“Leadership consists not in degrees of technique but in traits of character; it requires moral rather than athletic or intellectual effort, and it imposes on both leader and follower alike the burdens of self-restraint.”

– Lewis H. Lapham

Jobs Update

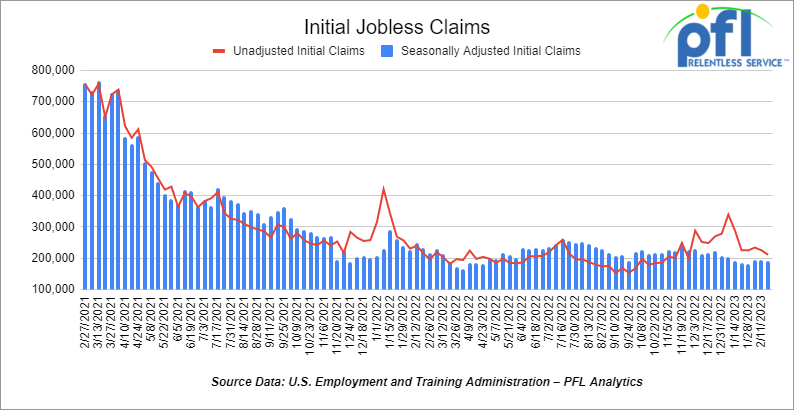

- Initial jobless claims for the week ending February 18th, 2023 came in at 192,000, down -3,000 people week-over-week.

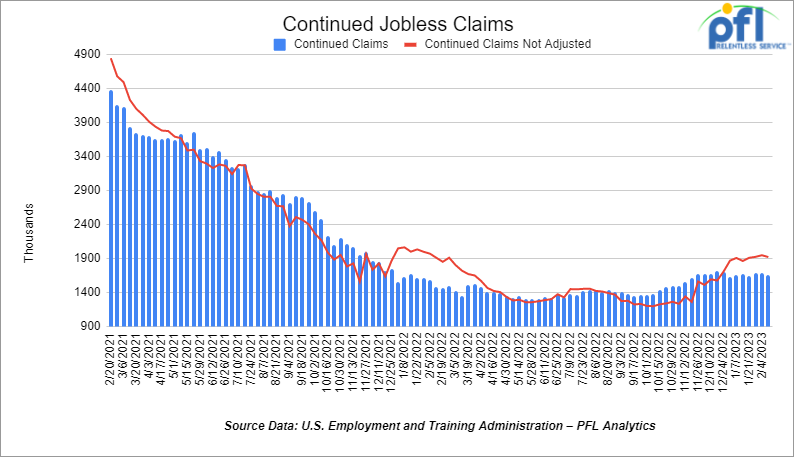

- Continuing jobless claims came in at 1.654 million people, versus the adjusted number of 1.691 million people from the week prior, down -37,000 people week over week.

Stocks closed lower on Friday of last week and lower week over week

The DOW closed lower on Friday of last week, down -336.99 points (-1.02%), closing out the week at 32,816.92 down -1,052.77 points week over week. The S&P 500 closed lower on Friday of last week, down -42.28 points (-1.05%) and closed out the week at 3,970.04, down -109.37 points week over week. The NASDAQ closed lower on Friday of last week, down -195.46 points (-1.7%), and closed the week at 11,394.94, down -195.46 points week over week.

In overnight trading, DOW futures traded higher and are expected to open at 32,959 this morning up 133 points.

WTI closed higher on Friday of last week, but lower week over week

WTI traded up $0.93 per barrel (1.2%) to close at $76.32 per barrel on Friday of last week, down $1.60 per barrel week over week. Brent traded up US$0.95 per barrel (1.2%) on Friday of last week, to close at US$83.16 per barrel, down – US$1.02 per barrel week over week.

