“Never confuse a single defeat with a final defeat. “

F. Scott Fitzgerald

Jobs Update

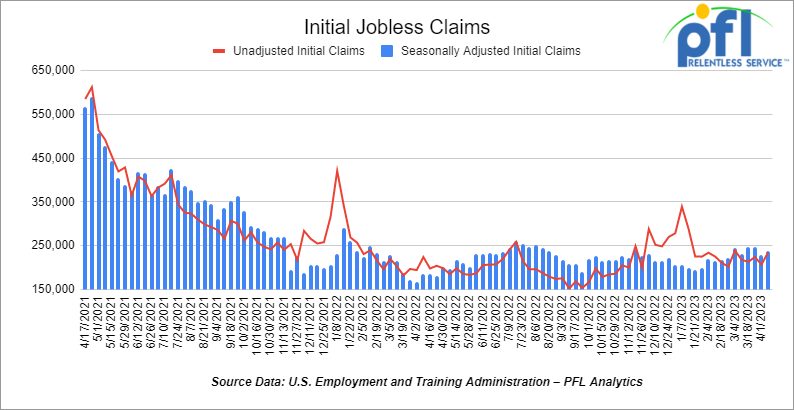

- Initial jobless claims for the week ending April 8th, 2023 came in at 239,000, up 11,000 people week-over-week.

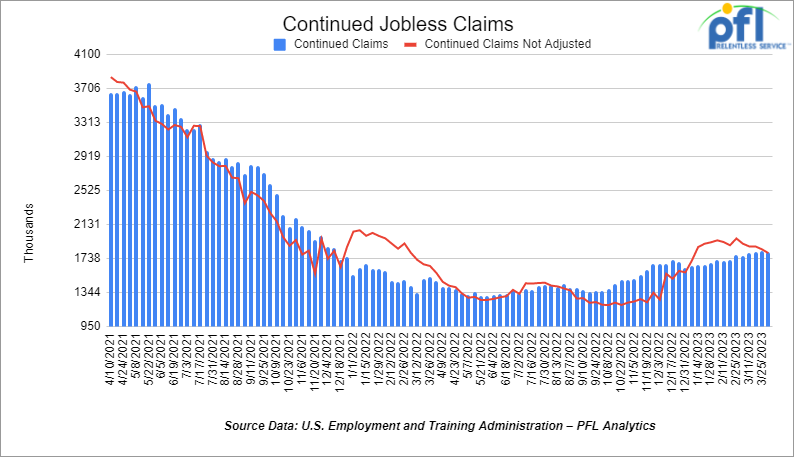

- Continuing jobless claims came in at 1.810 million people, versus the adjusted number of 1.823 million people from the week prior, down -13,000 people week over week.

Stocks closed lower on Friday of last week, but up week over week

The DOW closed lower on Friday of last week, down -143.22 points (-0.42%), closing out the week at 33,886.47, up 299.95 points week over week. The S&P 500 closed lower on Friday of last week, down -8.58 points (-0.21%) and closed out the week at 4,137.64, up 28.53 points week over week. The NASDAQ closed lower on Friday of last week, down -42.81 points (-0.35%), and closed the week at 12,123.47, up 39.11 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,055 this morning up +18 points.

WTI closed higher on Friday of last week and up week over week

WTI traded up $0.36 per barrel (0.4%) to close at $82.52 per barrel on Friday of last week, and up $1.82 per barrel week over week. Brent traded up $0.22 per barrel (0.3%) on Friday of last week, to close at US$86.31 per barrel, up US$1.19 per barrel week over week.

