“The one thing we know about the future is that it comes only one day at a time.”

– Jeff Rich

Jobs Update

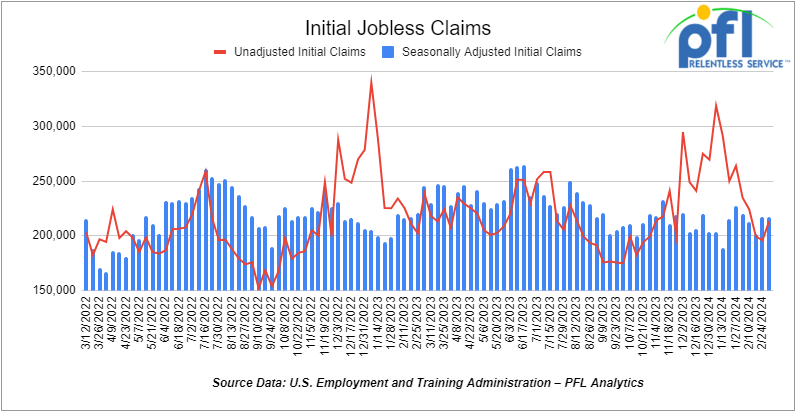

- Initial jobless claims seasonally adjusted for the week ending March 2nd, 2023 came in at 217,000, flat week-over-week.

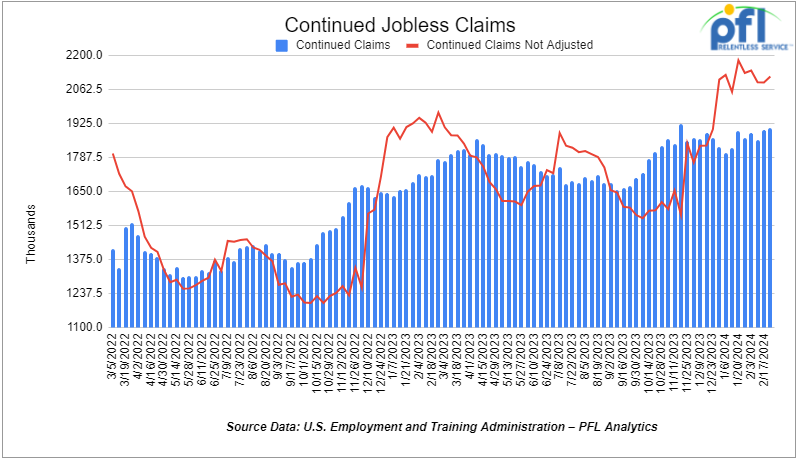

- Continuing jobless claims came in at 1.906 million people, versus the adjusted number of 1.898 million people from the week prior, up 8,000 people week-over-week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -68.66 points (-0.18%), closing out the week at 38,722.69, down -364.69 points week-over-week. The S&P 500 closed lower on Friday of last week,down -33.67 points (-0.65%), and closed out the week at 5,123.69, down -13.39 points week-over-week. The NASDAQ closed lower on Friday of last week, down -188.26 points (-1.16%), and closed out the week at 16,085.11, down -189.83 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 38,620 this morning down -136 points.

Crude oil closed lower on Friday of last week and lower week over week.

WTI traded down $0.82 per barrel (-1.2%) to close at $78.01 per barrel on Friday of last week, down $1.96 per barrel week-over-week. Brent traded down -US$0.88 per barrel (-1.1%) on Friday of last week, to close at US$82.08 per barrel, down -US$1.47 per barrel week-over-week.

One Exchange WCS (Western Canadian Select) for April delivery settled Friday at US$15.70 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$61.67 per barrel. On Thursday, it settled at US$16.00 below the WTI-CMA for April delivery. The implied value was US$62.17 per barrel.

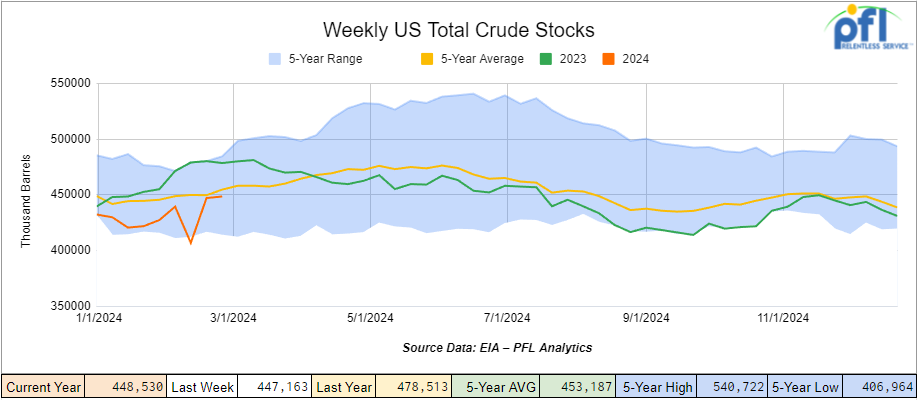

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 1.4 million barrels week-over-week. At 448.5 million barrels, U.S. crude oil inventories are 1% below the five-year average for this time of year.

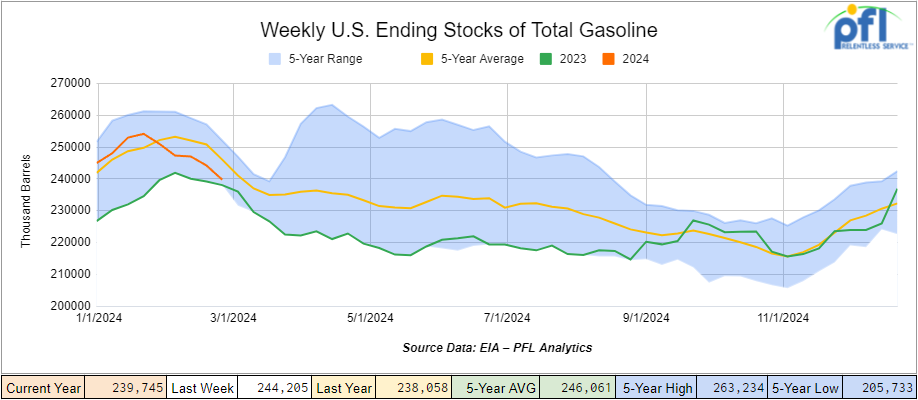

Total motor gasoline inventories decreased by 4.5 million barrels week-over-week and are 2% below the five-year average for this time of year.

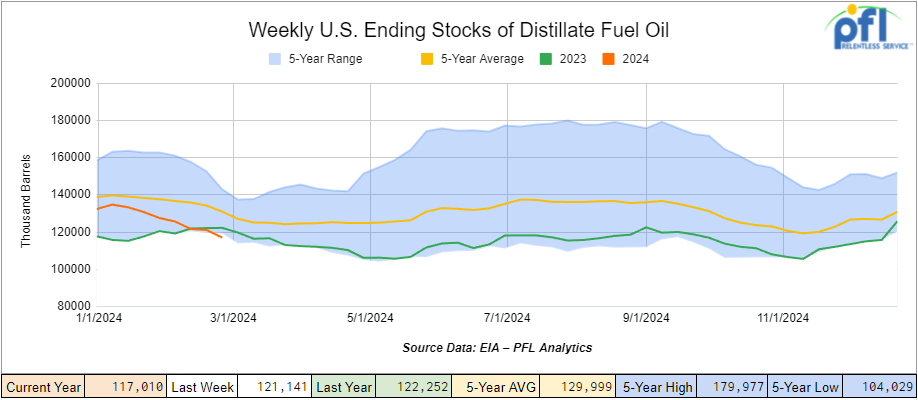

Distillate fuel inventories decreased by 4.1 million barrels week-over-week and are 10% below the five-year average for this time of year.

