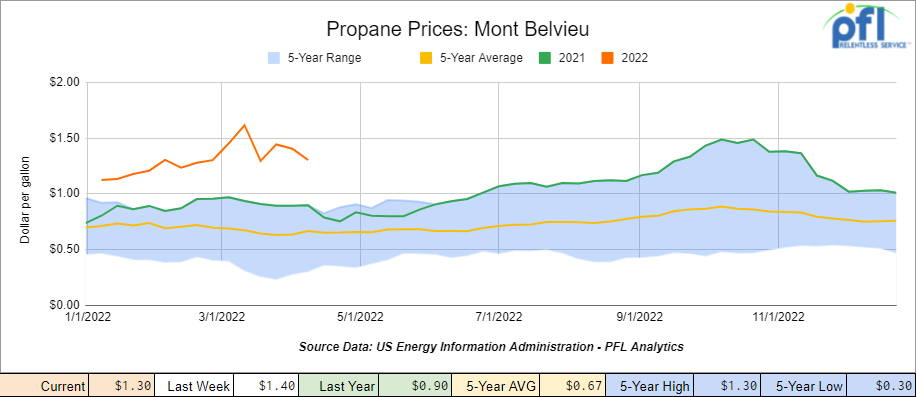

Propane prices are down 10 cents a gallon week over week closing at $1.30 per gallon, up 40 cents a gallon year over year.

Overall, total commercial petroleum inventories increased by 7.4 million barrels week-over-week.

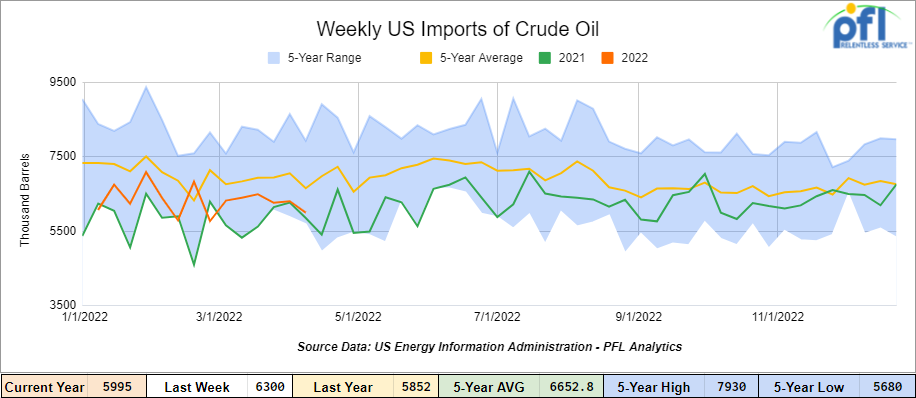

U.S. crude oil imports averaged 6.0 million barrels per day for the week ending April 8th, down by 305,000 barrels per day from the previous week. Over the past four weeks, crude oil imports averaged about 6.3 million barrels per day, 4.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 439,000 barrels per day and distillate fuel imports averaged 154,000 barrels per day for the week ending April 8th.

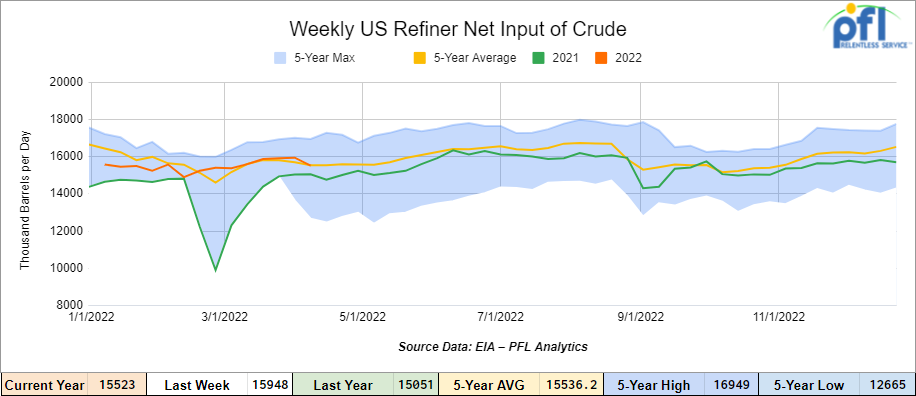

U.S. crude oil refinery inputs averaged 15.5 million barrels per day during the week ending April 8, 2022, which was 424,000 barrels per day less than the previous week’s average.

