“Any man is liable to err, only a fool persists in error.”

-Marcus Tullius Cicero

Jobs Update

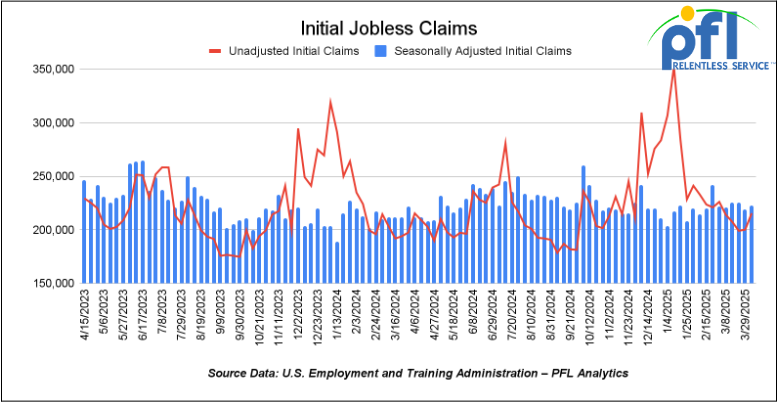

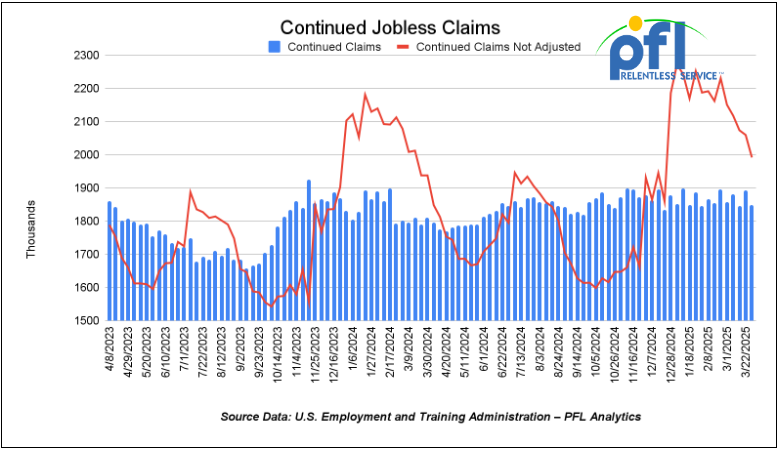

- Initial jobless claims seasonally adjusted for the week ending April 10th came in at 223,000, up 4,000 people week-over-week.

- Continuing jobless claims came in at 1.85 million people, versus the adjusted number of 1.893 million people from the week prior, down 43,000 people week-over-week.

Stocks closed higher on Friday of last week and higher week over week

The DOW closed higher on Friday of last week, up 619.05 points (1.56%) and closing out the week at 40,212.71, up 1,897.85 points week-over-week. The S&P 500 closed higher on Friday of last week, up 95.31 points, and closed out the week at 5,363.36, up 289.28 points week-over-week. The NASDAQ closed higher on Friday of last week, up 337.14 points (2.16%), and closed out the week at 16,724.46, up 1,136.67 points week-over-week.

The markets had yet another wild ride last week. People are finding it hard to figure out what is going to be tariffed and what wont. In the latest, it seems smartphones and computers are among many tech devices and components that will be exempted from reciprocal tariffs imposed by President Trump, according to new guidance from U.S. Customs and Border Protection.

The guidance, was issued late Friday evening, comes after Trump earlier imposed 145% tariffs on products from China. Apple should be happy!

The guidance also includes exclusions for other electronic devices and components, including semiconductors, solar cells, flat panel TV displays, flash drives, and memory cards.

These products could eventually be subject to additional duties, but they are likely to be far lower than the 145% rate that Trump had imposed on goods from China. We know everybody is watching this one!

In overnight trading, DOW futures traded higher and are expected to open at 40,756 this morning up 357 points from Friday’s close.

Crude oil closed higher on Friday of last week, but lower week over week.

West Texas Intermediate (WTI) crude closed up $1.43 per barrel (2.38%), to close at $61.50 per barrel on Friday of last week, down $5.45 per barrel week over week. Brent traded up $1.43 USD per barrel (2.26%) on Friday of last week, to close at $64.76 per barrel, down $5.38 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for May delivery settled on Friday of last week at US$9.85 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$49.63 per barrel.

