“When you run a part of the relay and pass on the baton, there is no sense of unfinished business in your mind. There is just the sense of having done your part to the best of your ability. That is it. The hope is to pass on the baton to somebody who will run faster and run a better marathon.”

– N. R. Narayana Murthy

Jobs Update

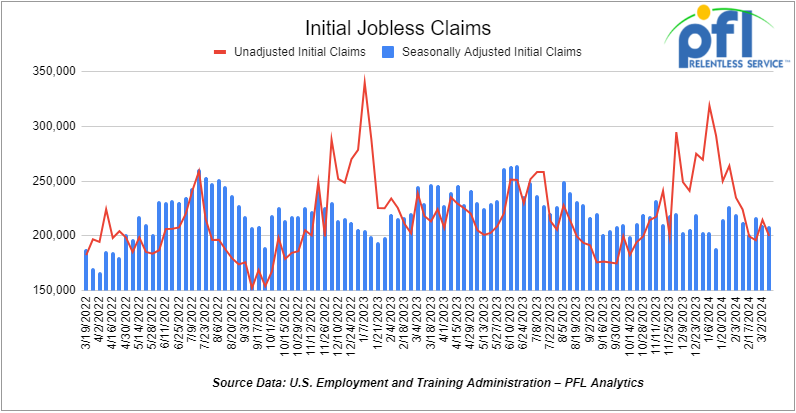

- Initial jobless claims seasonally adjusted for the week ending March 9th, 2023 came in at 209,000, flat week-over-week.

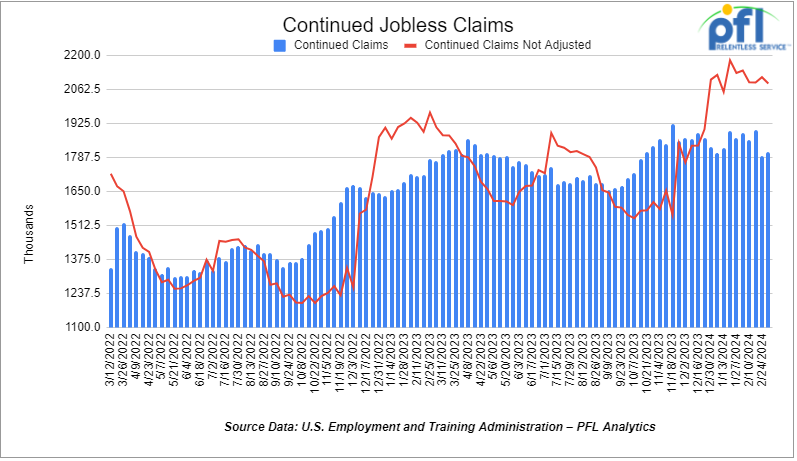

- Continuing jobless claims came in at 1.811 million people, versus the adjusted number of 1.794 million people from the week prior, up 17,000 people week-over-week.

Stocks closed lower on Friday of last week, but higher week over week

The DOW closed lower on Friday of last week, down -190.89 points (-0.49%), closing out the week at 38,714.77, down -7.92 points week-over-week. The S&P 500 closed lower on Friday of last week, down -33.39 points (-0.65%), and closed out the week at 5,117.09, down -6.6 points week-over-week. The NASDAQ closed lower on Friday of last week, down -155.36 points (-.97%), and closed out the week at 15,973.17, down -111.94 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 39,150 this morning down 3 points.

Crude oil closed lower on Friday of last week but higher week over week.

WTI traded down $0.17 per barrel (-0.21%) to close at $81.09 per barrel on Friday of last week, up $3.08 per barrel week-over-week. Brent traded down -US$0.09 per barrel (-.011%) on Friday of last week, to close at US$85.33 per barrel, up -US$3.25 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for May delivery settled Friday at US$12.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$67.07 per barrel. On Thursday, it settled at US$15.40 below the WTI-CMA for May delivery. The implied value was US$65.19 per barrel.