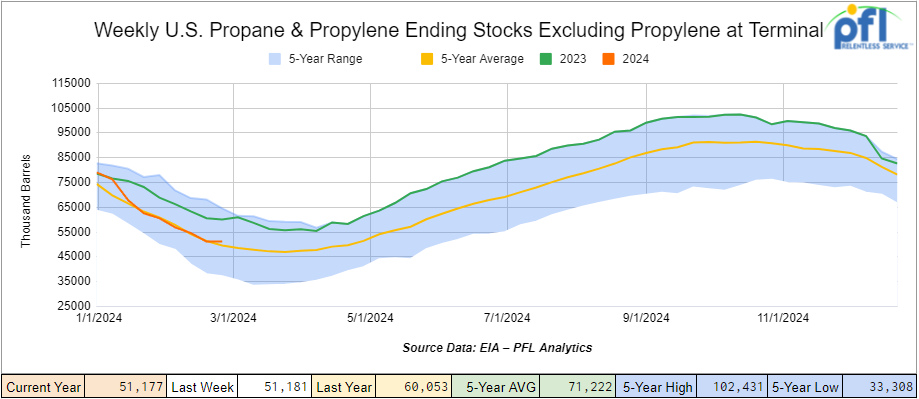

Propane/propylene inventories slightly decreased week-over-week and are 4% above the five-year average for this time of year.

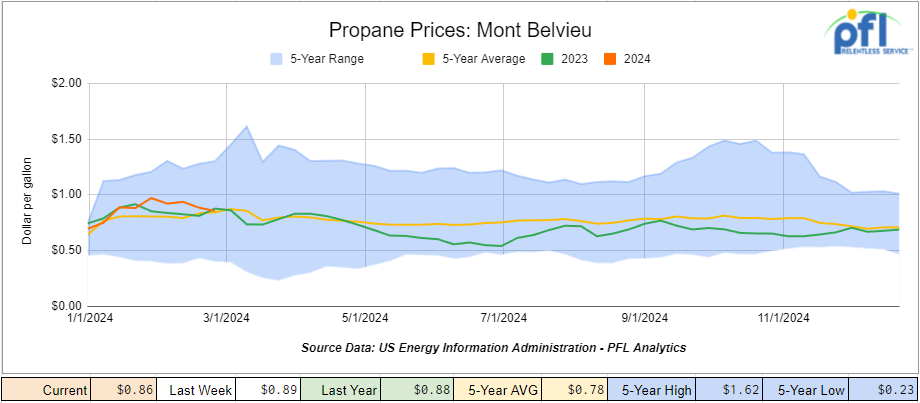

Propane prices closed at 86 cents per gallon, down 3 cents per gallon week-over-week and down 2 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 5.5 million barrels during the week ending March 1st, 2024.

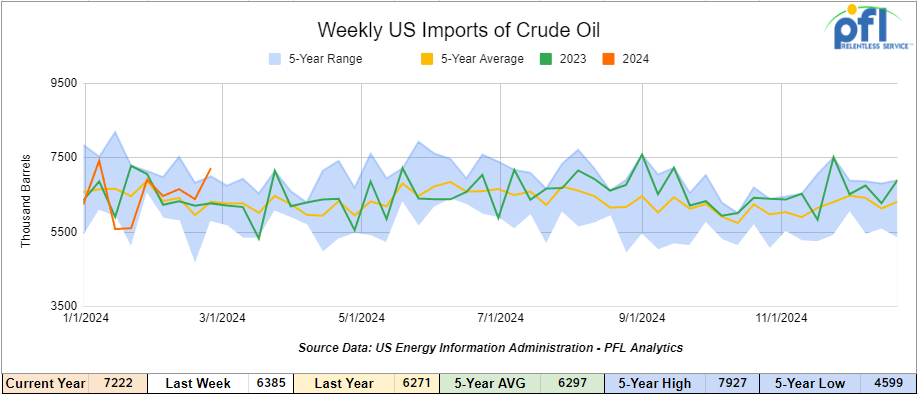

U.S. crude oil imports averaged 7.2 million barrels per day during the week ending March 1st, 2024, an increase of 837,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 6.8% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 588,000 barrels per day, and distillate fuel imports averaged 195,000 barrels per day during the week ending March 1st, 2024.

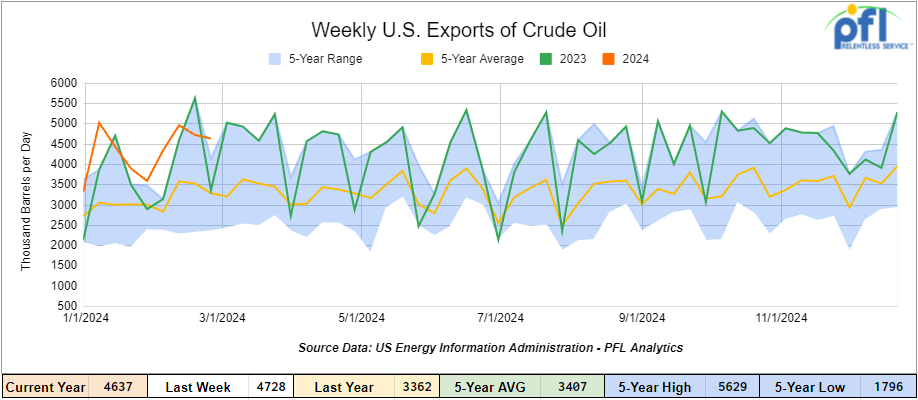

U.S. crude oil exports averaged 4.637 million barrels per day for the week ending March 1st, 2024, a decrease of 91,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 4.669 million barrels per day.

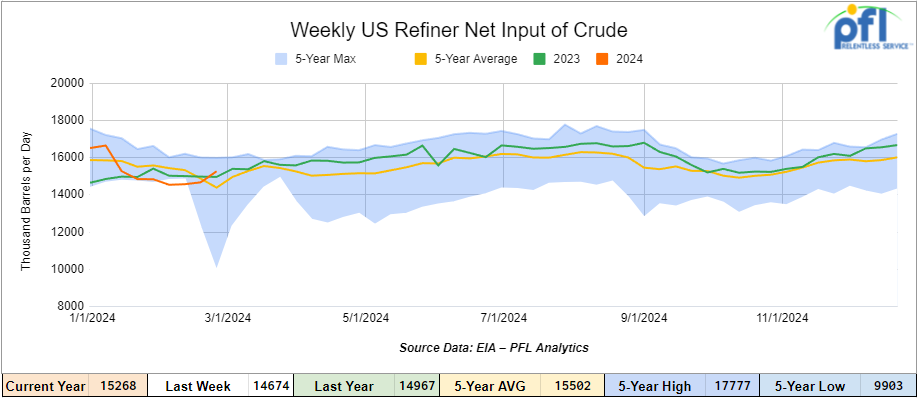

U.S. crude oil refinery inputs averaged 15.3 million barrels per day during the week ending March 1, 2024, which was 595,000 barrels per day more week-over-week.

