“We are all born ignorant, but one must work hard to remain stupid.”

Benjamin Franklin

COVID 19 and Markets Update

Folks, the battle continues with COVID -19 as cases continued to rise over the weekend and deaths intensified. In the United States, we currently have 557,590 confirmed cases. There has been significant chatter that we may return to work in some sort of organized fashion by May 1st as officials are deeming the virus has peaked and significant steps will be taken to contain it. One thing is for sure- the markets certainly believe this with the DOW gaining 3,000 points last week alone, as the Fed keeps printing money.In the meantime, we lost another 6 million+ jobs last week. We were off with our projection of closer to 9 million, but they will come as State and Federal Agencies seemed to have a variety of computer related issues. Florida had to hand out paper applications for people to complete, forming long car lines across the state.

A virtual meeting that took place between OPEC and others last week failed to produce anything substantial. OPEC was trying to get other nations to participate in forced crude oil production cuts. Mexico complained about its portion of proposed cuts and wanted the United States to cover them for a portion. Meetings continued throughout weekend and there was finally a resolution on Sunday.

OPEC+ will cut 9.7 million barrels a day — just below the initial proposal of 10 million. The U.S., Brazil and Canada will contribute another 3.7 million barrels as their production declines. It is not clear if those numbers will represent real cuts or just production idled because of market forces. Mexico appeared to have won a diplomatic victory as it will only be required to cut 100,000 barrels — less than its pro-rated share. The question now for the oil market is whether the cuts will be enough to throw a floor under prices as demand destruction continues – we don’t think so.

As of the writing of this report oil is slightly higher printing 22.88 up 12cts per barrel from Thursday’s close.

Equities traded up on Thursday, markets were closed on Friday in observance of Good Friday. In overnight trading futures traded lower and we are expected to open down roughly 100 points points on the DOW.

We have been extremely busy at PFL with return on lease programs, storage – please call PFL today 239-390-2885.

Railcar Volumes

North American rail volumes declined 8.0% year over year in March compared to the 6.6% year over year decrease in February. March’s volumes were -11.7% compared to -8.4% in February. Volumes were negatively impacted by accelerating declines in intermodal volumes that we attribute to COVID-19.The outlook has deteriorated significantly over the past month, as intensifying efforts to slow the spread of COVID-19 (quarantine orders, non-essential business shutdowns, etc.) have led to a sharp reduction in economic activity. Additionally, the collapse in oil prices has led to a much weaker outlook for crude-by-rail previously a bright spot.

In a press release last week by the AAR stated that they have not witnessed such sustained declines of carloads at the current level since the Great Recession. AAR’s Senior Vice President, John Gray, said:

“Since 1988, when our data began, total U.S. rail carloads were lower than they were last week only during a few Christmas’s and New Year’s weeks, when rail operations are seasonally low.” He went on to state that: “Part of the problem now is sustained weakness in coal carloads, but even excluding coal, carloads last week were down 13.1 percent.”

North American rail volumes were down 16.1% year over year in week 14 (U.S. -15.9%, Canada -15.1%, Mexico -23.0%), resulting in year to date volumes that are down 6.7% (U.S. -8.1%, Canada -3.7%, Mexico +0.3%). 10 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-15.5%), motor vehicles & parts (-82.6%), coal (-22.5%) and nonmetallic minerals (-17.6%).

In the East, CSX’s total volumes were down 15.2%, with the largest decreases coming from motor vehicles & parts (-78.8%), coal (-32.0%) and intermodal (-9.9%). NS’s total volumes were down 25.5%, with the largest decreases coming from intermodal (-20.8%), coal (-41.7%) and motor vehicles & parts (-87.2%).

In the West, BN’s total volumes were down 13.7%, with the largest decreases coming from intermodal (-15.3%), motor vehicles & parts (-69.4%), coal (-11.8%), stone sand & gravel (-35.9%) and petroleum (-18.0%). UP’s total volumes were down 18.4%, with the largest decreases coming from intermodal (-19.0%), motor vehicles & parts (-74.8%), coal (-25.3%), stone sand & gravel (-26.6%) and petroleum (-28.8%).

In Canada, CN’s total volumes were down 15.8% with the largest decreases coming from intermodal (-12.4%), motor vehicles & parts (-83.1%), petroleum (-20.0%), stone sand & gravel (-36.7%) and coal (-20.3%). RTMs were down 10.3%. CP’s total volumes were down 15.5%, with the largest decreases coming from intermodal (-14.0%), motor vehicles & parts (-67.5%), stone sand & gravel (-67.1%) and petroleum (-23.1%). RTMs were down 13.0%.

KCS’s total volumes were down 9.4% , with the largest decreases coming from intermodal (-14.5%) and motor vehicles & parts (-83.8%).

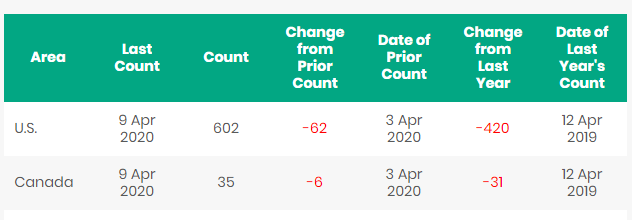

North American Rig count is down 68 rigs week over week with the U.S. losing 62 rigs and Canada losing 6 rigs week over week. Year over year we are down 451 rigs collectively. Cuts in drilling continue as oil and gasoline demand continues to decline and storage continues to fill. Canada now only has 31 rigs nationwide operating and the U.S 602 expect continued declining rig counts.

North American Rig Count Summary

Railcar Markets

PFL is offering: 25.5s for asphalt service. 117Rs last used in diesel for dirty to dirty lease. CPC1232 non coil non insulated last used in gasoline service. Call PFL for details today as the markets as changing daily!

PFL is seeking: 100, 340w winter pressure cars.

Live Railcar Markets

Lease Offers

Lease Bids

Sales Offers

Sales Bids

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|