“Motivation is not about pumping people up, it’s about pulling out the greatness that’s already within them.”

– Jon Gordon

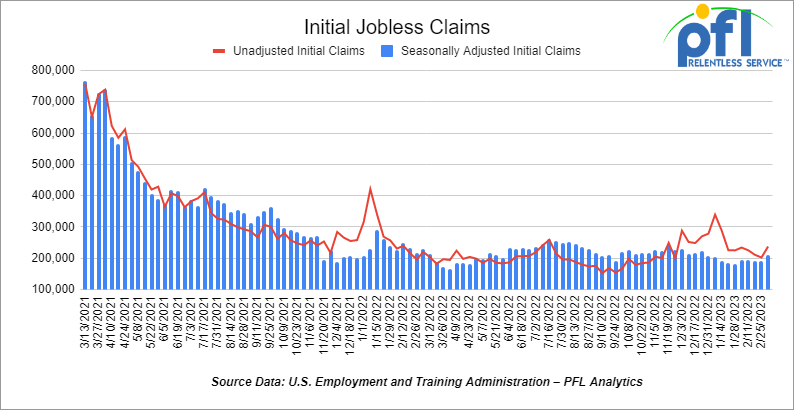

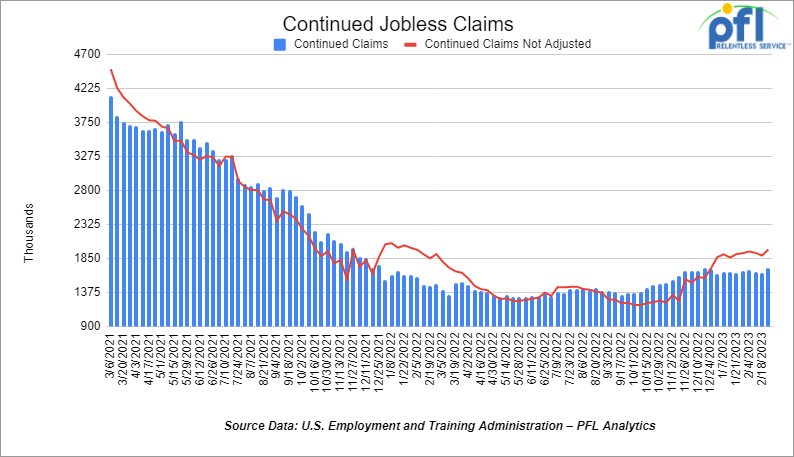

Jobs Update

- Initial jobless claims for the week ending March 4th, 2023 came in at 211,000, up 21,000 people week-over-week.

- Continuing jobless claims came in at 1.718 million people, versus the adjusted number of 1.649 million people from the week prior, up 69,000 people week over week.

Stocks closed lower on Friday of last week and down week over week

The DOW closed lower on Friday of last week, down -345.22 points (-1.07%), closing out the week at 31,909.64 down -1,093.93 points week over week. The S&P 500 closed lower on Friday of last week, down -56.73 points (-1.45%) and closed out the week at 3,861.59, down -184.05 points week over week. The NASDAQ closed lower on Friday of last week, down -199.47 points (-1.71%), and closed the week at 11,138.89, down -550.12 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 31,951 this morning up +33 points.

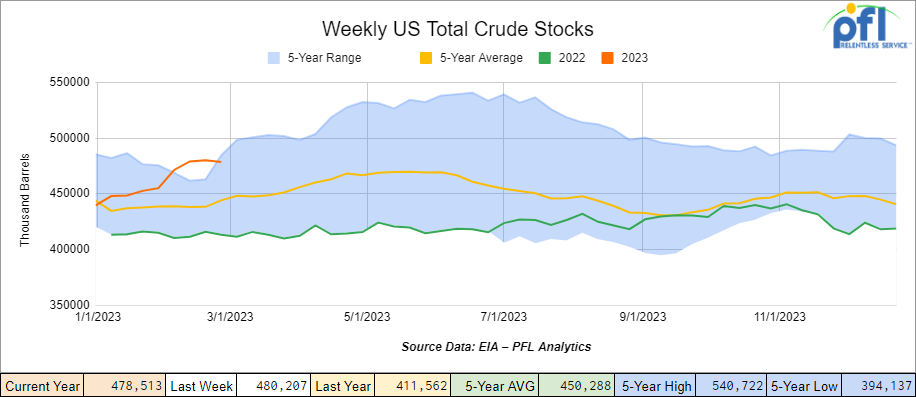

WTI closed higher on Friday of last week but down week over week

WTI traded up $0.96 per barrel (+1.3%) to close at $76.68 per barrel on Friday of last week, down -$1.48 per barrel week over week. Brent traded up US$1.19 per barrel (+1.5%) on Friday of last week, to close at US$82.78 per barrel, down -US$1.97 per barrel week over week.