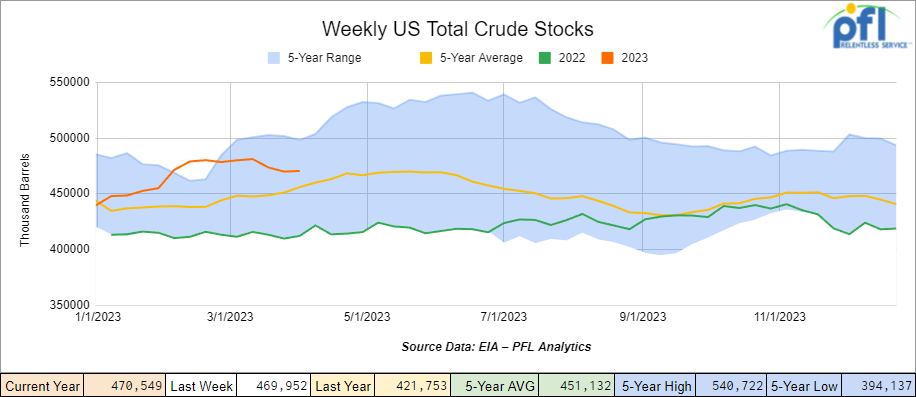

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 600,000 barrels week over week. At 470.5 million barrels, U.S. crude oil inventories are 3% above the five-year average for this time of year.

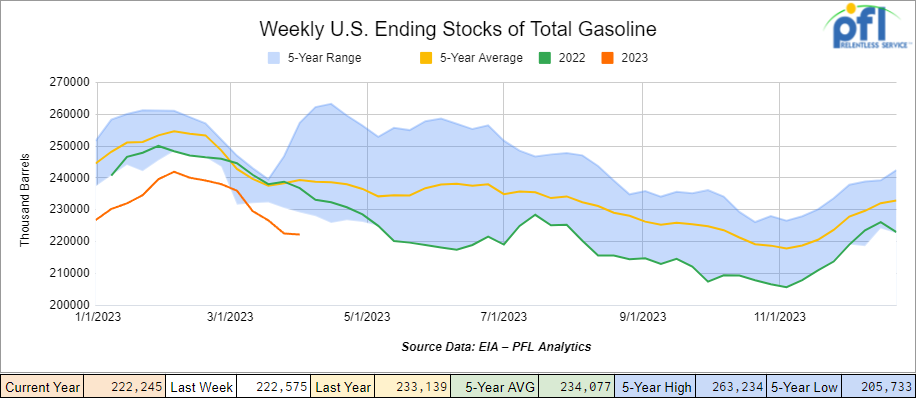

Total motor gasoline inventories decreased by 300,000 barrels week over week and are 7% below the five-year average for this time of year.

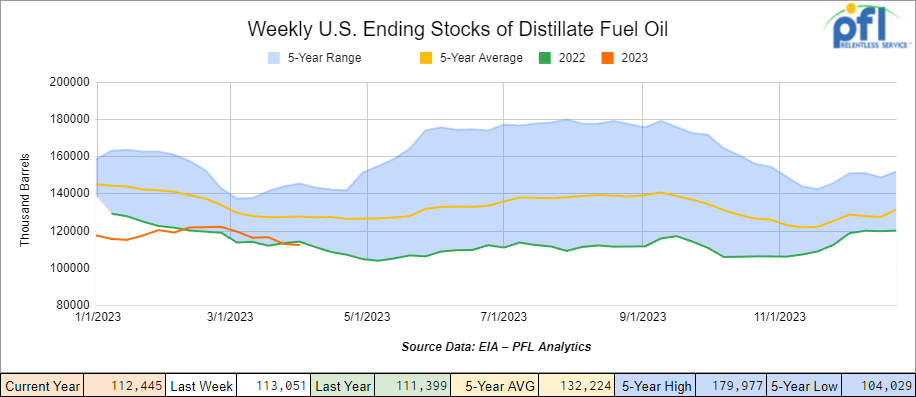

Distillate fuel inventories decreased by 600,000 barrels week over week and are 11% below the five-year average for this time of year.