WTI is poised to open at 78.22, up 21 cents per barrel from Friday’s close.

North American Rail Traffic

Week Ending March 6th, 2024.

Total North American weekly rail volumes were up (2.89%) in week 10, compared with the same week last year. Total carloads for the week ending on March 6th were 346,772, down (-3.46%) compared with the same week in 2023, while weekly intermodal volume was 327,330, up (10.59%) compared to the same week in 2023. 8 of the AAR’s 11 major traffic categories posted year-over-year increases. The most significant decrease came from Coal, which was down (-20.49%). The most significant increase came from Intermodal which was up (+10.59%).

In the East, CSX’s total volumes were up (6.44%), with the largest decrease coming from Grain, down (-14.23%) while the largest increase came from Petroleum and Petroleum Products (18.8%). NS’s volumes were up (5.06%), with the largest increase coming from Other (+14.24%) while the largest decrease came from Petroleum and Petroleum Products (-17.63%).

In the West, BN’s total volumes were up (5.85%), with the largest increase coming from Metallic Ores and Metals (+23.19%) while the largest decrease came from Coal, down (-34.61%). UP’s total rail volumes were down (-5.24%) with the largest decrease coming from Coal, down (-30.19%) while the largest increase came from Forest Products which was up (12.87%).

In Canada, CN’s total rail volumes were down (-3.77%) with the largest decrease coming from Other, down (-44.99%) while the largest increase came from Farm Products, up (+16.73%). CP’s total rail volumes were up (+26.04%) with the largest increase coming from Grain (+135.81%) while the largest decrease came from Petroleum and Petroleum Products, down (-21.10%).KCS’s total rail volumes were down (-11.61%) with the largest decrease coming from Other (-25.61%) and the largest increase coming from Motor Vehicles and Parts (+37.3%).

Source Data: AAR – PFL Analytics

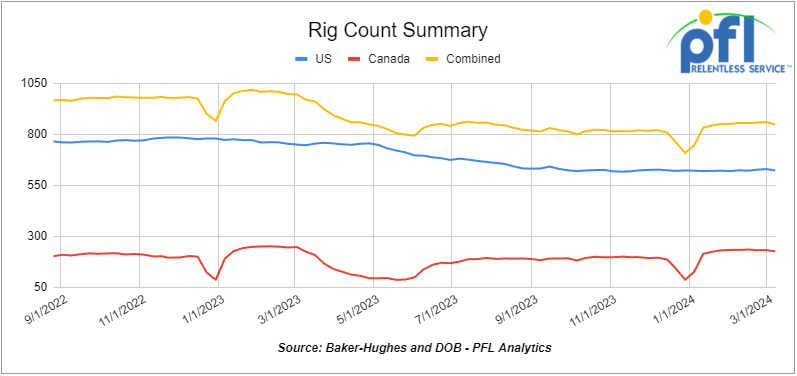

Rig Count

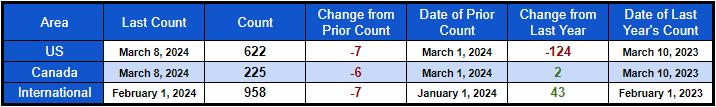

North American rig count was down by -13 rigs week-over-week. U.S. rig count was down by -7 rigs week-over-week and down by -124 rigs year-over-year. The U.S. currently has 622 active rigs. Canada’s rig count was down by -6 rigs week-over-week, but up by +2 rigs year-over-year. Canada’s overall rig count is 225 active rigs. Overall, year-over-year, we are down -122 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 29,501 from 30,125, which was a loss of 624 rail cars week-over-week. Canadian volumes were mixed. CPKC’s shipments were flat week over week. CN’s volumes were lower by -7.4% week-over-week. U.S. shipments were also mixed. The UP had the largest percentage decrease and was down by -10.9%. The CSX had the largest percentage increase and was up by 4.4%.

We are Watching the Biden Administration Continued Battle Against U.S. Oil and Gas and Increasing Government Oversight

In case you missed it, the US Securities and Exchange Commission (SEC) on Wednesday of last week voted to require most publicly traded companies to disclose their levels of greenhouse gas emissions and ways climate change may present business risks.

In a 3-2 vote, the SEC moved forward with the far-reaching—and contentious—rule that weaves climate accountability into financial oversight to give investors more transparent and comparable data on which to make decisions.

Under the rule, businesses must reveal their climate-related goals, including efforts to transition away from fossil fuels. The disclosures are legally binding, meaning companies could be liable if they misstate their emissions.

The rule was the most anticipated in SEC history, generating nearly 25,000 comments from companies, trade groups, investors and climate activists.

Hopefully, battery manufacturers and electric car manufacturers have to report their overall impact on the environment and the exploitation of undeveloped economies – just a thought.

On another note, the EPA said on February 29 that it is delaying plans to set greenhouse gas emissions limits for existing natural gas-fired power plants, but they are not done. The Environmental Protection Agency is withdrawing plans to set greenhouse gas emissions limits for existing gas-fired power plants from a broad proposal for generator emission reductions and will develop standards in an upcoming rulemaking process. “The agency is taking a new, comprehensive approach to cover the entire fleet of natural gas-fired turbines, as well as cover more pollutants including climate, toxic and criteria air pollution,” EPA Administrator Michael Regan said in a statement. The EPA plans to soon start a stakeholder process to develop standards for existing gas-fired power plants.

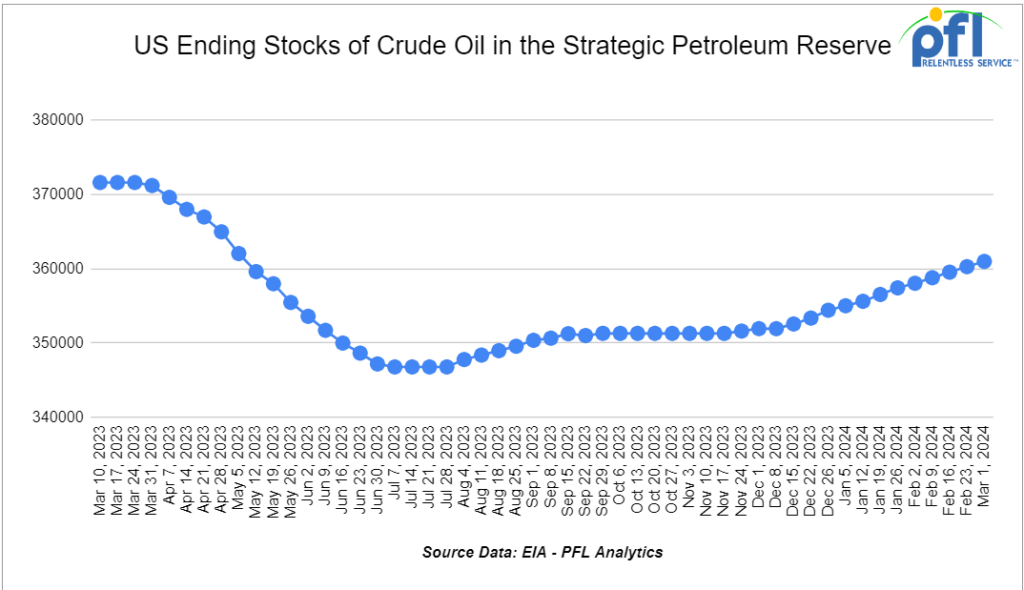

We are watching the Biden Administration Continuing to Buy Bits and Pieces of Crude to Replenish the SPR

