“They can because they think they can.”― Virgil

Jobs Update

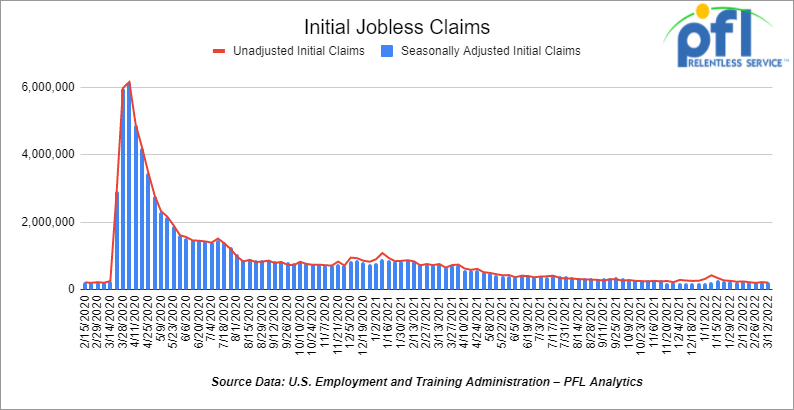

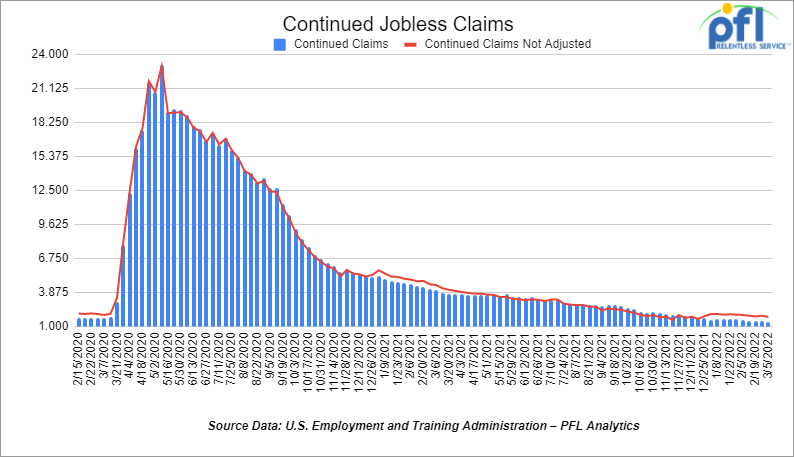

- Initial jobless claims for the week ending March 12th came in at 214,000, down -15,000 people week over week.

- Continuing claims came in at 1.419 million people versus the adjusted number of 1.490 million people from the week prior, down -71,000 people week over week.

Stocks closed higher on Friday of last week and up week over week

The DOW closed higher on Friday of last week, up 274.17 points (0.8%), closing out the week at 34,754.92 points, up 1,810.73 points week over week. The S&P 500 closed higher on Friday of last week, up 51.45 points and closed out the week at 4,463.12, up 258.81 points week over week. The Nasdaq closed higher on Friday of last week, up 279.06 points (2.05%) and closed out the week at 13,893.84 up 1,050.03 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 34,573 this morning down -60 points.

Oil closed higher on Friday of last week but lower week over week

Oil prices are back above $100 after negotiations between Russia and Ukraine deteriorated. Energy markets are rife with uncertainty with the IEA suggesting that consumers will have to figure out how to reduce demand as supply shortages loom. WTI gained (1.7%) on Friday of last week with U.S. West Texas Intermediate crude futures settling up $1.72 per barrel at $104.70 per barrel adding to the previous session’s eight per cent jump. Brent crude futures settled up $1.29, or 1.2 per cent, to US$107.93 per barrel, a day after surging nearly nine percent in the biggest daily percentage gain since mid-2020.