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.7 million barrels week over week. At 478.5 million barrels, U.S. crude oil inventories are 7% above the five-year average for this time of year.

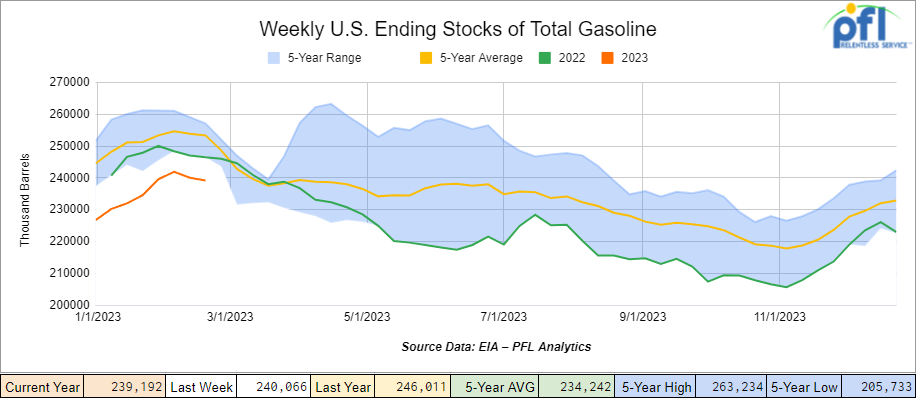

Total motor gasoline inventories decreased by 1.1 million barrels from week over week and are 3% below the five-year average for this time of year.

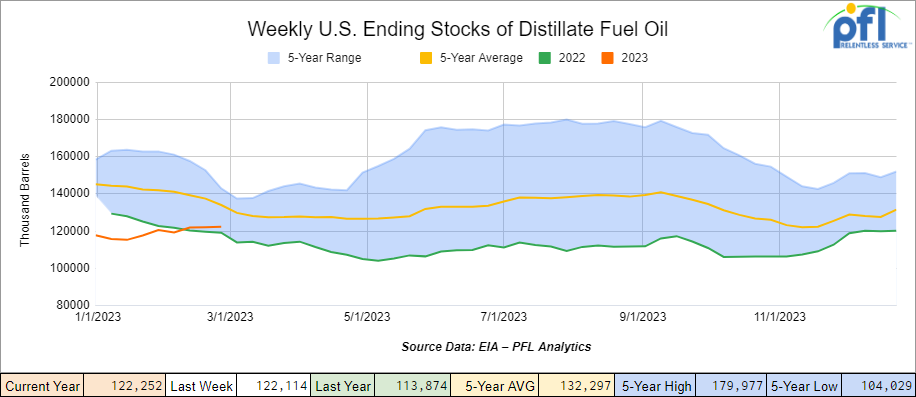

Distillate fuel inventories increased by 100,000 barrels week over week and are 7% below the five-year average for this time of year.

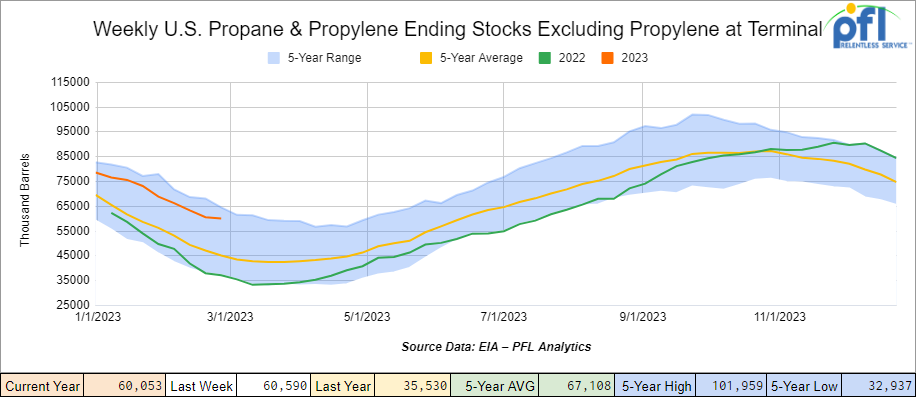

Propane/propylene inventories decreased by 500,000 barrels week over week and are 34% above the five-year average for this time of year.

