“Do not let the memories of your past limit the potential of your future. There are no limits to what you can achieve on your journey through life, except in your mind.” ― Roy T. Bennet

Jobs Update

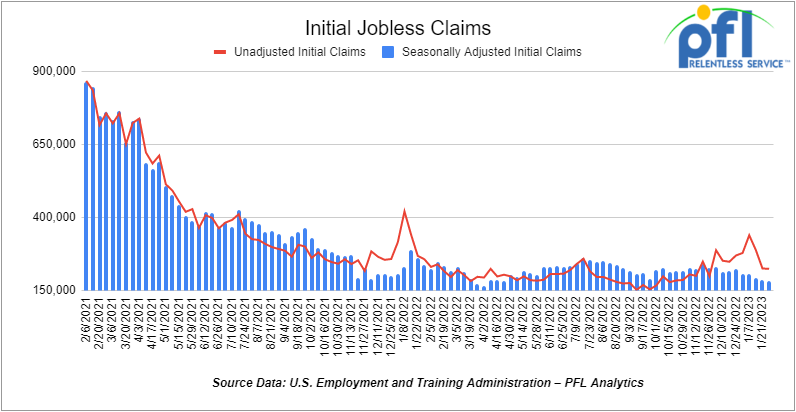

- Initial jobless claims for the week ending January 28th, 2023 came in at 183,000, down -3,000 people week-over-week.

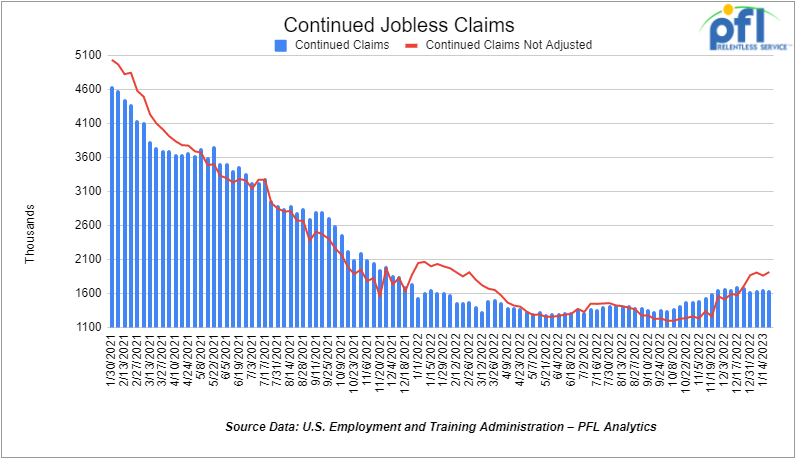

- Continuing jobless claims came in at 1.655 million people, versus the adjusted number of 1.666 million people from the week prior, down -11,000 people week-over-week.

Stocks closed lower on Friday of last week, but mixed week over week

The DOW closed lower on Friday of last week, down -127.93 points (-0.38%), closing out the week at 33,926.01, down -52.07 points week over week. The S&P 500 closed lower on Friday of last week, down -43.28 points (-1.04%) and closed out the week at 4,123.48, up 65.92 points week-over-week. The NASDAQ closed lower on Friday of last week, down -193.86 points (-1.67%), and closed the week at 12,006.96, up 385.25 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 33,738 this morning down -224 points.

WTI closed lower on Friday of last week and lower week over week

WTI traded down -$2.49 per barrel (-3.33%) to close at $73.39 per barrel on Friday of last week, down -$6.29 per barrel week over week. Brent traded down -US$2.23 per barrel (-2.7%) on Friday of last week, to close at US$79.94 per barrel, down -$6.72 per barrel week-over-week.

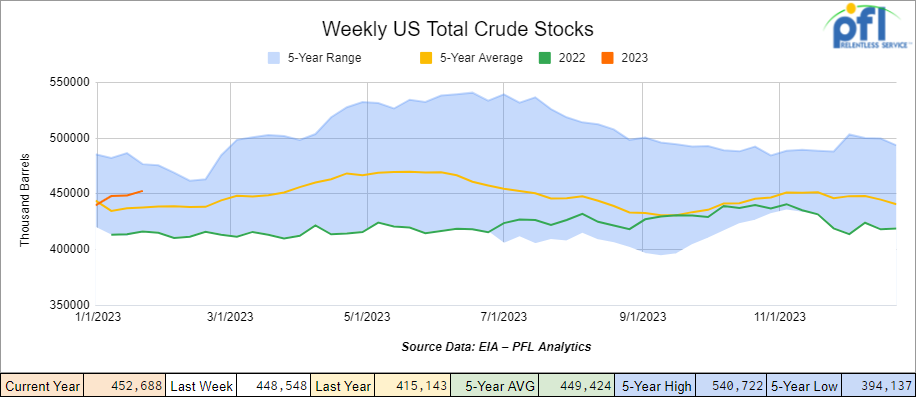

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 4.1 million barrels week over week. At 452.7 million barrels, U.S. crude oil inventories are 4% above the five-year average for this time of year.

