“We must believe that we are gifted for something”

–Marie Curie

Jobs Update

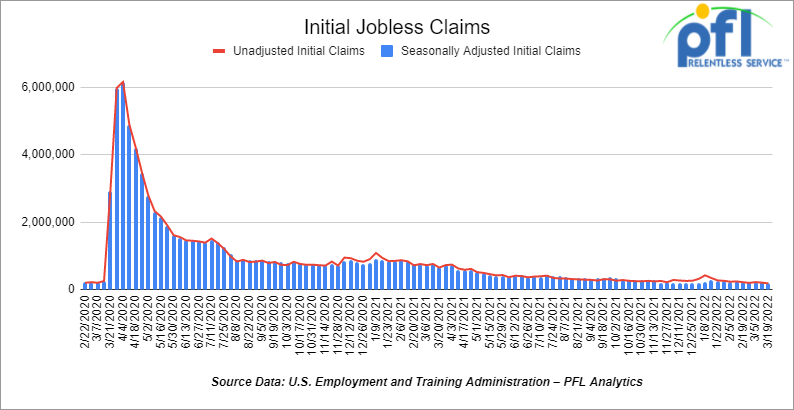

- Initial jobless claims for the week ending March 19, 2022 came in at 187,000, down -28,000 people week over week.

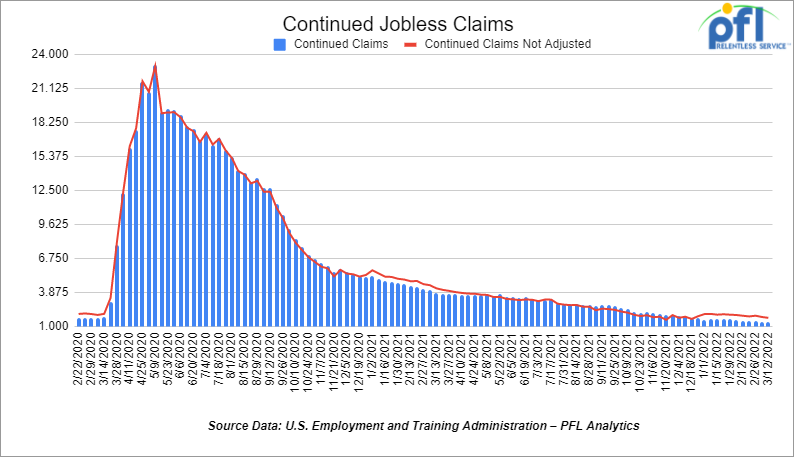

- Continuing claims came in at 1.35 million people versus the adjusted number of 1.417 million people from the week prior, down -67,000 people week over week.

Stocks mostly higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 153.30 points (0.44%), closing out the week at 34,861.24 points, up 106.32 points week over week. The S&P 500 closed higher on Friday of last week, up 22.9 points, and closed out the week at 4,543.06, up 79.94 points week over week. The Nasdaq closed lower on Friday of last week, down 22.54 points (-0.16%), and closed out the week at 14,169.3, up 275.46 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 34,771 this morning up 12 points.

Oil closed higher on Friday of last week and higher week over week

Folks, what a ride last week! Crude prices rose more than one percent on Friday of last week as traders reconciled the impact of a missile attack on an oil distribution facility in Saudi Arabia with a possible release of oil reserves by the U.S. WTI crude ended up closing up $1.56 (1.4%) at $113.90 per barrel. Brent crude settled up $1.62, also up 1.4 percent as well, to US$120.65 per barrel. Yemen’s Houthi group took credit for the attack and said that they had attacked a Saudi Aramco site with missiles. Both benchmarks notched their first weekly gains in three weeks — Brent rose more than 11.5% week over week and WTI gained 8.8% week over week. The market has been wrestling with Russian crude and what to do with it. China and India are buying it secretly. This attack by Yemen is not helpful and exposes the vulnerability of the supply mix.