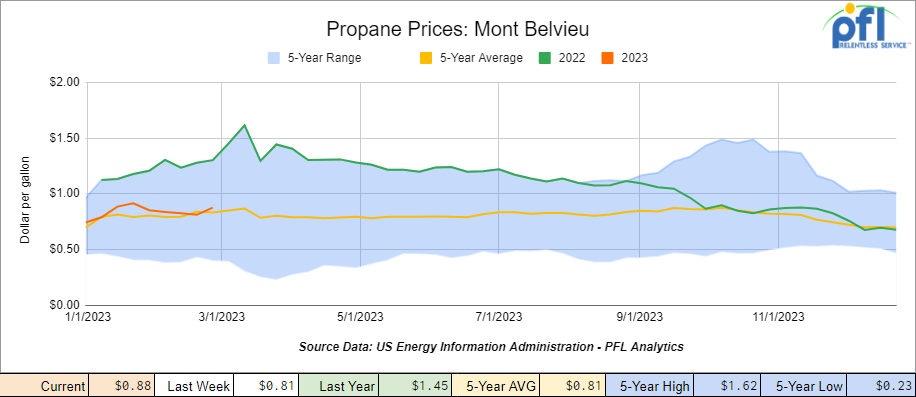

Propane gained 7 cents per gallon week over week, closing at 88 cents a gallon, down 57 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 1.9 million barrels week over week.

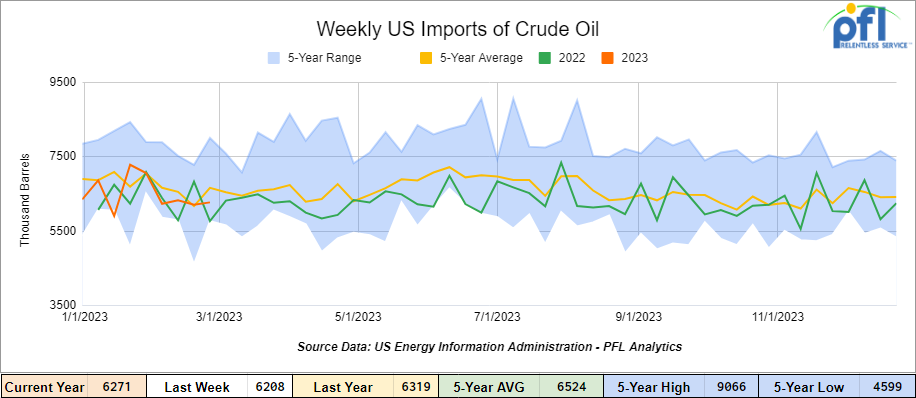

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending March 3rd, 2023, an increase of 63,000 barrels per day week over. Over the past four weeks, crude oil imports averaged 6.3 million barrels per day, 1.4% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 446,000 barrels per day, and distillate fuel imports averaged 141,000 barrels per day during the week ending March 3rd, 2023.

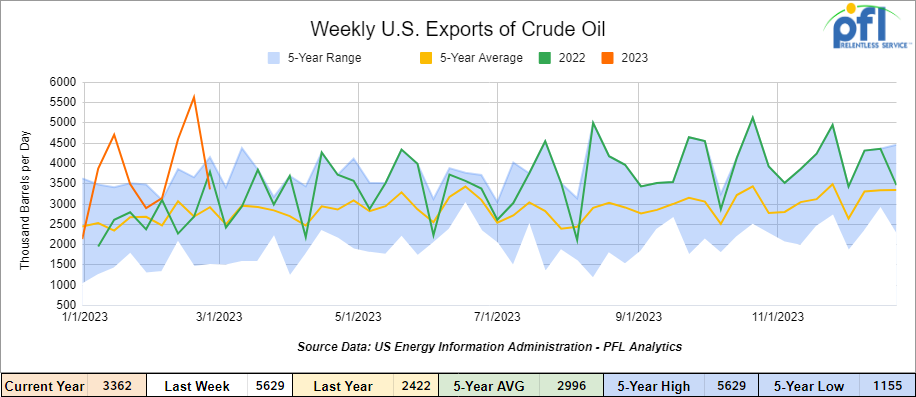

U.S. crude oil exports averaged 3.362 million barrels per day for the week ending March 3rd, 2023, a decrease of -2.267 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 4.183 million barrels per day.

