“If everyone is thinking alike, then somebody isn’t thinking.”

– George S. Patton

Jobs Update

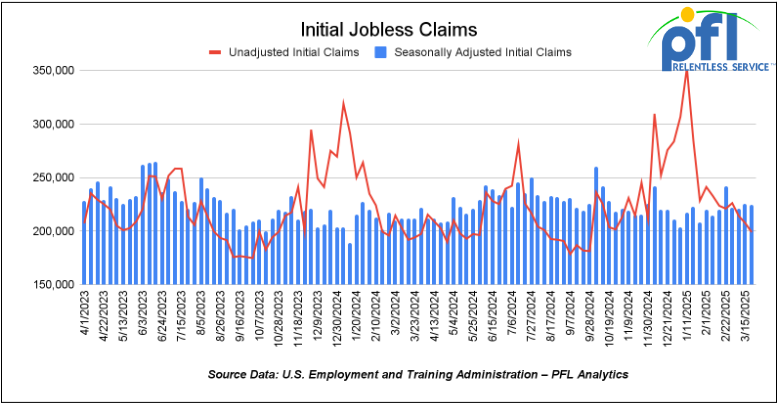

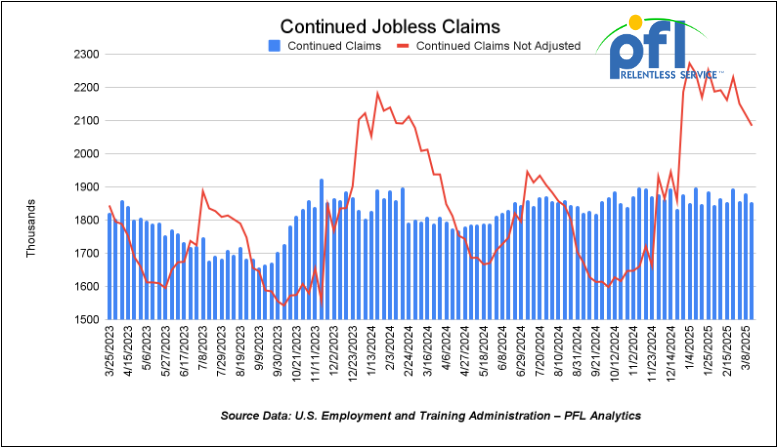

- Initial jobless claims seasonally adjusted for the week ending March 27th came in at 224,000, down 1,000 people week-over-week.

- Continuing jobless claims came in at 1.856 million people, versus the adjusted number of 1.881 million people from the week prior, down 25,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down 716.11 points (-1.69%) and closing out the week at 41,583.59, down -401.77 points week-over-week. The S&P 500 closed lower on Friday of last week, down -112.41 points, and closed out the week at 5,580.9, down -86.66 points week-over-week. The NASDAQ closed lower on Friday of last week, down 481.04 points (-2.7%), and closed out the week at 17,322.99, down -461.06 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 41,568 this morning, down 283 points from Friday’s close

Crude oil closed lower on Friday of last week, but higher week over week.

West Texas Intermediate (WTI) crude closed down $0.56 per barrel (-0.8%), to close at $69.36 per barrel on Friday of last week, up $1.08 per barrel week over week. Brent traded down $0.40 USD per barrel (-0.5%) on Friday of last week, to close at $73.63 per barrel, up $1.47 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for May delivery settled on Friday of last week at US$10.05 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$59.28 per barrel.

Basis in Alberta has been tightening – ironically, Canadian crude exporters are unintended recipients of a Trump bump in prices. Despite looming tariffs on Canadian Oil, Canadian oil producers selling crude to U.S. refiners are enjoying a significant windfall, and they have one man to thank: President Donald Trump. Canada, the world’s fourth-largest crude producer, supplied U.S. refiners with around 4 million barrels per day in 2024, roughly half of total crude imports for the world’s biggest oil consumer.