The U.S. Department of Energy’s (DOE) Office of Petroleum Reserves announced last week a solicitation for approximately 3 million barrels of oil for delivery to the Strategic Petroleum Reserve (SPR) in September. The DOE has purchased 26.28 million barrels of oil, a mere fraction of what it sold to try and control prices. The announcement was touted as a good deal for taxpayers.

Bids for the solicitation are due no later than 11:00 a.m. Central Time on March 13, 2024. The delivery will be received by the Big Hill storage facility.

We are Watching Industry Get-Togethers – PFL was in Full Travel Mode Last Week – Rail Equipment Finance, SWARS, and Opis’s NGL Summit.

Rail Equipment Finance – Rail Cars – Palm Springs California

We heard from industry participants from both the leasing and manufacturing arms of the industry who describe a potentially structural shift toward a less erratic build cycle, with builds hovering around replacement for the next few years. Lessors appear to see annual replacement as being 35-40K railcars, while the manufacturers see 40-50K units. Most likely, the actual number will fall somewhere in the middle. At the end of the day, replacement will be a function of a structurally trimmed manufacturing capacity for the industry, elevated material costs, labor challenges, high-interest rates, and anemic rail traffic. As far as the 2024 production forecast, we heard estimates as low as 32K units and as high as above 40K units. The industry’s consensus view may be around 38K units. This number could be exceeded if the Mexico border issues are alleviated, and barring further increases in steel prices and labor challenges.

Lease rates and valuations continue to be strong, although some lessors have seen some softening in recent months. Given the modest build outlook this year, we do not see rates declining materially in the foreseeable future.

Rail Equipment Finance – Locomotive – Palm Springs California

There appears to be a near-consensus within the industry that the fleet will be zero-emission non-diesel in the long term, but no clear consensus on what that will be, although hydrogen electrolyzer is a leading candidate. Bridge technologies could include biofuels, renewable diesel, hydrogen ICE, and batteries.

One expert suggested that replacing 25% of the 24K active North American road diesel locomotives with non-diesel units could take 10 years, including an initial few years of design and resource ramping. The expert suggested that between WAB’s Forth Worth and Erie plants and CAT’s Progress Rail’s footprint, there is plenty of plant capacity. However, other constraints, including labor, would put a lid on annual builds.

Class I rails are eager to identify the zero-emission technology of the future now and begin working toward it, as opposed to experimenting with several options or intermediate solutions. WAB is testing biofuels and other renewables that would allow the rails to switch back and forth between diesel and renewable fuel almost seamlessly as dictated by the availability and the economics of the latter. This applies to just about all tiers of locomotives. Hydrogen ICE is another viable option, but its reversibility to diesel is limited to Tier 4 and Tier 3 locomotives.

South West Association of Rail Shippers (SWARS) – Galveston, Texas

One of our favorite conferences did not let us down! It was a sold-out event folks and they ran out of hotel rooms. PFL is a proud sponsor of SWARS and the association has been a valuable partner of PFL for years. Speakers included Keven Boone (CSX), Coby Bullard (CPKC), Nicholas Clark CN, and John Doggett from the University of Texas amongst others.

People at the SWARS Spring session were there to do deals. Everyone seemed to be working on something. Requalifications and shop time are a big concern for many. Expanding storage operators are looking for cars to be parked at their facilities in a declining storage market. We are seeing spaces open up in different parts of the country where spots were previously tight.

Barring any catastrophic events, we see a steady and robust 2024 in Services (rail car scrapping, rail car flaring, rail car repair, and rail car cleaning).

Rail car traffic has been increasing week over week – class 1’s were upbeat and the rest of the industry crossing their fingers. After saying that, the BN laid off a bunch of people last week and has reportedly furloughed hundreds of people. The furloughs were announced Tuesday, with 362 workers reportedly losing their jobs, according to the Transportation Trades Department (TTD) with the AFL-CIO, the transportation labor federation representing U.S. rail unions and workers.

“BNSF Railway callously announced it has furloughed over 362 mechanical department positions at numerous locations across their system,” Greg Regan, president of the TTD AFL-CIO, said in a letter. “BNSF has said that the slashing of these positions was necessary to realign with their business operations and to respond to business decline.”

Workers at BNSF terminals were reportedly furloughed at rail terminals in Kansas, Montana, Nebraska and Texas, according to posts on social media. While TTD AFL-CIO said the furloughs were in the mechanical department, social media posts indicated positions such as clerks, carmen, pipe fitters, and laborers were also affected.

