“Yesterday is not ours to recover, but tomorrow is ours to win or lose.”

Lyndon B. Johnson

Jobs Update

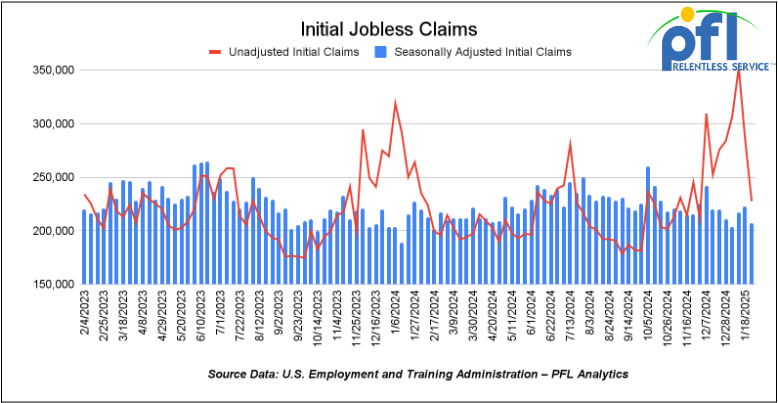

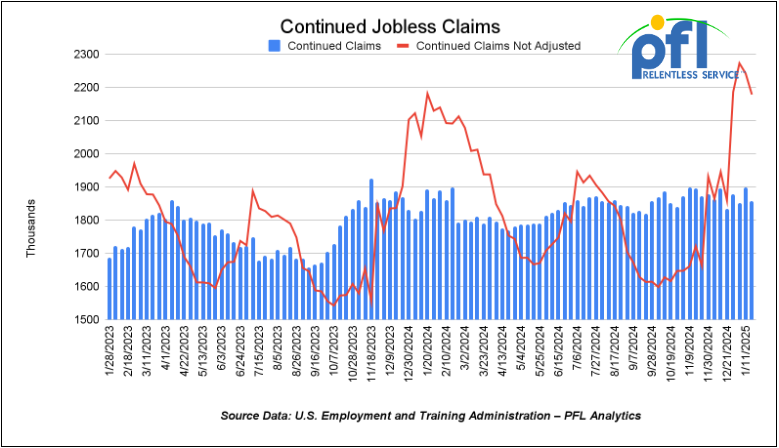

- Initial jobless claims seasonally adjusted for the week ending January 25th came in at 207,000, down -16,000 people week-over-week.

- Continuing jobless claims came in at 1.858 million people, versus the adjusted number of 1.9 million people from the week prior, down 42,000 people week-over-week.

Stocks closed lower on Friday of last week, but mixed week over week

The DOW closed lower on Friday of last week, down -337.47 points (-0.75%) and closing out the week at 44,544.66, up 120.42 points week-over-week. The S&P 500 closed lower on Friday of last week, down 30.64 points, and closed out the week at 6,040.53, down -60.71 points week-over-week. The NASDAQ closed lower on Friday of last week, down -54.31 points (0.27%), and closed out the week at 19,627.44, down -326.87 points week-over-week.

In overnight trading, DOW futures traded lower and are expected to open at 44,123 this morning down -575 points.

Crude oil closed lower on Friday of last week and lower week over week.

West Texas Intermediate (WTI) crude closed down -$0.20 cents per barrel (-0.3%), to close at $72.53 per barrel on Friday of last week, down -$2.13 per barrel week over week. Brent traded down $0.11 cents USD per barrel (-0.14%) on Friday of last week, to close at $76.76 per barrel, down -$1.74 per barrel week-over-week. One Exchange WCS (Western Canadian Select) for March delivery settled on Friday of last week at US$14.90 below the WTI-CMA (West Texas Intermediate – Calendar Month Average). The implied value was US$57.09 per barrel.