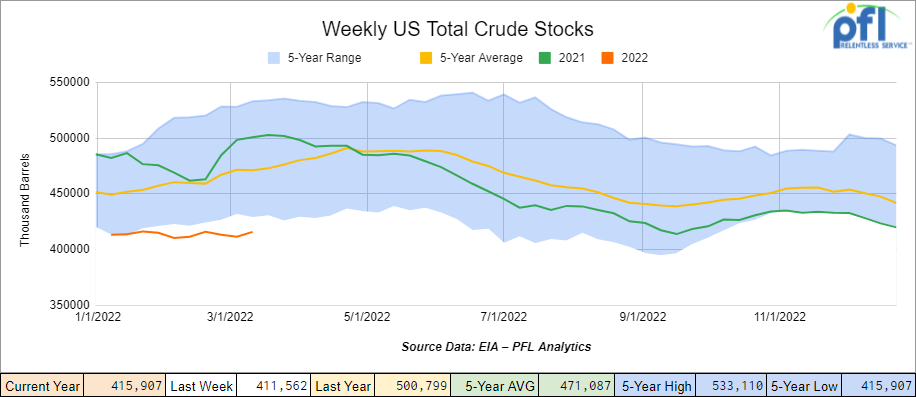

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.3 million barrels week over week. At 415.9 million barrels, U.S. crude oil inventories are 12% below the five-year average for this time of year.

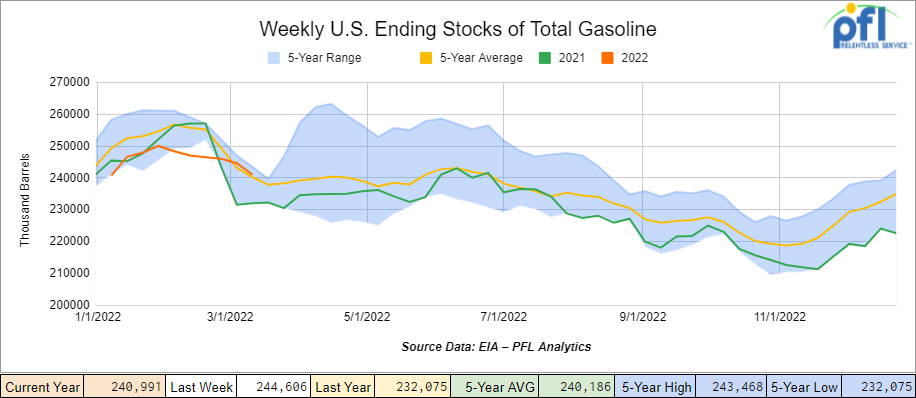

Total motor gasoline inventories decreased by 3.6 million barrels week over week and are at the five-year average for this time of year.

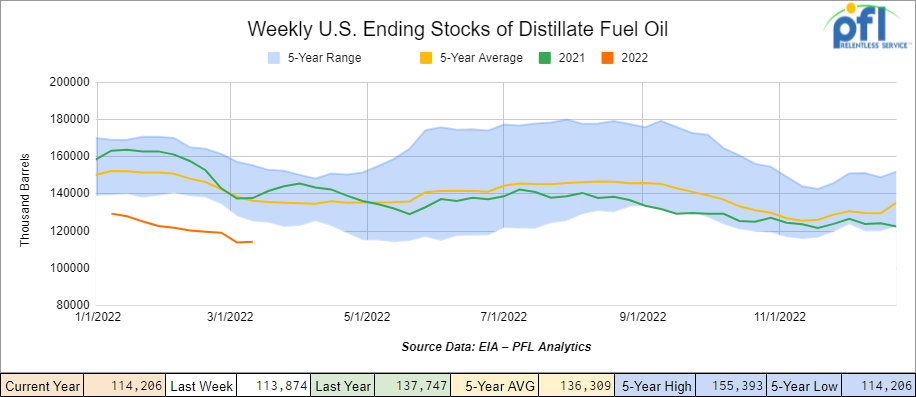

Distillate fuel inventories increased by 300,000 barrels week over week and are 16% below the five-year average for this time of year.