Canada sends around 90% of its oil exports to the United States, which is mostly shipped via pipelines from the western province of Alberta to land-locked refiners in the U.S. Midwest. But in recent weeks, the discount for WCS delivered in Hardisty, Alberta has steadily shrunk, hitting a low of below the WTI-CMA $9.75 a barrel last week, the tightest since late November 2020.

The reduction in the WCS discount is also linked to Trump’s recent actions against Venezuela. The administration revoked a production license for Chevron, which imported 210,000 bpd of heavy-grade Venezuelan oil into the United States last year, and slapped a tariff on countries buying oil from Caracas.

As it happens, Canadian crude is a good substitute for the Venezuelan grade, meaning it is now in high demand from U.S. Gulf Coast refineries that require heavy crude.

Canadian producers have also benefited from the completion last year of the Trans Mountain pipeline expansion, which raised its capacity to 890,000 bpd. The pipeline offers producers the only export route to international markets, bypassing the United States. Crude exports from Vancouver are set to rise to a record of 643,000 bpd in March.

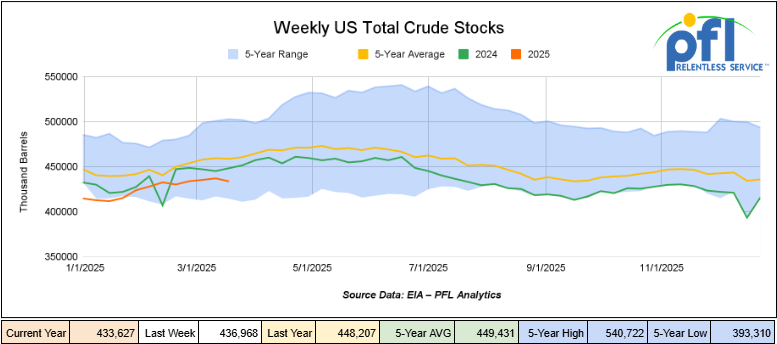

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.3 million barrels week-over-week. At 433.6 million barrels, U.S. crude oil inventories are 5% below the five-year average for this time of year.

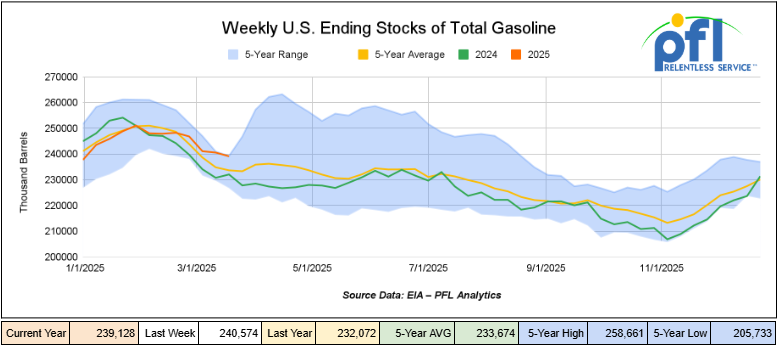

Total motor gasoline inventories decreased by 1.4 million barrels week-over-week and are 2% above the five-year average for this time of year.

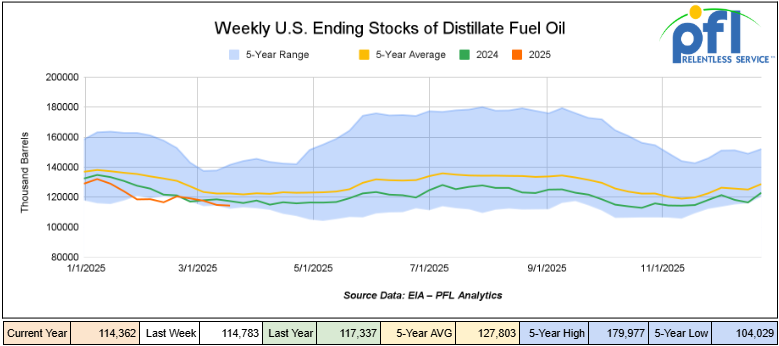

Distillate fuel inventories decreased by 400,000 barrels week-over-week and are 7% below the five-year average for this time of year.

