“The growth and development of people is the highest calling of leadership.”

-Harvey S. Firestone

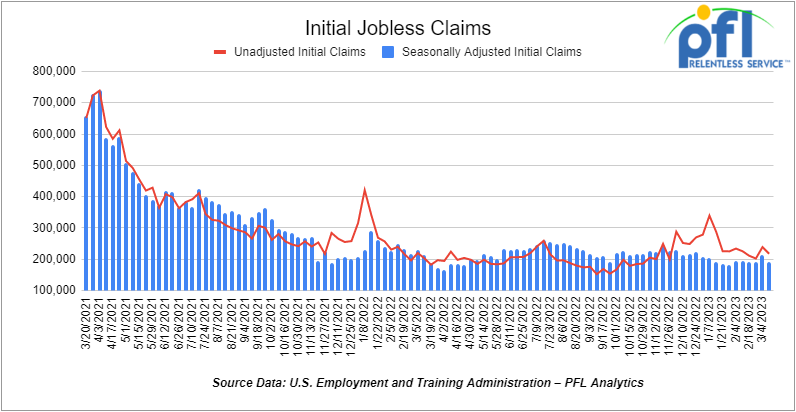

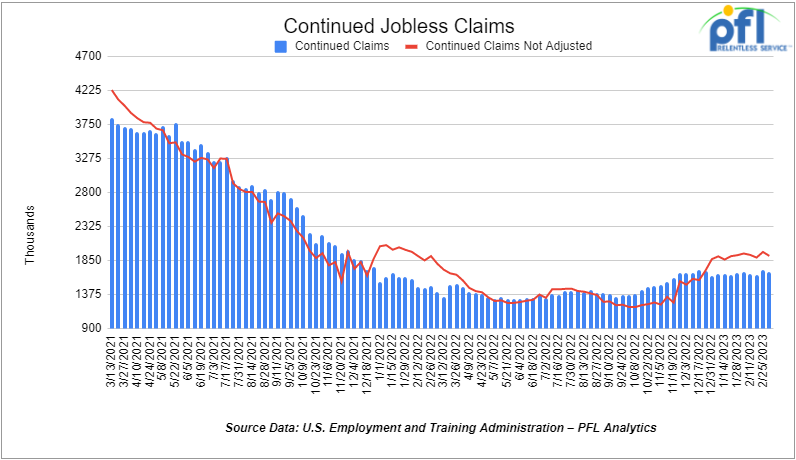

Jobs Update

- Initial jobless claims for the week ending March 11th, 2023 came in at 192,000, down -20,000 people week-over-week.

- Continuing jobless claims came in at 1.684 million people, versus the adjusted number of 1.713 million people from the week prior, down -29,000 people week over week.

Stocks closed lower on Friday of last week and mixed week over week

The DOW closed lower on Friday of last week, down -384.57 points (-1.19%), closing out the week at 31,861.98 down -392.88 points week over week. The S&P 500 closed lower on Friday of last week, down -43.64 points (-1.1%) and closed out the week at 3,916.64, up 55.05 points week over week. The NASDAQ closed lower on Friday of last week, down -86.76 points (-0.78%), and closed the week at 11,630.51, up 491.62 points week over week.

In overnight trading, DOW futures traded lower and are expected to open at 31,946 this morning down -125 points.

WTI closed lower on Friday of last week and down week over week

WTI traded down -$1.61 per barrel (-2.4%) to close at $66.74 per barrel on Friday of last week, down -$9.94 per barrel week over week. Brent traded down -US$1.73 per barrel (-2.3%) on Friday of last week, to close at US$72.97 per barrel, down -US$9.81 per barrel week over week.