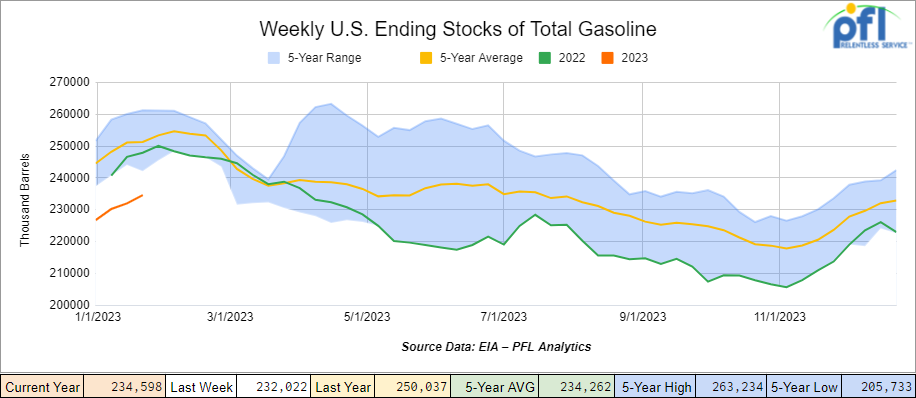

Total motor gasoline inventories increased by 2.6 million barrels week-over-week and are 7% below the five-year average for this time of year.

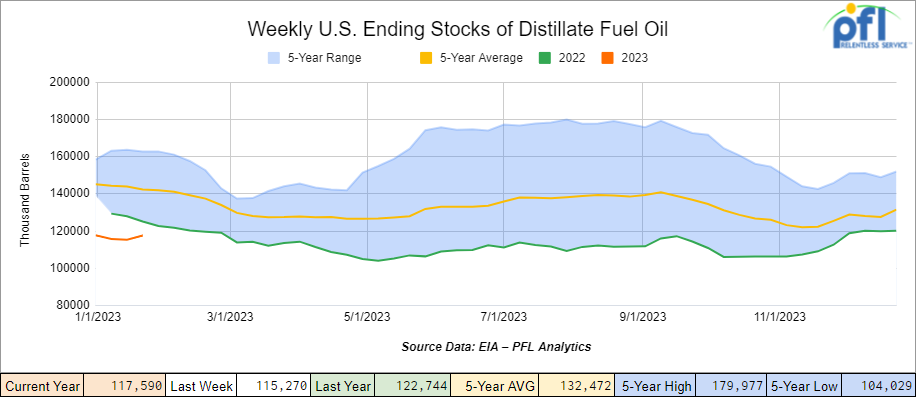

Distillate fuel inventories increased by 2.3 million barrels week over week and are 17% below the five-year average for this time of year.

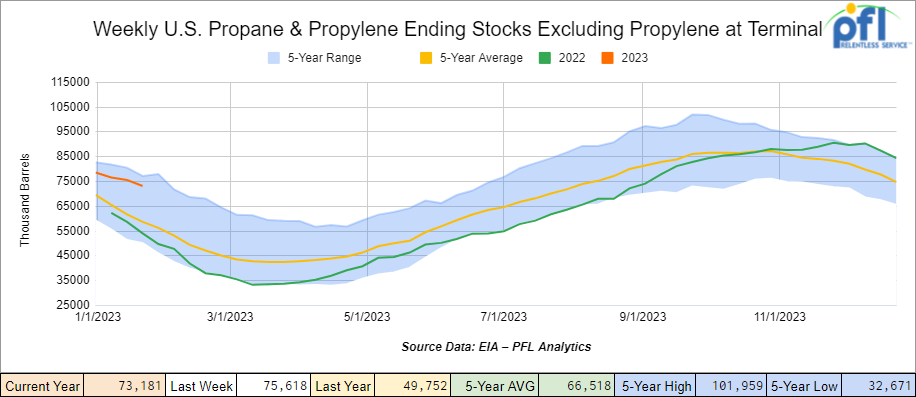

Propane/propylene inventories decreased by 2.4 million barrels week over week and are 27% above the five-year average for this time of year.