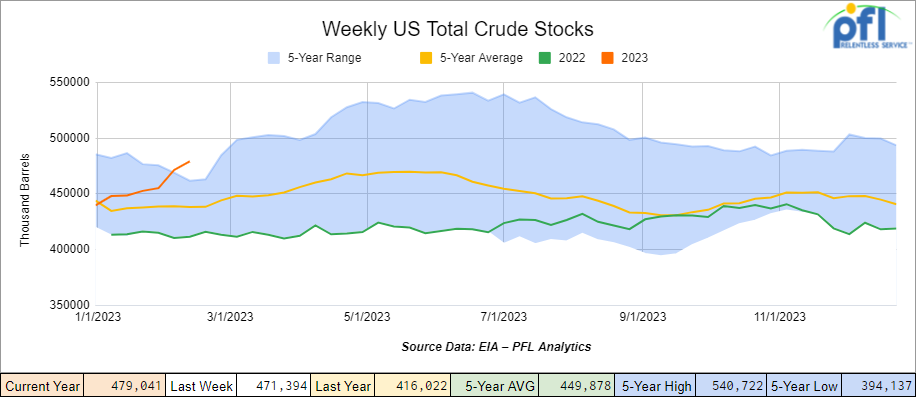

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 7.6 million barrels week over week. At 479.0 million barrels, U.S. crude oil inventories are 9% above the five-year average for this time of year.

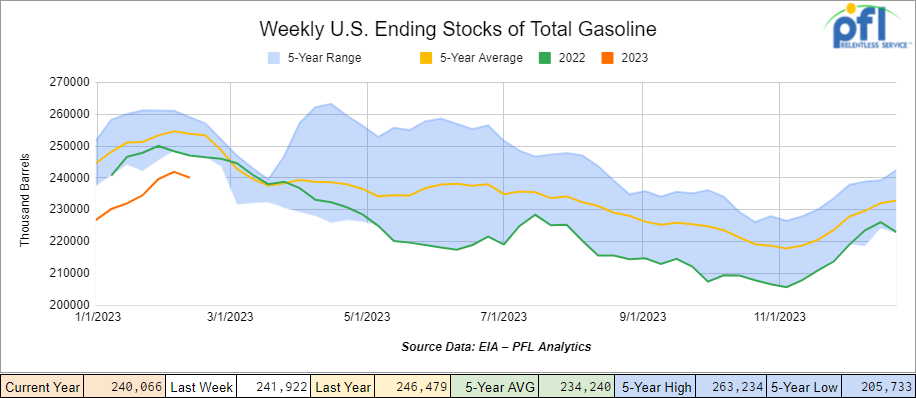

Total motor gasoline inventories decreased by 1.9 million barrels week over week and are 5% below the five-year average for this time of year.

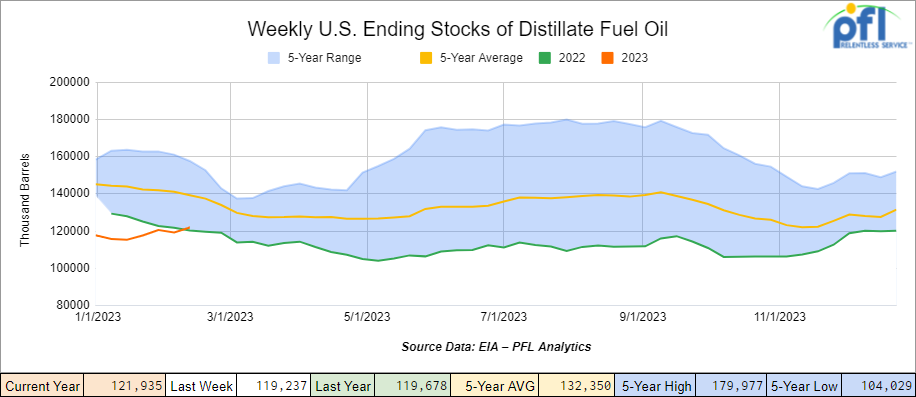

Distillate fuel inventories increased by 2.7 million barrels week over week and are 12% below the five-year average for this time of year.