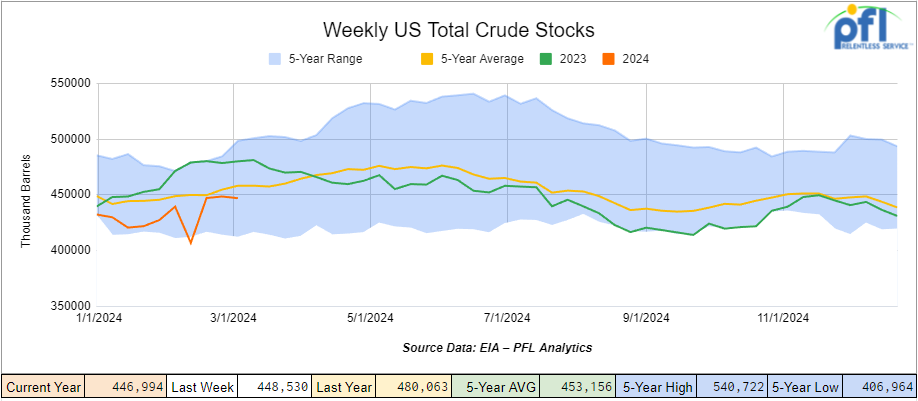

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.5 million barrels week-over-week. At 447.0 million barrels, U.S. crude oil inventories are 3% below the five-year average for this time of year.

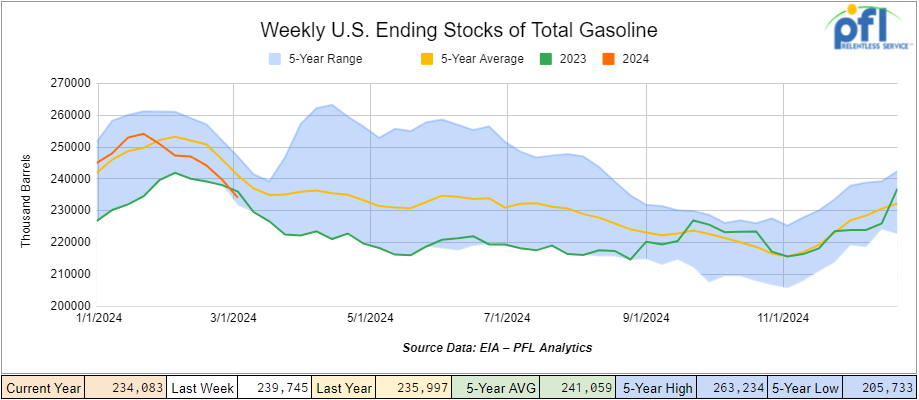

Total motor gasoline inventories decreased by 5.7 million barrels week-over-week and are 3% below the five-year average for this time of year.

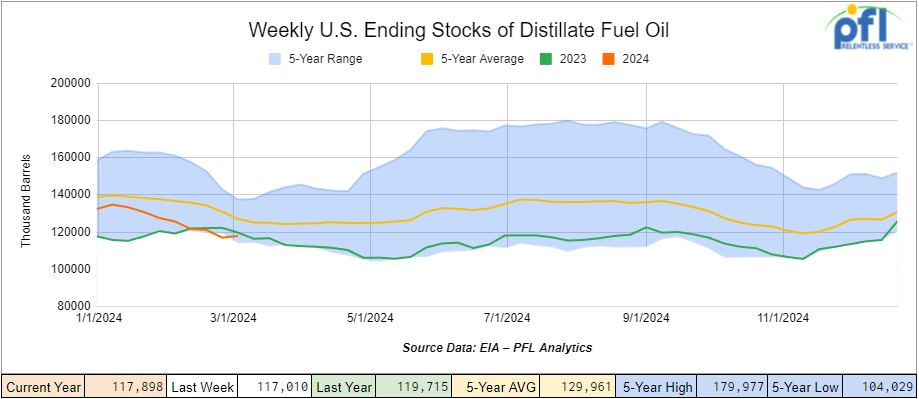

Distillate fuel inventories increased by 900,000 barrels last week and are 7% below the five-year average for this time of year.

