“You’re off to great places, today is your day. Your mountain is waiting, so get on your way.”

– Dr. Seuss

COVID-19

The United States currently has 30,521,774 confirmed COVID 19 cases and 555,314 confirmed deaths.

US Jobless Claims

In the week ending March 13, the advance figure for seasonally adjusted initial unemployment claims was 770,000, an increase of 45,000 from the previous week’s revised level. The previous week’s level was revised up by 13,000 from 712,000 to 725,000. The 4-week moving average was 746,250, a decrease of 16,000 from the previous week’s revised average. The previous week’s average was revised up by 3,250 from 759,000 to 762,250. The advance seasonally adjusted insured unemployment rate was 3.0 percent for the week ending March 6, an increase of 0.1 percentage point from the previous week’s unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending March 6 was 4,124,000, a decrease of 18,000 from the previous week’s revised level. The previous week’s level was revised down by 2,000 from 4,144,000 to 4,142,000. The 4-week moving average was 4,255,500, a decrease of 99,000 from the previous week’s revised average. The previous week’s average was revised down by 500 from 4,355,000 to 4,354,500.

Markets were Lower Week over Week

The Dow closed lower on Friday of last week, down -234.33 (-.71%) closing out the week at 32,627.97 points, down -150.67 points week over week. The S&P 500 closed lower on Friday of last week, down -2.36 points (-.06%) and closing out the week at 3,913.10 , down -30.24 points week over week. The Nasdaq closed higher on Friday of last week, up +99.07 points (+0.76%) closing out the week at 13,215.24 points, down -104.62 points week over week.

In overnight trading, DOW futures traded lower and are expected to open down this morning 65 points

Crude Rally Collapses week over week

Oil traded lower this week on the back of a stronger U.S. dollar, persistently weak fundamentals and Iranian crude oil hitting the market. China, the world’s largest crude oil importer, is currently buying close to 1 million barrels a day of sanctioned crude, condensate and fuel oil from Iran according to estimates by traders and analysts. Oil did have a comeback on Friday of last week from the most recent selloff on comments from investment banks from Goldman Sachs to Morgan Stanley that said the selloff was excessive and offered an opportunity to buy, with physical crude markets still showing signs of strength in the long run. WTI crude oil for April delivery rose +$1.44 to settle at $61.44 a barrel Friday of last week, down $4.17 a barrel week over week. Brent crude oil for May delivery also rose higher gaining $1.25 a barrel on Friday of last week closing at $64.53 a barrel, down $4.69 per barrel week over week.

U.S. commercial crude oil inventories increased by 2.4 million barrels week over week. At 500.8 million barrels, U.S. crude oil inventories are 6% above the five year average for this time of year. Total motor gasoline inventories increased by 0.5 million barrels week over week and are 4% below the five year average for this time of year. Finished gasoline inventories increased while blending components inventories remained unchanged last week. Distillate fuel inventories increased by 0.3 million barrels week over week and are 2% below the five year average for this time of year.

Propane/ propylene inventories decreased by 0.2 million barrels last week and are 15% below the five year average for this time of year. Total commercial petroleum inventories increased by 3.6 million barrels last week.

U.S. crude oil refinery inputs averaged 13.4 million barrels per day during the week ending March 12, 2021 which was 1.1 million barrels per day more than the previous week’s average. Refineries operated at 76.1% of their operable capacity last week. Gasoline production decreased last week, averaging 8.9 million barrels per day. Distillate fuel production increased last week, averaging 4.2 million barrels per day.

U.S. crude oil imports averaged 5.3 million barrels per day last week, down by 332,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.5 million barrels per day, 13.9% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 910,000 barrels per day, and distillate fuel imports averaged 524,000 barrels per day.

Oil is higher in overnight trading and, as of the writing of this report, WTI is poised to open at $61.78, up 36 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were up 10.3% year over year in week 10 (U.S. +12.5%, Canada +8.1%, Mexico -6.9%) resulting in year to date volumes that are up 2.8% year over year (U.S. +2.7%, Canada +5.6%, Mexico -5.8%). 5 of the AAR’s 11 major traffic categories posted year over year increases with the largest increases coming from intermodal (+21.5%), coal (+13.0%) and grain (+21.2%). The largest decreases came from motor vehicles & parts (-19.9%).

In the East, CSX’s total volumes were up 6.4%, with the largest increase coming from intermodal (+20.2%). The largest decrease came from motor vehicles & parts (-24.5%). NS’s total volumes were up 11.4%, with the largest increases coming from intermodal (+16.4%), coal (+38.2%) and metals & products (+22.6%). The largest decrease came from motor vehicles & parts (-22.4%).

In the West, BN’s total volumes were up 18.4%, with the largest increases coming from intermodal (+32.9%) and coal (+25.6%). The largest decreases came from petroleum (-22.5%) and motor vehicles & parts (-20.1%). UP’s total volumes were up 5.2%, with the largest increases coming from intermodal (+18.4%) and grain (+59.6%). The largest decreases came from chemicals (-14.5%), motor vehicles & parts (-18.7%) and stone sand & gravel (-17.1%).