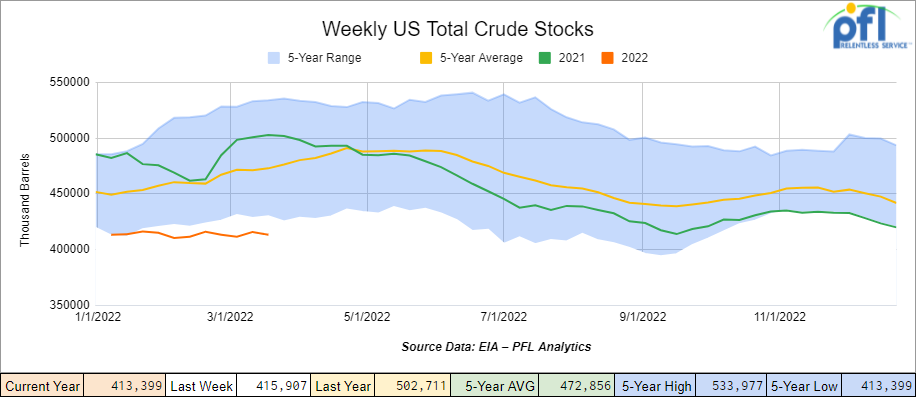

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.5 million barrels week over week. At 413.4 million barrels, U.S. crude oil inventories are 13% below the five-year average for this time of year.

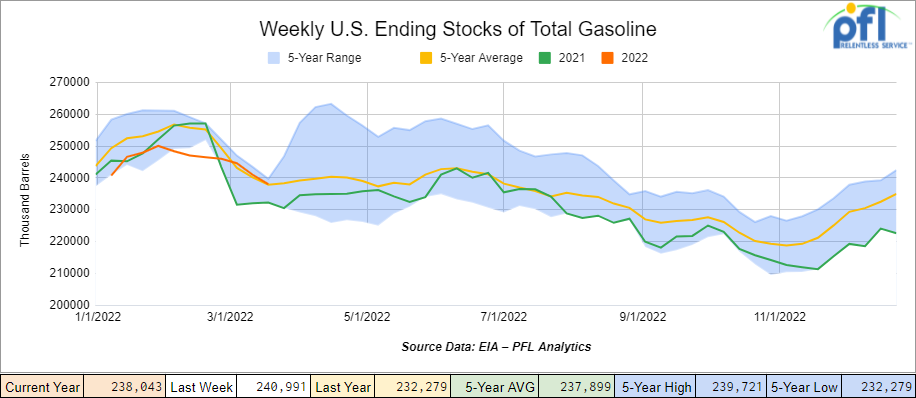

Total motor gasoline inventories decreased by 2.9 million barrels week over week and are at the five-year average for this time of year.

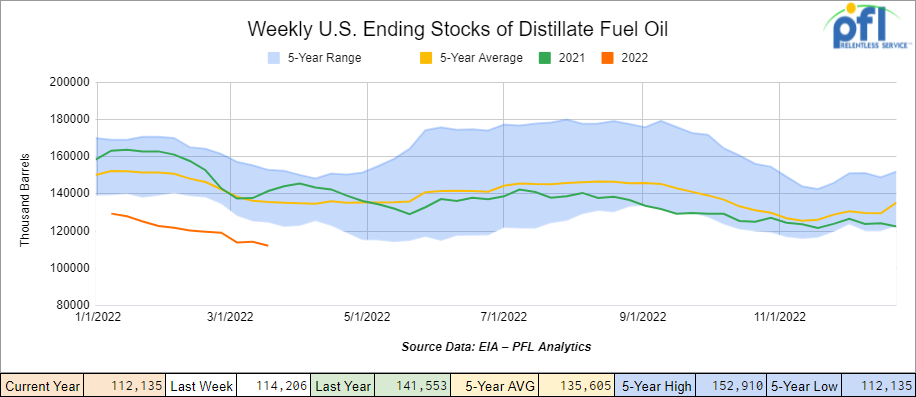

Distillate fuel inventories decreased by 2.1 million barrels week over week and are 17% below the five-year average for this time of year.