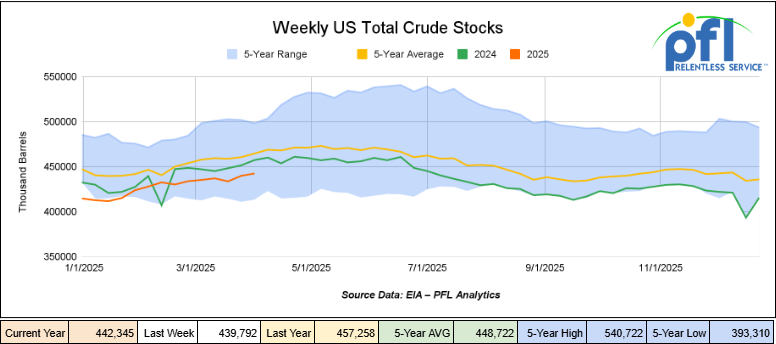

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 2.6 million barrels week-over-week. At 442.3 million barrels, U.S. crude oil inventories are about 5% below the five-year average for this time of year.

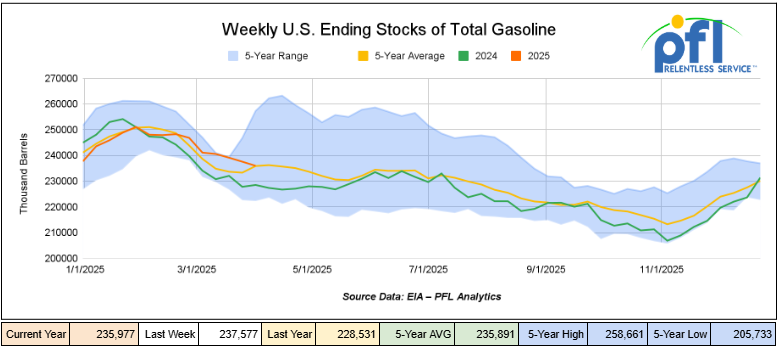

Total motor gasoline inventories decreased by 1.6 million barrels week-over-week and are the same as the five-year average for this time of year.

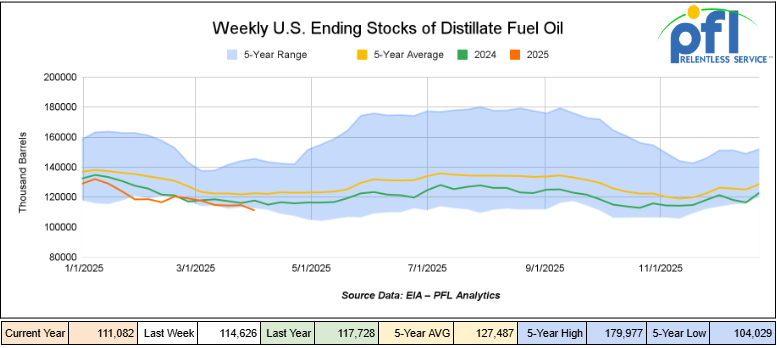

Distillate fuel inventories decreased by 3.5 million barrels week-over-week and are 9% below the five-year average for this time of year.

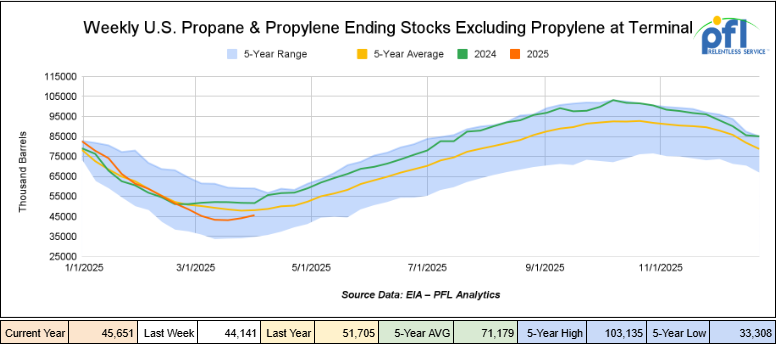

Propane/propylene inventories increased by 1.5 million barrels week-over-week and are 5% below the five-year average for this time of year