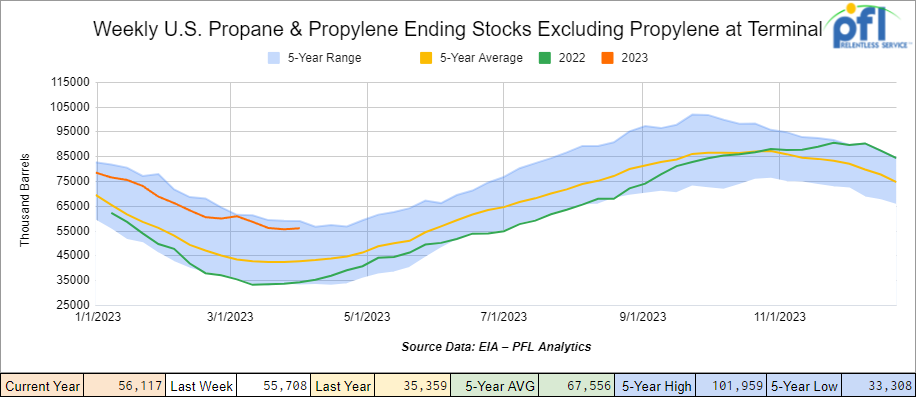

Propane/propylene inventories increased by 500,000 barrels week over week and are 30% above the five-year average for this time of year. Propane inventories have been trending lower which are still above the five-year average peaking at over 40% above 2022 levels for this time of year at the end of March. The EIA’s projection for NGL production was revised slightly to 6.14 million barrels a day.

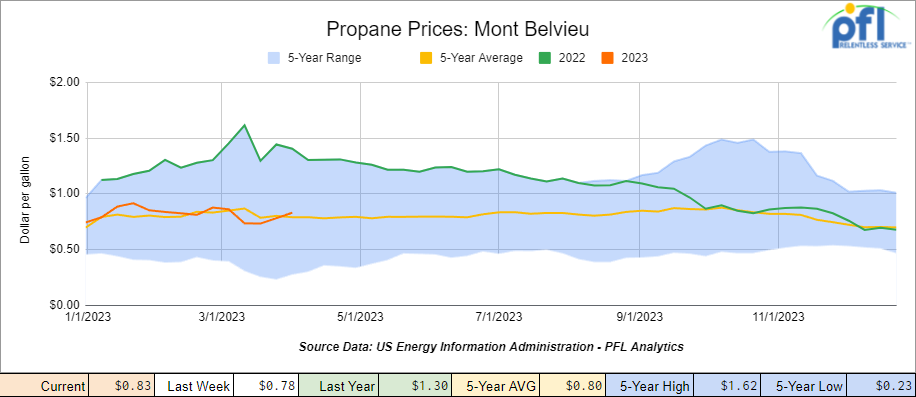

Propane gained 5 cents per gallon week over week for a second week in a row, closing at 83 cents a gallon, down -47 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 8.4 million barrels during the week ending April 7th, 2023.

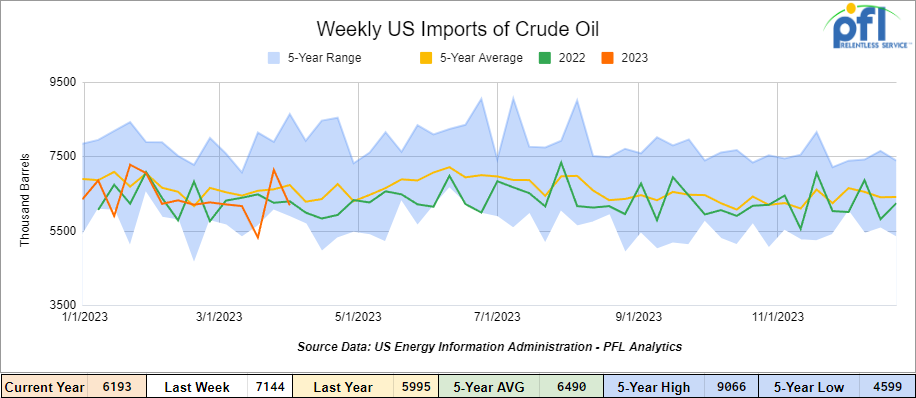

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending April 7th, 2023, a decrease of 951,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 0.8% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 813,000 barrels per day, and distillate fuel imports averaged 233,000 barrels per day during the week ending April 7th, 2023.

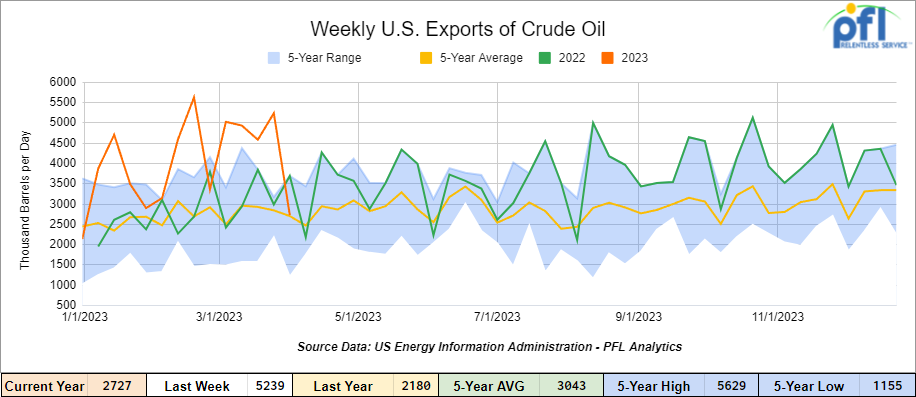

U.S. crude oil exports averaged 2.727 million barrels per day for the week ending April 7th, 2023, a decrease of -2.512 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.371 million barrels per day.