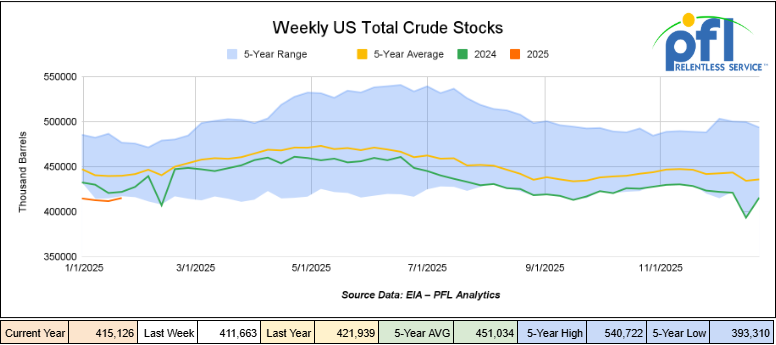

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 3.5 million barrels week-over-week. At 415.1 million barrels, U.S. crude oil inventories are 6% below the five-year average for this time of year.

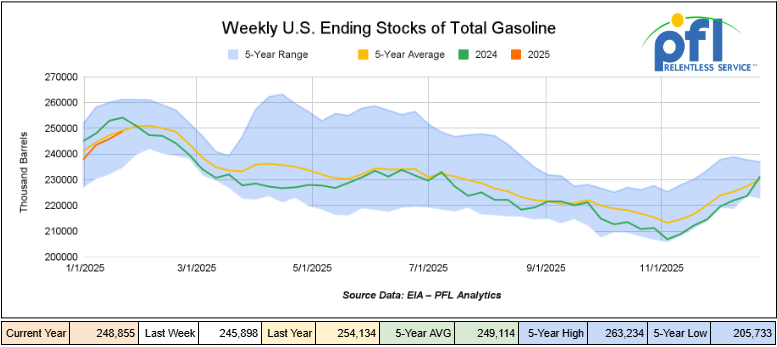

Total motor gasoline inventories increased by 3 million barrels week-over-week and are slightly below the five-year average for this time of year.

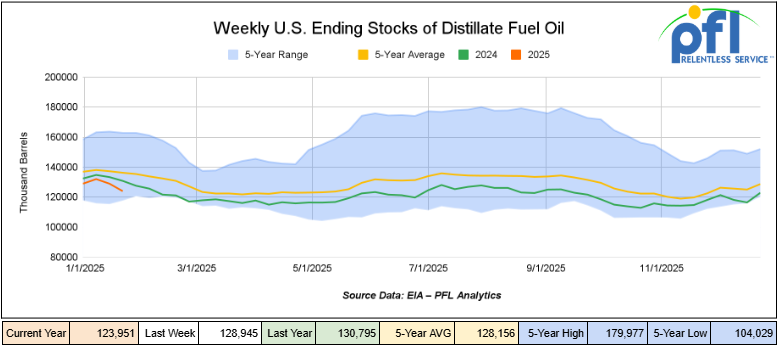

Distillate fuel inventories decreased by 5.0 million barrels week-over-week and are 9% below the five-year average for this time of year.

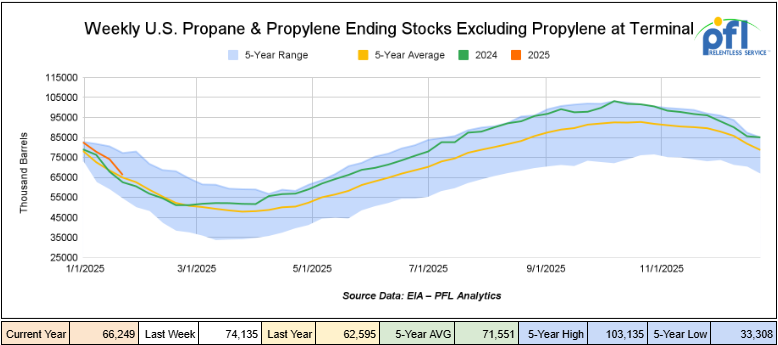

Propane/propylene inventories decreased by 7.9 million barrels week-over-week and are 2% above the five-year average for this time of year.