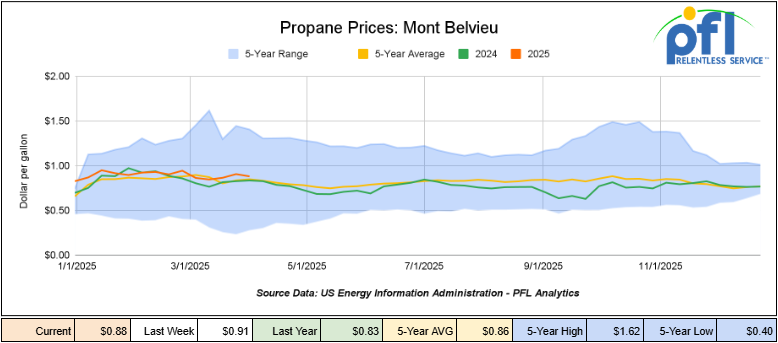

Propane prices closed at 88 cents per gallon on Friday of last week, down 3 cents per gallon week-over-week, and up 5 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 1.2 million barrels during the week ending March 28, 2025.

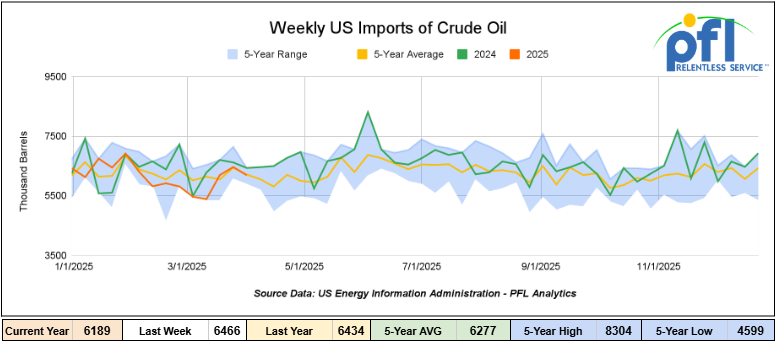

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending April 4, 2025, a decrease of 277,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.1 million barrels per day, 6.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 778,000 barrels per day, and distillate fuel imports averaged 69,000 barrels per day during the week ending April 4, 2025.

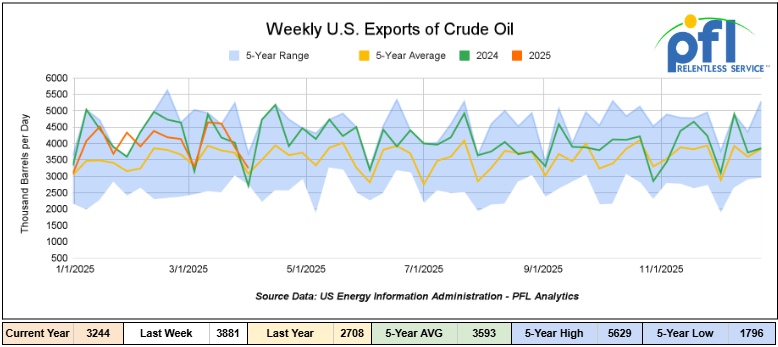

U.S. crude oil exports averaged 3.244 million barrels per day during the week ending April 10, 2025, a decrease of 637,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.095 million barrels per day.

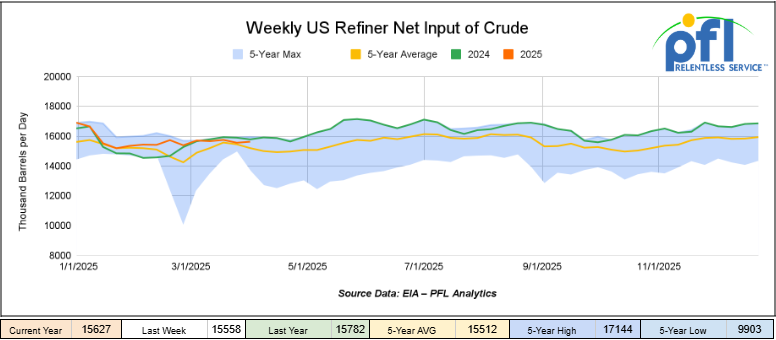

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending April 4, 2025, which was 69,000 barrels per day more week-over-week.