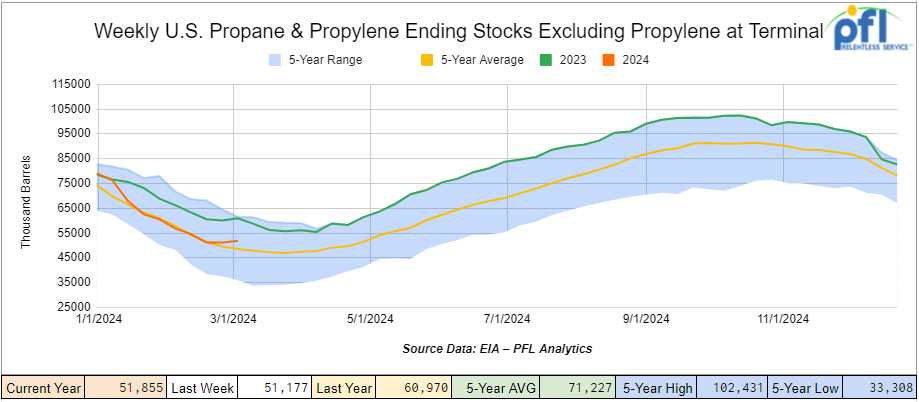

Propane/propylene inventories increased by 700,000 barrels week-over-week and are 8% above the five-year average for this time of year.

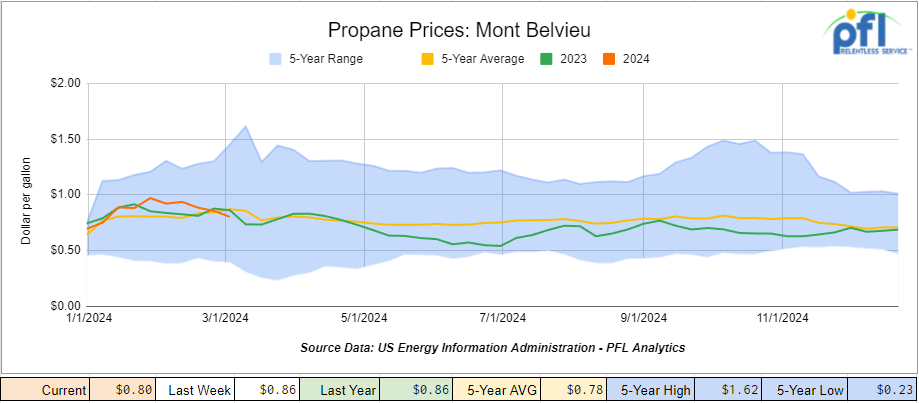

Propane prices closed at 80 cents per gallon, down 6 cents per gallon week-over-week and down 6 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 4.7 million barrels, during the week ending March 8th, 2024.