Opis NGL Summit – Las Vegas, Nevada

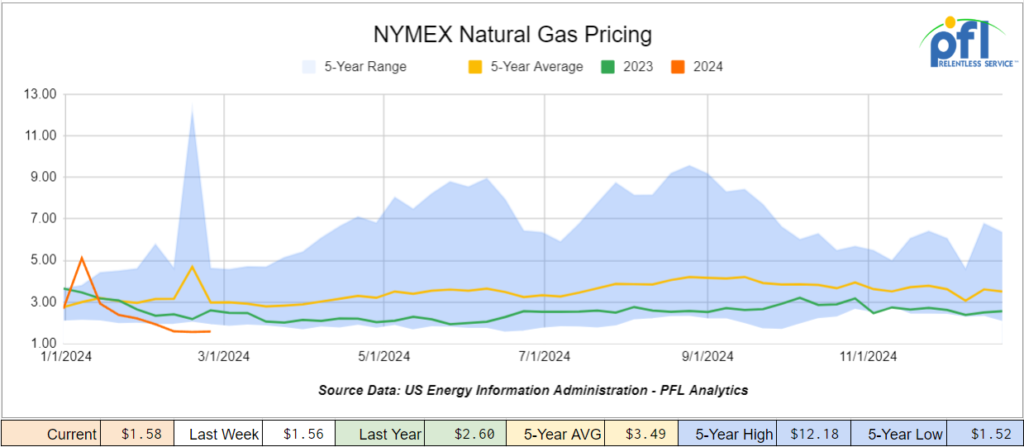

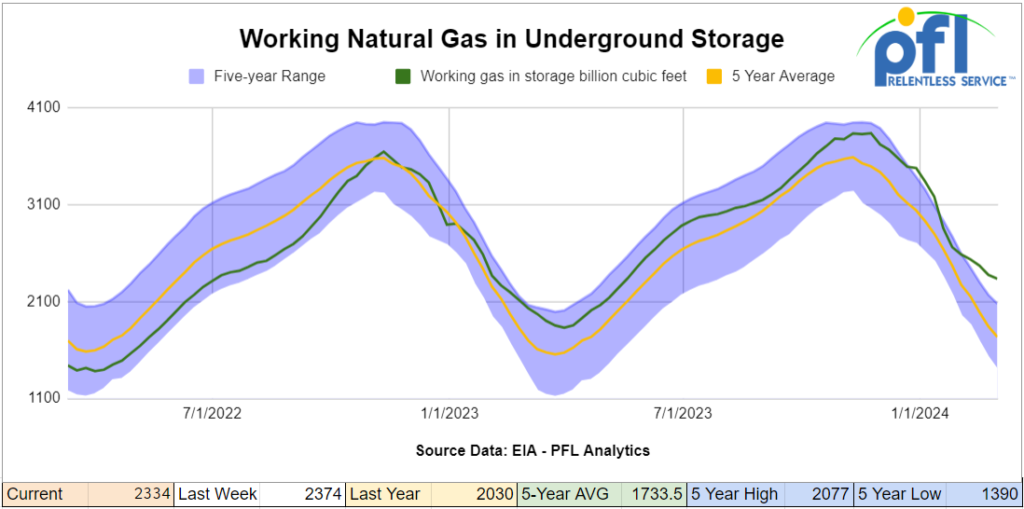

PFL was also a proud sponsor of the NGL summit and has been for years. We had a table at the summit with a bunch of people stopping by. With winter pretty much over, people are looking forward to spring and replenishing supplies for next year’s heating season. It seems to us that most are generally long cars but really not wanting to give them up as when you need them it is hard to get them back. The NGL market is dependent upon natural gas production and with prices so low and inventory levels high, some of that production is being taken offline. EQT recently announced that it is taking 1 bcf per day offline. See updated pricing and inventory levels below:

We are seeing early loaded rail car storage interest and are ready to roll here at PFL if that is the case, however, supply and demand always have a way of working itself out!

We are watching renewables

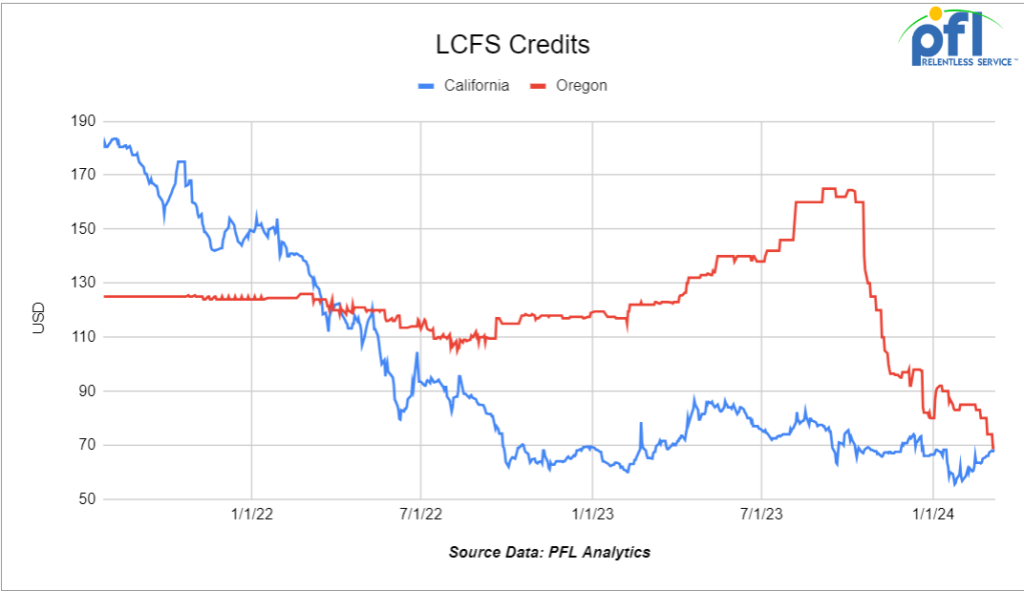

This is a tricky one folks. Currently, we have a green liberal government that is jamming renewables down our throats for the sake of saving the planet. As we dive into it, we are all finding out that some of these renewable initiatives are worse for the environment (Solar and Wind) than they are intending to save. So many incentives as far as credits go are collapsing due to overall demand destruction and overproduction of mandated markets. Don’t get us wrong, we love renewables – Ethanol, Renewable Diesel, and Biodiesel are important fuels in our supply chain. We just don’t like the ones that don’t make sense.

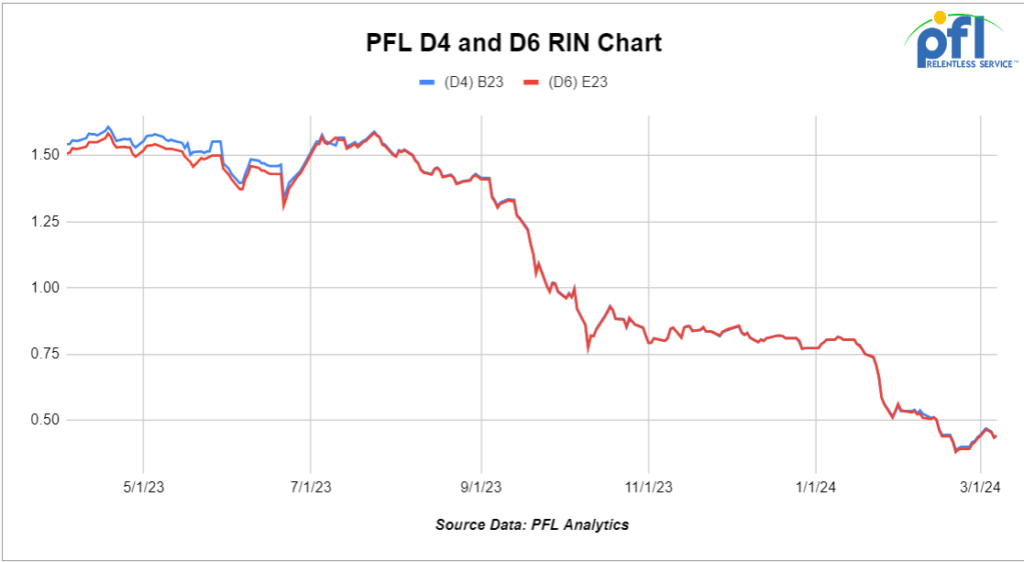

When you take into account renewable diesel imports – increasing biodiesel production and renewable diesel production here in the U.S. we have hit a low on D4 RINS and Credits in California and Oregon Credits (Note Oregon and California credits now trading at parity)

As it relates to Biodiesel and Renewable Diesel, it is hard to tell how this one is going to shape up and have an effect on rail. There are many factors at play here that are going to have an effect on the coiled and insulated car (we will expand more on this in next week’s rail report – stay tuned to PFL). Chevron recently confirmed the indefinite idling of two biodiesel production facilities in the U.S. Midwest due to weakening economics for renewable fuels. This decision comes as a significant move for the second-largest U.S. oil producer, which had previously acquired biodiesel maker Renewable Energy Group for $3.15 billion in 2022. The acquisition was aimed toward expanding Chevron’s renewable fuels production to 100,000 barrels per day by 2030, adding 10 biodiesel plants and one renewable diesel facility to its portfolio. The idled plants, located in Ralston, IA, and Madison, WI, have a combined capacity of processing 50 million gallons per year of biodiesel. Despite the potential of biodiesel as a cleaner burning fuel made from agricultural oils and animal fats, its production is costlier than that of petroleum-based diesel. The biodiesel production also generates credits that can offset production costs, and with those credits collapsing (D4 RINS- below Chart and LCFS Credits in California – above Chart) we expect to see more instability in the days to come if all remains the same.