WTI is poised to open at $62.10, up 60 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending April 9, 2025.

Total North American weekly rail volumes were up (8.37%) in week 15, compared with the same week last year. Total carloads for the week ending on April 9 were 351,595, up (5.51%) compared with the same week in 2024, while weekly intermodal volume was 339,029, up (11.5%) compared to the same week in 2024.

8 of the AAR’s 11 major traffic categories posted year-over-year increases. The largest increase came from Coal, which was up (24.71%) while the largest decrease was from Petroleum and Petroleum Products, which was down (-6.08%)

In the East, CSX’s total volumes were up (7.14%), with the largest decrease coming from Grain (-15.89) while the largest increase came from Other (15.22%). NS’s volumes were up (11.72%), with the largest increase coming from Coal (39.55%) while the largest decrease came from Farm Products (-4.77%).

In the West, BN’s total volumes were up (8.91%), with the largest increase coming from Coal (23.38%) while the largest decrease came from Nonmetallic Minerals (-7.21%). UP’s total rail volumes were up (12.77%), with the largest increase coming from Coal (35.12%), while the largest decrease came from Other (-18.16%).

In Canada, CN’s total rail volumes were down (*10.13%) with the largest increase coming from Grain, up (+72.41%), while the largest decrease came from Intermodal (-28.45%). CP’s total rail volumes were up (5.19%) with the largest increase coming from Coal (60.81%), while the largest decrease came from Motor Vehicles and Parts (-26.24%).

KCS’s total rail volumes were up (7.15%) with the largest increase coming from Coal (+42.97%), while the largest decrease came from Other (-16%).

Source Data: AAR – PFL Analytics

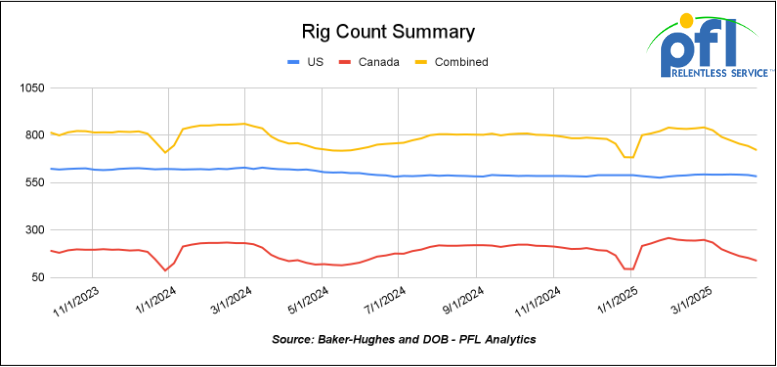

Rig Count

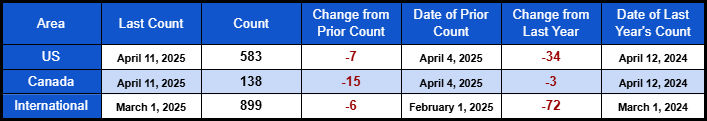

North American rig count was down by -22 rigs week-over-week. U.S. rig count was down -7 rigs week over week and down by -34 rigs year-over-year. The U.S. currently has 583 active rigs. Canada’s rig count was down -15 rigs week-over-week and down by -3 rigs year-over-year. Canada currently has 138 active rigs. Overall, year over year we are down by -37 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 27,268 from 27,982, which was a decrease of 714 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -1.3% week over week, and CN’s volumes were lower by -15% week-over-week. U.S. shipments were mostly lower. The BN had the largest percentage decrease and was down by -13.4%. The NS was the sole gainer and was up by +15.9%

We are watching the Keystone Pipeline

Keystone Pipeline, which ships Canadian crude to Midwest refineries, was shut down on Tuesday of last week due to a pipeline rupture in North Dakota. Trucks and workers started cleaning up the Keystone oil pipeline spill in rural North Dakota – the cause and completion time are unknown as of the writing of this report.

Keystone Spill Zone

Source: Trans Canada – PFL Analytics

South Bow, which manages the pipeline, estimated the spill’s volume at 3,500 barrels, or 147,000 gallons. Keystone’s entire system remains shut down. The estimated volume is equal to 16 tanker trucks of oil.

