“The secret of getting ahead is getting started.”

– Mark Twain

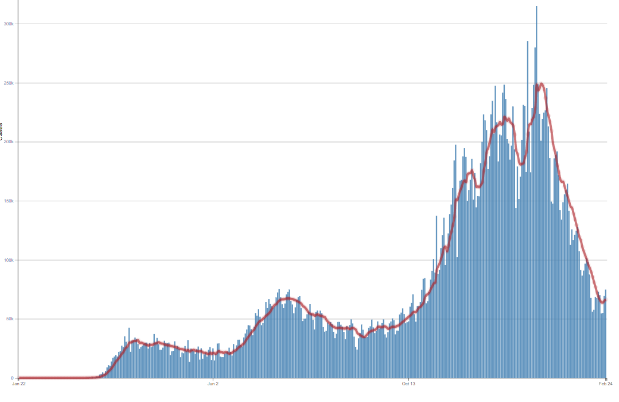

COVID-19

Folks, welcome to the month of March 2021 – spring break is right around the corner and April showers are in 31 days – hang in there winter is almost over and so is COVID-19 apparently – is heard immunity right amount the corner? – Not if you listen to Dr. Anthony Fauci, we report you decide but the chart is impressive, and it looks like we are going to get more help on the vaccine front from Johnson & Johnson as the FDA gives Johnson and Johnson the green light for emergency use of its COVID -19 vaccine which is only one dose. Apparently 4 million doses will be made available this week and 20 million doses available by Mid-March! Maybe Dr. Fauci needs a new job because it does not look as though he can keep dragging this one out.

Daily Trends in COVID-19 Cases in the United

The United States currently has 29,255,344 confirmed COVID 19 cases and 525,776 confirmed deaths.

US Jobless Claims

Weekly unemployment claims fell far more than expected last week. The Department of Labor released its weekly report on new jobless claims Thursday of last week and Initial jobless claims came in at 730,000 versus 825,000 expected and revised 841,000 during prior week. Initial unemployment claims fell first time in five weeks for the period ending Feb. 20, and broke below 800,000 for the first time in seven weeks. But the even bigger than expected drop left claims well above their pre-pandemic levels, when claims were coming in at an average of just over 200,000 per week. The vast majority of U.S. states reported decreases in new claims last week, helping contribute to the overall improvement. California posted by far the largest drop of 50,000 new claims on an unadjusted basis, followed by Ohio with a drop of 46,000 new claims. These more than offset notable increases in new claims in states including Illinois at 12,500, and Missouri at 4,200.

Continuing claims came in at 4.419 million vs. 4.460 million expected. Continuing jobless claims, which are reported on a one-week lag and measure the total number of individuals still receiving regular state unemployment benefits, have fallen for the past six consecutive weeks. However, these numbers remain more than double their pre-pandemic levels, even as more and more Americans have exhausted their six months of continuing state benefits and rolled onto longer-term federal unemployment programs.

Markets closed lower Week over Week

The Dow closed lower on Friday of last week, down -469.64 (-1.50%) closing out the week at 30,923.37 points, down -570.95 points week over week. The S&P 500 closed lower on Friday of last week, down -18.19 points (-0.48%) and closing out the week at 3,811.15 points, down -95.56 points week over week. The Nasdaq closed higher on Friday of last week, up +72.92 points (+0.56%) closing out the week at 13,192.35 points, down -682.11 points week over week.

In overnight trading, DOW futures traded higher and are expected to open up this morning 322 points.