As of the writing of this report, WTI is poised to open at 106.56, down -0.39 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 1.0% year over year in week 14 (U.S. -1.0%, Canada -0.4%, Mexico -2.2%) resulting in year-to-date volumes that are down 3.7% year over year (U.S. -2.5%, Canada -8.8%, Mexico +2.2%). 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-2.6%) and grain (-10.9%). The largest increases came from coal (+9.6%) and motor vehicles and parts (+8.5%).

In the East, CSX’s total volumes were up 2.6%, with the largest increases coming from intermodal (+3.1%) and stone sand and gravel (+28.2%). NS’s total volumes were up 0.4% year over year with the largest increase coming from stone sand and gravel (+18.6%). The largest decrease came from intermodal (-1.3%).

In the West, BN’s total volumes were down 2.9%, with the largest decreases coming from intermodal (-4.3%) and petroleum (-19.2%). The largest increase came from motor vehicles and parts (+30.5%). UP’s total volumes were up 5.9%, with the largest increases coming from coal (+24.0%) and chemicals (+13.6%). The largest decrease came from intermodal (-1.9%).

In Canada, CN’s total volumes were up 1.3%, with the largest increases coming from coal (+45.5%), petroleum (+46.5%), and motor vehicles and parts (+44.0%). The largest decrease came from grain (-22.4%). Revenue per ton-miles was down 0.3%. CP’s total volumes were down 1.4%, with the largest decrease coming from grain (-30.0%). The largest increase came from coal (+19.7%). Revenue per ton-miles was down 1.8%.

KCS’s total volumes were up 6.9%, with the largest increases coming from intermodal (+12.6%) and metals products (+69.6%). The largest decrease came from petroleum (-32.4%).

Source: Stephens

Rig Count

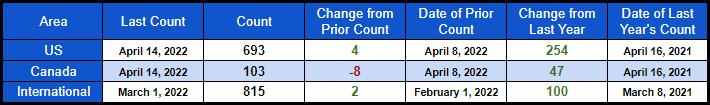

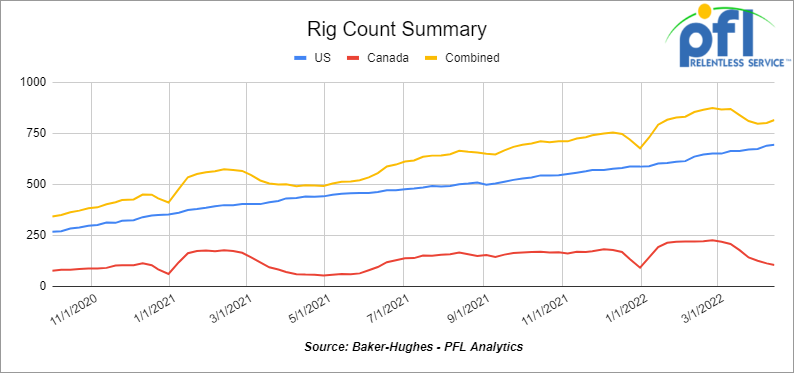

North American rig count is down by 4 rigs week over week. U.S. rig count was up by 4 rigs week-over-week and up by 254 rigs year over year. The U.S. currently has 693 active rigs. Canada’s rig count was down by -8 rigs week-over-week and up by 47 rigs year-over-year and Canada’s overall rig count is 103 active rigs. Overall, year over year, we are up 301 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,339 from 23,363, which is a loss of 24 rail cars week-over-week. Canadian volumes were mixed: CP shipments fell marginally while CN volumes were up by 8.9%. U.S. volumes were up across the board with the UP having the largest percentage increase (up by 7.6%).

We are Watching China – Trying to get a handle on Commodity Markets

Folks, as we are opening up in what they used to call the free world – At the same time, anti-virus controls that have shut down some of China’s biggest cities and fueled public irritation are spreading as infections rise, hurting a weak economy and prompting warnings of possible global shockwaves. The Chinese government reported 29,411 new COVID cases on Thursday of last week.

Shanghai is easing rules that confined most of its 25 million people to their homes after complaints they had trouble getting food, but most of its businesses still are closed. Access to Guangzhou, an industrial center of 19 million people near Hong Kong, was suspended this week. Other cities are cutting off access or closing factories and schools.

What are the ramifications: First of all, spring planting by Chinese farmers who feed 1.4 billion people might be disrupted, boosting demand for imported wheat and other food by China, which would push higher already high global prices. Ukraine seems to be a write off this year and farmers in the U.S. and other developed nations are already getting slammed with input costs – some may not even plant this year on the back of it.