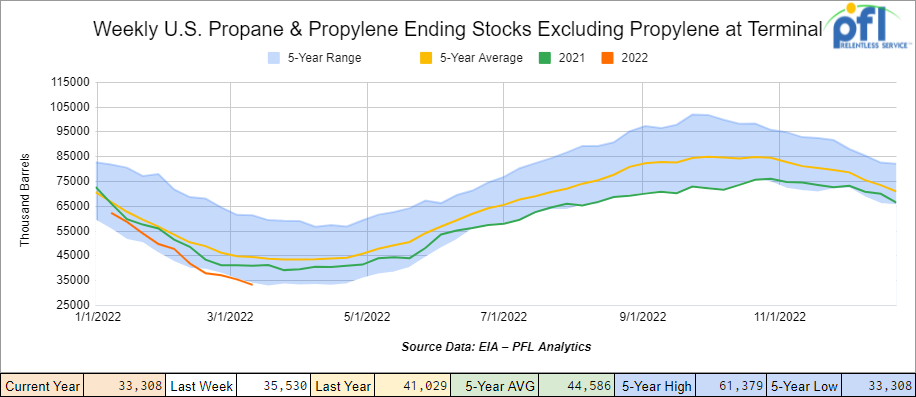

Propane/propylene inventories decreased by 2.2 million barrels week over week and are 25% below the five-year average for this time of year.

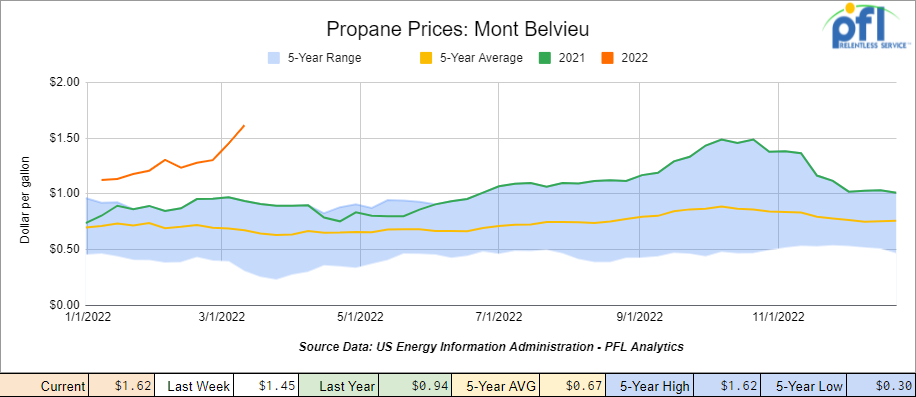

Propane prices moved significantly higher week over week, up 17 cents per gallon and up 66 cents per gallon year over year.

Overall, total commercial petroleum inventories decreased by 3.6 million barrels week over week.

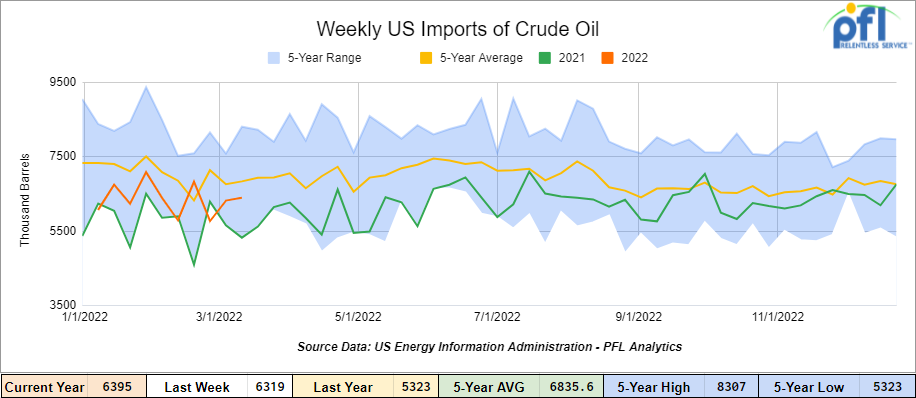

U.S. crude oil imports averaged 6.4 million barrels per day, up by 76,000 barrels per day, week over week. Over the past four weeks, crude oil imports averaged about 6.3 million barrels per day, 15.7% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 531,000 barrels per day, and distillate fuel imports averaged 222,000 barrels per day for the week ending March 11th, 2022.