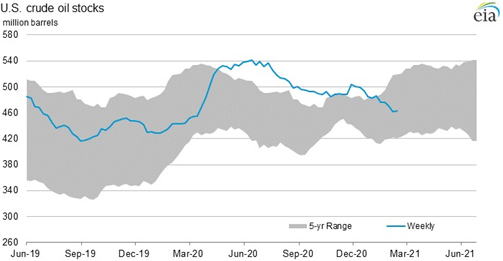

WTI Higher Week over Week – Supply Demand Balance Seen in Check

WTI crude oil for April delivery declined -$2.03 to settle at $61.50 a barrel Friday of last week, but was up 3.8% a barrel week over week. Brent crude oil for April delivery declined -$0.75 to $66.13 a barrel Friday of last week, up $3.22 per barrel week over week. Brent crude for April delivery came off the board on Friday of last week.

U.S. commercial crude oil inventories increased by +1.3 million barrels week over week. At 463.0 million barrels, U.S. crude oil inventories are within the five year average for this time of year.

Total motor gasoline inventories were virtually unchanged week over week and are 1% above the five year average for this time of year. Finished gasoline inventories increased while blending components inventories decreased last week. Distillate fuel inventories decreased by 5.0 million barrels week over week and are 3% above the five year average for this time of year. Propane/propylene inventories decreased by 5.2 million barrels week over week and are 17% below the five year average for this time of year. Total commercial petroleum inventories decreased by 13.8 million barrels week over week.

U.S. crude oil imports averaged 4.6 million barrels per day last week, a decrease of 1.3 million barrels per day week over week. Over the past four weeks, crude oil imports averaged about 5.7 million barrels per day, 13.3% less than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 531,000 barrels per day, and distillate fuel imports averaged 303,000 barrels per day.

Oil is higher in overnight trading and as of the writing of this report, WTI is poised to open at $62.31, up 81 cents per barrel from Friday’s close.

North American Rail Traffic

Total North American rail volumes were down 17.1% year over year in week 7 (U.S. -21.7%, Canada -0.6%, Mexico -15.7%) resulting in year to date volumes that are up 0.4% year over year (U.S. +0.4%, Canada +4.6%, Mexico -14.3%). We would highlight that this decline was clearly a function of disruptions from severe winter weather during week 7 across the U.S. All of the AAR’s 11 major traffic categories posted year over year decreases with the largest declines coming from intermodal (-11.9%), nonmetallic minerals (-37.5%), coal (-20.5%) and chemicals (-24.1%).

In the East, CSX’s total volumes were down -15.6%, with the largest decreases coming from intermodal (-11.2%), motor vehicles & parts (-45.4%) and coal (-20.0%). NS’s total volumes were down -17.4%, with the largest decreases coming from intermodal (-18.8%) and motor vehicles & parts (-30.9%). The largest increase came from coal (+14.7%).

In the West, BN’s total volumes were down -20.5%, with the largest decreases coming from coal (-32.6%), intermodal (-9.3%), chemicals (-41.2%) and petroleum (-44.2%). UP’s total volumes were down -31.0%, with the largest decreases coming from intermodal (-28.0%), stone sand & gravel (-79.8%), chemicals (-28.3%), coal (-30.8%) and motor vehicles & parts (-44.8%).

In Canada, CN’s total volumes were up +4.1%, with the largest increase coming from intermodal (+32.8%). The largest decreases came from metallic ores (-19.5%) and chemicals (-20.4%). RTMs were up 5.7%. CP’s total volumes were down -13.9%, with the largest decreases coming from intermodal (-14.5%) and petroleum (-45.1%). RTMs were down 11.4%.

KCS’s total volumes were down 28.1%, with the largest decreases coming from intermodal (-32.2%) and motor vehicles & parts (-52.6%).

Source: Stephens

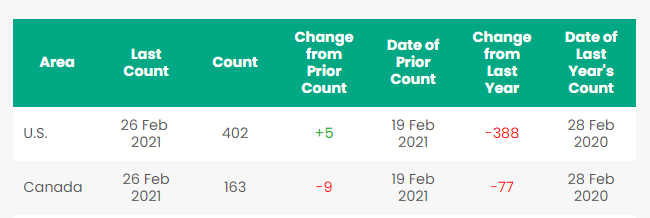

Rig Count

North America rig count is down by 4 rigs week over week. The U.S. was up by 5 rigs week over week (oil rigs were up 4 to 309, gas rigs up 1 to 92, and miscellaneous rigs unchanged at one rig, according to Baker Hughes). The U.S. currently has 402 active rigs. Canada’s rig count was down by 9 rigs week over week and Canada’s overall rig count is 163 active rigs. Year over year we are down 465 rigs collectively.