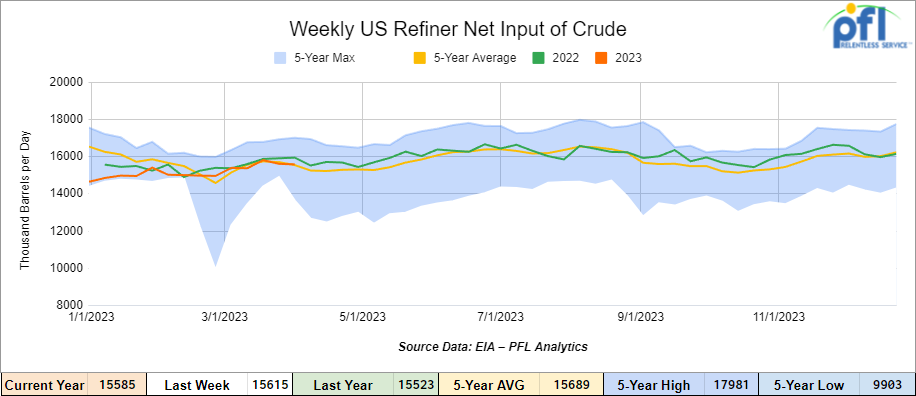

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending April 7, 2023 which was 30,000 thousand barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $82.19 down -$0.33 per barrel from Monday’s close.

North American Rail Traffic

Week Ending April 12th, 2023.

Total North American weekly rail volumes were down (-11.44%) in week 14 compared with the same week last year. Total carloads for the week ending on April 12th were 339,018, down (-5.25%) compared with the same week in 2022, while weekly intermodal volume was 284,465, down (-17.82%) compared to the same week in 2022. 10 of the AAR’s 11 major traffic categories posted year over year decreases with the most significant decrease coming from Intermodal (-17.82%). The only year over year increase in week 14 was from Motor Vehicles and parts (+9.15%).

In the east, CSX’s total volumes were down (-7.8%), with the largest decrease coming from Intermodal (-15.13%) and the largest increase Motor Vehicles and Parts (+15.44%). NS’s volumes were down (-10.92%), with the largest decrease coming from Petroleum and Petroleum Products (-34.81%) and the largest increase from Grain (+5.89%).

In the West, BN’s total volumes were down (-16.78%), with the largest decrease coming from Intermodal (-24.68%), and the largest increase coming from Metallic Ores and Metals (+18.06%). UP’s total rail volumes were down (-6.21%) with the largest decrease coming from Other (-21.25%) and the largest increase coming from Petroleum and Petroleum Products (+18.69%).

In Canada, CN’s total rail volumes were down (-13.27%) with the largest increase coming from Coal (+13.79%) and the largest decreases coming from Intermodal (-29.89%) and Grain which was a close second down (-29.76%). CP’s total rail volumes were down (-16.41%) with the largest decrease coming from Grain (-49.92%) and the largest increase coming from Coal (+34.89%).

KCS’s total rail volumes were down (-18.55%) with the largest decrease coming from Farm Products (-31.49%) and the largest increase coming from Motor Vehicles and Parts (+18.02%).