The risk that China might tumble into recession is increasing, Ting Lu, Jing Wang and Harrison Zhang of Nomura (global financial services group) warned in a recent report.

The volume of cargo handled by the Shanghai port, the world’s busiest, has fallen 40%, according to an estimate by the European Union Chamber of Commerce in China. Automakers have suspended production due to disruption in deliveries of supplies.

Secondly, we are dealing with significant demand destruction. Chinese refiners are set to cut crude throughput this month by about six percent — a scale last seen in the early days of the COVID-19 pandemic two years ago — to ease bulging fuel inventories as recent COVID lockdowns undercut consumption.

We view the issue of demand destruction in China as temporary. President Xi of China, while enforcing a 0 COVID policy, will have to rethink his own strategy and learn to live with COVID like the rest of us.

Given what we know in agricultural markets, expect it to be robust as it relates to rail – we are going to be running flat out on exports and we are bullish on grains for obvious reasons.

Oil and Natural Gas Markets

U.S. oil stocks rose by more than nine million barrels week over week as detailed in the above graph, driven in part by releases from the nation’s strategic reserves. However, U.S. gasoline stocks fell 3.6 million barrels week over week, far more than anticipated, and distillate inventories also declined by 2.6 million barrels. Overall, total commercial petroleum inventories increased by 7.4 million barrels week-over-week.

On a positive note, U.S. oil production forecasts are being revised upwards. The EIA on April 12th forecasted that U.S. crude oil production will average 12.0 million barrels per day in 2022, up 800,000 barrels per day from 2021. They also forecasted production to increase another 900.000 barrels per day in 2023 to average almost 13.0 million barrels per day, surpassing the previous annual average record of 12.3 million barrels per day set in 2019.

On the flip side, the International Energy Agency (IEA) on Wednesday of last week warned that from May onwards roughly three million bbls per day of Russian oil could be shut in due to sanctions or buyers voluntarily shunning Russian cargoes.

Russia’s Energy Ministry said on Thursday of last week it was limiting access to its statistics on oil and gas production and exports.

Natural gas production rising and so will NGL’s that’s good for Rail!

Is Keystone Really Dead? – we always wrote that it would resurface and it did

Joe Manchin, the Democratic senator from West Virginia and long-standing ally of the energy industry visited Alberta Canada Last week.

Alberta Premier Jason Kenney took Manchin on a tour of oil sands facilities near Fort McMurray on Monday of last week, and then the senator attended an energy roundtable on Tuesday with diplomats and business leaders from Canadian energy and pipeline companies. (See Joe below in Canada)

Source: Joe Manchin Newsroom

Source: Joe Manchin Newsroom

The U.S. government is scrambling to find ways to ease an oil market supply crisis that has been exacerbated by Russia’s invasion of Ukraine.

In January, Canada exported almost 4.6 million barrels per day of oil and other petroleum products into the United States. Officials on both sides of the border have said they’re looking for ways to boost those numbers to help the U.S. and its allies fulfill their energy needs.

At a press conference on Tuesday of last week, Manchin said the United States needs Canadian energy. Manchin, who chairs the U.S. Senate Committee on Energy and Natural Resources, called for a North American energy alliance to promote the movement of energy and critical minerals across the continent.

“North America could be the energy leaders of the world,” Manchin said. “It really could be (leaders) of the cleanest energy production in the world”.

“I’m doing everything I can. I intend to have Premier (Kenney) and a delegation come down to the United States to the Capitol and testify on what you do, how you do it and how well you do it and how much we need each other and how much we depend on each other.”

Manchin was a vocal proponent of the Keystone XL pipeline, which would have carried Canadian crude from Edmonton to Nebraska, a project in which the Alberta government invested more than $1 billion only to see it canceled by President Joe Biden last year.

More recently, Manchin has called on the U.S. president to restore Keystone XL as a means to boost domestic oil supply as gasoline prices in the country continue to rise. A call he renewed on Tuesday of last week.

“The (Keystone) XL pipeline is something we should’ve never abandoned,” Manchin said

Stay tuned to PFL for further details, but the pipeline is already completed to the U.S./Canadian border and could be in operation inside of a year pumping almost 1 million barrels a day to the U.S.