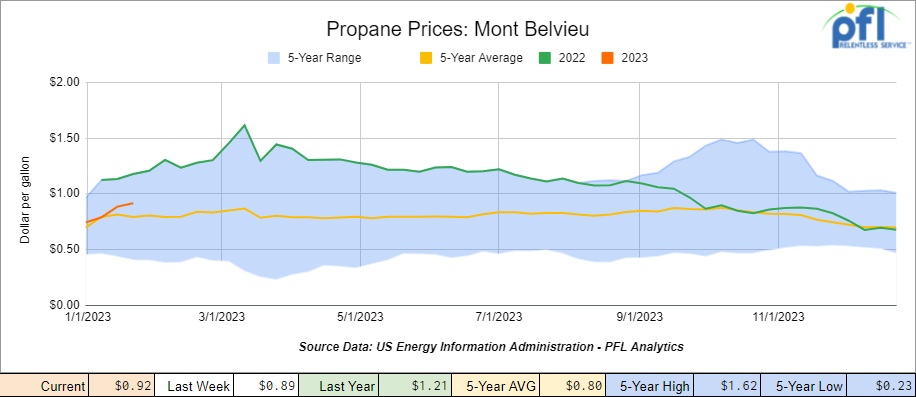

Propane prices were up 3 cents per gallon week over week, closing at 92 cents per gallon, down 29 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 1.6 million barrels during the week ending January 27th, 2023.

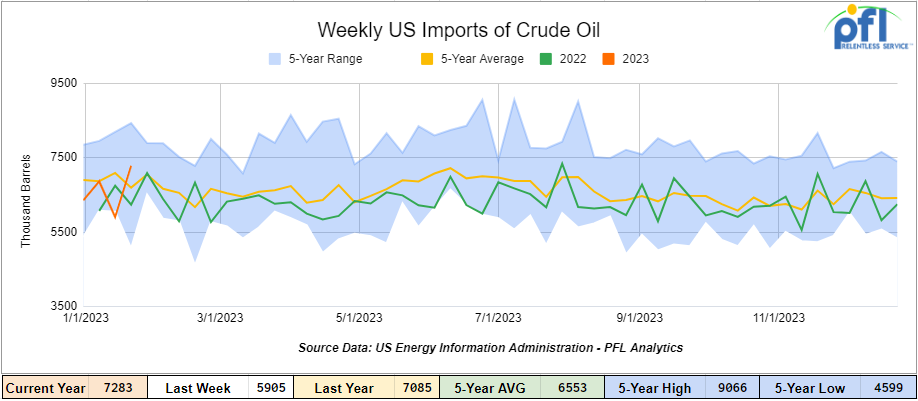

U.S. crude oil imports averaged 7.3 million barrels per day during the week ending January 27th, 2023, an increase of 1.4 million barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.6 million barrels per day, 1.0% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 501,000 barrels per day, and distillate fuel imports averaged 313,000 barrels per day during the week ending January 27th, 2023.

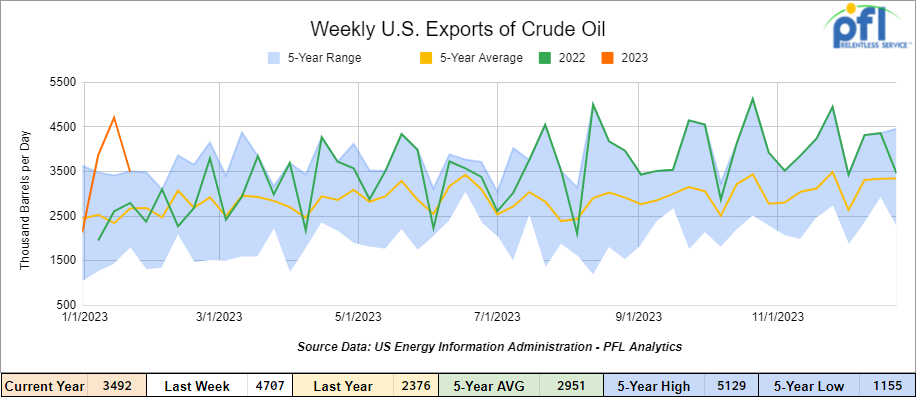

U.S. crude oil exports averaged 3.492 million barrels per day for the week ending January 27th, a decrease of 1.215 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.557 million barrels per day.