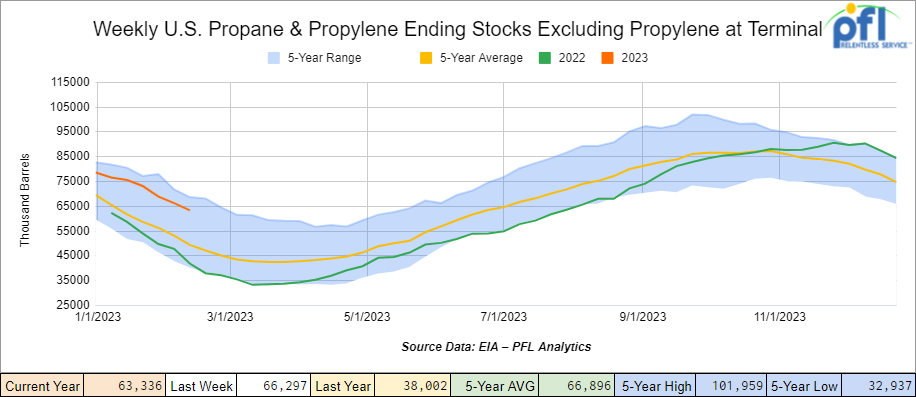

Propane/propylene inventories decreased by 3 million barrels week over week and are 33% above the five-year average for this time of year.

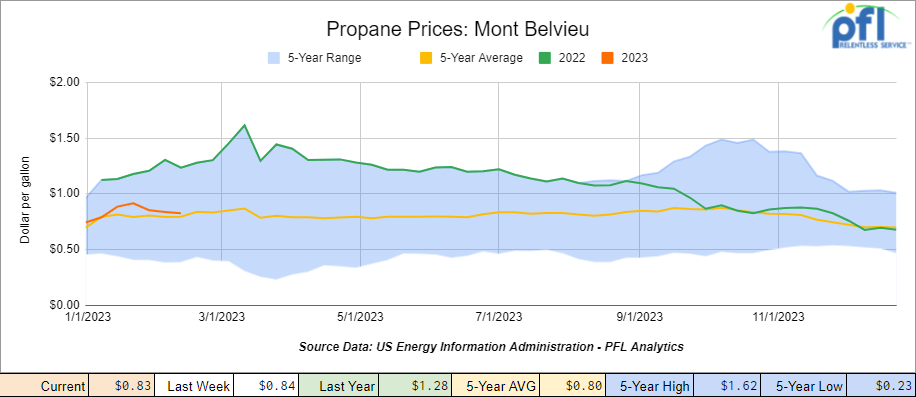

Propane lost another penny per gallon week over week, closing at 83 cents a gallon, down 45 cents per gallon year over year.

Overall, total commercial petroleum inventories increased by 3.3 million barrels week over week.

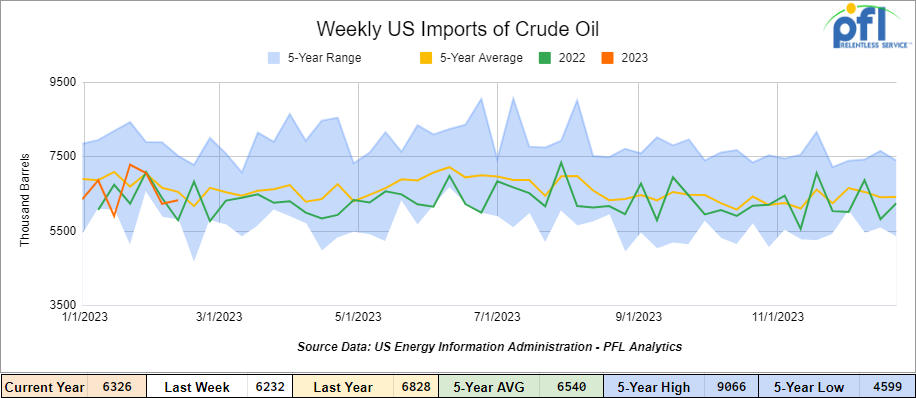

U.S. crude oil imports averaged 6.3 million barrels per day during the week ending February 17th, 2023, an increase of 94,000 barrels per day week over week. Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, 3.1% more than the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) averaged 476,000 barrels per day, and distillate fuel imports averaged 414,000 barrels per day during the week ending February 17th, 2023.