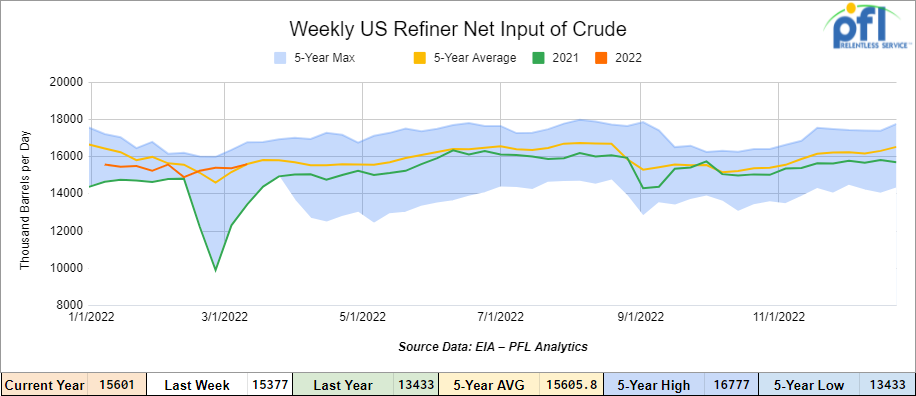

U.S. crude oil refinery inputs averaged 15.6 million barrels per day during the week ending March 11, 2022 which was 224,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $108.29 , up $3.59 per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 4.9% year over year in week 10 (U.S. -4.7%, Canada -8.9%, Mexico +10.3%) resulting in quarter to date volumes that are down 4.0% year over year (U.S. -2.6%, Canada -10.2%, Mexico +2.3%). 8 of the AAR’s 11 major traffic categories posted year over year declines with the largest decreases coming from intermodal (-8.1%) and grain (-16.2%). The largest increase came from chemicals (+11.5%).

In the East, CSX’s total volumes were down 1.2%, with the largest decrease coming from intermodal (-4.1%). The largest increase came from chemicals (+15.4%). NS’s total volumes were down 5.5%, with the largest decreases coming from intermodal (-6.4%) and coal (-16.6%). The largest increase came from chemicals (+14.5%).

In the West, BN’s total volumes were down 6.5%, with the largest decreases coming from intermodal (-9.9%), grain (-12.8%) and petroleum (-19.9%). The largest increases came from chemicals (+15.8%) and stone sand & gravel (+26.9%). UP’s total volumes were up 1.4%, with the largest increases coming from chemicals (+29.6%) and coal (+22.7%). The largest decrease came from intermodal (-6.5%).

In Canada, CN’s total volumes were down 6.2%, with the largest decreases coming from intermodal (-11.0%) and metallic ores (-19.8%). The largest increase came from coal (+98.4%). Revenue per ton miles was down 8.4%. CP’s total volumes were down 6.9%, with the largest decreases coming from grain (-29.6%) and farm products (-57.4%). Revenue per ton miles was down 12.2%.

KCS’s total volumes were up 2.7%, with the largest increase coming from intermodal (+12.6%) and the largest decrease coming from petroleum (-29.2%).

Source: Stephens

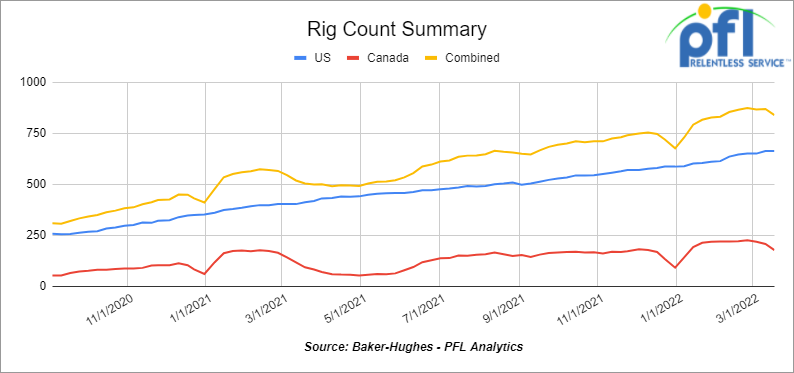

Rig Count

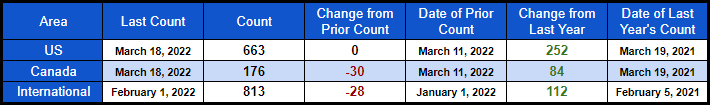

North American rig count is down by -30 rigs week over week. U.S. rig count was flat week over week and up by 252 rigs year over year. The U.S. currently has 663 active rigs. Canada’s rig count was down by -30 rigs week over week and up by 84 rigs year over year and Canada’s overall rig count is 176 active rigs. Overall, year over year, we are up 336 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on:

CP on Strike

CP Rail trains stopped moving Sunday morning after thousands of workers began a long anticipated strike. With nearly 3000 conductors, engineers and other workers on the sidelines, this move will only add to the supply chain woes that are affecting the shipment of goods across the continent and the world. This is a serious blow to normalizing shipments of food, grains and other essentials for businesses and consumers. Farmers are particularly vulnerable to a delay in seed and fertilizer for the spring plantings. There are 26 outstanding issues on the table and let’s hope the sides are moving to a quick resolution.

Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,274 from 24,623, which is a loss of 349 rail-cars week over week. Canadian volumes were lower week over week CP shipments were down by 5.8% while CN volumes were down by 6.2 %. U.S. volumes were mostly lower with the BN having the largest percentage decrease (down by 5.3%) Up had the largest percentage increase up by 5.5%.

Rail Headcount

The Surface Transportation Board (STB) recently released February headcount data for the U.S. rails. For the industry as a whole, February headcount was down 0.2% year over year versus January headcount that was down 1.5% year over year. Industry headcount did increase 1.9% versus the 5-year February average of flat sequentially. All rails saw a sequential improvement in headcount with the exception of KCS.. All class ones have been vocal around their efforts to build their labor pipeline for months and this is starting to materialize in higher headcount levels albeit not enough. Hopefully headcount will continue to increase and service improves.

Russian Crude Scattering to Find a Home Before Deadline

At least 10 vessels carrying Russia-linked cargoes of crude and refined products were approaching the United States as of Wednesday last week, as suppliers rushed to deliver ahead of the U.S. government’s deadline to wind down Russian energy purchases.

The United States earlier this month banned imports of Russian energy products due to the invasion of Ukraine. Washington’s ban gives importers until April 22 to discharge cargoes moving under pre-ban contracts.

At least one tanker carrying fuel oil heading to the United States has diverted, and at least two others that stopped at Russian terminals are awaiting discharge at U.S. ports, according to Refinitiv.

U.S. crude and products arrivals from Russia are forecast to be 18 million barrels, or 597,000 barrels per day (bpd) on average this month. That compared with an average of 672,000 bpd last year, according to U.S. government data. We expect this shortfall to the U.S. will somehow reach China – others say Russia may have to shut in some barrels.

Russia may have to shut in 3 million barrels of crude oil per day – IEA Says it has the Answer

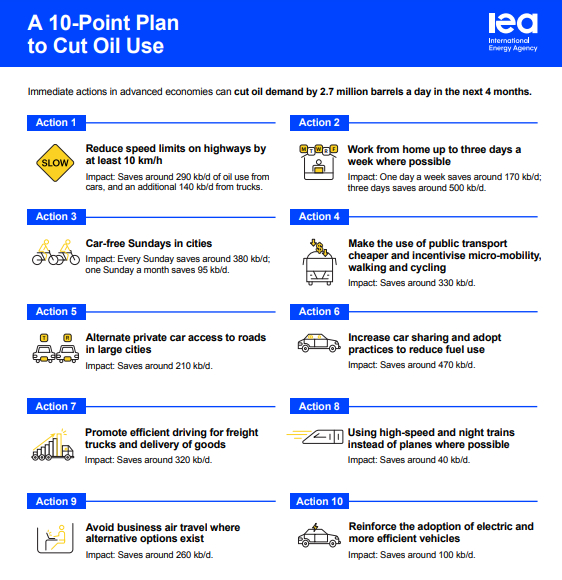

In a press release on March 18th,the IEA seems like they figured it out and said – “With Russia’s invasion of Ukraine resulting in lower supplies to oil markets ahead of peak demand season, IEA 10-Point Plan proposes actions to ease strains and price pain.” The IEA’s new 10-Point Plan to Cut Oil Use they said would lower oil demand by 2.7 million barrels a day within four months – equivalent to the oil demand of all the cars in China. This would significantly reduce potential strains at a time when a large amount of Russian supplies may no longer reach the market and the peak demand season of July and August is approaching. The measures would have an even greater effect if adopted in part or in full in emerging economies as well, the IEA went on to say. Folks, we believe there will be natural demand destruction at some point prices do not go up forever. China has 37 million people on lockdown right now due to COVID19. See the 10-point plan below and you decide, looks like the IEA is recommending a lot of government control (as if we don’t have enough already!).