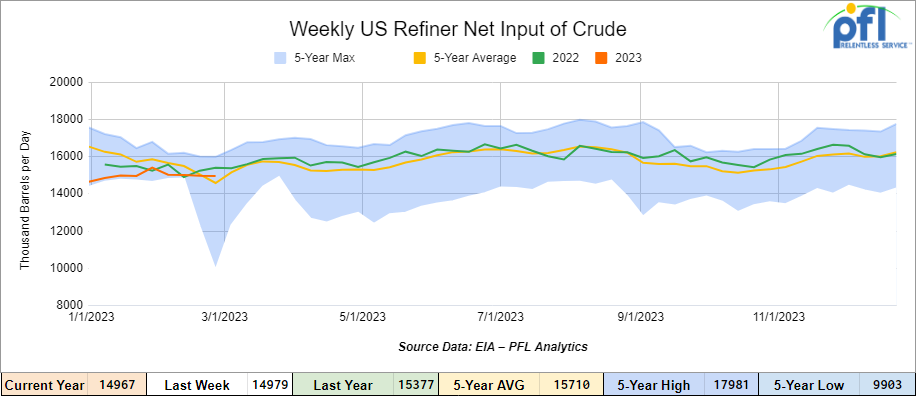

U.S. crude oil refinery inputs averaged 15 million barrels per day during the week ending March 3, 2023, which was 12,000 barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $76.19 down -$0.49 per barrel from Monday’s close.

North American Rail Traffic

Week Ending March 8th, 2023.

Total North American weekly rail volumes were down (-6.39%) in week 9 compared with the same week last year. Total carloads for the week ending on March 8th were 359,209, down (-0.26%) compared with the same week in 2022, while weekly intermodal volume was 295,985, down (-12.88%) compared to the same week in 2022. 6 of the AAR’s 11 major traffic categories posted year over year increases with the most significant decrease coming from Grain (-21.33%). The largest increase was from Motor Vehicles and Parts (+11.85%).

In the east, CSX’s total volumes were down (-4.33%), with the largest decrease coming from Intermodal (-13.12%) and the largest increase Coal (+20.09%). NS’s volumes were down (-3.32%), with the largest decrease coming from Intermodal (-8.1%) and the largest increase from Motor Vehicles and Parts (+12.13%).

In the West, BN’s total volumes were down (-10.59%), with the largest decrease coming from Grain (-28.88%), and the largest increase coming from Motor Vehicles and Parts (+26.68%). UP’s total rail volumes were down (-4.2%) with the largest decrease coming from Forest Products (-25.43%) and the largest increase coming from Petroleum and Petroleum Products (+16.06%).

In Canada, CN’s total rail volumes were down (-6.86%) with the largest increase coming from Other (29.46%) and the largest decrease coming from Grain (-29.18). CP’s total rail volumes were down (-11.50%) with the largest decrease coming from Grain (-57.56%) and the largest increase coming from Petroleum and Petroleum Products (+52.46%).

KCS’s total rail volumes were down (-11.45%) with the largest decrease coming from Coal (-21.19%) and the largest increase coming from Petroleum and Petroleum Products (+27.25%).