In Canada, CN’s total volumes were up 9.8%, with the largest increase coming from intermodal (+35.1%). The largest decreases came from motor vehicles & parts (-24.7%) and metallic ores (-12.0%). RTMs were up 4.7%. CP’s total volumes were up 1.4%, with the largest increase coming from grain (+53.1%). The largest decrease came from petroleum (-22.9%). RTMs were down 1.2%.

KCS’s total volumes were up 4.4%, with the largest increases coming from coal (+106.8%) and petroleum (+29.3%). The largest decrease came from motor vehicles & parts (-30.4%).

Source: Stephens

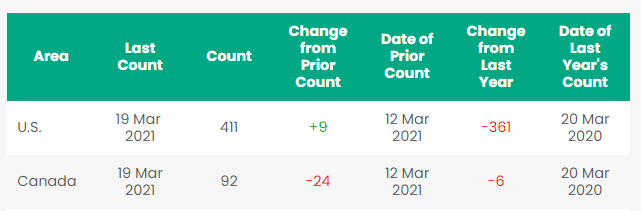

Rig Count

North America rig count is down by 15 rigs week over week. The U.S. was up by 9 rigs week over week The U.S. currently has 411 active rigs. (Oil rigs were up nine rigs week over week and are currently at 318 active rigs, gas rigs are unchanged at 92 rigs and miscellaneous rigs are unchanged at one active rig). More than half the U.S. oil rigs are in the Permian basin in West Texas and eastern New Mexico where total units rose four to 216 this week, the most since May. So far this year, drillers have added 41 rigs in the Permian. That compares with no rigs added in the basin during the same period last year. Oil output from the Permian, the top producing basin in the country, is expected to rise for a second straight month in April, the government said in a monthly forecast on Monday of last week. Canada’s rig count was down by 24 rigs week over week and Canada’s overall rig count is 92 active rigs. Canada’s rig utilization rate currently sits at 20%. Year over year we are down 367 rigs collectively.

North American Rig Count Summary

Things We are Keeping an Eye on

1. Calgary based -Canadian Pacific Railway Ltd. (CP) has offered to buy Kansas City Southern (KCS) for $28.9 billion. CP has offered KCS $275 a share in a cash and stock deal. The price represents a 23% premium to Friday’s close of $224.16.

The transaction will give CP access to the KCS’, Midwestern rail network that connects farms in Kansas and Missouri to ports along the Gulf of Mexico. It would also give it reach to Mexico, which made up almost half of KCS’s revenue last year, and create the only network that cuts through all three North American countries. CP and KCS meet at Kansas City, and a combination of the two would be able to operate from Canada’s industrial heartland all the way down through the middle of the United States and on through Mexico’s industrial centers and to the port of Lazaro Cardenas on Mexico’s Pacific coast. (See map below)

CP & KCS a Combined Force

No filing has been posted with the U.S. Surface Transportation Board as of Friday, according to the regulator’s website.

Mexico is a crucial supplier of automobiles, electronics and food and a major customer of grain, fuel and consumer goods — ties that are likely to be strengthened by July’s passage of the U.S.-Mexico-Canada trade pact.

Shares of KCS have jumped 9.8% this year, CP’s share rose to a record on Thursday of last week and has climbed 7.4% for the year.

2. Keystone Pipeline – A group of twenty one states is suing the Biden administration for its cancellation of the Keystone XL pipeline including Alabama, Arizona, Arkansas, Georgia, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Texas, Utah, West Virginia and Wyoming. The multistate lawsuit led by Montana and Texas was filed Wednesday of last week in the U.S. District Court for the Southern District of Texas. The suit claims only Congress has the legal authority to approve or cancel the pipeline permit. TC Energy has not cancelled the project yet but has suspended the project and is accessing options with its partners that includes the Government of Alberta itself.

3. Petroleum by Rail – The four-week rolling average of petroleum carloads carried on the sixth largest North American railroads rose to 25,396 from 24,448 week over week on the back of continuing improvement in weather conditions. Canadian volumes suffered on the back of weaker differentials. CP shipments fell by 20.1% and CN volumes were down by 2.9%. U.S. railroad operators were mixed, the UP had the largest percentage increase, up by 2.8% while CSX’s shipments were down by 13.5%.

4. President Joe Biden’s Administration is asking a court for a chance to reconsider the 2020 rule that relaxed the stringency of environmental reviews for pipeline, federal oil and gas leases, LNG export facilities and highways. The 2020 rule enacted by the Trump administration limited the review time to two years amongst other items to allow pipelines and other infrastructure projects to get built faster. It seems that Biden wants to institute tighter scrutiny and more regulations to getting projects shovel ready.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 20 CPC 1232s for the use in Sweet crude needed in Kentucky for 1 year.

- 150 2400 CF Steel Gondolas needed for Iron Pyrite Service in Montana for 1-3 Years. Needed end of Q4 2021

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- 50 29,188 US GAL EC&I CPC 1232s with Magnetic gage rods for up to 1 year starting April 1.

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|