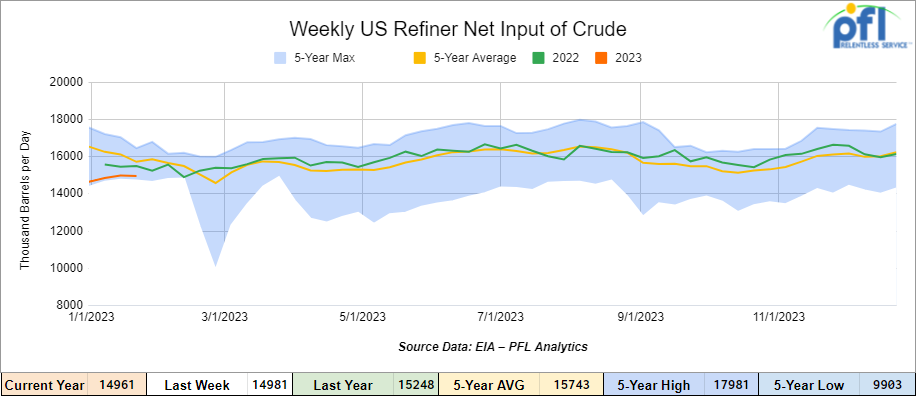

U.S. crude oil refinery inputs averaged 15 million barrels per day during the week ending January 27, 2023 which was 19 thousand barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $73.67 up $0.28 per barrel from Monday’s close.

North American Rail Traffic

Week Ending February 1st, 2022.

Total North American weekly rail volumes were down (-3.14%) in week 4 compared with the same week last year. Total carloads for the week ending on February 1st were 356,274, up (+1.95%) compared with the same week in 2022, while weekly intermodal volume was 296,439, down (-8.61%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year increases with the most significant increase coming from Petroleum and Petroleum Products (+12.97%). The largest decrease was from Intermodal (-8.61%).

In the east, CSX’s total volumes were down (-0.60%), with the largest decrease coming from Intermodal (-8.05%) and the largest increase Coal (+27.37%). NS’s volumes were up (+5.75%), with the largest decrease coming from Chemicals (-3.43%) and the largest increase from Petroleum and Petroleum Products (+36.12%).

In the West, BN’s total volumes were down (-9.95%), with the largest decrease coming from Metallic Ores and Minerals (-18.51%), and the largest increase coming from Motor Vehicles and Parts (+15.49%). UP’s total rail volumes were down (-3.26%) with the largest decrease coming from Other (33.22%) and the largest increase coming from Grain (+10.13%).

In Canada, CN’s total rail volumes were down (+1.76%) with the largest decrease coming from Intermodal (-16.37%) and the largest increase coming from Motor Vehicles and Parts (+27.65%). CP’s total rail volumes were down (+11.3%) with the largest decrease coming from Coal (-36.42%) and the largest increase coming from Other (+71.74%).

KCS’s total rail volumes were down (-13.82%) with the largest decrease coming from Nonmetallic Minerals (-33.56%) and largest increase coming from Other (+44.23%).

Source Data: AAR – PFL Analytics

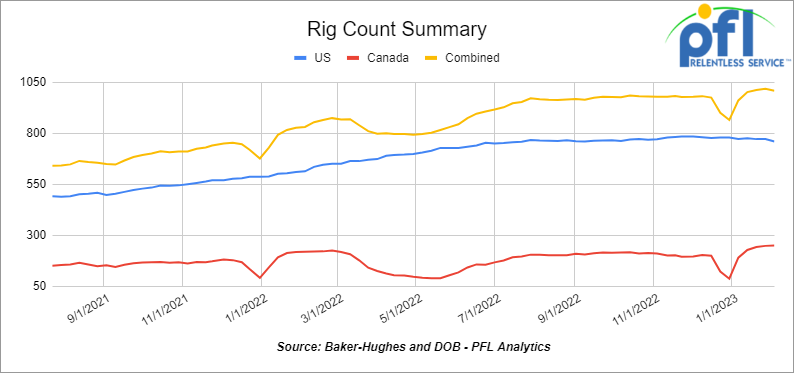

Rig Count

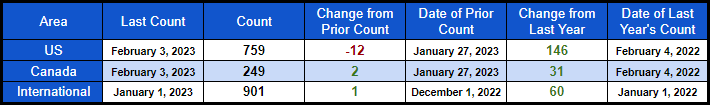

North American rig count was down by -10 rigs week over week. U.S. rig count was down -12 rigs week-over-week and up by +146 rigs year over year. The U.S. currently has 759 active rigs. Canada’s rig count was up by 2 rigs week-over-week and up by 31 rigs year-over-year. Canada’s overall rig count is 249 active rigs. Overall, year over year, we are up +177 rigs collectively.