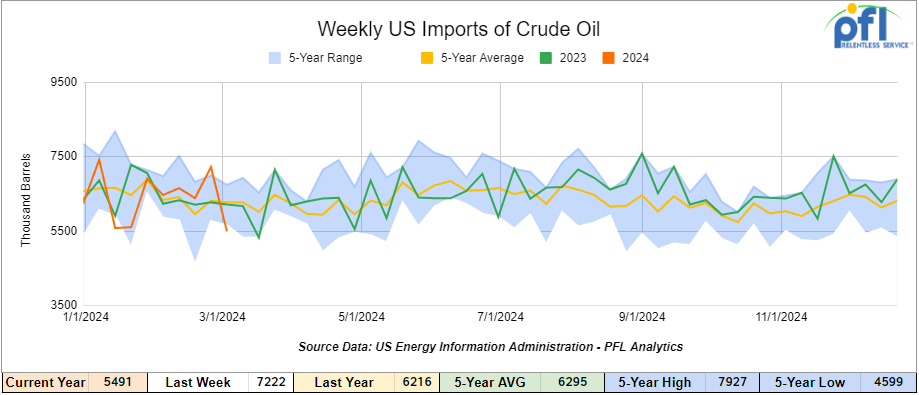

U.S. crude oil imports averaged 5.5 million barrels per day during the week ending March 8th, 2024, a decrease of 1.7 million barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 2.9% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 634,000 barrels per day, and distillate fuel imports averaged 171,000 barrels per day during the week ending March 8th, 2024.

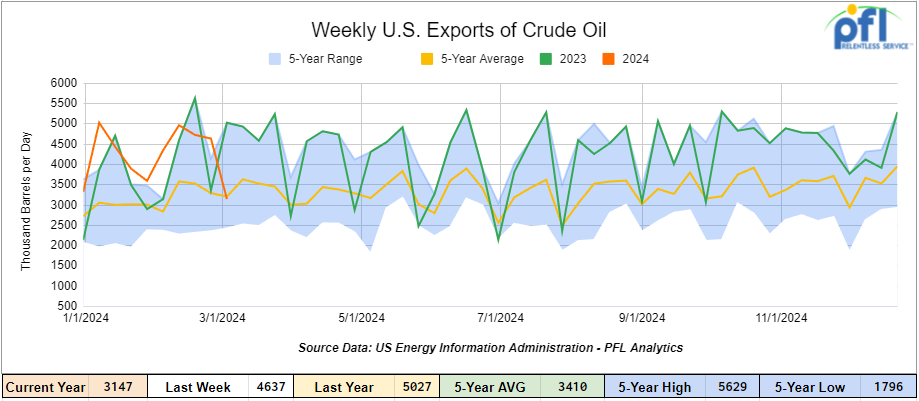

U.S. crude oil exports averaged 3.147 million barrels per day for the week ending March 8th, 2024, a decrease of 1.49 million barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.369 million barrels per day.

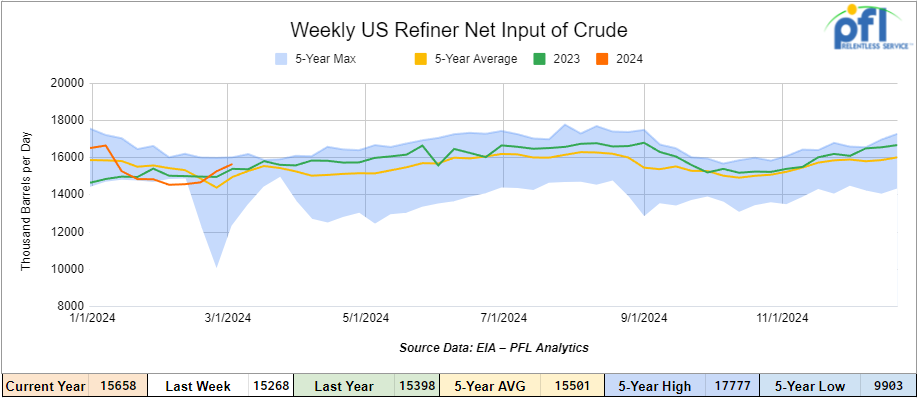

U.S. crude oil refinery inputs averaged 15.7 million barrels per day during the week ending March 8, 2024, which was 390,000 barrels per day more week-over-week.

WTI is poised to open at 81.70, up 66 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending March 15th, 2024.

Total North American weekly rail volumes were up (5.1%) in week 11, compared with the same week last year. Total carloads for the week ending on March 15th were 340304, down (-2.46%) compared with the same week in 2023, while weekly intermodal volume was 326,415, up (14.34%) compared to the same week in 2023. 7 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-15.83%). The most significant increase came from Intermodal which was up (+14.34%).