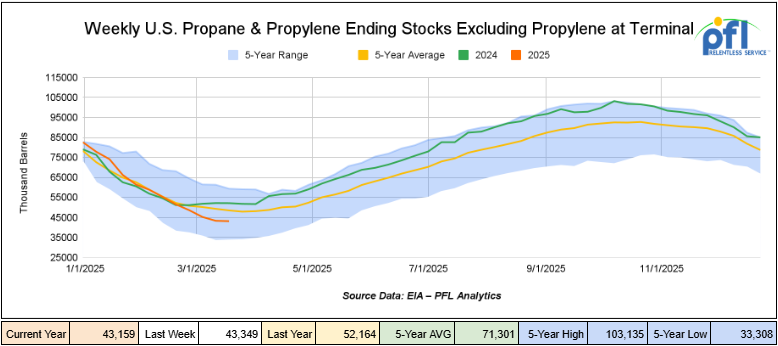

Propane/propylene inventories decreased by 200,000 barrels week-over-week and are 11% below the five year average for this time of year.

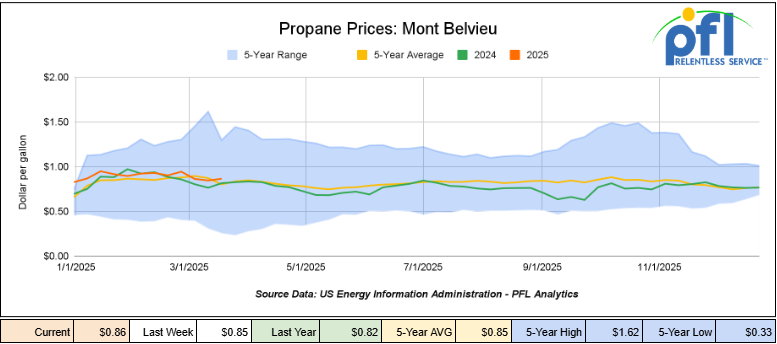

Propane prices closed at 86 cents per gallon on Friday of last week, up 1 cent per gallon week-over-week, but down 4 cents per gallon year-over-year.

Overall, total commercial petroleum inventories increased by 3.2 million barrels during the week ending March 21st, 2025.

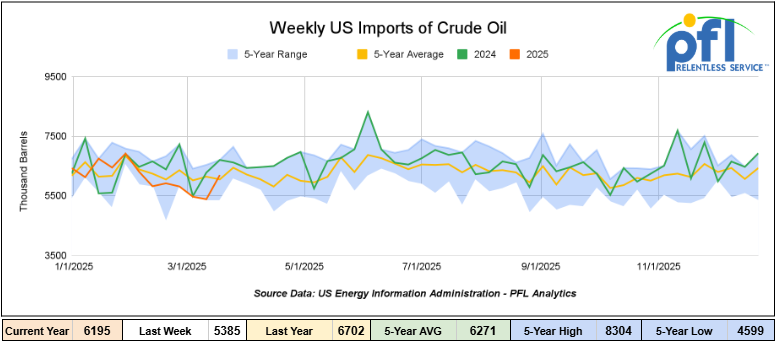

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending March 21st, 2025, an increase of 810,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 11.0% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 589,000 barrels per day, and distillate fuel imports averaged 120,000 barrels per day during the week ending March 21st, 2025.

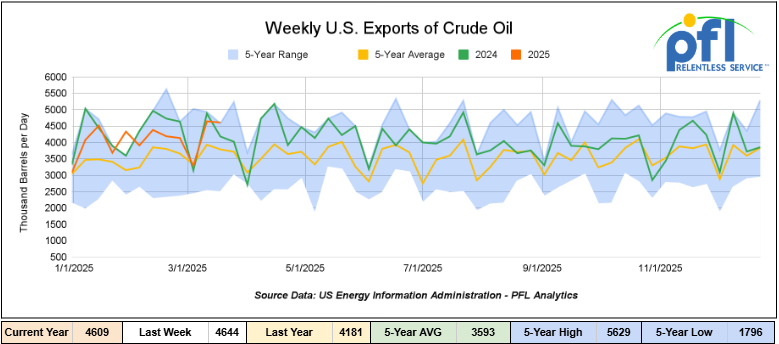

U.S. crude oil exports averaged 4.609 million barrels per day during the week ending March 21st, 2025, a decrease of 35,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.17 million barrels per day.