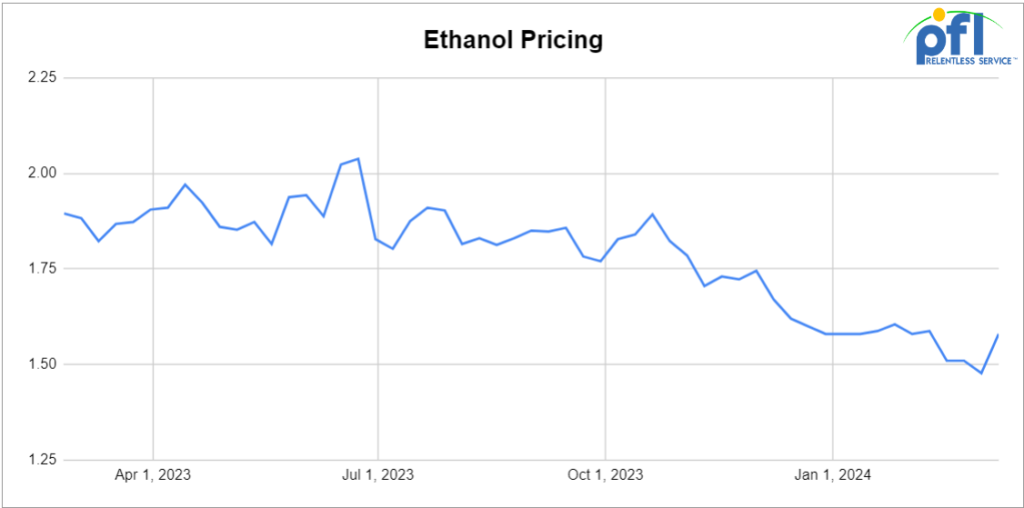

In regards to Ethanol, that pricing structure has fallen out of bed mainly due to lack of demand. And those RINS or producer incentives (D6 RINS – above Chart) which have also collapsed and we don’t know if they are coming back anytime soon, as producers have throttled back in recent weeks in regards to physical Ethanol production (see chart below).To sum it all up, on Friday of last week, D4 RINS closed at 47 cents per RIN, up 1 and ½ cents per RIN day over day and up 2 and ½ cents per RIN week over week. D6 RINS ended the week closing at 44 and ½ of a cent per RIN, no change day over day and no change week over week. Ethanol at Argo closed out the day and the week at $1.58 per gallon, up ½ of a cent per gallon day over day and up 15 cents per gallon week over week. Last, but not least, LCFS credits in California closed out the day and the week at $68 per MT, down $1 per MT day over day, but flat week over week.

We are Watching Some Key Economic Indicators

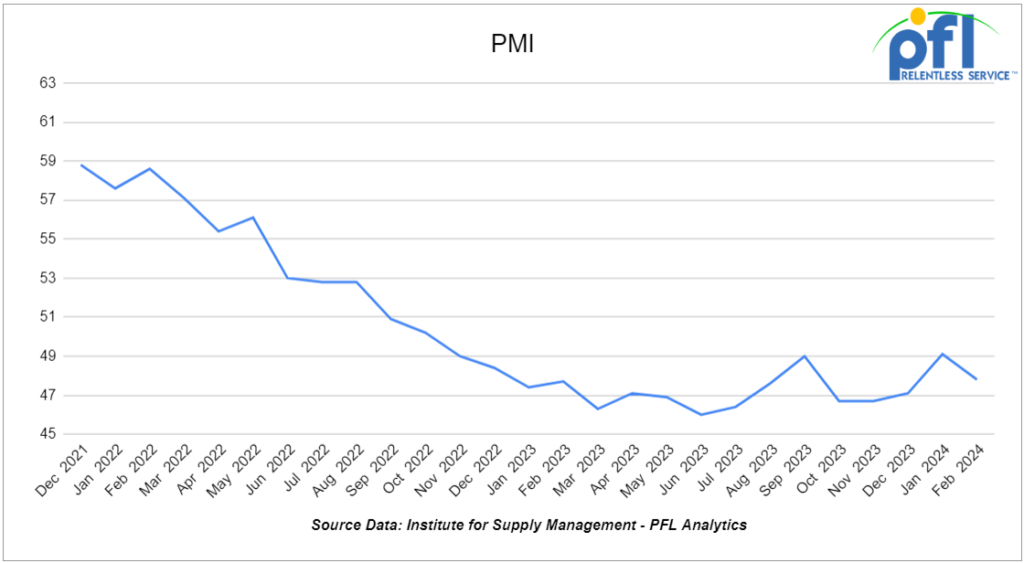

Purchasing Managers Index (PMI)

The Institute for Supply Management releases two PMI reports – one covering manufacturing and the other covering services. These reports are based on surveys of supply managers across the country and track changes in business activity. A reading above 50% on the index indicates expansion, while a reading below 50% signifies contraction, with a faster pace of change the farther the reading is from 50. The overall Manufacturing PMI was 47.8% in February, close to the level seen throughout 2023 and down from 49.1% in January. February 2024 marks the 16th month of contraction in a row. The new orders sub-index also fell in February, from 52.5% to 49.2%, while the new export orders index and the imports index both rose to their highest levels since July 2022.

The Services PMI focuses on services industries rather than manufacturing and shows that the much larger services part of the economy continues to outperform manufacturing. The Services PMI was 52.6% in February, down 0.8 percentage points from 53.4% in January.