Source Data: AAR – PFL Analytics

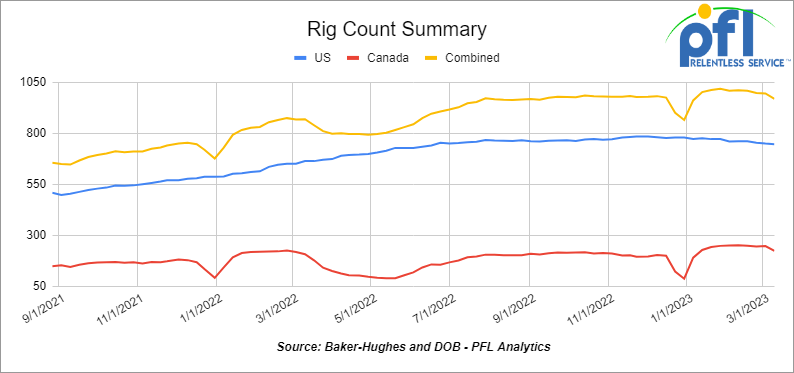

Rig Count

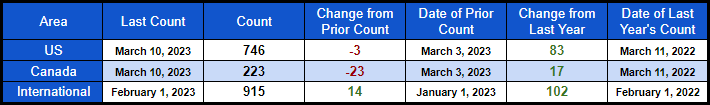

North American rig count was down by -26 rigs week over week. U.S. rig count was down -3 rigs week over week and up by +83 rigs year over year. The U.S. currently has 746 active rigs. Canada’s rig count was down by -23 rigs week-over-week and up by 17 rigs year over year. Canada’s overall rig count is 223 active rigs. Overall, year over year, we are up +100 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

PFL Was in Travel Mode Last Week

With representatives at the Opis NGL Conference in San Diego and the Rail Equipment Finance Conference in Palm Springs, PFL was in full travel mode last week.

As usual, the OPIS NGL Summit exceeded expectations. PFL has been a proud sponsor of that event for nearly a decade. With the beautiful city of San Diego as the backdrop and the wonderful Sheraton as the host for this year’s conference, everything went perfectly. We enjoyed meeting new colleagues as well as connecting with old friends. The receptions, meetings, and events all went smoothly and there were plenty of deals to be done! We thank David Coates and his team for once again putting on a great conference and look forward to next year’s event. We also wanted to say a special thank you to Targa for hosting a great Welcome Reception in San Diego. General consensus in the market is that the market is long pressure cars, but scared to give them up due to service uncertainty. For more information as it relates to this event, please contact PFL today.

The Rail Equipment Finance conference was another smash hit. Executives involved in money-making decisions from all over North America were there (roughly 500 people were in attendance). It is one of PFL’s favorites with intense sessions – no one skips the sessions for a meeting. Some key takeaways from the meeting:

- Fleet size is up 3,895 cars year over year;

- People are holding onto older cars because of expensive return on lease costs;

- Car values are up year over year;

- Retrofits not worth it – high cost and uncertainty particularly with the East Palestine accident in Ohio – new regs are coming and no one knows what is going to happen with that one;

- Short Lines are nervous and not as positive as they were last year – need service to improve with their class 1 partners – short lines have been trading at 20 times EBITDA higher than their class 1 partners. Shortlines can’t keep up with demand – a two-man crew is going to hurt. Everyone is short Box Cars and the shortlines are losing out to other modes of transportation. There is a Box Car battle going on right now and the business models for Box Cars may change.

Bottom line: a lot of good information and forward-looking thinking at this year’s REF. If you want to discuss either Opis or REF please call the PFL desk at 239-390-2885.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,348 from 25,327, which was a gain of +21 railcars week-over-week. Canadian volumes were mixed; CP’s shipments increased by +4.6% week over week, and CN’s volumes were lower by -3.6% week over week. U.S. shipments were also mixed. The BN had the largest percentage increase up by +7.1% and the NS had the largest percentage decrease and was down by -10.2%.

Oil Flows on Keystone Pipeline ordered Reduced by the PHMSA

Even though Oil flows on TC Energy Corporation was ordered to be reduced, Keystone pipeline will not change after the U.S. pipeline regulator said it would require the company to reduce pressure following a 13,000-bbl oil spill in Kansas in December, chief executive François Poirier said on Thursday of last week.

Keystone has already been operating within the requirements of the new order from the Pipeline and Hazardous Materials Safety Administration (PHMSA), Poirier said in an interview. The Canadian pipeline operator completed a controlled restart of the 622,000 bbl/d pipeline to Cushing, Oklahoma, on December 29th 2022, returning it to service after a 21-day outage following the biggest U.S oil spill in nine years.

Before the order, “we had the ability to meet the entirety of our contractual commitments of 594,000 barrels of oil per day and so obviously that remains the same.”