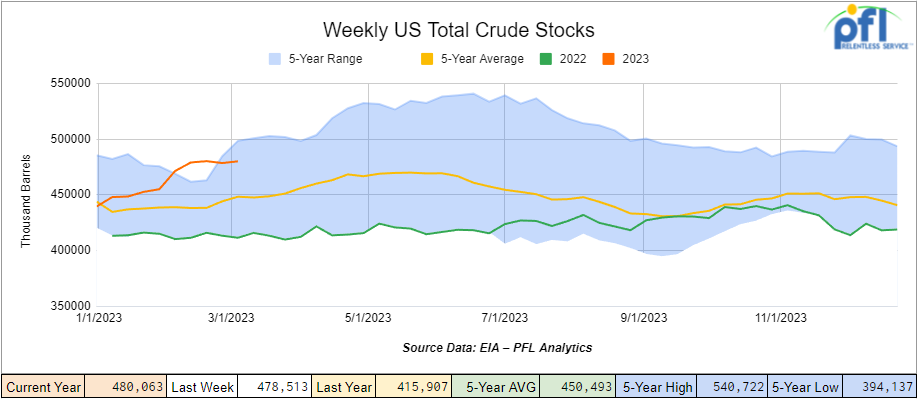

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.6 million barrels week over week. At 480.1 million barrels, U.S. crude oil inventories are 7% above the five-year average for this time of year.

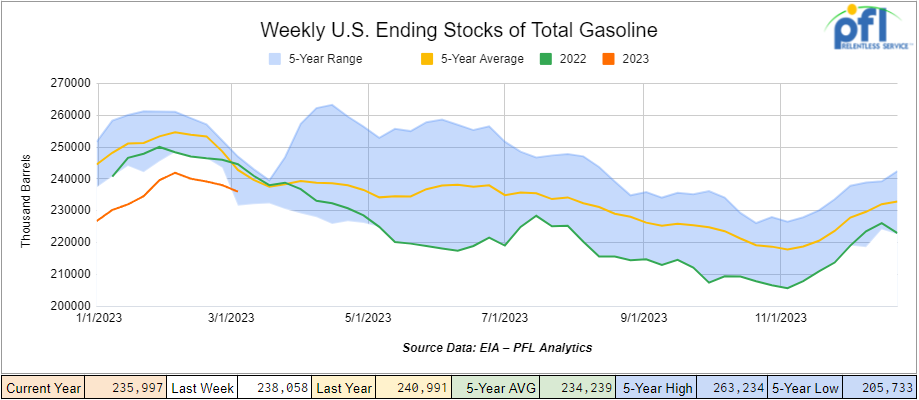

Total motor gasoline inventories decreased by 2.1 million barrels week over week and are 3% below the five-year average for this time of year.

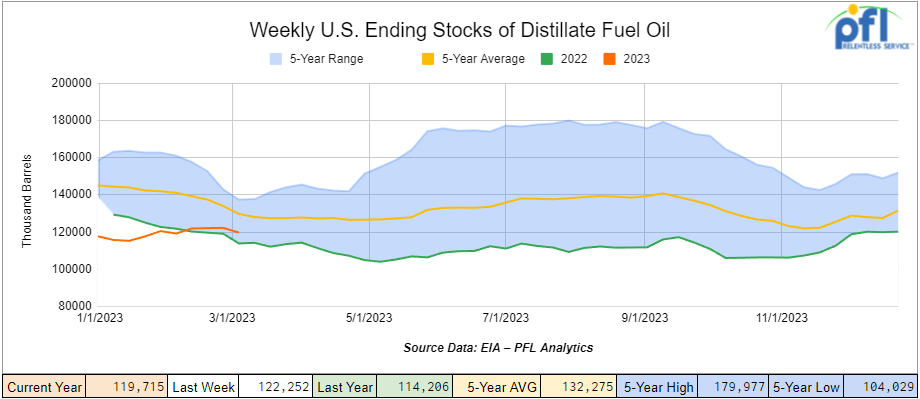

Distillate fuel inventories decreased by 2.5 million barrels week over week and are 8% below the five-year average for this time of year.