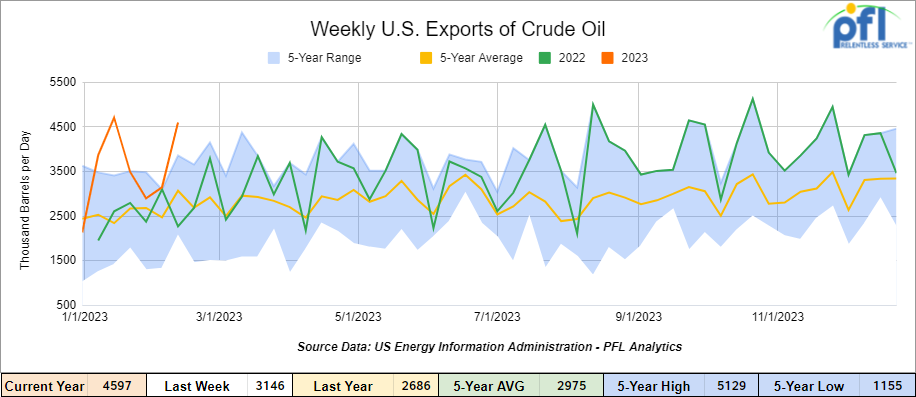

U.S. crude oil exports averaged 4.6 million barrels per day for the week ending February 17th, 2023, an increase of 1.45 million barrels per day week over week. Over the past four weeks, crude oil exports averaged 3.533 million barrels per day.

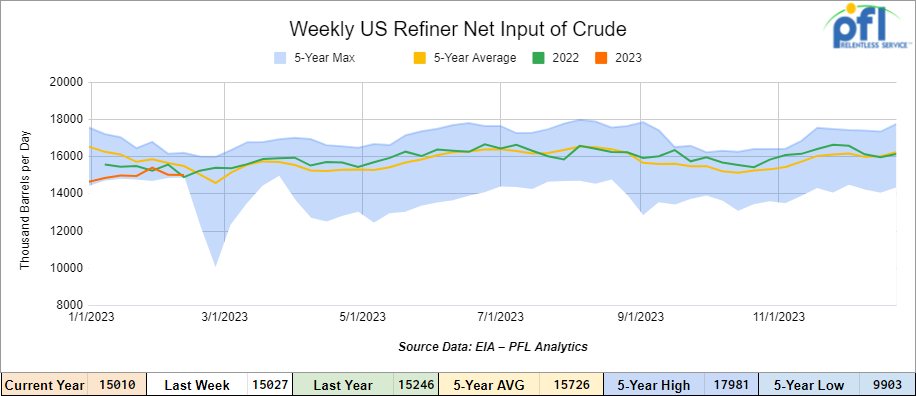

U.S. crude oil refinery inputs averaged 15.0 million barrels per day during the week ending February 17, 2023, which was 17 thousand barrels per day less week over week.

As of the writing of this report, WTI is poised to open at $76.53 up $0.321 per barrel from Monday’s close.

North American Rail Traffic

Week Ending February 22nd, 2023.

Total North American weekly rail volumes were down (-4.64%) in week 7 compared with the same week last year. Total carloads for the week ending on February 22nd were 349,919, down (-0.70%) compared with the same week in 2022, while weekly intermodal volume was 297,115, down (-8.9%) compared to the same week in 2022. 7 of the AAR’s 11 major traffic categories posted year-over-year decreases with the most significant decrease coming from Grain (-12.64%). The largest increase was from Petroleum and Petroleum Products (11.34%).

In the east, CSX’s total volumes were down (-1.52%), with the largest decrease coming from Intermodal (-10.20%) and the largest increase Coal (+21.84%). NS’s volumes were down (-2.81%), with the largest decrease coming from Coal (-12.78%) and the largest increase from Motor Vehicles and Parts (+24.22%).

In the West, BN’s total volumes were down (-8.84%), with the largest decrease coming from Chemicals (-14.61%), and the largest increase coming from Petroleum and Petroleum Products (+20.86%). UP’s total rail volumes were down (-5.08%) with the largest decrease coming from Grain (-26.81%) and the largest increase coming from Motor Vehicles and Parts (+7.77%).

In Canada, CN’s total rail volumes were down (-1.09%) with the largest decrease coming from Intermodal (-20.32%) and the largest increase coming from Nonmetallic Minerals (+29.92%). CP’s total rail volumes were down (-13.61%) with the largest decrease coming from Grain (-49.68%) and the largest increase coming from Nonmetallic Minerals (+55.85%).