In the East, CSX’s total volumes were up (5.56%), with the largest decrease coming from Grain, down (-21.89%) while the largest increase came from Petroleum and Petroleum Products (14.08%). NS’s volumes were up (6.16%), with the largest increase coming from Intermodal (+11.89%) while the largest decrease came from Petroleum and Petroleum Products (-28.37%).

In the West, BN’s total volumes were up (10.47%), with the largest increase coming from Intermodal (+27.36%) while the largest decrease came from Coal, down (-26.68%). UP’s total rail volumes were down (-0.52%) with the largest decrease coming from Coal, down (-30.84%) while the largest increase came from Petroleum and Petroleum Products which was up (22.03%).

In Canada, CN’s total rail volumes were up (0.11%) with the largest decrease coming from Coal, down (-34.5%) while the largest increase came from Intermodal, up (+12.28%). CP’s total rail volumes were up (+10.41%) with the largest increase coming from Intermodal Units (+147.95%) while the largest decrease came from Coal, down (-47.73%).

KCS’s total rail volumes were up (5.44%) with the largest decrease coming from Other (-48.3%) and the largest increase coming from Farm Products (+36.69%).

Source Data: AAR – PFL Analytics

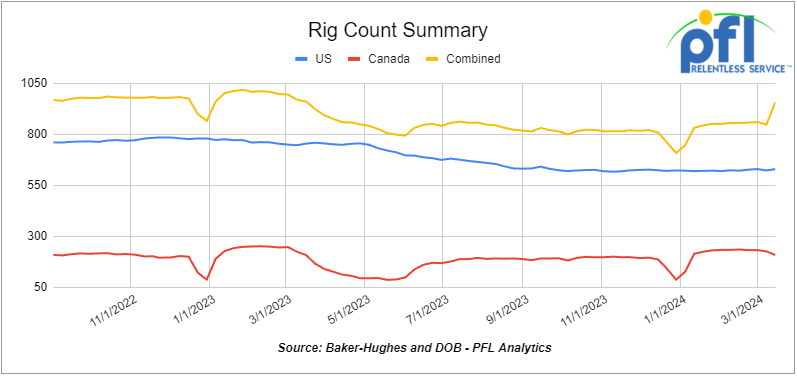

Rig Count

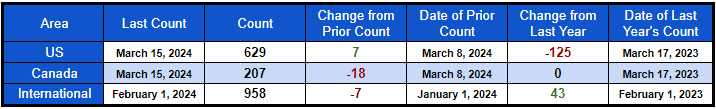

North American rig count was down by -11 rigs week-over-week. U.S. rig count was up by 7 rigs week-over-week and down by -125 rigs year-over-year. The U.S. currently has 629 active rigs. Canada’s rig count was down by -18 rigs week-over-week, but flat year-over-year. Canada’s overall rig count is 207 active rigs. Overall, year-over-year, we are down -125 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,048 from 29,501 which was a loss of 457 rail cars week-over-week. Canadian volumes were lower. CPKC’s shipments were lower by -9.8% week over week. CN’s volumes were lower by -0.05% week-over-week. U.S. shipments were mostly lower. The BN had the largest percentage decrease and was down by -16.5%. The UP was the sole gainer and was up by +16.6%.

We are Watching the LNG Battles Continue

Folks, the Biden Administration’s decision to halt the approval of new licenses for liquefied natural gas (LNG) exporters continues to cause significant setbacks for the industry. Projects in the pipeline, like Venture Global LNG Inc.’s CP2 project in Louisiana, are facing delays as they wait for necessary approvals. We have written on this topic extensively, but this freeze continues to create new challenges and affects the United State’s ability to compete in a global market. Namely, projects are now running into trouble with securing financing from banks, which greatly harms the progress of these multi-billion dollar ventures. Not to mention all of the job creation being put on hold.