Source: IEA

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 5, 29k Tank Cars needed in Texas off the KCS for 5 years. Needs to be lined.

- 100, 2480CUFT Ag Gons needed in Texas off the UP for 1-3 Years.

- 50, 30K+ Tank cars needed in several locations. Can take in various location off various Class 1’s. Can have prior Ethanol heel or Gasoline heel.

- 300 5800 Covered hoppers needed for plastic – 5 year lease – negotiable

- 50 29K C&I Tanks for veg oil to purchase – Immediate need

- 15 5200-5500 PD hoppers in the west UP for 5 years for soda ash negotiable

- 30 5800 and 6250 covered gons for sale

- 50, 5800cuft or larger Covered Hopper for use in DDG needed in the Midwest for 3-4 years. Immediate need.

- 10-20 Covered hopper grain cars in the midwest 5200-5500 2-3 years

- 20-30, 19K Tank Cars for Caustic Soda needed in Texas off the UP or BN.

- 100 Moulton Sulfur cars for purchase – any location – negotiable

- 12 Plate F 286 GRL Boxcars 12’ plug doors midwest preferred for 1 year lease

- 30-50 Log Flats with stanchions 286K GRL in the midwest/east CSX NS 1-3 years negotiable

- 50 Ag Gons 2500-2800cuft 286k GRL in the east CSX for 5 years negotiable

- 25 Covered wood chip Gons 6000CF 286 GRL any location for 1-3 years negotiable

- 25 Boxcars for paper 6000CF 286 GRL 1-3 years anywhere

- 100 15K Tanks 286 for Molten Sulfur in the Northeast CSX/NS for 6 months negotiable

- 100, 5800 Covered Hoppers 286 can be West or East for Plastic 3-5 years

- 70, 117R or J needed for Ethanol for 3 years. Can take in the South.

- 50, 6500+ cu-ft Mill Gon or Open Top Hopper for wood chips in the Southeast for 5 Years.

- 25 bulkhead flats 286 any class one for up to 5 years Negotiable

- 20, 19,000 Gal Stainless cars in Louisiana UP for nitric acid 1-3 years – Oct negotiable

- 10, 6,300CF or greater covered hoppers are needed in the Midwest.

- 2, 89’ Flat cars for purchase or lease – needed in TX off the BNSF

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations including Rs 111s, and Js – Selection is Dwindling. Call Today!

- 200 Clean C/I 25.5K 117J in Texas. Brand New Cars!

- 150 25.5 111’s in the midwest for sale – Negotiable

- Up to 150 sand cars for sale various locations and class ones – Great Price!

- 150 117R’s 31.8 clean for lease in Texas KCS – negotiable

- 31.8K Tank Cars last in Diesel. Dirty to dirty in Texas

- 200 117Js 29K OK and TX Clean and brand new – Lined- lease negotiable

- 100 117Rs dirty last in Gasoline in Texas for lease Negotiable

- 90 117Rs 30K located in Alberta CN or CP Refined Products Dirty – negotiable

- 99 340W Pressure Cars various locations Butane and Propane dirty negotiable

- 100 73 ft 286 GRL riser less deck, center part for sale

- 30 CPC 1232 25.5K C/I Pennsylvania NS clean negotiable

- 100-150 29K C/I 117J cars for lease. Dirty in Bakken crude and can be returned dirty.

- 100 29K C/I 1232 cars for lease. Dirty in Heavy Crude and can be returned dirty.

- 50 29K 117Js in Nebraska for sale or lease clean last in crude

- 100 117Rs 29K clean last used in crude Washington State – price negotiable sale or lease

- 100 111s of various volumes and locations last in fuel oil dirty price negotiable

- Various Hoppers for lease 3000-6250 CF 263 and 286 multiple locations negotiable

- 28 20K Veg oil cars for lease in Arkansas – Negotiable

- 100 3200 Covered Hoppers for sale price negotiable

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offer Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|