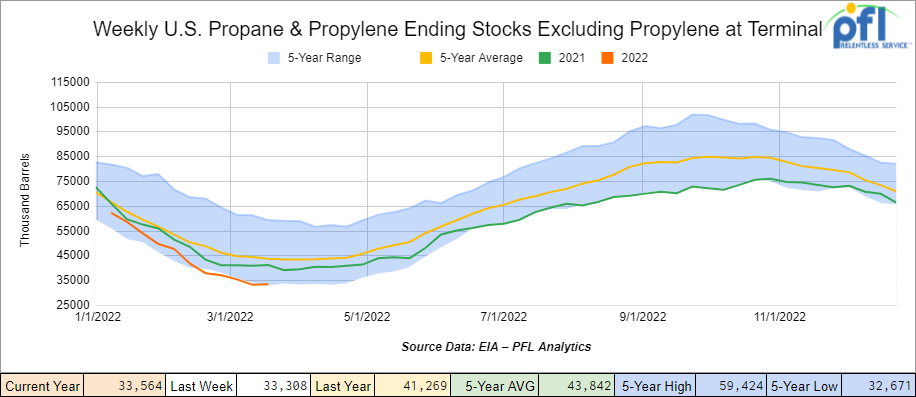

Propane/propylene inventories decreased by 2.2 million barrels week over week and are 25% below the five-year average for this time of year.

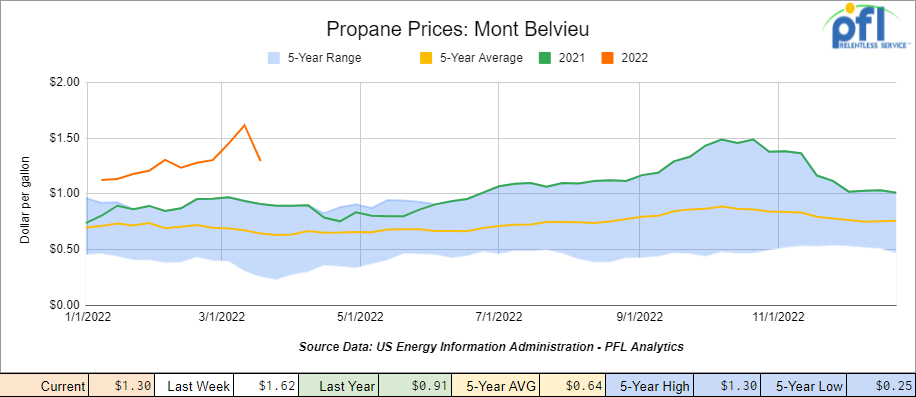

Propane prices fell sharply last week as weather improved and demand for prompt propane saw some relief. Propane prices fell 32 cents per gallon week over week to close at $1.30 per gallon, up 39 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 6.7 million barrels week over week.

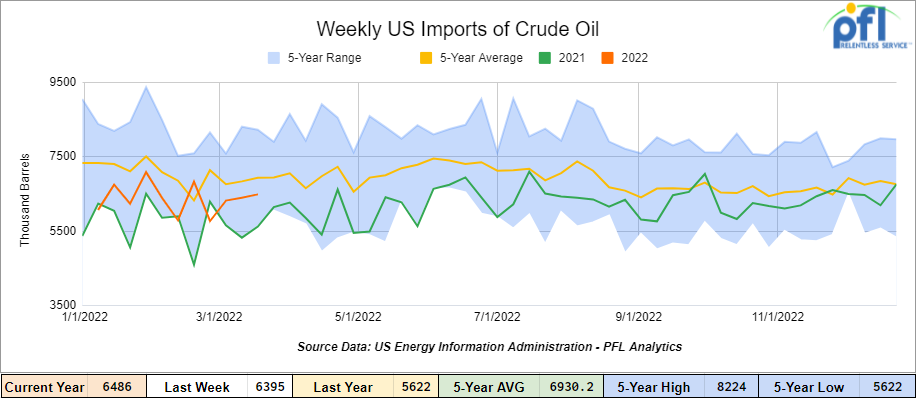

U.S. crude oil imports averaged 6.5 million barrels per day last week, up by 92,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.2 million barrels per day, 9.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 721,000 barrels per day, and distillate fuel imports averaged 172,000 barrels per day for the week ending March 18, 2022.