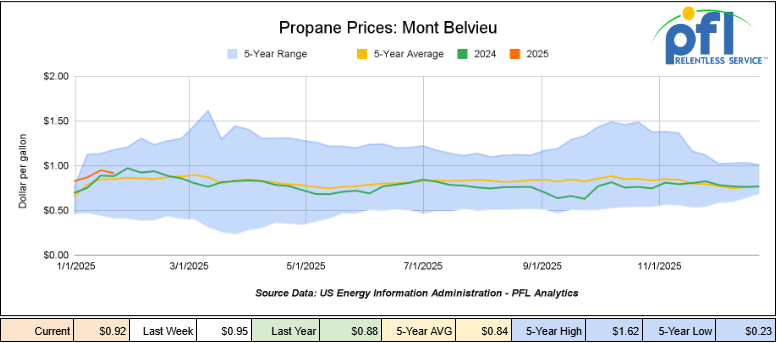

Propane prices closed at 92 cents per gallon on Friday of last week, down 3 cents per gallon week-over-week, and up 4 cents per gallon year-over-year.

Overall, total commercial petroleum inventories decreased by 13.9 million barrels during the week ending January 24th, 2025.

U.S. crude oil imports averaged 6.4 million barrels per day last week a decrease of 297,000 barrels per day week-over-week. Over the past four weeks, crude oil imports averaged 6.4 million barrels per day, 3.6% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 634,000 barrels per day, and distillate fuel imports averaged 182,000 barrels per day during the week ending January 24th, 2025.

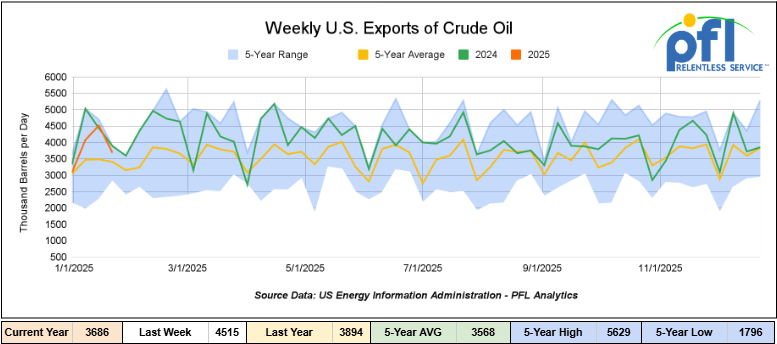

U.S. crude oil exports averaged 3.686 million barrels per day during the week ending January 24th, 2025, a decrease of 829,000 barrels per day week-over-week. Over the past four weeks, crude oil exports averaged 3,839 million barrels per day.

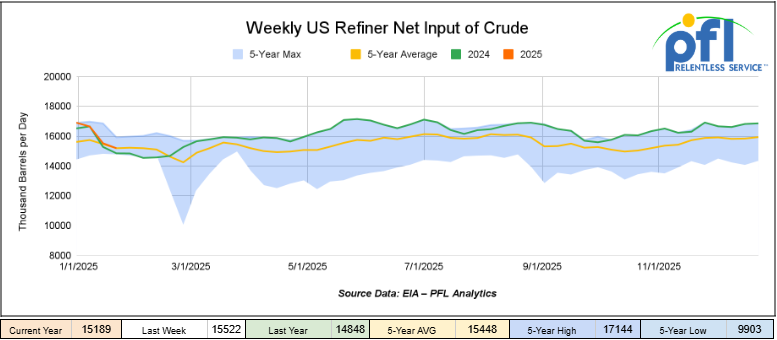

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending January 24, 2025, which was 333,000 barrels per day less than the previous week’s average.

WTI is poised to open at $73.86, up $1.33 per barrel from Friday’s close.

North American Rail Traffic

Week Ending January 29, 2025.

Total North American weekly rail volumes were down (-3.35%) in week 5, compared with the same week last year. Total carloads for the week ending on January 29 were 301,054, down (-8.85%) compared with the same week in 2024, while weekly intermodal volume was 330,022, up (2.27%) compared to the same week in 2024.