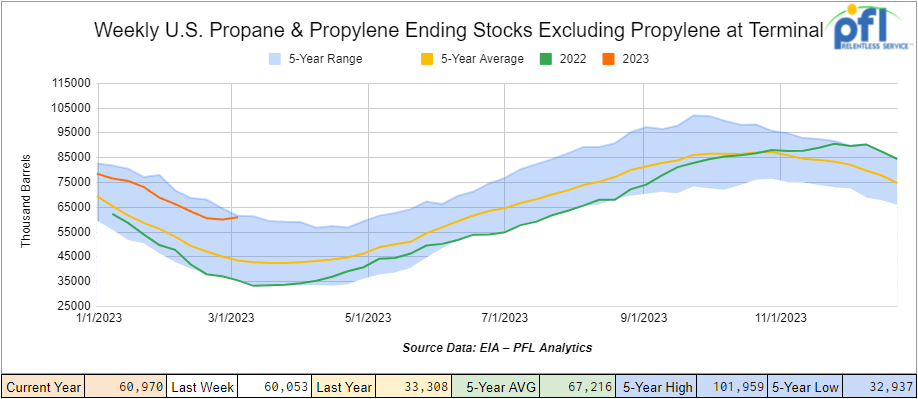

Propane/propylene inventories increased by 900,000 barrels week over week and are 42% above the five-year average for this time of year.

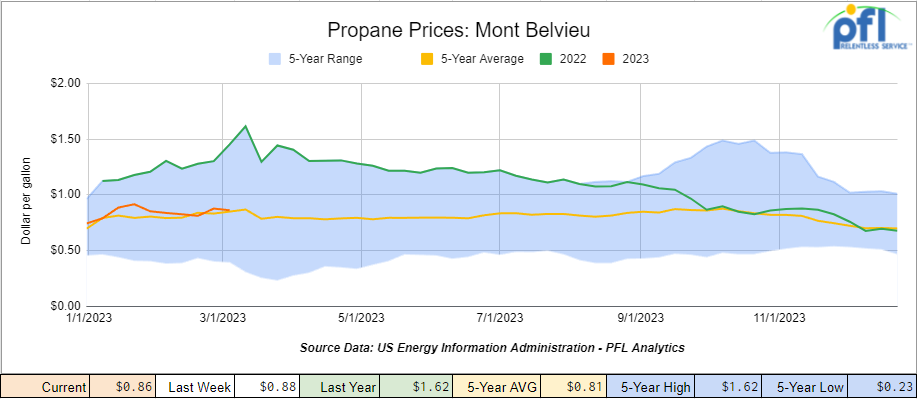

According to the EIA weekly Propane lost 2 cents per gallon week over week, closing at 86 cents a gallon, down 76 cents per gallon year over year however, spot propane prices closed even lower on Friday of last week closing out the day, and the week at 72 and ½ of a cent per gallon.

Overall, total commercial petroleum inventories decreased by 1.9 million barrels week over week.

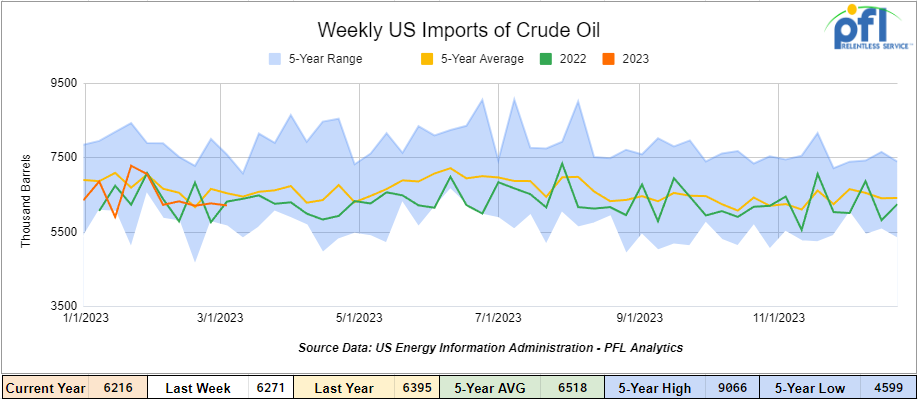

U.S. crude oil imports averaged 6.2 million barrels per day during the week ending March 10th, 2023, a decrease of 55,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, which is 1.1% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 450,000 barrels per day, and distillate fuel imports averaged 155,000 barrels per day during the week ending March 10th, 2023.