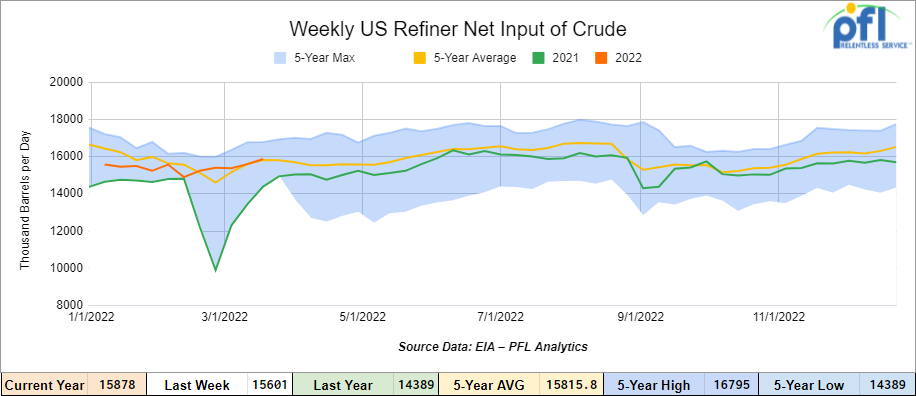

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending March 18, 2022, which was up 276,000 barrels per day week-over-week.

As of the writing of this report, WTI is poised to open at 109.48, down -4.42 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 3.5% year over year in week 11 (U.S.-2.7%, Canada -10.1%, Mexico +14.9%) resulting in the quarter to date volumes that are down 4.0% year over year (U.S. -2.6%, Canada -10.2%, Mexico +3.4%). 7 of the AAR’s 11 major traffic categories posted year-over-year declines with the largest decreases coming from intermodal (-6.0%) and grain (-18.7%). The largest increase came from coal (+8.4%).

CSX’s total volumes were down 1.7%, with the largest decreases coming from coal (-11.1%) and motor vehicles & parts (-13.5%). NS’s total volumes were down 3.1%, with the largest decreases coming from intermodal (-2.8%) and metals & products (-18.9%).

In the West, BN’s total volumes were down 2.6%, with the largest decreases coming from intermodal (-6.9%), grain (-21.4%) and petroleum (-26.2%). The largest increases came from coal (+20.0%) and stone sand & gravel (+37.4%). UP’s total volumes were up 1.8%, with the largest increases coming from chemicals (+18.3%) and coal (+16.5%). The largest decreases came from intermodal (-5.6%) and grain (-15.6%).

In Canada, CN’s total volumes were down 1.8%, with the largest decreases coming from intermodal (-9.3%) and grain (-27.4%). The largest increases came from coal (+171.9%) and petroleum (+37.2%). Revenue per ton miles was up 0.1%. CP’s total volumes were down 15.3%, with the largest decreases coming from intermodal (-11.9%), petroleum (-40.1%), grain (-20.7%) and farm products (-52.7%). Revenue per ton miles was down 24.0%.

KCS’s total volumes were up 5.5%, with the largest increases coming from intermodal (+9.8%) and coal (+62.5%). The largest decrease came from petroleum (-40.6%).