North American Rig Count Summary

Things we are keeping an eye on

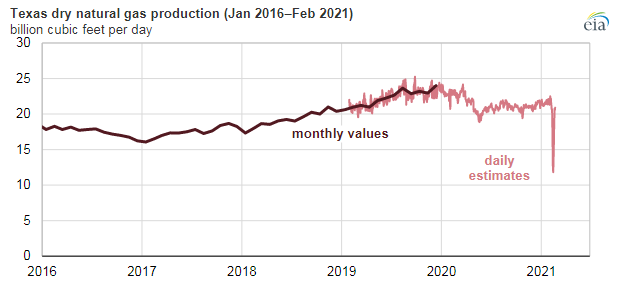

Still have our eyes on Texas Folks

We said it would be complicated in last week’s rail report and it is. Texas and Midwest refiners began thawing out their plants after the polar vortex invaded in a big way. As of the close of business on Friday of last week US refining capacity was estimated to be down almost 7.6 million b/d with 5.4 million b/d coming from the Gulf. The majority of the plants along Texas’s refinery row are in the process of restarting, with most expected back online by mid-March. This is according to company statements and filings made with state regulatory agencies detailing emissions events, which go along with plant restarts, others may not make it online until sometime in April. While Texas refiners took main units down at the request of Governor Abbott to conserve scarce electricity so that people could heat their homes, some refiners – like ExxonMobil and Shell – even supplied energy to the grid from their cogeneration plants that normally would have powered their refineries. How cool is that folks, hats off to them.

During the cold snap that affected much of the central part of the country, U.S. natural gas production fell to as low as 69.7 billion cubic feet per day (Bcf/d) on February 17, a decline of 21%, or down nearly 18.9 Bcf/d from the week ending February 13. Natural gas production in Texas fell almost 45% from 21.3 Bcf/d during the week ending February 13 to a daily low of 11.8 Bcf/d during the cold snap. Temperatures in Texas averaged nearly 30 degrees Fahrenheit lower than normal during the week of February 14. (see production numbers below)

ERCOT Texas Electricity grid board members who live outside of Texas have resigned in the aftermath of the power outage and winter storm. Five board members, including the chair, resigned Wednesday of last week. The vacancies will not immediately be filled. Sally Talberg, board chair; Peter Cramton, vice chair; Terry Bulger, finance and audit chair; and Raymond Hepper, human resources and governance committee chair, occupy the “unaffiliated” director positions on the board, which mean they must remain independent of any business ERCOT oversees. Their resignations will be effective immediately. In addition, Vanessa Anesetti-Parra, the market segment director for the independent retail electric provider market segment, will also resign her position as a board member. Craig Ivey, who was slated to fill a vacant unaffiliated director position, withdrew his application. ERCOT board members had come under fire last week when it was reported that some did not reside in the state. ERCOT officials, during a press conference last week, said it had temporarily removed personal information about the directors from its website because they were experiencing harassment. The board has been criticized for last week’s mass power outage during a winter storm that has claimed the lives of dozens of Texans. More than 4.5 million customers were without power at one point last week.

Gov. Greg Abbott had called on ERCOT board members to resign in the aftermath of the crisis and said in a statement on Tuesday of last week that he welcomes their resignations, promising to investigate the grid operator. “I welcome the resignations,” Abbott said. “The lack of preparedness and transparency at ERCOT is unacceptable. We will ensure that the disastrous events of last week are never repeated.” ERCOT, a nonprofit, is governed by a board of directors, but overseen by the Public Utility Commission. Fifteen members serve on the ERCOT board, including the five unaffiliated director positions.