KCS’s total rail volumes were up (+2.31%) with the largest decrease coming from Coal (-6.57%) and largest increase coming from Other (+20.91%).

Source Data: AAR – PFL Analytics

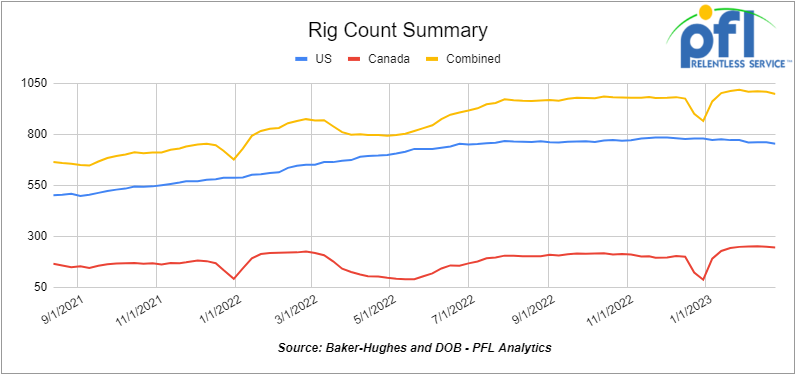

Rig Count

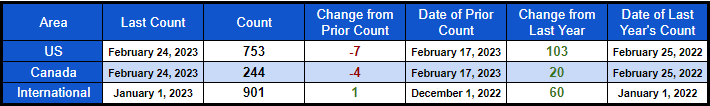

North American rig count was down by -11 rigs week over week. U.S. rig count was down -7 rig week-over-week and up by +103 rigs year over year. The U.S. currently has 753 active rigs. Canada’s rig count was down by -4 rigs week-over-week and up by 20 rigs year-over-year. Canada’s overall rig count is 244 active rigs. Overall, year over year, we are up +123 rigs collectively.

North American Rig Count Summary

A few things we are keeping an eye on

We are watching Petroleum Carloads

The four-week rolling average of petroleum carloads carried on the six largest North American railroads fell to 25,649 from 26,020, which was a loss of -371 railcars week-over-week. Canadian volumes were down; CP’s shipments decreased by -1.4% week over week, and CN’s volumes were lower by -5.1% week over week. U.S. shipments were mixed. The UP had the largest percentage decrease down by -11.5% and the BN was up by 11.5%.