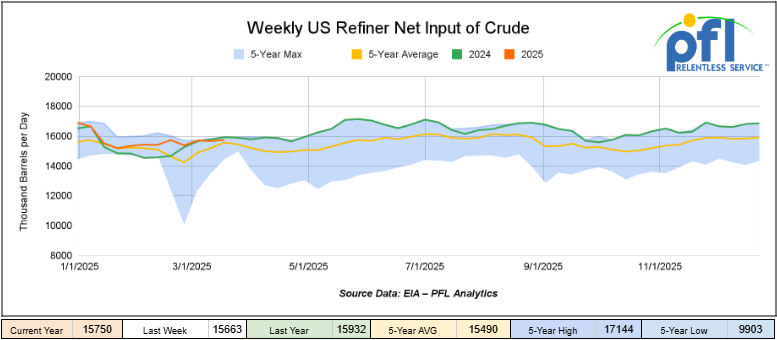

U.S. crude oil refinery inputs averaged 15.8 million barrels per day during the week ending March 21, 2025, which was 87,000 barrels per day more week-over-week.

WTI is poised to open at $69.44, up 8 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending March 26, 2025.

Total North American weekly rail volumes were up (3.01%) in week 13, compared with the same week last year. Total carloads for the week ending on March 26 were 347,439, up (1.02%) compared with the same week in 2024, while weekly intermodal volume was 337,694, up (5.14%) compared to the same week in 2024.

6 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Coal which was up (6.73%) while the largest decrease was from Metallic Ores and Metals which was down (-6.24%)

In the East, CSX’s total volumes were down (2.95%), with the largest decrease coming from Coal (-15.07%) while the largest increase came from Metallic Ores and Metals (19.72%). NS’s volumes were up (4.07%), with the largest increase coming from Motor Vehicles and Parts (10.28%) while the largest decrease came from Chemicals (-10.19%).

In the West, BN’s total volumes were up (6.37%), with the largest increase coming from Grain (17.15%) while the largest decrease came from Forest Products (-5.31%). UP’s total rail volumes were up (6.15%), with the largest increase coming from Nonmetallic Minerals (19.6%), while the largest decrease came from Grain (-18.7%).

In Canada, CN’s total rail volumes were down (-8.91%) with the largest increase coming from Grain, up (+55.47%), while the largest decrease came from Metallic Ores and Metals (-24.12%). CP’s total rail volumes were up (6.69%) with the largest increase coming from Coal (+132.55%), while the largest decrease came from Metallic Ores and Metals (-19.15%).

KCS’s total rail volumes were up (8.35%) with the largest increase coming from Motor Vehicles and Parts (+64.84%), while the largest decrease came from Other (-27.56%).