10 of the AAR’s 11 major traffic categories posted year-over-year decreases. The largest increase came from Intermodal which was up (2.27%) while the largest decrease was from Nonmetallic Minerals which was down (-13.38%)

In the East, CSX’s total volumes were down (-11.53%), with the largest decrease coming from Motor Vehicles and Parts (-21.43%). NS’s volumes were down (-10.01%), with the largest increase coming from Other (6.5%) while the largest decrease came from nonmetallic Minerals (-29.59%).

In the West, BN’s total volumes were up (0.63%), with the largest increase coming from Intermodal (6.87%) while the largest decrease came from Nonmetallic Minerals (-20.24%). UP’s total rail volumes were up (6.04%) with the largest increase coming from Intermodal (17.95%) while the largest decrease came from Petroleum and Petroleum products (-25.13%).

In Canada, CN’s total rail volumes were down (-11.59%) with the largest increase coming from Other, up (+97.58%) while the largest decrease came from Intermodal (-26.47%). CP’s total rail volumes were down (-1.97%) with the largest increase coming from Motor Vehicles and Parts(+90.12%), while the largest decrease came from Petroleum and Petroleum Products (-28.61%).

KCS’s total rail volumes were up (6.56%) with the largest increase coming from Motor Vehicles and Parts (+115.60%) while the largest decrease came from Coal (-21.88%).

Source Data: AAR – PFL Analytics

Rig Count

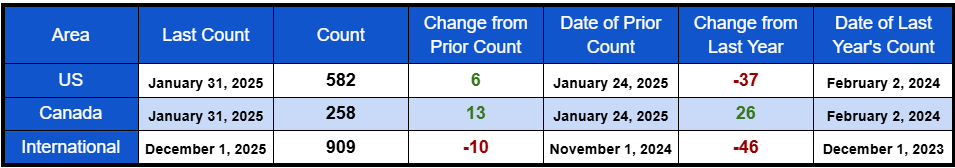

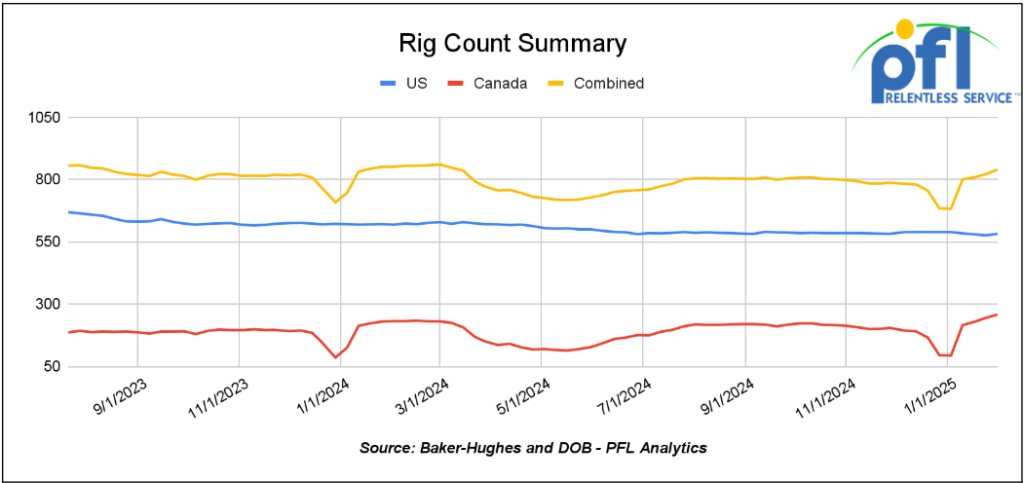

North American rig count was up by 19 rigs week-over-week. U.S. rig count was up by 6 rigs week over week and down by -37 rigs year-over-year. The U.S. currently has 582 active rigs. Canada’s rig count was up 13 rigs week-over-week, and up by 26 rigs year-over-year, and Canada’s overall rig count is 258 active rigs. Overall, year over year we are down by -11 rigs collectively.