Keystone Spill

Source: South Bow – PFL Analytics

The U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) on Friday issued a Corrective Action Order (CAO) to South Bow which directs the operator to take specific actions to improve the safety of the Keystone Pipeline after a crude oil release was discovered on April 8, 2025, in Ransom County, North Dakota.

The affected pipeline segment cannot be restarted until PHMSA gives the operator permission.

The $5.2 billion Keystone Pipeline was built in 2010. TC Energy built the pipeline which is operated by South Bow as of last year. The Keystone pipeline is a 2,700-mile (4,350-kilometer) pipeline that originates in Alberta, Canada, and carries heavy crude oil south across the Dakotas and Nebraska before splitting to carry oil to refineries in Illinois and south to Oklahoma and Texas. The pipeline’s capacity is some 600,000 barrels per day of crude. We are watching this one closely – depending on the length of shut down could have a positive impact on crude by rail. As it stands right now, affected refineries have quite a bit of storage onsite and so does Alberta. Alberta crude inventories at the end of February were 55.8 million barrels, the lowest level since September of 2024 and down 14.6 million barrels year over year.

We are Watching Coal

President Donald Trump, on Tuesday of last week, signed four executive orders designed to boost the U.S. coal industry, outlining steps to protect coal-fired power plants and expedite leases for coal mining on U.S. land.

The executive order instructed the National Energy Dominance Council to designate coal as a “mineral” under another measure that sought to “boost American mineral production, streamline permitting, and enhance national security,” according to the White House.

His order included other measures, including one instructing Doug Burgum Interior Secretary to “acknowledge the Jewell Moratorium” that halted coal leasing on federal land and one ordering agencies to “identify coal resources on federal lands,” get rid of barriers to mining and make coal leasing on federal lands a priority.

We are watching Renewables

A new bill introduced on Thursday of last week by Senators Roger Marshall (KS) and Amy Klobuchar (MN) may have big impacts across the biofuels supply chain. Called the Farmer First Fuel Incentives Act, it proposes two key changes:

- Extend the 45Z tax credit from 2027 to 2034 — giving fuel producers seven more years to benefit from tax breaks on clean fuels like ethanol, biodiesel, renewable diesel, and SAF. The purpose is to incentive investment.

- Limit the credit to U.S.-grown feedstocks — meaning imported materials like used cooking oil (UCO) from China or South America would not qualify for the tax credit.

Shuttered biodiesel facilities were lobbying to have the $1 biodiesel tax credit extended for another year the proposed extension of the 45Z tax credit may not make everybody happy in the short term but is praised by the ethanol industry.

If you’re involved in producing, moving, or investing in biofuels, this could directly affect your operations and planning.

The Biden Administration created the original 45Z credit to encourage clean fuel production under the Inflation Reduction Act. But, the rules were unclear—especially around what feedstocks qualified—so many producers started using cheaper, imported materials like used cooking oil. That didn’t sit well with U.S. farmers, who felt sidelined while foreign suppliers cashed in on American tax breaks. (see below)

U.S. used cooking oil imports by country

Source: South USDA – PFL Analytics

Now, lawmakers want to focus the credit on fuels made from American-grown materials, helping support U.S. agriculture and reduce reliance on imports.

In the 2023/24 marketing year, China provided 55% of U.S. used cooking oil imports, with Canada and Malaysia next. These imports made up 13% of the feedstocks used in biomass-based diesel, up from 7% the year before.

What It Could Mean for Your Business

For logistics: More U.S.-grown feedstocks means higher volumes moving from farms to fuel producers, driving demand for tank cars, transloading, and short-line rail, especially in the Midwest.

For biofuels or renewable trading: Limiting feedstocks to domestic sources could tighten the market for low-CI fuels, impacting RINs, LCFS, and 45Z credit values. Keep an eye on this if you rely on imports.

For tax credits or investment incentives: Extending 45Z to 2034 gives investors more time to plan, potentially leading to new biorefineries and infrastructure in rural areas.

This bill hasn’t passed yet, but it’s gaining traction—and it lines up with growing support for “U.S. fuel, U.S. jobs, U.S. tax credits.” Whether you’re a shipper, a fuel producer, or part of the renewable energy ecosystem, We are watching this one closely, so stay tuned to PFL for further updates.