Source Data: AAR – PFL Analytics

Rig Count

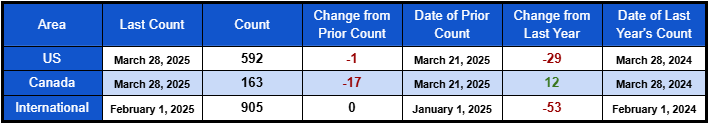

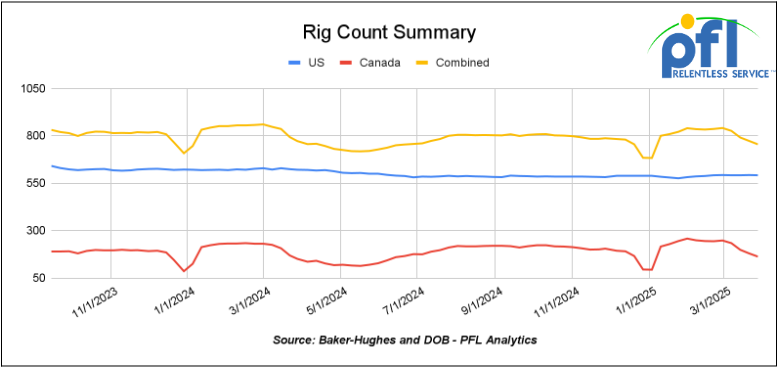

North American rig count was down by -18 rigs week-over-week. U.S. rig count was down 1 rig week over week and down by -29 rigs year-over-year. The U.S. currently has 592 active rigs. Canada’s rig count was down -17 rigs week-over-week but up by 12 rigs year-over-year. Canada currently has 163 active rigs. Overall, year over year we are down by -17 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 28,302 from 27,909 which was an increase of 393 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were higher by +5.8% week over week, CN’s volumes were lower by -0.4% week-over-week. U.S. shipments were up across the board. The CSX had the largest percentage increase and was up by +14.9%.

We are Watching Crude by Rail out of Canada

The Canadian Energy regulator reported on March 25, 2025, that 83,328 barrels were exported per day during the month of January 2025, up from 75,412 barrels in December of 2024, an increase of 7,916 barrels per day, month over month.

Crude by rail will always be necessary out of Canada for stranded oil not connected by pipelines. Raw bitumen, which is shipped as a non-haz product and is not able to flow in pipelines, is competitive with pipeline tolls and is a growing market to keep an eye on.. Other factors would be existing long-term contractual commitments and basis – we really need to see the WTI-CMA (West Texas Intermediate – Calendar Month Average) blow out to -17 per barrel for sustained periods of time to make economic sense. Crude by rail will obviously be impacted by tariffs against Canadian crude imports but we don’t know how that will look this 10 seconds. Stay tuned to PFL for further details – we are watching this one closely.

We are Watching Canada

Little read about Saskatchewan Premier Scott Moe weighed in at the Canadian Association of Energy Contractors’ (CAOEC) annual Spring Luncheon a week ago Friday in Calgary, Alberta, Canada. Saskatchewan is Canada’s second-largest oil producer next to Alberta and does a fair amount of crude by rail out of that Province into U.S. refineries. The right-wing Premier believes that political uncertainties on energy development will pass. He indicated the ongoing uncertainty in the energy sector driven by U.S. tariff threats and federal election politics, is a temporary problem.

“The next one to four months are going to be very choppy,” Moe said, but he is seeing movement in the right direction both in the U.S. on the trade front and in Ottawa on the regulatory front.

Saskatchewan and Alberta officials have been blitzing the U.S., talking to representatives from all levels of government to better understand the Trump government’s rationale for its energy and trade policies and how the Canadian industry fits into those plans, he said.

“When we hear talk about energy dominance it’s because the administration believes an arms race is beginning on tech and AI with China. And that all takes energy. It takes all forms of energy.”

According to the Premier, he believes the administration thinks of AI as manufacturing intelligence, and believes there is endless demand for intelligence that will drive endless demand for energy.

It is pulling out all stops to build energy infrastructure and develop supply to feed data centers and other industrial development like reshoring chip manufacturing, while also building out export infrastructure to support allies, to win the tech war, Moe said.

“It’s not what we normally see in U.S. energy policy. This is down to an arms race.”

Saskatchewan and Alberta have been making the case its resources can provide the energy security needed for the U.S. and its allies to prevail in the battle.

“You will not attain American energy dominance unless you put a North in front of America,” he said. An interesting perspective – we will see what happens on Wednesday, folks – fasten your seatbelts.

We are watching Texas – shifts energy focus to more reliable sources

On March 27, 2025, the Texas Senate passed Senate Bill 388 (SB388), a major step in changing how the state will produce electricity in the future. Starting in 2026, the bill requires that 50% of new electricity added to the grid come from reliable, dispatchable sources such as natural gas and nuclear. This is a shift from the previous focus on so-called renewable sources like wind and solar.