Source: Stephens

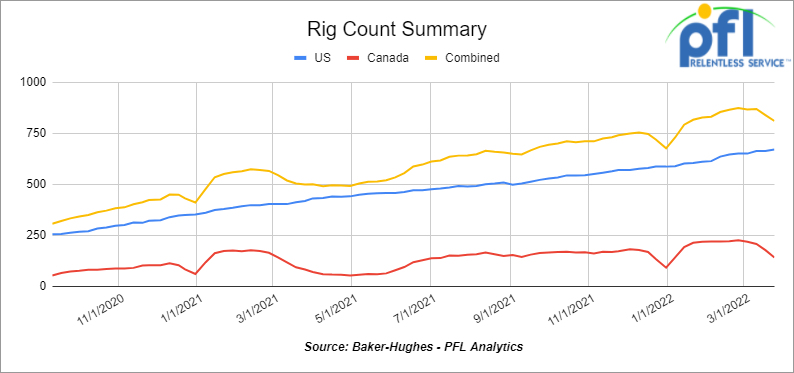

Rig Count

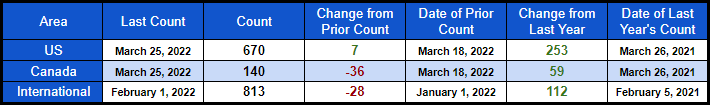

North American rig count is down by -29 rigs week over week. U.S. rig count was up by 7 rigs week over week and up by 253 rigs year over year. The U.S. currently has 670 active rigs. Canada’s rig count was down by -36 rigs week over week and up by 59 rigs year over year and Canada’s overall rig count is 140 active rigs. Overall, year over year, we are up 312 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,117 from 24,274, which is a loss of 157 rail-cars week over week. Canadian volumes were mixed week over week and CP shipments were down by 18.7% while CN volumes were up by 12.3%. U.S. volumes were mostly lower with the BN having the largest percentage increase (up by 5.8%) UP had the largest percentage decrease down by 12.2%.

We Are Watching Commodities

As I am sure all of you know, President Biden was running around Europe this past week and weekend touting that the U.S. is going to come to the rescue – provide Natural gas to Europe and wean Europe off of Russian Oil. If true, policies are going to change here at home and would be great news for the rail industry, the U.S. economy and consumers alike. In today’s report we are going to take a look at crude by rail, Natgas and LNG.

i) Crude and crude by rail. – Folks, we at PFL have had several conversations with a lot of people in the industry last week who have tank cars looking to lease out and have been asking what happened to crude by rail? When is it coming back? Why is it not back right now when oil is so high and we are having supply disruptions while in the middle of a war? These are very good questions and we will try and answer them the best we can, but the bottom line is it comes down to pipeline capacity, production, and governmental policies.

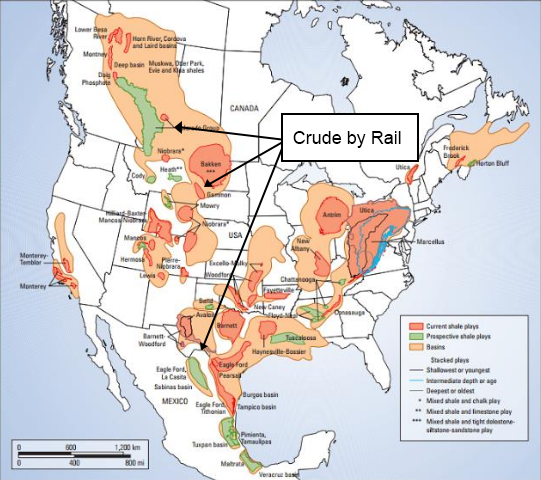

If you take a look at the three basins where crude by rail was prevalent in a big way, it was the Permian, Bakken and Alberta (Saskatchewan to a lesser extent).

Historical Major Crude by Rail Locations

Source: EIA PFL Analytics

The Permian play was short-term. Pipeline space was underbuilt in October of 2020 and midstream companies were tripping over themselves to get rail cars out to West Texas to load railcars with transloaders; either from wellhead directly into railcars, or trucking from wellhead to terminals where they were then loaded into rail cars. It was a play that only stuck around for 12 months. Pipeline companies caught up and once they came online made rail uncompetitive. We do not see this crude by rail play coming back anytime soon.