Lawsuits have already been filed against ERCOT in response to the crisis. It’s unclear whether ERCOT, which falls under the PUC’s jurisdiction, can be held liable by such suits: The Texas Supreme Court is expected to decide this year whether ERCOT is entitled to sovereign immunity, a legal principle that protects government agencies from lawsuits

Alberta not giving up on Keystone

The Alberta government says it is working with TC Energy Corporation “to explore all options” to advance the Keystone (“KXL”) project and is “strongly encouraging the Government of Canada to do the same,” the province said in budget documents released on Thursday of last week. “If KXL does not proceed, the Alberta government will explore all options to recoup the investment. On January 20, 2021, the presidential permit for the KXL border crossing was revoked by the U.S. administration.

The exposure to the Alberta government from the financial commitment, as of February 2021, is $1.276 billion (CAD) “Alberta has experienced first-hand the devastating impacts of insufficient market access,” the province said. “With a capacity of 830,000 [bbls/d], the pipeline would have provided the country with access to the U.S. Gulf Coast, one of the largest refinery centers in the world designed to process heavy crude. It was also a step toward climate action and North American energy security. “With a commitment to net zero emissions, the pipeline would have helped Canada replace declining heavy oil production from Mexico and Venezuela and reduce reliance on OPEC crudes in the U.S. market.”

Key Stone pipe waiting to be put together

Petroleum By Rail

The four week rolling average of petroleum carloads carried on the sixth largest North American railroads fell to 24,415 from 26,053 week over week on the back of continued weather delays. Canadian volumes were mixed, CP shipments fell by 5.2% and CN volumes were up by 3.4%. U.S. rail road operators were also mixed. UP had the largest percentage loss, down by 17% while the NS had the largest percentage gain up 18.2%.

Government Spending gone wild

As most of you know the house passed a $1.9 trillion rescue plan. There wasn’t any Republican support or input and two Democrats crossed party lines and voted down the plan. The Bill included a $15 minimum wage but not expected to be passed by the Senate. Billions of dollars going to vaccination programs, expanded unemployment insurance, $1,400 stimulus checks, state and local governments, school re-openings and more. What is in the spending plan?

Stimulus checks, unemployment insurance, child tax credit

• The House bill provides $1,400 stimulus checks, on top of the $600 payments issued through the stimulus bill passed in December. The Committee for a Responsible Federal Budget puts the price tag of this next wave of checks at $422 billion.

• The vast majority of Americans who received an earlier stimulus payment will get one again. But the most affluent families would be left out. Republicans and more moderate Democrats argue that this next round of payments should only go to the hardest-hit households.

Expanded unemployment insurance and child tax credit

• The $900 billion stimulus package passed in December provided the unemployed an extra $300 per week in unemployment benefits. But that program expires in mid-March, raising concerns about a looming cliff facing its recipients. Nineteen million Americans were on some form of unemployment insurance for the week ending Feb. 6.

• The House legislation increases the weekly benefit from $300 to $400 per week through August 29. That’s one month shorter than Biden’s original proposal.

• The House law also expands the Child Tax Credit to $3,000 per child, and $3,600 for children under age 6. The bill also expands the Child and Dependent Tax Credit so families can claim up to half of their childcare expenses on their taxes.

Pandemic response

• $50 billion will fund coronavirus testing and contact tracing. Another $19 billion will go to increase the size of the public health workforce. And another $16 billion will fund vaccine distribution and supply chains.

Aid for state and local governments and transit

• $350 billion for state and local governments, territories, and tribes.

• $90 billion would go toward various transportation and infrastructure causes. $47 billion would increase funding for the Disaster Relief Fund, which is managed by FEMA, and cover funeral expenses tied to Covid. Transit agencies would get $28 billion in grants, and $11 billion would go to airports and aviation manufacturers. About $2 billion goes to Amtrak and other transit-related spending.