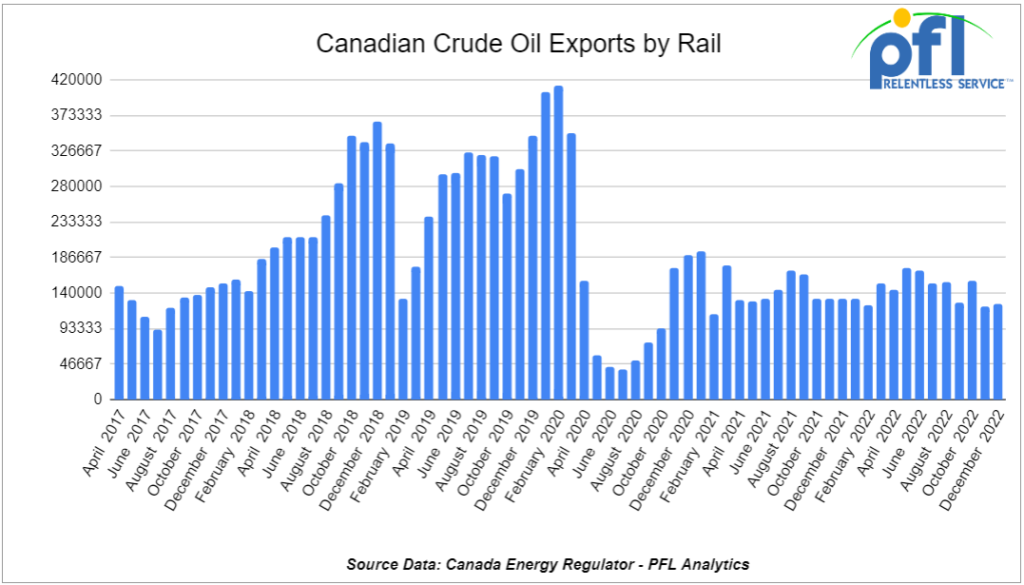

We are watching Crude by Rail Out of Canada

The Canadian Energy Regulator (“CER”) updated its monthly crude by rail numbers on February 21, 2023. For December 2022, Canada exported 126,198 barrels per day by rail (up by +4,291 barrels per day month over month); we expected to see a larger increase but weather and weaker differentials played havoc. Crude by rail out of Alberta and Saskatchewan is popular for raw Bitumen (no diluent added), as it can be shipped as a non-hazmat product resulting in lower shipping costs that are competitive with pipelines. We are expecting to see volumes significantly increase as we head into April as the weather warms and producers begin to build inventory awaiting the arrival of the 590,000 barrel per day Trans Mountain Expansion. The pipeline will connect Alberta to Canada’s West coast and is expected to come online sometime in Q4 of 2023 and is 75% built. WCS’s basis in Edmonton has held steady this past week +/- $US-18 per barrel in Edmonton with WCS for April delivery closing at its highs at $US-$16.40 below the WTI-CMA for April delivery. The implied value was US$59.22/bbl. Before crude by rail out of Canada can come back in a meaningful way, supply needs to significantly exceed pipeline capacity and we need to see a much wider basis for a sustained period of time (or at least predictable). We have seen wider basis numbers that have worked albeit very briefly not allowing traders to lock in meaningful margins. Although congestion remains on Canadian pipelines as production in Canada continues to rise, Canada’s Trans Mountain expansion is 75% complete and will add 590,000 barrels a day of additional pipeline capacity from Edmonton to Canada’s west coast by Q4. The pipeline is certainly needed as Enbridge’s apportionment rose to 11% in December from 2% in November allowing only 88% of shippers crude nominations to flow.

We are watching East Palestine, Ohio. Buttigieg Expects more federal regulation on rail safety

Former Small town Indiana mayor, now the country’s transportation secretary, plans to ask Congress to increase fines for railroads and speed up tank car regulations.

Federal officials and Democratic lawmakers are hinting that more regulation of the freight railroads is on the way as leaders explore the safety procedures surrounding trains that haul hazardous materials.

Federal scrutiny of rail safety comes as Norfolk Southern, federal, state and local leaders, and the local community seek to recover from a Feb. 3 derailment involving an NS train near East Palestine, Ohio. The fallout was exacerbated by N.S. delayed response to address community concerns and provide immediate resources.

U.S. Transportation Secretary Pete Buttigieg told NS President and CEO Alan Shaw in a letter that NS — along with the other major railroads — should anticipate changes to rail safety regulations, including the amount of fines the railroads must pay after a major incident.

Pete said, “I will … be calling on Congress to raise the cap on fines against railroads for violating safety regulations, to ensure their deterrent effect is commensurate with the economic proportions of today’s large railroad companies,”. The letter also refers to an increase in NS’ operating income and operating margin in 2022 versus 2021.

“Even as we await results from NTSB’s investigation into what caused the derailment in East Palestine, I expect that Norfolk Southern and other railroads will take action now, not later, to address public safety concerns and better prevent future disasters,” Buttigieg continued.

Buttigieg said the Federal Railroad Administration “will conduct its own analysis of the derailment to see if any safety violations occurred, and the agency could hold NS accountable legally after it conducts its review and incorporates the findings from the National Transportation Safety Board’s investigation”.

NS must also respect EPA’s authority to hold the NS accountable for any violations, Buttigieg continued. NS is to outline its cleanup actions to EPA.

Buttigieg’s letter also admonishes the railroad industry for lobbying against safety regulations: “Norfolk Southern and other rail companies spent millions of dollars in the courts and lobbying members of Congress to oppose common-sense safety regulations, stopping some entirely and reducing the scope of others”.

“Also, the completion date for phase-in of more durable rail cars to transport hazardous material was delayed by years, to 2029 from an originally envisioned date of 2025.” Speeding up this phase-out would be a big problem for the industry and rail itself.

“While we do not yet know what the NTSB investigation will conclude regarding what caused the derailment in East Palestine, we do know that these steps that Norfolk Southern and its peers lobbied against were intended to improve rail safety and to help keep Americans safe.”