At the same time, crude by rail out of the Bakken was also on fire – terminals were built-in ND and railcars were in high demand driving prices up for rail cars significantly. The Dakota Access Pipeline (“DAPL”) solved that problem when it came online and again made rail uncompetitive, except out to the West Coast to feed refineries that did not have access to pipe out of the Bakken and limited pipeline capacity from Canada via TransMountain. President Trump got DAPL built, however, lawsuits continue to this day and the Standing Rock Sioux tribe wants the pipeline shut down despite DAPL wanting to expand (seems like it may be a good idea from a consumer standpoint to add some pumping stations and expand DAPL). Crude by rail out of North Dakota gaining significant traction once again is a wild card, but stay tuned to PFL we are watching this one closely.

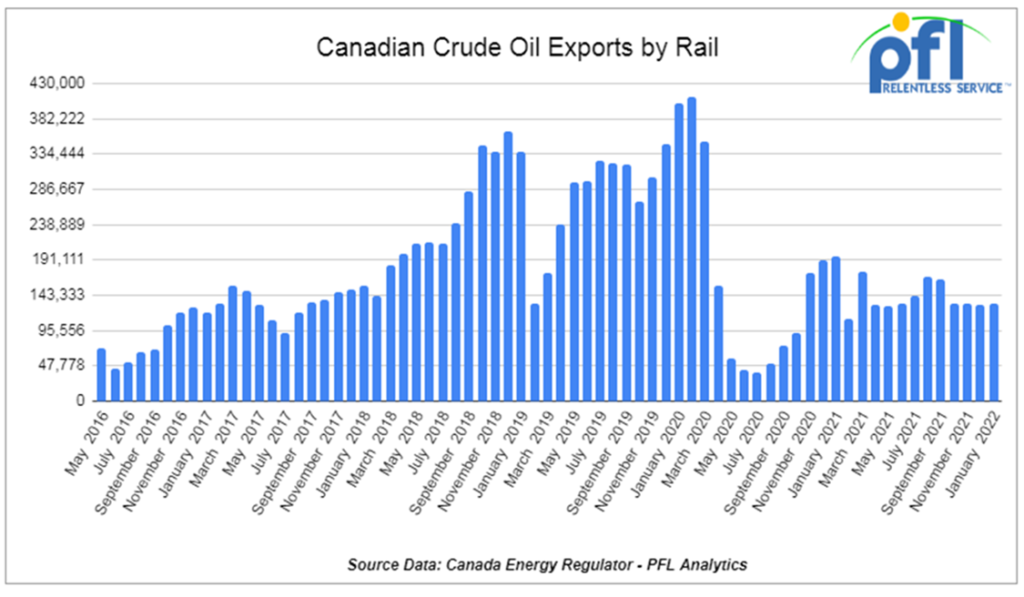

Let’s take a look at Canada: The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on Monday of last week. For January 2022, Canada exported 131,497 barrels per day by rail, up a mere 273 barrels per day month over month and a far cry from its peak of 411,991 barrels per day in February 2020.

Why is crude by rail not moving out of Canada? There are a few factors – but it all comes down to pipeline capacity and production. In 2020 there was not enough pipe out of Alberta. Basis in Alberta blew out to -40 against WTI and everyone was tripping over themselves to build and lease cars. Then COVID came, oil collapsed and railcars headed to storage. On top of that, the Alberta Government leased out 4,000 rail cars and never moved a barrel of crude and those cars stayed in storage. Enbridge line 3 came on in October 2021 and soaked up what volume could have moved by rail adding 370,000 barrels per day of capacity. The current situation in Alberta is as follows:

a) Inventories in Alberta have fallen sharply CER is reporting only 64 million barrels in storage as of the end of January down 17 million barrels from just three months ago, its lowest level since 2020.