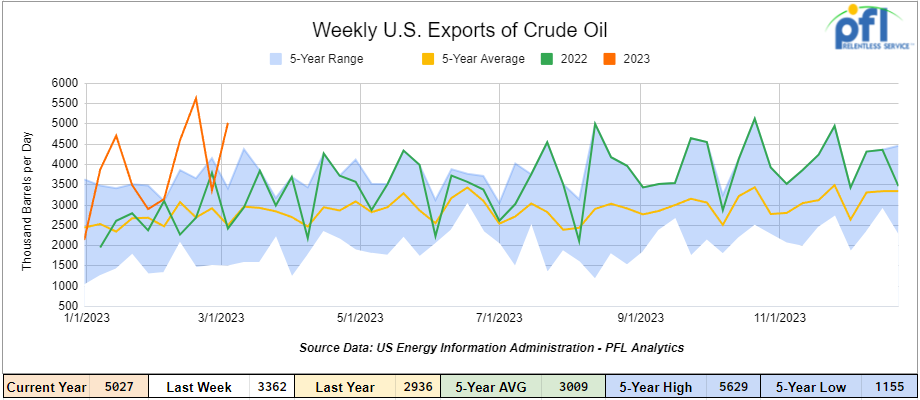

U.S. crude oil exports averaged 5.027 million barrels per day for the week ending March 10th, 2023, an increase of 1.665 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.654 million barrels per day.

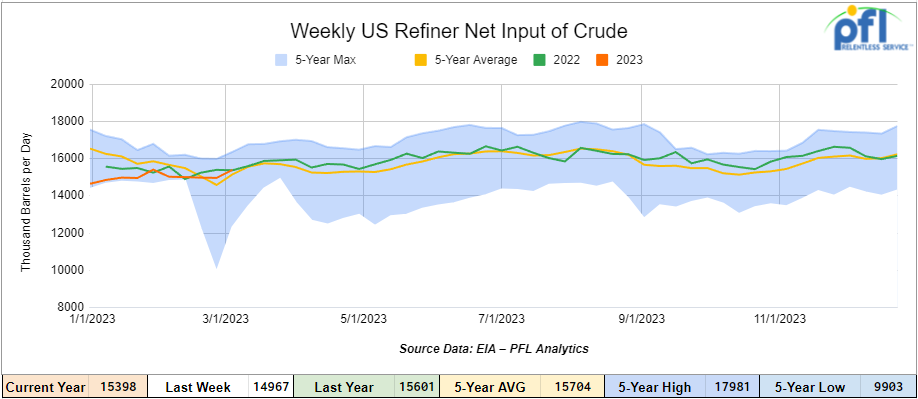

U.S. crude oil refinery inputs averaged 15.4 million barrels per day during the week ending March 10, 2023, which was 430,000 barrels per day more than the previous week’s average.

As of the writing of this report, WTI is poised to open at $65.30 down -$1.44 per barrel from Monday’s close.

North American Rail Traffic

Week Ending March 15th, 2023.

Total North American weekly rail volumes were down (-8.12%) in week 10 compared with the same week last year. Total carloads for the week ending on March 15th were 348,890, down (-0.56%) compared with the same week in 2022, while weekly intermodal volume was 285,486, down (-15.92%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant decrease coming from Intermodal (-15.92%). The largest increase was from Motor Vehicles and Parts (+5.94%).

In the east, CSX’s total volumes were down (-6.38%), with the largest decrease coming from Intermodal (-14.14%) and the largest increase Forest Products (+11.06%). NS’s volumes were down (-4.46%), with the largest decrease coming from Intermodal (-9.49%) and the largest increase from Grain (+20.20%).