Hurricane Season starts in June – Colorado State University Reports

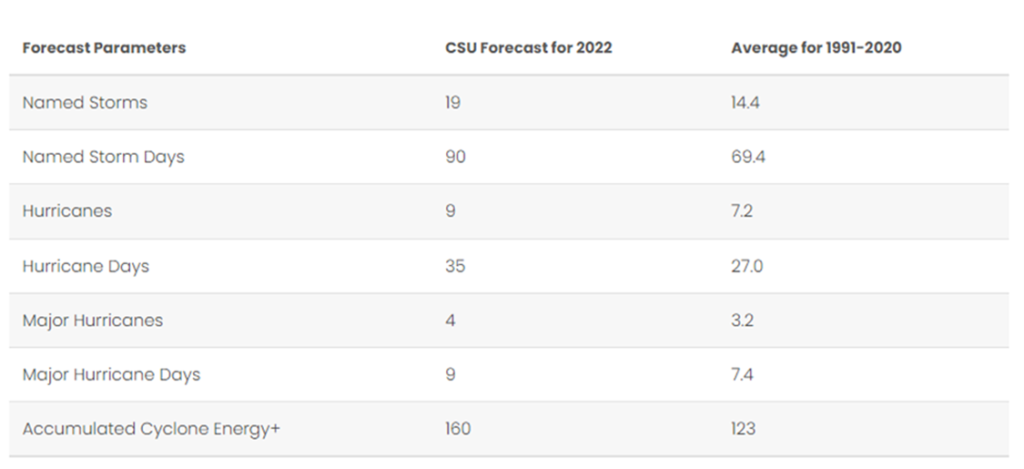

CSU released its first extended range forecast for the 2022 Atlantic hurricane season on 7 April 2022. They anticipate that the 2022 Atlantic basin hurricane season will have above-normal activity.

Current weak La Niña conditions look fairly likely to transition to neutral ENSO by this summer/fall, but the odds of a significant El Niño seem unlikely. Sea surface temperatures averaged across the eastern and central tropical Atlantic are currently near average, while Caribbean and subtropical Atlantic Sea surface temperatures are warmer than normal. CSU anticipates an above-average probability for major hurricanes making landfall along the continental United States coastline and in the Caribbean. See below:

Forecast for 2022 Hurricane Activity

Source: Colorado State University

Are We Headed for a Recession or are we already in one?

We believe we are most likely in a recession right now and just don’t know it or at least in the early stages of one. Housing in Florida is starting to level off and even slowing. Mortgage rates are over 5%. Rail traffic, a key economic indicator, is down year over year. Trucking indicators are worrisome with rates coming down. Demand for freight has slowed.

On Wednesday of last week, the Cass Transportation Index Report declared that the freight market is in a slowdown, though the index’s experts said it’s too soon to declare a recession. Banks like Cowen and Bank of America have recently downgraded trucking stocks.

Dry van rates have tanked by 37% from Dec. 31, according to Bank of America analyst Ken Hoexter. Those rates are on the spot market – where loads are picked up on demand, rather than through a contract. The spot market is just a fraction of the trucking world, but spot numbers point to where contract rates will go.

Another indicator of a downturn is the drop in contracted loads rejected by carriers. Truckers can reject loads they previously agreed to carry. Usually, they reject a contract load if they can get a better job on the spot market. Analysts follow the outbound tender reject index to see if the trucking market is hot or not. Compared to last year, the market is decidedly not. Only 11% of loads are getting rejected right now, way down from 25% at this time last year.

The supply of truckers is way up. Thousands of new fleets are registered each month in the U.S., and it’s reached a fever pitch in recent months. In February alone, a record 20,166 trucking companies entered the market.

Demand for truckers has softened. Consumers are slashing their spending – particularly when it comes to buying more and more stuff. Core retail sales fell by 1.2% in February, the most recent number available from the feds. Those sales will likely continue to soften. In response to historic inflation, 84% of Americans surveyed by Bloomberg News said they would cut back spending. Some have already been forced to cut back.. Remember consumer spending represents 70% of the U.S. economy – it is going to be a trickle-down effect. The more we pay for gas and food other things have to go- it is that simple – we are no longer in the sweet spot.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- 5, 29k Tank Cars needed in Texas off the KCS for 5 years. Need to be lined.

- Up to 40 5500 Covered Gons 286 unlined CSX/NS preferred but will consider other

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480 CU-FT Ag Gons needed in Texas off the UP for 1-3 Years.

- 50, 30K+ Tank cars are needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5-year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the Midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors Midwest preferred for a 1-year lease

- 30-50 Log Flats with stanchions 286K GRL in the Midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000 CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flatcars for purchase or lease – needed in TX off the BNSF

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|