International rig count which is reported monthly was up by 1 rig month over month and up 60 rigs year over year. Internationally there are 901 active rigs.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads rose to 25,997 from 24,933, which was a gain of 1,064 railcars week-over-week. Canadian volumes were mixed; CP’s shipments increased by 1.8% week over week, and CN’s volumes were down by -3.5% week over week. U.S. shipments were mostly higher. The NS had the largest percentage increase and was up by +3.1%. The CSX was down by -11.6%.

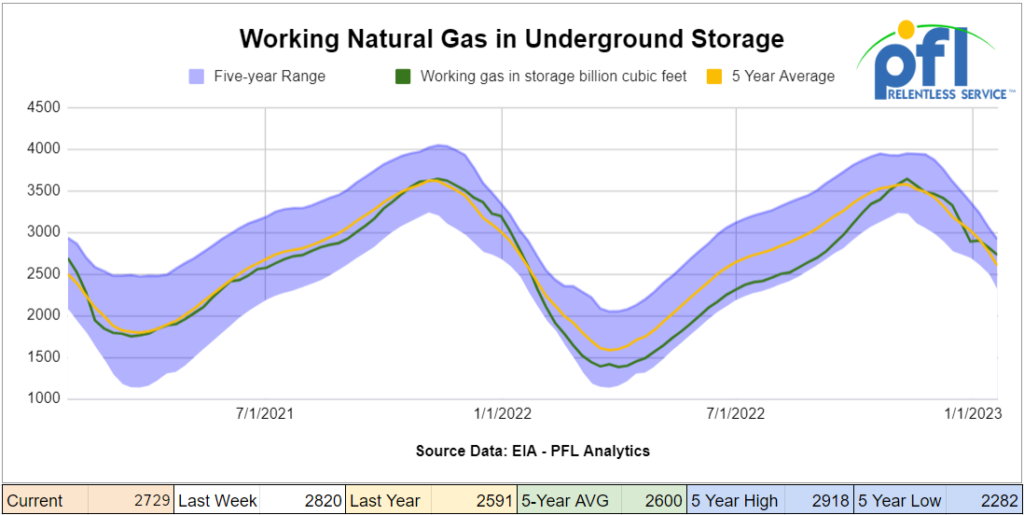

We are Watching Natural Gas and the Freeport restart

Freeport LNG, the second-biggest U.S. liquefied natural gas (LNG) exporter, has restarted one of three liquefaction trains at its long-idled Texas export plant last week. Liquefaction trains turn natural gas into LNG for export.

In a filing with Texas environmental regulators, Freeport said it “anticipates the purge and restart of Liquefaction Train 3 will begin on Feb. 3 with Trains 2 and 1 following sequentially.”That will allow “time between startups for each train to stabilize and run for several days at nominal rates,” Freeport said in the filing. Freeport also said the “initial purging, restart, and cool down of each train will result in venting to the Liquefaction Flare as the trains are brought to operating temperatures that allow for the cessation of flaring.”

Federal regulators last week approved Freeport’s plan to start sending gas to Train 3. On Thursday of last week, Freeport asked regulators for permission to start loading LNG on ships to free up space in the storage tanks for the new LNG expected to be produced.

It is expected it will take until mid-March or later for Freeport to return to full LNG production.

The Freeport plant shut after a fire in June 2022. The energy market does expect gas prices to rise once the plant starts producing LNG again. When operating at full power, Freeport can turn about 2.1 billion cubic feet (bcf) of gas into LNG each day. That is about 2% of total U.S. daily gas production.

Despite the planned Freeport restart, U.S. gas futures fell about 2% to a 25-month low on Friday of last week, closing at 2.41 per MMBTU due to forecasts for milder weather in February and there is lots of gas in storage coupled with increasing production.