North American Rig Count Summary

A few things we are watching:

We were watching Ground Hog Day

Well, folks its official, Punxsutawney Phil saw his shadow on Sunday morning, signaling six more weeks of winter. This is a reversal from 2024 when Phil called for an early spring. This year marks the 139th celebration of Groundhog Day. The tradition dates back to the 1800s. Massive crowds gather in central Pennsylvania every year to cheer on the world-famous groundhog and wait to hear his annual forecast. Meanwhile, according to AccuWeather, Phil’s forecast is not as straightforward as theirs. “We’re already seeing spring establishing itself in the South,” AccuWeather Long-Range Expert Paul Pastelok said. He noted that springlike weather could be sluggish to arrive farther north, with more information to come in Wednesday’s detailed seasonal forecast.

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads, rose to 29,165 from 28,020, which was a gain of 1,145 rail cars week-over-week. Canadian volumes were mixed. CN’s shipments were higher by +8.5% week over week, CPKC’s volumes were lower by -4.2% week-over-week. U.S. shipments were mostly lower. The BN was the sole gainer and was up by +5.2%. The UP had the largest percentage decrease and was down by -23.9%.

We are watching Tariffs – was a busy news weekend

U.S. President Donald Trump said on Friday of last week, that he expects his administration to impose tariffs related to oil and gas around February 18th and it could reduce the planned levy on some Canadian crude.

The U.S. imports some 4 million barrels per day of oil from Canada, roughly 70% of which is processed by refiners in the U.S. Midwest. A tariff on oil imports could lead to lower production of fuel at those facilities and drive-up costs for consumers, analysts and companies have warned.

On Friday of last week, Trump did not name a specific country to which the new tariffs would apply or provide any more details about the plans.

“We’re going to put tariffs on oil and gas,” Trump told reporters in the White House’s Oval Office. “That’ll happen fairly soon, I think around the 18th of February.”

He was asked if Saturday’s tariffs would include Canadian crude, Trump said: “I’m probably going to reduce the tariff a little bit on that. We think we’re going to bring it down to 10% for the oil.”

That would be instead of 25% that Trump has previously spoken about. Many U.S. oil refiners, especially in the Midwest, rely on imported crude because their facilities are configured to run heavier crude grades, such as those from Mexico and Canada.. Earlier last month, imports of crude from Canada to the United States hit record levels.

From a Canadian perspective, on Saturday morning of last week, it was reported by CTV that Canadians are prepared to retaliate. The Federal Canadian government has said it has multiple options for retaliatory tariffs ready to deploy, depending on what Trump ultimately does. Ontario Progressive Conservative Leader and Premier, Doug Ford, said Saturday he is waiting to see what materializes. At an election campaign stop in Brampton, Ont., Ford said Trump was clear that he would move forward with “reckless tariffs.” However, Premiers disagreed on how Canada should respond if Trump follows through on his threats.

Some say everything must be on the table, while Alberta Premier Danielle Smith and Saskatchewan Premier Scott Moe have said exports of oil and other resources like potash should not be included in retaliation plans.

Then came Saturday afternoon – the Government of Canada reported that U.S. President Donald Trump made good on his threat to hit Canada with massive tariffs.The tariff on Canada will be 25 percent across the board, with the exception of energy, which will be hit with a 10 percent tariff, according to senior government sources.

Trump has declared a national emergency under the International Emergency Economic Powers Act to back the tariffs, which allows sweeping powers to address crises.

Trump’s major trade action is expected to take effect on Tuesday.

Shortly after receiving confirmation, tariffs were coming, failed Prime Minister of Canada Justin Trudeau held an emergency meeting with his cabinet ministers at 3 p.m. EST, on Saturday and spoke with premiers afterwards and had a press conference Saturday evening.

Vowing that Canada would hit back Day 1, the failed prime minister said he would be announcing Canada’s initial retaliation at 6 p.m. EST in Ottawa of Saturday of last week, alongside Minister of Intergovernmental Affairs and Minister of Finance Dominic LeBlanc.