In the West, BN’s total volumes were down (-13.74%), with the largest decrease coming from Intermodal (-22.32%), and the largest increase coming from Motor Vehicles and Parts (+26.63%). UP’s total rail volumes were down (-3.01%) with the largest decrease coming from Forest Products (-18.55%) and the largest increase coming from Petroleum and Petroleum Products (+10.67%).

In Canada, CN’s total rail volumes were down (-8.26%) with the largest increase coming from Metallic Ores and Minerals (+17.15%) and the largest decrease coming from Intermodal (-32.10). CP’s total rail volumes were down (-14.86%) with the largest decrease coming from Intermodal (-55.22%) and the largest increase coming from Other (+86%).

KCS’s total rail volumes were down (-22.85%) with the largest decrease coming from Farm products (-33.95%) and the largest increase coming from Motor Vehicles and Parts (+17.3%).

Source Data: AAR – PFL Analytics

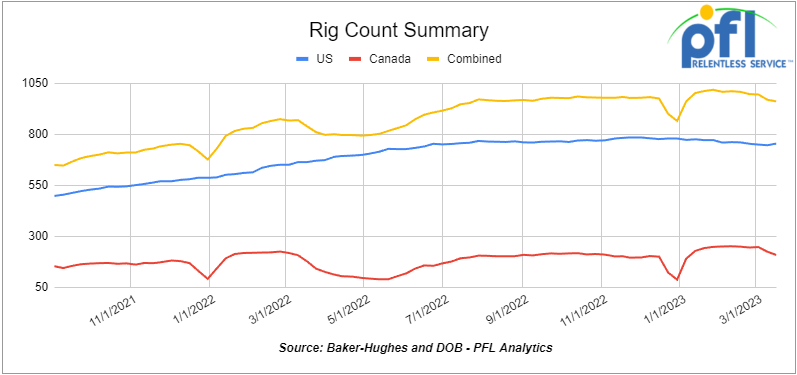

Rig Count

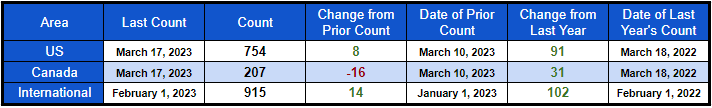

North American rig count was down by -8 rigs week over week. U.S. rig count was up 8 rigs week over week and up by +91 rigs year over year. The U.S. currently has 754 active rigs. Canada’s rig count was down by -16 rigs week-over-week and up by +31 rigs year over year. Canada’s overall rig count is 207 active rigs. Overall, year over year, we are up +122 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 24,945 from 25,348, which was a loss of -345 railcars week-over-week. Canadian volumes were mixed; CP’s shipments decreased by -12% week over week, and CN’s volumes were higher by +2.5% week over week. U.S. shipments were mostly higher. The NS had the largest percentage increase up by +3.5% and the BN had the largest percentage decrease and was down by -15.7%.

We are watching CP and KCS Merger (Approved by the STB)

The Surface Transportation Board announced on Wednesday of last week it has approved the merger of Canadian Pacific and Kansas City Southern, but with several conditions.

The combined entity of the two smallest Class 1s will be known as Canadian Pacific Kansas City (CPKC) and will be the smallest of the Class 1s. The merger creates the first railroad providing single-line service spanning Canada, the United States, and Mexico.

“Among many other single-line options, the new direct service will facilitate the flow of grain from the Midwest to the Gulf Coast and Mexico, the movement of intermodal goods between Dallas and Chicago, and the trade in automotive parts, finished vehicles, and other containerized mixed goods between the United States and Mexico,” the board noted in its decision.

The STB’s decision takes effect on April 14. Petitions for reconsideration of the decision must be filed by April 4 and requests for a stay must be filed by March 27.

Also, STB addresses hazmat safety concerns over CP-KCS merger approval and said that the merger of Canadian Pacific and Kansas City Southern will reduce (not increase) the risk of dangerous hazardous material spills, according to The Surface Transportation Board Chairman Martin Oberman who made this statement at a press conference on Wednesday of last week announcing the board’s decision to approve the Class 1s’ combination.