Why This Bill is Important:

Texas has seen its share of energy problems in recent years, like Winter Storm Uri in 2021, which caused power outages across the state. Because of these issues, lawmakers are now focusing on making the state’s grid more reliable, and SB388 is one way to do that.

The bill also includes battery storage systems that can store excess energy for later use. This move is meant to prevent blackouts and keep the lights on when the weather is bad or when the demand for power is high.

How This Will Affect the Freight Rail Industry

The shift in Texas’s energy policy will have a direct impact on the freight rail industry. As the state moves toward more reliable energy sources, the demand for materials needed for natural gas-fired cogeneration and nuclear plants will increase. Freight rail will be needed to transport equipment, nuclear materials such as uranium and reactor parts, and potential battery storage systems that require special transportation due to their size and weight

Rail will also be critical for moving the construction materials needed for new power plants, including steel, concrete, and other building materials. As Texas invests in its energy infrastructure, freight rail will be a key part of making sure these projects stay on track.

SB388 in the Bigger Picture

Texas isn’t the only state making changes to how it generates energy. Across the U.S., states like Florida, Ohio, and Pennsylvania are also focusing on balancing renewable energy with reliable sources like natural gas and nuclear.

The demand for freight rail will continue to grow. Rail will play a major role in transporting the materials needed for energy infrastructure projects, whether it’s for natural gas pipelines, nuclear plants, or the storage systems required for new energy grids.

The goal of this bill is to make Texas’s energy supply more stable and less dependent on sources that can be unreliable, especially during extreme weather or when energy demand is high.

We are Watching Key Economic Indicators

Consumer Spending

In February 2025, total consumer spending adjusted for inflation rose by 0.1% over January 2025. This follows a decline of 0.6% in January and an increase of 0.4% in December. According to the government, year-over-year inflation-adjusted total spending in February 2025 was up 2.1%. Inflation-adjusted spending on goods increased by 0.2% in February, following a 0.1% rise in January. Inflation-adjusted spending on services rose by 0.1% in February, following no change in January and marking the thirteenth consecutive month-to-month increase.

Consumer Confidence

The Index of Consumer Sentiment from the University of Michigan decreased from 64.7 in February to 57.9 in March.

The University of Michigan’s Index of Consumer Sentiment decreased from 100.1 in February to 92.9 in March.

Lease Bids

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Roud Hatch, Bottom Outlet Doors

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 20, 25.5k CPC 1232 Tanks needed off of UP, BN, CSX, NS in OK, TX, Northeast for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

- 100, 30K 117J Tanks needed off of BN in Montana for 2 years. Cars are needed for use in Crude service.

- 10, 25.5K Any Type Tanks needed off of CSX in Florida for 2 Years. Cars are needed for use in UCO service.

- 10, 25.5K Any Type Tanks needed off of Any Class 1 in Any Location for 3-12 months. Cars are needed for use in Asphalt service.

- 20, GP Tanks needed off of various class 1s in various locations for 1-5 years.

Sales Bids

- 28, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 24, 25.5K-30K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Base Oils. 1-2 Year

Sales Offers

- 21, 50′, Plate C Boxcars located off of various class 1s in NM. End of Life

- 3, 50′, Plate C Boxcars located off of various class 1s in multiple locations. End of Life

- 27, 50′, Plate C Boxcars located off of various class 1s in PQ. End of Life

- 100-300, 3250, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 5, 2740, Mill Gondolas located off of various class 1s in NC. End of Life

- 1, 2260, Mill Gondolas located off of various class 1s in AL. End of Life

- 30, 2740, Mill Gondolas located off of various class 1s in multiple locations. End of Life

- 21, 2740, Mill Gondolas located off of various class 1s in WA. End of Life

- 15, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 5, 4750, Covered Hoppers located off of various class 1s in multiple locations. End of Life

- 50-100, 31.8K, CPC 1232 Tanks located off of UP or BN in TX. Requal Due in 2025

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website