The pause is also prompting caution among LNG buyers, with companies in countries like Malaysia, Japan, and China holding off on signing long-term contracts until there is more clarity on licensing. This puts U.S. LNG at a big competitive disadvantage. While American projects are on hold, developments in other countries such as Qatar and the United Arab Emirates are moving forward swiftly, potentially capturing market share that would have gone to the U.S. This is a big problem for the U.S. as this dynamic threatens the long-term viability of U.S. LNG exports and incremental NGL production along with it. The world needs more clean-burning natural gas and no one is more well-positioned than the U.S. to provide it, if the Biden Administration could stay out of its own way.

The amount of additional gas this country could export is staggering. Meanwhile, the EIA is revising its forecast downward for Henry Hub natural gas prices, the US’s key gas index. The month of February saw the lowest inflation-adjusted prices for natural gas on record! “The U.S. benchmark Henry Hub natural gas spot price averaged an inflation-adjusted record-low of $1.72 per MMBtu in February,” the EIA stated in its March STEO. “We forecast prices will stay under $2.00 per MMBtu in the second quarter of 2024 (2Q24) because we expect natural gas inventories will remain high relative to the five-year average as the United States enters the shoulder season when there is typically less U.S. natural gas consumption than at other times of the year,” it added. Gas at the Waha hub, the spot price for natural gas in the Permian Basin, traded below $.05/MMBtu on Thursday of last week before bids went negative on Friday.

We are Watching the Walking Back of Green for More Oil & Gas

European energy Majors have begun to walk back their carbon emissions cuts with the latest to announce this move being Shell PLC. Shell is following in the footsteps of rival BP, who also recently announced cuts to their carbon reduction targets. Instead of the 20% reduction by 2030 previously announced, Shell is now seeking a 15-20% reduction by 2030. The revised carbon-emission reduction target on energy products sold is a result of a narrowing of its markets and segments for the integrated power business, which include selling more power to commercial customers and less to retail, Shell said. They added, “Our focus on where we can add the most value has led to a strategic shift in our integrated power business”. BP recently cut emissions targets from 35% by 2030 to 20-30% by 2030, sending their stock to 3 and ½ year highs. This is a bit of a reality check for European oil majors who are now increasing traditional oil and gas production and hoping to bring their valuations closer to U.S. competitors Chevron and Exxon. Darren Woods, CEO of Exxon Mobil said it best when he said “Until you have lower-emissions competitive alternatives that address the full set of needs for society, there’s going to continue to be a demand for oil and gas products,” Woods said. He added, “We leaned in when others leaned out” noting Exxon was at an advantage as some of its competitors have “stepped back”. If these last few years have shown us anything, it’s that the world continues to need secure, reliable, and affordable energy and a lot of the “green” solutions being proposed aren’t nearly cutting it.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 100-200, 5200 Covered Hoppers needed off of UP, BNSF in Gulf area for 1-2 years. Cars are needed for use in Petcoke service. Open to smaller cube or longer-term

- 10, 28.3K 117J Tanks needed off of UP or BN in Texas for 3 Year.

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed off of in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 25-30, 23.5K or 25.5K Dot 111 or CPC 1232 Tanks needed off of UP or BN in TX, OK, or AR for 3-5 Years. Cars are needed for use in Asphalt service. Needed ASAP., Lined or Unlined. Splash Load

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 5, 23,5K DOT 111 Tanks needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in Aggregate service. Gravity dump

- 5, 30K DOT 111 Tanks needed off of in US. Cars are needed for use in fuel service.

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 50, 33K, 340W Pressures located off of in Moving. Cars were last used in Propane. 1 year lease

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

- 200-500, 5200, Covered Hoppers located off of CN and NS in Moving on CN and NS. Cars were last used in Grain. Lease is available until Fall.

- 100, 33K, 340W Pressure Tanks located off of CN or CP in Canada. Cars are clean

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 40, 29K, DOT111 Tanks located off of CN in Canada. C/I; Free Move CN

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website