Canadian officials were informed that the tariffs would remain in place until the fentanyl overdose and illegal border crossing issues are adequately addressed, with the US providing President Trump’s concern about the issue as the reasoning for imposing tariffs. Canada announced that the Government of Canada is moving forward with 25 percent tariffs on $155 billion worth of goods in response to the unjustified and unreasonable tariffs imposed by the United States (U.S.) on Canadian goods. The first phase of Canada’s response will include tariffs on $30 billion in goods imported from the U.S., effective February 4, 2025, when the U.S tariffs are applied. The list includes products such as orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper. A detailed list of these goods will be made available shortly according to Canadian officials.

Failed Liberal Canadian finance Minister LeBlanc also announced that the government intends to impose tariffs on an additional list of imported U.S. goods worth $125 billion. A full list of these goods will be made available for a 21-day public comment period prior to implementation and will include products such as passenger vehicles and trucks, including electric vehicles, steel and aluminum products, certain fruits and vegetables, aerospace products, beef, pork, dairy, trucks and buses, recreational vehicles, and recreational boats.

According to the Canadian Federal government, less than one percent of fentanyl and illegal crossings into the United States come from Canada, with U.S. Customs and Border Protection seizing just 43 pounds of fentanyl at the northern border in the 2024 fiscal year. Canada said that they will be hitting back with countermeasures of their own, however, the Trump orders also include retaliation clauses that would increase U.S. tariffs if Canada and Mexico respond in kind.

Mexico is being hit with 25 percent tariffs on all imports, including energy. China is being subjected to a 10 percent tariff across the board. Both countries are threatening to retaliate.

One thing is for sure, the move by Trump as it relates to Canada has changed the North American landscape and trust for a long time. While Canada has a failed leadership under Justin Trudeau which should be fixed in short order, 150 years of working together has been shattered in the eyes of the average Canadian. New supply chains will be created and Canada will not put itself in the position of being pigeonholed again. Short-term pain for long-term gain potentially. Certainly, Canada’s version of the Green New Deal must be scrapped immediately, with a focus on resource-based manufacturing and alternate supply and export chains if they want to compete in this ever-changing landscape.

We are watching Renewables

There is, right now, quite a few shuttered biodiesel plants out there for a number of reasons and renewable diesel producers are seeing some headwinds. If you are not an integrated and a standalone plant chances are you are shut in as you are most likely losing 40-50 cents per gallon. Why? Preliminary 45Z guidance issued in the last days of the Biden administration included a model that will be used to measure a fuel’s carbon intensity and the subsidy that you will be paid for producing renewables here in the United States from various inputs. For vegetable oils, you will be paid 0 cents per gallon for canola oil and 16 cents for soybean oil. For waste oils, you will be paid roughly 60 cents per gallon. In all cases that is far less than the $1 tax credit you were paid prior to 45Z if you are a biodiesel or renewable diesel producer and right now is a fairly negative margin environment for non-waste oils.

Valero said that so far this year, it has used 10,000 barrels per day of renewable diesel from its Port Arthur, Tex., facility to make Sustainable Aviation Fuel (“SAF”). An upgrade it completed in Q4 2024 allows Diamond Green to turn approximately ½ of of the facility’s 470-million-gallon per year capacity into SAF. Phillips is also stepping up SAF production in California. The most attractive markets for SAF are California, Europe and Canada because of their mandates.