Some Key Economic Indicators

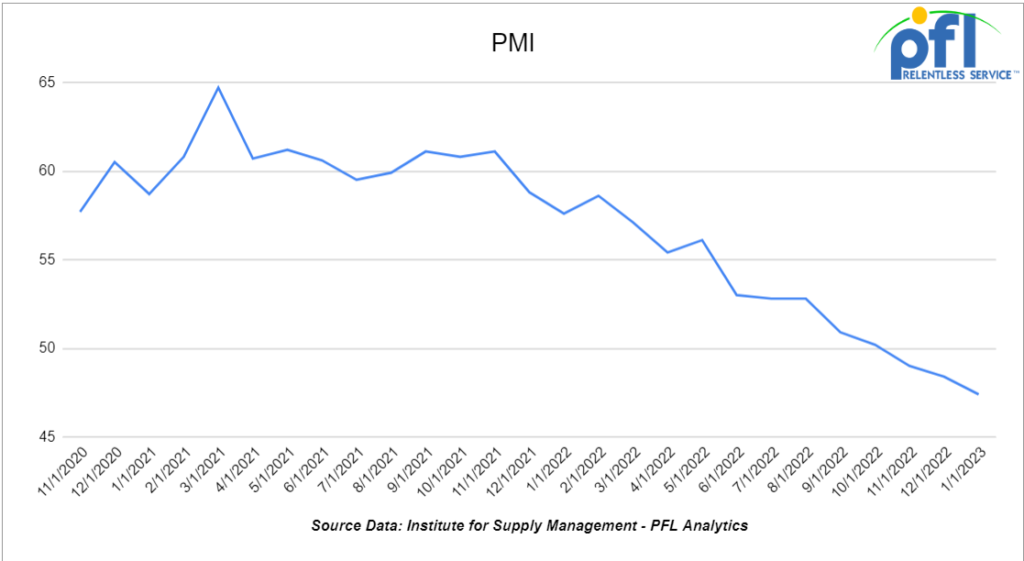

Purchasing Managers Index (“PMI”) – The PMI (which covers manufacturing) and the Services PMI (covering services) are both from the Institute for Supply Management. They are based on surveys of supply managers around the country. The surveys track the direction of changes in business activity. An index reading above 50% indicates expansion; below 50% means contraction. The more above or below 50, the faster the pace of change. The PMI was down month over month at 47.4% in January versus 48.4% in December. The third consecutive month of readings below 50% and the lowest it has been since May 2020, The new orders component was 42.5% in January, down from 45.1% in December and the lowest it’s been since May 2020 as well.

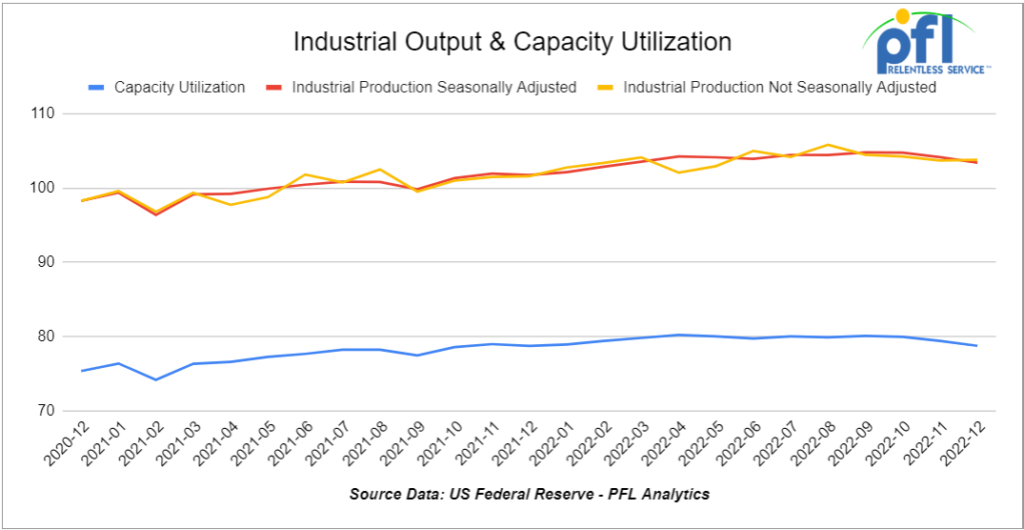

Industrial Output and Capacity Utilization U.S. industrial output finished 2022 on a down note, falling a preliminary 0.7% in December from November. That’s the biggest month-to-month decline in 15 months and follows a revised 0.6% decline in November from October. Total output in December 2022 was 1.6% higher than in December 2021, the smallest year-over-year increase since March 2021.