Source Data: AAR – PFL Analytics

Rig Count

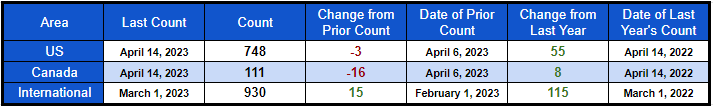

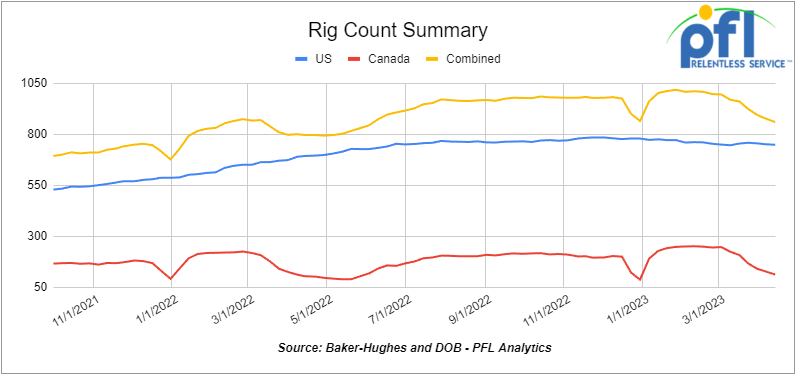

North American rig count was down by -19 rigs week over week. U.S. rig count was down -3 rigs week over week and up by +55 rigs year over year. The U.S. currently has 748 active rigs. Canada’s rig count was down by -16 rigs week-over-week and up by +8 rigs year over year. Canada’s overall rig count is 111 active rigs. Overall, year over year, we are up +63 rigs collectively.

North American Rig Count Summary

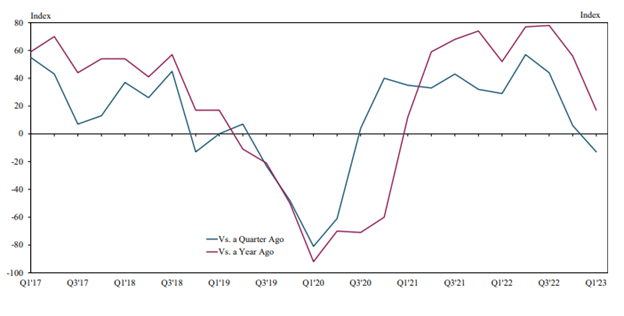

The Federal Reserve Bank of Kansas City conducted their first quarter survey on its outlook in energy across the plain states,including the Permian and released the results on Friday of last week. We expect to see declines in drilling activity for the foreseeable future given the current cost structure and commodity prices that are not cooperating.

First quarter energy survey results revealed that Tenth District energy activity declined moderately and is expected to continue to slow. Firms reported that oil prices needed to be on average $64 per barrel for drilling to be profitable, and $86 per barrel for a substantial increase in drilling to occur. Similarly, natural gas prices needed to be $3.45 per MMBTU for drilling to be profitable on average, and $4.74 per MMBTU for drilling to increase substantially. Tenth District energy activity declined moderately in the first quarter of 2023, as indicated by firms contacted between March 15th, 2023, and March 31st, 2023. The drilling and business activity index decreased from 6 to -13. All other indexes decreased from previous readings, except the supplier delivery time index increased from -11 to -3. Year-over-year indexes remained mixed. The year-over-year indexes for drilling/business activity, capital expenditures, total profits, number of employees, employee hours, and wages and benefits all cooled but remained in positive territory. The total revenues index declined substantially from 67 to -10. However, the supplier delivery time and access to credit indexes increased.

Expectations for future activity also decreased moderately in Q1 2023. The future drilling and business activity index fell from 19 to -13, and expectations for future revenues and profits declined significantly. Price expectations for oil fell slightly, and expectations for natural gas prices decreased substantially. Natgas traded below $2.00 on Friday of last week before closing at $2.114 per MMBTU.

Drilling Business Activity Indexes

Source: Tenth District Federal Reserve Bank of Kansas City

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 23,489 from 23,885, which was a loss of -396 rail cars week-over-week. Canadian volumes were mixed; CP’s shipments increased by +7.6% week over week, and CN’s volumes were lower by -9.4% week over week. U.S. shipments were down across the board. The NS had the largest percentage decrease and was down by -36.5% week over week.

It’s official, Folks: CP & KCS are now CPKC

Canadian Pacific and Kansas City Southern on Friday of last week formally combined to create Canadian Pacific Kansas City (CPKC), as authorized by the Surface Transportation Board’s final decision issued on March 15.

The merger creates the first single-line railway connecting Canada, the United States and Mexico.