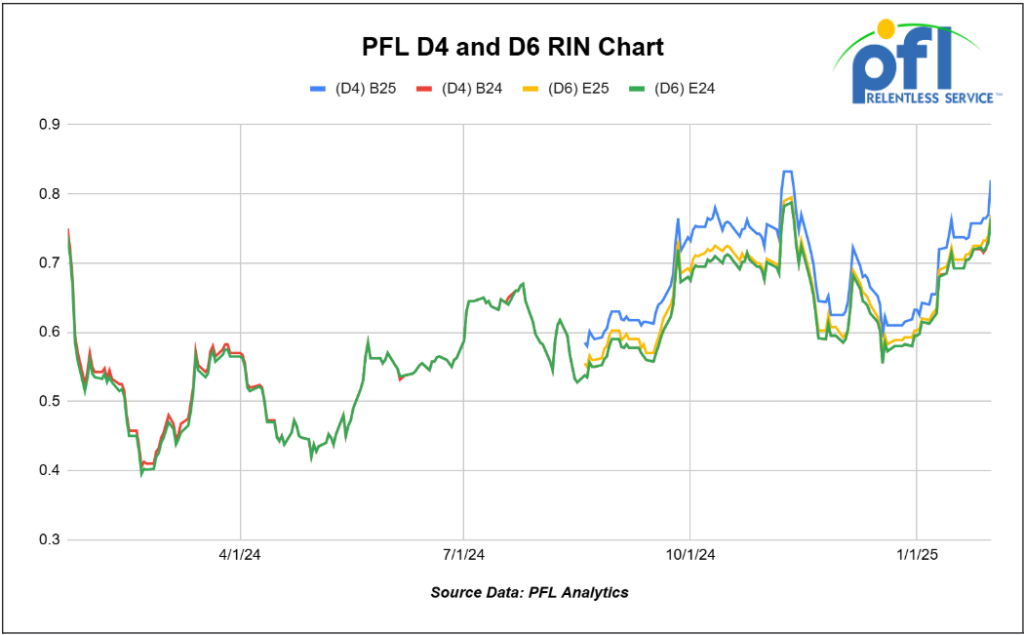

In RINS, another hidden tax for the U.S. consumer, Ethanol-related D6 and biomass-based diesel D4 Renewable Identification Number credit prices strengthened again on Friday of last week, as the BOHO spread surged with robust soybean oil prices following reports that the Trump Administration will impose tariffs on Canada, China and Mexico.

In a very active day in RINS on Friday of last week, D4 RINS closed out the day, and the week, at 83 cents per RIN, up six cents per RIN day over day, and up 7 cents per RIN week over week. Meanwhile, D6 RINS closed at 77 and ½ of a cent per RIN, up 3 and ½ of a cent per RIN day over day, and up 5 cents per RIN week over week.

We Are Watching Key Economic Indicators

Consumer Confidence

The Conference Board’s Index of Consumer Confidence decreased to 104.1 in January 2025, down from an upwardly revised 109.5 in December.

The University of Michigan’s Index of Consumer Sentiment decreased to 71.1 in January 2025, compared to 74 in December.

Consumer Spending

In December 2024, total consumer spending adjusted for inflation rose by 0.4% over November 2024. This follows a gain of 0.3% in November and a gain of 0.2% in October. According to the government, year-over-year inflation-adjusted total spending in December 2024 was up 2.9%. Inflation-adjusted spending on goods increased by 0.2% in December, following a 0.4% rise in November. Inflation-adjusted spending on services rose by 0.3% in December.

Lease Bids

- 100, 5200 Covered Hoppers needed off of UP or BN in Northwest for 6 month. Cars are needed for use in Pet Coke service. Round Hatch, Bottom Outlet Doors

- 10, 5250 Covered Hoppers needed off of UP or BN in Midwest for up to 5 years. Cars are needed for use in Dry Edible Beans service.

- 30, 4750-5200 Covered Hoppers needed off of BN or UP in Lake Charles, LA for 5 Years. Cars are needed for use in Pet Coke service.

- 10, 2500CF Open Top Hoppers needed off of UP or BN in Texas for 5 years. Cars are needed for use in aggregate service. Need Rapid Discharge Doors

- 25, 3230 PD Hoppers needed off of NS or CSX in Ohio for 5 years. Cars are needed for use in Flyash service.

- 100, 4750 Covered Hoppers needed off of UP or BN in Texas for 1-5 Years. Cars are needed for use in Petcoke service.

- 30, 33K 340W Pressure Tanks needed off of UP or BN in Gulf Coast for Winter Lease. Cars are needed for use in Propane service.

- 50, 28.3K DOT 111 Tanks needed off of Any Class 1 in any location for 3-7 Years. Cars are needed for use in Base Oils service.

- 20, 25.5k CPC 1232 Tanks needed off of UP or BN in OK, TX for 3 Year. Cars are needed for use in Asphalt service.