Manufacturing output, which accounts for around 75% of total output, fell a preliminary 1.3% in December and fell 1.1% in November. That’s the first time manufacturing output fell by more than 1% two months in a row since April 2020. Manufacturing output in December 2022 was down a preliminary 0.5% from December 2021, the first year-over-year decline since February 2021.

Output in most manufacturing sectors important to railroads fell in December from November on a seasonally adjusted basis, including nonmetallic minerals (down 4.5%), paper (down 1.6%), petroleum refineries (down 2.1%), wood products (down 2.1%), and grain mill products (down 1.5%).

Overall, capacity utilization fell to a preliminary and seasonally adjusted 78.8% in December, the lowest total capacity utilization has been in a year. Capacity utilization in December for manufacturing was a preliminary 77.5%, the lowest it’s been in 15 months.

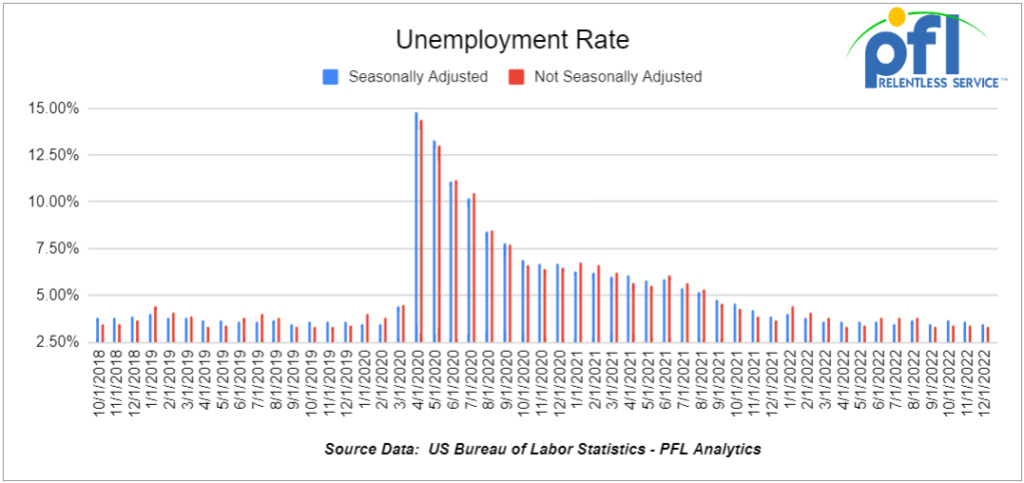

U.S. Unemployment Rate – The Bureau of Labor Statistics reported last week that a preliminary 517,000 net new jobs were created in January. The official unemployment rate was down slightly in January to 3.4% from December at 3.5%.

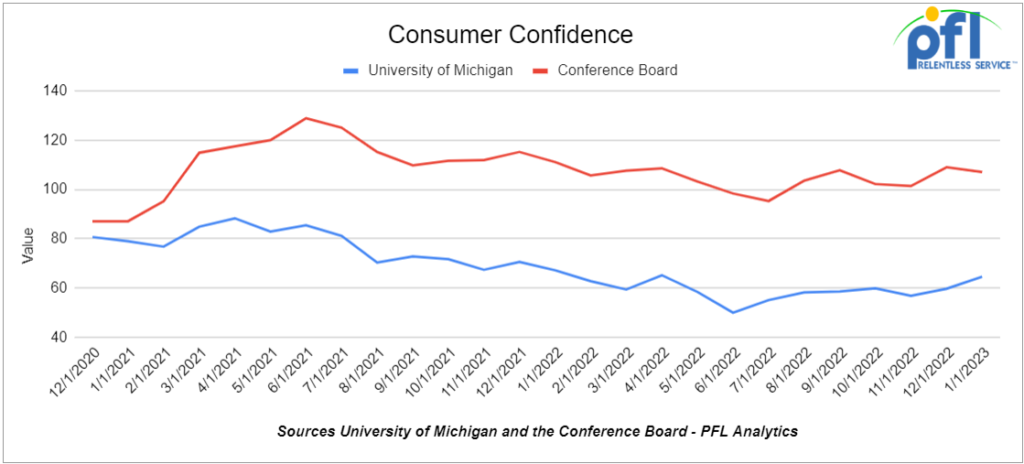

Consumer Confidence was 107.1 in January, down from 109.0 in December 2022. We are not surprised to see the downtick and expect more to come.