“Today, we celebrate this historic combination creating a truly unique single-line rail network that begins a new chapter of railroad history in North America,” said CPKC President and CEO Keith Creel in a press release on Friday of last week. “As we mark this once-in-a-lifetime occasion by driving the final spike in Kansas City, Missouri, where CP and KCS come together, we stand ready to bring new competition into the North American rail industry at a time when our supply chains have never needed it more.”

CP completed its $31 billion acquisition of KCS on Dec. 14, 2021. KCS shares were then placed into a voting trust, which ensured that KCS operated independently of CP during the regulatory review process. On Friday of last week, the voting trustee transferred the KCS shares to an affiliate of CP, formally bringing KCS into the CPKC family.

In Kansas City on Friday of last week, the company marked the start of CPKC at a celebration featuring the driving of the ceremonial final spike at the only place where the CP and KCS railroads meet. CPKC will also break ground on a new yard office, the future location of the U.S. operations center. CPKC’s corporate headquarters are in Calgary, Alberta.

CPKC announced the appointment of four new board directors. As required by the merger agreement, the four appointees were members of the former KCS board.

They are: David Garza-Santos, a KCS director since 2016 and a business and community leader in Monterrey, N.L. Mexico; Antonio Garza, a KCS director since 2010 and former U.S. ambassador to Mexico; Henry Maier, a KCS director since 2017 and former president and CEO of FedEx Ground; and Janet Kennedy, a KCS director since 2017 and a former vice president at Google.

The four directors will be nominated for election to CPKC’s Board at its annual general meeting to be held on June 15.

Tank Car Committee Meeting

We are going to be there, folks – Curtis Chandler and David Cohen will be in Denver tomorrow representing PFL – make sure to look us up when you are there and we look forward to seeing you in Denver

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

- 100, 30K 117R or 117J Tanks needed off of UP or BN in Midwest for 2 Years. Cars are needed for use in Ethanol service.

- 30, 17K-20K 117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 Years. Cars are needed for use in Caustic service.

- 13-15, Any Flat Bottom Gondolas needed off of any class 1 in Texas for 1-3 Years. For lease or purchase

- 20, 28.3K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Bakersfield, CA for Month to Month. Cars are needed for use in Biodiesel service.

- 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

- 150, 23.5K DOT 111 Tanks needed off of any class 1 in LA for 2-3 Years. Cars are needed for use in Fluid service. Needed July

- 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

- 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

- 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of any class 1 in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

- 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

- 40, 30K 117R or 117J Tanks needed off of CP in MN for 2 Years. Cars are needed for use in Ethanol service.

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 30-40, 286K DOT 113 Tanks needed off of CN or CP/ UP in Canada/MM for 5 Years. Cars are needed for use in CO2 service.

- 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

- 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

- 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

- 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

- 25-50, 5000CF-5100CF Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

- 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

- 10-20, 20K-25K CPC 1232 or 117J Tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

- 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

- 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

- 50-100, 25.5K CPC1232 or 117J Tanks needed off of any class 1 in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

- 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

- 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

- 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

- 100, 33K 340W Pressure Tanks needed off of CN in Canada for 3-5 Years. Cars are needed for use in Propane service.

- 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

- 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

- 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

- Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

- 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

- 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

- 20-25, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

- 15, 30K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service.

- 16, Covered Hoppers needed off of UP or BN in Texas. 60′ Box cars with plug door

- 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 100, Plate F Boxcars needed off of BN or UP in Texas.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 10, 4000 Hoppers are needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

- 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 30-40, 30K 117, DOT-111, CPC 1232 Tanks. Cars are needed for use in CO2 & Ethanol service.

Lease Offers

- 100-200, 31.8, 1232 Tanks located off of BN in Chicago. Cars are clean Sale or Lease

- 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

- 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

- 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean / UAN.

- 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in the Midwest. Cars were last used in Fertilizer / Corn syrup. Free Move

- 20, 20k, Dot 111 Tanks located off of CSX in GA. Cars are clean

- 2, 20K, Dot 111 Tanks located off of UP in TX. Cars are clean

- 5, 20K, Dot 111 Tanks located off of UP in TX. Cars were last used in Sulfuirc Acid. Free Move

- 108, 28.3K, 117R Tanks located off of CN in Canada. Cars were last used in Crude. Free Move, Dirty to Dirty

Sales Offers

- 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

- 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

- 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|