The PHMSA said on Tuesday of last week it would require TC Energy to reduce operating pressure on more than 1,000 additional miles (1,609 km) of Keystone.

Though an analysis has not been completed, Poirier said the company recently has indicated in disclosures that the spill was caused by issues around the girth weld on the pipeline combined with stress on the line.

Poirier said the company has not changed its estimate of $480 million in costs related to the incident.

Trans Mountain Expansion Delayed (Again)

Trans Mountain Corporation says its expansion project is close to 80 percent complete, with mechanical completion expected to occur at the end of 2023, and the pipeline will be in-service in the first quarter of 2024. An update last February had pegged mechanical completion of the project in the third quarter of 2023.

The total project cost is now estimated to be approximately $30.9 billion, up from the previous $21.4 billion, which had been raised from $12.6 billion.

Once completed, the pipeline system will have nearly tripled its capacity, representing an increase of 590,000 barrels per day to a total of 890,000 barrels per day.

Trans Mountain is in the process of securing external financing to fund the remaining cost of the project. The project capacity is primarily committed to 11 shippers representing a mix of Canadian and international producers and refiners who are contracted for 80 percent of the available capacity under long-term, take-or-pay transportation contracts for 15 and 20 years. The remaining 20 percent of the capacity on the expanded system will be available through market mechanisms.

Specific factors for cost increases include high global inflation and global supply chain challenges; unprecedented floods in British Columbia; unexpected major archaeological discoveries; challenging terrain between Merritt and Hope; earthquake standards in the Burnaby Mountain tunnel; unexpected water disposal costs in the Sumas Prairie; and issues regarding densely populated areas between Sumas and Burnaby.

“Canada has among the world’s highest standards for the protection of people, the environment, and Indigenous participation when building major infrastructure projects. By including these commitments into the project design and development from the beginning, we have ensured the project will provide economic benefits to Canadians well into the future,” said Dawn Farrell, president and CEO of Trans Mountain Corporation. This reality will be a positive for rail in the short term

The NS Determined an urgent Rail Car Safety Issue on Thursday of last Week

In a press release last week the NS said:

“During Norfolk Southern’s cleanup of the derailment in Springfield, Ohio on March 5, the company determined that a specific model and series of railcars had loose wheels, which could cause a derailment. The investigative team identified these wheels as coming from a series of recently acquired cars from a specific manufacturer. Although the investigation into the cause of the accident is still underway, we immediately notified the National Transportation Safety Board and the Federal Railroad Administration and began inspecting other cars from this series on our network.

Upon identifying additional cases of unusual wheel movement, we acted swiftly. We issued orders to remove these cars from service until their wheelsets could be replaced, and we have taken steps to remove this specific model and series from service until they can be fully inspected. We also notified the manufacturer and worked urgently to inform the rest of the railroad industry, as Norfolk Southern is not the only user of these cars. As a result, the Association of American Railroads issued an advisory to halt the use of these cars. Norfolk Southern will continue to investigate this matter and take appropriate action.”

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

• 25-50, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 40, 30K 117R or 117J Tanks needed off of CP in MN for 1 Year . Cars are needed for use in Ethanol service.

• 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 30-40, DOT 113 Tanks needed off of in for 5 Years. Cars are needed for use in CO2 service.

• 70, 32K 340W Pressure Tanks needed off of CP or CN in Edmonton for 3 Years. Cars are needed for use in Propane service.

• 200-300, 28.3K 117R or 117J Tanks needed off of CP or CN in Sarnia for 3 Years. Cars are needed for use in Fuel Oil service.

• 30, 30K DOT 111 Tanks needed off of UP in Texas for 1-3 Years. Cars are needed for use in Diesel service.

• 5-7, 28.3K 117R Tanks needed off of NS or CSX in NC for 1 Year. Cars are needed for use in UCO service.

• 25-50, 5000-5100 Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

• 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

• 10-20, 20-25 CPC 1232 or 117J tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

• 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

• 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

• 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

• 100, 28.3K 117, CPC 1232, DOT 111 Tanks needed off of Any in Midwest for 1-2 Years. Cars are needed for use in Fuel Oil service.

• 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

Sales Bids

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 100, 15.7K Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

Lease Offers

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

Sales Offers

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|