We are Watching Trump – Trump signed an Executive Order to Rein in State Climate Laws

In case you missed it, on Tuesday of last week (April 8th), President Trump signed a new Executive Order that could shake up how state climate laws are enforced across the country. The order directs the Department of Justice (DOJ) to push back on state and local environmental rules that go further than federal standards — especially those that, in the administration’s words, “unfairly burden” fossil fuel development. California may be on the radar.

At its core, the move is about streamlining regulations and giving more power back to federal policy. For companies navigating the complex world of energy logistics, this could reduce uncertainty and ease some of the regulatory headaches that slow things down.

President Trump put it simply:

“We’re protecting America’s energy future from unlawful state interference.”

However, not everyone sees it that way. New York Governor Kathy Hochul, speaking the next day on April 9, called the order “unconstitutional” and made it clear that states like hers won’t be backing down without a fight.

Key Takeaways

Here’s what to know:

- By June 7, 2025: The DOJ is required to release an enforcement update (that’s 60 days after the order).

- Legal challenges are coming — especially in states with stricter emissions targets like California, New York, and Vermont.

- Major energy trade groups are backing the move, citing the need for consistent rules across state lines.

We know state-by-state regulations can affect everything from railcar demand to cross-border scheduling and fleet planning. If this order holds, it could help reduce permitting delays and make things more predictable. But, we also know court challenges are coming and that could mean a bumpy ride in the short term.

The timing of the signing of this order is no coincidence. The order was signed the same day as a nationwide youth-led climate protest — a signal of just how politically charged this issue is. Just one day earlier, on April 7, news broke that the administration is looking at cuts to NOAA’s climate research budget.

Together, these moves point to a broader shift in federal priorities: less focus on environmental oversight, more focus on energy development and infrastructure.

From the PFL Team:

Whether you operate in California, the Northeast, or run cross–border into Canada, this policy change will affect how you plan, permit, and operate — especially if you’re managing emissions compliance or navigating state-specific rules. At the end of the day bullish for rail and seemingly good for the consumer in lower prices. Stay tuned to PFL, we are watching this one.

We are watching the Federal Government – Enforcing Crime

Well, folks, in the good old days (which is seemingly not that long ago) it used to be the case that if you commit a crime, you do the time! It’s back! The Association of American Railroads on Thursday of last week endorsed the proposed Combating Organized Retail Crime Act of 2025, which would tackle evolving trends in organized retail theft.

The bill that was introduced by U.S. Senate Judiciary Committee Chairman Chuck Grassley (R-Iowa) and Sen. Catherine Cortez Masto (D-Nev.), the legislation would establish a coordinated multi-agency response and create new tools to tackle evolving trends in organized retail theft. The bill calls for a coordinated federal response to the mounting wave of sophisticated attacks against the nation’s supply chain and retailers, AAR officials said in a press release.

The legislation would create an Organized Retail and Supply Chain Coordination Center to bring together federal law enforcement agencies with state and local partners as well as railroad police to counter and dismantle domestic and transnational organized theft operations, according to AAR.

“Organized criminal operations continue to evolve and escalate their targeted attacks against our nation’s supply chain and retailers,” said Association of American Railroads President and CEO Ian Jefferies. “This alarming trend affects every industry — including the nation’s largest railroads, which experienced a 40% spike in cargo theft last year.”

For railroads, both the frequency and tactics of cargo theft attempts have evolved rapidly and escalated. Such thefts cost the rail industry more than $100 billion last year, according to AAR. Not to mention, our retailers that suffer on the back of it ultimately costing the consumer with higher prices and poorer services. We are watching this one, please click here for a summary of the bill.

We are Watching Key Economic Indicators

Producer Price Index (“PPI”) | Consumer Price Index (“CPI”)

In March 2025, the U.S. PPI decreased by 0.4% month over month, marking the first decline in nearly 18 months. This follows a flat reading in February. On an annual basis, the PPI rose 2.7%, down from 3.2% in February, indicating continued easing in wholesale inflation.

The CPI decreased by 0.1% month over month, the first monthly decline in several months, following a 0.2% increase in February. This brought the annual inflation rate to 2.4%, down from 2.8% in February. Core CPI, which excludes food and energy, rose by 0.1% over the month, leading to an annual core inflation rate of 2.8%, the lowest since March 2021.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, GP Tanks needed off of various class 1s in various locations for 1-5 years.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website