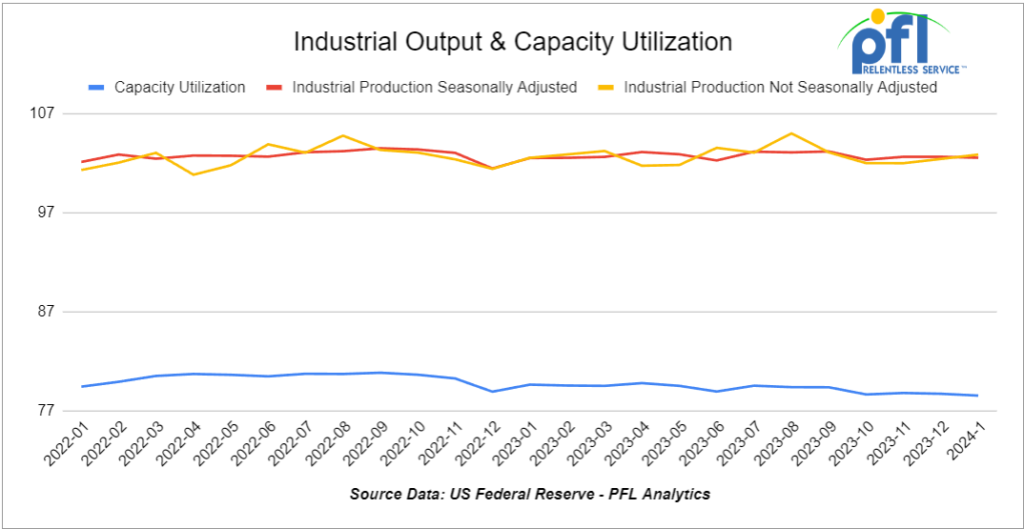

Industrial Output & Capacity Utilization

According to preliminary seasonally adjusted data released by the Federal Reserve on February 15, total U.S. industrial output in January 2024 fell 0.1% from December 2023. Total output was flat in December from November.

Manufacturing output fell a preliminary 0.5% in January from December, following a 0.1% increase in December and a 0.4% increase in November. In the 25 months since January 2022, manufacturing output has risen on a month-to-month basis 14 times and fallen 11 times with no clear pattern and an overall slightly downward trend. Year-over-year manufacturing output was down 0.9% in January, its eighth year-over-year decline in the past nine months.

Overall capacity utilization was a preliminary 78.5% in January, the lowest since September 2021. Capacity utilization for manufacturing was 76.6% in January, the lowest it’s been since April 2021.

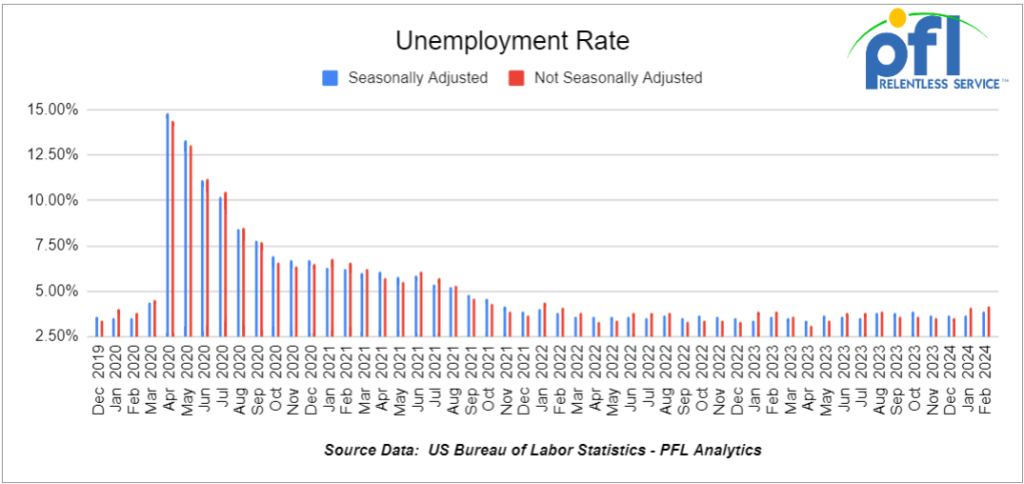

U.S Unemployment

According to the Bureau of Labor Statistics (BLS), a preliminary 275,000 net new jobs were created in February 2024. That’s up from a revised 229,000 in January and not far from December’s revised 290,000 people.

The official unemployment rate was 3.9% (6.5 million people) in February, up 0.2% month over month.

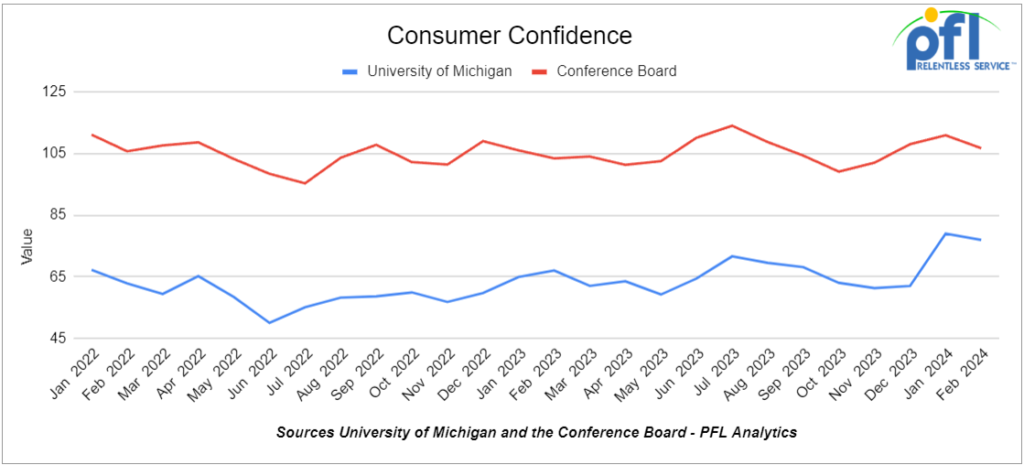

Consumer Confidence

The Conference Board’s Index of Consumer Confidence fell to 106.7 in February from 110.9 in January. The first decline after three months of month-over-month increases.

The index of consumer sentiment from the University of Michigan also declined – to 76.9 from 79.0.

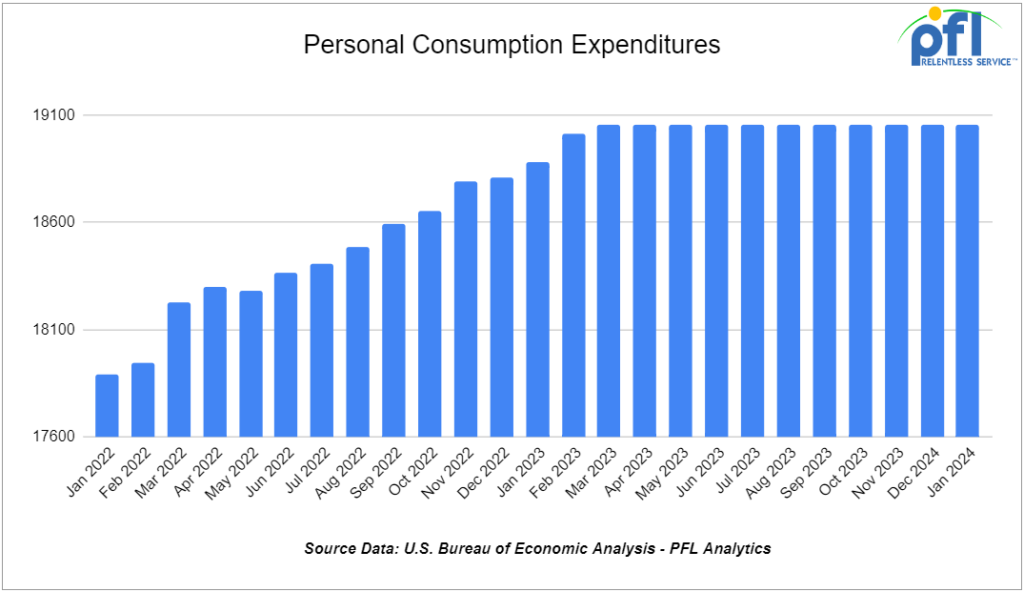

Consumer Spending

In January 2024, total consumer spending not adjusted for inflation rose a preliminary 0.2% from December 2023, following a 0.7% increase in December from November. Adjusted for inflation, total spending fell 0.1% in January, the first decline since August 2023.