• Another $12 billion provides grants to airlines and contractors to freeze layoffs at airlines through September, according to the Committee for a Responsible Federal Budget breakdown.

Schools and child care block grants

• The bill sets aside almost $130 billion for K-12 education. That money would go to improving ventilation systems, reducing class sizes, buying personal protective equipment and implementing social distancing.

• Colleges and other higher-education institutions would get almost $40 billion. Schools must dedicate at least half of the funding for emergency financial aid grants to prevent hunger, homelessness or other challenges for students during the pandemic, according to the House committee.

America’s Federal Debt will exceed the size of the entire US economy.

We have been extremely busy at PFL with return on lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to trouble shoot a return on lease scenario or have storage availability. Whether you are a car owner, lessor or lessee or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Railcar Markets

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

- 35 3000-3400 CF Aluminum Hoppers with Manual Knocker Gates for the use in Sulfur in Alberta for 3-5 Years.

- 30 28.3K Tank Cars for the use in Biodiesel service in Chicago for 1 Year.

- 50 25.5K CPC 1232’s for the use in Asphalt service in Chicago for 1 Year.

- 150 2400 CF Steel Gondolas needed for Iron Pyrite Service in Montana for 1-3 Years. Needed end of Q4 2021

- 50 25.5K-29K CPC 1232’s for the use in Bitumen Service in Saskatchewan for 1 Year.

- 100 30K 117J’s for the use in Bakken Service in North Dakota for 1 Year.

- 100 31.8K CPC 1232’s for the use in Condensate in the Northeast for 1 Year. Must have Mag Rods.

- 10 30K Tank Cars for the Use in Veg Oil in the Midwest for 1-3 Years.

- 50 340W Pressure Cars needed for Butane in the Northeast for 1 Year.

- 10 31.8K CPC 1232’s or 30K 117Rs for the use in Liquor service for 5 Years. Must have specific lining.

- 100 31.8k CPC 1232’s for the Use in Gas or Diesel service in Texas for 1 Year.

- 100 23.5K CPC 1232’s for the use in Asphalt service in the Midwest or Canada.

- 30-50 Stainless Steel Tank Cars needed for the use in Liquor in the Southeast for 3-5 Years.

- 150 steel gondolas 2400 in Montana for 3 years BNSF Negotiable

- 50 cars for the use of Asphalt in Chicago for 1 Year. Cars can be 23.5K or 25.5K.

- 30 28.3K Tank Cars for the use of Biodiesel in Chicago for 1 Year.

- 25 CPC 1232s 31.8 Texas off UP 3 month to one year refined product negotiable.

PFL is offering:

- Various tank cars for lease with dirty to dirty service including, nitric acid, gasoline, diesel, crude oil, Lease terms negotiable, clean service also available in various tanks and locations

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

- 50 CPC 1232 28.3 tanks clean last veg oil various locations negotiable

- 200 30K tankers cleaned and ready for service, for sale or lease,

- 218 73 ft 286 GRL riser less deck, center part for sale,

- 19 auto-max II automobile carrier racks – tri-level for sale or lease in Arkansas

- 49 60’ Box cars 286 EOL refurbished in Tenn.,

- 20 low sided gondolas for lease in NJ 2743 cu ft,

- 100 34.2 Gallon Dot 111 for lease great for Ethanol or Alcohol

- 10 food grade stainless steel cars

- 30 CPC 1232 25.5K Pennsylvania NS clean negotiable

- 9 31.8 crude tanks in Detroit clean NS CSX CN Negotiable

- Covered PD Hoppers clean various sizes and locations 263 and 286’s negotiable

- 70 117Js in Texas dirty to dirty price negotiable

- 100 117Js 28.3 C/I for sale or lease in Texas

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scraping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|