b) Right now in Alberta there is no appropriation on pipelines like there used to be, meaning there is spare capacity for crude to be shipped via pipeline. The bottom line is production has not caught up to available takeaway capacity.

c) Basis in Alberta against WTI is only -$11 USD per barrel – there is no commercial rail play right now. Only a producer would benefit from this, producers don’t care about basis they only care about netbacks and right now they are extraordinary producers who are not over producing are unable to do so.

d) Enbridge is in never-ending legal battles over line 3 with the state of Michigan and Environmental groups. The Governor of Michigan – Gretchen Whitmer really wants the pipeline shut down.

If the Governor of Michigan is successful in getting Enbridge shut down, crude by rail will roar back – we are doubtful this will happen anytime soon given the current situation we are in, and in our mind would be political suicide. Non-haz raw bitumen in Canada is gaining traction and both CP and CN are excited about it. We see this picking up – raw bitumen can compete head-on with pipe capacity but it is going to take time. We also expect to see Canadian production increase – they have never had it so good up in Canada. The CAD$ is weak and there is an endless production that can be brought online. We do expect crude by rail in Canada to come back; it is just a matter of when that will be. However, don’t get all excited, it is going to be rocky, and don’t forget about the TransMountain pipeline that will add some significant takeaway capacity in December 2023. Crude by rail out of Alberta is up to the Canadian producer. Unless Keystone is resurrected, it’s coming.

ii) Natural Gas – Folks, the more Natural Gas we produce the more Natural Gas Liquids (“NGL”) we produce. NGLs include natural gasoline, propane, and butane and have a positive effect on the rail industry for obvious reasons – more rail traffic. Of course the more natural gas we produce, the more Liquefied Natural Gas (“LNG”) we can export. I know this is all basic stuff but why are we saying that we will bail out Europe out of their energy problem? We are at capacity as far as what LNG we can export. We are short propane here in the United States and prices are 50% higher than this time last year. Working Natgas in storage was 1,389 Bcf as of Friday, March 18, 2022, according to EIA estimates. Natural gas stocks were 366 Bcf less than last year at this time and 293 Bcf below the five-year average for this time of year. It looks as though we don’t have any incremental natural gas to give to Europe right now and the only way at this point we can give LNG to Europe is to divert cargo from Asia to Europe. LNG supply in the short term will not increase.

The reality is, we can produce more natural gas, export more LNG, and produce more NGLs pretty quickly if policies change and executive orders are signed by the President cutting red tape and legal challenges. The expansion of natural gas in the United States and natural gas pipelines is just as litigated as crude. Take the Mountain Valley Pipeline for example – this pipeline is 95% complete, however, environmental groups have successfully brought the project to a halt over concerns about impacts on waterways and endangered species. Senator Joe Manchin, who chairs the Senate Energy and Natural Resources Committee, said the pipeline should be completed now and said on March 7th

“That one pipeline coming out of West Virginia will put 2 billion cubic feet of gas a day into the market,” That can be accomplished in eight months. They’re 95 percent completed.”

Manchin is leading a bipartisan group of lawmakers in an effort to ban Russian imports of oil, natural gas and coal.

Letting companies drill on Federal Lands and rubber stamping permits will also help! Let’s see if we got lip service over in Europe or if real change is on the way.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off the KCS for 5 years. Needs to be lined.

- 30 boxcars on UP or CP for 3 years to run from TX to Edmonton – negotiable

- 6-10 Open top 4200 gons for hauling scrap NS in Ohio for 1-3 years

- 100, 2480CUFT Ag Gons needed in Texas off the UP for 1-3 Years.

- 50, 30K+ Tank cars needed in several locations. Can take in various locations off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale at various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale

- 20 20K Stainless cars in 3 locations in the south – sale or lease – negotiable

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

- 100 Center beam Flats with risers 73ft in SD and Iowa for sale negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|