Spending on services was up 1.0% in January, not adjusted for inflation. Spending on goods, which is more important for transportation providers like railroads, fell 1.2% in January.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs at 239-390-2885

Lease Bids

- 250, 4000 Rapid Hoppers needed off of BNSF in TX IL for 5 years. Cars are needed for use in Coal service. in rotary/rapid cars with the electric dumping shoe

- 4, 6260 Covered Hoppers needed off of CSX in Bostick, NC for 2-4 Years. Cars are needed for use in Polypropene Pellets service.

- 50-100, 4750CF Open/Covered Hoppers needed off of BN in Washington for Feb-Jun. Cars are needed for use in Petcoke service.

- 80, 30K 117R or 117J Tanks needed off of UP in Nebraska for 12 Months. Cars are needed for use in Ethanol service.

- 100, 30K Dot 111 or CPC 1232 Tanks needed off of UP or BN in New Orleans/Pasadena for 6-12 Months. Cars are needed for use in Gasoline/Diesel service.

- 80, 29k 117R or 117J Tanks needed off of Any Class 1 in Kentucky for 1-5 Years. Cars are needed for use in Crude service.

- 50, 19k DOT111 Tanks needed off of UP or BN in Nevada or CA for 1 year. Cars are needed for use in Sulfuric Acid service. March or April

- 8, 28-30K Any Tanks needed off of UP BN in Texas and Gulf for 5 years. Cars are needed for use in Chlorobenzene service. Need Magrods

- 14, 23.5K DOT111 Tanks needed off of UP in Morrilton, AR for 1 year. Cars are needed for use in Turpentine service.

- 10, 30k any Tanks needed off of UP BN in Texas for 1 year plus. Cars are needed for use in Fuel Oil service.

- 25-50, 5000CF-5100CF Covered Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in Dry sugar service. 3 bay gravity dump, Hempel 37700

- 30-40, 28.3K DOT117R, DOT117J, DOT111 Tanks needed off of UP in Iowa for 2-3 years. Cars are needed for use in Feedstocks service.

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 50, 23.5-25.5 DOT111 tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 25, 30K Any Tanks needed in Houston for December -June. Cars are needed for use in Diesel service.

- 75, 30K Any Tanks needed off of Any Class 1 in Chicago for December 23-May 24. Cars are needed for use in Gasoline service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 108, 28.3K Any Tanks needed off of CN in Canada for 1-3 years. Cars are needed for use in Crude service.

- 20-25, 30K DOT117 Tanks needed off of UP or BN in Illinois for 5 years. Cars are needed for use in Ethanol service.

- 100, 28.3K Any Tanks needed off of UP or BN in Midwest/Texas for 5 years. Cars are needed for use in Veg Oils / Biodiesel service. Need to be Unlined

- 50-100, 4550 Covered Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in Grain service.

- 10, 33K 340W Pressure Tanks needed off of CN in LA for 1 year. Cars are needed for use in Butane service.

- 25, 20.5K CPC1232 or DOT117J Tanks needed off of BNSF or UP in the west for 3-5 years. Cars are needed for use in Magnesium chloride service. SDS onhand

- 25-50, 25.5K DOT117J Tanks needed off of NS CSX in Northeast for 5 years. Cars are needed for use in Asphalt / Heavy Fuel Oil service.

- 15, 28.3K DOT117J Tanks needed off of any class 1 in any location for 3 years. Cars are needed for use in Glycerin & Palm Oil service.

- 30, 17K-20K DOT117J Tanks needed off of UP or BN in Midwest/West Coast for 3-5 years. Cars are needed for use in Caustic service.

- 150, 23.5K DOT111 Tanks needed off of any class 1 in LA for 2-3 years. Cars are needed for use in Fluid service. Needed July

- 10, 5200cf PD Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

Sales Bids

- 10, 2770 Mill Gondolas needed off of any class 1 in St. Louis. Cars are needed for use in Cement service.

- 20, 2770-3400 Mill Gondolas needed off of any class 1 in South Texas. Cars are needed for use in scrap metal service.

- 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Sand service.

- 8, 5200 Covered Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

- 20-30, 3000 – 3300 PD Hoppers needed off of BN or UP preferred in West. Cars are needed for use in Cement service. C612

- 10, 4000 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

- 10, 6400 Open Top Hoppers needed off of CSX in the northeast. Cars are needed for use in wood chip service. Open top hopper, flat bottom

- 45, 3000 cf PD Hoppers needed off of any class 1 in Texas. Negotiable

- 200+, 5000cf Covered Hoppers needed off of any class 1 in various locations.

- 5, 3400CF Covered Hoppers needed off of any class 1 in Ohio. Cars are needed for use in Sand service.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 100, 15.7K DOT111 Tanks needed off of CSX or NS in the east. Cars are needed for use in Molten Sulfur service.

- 30, 17K-20K DOT111 Tanks needed off of UP or BN in Texas. Cars are needed for use in UAN service.

- 2-4, 28K DOT111 Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

- 20-30, Open Top Hoppers needed off of NS or CSX in Northeast. Cars are needed for use in Aggregate service. Gravity dump

- 5, 30K DOT 111 Tanks needed in US. Cars are needed for use in Fuels service.

Lease Offers

- 15, Plate E and F Boxs located off of NS in New Orleans. Cars are clean Double Sliding Doors

- 38, 4750 plus, 3-4 Hatch Gravity Covered Hopperss located off of CSX CN CP in Florida. Sub-lease 12-18 months

- 50, 33K, 340W Pressures currently moving. Cars were last used in Propane. 1 year lease

- 10, 28.3K, DOT117R Tanks located off of All Class Ones in St Louis. Cars are clean Call 239-390-2885 for more information

- 10, 21.9K, Tanks located off of UP in Longview, TX. Cars are clean CO2 Cars. Brand New. 2-5 Year Lease

- 125, 28.3K, 117J Tanks located off of Various Class 1s in Multiple locations. Cars are clean Long Term Lease, 5 Years +

- 80, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Long-term Lease.

- 50, 28.3K, AAR 211 Tanks located off of BN in Moving. Cars were last used in Biodiesel. 1 Year Lease; Free Move on BN

Sales Offers

- 20, Refer, Box Boxcars located off of UP in ID.

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 100, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 100, 17K, DOT111 Tanks located off of various class 1s in multiple locations.

- 100, 19K, DOT111 Tanks located off of various class 1s in multiple locations.

- 40, 29K, DOT111 Tanks located off of CN in Canada. C/I; Free Move CN

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website