The industry has argued that overregulation can stymie potentially innovative solutions to address operational and safety issues, especially when it comes to the use of technology.

The industry has also pointed to data illustrating the railroads’ safe operations. The Association of American Railroads says that 99.9% of all hazmat shipments reach their destination without incident and that since 2012, the hazmat accident rate has declined by 55%. AAR also says that over the past 10 years, less than 1% of all train accidents have resulted in a hazmat release. At the end of the day, it will be easier for the Railroads to blame the tank car as the culprit and agree to speed up modifications to 117Rs or 117Js Good for the tank car manufacturer. Stay tuned to the PFL. We are watching this one closely.

We have been extremely busy at PFL with return-on-lease programs involving rail car storage instead of returning cars to a shop. A quick turnaround is what we all want and need. Railcar storage in general has been extremely active. Please call PFL now at 239-390-2885 if you are looking for rail car storage, want to troubleshoot a return on lease scenario, or have storage availability. Whether you are a car owner, lessor or lessee, or even a class 1 that wants to help out a customer we are here to “help you help your customer!”

Leasing and Subleasing has been brisk as economic activity picks up. Inquiries have continued to be brisk and strong Call PFL Today for all your rail car needs 239-390-2885

Lease Bids

• 25-50, 5000-5100 Lined Hoppers needed off of BNSF, CSX, KCS, UP in Gulf LA for 3-10 years. Cars are needed for use in dry sugar service. 3 bay gravity dump

• 25-50, 25.5K 117J Tanks needed off of NS CSX in NorthEast for 5 Years. Cars are needed for use in Asphalt/Heavy Fuel Oil service.

• 10-20, 20-25 CPC 1232 or 117J tanks needed off of UP CN in Illinois for 3-5 years. Cars are needed for use in Liquid feed service.

• 100-150, 4000CF Covered Hoppers needed off of UP BN in Texas for Purchase or 5 years. Cars are needed for use in Aggregate service.

• 25, 30K 117Rs or Js Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Diesel service.

• 25, 340W Pressure Tanks needed off of UP or BN in Texas for 1-2 Years. Cars are needed for use in Propane service.

• 25, 30K 117Rs or Js Tanks needed off of Any Class One in Midwest for 2-3 years. Cars are needed for use in Ethanol service.

• 10, any capacity Stainless Steel Tanks needed off of any class 1 in Canada for 5-10 years. Cars are needed for use in Alcohol service.

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of Any in any location for 5 Years. Cars are needed for use in Veg Oil service. Unlined

• 30-50, 30K 117 Tanks needed off of any class 1 in Northeast or Midwest for 1 Year. Cars are needed for use in C5 service. Must have Magrods

• 10-12, 340W Pressure Tanks needed off of UP in Utah to Cali for 1 year. Cars are needed for use in propane service. Needs them in April 2023

• 100-300, 31.8k CPC1232 or 117J Tanks needed off of various class 1s in Canada/US for 1-3 years. Cars are needed for use in Crude service. Various needs in the market to move crude immediately

• 100 , 340W Pressure Tanks needed off of various class 1s in various locations for 6 months to a year. Cars are needed for use in Propane service. Immediate need

• 100-200, 25.5K-28.3K 117J Tanks needed off of CN or CP in Edmonton for 3-6 Months. Cars are needed for use in Crude service. Dirty to Dirty.

• 10-20, 340W Pressure Tanks needed off of CN or CP in Canada for 6 months to 1 year. Cars are needed for use in Propylene service. Immediate

• 25, 20.5K CPC1232 or 117J Tanks needed off of BNSF or UP in the west for 1-3 years. Cars are needed for use in magnesium chloride service. SDS onhand

• 5, 23.5K CPC1232 Tanks needed off of CSX in West Virginia for 2 years plus. Cars are needed for use in Polyacrylamide service. Unlined

• 10-100, 20K CPC1232 or 117J Tanks needed off of BNSF, CN or UP in the south or midwest for 5 years. Cars are needed for use in Urea Ammonium Nitrate service. CN Miss, BN Oklahoma, UP LA and Iowa- Must be lined

• 10, 50-60 footers Plate F Boxcars needed off of CN and UP or BNSF in Texas in Tennesse & Houston for 1 year. Cars are needed for use in Barium Sulfate service. Requires double door boxcars.