The University of Michigan’s Index of Consumer Sentiment rose in January, to 64.9 from 59.7 in December.

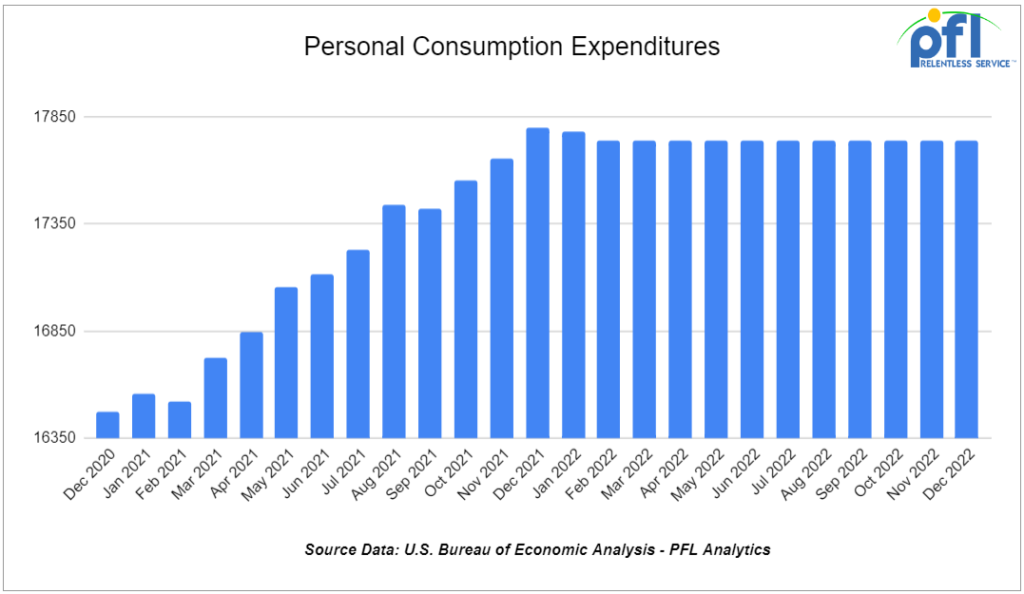

Total consumer spending in December 2022 was -0.2% (Adjusted for inflation, the declines were 0.3%) lower than in November 2022, according to Bureau of Economic Analysis data just released. It’s the first time since March and April 2020 that total consumer spending fell two months in a row.

A potentially troubling sign is that personal savings as a percentage of disposable personal income, a measure of how much money consumers, have stashed away, was just 3.4% in December. That’s less than half what it was a year ago. Personal savings in December 2022 was the lowest since March 2010. Moreover, with interest rates rising, financing purchases through credit cards or loans becomes more difficult. (The Federal Reserve Bank of New York says credit-card balances rose 15% in Q3 2022 over Q3 2021, the biggest increase in more than 20 years.)

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

PFL is seeking:

• 100-150, 4000 Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

• 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

• 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

• 20, 4700 – 5000cf Trough Top Covered Hoppers needed in Alabama for 1 + years. Cars are needed for use in Salt service.

• 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 50, 25.5K CPC1232 or 117J Tanks needed off of UP or CSX in multiple locations for 3-5 Years. Cars are needed for use in Tall Oil service. Lined or Unlined

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 5, 23.5K CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 30, 5200cf Covered Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 225, 5250cf-5800cf Covered Hoppers needed off of CSX, NS in the southeast for 5 years. Cars are needed for use in Plastic service. Call for details

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location, but prefers the west. Cars are needed for use in Cement service. C612

• 100, 15.7K Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

PFL is offering:

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 150, 3250 CF, hopper Hoppers located off of various class 1s in multiple locations. For sale

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 100, 29K, 117R Tanks located off of UP in Washington. Cars are clean Built in 2014. Coiled and insulated.

• 100, 29K, 117R Tanks located off of UP in Washington State. 2014. Coiled and insulated clean

• 150, 31.8, 117R Tanks located off of KCS in Texas. Cars are clean Currently being shopped. Call for info.

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

• 100, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 200, 29K, 117J Tanks located off of BNSF, UP in Oklahoma & Texas. Cars are clean Hempel 15500 Lining.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|