Oberman said the STB is aware of the recent elevated level of public concern stemming from the Norfolk Southern Railway train derailment last month in East Palestine, Ohio. Since that derailment occurred, political and community leaders have asked the STB to pause the CP-KCS merger decision out of a concern that increased freight-rail traffic growth stemming from the merger would increase the risk of more hazmat train derailments.

Biden Administration sees no Rush in Filling the Strategic Petroleum Reserves

The U.S. says it is committed to replenishing the Strategic Petroleum Reserve but won’t rush to do so immediately despite the recent decline in oil prices, a top Biden administration official said.

“Why don’t we take this one day at a time,” Amos Hochstein said in an interview on Bloomberg Television’s “Balance of Power.” Hochstein is the special presidential coordinator for global infrastructure and energy security.

“We’ve seen a decline in oil prices, we’re seeing some crunch there,” Hochstein said. “We should take a deep breath and wait and see how this crisis right now impacts the oil and gas industry, production, and what the profile is. So far prices have come down. We’re watching it very closely; we’ll continue to watch it over the next several days.”

The SPR, which was designed to shield the country from supply disruptions, is currently at 371.6 million barrels, the lowest since the 1980s, after the historic release of 180 million barrels last year to what it said to tame gasoline prices in the wake of already failed energy policies by the administration.

The administration previously laid out a plan to refill the reserve at prices close to $70. WTI futures tumbled to almost $66 in New York on Wednesday of last week which is below the administration’s target. Don’t know what they are waiting for, but stay tuned to PFL.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

• 10, 286K 15.7K Tanks needed off of KCS in Texas for 1 Year. Cars are needed for use in Sulfuric Acid service. Needed Next few months

• 150, 23.5K DOT 111 Tanks needed off of Any in LA for 2-3 Year. Cars are needed for use in Fluid service. Needed July

• 25-50, 32K 340W Pressure Tanks needed off of NS or CSX in Marcellus for 1-2 Years. Cars are needed for use in Propane service.

• 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of CN or CP in WI, Sarnia for 1-2 Years. Cars are needed for use in Diesel service.

• 25-50, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Chicago for 1-2 Months. Cars are needed for use in Diesel service.

• 100, 30K DOT 111, 117, CPC 1232 Tanks needed off of Any in Texas for 1 Year. Cars are needed for use in West Texas Sour service.

• 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 40, 30K 117R or 117J Tanks needed off of CP in MN for 1 Year . Cars are needed for use in Ethanol service.

• 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 30-40, DOT 113 Tanks needed off of in for 5 Years. Cars are needed for use in CO2 service.

• 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

• 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

• 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

• 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

• 25-50, 5000-5100 Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

• 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

• 10-20, 20-25 CPC 1232 or 117J tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

• 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

• 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

• 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

• 100, 28.3K 117, CPC 1232, DOT 111 Tanks needed off of Any in Midwest for 1-2 Years. Cars are needed for use in Fuel Oil service.

• 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada / US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennessee & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 100, 15.7K DOT 111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

• 30, 17K-20K DOT 111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

Lease Offers

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 50, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 100, 6400CF, Covered Hoppers located off of NS or CSX in NY. Cars are clean Brand New and available for Sublease for 6-7 Months

• 30, 23.5K, DOT 111 Tanks located off of UP or BN in Texas. Cars were last used in Clean/UAN.

• 25-100, 17.6K, Dot 111 Tanks located off of UP or BN in Midwest. Cars were last used in Fertilizer/Corn syrup. Free Move

• 20, 20, Dot 111 Tanks located off of CSX in GA. Cars are clean

• 2, 20, Dot 111 Tanks located off of UP in TX. Cars are clean

• 5, 20, Dot 111 Tanks located off of UP in Tx. Cars were last used in Sulfuirc Acid. Free Move

Sales Offers

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|