- 10, 30K 117R or 117J Tanks needed off of Any Class 1 in USA for 1 year. Cars are needed for use in Glycerin service.

- 15-20, 29K 117R Tanks needed off of NS or CSX in Ohio for 6-12 Months. Cars are needed for use in Ply Oil service.

- 30-50, 23.5K Any Type Tanks needed off of any class 1 in any location for 1-5Years. Cars are needed for use in Glycols service.

- 50, 23.5-25.5 DOT111 Tanks needed off of Any Class 1 in USA for 5 years. Cars are needed for use in Asphalt service.

- 10, Any Size Stainless Steel DOT111 Tanks needed off of UP or BN in TX for 1-5 Years. Cars are needed for use in Refined Products service.

- 10, 30K 117R Tanks needed off of CSX or NS in Southeast for 6 Months. Cars are needed for use in Crude service. Needed in Jan

- 50, 30K 117R/117J Tanks needed off of CSX in Northeast for 5 Year. Cars are needed for use in Refined Fuels service.

- 12, 28.3K Any Type Tanks needed off of UP or BN in Houston for 2Year. Cars are needed for use in Lube Oil service.

- 20, 28K 117J Tanks needed off of CSX or NS in Midwest for 12 Months. Cars are needed for use in Crude service. Needed in Jan

- 100, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Diesel service. Needed in Jan

- 10-20, 25.5K Any Type Tanks needed off of UP in Harvey, LA for 6 Months. Cars are needed for use in UCO service.

- 20, 30K 117J Tanks needed off of UP or BN in Midwest for 5 Years. Cars are needed for use in Ethanol service.

Sales Bids

- 100-150, 3400CF Covered Hoppers needed off of UP BN in Texas. Cars are needed for use in Cement service. Cement Gates needed.

- 50, 4750CF Covered Hoppers needed off of any class 1 in Texas. Cars are needed for use in Grain service.

- 10, 5600CF PD Hoppers needed off of any class 1 in Texas.

- 20, 17K DOT111 Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

- 4, 25.5K DOT 111 Tanks needed off of any class 1 in Texas.

- 10, 30K DOT 111 Tanks needed off of any class 1 in Texas. Cars are needed for use in UCO service.

Lease Offers

- 60, 4750, Covered Hoppers located off of UP or BN in Eads, CO. Cars are clean UP to 5 Years, 3 Hopper, Gravity Gate, Trough Hatches

- 30, 33K, 340W Pressure Tanks located off of CN or CP in Edmonton. Cars were last used in Propane/Butane. 1 Year Starting In March

- 15-20, 29.2K, AAR211 Tanks located off of UP or BN in Houston. Cars were last used in Veg Oil. Up to 1 year

- 50, 29K , DOT 111 Tanks located off of CN in Hamilton, ON. Cars were last used in Biodiesel. 1 year +

- 39, 30K, 117R Tanks located off of CN, NS, CSX in Detroit. Cars were last used in Diesel. 5 Years; Mid 2029 Return

- 20-25, 30K, 117J Tanks located off of BNSF in West Texas. Cars were last used in Ethanol. 1 year minimum

- 50, 33K, 400W Pressure Tanks located off of All Class 1s in Chicago. Cars were last used in Propylene. 1 Year Term

Sales Offers

- 100-300, 3400, Covered Hoppers located off of various class 1s in multiple locations. Sand Cars

- 40, 33K, 340W Pressure Tanks located off of various class 1s in multiple locations. 10 Year old; Reqaul in 2034

- 150, 28.3K, DOT117J Tanks located off of various class 1s in multiple locations.

- 50, 17K, DOT 111 Tanks located off of various class 1s in multiple locations.

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars, or sell cars call PFL today at 239-390-2885

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Offer | Note |

|---|

PFL will be at the Following Conferences

- Where: La Quinta, CA

- Attending: David Cohen (954-729-4774)

- Conference Website

- Where: Hyatt Regency Dallas in Dallas, TX

- Attending:Curtis Chandler (239.405.3365), David Cohen (954-729-4774), Brian Baker (239.297.4519), Cyndi Popov(403) 402-5043

- Conference Website