• Up to 60, 5150cf Covered Hoppers needed off of CN, CSX, NS in the east or midwest for 3 years. Cars are needed for use in Fertilizer service. 3-4 hatch gravity dumps

• 30, 5200cf Covered Hoppers needed off of UP in Colorado for 1-3 years. Cars are needed for use in Silica service. Call for details

• 40, 2400cf Gondolas needed off of various class 1s in Indiana for 6 Months. Cars are needed for use in Rock service. Call for details

• 20-30, 14k Any Tanks needed off of BNSF, UP in Texas for 1-3 Years. Cars are needed for use in HCl service. Call for details

• 50-100, 25.5K CPC1232 or 117J Tanks needed off of UP or BN in any location for 3-5 Years. Cars are needed for use in Heavy Fuel Oil service.

• 225, 5250cf-5800cf Covered Hoppers needed off of CSX, NS in the southeast for 5 years. Cars are needed for use in Plastic service. Call for details

Sales Bids

• 10, 25.5K 117, DOT-111, CPC 1232 Tanks needed off of UP or BN in Texas. Cars are needed for use in Veg Oil service. Coiled and insulated

• 5, 3200 Covered Hoppers needed off of UP or BN in Texas.

• 2-4, 28K Tanks needed off of BNSF Preferred in Minnesota. Cars are needed for use in Biodiesel service. Coiled and insulated

• 100, Plate F Boxcars needed off of BN or UP in Texas.

• 20, 2770 Mill Gondolas needed off of CSX in the northeast. Cars are needed for use in non-haz soil service. 52-60 ft

• 8, Hoppers needed off of various class 1s in various locations. Cars are needed for use in Plastic Pellet service.

• 10, 4000 Hoppers needed off of CSX in the northeast. Cars are needed for use in scrap metal service. Open top hopper

• 20-30, 3000 – 3300 PDs Hoppers needed off of BN or UP preferred in any location but prefers the west. Cars are needed for use in Cement service. C612

• 20, 17K Tanks needed off of various class 1s in various locations. Cars are needed for use in corn syrup service.

• 100, 15.7K Tanks needed off of CSX or NS in the east. Cars are needed for use in Molton Sulfer service.

Lease Offers

• 100-200, 31.8, 1232` Tanks located off of BN in Chicago. Cars are clean Sale or Lease

• 70, 25.5K, 117J Tanks located off of UP in Texas. Cars are clean Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Gas. Call for information

• 100-200, 31.8K, CPC1232 Tanks located off of various class 1s in Texas. Cars were last used in Diesel. Call for information

• 150, 30K, DOT111 Tanks located off of various class 1s in various locations. Cars were last used in Ethanol. Call for information

Sales Offers

• 100, 28.3K, 117J Tanks located off of various class 1s in multiple locations. Clean

• 100, 30K, DOT 111 Tanks located off of various class 1s in multiple locations. Clean

• 100-200, 31.8K, CPC 1232` Tanks located off of BN in Chicago. Sale or Lease

Call PFL today to discuss your needs and our availability and market reach. Whether you are looking to lease cars, lease out cars, buy cars or sell cars call PFL today at 239-390-2885

PFL offers turn-key solutions to maximize your profitability. Our goal is to provide a win/win scenario for all and we can handle virtually all of your railcar needs. Whether it’s loaded storage, empty storage, subleasing or leasing excess cars, filling orders for cars wanted, mobile railcar cleaning, blasting, mobile railcar repair, or scrapping at strategic partner sites, PFL will do its best to assist you. PFL also assists fleets and lessors with leases and sales and offers Total Fleet Evaluation Services. We will analyze your current leases, storage, and company objectives to draw up a plan of action. We will save Lessor and Lessee the headache and aggravation of navigating through this rapidly changing landscape.

PFL IS READY TO CLEAN CARS TODAY ON A MOBILE BASIS WE ARE CURRENTLY IN EAST TEXAS

Live Railcar Markets

| CAT | Type | Capacity | GRL | QTY | LOC | Class | Prev. Use | Clean | Offer | Note |

|---|